Table Of Content

Switching to a new bank can seem like a daunting task, but it's actually a straightforward process that can offer a range of benefits. Whether you're looking for better interest rates, improved customer service, or simply want to switch to a bank that aligns with your values, changing your bank account can be a positive move.

In this article, we'll explore the steps involved in switching bank accounts, including how to compare different banks, the paperwork you'll need, and tips for a smooth transition.

1. Research Your New Bank Or Credit Union

Researching banks is the first step when switching bank accounts. Without proper research, you may end up with a bank that doesn't offer the features or services you need, or that charges high fees or offers low interest rates.

Researching allows you to compare the different options available and find the bank that best meets your needs before your close the old one.

Here's how to research banks wisely:

Identify your priorities: Before you start researching banks, consider what's most important to you. This might include interest rates, fees, customer service, branch locations, or mobile banking features.

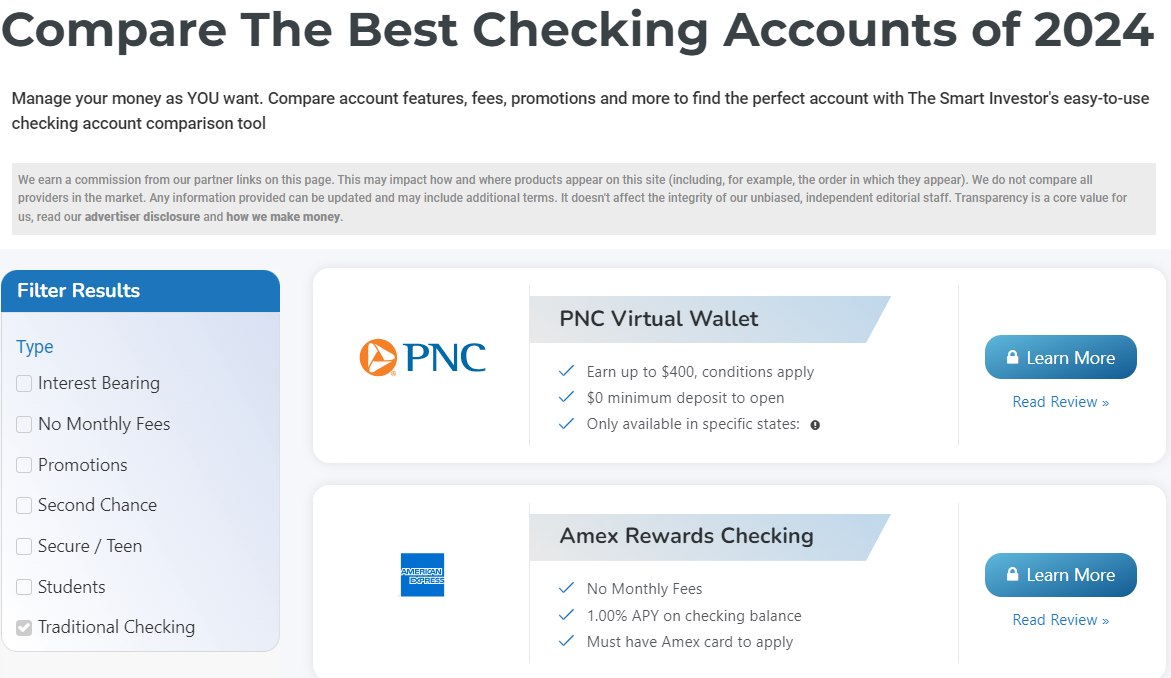

Use online resources to compare: There are a variety of online resources available to help you compare banks. If you have a large deposit, you can also compare savings accounts and CDs. Many comparison tools allow you to breakdowns by the preferred account type for your needs such as free checking accounts, interest-bearing accounts, or online-only banks.

- Look at bank promotions: Banks often offer promotions to entice new customers, such as cash bonuses for opening a new account or waiving fees for a certain period of time.

Talk to friends and family: Don't underestimate the power of word of mouth. Ask friends and family about their experiences with their banks, and whether they would recommend them.

