This article will explore an in-depth comparison of savings accounts, checking accounts, CDs, credit cards, and lending products offered by Wells Fargo and M&T Bank.

Checking Accounts

There is no clear winner between M&T Bank and Wells Fargo bank accounts.

Both banks have options for basic, mid-level, and premium customers, but they don't have many account choices for special groups like seniors or kids.

-

Account Types And Fees

M&T Bank offers four main types of checking accounts, such as the EZChoice checking for basic needs, MyChoice Plus for more features and benefits and MyChoice Premium for premium perks such as waived fees for multiple banking activities:

M&T Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

M&T Bank EZChoice Checking | $0 | N/A |

M&T Bank MyChoice Plus | $14.95 | $2,500 |

MyWay Banking from M&T | $4.95 | Single monthly deposit/withdrawal/debit payment |

M&T Bank MyChoice Premium | $24.95 | $7,500 |

Wells Fargo has different personal checking accounts for people. There's Clear Access Banking with lower fees, Everyday Checking, which is the standard choice, and Prime Checking and Premier Checking for those who want extra features.

Although there are monthly fees, customers can avoid them in different ways:

Wells Fargo Checking Account | Monthly Fee | Average Balance To Waive Fees |

|---|---|---|

Clear Access Banking | $5 | Only if you're under 24 |

Everyday Checking | $10 | $500 |

Prime Checking

| $25 | $20,000 (Combined with deposits) |

Premier Checking | $35 | $250,000 (Combined with deposits) |

-

Features

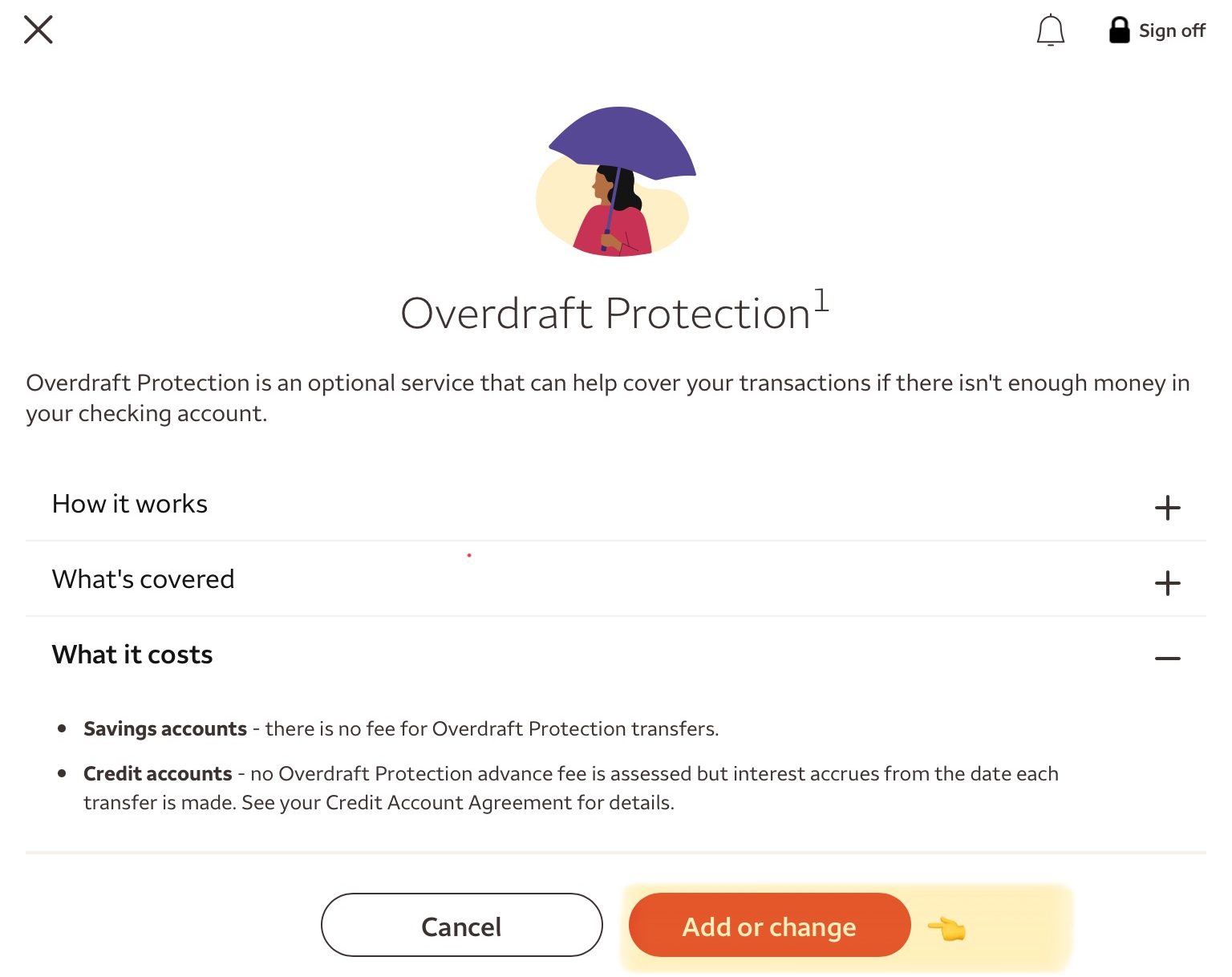

Wells Fargo's simple account comes with great perks to make banking better. Get your money before the usual payday with Early Pay Day. Manage your money online with easy online and mobile banking.

