Online banking have revolutionized the way we handle our money, offering convenience, flexibility, and often, higher savings rates.

If you're looking to maximize your savings potential and make the most of your hard-earned money, it's essential to explore the world of online banking.

This article will guide you through a selection of the online banks that provide high savings rates.

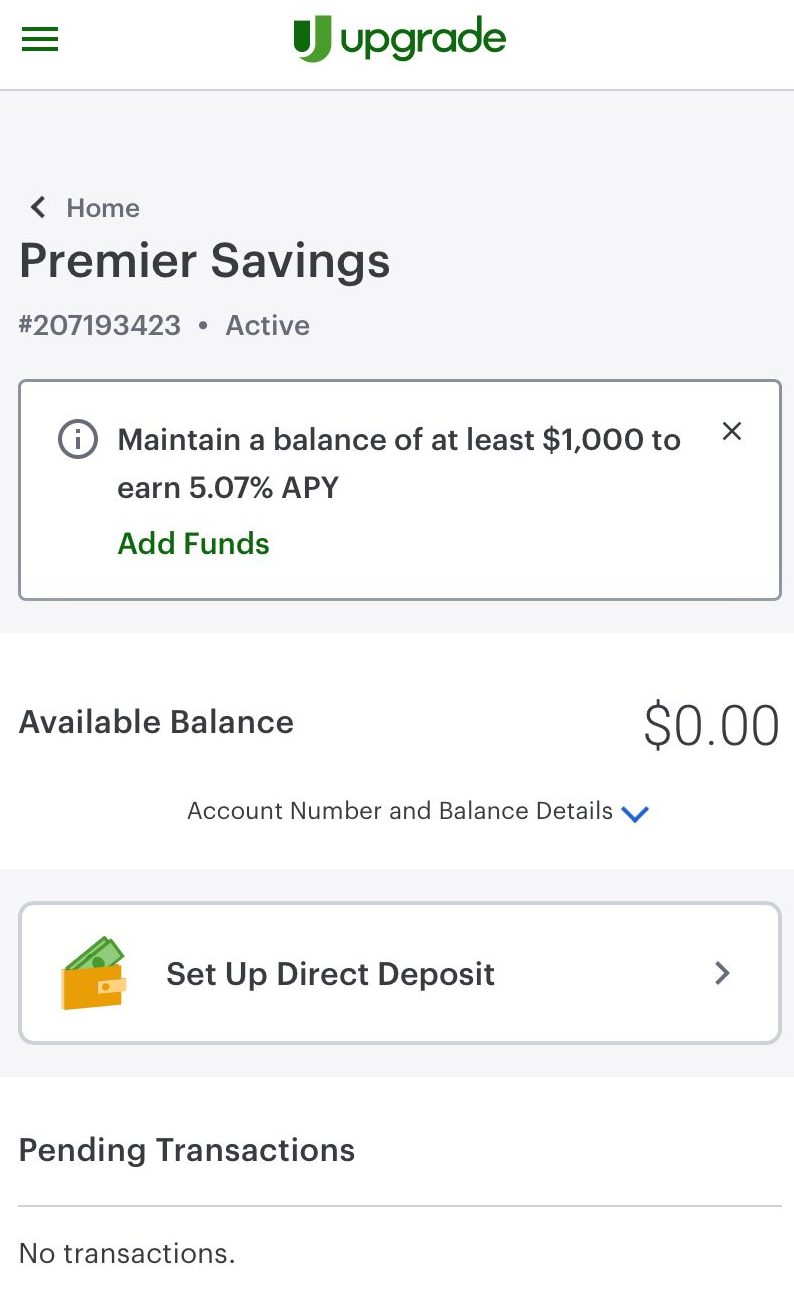

Upgrade

Savings APY

Minimum Deposit

FDIC Coverage

Fees

This Upgrade savings account offers an impressive 3.42% APY and comes with no monthly fees.

You have the flexibility to open and fund an Upgrade Premier Savings account independently without the need for a corresponding checking account.

There are multiple methods available to fund your account. Deposits can be made into your Premier Savings account through standard ACH transactions or wire transfers.

Alternatively, you can arrange with your payroll provider to set up direct deposit.

However, it's worth noting that while the Premier Savings account is highly regarded, it lacks certain mobile-friendly features, such as mobile check deposits and person-to-person transfers.

