Table Of Content

With its emphasis on simplicity, competitive interest rates, and flexible features, Marcus offers individuals a seamless experience to grow their savings.

In this article, we will guide you through the step-by-step process of opening a Marcus savings account, empowering you to take control of your finances and embark on a path to financial prosperity.

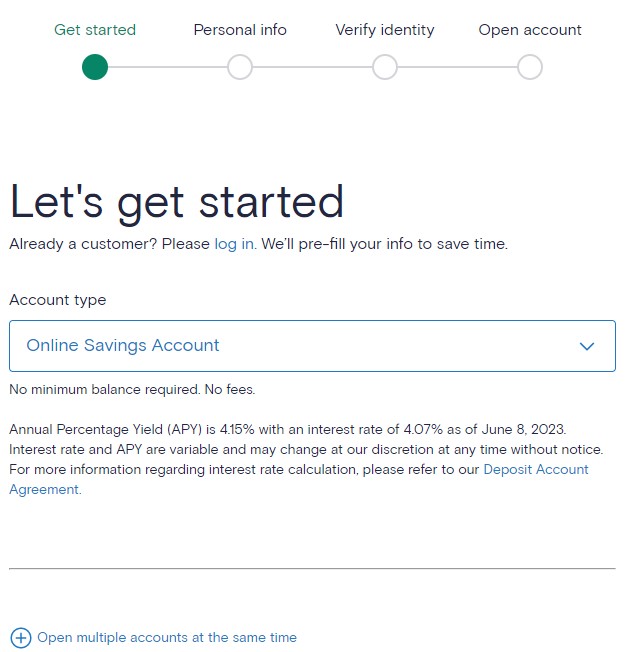

1. Start Your Application On Marcus Website

To start your application for a Marcus savings account, the first step is to visit the Marcus website.

Visit the Marcus Website: Open your preferred web browser and navigate to the official Marcus website. The website is designed to be intuitive and easy to navigate, ensuring a smooth application process.

Locate the Savings Account Section: Once you're on the Marcus website, locate the section dedicated to the savings account. Typically, you can find this section on the homepage or in the main menu. It may be labeled as “Savings” or “Open an Account.”

Click on “Open an Account”: Within the savings account section, you will find a button or link that says “Open an Account” or something similar. Click on it to initiate the application process.

Unlike accounts such as Citi Accelerate, with Marcus all of the process is done entirely online.

2. Select Account Type

Upon starting your application, you will be prompted to select the account type you wish to open. Marcus offers different types of savings accounts, such as individual savings accounts, CDs or joint accounts.

One notable feature of opening a Marcus savings account is the option to open multiple accounts simultaneously. This flexibility allows you to create separate savings accounts for different purposes or goals.

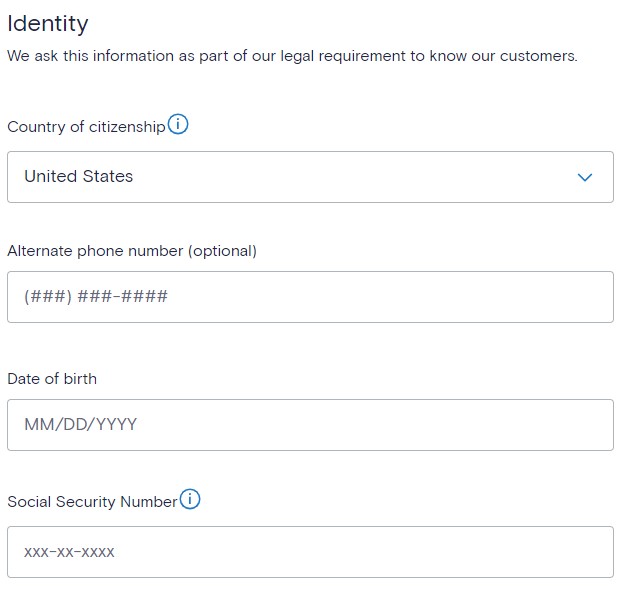

3. Add Personal Information

When opening a Marcus savings account, you will be required to enter certain personal information to comply with legal requirements and ensure the security of your account. Here's an explanation based on the provided data:

Name: Enter your legal first and last name as it appears on your government-issued identification.

Email address: Provide a valid email address where Marcus can communicate with you regarding your account. This email address will also be used for account-related notifications and updates.

Phone number: Enter your primary phone number, which will be used for communication purposes and account verification. This phone number should be one that you have immediate access to.

Residential address: Enter your home address, which should be your primary place of residence. Please note that PO boxes or business addresses are not acceptable. This address is required for identity verification and account correspondence.

Country of citizenship: Indicate your country of citizenship, which is the country whose nationality you hold.

Date of birth: Enter your date of birth in the format specified. This information is necessary for identity verification and to confirm that you meet the age requirements for opening a Marcus savings account.

Social Security Number: Provide your Social Security Number (SSN), which is used for identity verification purposes. This helps Marcus comply with legal requirements and ensure the security of your account.

