PNC and Huntington Bank both offer various banking products, but which one is a better fit for you? Let's take a closer look at both in this article to help you decide.

Checking Accounts

There is no clear winner when it comes to checking accounts, as both Huntington and PNC offer various accounts for different purposes.

-

Account Types

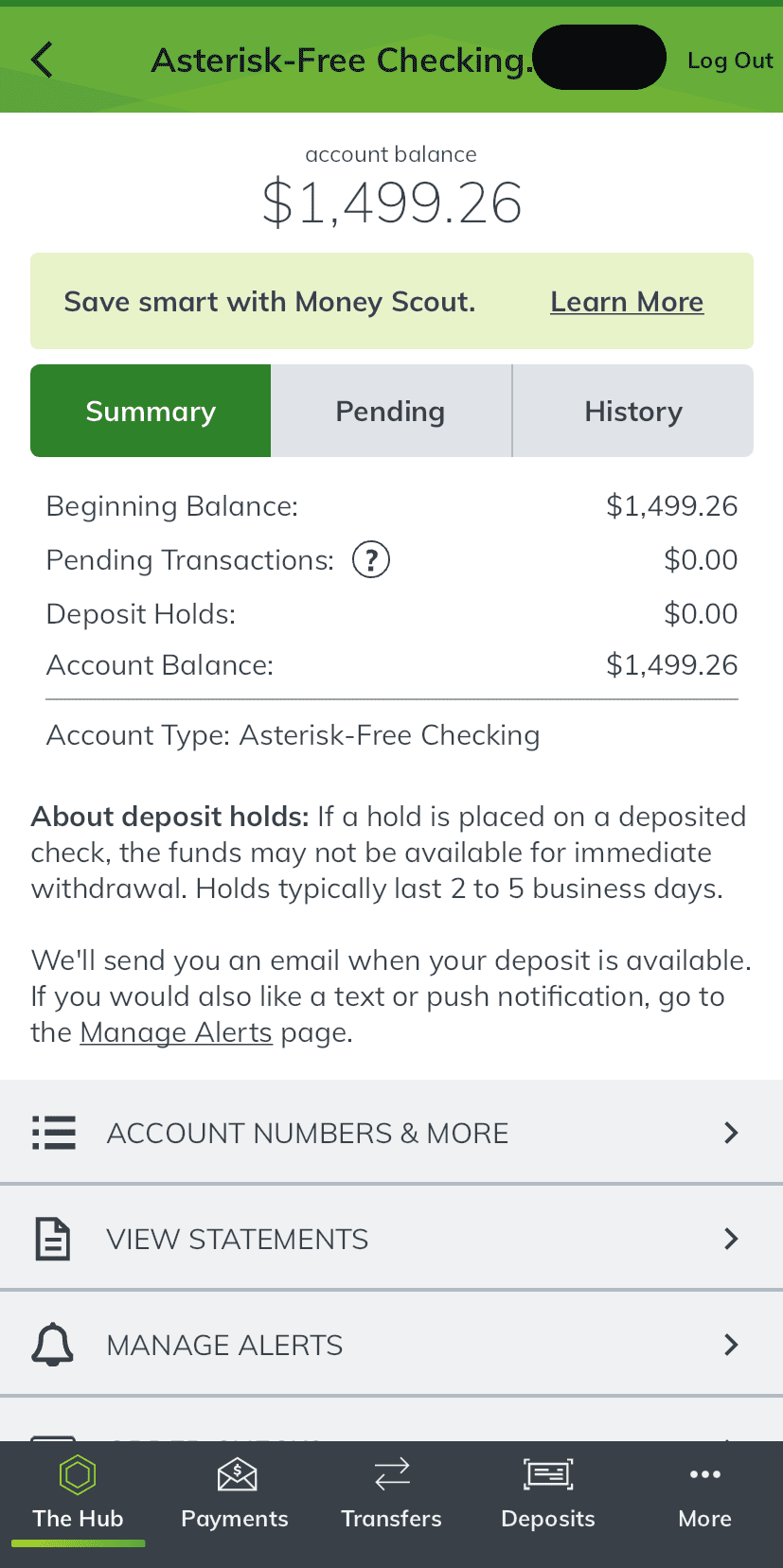

Huntington Bank has different kinds of checking accounts. There's the Asterisk-Free Checking, which is a simple account without monthly fees.

Then, there's the Huntington Platinum Perks Checking and Huntington Perks Checking, which give you interest rates and extra benefits. But, these accounts may have monthly fees, although you can avoid them in a couple of ways.

Huntington Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Huntington Asterisk-Free | $0 | N/A |

Huntington Perks Checking | $10 | $5,000 |

Huntington Platinum Perks | $25 | $25,000 |

Huntington SmartInvest | $0 | $100,000 |

PNC Bank's Virtual Wallet offers a comprehensive digital banking experience, combining Spend (primary checking), Reserve (secondary checking for short-term planning), and Growth (long-term savings) accounts.

