Table Of Content

What Is A Checking Account?

A Checking account is a type of bank account that one can use for everyday spending. People use their deposited funds through debit cards, online banking, or digital wallets to carry out their daily financial transactions.

With a checking account, you have easy and quick access to cash which is why it is often termed a liquid current account.

Banking organizations specifically design checking accounts to cater to the needs of people’s day-to-day transactions. There are different types of checking accounts such as senior, student, or interest-bearing checking accounts. Banks do it by providing lower account maintenance charges and fewer administrative hassles as compared to other types of accounts.

How Checking Account Work?

People use checking accounts to meet their everyday expenses like making payments to utilities, withdrawing money for cash usage, and making deposits.

These transactions can be made using different channels that the banks provide.

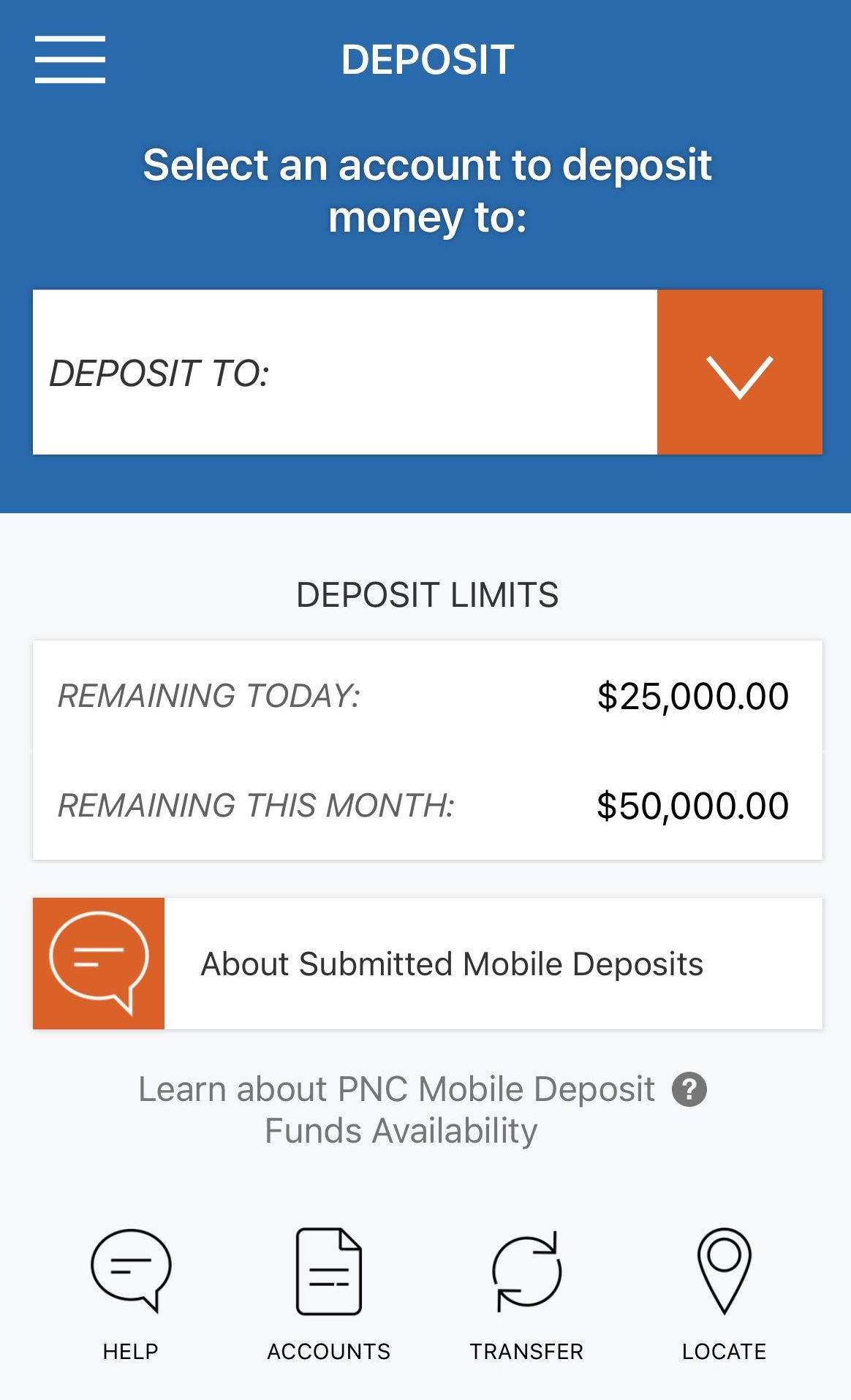

To make a deposit in a checking account, you can:

- Write a check from your other account and submit it to the cashier at the bank’s branch.