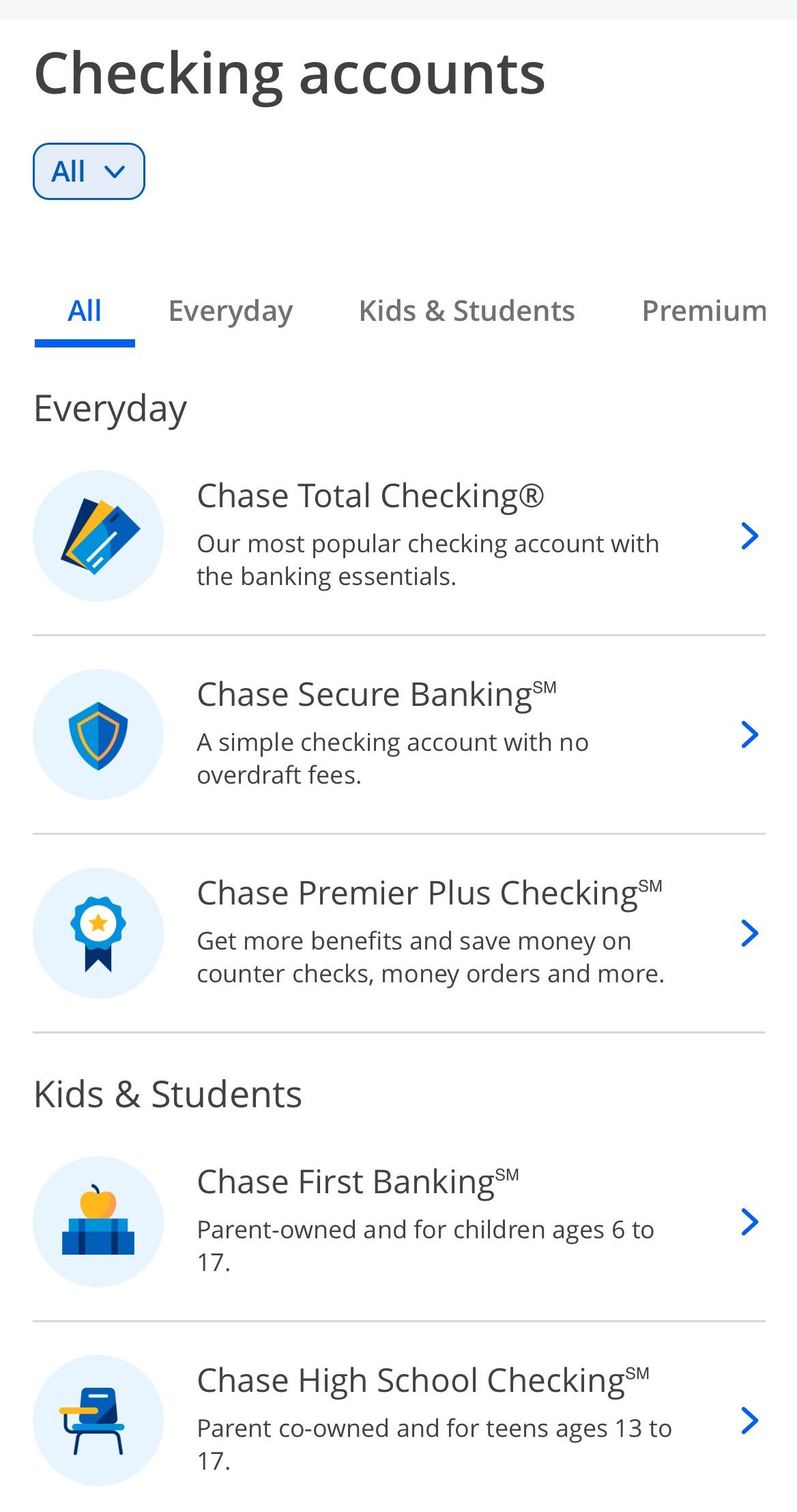

For example, if you're looking for a bank with strong mobile banking features, you might compare options like Ally Bank, Chime, and Discover Bank. Alternatively, if you're interested in traditional banks, you can consider Chase, Bank Of America or Citi.