Customers can choose from three tiers – Virtual Wallet, Performance Spend, and Performance Select, each offering varying benefits.

PNC Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Virtual Wallet Performance Select Checking | $25 | $5,000 |

Virtual Wallet Performance Checking | $15 | $2,000 |

Virtual Wallet Standard Checking | $7 | $500 |

Foundation Checking

| $5 | Can't be waived |

-

Features

Huntington Bank offers a range of perks across its checking accounts, enhancing the overall banking experience for customers.

For the Platinum Perks account, these include discounts on mortgages and home equity loans, identity monitoring services add an extra layer of security and unlimited free checks, and waived ATMs fees contribute to cost savings.

Additional perks of all accounts encompass modern banking conveniences such as Zelle for easy money transfers, Early Pay for quicker access to funds, and comprehensive online and mobile banking services.

Huntington Account | Main Features |

|---|---|

Huntington Platinum Perks | Mortgage discounts, unlimited free checks and ATMs fees |

Huntington Perks Checking | 5 free non-Huntington withdrawals, interest bearing, Relationship rates |

Asterisk-Free Checking

| Zelle, Early Pay, mobile banking, $50 Safety Zone and 24-Hour Grace |

Huntington SmartInvest

| Credit Score & Identity Monitoring, speical rates, investing, unlimited free checks and ATMs fees |

PNC's Virtual Wallet offers a range of features, including Zelle for easy money transfers, spending analysis tools, and the ability to set savings goals. Account holders may also enjoy reimbursements for select non-PNC ATM fees and benefit from higher relationship interest rates.

PNC's Foundation Checking account provides convenient mobile banking services, waives overdraft fees, and offers complimentary cashier checks.

PNC Checking Account | Main Features |

|---|---|

Virtual Wallet Performance Select | No PNC charges for using other banks' ATMs or domestic wires |

Virtual Wallet Performance | Reimbursements for some non-PNC ATM fees, higher relationship interest rates |

Virtual Wallet Standard | Zelle, spending analysis, savings goals |

Foundation Checking

| Mobile banking, no overdraft fee, free cashier checks, debit card |

Savings Accounts

PNC high-yield savings accounts is our winner as it offers much higher rates compared to Huntington Bank savings account.

Huntington Bank provides a savings account, but the rate is very low. Yet, the Relationship Money Market Account from Huntington stands out, offering a more attractive interest rate

Huntington Bank Savings | Huntington Money Market | |

|---|---|---|

Savings Rate | 0.01% – 3.03% | 0.00% / 0.25% / 3.45%

|

Minimum Deposit | $0 | $25,000 |

Fees | $10

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $2,500

| $25

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $25,000

|

On the other hand, PNC offers a High Yield Savings account exclusively for eligible customers, featuring a competitive online-only rate and no required minimum deposit.

Additionally, PNC provides a Premiere Money Market account with tiered rates based on balance and eligibility for relationship rates. This account allows unlimited deposits and includes a debit card for account holders.

PNC Savings | PNC Money Market | |

|---|---|---|

Savings Rate | 0.01% – 0.03% | 0.04% – 0.05% |

Minimum Deposit | $0 | $1 |

Fees | $0 | $12

Can be waived if you maintain a minimum daily balance of $5,000

|

Certificate Of Deposits (CDs)

When it comes to CDs, Huntington Bank is our winner. Both banks offer high rates only on promotional, special terms – but Huntington Bank offers more terms with high CD rates than PNC Bank.

-

Huntington CD Rates

Term | Huntington Bank CD Rates |

|---|---|

5 Month | 3.82% |

9 Month | 0.50% – 3.05% |

Minimum Deposit | $1,000 |

-

PNC CD Rates

CD Term | APY |

|---|---|

7 Months (Featured) | 0.01% / 3.70%

|

12 Months | 0.01% – 0.03% |

13 Months (Featured) | 0.01% – 2.00% |

19 Months (Featured) | 0.01% – 2.10% |

24 Months | 0.01% – 0.03% |

25 Months (Featured) | 0.01% – 2.20% |

24 Months | 0.01% – 0.03% |

37 Months (Featured) | 0.01% – 2.40% |

36 Months | 0.01% – 0.03% |

61 Months (Featured) | 0.01% – 2.60% |

Credit Cards

PNC Bank is our winner when it comes to credit cards, as it offers more enticing options, higher rewards, and a secured card.

PNC Bank offers a couple of rewards credit cards, including cash back and points rewards, as well as secured cards and long 0% intro APR cards.

Unlike Bank Of America, PNC doesn't offer a premium credit card, and its redemption options are limited compared to the BofA credit card options.