- Deposit cash by physically visiting the branch.

- Use online options to transfer the funds directly into your bank account, like asking your employer to credit your salary.

- Using the bank’s ATM to deposit the cash.

- Use wire or ACH transfers to move funds from your savings to your checking account.

To make payments and withdraw cash, you can:

- Use the debit card to withdraw the cash directly from your account.

- Use the debit card to pay for services or goods you are buying in your daily life like grocery shopping, clothing, etc.

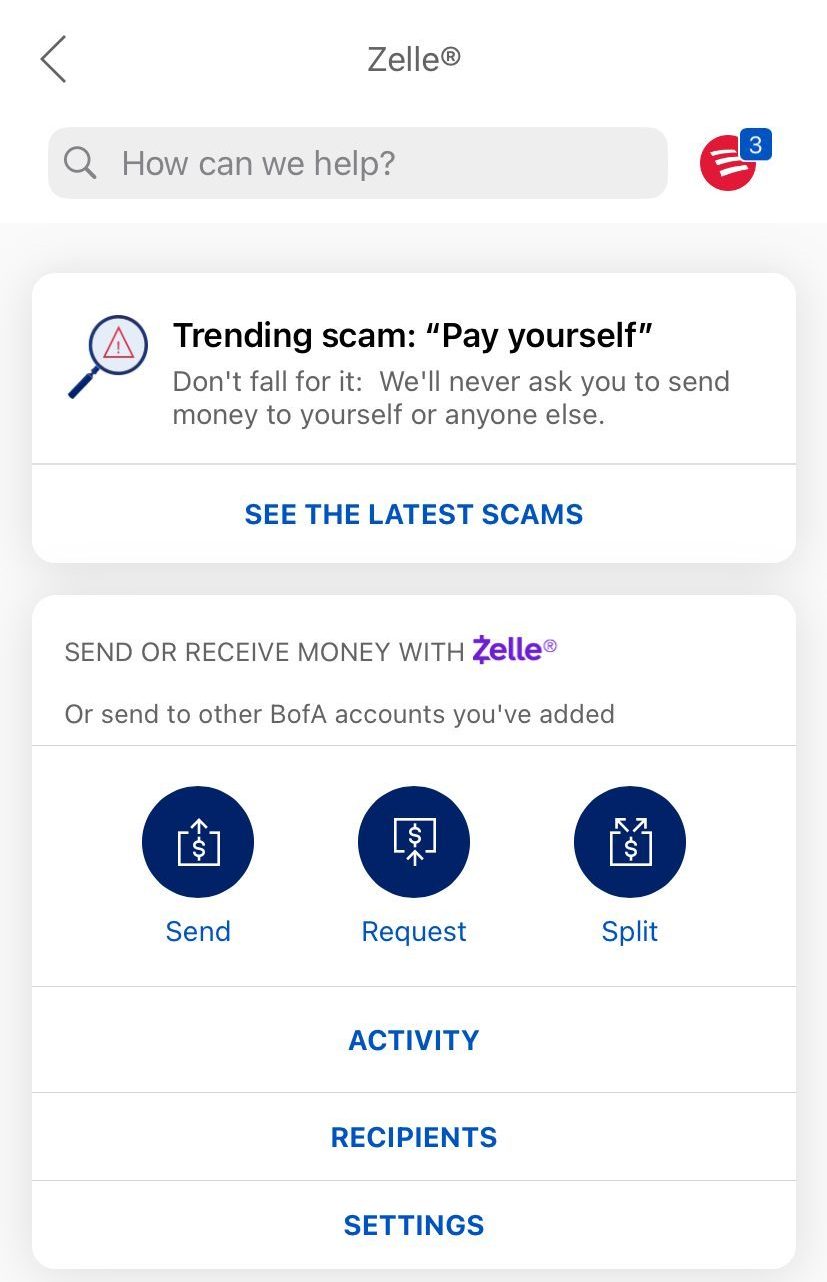

- Pay your suppliers using online methods to transfer the money from your account.