If you want more from your bank, Wells Fargo's premium accounts have cool features. Earn interest on your balance with interest-bearing accounts. Enjoy extras like free checks, no fees for using non-Wells Fargo ATMs, priority customer service, and waived fees for money orders, cashier checks, and international debit card purchases.

Wells Fargo Account | Main Features |

|---|---|

Clear Access Banking | No overdraft fees, Early Pay Day |

Everyday Checking | Overdraft Services, check writing, Early Pay Day |

Prime Checking

| Interest-bearing, free check orders, free Non-Wells Fargo ATM withdrawals |

Premier Checking | priority customer service, No fees on money orders/cashier checks/International debit card purchase |

M&T Bank's Basic Checking Account gives you handy features like online and mobile banking, M&T Alerts, access to 2,000 ATMs and 900 branches, and a debit card.

Customers can upgrade to the Premium Checking Account for even more convenience. You get all the Basic account benefits, plus extra perks like no fees at non-M&T ATMs, the ability to earn interest, easy check handling with Mobile Deposit, an M&T Debit Card, no fees for using non-M&T ATMs, free standard check orders, and special deposit rates.

M&T Bank | Main Features |

|---|---|

M&T Bank EZChoice Checking | Online & mobile banking, alerts, 2,000 ATMs, 900 branches, debit card |

M&T Bank MyChoice Plus | No Fee at non-M&T ATMs, Interest-bearing, mobile deposit, debit card |

MyWay Banking from M&T | No overdraft fees, online and mobile bill pay, checkless account |

M&T Bank MyChoice Premium | No fee at non-M&T ATMs, free check orders, special deposit rates |

Savings Accounts

Wells Fargo is our winner when it comes to savings account as it offers higher rates than M&T Bank.

Wells Fargo has two main savings account options – Way2Save Savings and Platinum Savings, and a kids' savings account. Although Way2Save Savings has a low APY, the Platinum Savings plan offers a higher rate. However, to access the highest rate, you'll need more than $1 million in your account.

Also, neither Wells Fargo nor M&T Bank offers a money market account.

M&T Bank Savings | Wells Fargo Platinum Savings | |

|---|---|---|

Savings Rate | 0.01% | 0.01% – 2.51% |

Minimum Deposit | $0 | $25 |

Fees | $7.5

Can be waived if you maintain a minimum daily balance of $500 or more or have a personal checking account with M&T Bank or by making at least one deposit in your Relationship Savings account

| $5

can be waived by maintaining a $300 minimum daily balance, one qualified automatic transfer, one or more Save as You Go transfers from your Wells Fargo checking account. Primary account owners age 24 or younger are exempt from the fees

|

Certificate Of Deposits (CDs)

For CDs, Wells Fargo comes out on top.

Both M&T Bank and Wells Fargo have higher rates, but it's important to note that these rates are only for promotional terms. Although the rates are pretty close, Wells Fargo provides more choices compared to M&T Bank.

-

M&T Bank CD Rates

M&T CDs | |

|---|---|

Select CD 6 Month | 3.80% |

Select CD 12 Month | 3.00% |

Regular CD 6 Month | N/A |

Minimum Deposit | $1,000 |

-

Wells Fargo CD Rates

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

7 Months | 3.64% – 3.90%

| 3 months interest |

11 Months | 4.50% – 4.76% | 3 months interest |

3 Months | 1.50% – 1.51% | 1 month interest |

6 Months | 1.50% – 1.51% | 3 months interest |

12 Months | 2.00% – 2.01% | 6 months interest |

Top Offers From Our Partners

![]()

Credit Cards

Wells Fargo wins when it comes to credit cards. It has a more diverse portfolio of credit cards and better redemption options than M&T Bank.

Wells Fargo provides different credit cards to suit various needs. If you prefer getting cash back, the Wells Fargo Cash Wise Visa Card is a good option, offering unlimited cash back on your purchases along with a cash rewards bonus. For those who spend on everyday items and travel, the Wells Fargo Autograph Card is designed for you. If you're looking for a card with a 0% introductory APR, the Reflect card is the best choice.

Additionally, Wells Fargo offers the Choice Privileges Mastercard, which allows you to earn points for staying at specific Choice Hotels. Moreover, you can also accumulate points for purchasing gas, groceries, home improvement items, and phone plans with this card.