Upgrade, a financial technology company founded in 2017, has swiftly earned a strong reputation for assisting individuals in achieving their financial goals.

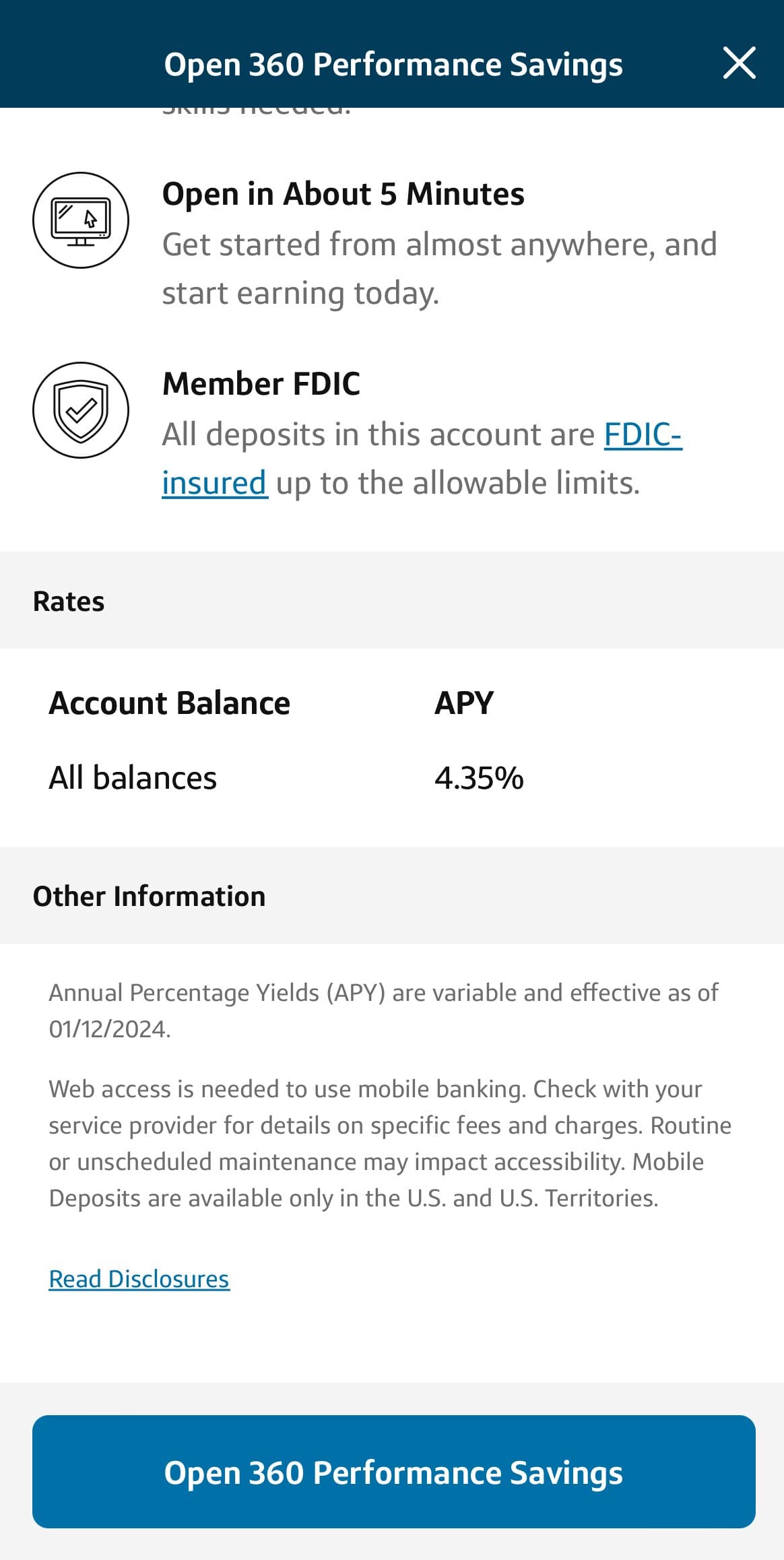

Capital One

Savings APY

Minimum Deposit

FDIC Coverage

Fees

The 360 Performance Savings account from Capital One offers highly competitive APY, providing one of the best savings rates available with a significantly higher than average APY.

As of November 2025, the account offers 3.50% APY.

