Table Of Content

What Is Your Bank Account Number?

Bank account numbers can help identify a specific bank institution or bank account.

Bank account numbers are unique numbers assigned to account holders once a consumer has a bank account. Bank account numbers are significant for both banks and account holders.

Ultimately, it identifies which account to withdraw money from or which account to deposit the money into. It is typically used for transactions through checks, account transfers, direct deposits, and direct payments.

Bank account numbers typically consist of eight to twelve digits. However, some accounts could be up to 17 digits. These numbers are entirely randomized and are unique to each person. Furthermore, you cannot choose the numbers, they are picked for you.

Where Can I Find My Bank Account Number

Despite what many people may think, finding your bank account number is a relatively simple process that is similar across almost all financial institutions.

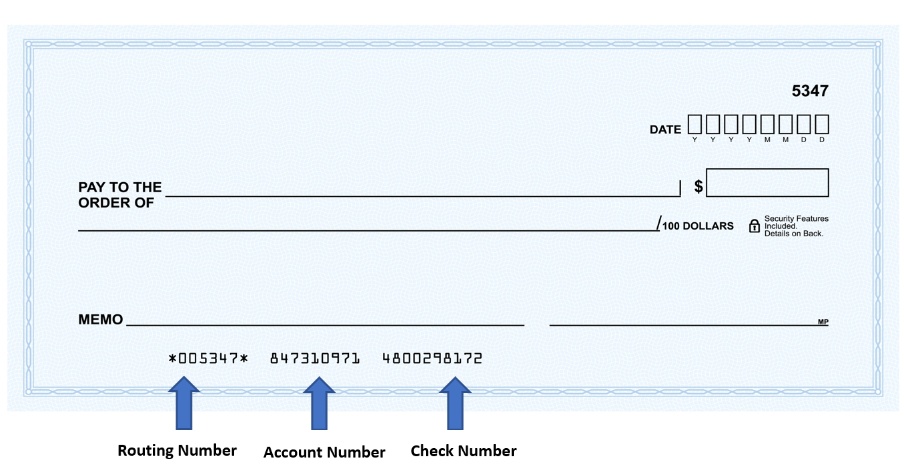

1. Check

If you have a checkbook, you are able to locate your account number right on the check. There are a few series of numbers on the bottom of the check.

The bottom left would refer to the routing number, the second set of numbers would refer to your account number.

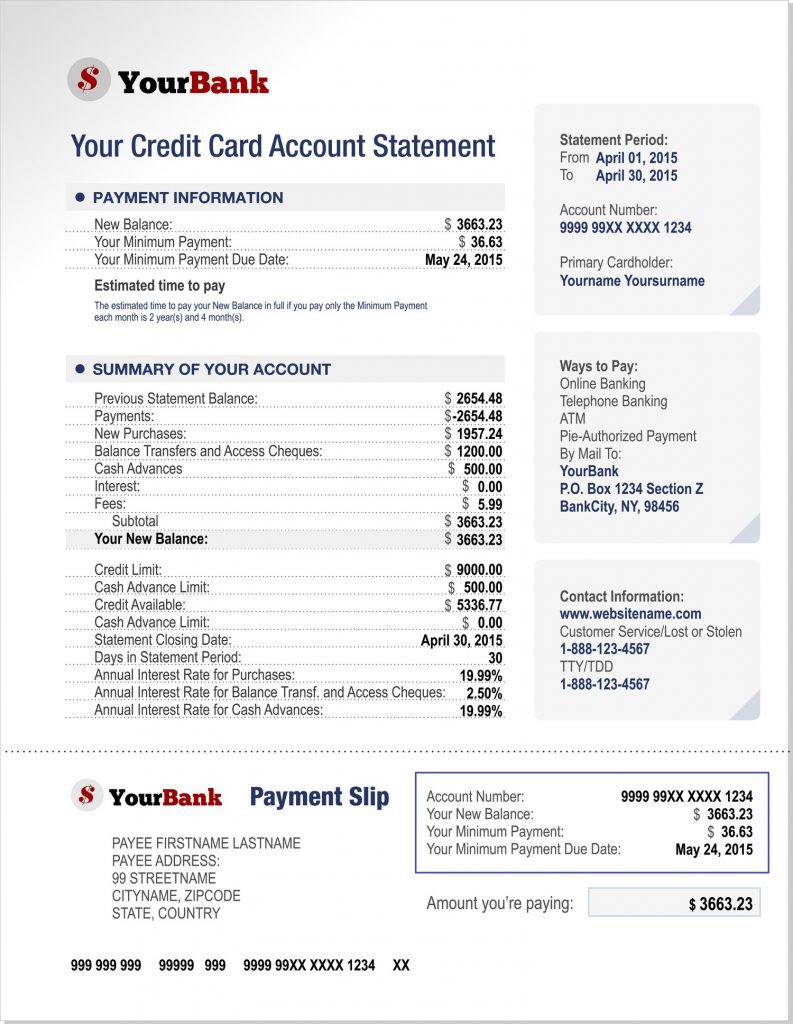

2. Bank Statements

Each bank statement you receive will have your account number. This will be the case whether you receive an online or hard copy statement.