Account | Monthly Fee | Savings APY | CDs APY |

|---|---|---|---|

$0 | 3.70% | 3.50% – 4.00% | |

$0 | 3.60% | 2.90% – 4.00% | |

$12

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| 0.01% | 0.02% – 4.00% | |

$0 | up to 3.80% | N/A | |

$0 | 3.70% | Up to 4.00% | |

$10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| 0.26% – 2.51% | 0.01%- 4.00% | |

$12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| 0.01% – 0.04% | 0.03% – 4.00% | |

$10

Can be waived if you have monthly direct deposits of at least $500 or you maintain a daily balance of at least $500

| 2.90% | 2.70% – 4.70% |

2. Open Your New Bank Account

Once you have researched banks and found the right one for your needs, the next step when switching bank accounts is opening a new one. Here's how to do it:

Choose a bank: Based on your research, choose a bank that meets your needs and priorities.

Gather required documents: You'll typically need to provide government-issued identification, proof of address, and other financial information like your social security number or tax ID number.

3. Apply for an account: You can apply for an account online or in person at a branch. Make sure you review the account terms and conditions carefully and understand any fees or minimum balance requirements.

4. Fund your account: If the new account require a minimum deposit, it's time to send it over to make sure you can start using your new account.

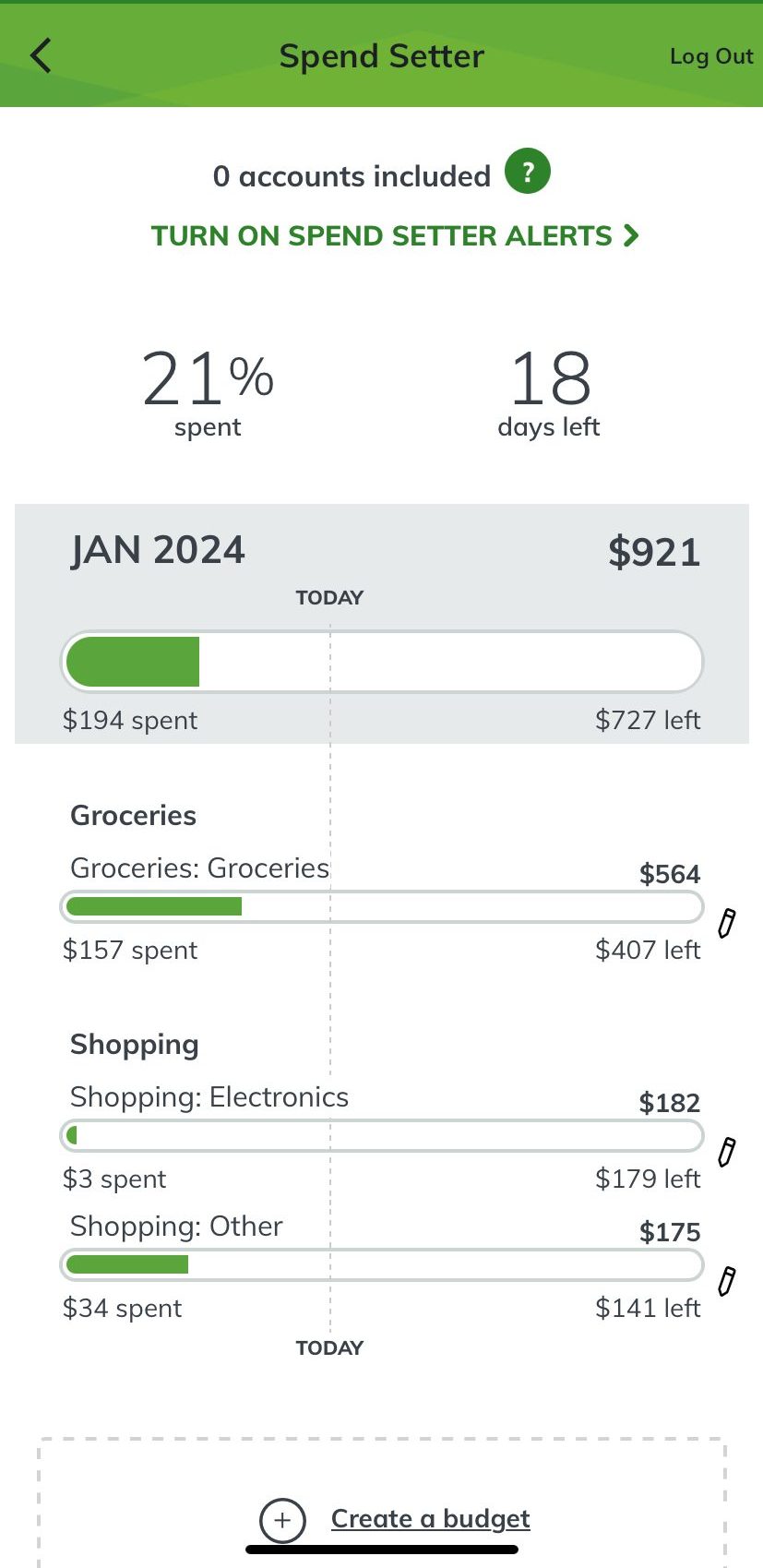

3. Get Used To Your New Bank Account

Before fully switching to your new bank account, it's important to get used to the new bank and its features. This can help you avoid any potential issues and make sure that the bank meets your needs. Here's how to do it:

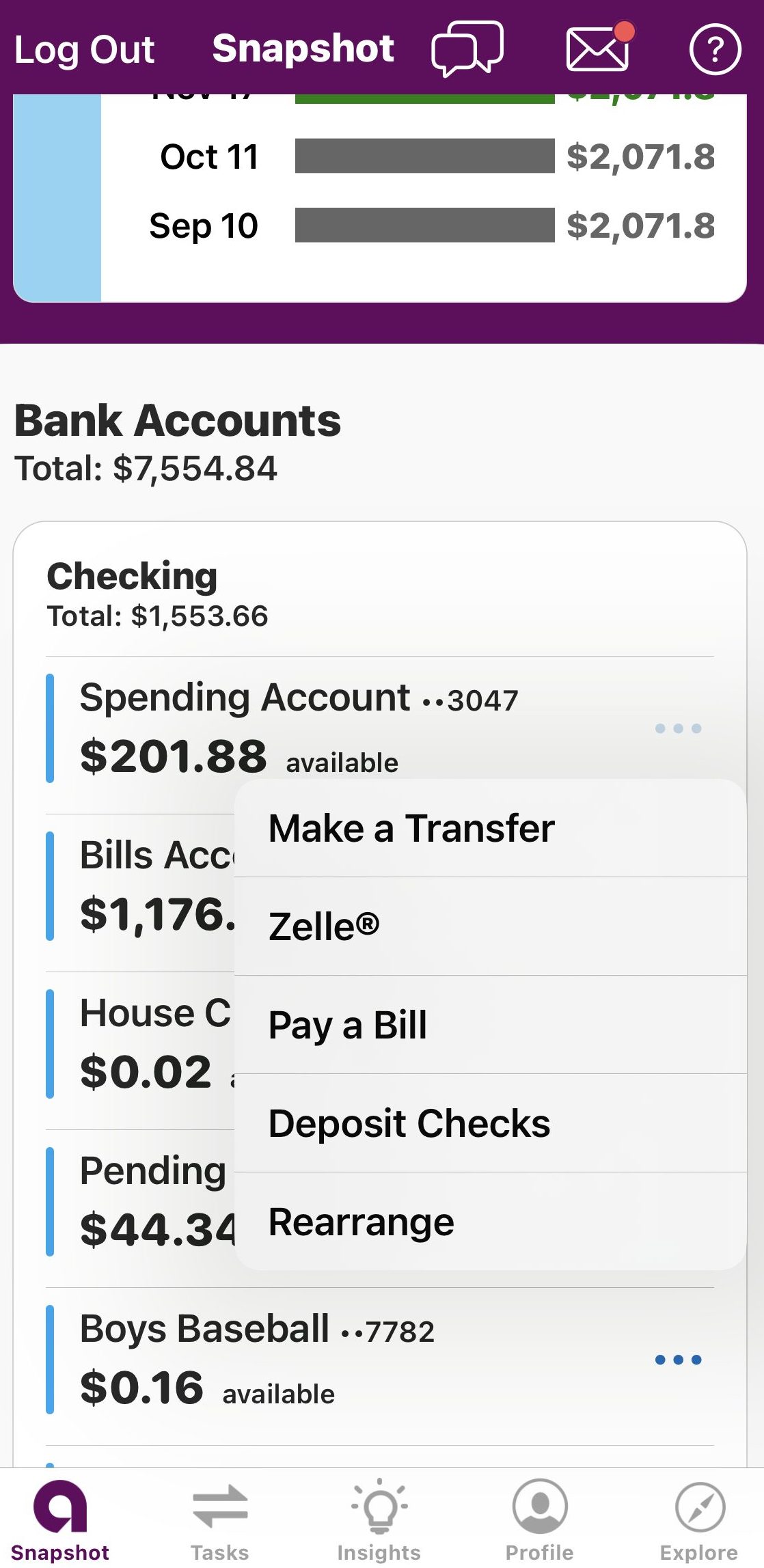

Familiarize yourself with the bank's features: Spend some time exploring the bank's website or mobile app to learn about its features and services.