- Write a check to make the payments to your supplier or vendors.

Benefits Of Checking Account

A checking account gives several benefits to its users like instant access to cash, better funds management, tracking transaction records, credit scoring, etc. Let’s discuss some in detail;

Pros | Cons |

|---|---|

Withdrawal And Send Money | Fees |

Track Your Transactions |

No profit/interest |

FDIC Insurance | Fraud |

Direct Deposits And Payments | |

Build Credit | |

Digital Wallets | |

Security |

- Withdrawal And Send Money

The good news about checking bank account holders is that they can make multiple withdrawals and deposits in a day without paying higher fees associated with other types of bank accounts.

If possible, your bank should provide access to fee-free ATMs; otherwise, they should provide some sort of reimbursement for ATM fees. Some banks go a step further and offer fee-free machines and compensation if you use a non-network machine up to a certain monthly cap.

However, Banks usually define the maximum amount of money that can be transferred in a single day.

- Security

With a checking account, you get the benefit of making your transactions securely. Whether you perform online transactions, write checks from your account, or use debit cards, all modes come with security to avoid any theft or mishandling.

- Track Your Transactions

The most common objective of a checking account is to spend your funds in your routine life. Almost all of the banks give you modern tools to track your expenses.

With easy tracking, you can efficiently plan your budget and carry out your spending