The account number is typically located at the top of the document on the left or right hand side. Either way, the number will be labeled as “account number”.

3. Banking Website or Bank Application

When online, navigate the website to select a summary of your account. The account number is typically listed within the summary of your account.

4. Contact Your Bank

If you are unable to find your account number in the previous three options, you could always call the number on the back of your debit/credit card or find their customer service number online.

With this option, you must provide your name, address, and social security number in order to verify your identity.

Bank/Institution | Customer Service Number |

|---|---|

Chase | 1-800-935-9935 |

Capital One | 1-877-383-4802

|

Bank of America | 1-800-432-1000 |

PNC Bank | 1-888-762-2265

|

Wells Fargo | 1-800-869-3557 |

Citibank | 1-800-374-9700

|

Discover | 1-800-347-2683 |

US Bank | 1-800-872-2657 |

TD Bank | 1-888-751-9000 |

PenFED | 1-800-247-5626 |

Alliant Credit Union | 1-800-328-1935 |

Citizens Bank | 1-800-922-9999 |

Ally Bank | 1-877-247-2559 |

Bank Account Number vs. Routing Number

Despite both dealing with bank accounts, there are a few distinctions that separate a bank account from a routing number.

- Bank Account Number

The bank account number identifies the bank account within the financial institution. This could be associated with a checking account or savings account.

Depending on the bank institution, each account will have specific guidelines for how often you may deposit or withdraw from the account, how much you are earning while the money is in the account, and what the minimum amount of money must be in the account for it to be active.

Each of these separate bank accounts would have a unique bank account number different from one another even though they all belong to the same person.

- Routing Number

The routing number is used to identify the specific bank or Credit Union. The routing number is made up of nine digits, which identifies the financial institution.

Account holders will only have one routing number per account instead of bank account numbers.

Bank Account Number vs SWIFT Code

While both the IBAN and SWIFT Codes are standard for international transfers, they have a few major distinctions that separate the two.

- Society for Worldwide Interbank Financial Telecommunication Code (SWIFT)

The SWIFT code is used to identify a bank during international transactions. The SWIFT code is ultimately used as a messaging network for financial institutions to securely transmit information and instructions through a standard set of codes.

This system assigns each financial institution a unique code that has either eight or eleven characters. Furthermore, this allows institutions to share financial data, like the status of the account, debit and credit amounts, and the details related to the money transfer.

As far as numbers are concerned, it starts with a two-digit country code, two numbers, followed by three to five alphanumeric characters.

An example of a SWIFT Code would be: BOFAUS3NXXX. “BOFA” would refer to the bank (Bank of America), “US” the country code (United States), “3N” the location code of New York City, and “XXX” refers to the bank’s head office.

- International Bank Account Number (IBAN)

IBAN on the other hand refers to the individual account involved in the international transaction. IBAN also helps for easy identification of the country where the bank resides and the account number of the recipient of the money transfer.

Furthermore, it acts as a method of checking that the transaction details are correct. IBAN is made up of 32 alphanumeric characters, that includes two-digit country code and a two-digit checksum.

An example of a random account in Turkey would be: TR330006100519786457841326. The “TR” refers to the country, “33” the checksum that signifies if the rest of the number is typed correctly. The recipient bank is the “00061”, and the receiver account number is 0519786457841326.

What Happens If Aomeone Has Your Bank Account Number?

While it is a great feature that people are able to find their bank account numbers quickly, it is a major issue if a scammer has your account number. With your account number, scammers are able to make fraudulent ACH transfers or payments.

It should be noted however, if they only have your account number and nothing else, you do not have to worry as much. With the account and routing number or account number and your identity information, they are able to do some real damage.

FAQs

Can you find bank account number from ATM card?

While the bank account number is not on the atm card itself, when using the atm the bank account number is listed on the ATM. Furthermore, the account number will be listed on the receipt of the transaction.

Where is the bank account number on a check?

The bank account number is located on the bottom of the check. There are three separate series of numbers, and the second set of numbers refer to the bank account number.

How to find bank accounts with social security number?

Individuals are able to bank accounts with the social security numbers by going through a Uniform Commercial Code filings (UCC Filings), which are authorized methods for a bank account search by Social Security Number.

Can I change my bank account number?

Consumers are not able to change their bank account numbers as they are automatically determined by the bank. For accounts that are compromised, people are able to open new bank accounts.

Banking Reviews

Aspiration Review

Alliant Credit Union Review