Card | Rewards | Bonus | Annual Fee |

| Wells Fargo Active Cash Card

| 2%

2% cash rewards on purchases (unlimited)

| $200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

| $0 |

|---|---|---|---|---|

| Wells Fargo Autograph Card | 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months – that's a $200 cash redemption value.

| $0 |

| Wells Fargo Reflect Card | N/A | 0% Intro APR: 21 months on purchases and balance transfers | $0 |

| Wells Fargo Bilt Mastercard | 1x – 3x

3X points on dining, 2X points on travel and 1X points on rent payments without the transaction fees and other purchases

| N/A | $0 |

| Wells Fargo Choice Privileges Mastercard | 1x – 5x

5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | 40,000 points

40,000 bonus points when you spend $1,000 in purchases in the first 3 months – enough to redeem for up to 5 reward nights at select Choice Hotels® properties.

| $0 |

| Wells Fargo Choice Privileges Select Mastercard | 1x – 10x

10X points on stays at participating Choice Hotels® properties plus on Choice Privileges point purchases, 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | N/A | $95 |

M&T Bank offers credit cards with varying features, including cash rewards and low introductory APR. The M&T Visa Signature Credit Card is notable for its rewards program and benefits.

However, the rewards plan and redemption options are limited compared to Wells Fargo's offering through their Wells Fargo Rewards Program.

Card | Rewards | Bonus | Annual Fee |

| M&T Visa Signature Credit Card

| 1.5%

1.5% cash back on every purchase | 10,000 points

10,000 bonus points ($100 value) after $500 in purchases made in the first 90 days from account opening.

| $0 |

|---|---|---|---|---|

| M&T Visa Credit Card with Rewards | 1x

1 point per $1 spent on every purchase | 10,000 points

10,000 bonus points after $500 in purchases made in the first 90 days from account opening | $0 |

| M&T Visa Credit Card | N/A | 0% Intro APR: 12 billing cycles on balance transfers and purchases | $0 |

| M&T Secured Credit Card | N/A | N/A | $0 |

Mortgage And Loans

M&T Bank is our top choice for loans because it provides more borrowing options than Wells Fargo.

M&T Bank stands out in the market, especially in mortgages and home equity loans. They offer various types of mortgages, like fixed-rate and adjustable-rate mortgages, catering to individual preferences. M&T Bank also provides auto loans, personal loans, and student loans, which are not offered by Wells Fargo.

Wells Fargo has similar loan options, including mortgages, mortgage refinancing, and home equity loans. They also offer personal loans for consolidating debt, auto purchase loans, and auto refinancing.

Which Bank Is Our Winner?

Wells Fargo is our winner, mainly due to more credit card options and decent checking features, including premium accounts. M&T Bank is best for borrowers. Unfortunately, none of these banks are great for savers as they offer limited CDs with high rates and lower-than-usual savings account rates.

However, it is crucial to assess various factors, primarily focusing on those significant for your specific considerations, such as banking services, overdraft assistance, frequent ATM usage, proximity to bank locations, and other elements that vary from person to person.

Understanding Our Banking Comparison Methodology

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.

Compare Wells Fargo With Other Banks

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

Both Ally and Wells Fargo have a fairly impressive banking product lineup that would make switching from a traditional high street bank simple.

Ally offers CDs, auto loans, mortgages, investments, and retirement products in addition to checking and savings. The only glaring omission in the lineup is the absence of a credit card.

Wells Fargo's product lineup is even more impressive. Checking and savings accounts, mortgages, loans, and a variety of investment options such as IRAs, 401ks, and wealth management services are all available.

Read Full Comparison: Ally vs Wells Fargo: Which Bank Account Is Better For You?

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

Wells Fargo offers a diverse range of banking services. Checking accounts, savings accounts, loans, mortgages, wealth management solutions, and investment options such as 401ks and IRAs are all available. Flagstar also offers a diverse product portfolio that includes a variety of checking and savings accounts, investments, home loans, and loans and investments.

It is important to note, however, that Flagstar does not operate in all states. This bank only operates in Michigan, California, Ohio, Indiana, and Wisconsin, where it has 150 branches. As a result, if you live outside of these areas, you may be unable to use Flagstar's banking services.

Read Full Comparison: Wells Fargo vs Flagstar: Which Bank Is Better For You?

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead. Here's why.

Wells Fargo offers better savings rates than Truist Bank, more selection for checking accounts and better credit cards. Here's our comparison: Truist Bank vs. Wells Fargo Bank

While Wells Fargo Bank and Citizens Bank offer a range of banking services, Wells Fargo is our winner in this competition. Here's why.

Wells Fargo Bank vs. Citizens Bank : Which Bank Account Is Better?

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

BMO has great options for checking accounts, and outshines Wells Fargo with higher savings rates. But is it our winner? See our comparison: Wells Fargo vs. BMO Bank

We'll explore Wells Fargo and Regions Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Wells Fargo vs. Regions Bank

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.