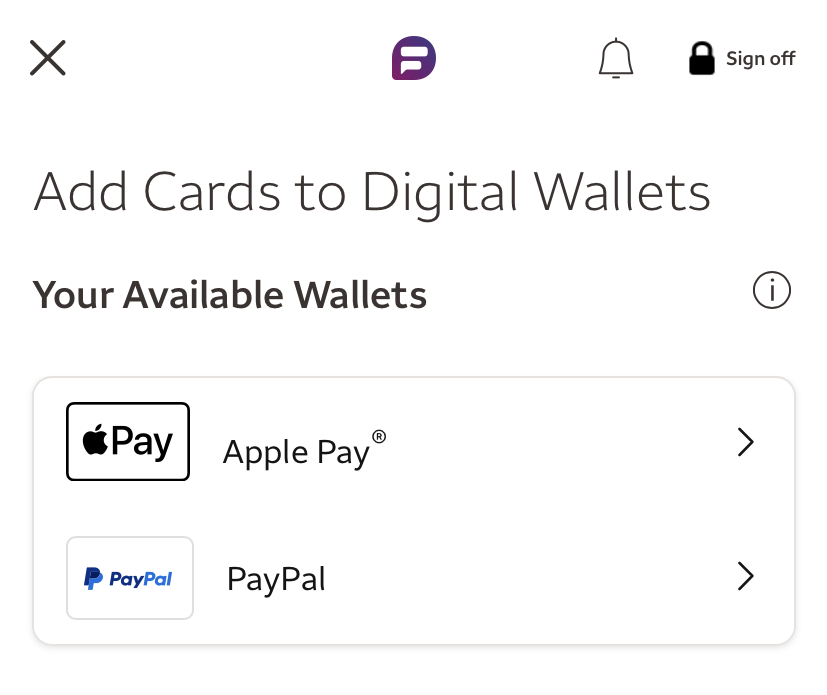

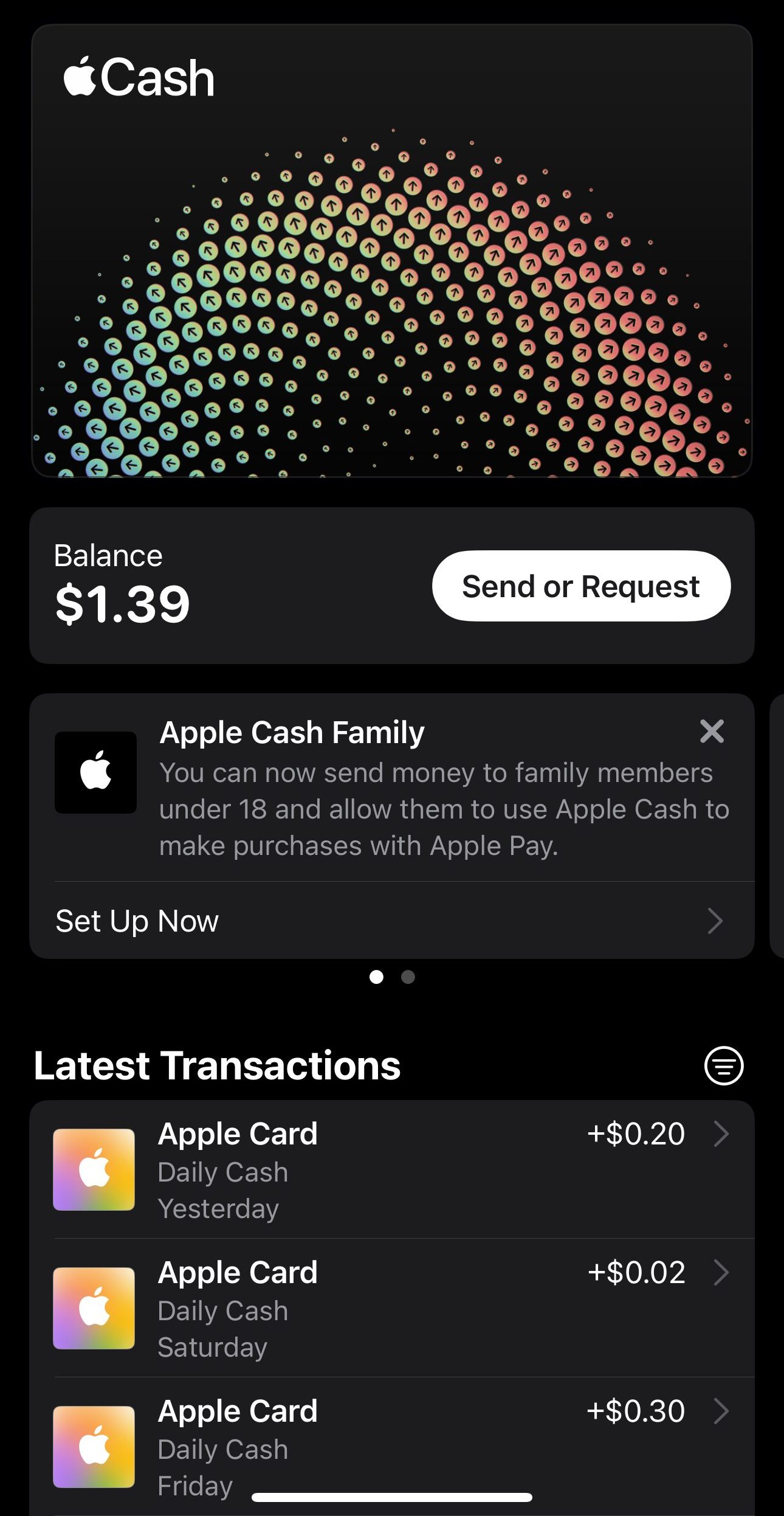

- Digital Wallets

Some banks enable you to link up your digital wallet with your checking account. In this way, you can transfer funds from your wallet and vice versa.

- FDIC Insurance

All the checking bank accounts are insured as per the guidelines of regulatory bodies.