With easy account transfers, you can move your funds effortlessly between linked Capital One accounts or external bank accounts, allowing you to capitalize on high-yield rates.

The automatic savings plan enables you to consistently grow your online accounts through automated transfers.

Additionally, the mobile check deposit feature lets you conveniently deposit checks by simply capturing a photo of the check using your phone.

Furthermore, Capital One provides free credit monitoring services to its customers, helping them monitor and improve their financial and credit health.

Lastly, with FDIC insurance, your funds are protected up to $250,000 in the event of Capital One's failure, ensuring the safety of your account.

LendingClub

Savings APY

Minimum Deposit

FDIC Coverage

Fees

The Lending Club Savings account offers a range of beneficial features for savers.

It provides a high APY, well above the national average, with the current rate of 4.20%, applied to your entire balance.

There are no monthly maintenance fees or minimum balance requirements after the initial $100 deposit.

Unlike many similar accounts, LendingClub provides an ATM card for easy withdrawals without ATM fees from MoneyPass and SUM machines, and there are no out-of-network fees, although the ATM operator may charge a fee.

The account includes mobile and online banking capabilities, enabling 24/7 account management, mobile check deposit, and bill payment.

LendingClub also offers a finance toolkit to help you analyze budgets, spending, and trends by linking external accounts.

With customizable alerts and travel notifications, you can stay in control of your account and enjoy free internal and external transfers. Opening a LendingClub savings account is fully online.