Card | Rewards | Bonus | Annual Fee |

| PNC Cash Unlimited Visa Signature Credit Card | 2%

unlimited 2% cash back on every purchase | 0% Intro APR: 12 billing cycles on purchases and balance transfers | $0 |

|---|---|---|---|---|

| PNC Cash Rewards Visa Credit Card | 1% – 4%

4% on Gas station purchases, 3% on Restaurant and 2% on Grocery store (for the first $8,000 in combined purchases in these three categories) and 1% cash back on all other purchases | $250

$200 cash back after you make $1,000 or more in purchases during the first 3 billing cycles following account opening | $0 |

| PNC points Visa Credit Card | 4x – 7x

4 points per $1 on purchases + 25% / 50% /75% bonus on all base points for PNC customers | 100,000 bonus points

Earn 100,000 bonus points after you have made at least $1,000 in purchases during the first 3 months following account opening. | $0 |

| PNC Core Visa Credit Card | N/A | 0% Intro APR: 15 billing cycles on purchases and balance transfers | $0 |

| PNC Secured Visa credit card | N/A | N/A | $0 |

Huntington Bank offers a selection of credit cards with features like cash back rewards and low APRs.

Card | Rewards | Bonus | Annual Fee |

| Huntington Cashback Credit Card

| 1x – 3x

3x reward points (3% cash back) when you use your credit card to make a purchase in your category of choice, up to $2,000 in spend per quarter, 1x on all other purchases | N/A | $0 |

|---|---|---|---|---|

| Huntington Voice Rewards Credit Card | 1x – 3x

3x reward points (3% cash back) when you use your credit card to make a purchase in your category of choice, up to $2,000 in spend per quarter, 1x on all other purchases | N/A | $0 |

| Huntington Voice Credit Card | N/A | N/A | $0 |

| The Ohio State Voice Credit Card | $100

$100 when you spend $1,000 within the first 60 days after account opening. For the Cashback Card, you will receive $100 cash bonus, which can be redeemed for a $100 statement credit or direct deposit. For the rewards card, you will receive 10,000 bonus points which can be redeemed for a $100 statement credit or direct deposit. For the lower rate card, you will receive a $100 statement credit | N/A | $0 |

Mortgage And Loans

When it comes to borrowing money, PNC Bank is our top choice because they offer a wider range of options compared to Huntington Bank.

PNC provides a variety of borrowing choices to meet different financial needs. They offer mortgage options for buying homes or refinancing, home equity lines of credit, loans for building or buying property, auto loans for vehicle financing, and personal loans for general financial needs.

PNC goes even further by offering Student Loans and Student Loan Refinancing to help with education expenses. This comprehensive range of borrowing options caters to various life stages and financial goals.

On the flip side, Huntington focuses on mortgages for homebuyers, mortgage refinancing, home equity loans, personal loans, and car financing for both new and used vehicles.

Which Bank Is Our Winner?

Overall, PNC is our winner in this competition. It has a better full banking package than Huntington Bank, including options for checking, decent savings rates, and better credit card options.

However, deciding which one is best for you means thinking about what you need, such as banking services, help with overdrafts, how easy it is to use ATMs, and how close the bank is to you. People care about different things, so it's important to take your time and figure out what's most important to you before making a choice.

Our Methodology for Comparing Banks

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.

Compare PNC With Other Banks

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

While PNC offers better savings rates than U.S. Bank, the latter has better credit cards. Which is best for bank account? Here's our verdict: U.S. Bank vs. PNC Bank

PNC Bank and Fifth Third Bank are two big players when it comes to brick-and-mortar banking. Let's compare them and see which is our winner: PNC Bank vs. Fifth Third Bank

We prefer PNC Bank over M&T, mainly due to higher savings and money market account rates and better credit cards. Here's our comparison: PNC Bank vs. M&T Bank

Our winner is PNC Bank as it offers more options for checking and higher savings rates than Truist bank. Here's our comparison: Truist Bank vs. PNC Bank

Both KeyBank and PNC Bank are active in various states, such as Pennsylvania, Indiana, Ohio, and more. Let's compare their banking products.

While the differences are insignificant, our winner is PNC Bank, which has better options than BMO Bank. Here's our complete comparison: PNC Bank vs. BMO Bank

PNC and Regions Bank operate in several states, including Florida, Georgia, Kentucky, and South Carolina. Let's compare them side by side: Regions Bank vs. PNC Bank

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

While PNC Bank is a brick-and-mortar bank, American Express Bank's is an online bank. Let's compare their banking products side by side: American Express Bank vs. PNC Bank

PNC Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Compare Huntington Versus Other Banks

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

There is no clear winner when comparing Huntington and U.S. Bank , but if we have to pick one – Huntington is our first choice. Here's why: U.S. Bank vs. Huntington Bank

Huntington and Fifth Third Bank provide various banking services, and figuring out which is best can be tricky. Here's our comparison: Fifth Third Bank vs. Huntington Bank