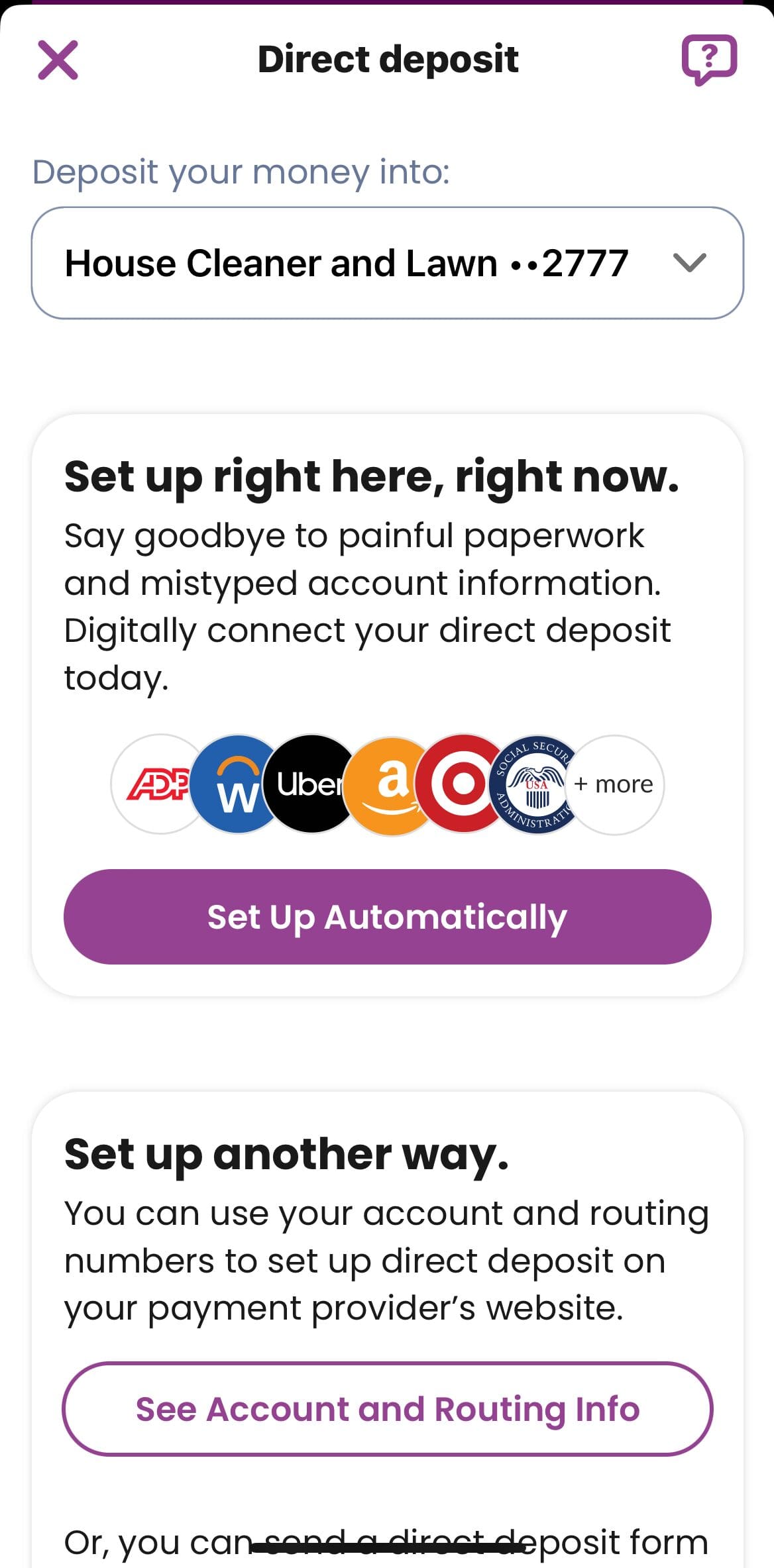

- Direct Deposits And Payments

You can set up direct deposits in your checking account to get your salary and other receivables on time and without the hassle of visiting the branch every time you get the check.

- Build Credit

Using your checking account to pay your credit card bills on time will help you in maintaining your credit rating.

With good credit ratings, you get many benefits such as lending more money from your bank to cover larger expenses like buying a house or funding your startup.

Drawbacks And Limitations Of Checking Account

A checking account gives many benefits to its users, but it has some limitations that you should also keep in mind while selecting the right kind of checking account.

The primary objective of every checking bank account is the same but its features and bank charges differ. Some of the highlights can be seen below:

- Fees

The majority of banks, especially physical ones, impose monthly account maintenance fees. In most cases, the price is under $5. For extra services like higher interest rates, special warnings, etc., the charge may occasionally be greater.

However, with other banks, these costs could be fully waived if you meet specific criteria, such as keeping a minimum balance or carrying out a certain number of transactions each month.

When an account is inactive for an extended length of time, banks impose an inactivity fee. Finally, the majority of banks continue to charge an overdraft fee even if your negative balance is a few dozen of dollars.

To ensure that you are signing up for the right kind of checking account, read the terms and conditions provided by the bank.

Bank/institution | Monthly Fee | Bank Type |

|---|---|---|

Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Traditional |

Chase Total Checking® | $12

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Traditional |

Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| Traditional |

PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

| Traditional |

U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

| Traditional |

Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Traditional |

Capital One 360 Checking | $0 | Online Only |

Amex Rewards Checking | $0 | Online Only |

SoFi Bank | $0 | Online Only |

- No profit / Interest

The money kept in a checking account does not grow as it grows in the saving account because of interest rates.