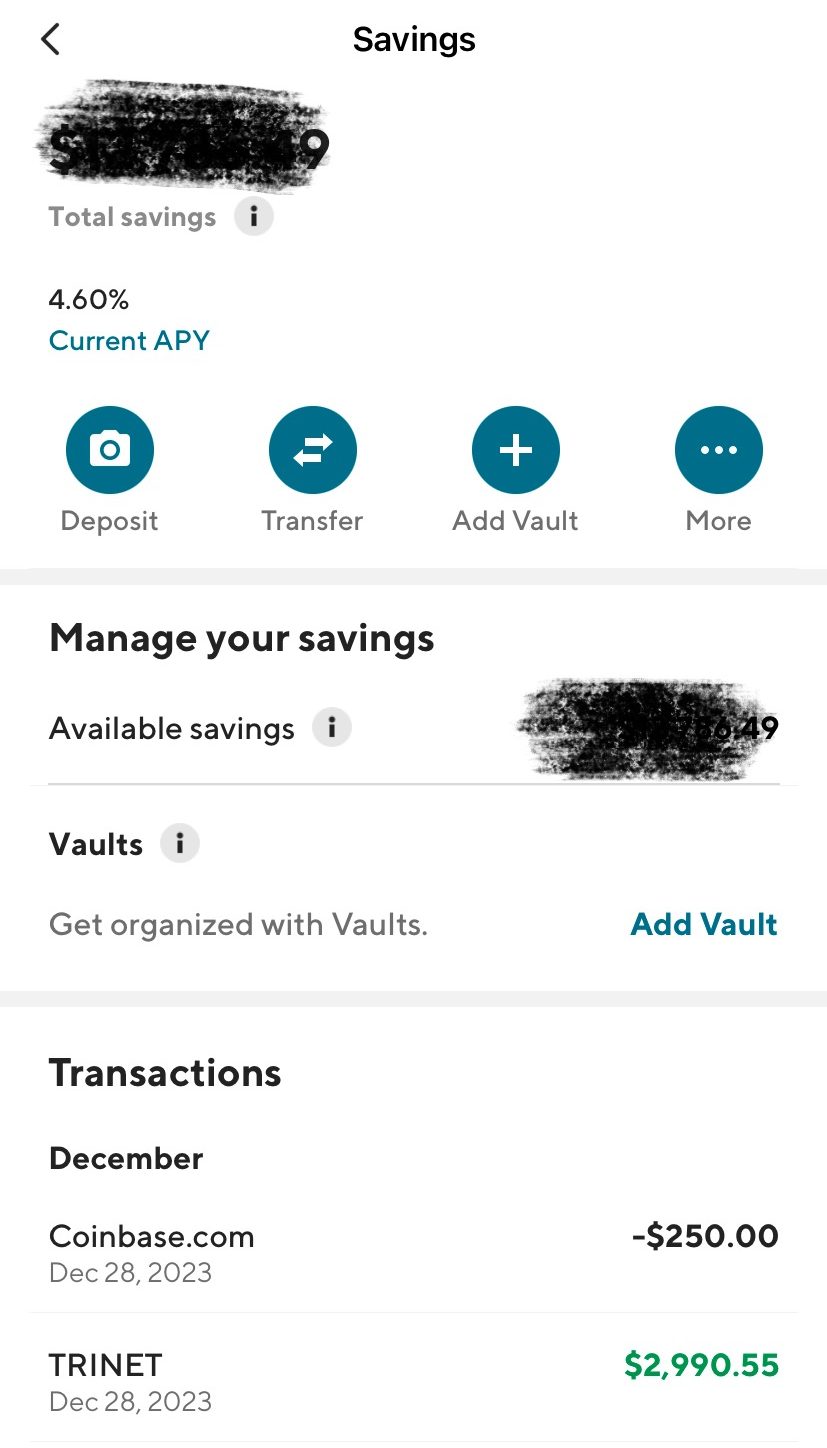

SoFi

Savings APY

Minimum Deposit

FDIC Coverage

Fees

The SoFi savings account offers a high rate of up to 4.50% APY and variety of features to help you save and achieve your financial goals.

With Roundups, your debit card purchases are automatically rounded up to the next dollar, and the extra amount is deposited into your savings Vault, allowing you to save even while spending.

Additionally, you can earn a cash bonus ranging from $50 to $250 based on your direct deposit amount, providing a great start to your savings journey.

SoFi's savings Vaults are designed to help you meet specific goals, whether it's for a dream vacation or a down payment on a home.

By utilizing AutoSave, you can set up automatic savings, allowing a portion of your paycheck to be deposited into your savings account without any effort.

With the SoFi mobile app, you have easy access to transfer funds, deposit checks, and monitor your savings, ensuring your finances are always at your fingertips.

Plus, automatic Roundups are applied to all debit card purchases, adding to your savings in a hassle-free manner.

Citizens Access

Savings APY

Minimum Deposit

FDIC Coverage

Fees

Citizens Access, a subsidiary of the Citizens Bank group, is an online-only financial institution.

Although it was established in 2018, its parent company boasts an impressive banking legacy of nearly 200 years and holds assets exceeding $150 billion.

Currently, Citizens Access offers a single savings account, which stands out for its high yield.

This account is designed to be transparent, with no concealed costs or fees attached. Opening an account online is incredibly convenient, requiring just a few minutes of your time and a mere penny as an initial deposit.

Moreover, this account facilitates direct deposits and recurring transfers.

Due to its online-only nature, Citizens Access has streamlined the account opening process.

With a few simple steps, you can open an account within minutes, eliminating the need for extensive paperwork or in-person visits.