Make a few transactions: Test out the bank by making a few small transactions, such as transferring funds or paying a bill, to ensure that everything is working smoothly.

Monitor your account: Keep an eye on your account to ensure that all of your transactions are going through as expected and that there are no issues.

- Manage your account for a while: It's a good idea to manage your new account for at least a month or two before fully transitioning to ensure that it meets your needs and works well for you.

Consider reaching out to customer service: If you have any questions or concerns, don't hesitate to reach out to the bank's customer service department for assistance.

By taking the time to get used to your new bank and its features, you can ensure a smooth transition and avoid any potential issues.

4. Transfer Automatic Payments And Direct Deposits

The next step when switching bank accounts is to update your financial information and transfer your automatic payments and deposits to your new account. This step is crucial to ensure that all of your financial obligations continue uninterrupted. Here's how to do it:

Make a list of your automatic payments and deposits: Review the list you made earlier of your automatic payments and deposits and identify which ones need to be transferred to your new account.

Contact service providers: Notify your service providers, such as your employer, utilities, and subscription services, of your new bank account information.

Update automatic payments: Update your automatic payments with your new bank account information to ensure that your payments continue uninterrupted.

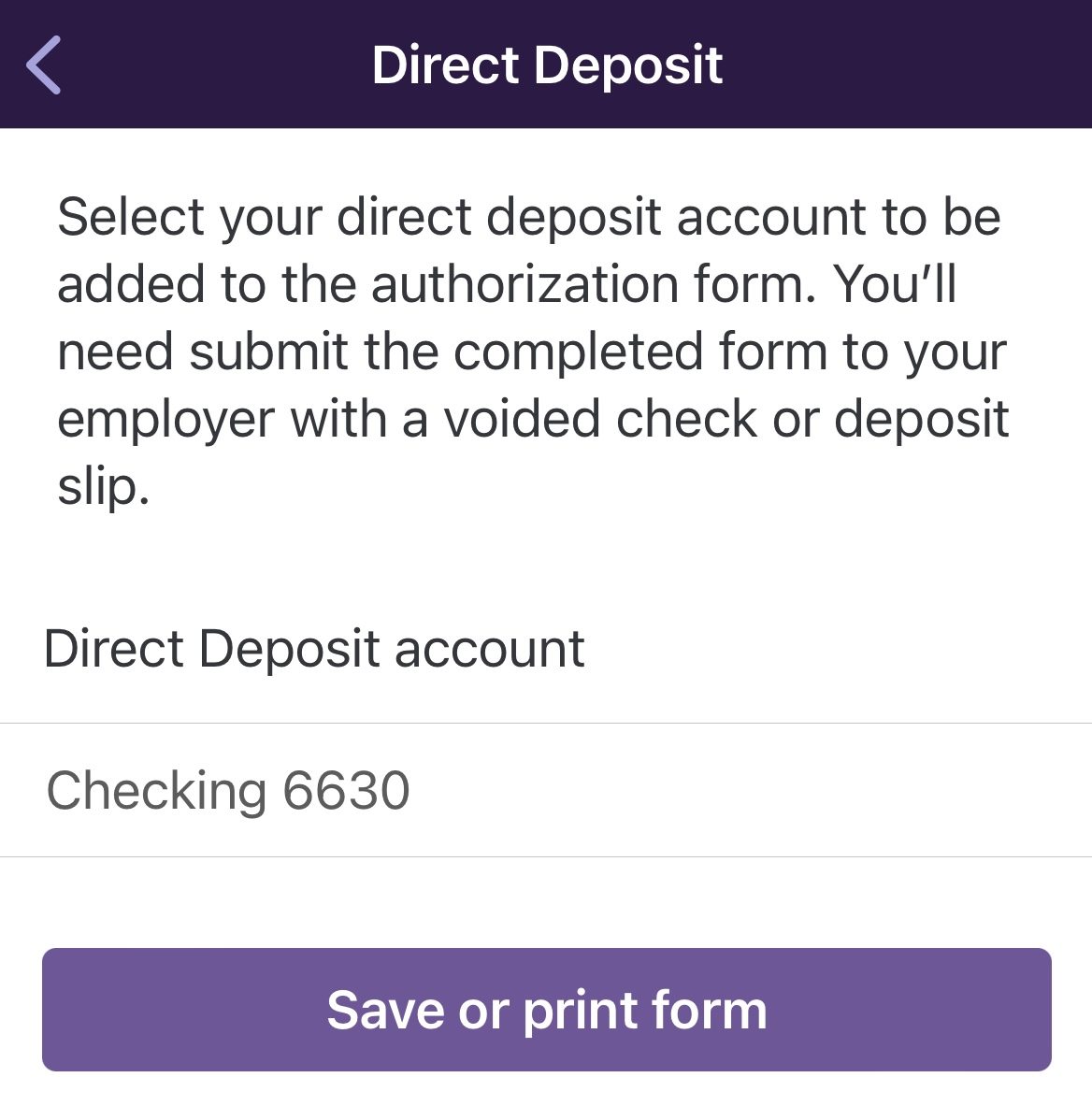

Update direct deposits: If you receive direct deposits, such as your paycheck, make sure to update your bank account information with your employer.

Monitor your accounts: Keep an eye on your accounts to ensure that all of your transactions are going through as expected and that there are no issues.

For example, if you have a monthly car loan payment that's automatically deducted from your bank account, you would need to update your payment information with your new bank to ensure that your payments continue uninterrupted.

Similarly, if you receive your paycheck via direct deposit, you'll need to notify your employer of your new bank account information.