Although some banks give you interest on your deposit balance the rate is very low compared to traditional savings accounts.

If you want to earn higher rates and still use your account similar to checking, you may want to consider a money market account. There are some differences between checking and money market accounts, but with a money market account, you can still earn high interest and enjoy account management features.

- Fraud

You can easily access your funds in your checking by presenting checks or using debit/ATM cards.

While there are ways to protect your account, if your card or check is lost or theft, then there is a high risk of fraud and scams and losing some confidential information.

How To Manage A Checking Account?

Opening a checking account and making payments is not enough. You also need to manage your account efficiently to avoid unnecessary fees and bank charges. Let’s discuss some points to maintain your account wisely.

- Always know your balance: Timely knowing your balance is very important to keep yourself away from being charged extra fees if the balance falls below the standard minimum limit. So it is better to set a notification alert via message on mobile or email to keep you updated about your low balance. In this way, you will not have to pay low balance fees.

- Automate your account: Life often gets busier in the hustle and bustle of professional and personal engagements. With busy routines, we often miss out to pay our financial obligation on time and ended up paying them with added fees. To avoid paying extra, set up automated transactions on your account and pay out your dues on time.

- Avoid overdraft charges: Checking accounts provide you with an overdraft facility but most banks charge their fees. To avoid unnecessary payment of overdraft charges you can set a notification alert if the balance goes down below the standard limit.

- Discover budgeting tools: You need to explore different online budgeting tools and link up these apps with your checking account to track down your earnings and expenses so you can manage your finances accordingly.

How To Set Up A Checking Account?

Setting up an account involves the following steps.