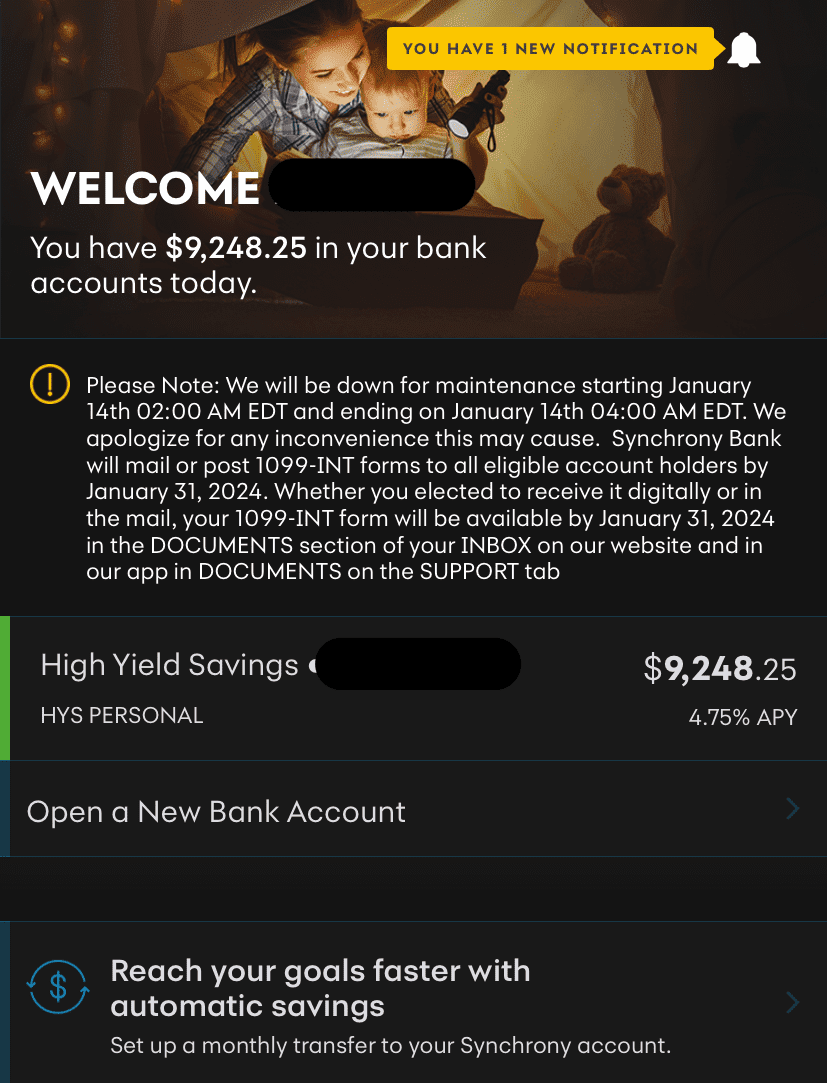

Synchrony High Yield Savings

Savings APY

Minimum Deposit

FDIC Coverage

Fees

The Synchrony High Yield Savings account is packed with features designed to benefit savers. With strong rates, it offers some of the best savings rates available.

What sets it apart is the absence of minimum balance requirements, allowing you to open an account with no restrictions and access the standard rate without maintaining a specific balance.

For convenience, the optional Synchrony ATM card provides free access to ATMs displaying an Accel or Plus logo, with Synchrony covering up to $5 per month for domestic ATMs.

Furthermore, the account comes with no maintenance fees, eliminating any worries about unexpected charges.

Unlike many online savings accounts, Synchrony offers multiple withdrawal methods, providing flexibility in accessing your funds.

Additionally, a helpful savings goal calculator is available to assist in planning and staying motivated towards reaching specific savings targets.

Online Bank Savings Account: Things To Consider

Besides rate and minimum deposit, when choosing an online banking service that is less popular compared to the significant, well-known online banks such as Marcus or Discover, there are some essential things to take into account:

- Account Accessibility: Evaluate the ease of accessing your funds. Ensure the online bank provides convenient options for withdrawals, such as online transfers or ATM access, to meet your needs.

- Customer Service and Support: Consider the quality of customer service provided by the online bank. Look for accessible customer support channels, such as phone, email, or live chat, to address any concerns or issues that may arise.

- Online Banking Features: Assess the online banking platform's functionality. Compare banking mobile apps, bill payment, and budgeting tools can enhance your banking experience and simplify financial management.

- Reviews and Reputation: Read customer reviews and check the online bank's reputation to gauge the experiences of other users. Look for positive feedback regarding reliability, customer service, and overall satisfaction.

- Account Integration: If you have accounts with other financial institutions, check whether the online bank allows easy integration or linking of external accounts for seamless transfers and consolidated financial tracking.

Savings Calculator: Find Your Growth

[elementor-template id=”184936″]

FAQs

Can I open multiple online bank savings accounts?

Yes, you can open multiple online bank savings accounts, either with the same bank or different ones, to allocate funds for specific goals or purposes.

Do online bank savings accounts offer additional perks or benefits?

Some online banks may offer additional perks such as fee reimbursements for using out-of-network ATMs, free checks, or discounts on other financial products. Explore the specific benefits offered by different banks.

Can I deposit cash into my online bank savings account?

Online banks typically don't have physical branches, making cash deposits more challenging. However, some online banks provide alternative solutions, such as depositing cash through partnered ATMs or utilizing money transfer services.

Can I open an online bank savings account if I have bad credit?

Yes, online bank savings accounts are generally accessible to individuals with various credit backgrounds. They don't typically perform credit checks since they are savings accounts, not credit-based products.

Can I earn rewards or cashback with an online bank savings account?

Generally, online bank savings accounts focus on providing competitive interest rates rather than rewards or cashback programs. However, it's worth exploring specific banks such as Upgrade or SoFi to see if they offer any additional incentives.