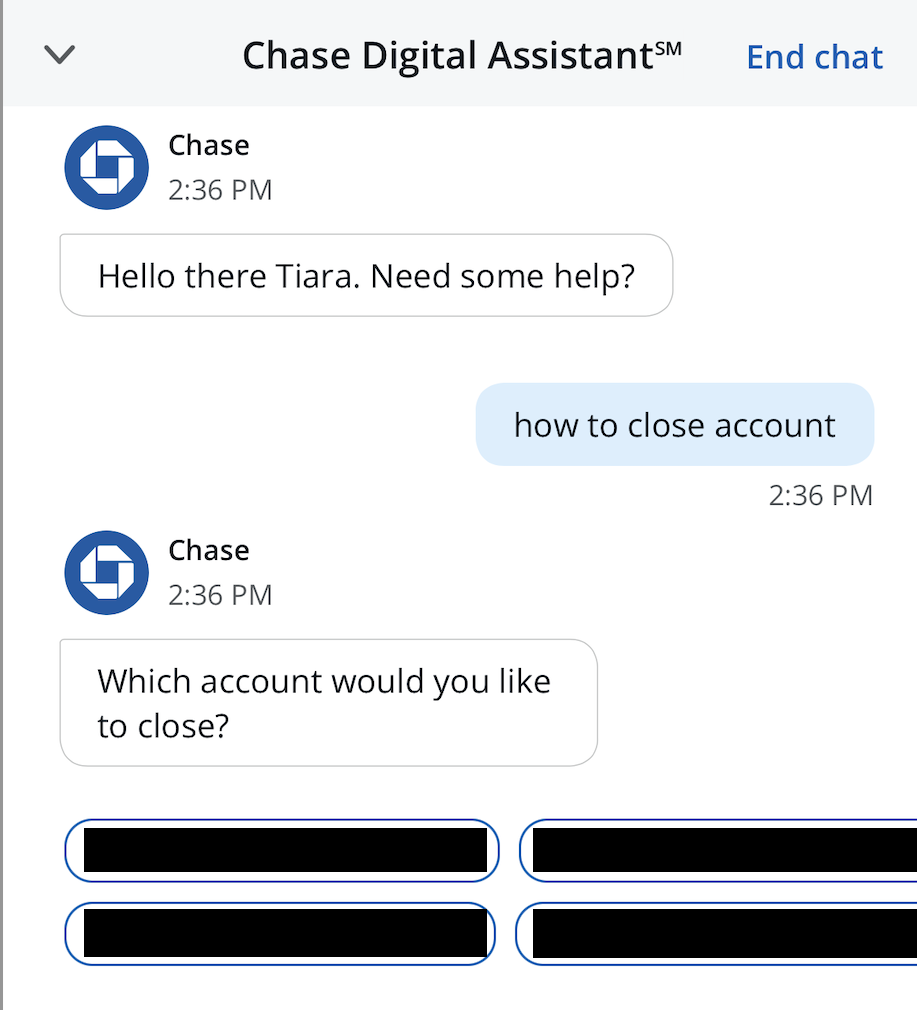

5. Close Your Old Bank Account

The final step when switching bank accounts is to close your previous account, but this step is not mandatory. If you need more time to get used to your new account or you're considering managing multiple bank accounts, you may want to keep your old bank account.

However, if you want to stay with a single account, it's time to close the old one.

Here's how to do it properly:

Verify all automatic payments and deposits have been transferred: Before closing your previous account, make sure that all of your automatic payments and deposits have been transferred to your new account.

Check for any outstanding balances or fees: Make sure that your previous account has a zero balance and there are no outstanding fees or charges.

Contact your bank: Contact your previous bank and inform them that you want to close your account. Follow their specific procedures for closing an account, which may include submitting a written request.

4. Confirm the account has been closed: Make sure to confirm with your previous bank that the account has been closed and there are no remaining balances or fees.

5. Destroy old checks and debit cards: Once your account is closed, destroy any old checks or debit cards associated with the account to prevent any potential fraud.

Should I Switch My Bank Account?

Switching your bank account to a new one have benefits, but also drawbacks to consider:

Pros | Cons |

|---|---|

Better Interest Rates | Inconvenience |

Lower Fees | Loss Of Established Relationships |

Improved Customer Service |

Possible Fees |

Access To New Features | Potential For Mistakes |

Cash Incentives |

- Better Interest Rates

Switching to a new bank account may offer the opportunity for better interest rates, which can help your savings grow faster.

- Improved Customer Service

A new bank account may offer lower fees or waive fees altogether, helping you save money on banking costs.

- Lower Fees

If you're not satisfied with the customer service at your current bank, switching to a new bank can provide better customer service and support.

- Access To New Features

A new bank may offer features like mobile banking or financial planning tools that your current bank does not.

- Cash Incentives

Some banks offer cash incentives for switching to a new account, providing an immediate financial benefit.

- Inconvenience

Switching bank accounts can be an inconvenient process, requiring you to update automatic payments and deposits and learn a new banking system.