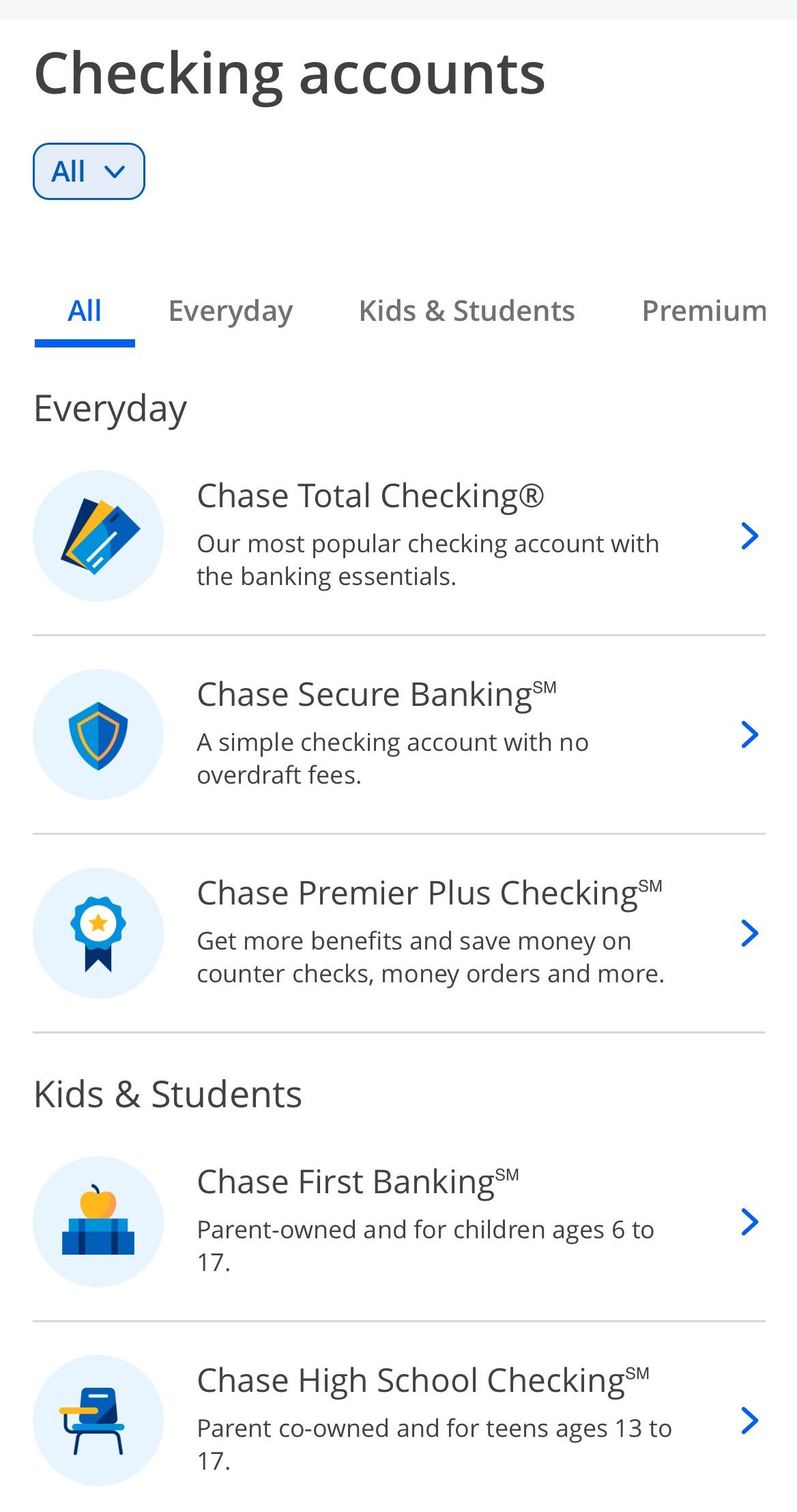

- Choose the right bank: Many banking organizations are offering checking accounts with their pros and cons. You need to figure out which bank fits the best in meeting all your requirements. Compare checking account features and review the different benefits they offer.

- Select the type of account: After choosing the right bank, the next step is to select the type of checking account. Different banks offer different services and features. You need to decide what suit your need.

3. Visit the nearest branch or apply online: After detailed research now it’s time to apply for a checking account. Here you have two options either you can apply online through the bank’s website or visit the nearby branch.

The bank will ask you to fill up the application form where you need to give all your personal and professional details and prove your identity by attaching the necessary documents as per the bank’s policy.

After investigating all the provided information your account will be processed and become operative within minutes to a few days depending on the bank.

- Minimum opening deposit: Some banks have the policy to open a checking account with zero balance while others may ask you to deposit some money to start using the account. It completely depends on the bank’s policy.

Bank/Institution | Minimum Deposit |

|---|---|

Chase | $0 |

PNC Bank | $0 |

Bank of America | $25 – $100 |

Capital One | $0 |

Wells Fargo | $25 |

Discover | $0 |

Citibank | $0 |

US Bank | $25 |

TD Bank | $0 |

Checking Account Alternatives

Many people do not have bank accounts to manage their day-to-day finances. Maybe they are hesitant to open it because of bank charges or maybe they do not even have interest in it. But how do they pay their bills? Where do they deposit their earnings?

In this era of technology and advancement when everything becomes digitized, do people need to have a bank account? What can they do if they do not want to open a checking account? Let’s discuss the secure and viable alternatives they can pursue:

- Digital wallets – Mobile App: Digital wallets are online payment tools that are increasingly becoming popular. In a basic sense, it is an electronic version of a physical wallet. They can be used to send and receive payments and make purchases similar to the bank’s checking account. However, some apps may still require opening up a bank account.

- Wire transfer: You can also send money to someone anywhere by purchasing a money order or through western union without having a bank account. Money transfer is a slow method because of the distance involved. However, this method is limited to only sending and receiving money.

- Prepaid cards: Prepaid cards are available from any local retail store without having a checking account. You can load the desired amount of money and use it for payment options. Prepaid cards are reloaded from time to time. These cards may have some additional fees depending on the seller.

- Cryptocurrencies: With the emerging technology, a cryptocurrency which is also called digital currency is widely used to make payments and transfer funds without having a checking account.

- Direct use of cash: You can still manage your day-to-day living by using cash to pay for your expenses. However, you won’t be able to make purchases from major e-commerce stores like Amazon or eBay.

FAQs

Checking accounts does not directly affect your credit score but your payment history does to get credit from any financial institution.

To open a checking account you must be 18 years of age or above.

Free services vary from bank to banks like free checkbooks, no minimum balance fees, no overdraft and transaction fees, and free internet banking.

Yes, many banks link your credit card with your checking account.

You can get a cashier’s check from any bank without having a bank account but it may charge a fee. Or you can also use a money order instead.

To open an account either in a bank or credit union, credit checks are not required unless you are applying for a loan.

No, banks do not run credit checks for opening a checking account.