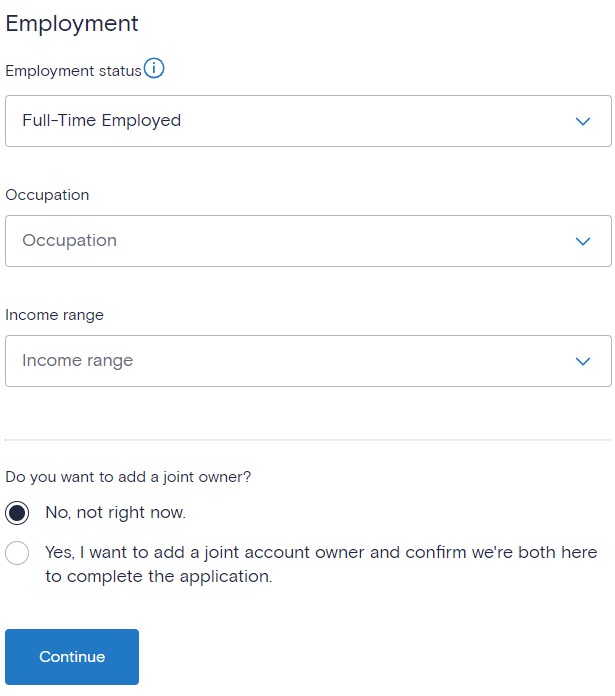

4. Share Employment Status, Income And Job Title

In this step, you'll need to provide info about your income, employment status and job title.

Employment Status: You will need to specify your current employment status. This typically includes options such as employed, self-employed, unemployed, student, or retired. Select the option that accurately reflects your current situation.

Job Title: Enter your job title or occupation. This information helps Marcus understand your professional background and may be used for verification purposes.

Income: Provide details about your income. Similar to SThis may include your annual salary, monthly earnings, or any other sources of income. Marcus requires this information to assess your financial stability and determine your eligibility for the savings account.

After adding the info, you'll be able to add a join owner. If you choose not to add a joint owner at the moment, you can select the option “No, not right now.” However, if you wish to include a joint owner, select “Yes, I want to add a joint account owner and confirm we're both here to complete the application.”

5. Choose Passwords And Agree To Terms And Conditions

In this step, you will establish security measures for your Marcus savings account. Choose a unique password, not shared with other accounts, to protect your account from unauthorized access.

Select a memorable but difficult-to-guess word and add a hint for yourself in case you forget it. These measures enhance the security and confidentiality of your account, ensuring that only you can access and manage your Marcus savings account.

Prior to proceeding, it is crucial to carefully review and acknowledge the terms and conditions that are associated with opening a Marcus savings account.

Top Offers From Our Partners

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 3.85% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 4.35% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

6. Fund Your Account

The last step, which can be done also after the account has been opened, is to fund the account. There are several ways to fund your Marcus savings account. :

- Transfer funds from a linked external bank account: You can transfer money from a linked external bank account to your Marcus savings. Marcus processes transfers of $1,000,000 or less made through Marcus by 12 pm ET on a business day, with the funds available by 5 pm ET on the same day.

- Direct deposit: For Marcus Online Savings Accounts, you have the option to set up direct deposit, typically used for payroll. Refer to the FAQ section on Marcus website for guidance on setting up direct deposit with your employer.

- Send a check by US mail: Deposit accounts can be funded by sending a check through US mail. However, cash deposits are not accepted as per the Deposit Account Agreement. Check the specific requirements and details in the “What kind of checks can I deposit” section on the Marcus website.

- Send a domestic wire transfer from another bank: You have the option to send a domestic wire transfer from another bank to fund your Marcus savings account. To initiate the transfer, you will need to provide the Goldman Sachs Bank USA Routing Transit Number (RTN) and your account number. The RTN for savings accounts is 1240-8526-0. The wire transfer address for Goldman Sachs Bank USA is provided as 11850 South Election Road, Draper, Utah 84020.

About Marcus

Marcus is an online banking platform that is part of Goldman Sachs, one of the leading financial institutions in the world.

It was launched in 2016 with the aim of providing consumer banking services and products. Marcus offers various financial solutions, including savings accounts, CDs, personal loans, and digital investment services.

The platform focuses on delivering user-friendly experiences, competitive interest rates, and transparent financial products to empower individuals in managing their money and achieving their financial goals.

FAQs

Is the Marcus savings account APY competitive?

Absolutely. Being an online bank, Marcus is able to provide one of the most competitive rates in the market. As of February 2025, Marcus offers an impressive APY of 3.90% for their savings account.

Is there a minimum deposit required to open an Online Savings Account?

No, there is no minimum deposit to open an Online Savings Account. However, if you don’t fund your account within 60 days of account opening, we may close your account

Are there any fees associated with my Online Savings Account?

We do not charge fees for transfers to or from your Online Savings Account. However, your external financial institution may charge you a fee.

When will I start earning interest on new deposits into my Online Savings Account?

You will start to earn interest on the business day we receive your deposit.