- Loss Of Established Relationships

If you have a long-standing relationship with your current bank, switching to a new bank may mean losing that established relationship.

- Possible Fees

Some banks may charge fees for opening or closing an account, and transferring funds between accounts can also incur fees.

- Potential For Mistakes

With the numerous steps involved in switching bank accounts, there is potential for mistakes to occur that can have negative consequences, such as missed payments or overdraft fees.

How Long Does It Takes To Switch Bank Accounts?

The length of time it takes to switch bank accounts can vary depending on the specific circumstances, such as the banks involved, the type of accounts being switched, and the efficiency of the account transfer process. Generally, switching bank accounts can take anywhere from a few days to a few weeks.

The process of opening a new account and transferring funds can typically be completed within a few days, while updating automatic payments and deposits may take a bit longer. Depending on the specific service provider, it can take up to one billing cycle for your automatic payments to be updated with your new account information.

It's important to note that some banks offer expedited account transfer services, which can help speed up the process of switching bank accounts.

FAQs

Research different banks and consider factors like interest rates, variety of products, fees, customer service, and mobile banking features to choose the best bank account for your needs.

You'll typically need government-issued identification, proof of address, and other financial information like your social security number or tax ID number.

Yes, most banks offer the option to apply for a new account online.

You can transfer funds electronically, by setting up a direct deposit or by depositing a check.

Make a list of your automatic payments and deposits and contact your service providers to notify them of your new bank account information.

Yes, you can choose to keep your old bank account open, but it's recommended to close it to avoid confusion or potential issues.

Yes, you can switch bank accounts even if you have outstanding loans or debts, but you'll need to continue making payments as usual.

Yes, but you'll need to coordinate with the other account holder to ensure a smooth transition.

Some banks may charge fees for opening or closing an account, and transferring funds between accounts can also incur fees.