Table Of Content

What is a Cash Account?

A cash account is basic and simple. You, as the account holder, simply trade using whatever money you have in your own account. You can’t advance or lend money to your broker. When you want to buy security, you must deposit cash into your account to settle the trade.

Although it’s simple to use, there are some strategies that you can’t do with a cash account. For example, you can’t trade futures in a cash account since futures trading makes use of a margin. And if you want to trade using options, there are only a few options-related strategies that you can avail using your cash account.

Obviously, you can see that because of this you can’t trade as often as you want because your account may not have enough available cash in it. This could be because the brokerage firm has not yet settled your past transactions and you don’t have yet the cash to use at the time you want to place your next buy order.

Although you can usually buy calls and puts, options are another thing. If you want to write options, then you need to cover your position with shares of stock in question – if not, your account should have enough cash to pay for your obligations if the option gets the green light.

There is one advantage that many experts find with cash options:

Brokers can’t take the stock holding they hold on behalf of their cash account customers and use them to form part of their securities lending practices.

There’s big money in securities lending for brokers, but the risk that the borrower of the shares might not be able to repay the loan is always present.

According to

What is a Margin Account?

One advantage of a margin account is that an investor can borrow against the value of the assets in the account if he wants to purchase new positions or sell short. This allows the investor to use margin to leverage his position and earn when the market moves whether it be a bullish or bearish climate. He can also make cash withdrawals versus the value of the account. The broker will take this up as a short-term loan.

This works very well for investors seeking to leverage their positions since a margin account provides convenience and cost-effectiveness. Even if what you have is a margin account, you can also trade using your own cash. You can use a margin account to trade using unsettled funds. This allows you to bypass all the settlement date-related violations that often occurs in a cash account.

There are also trading behaviors that are exclusive in a margin account such as short-selling, day-trading, and advanced options strategies. A margin account can give you the ability to leverage your investments and boost the return when the price of your instruments moves to your advantage.

Margin Account – Example

Let’s say you have $5,000 on hand to trade and you want to buy Company XYZ shares that go for $10 per share. If you have a regular brokerage account, you can only buy up to 500 shares. If Company XYZ shares were to double its price, you’d be $5,000 richer having made a +100% profit. On the other hand, if the shares fall to $5 per share, you’d register a loss of $2,500.

If you have a margin account, you can typically borrow up to half of the total purchase price of investments that qualify in a margin account.

This percentage amount varies from investments and brokers. The brokerage firm will normally define which investments among stocks, bonds, or mutual funds you can purchase on margin.

Using the figures from our previous example, you can purchase $10,000 worth of shares (or 1,000 shares) of Company XYZ with just $5,000 on your margin account by borrowing the $5,000 difference.

Should the shares move the same way above, when the shares double their selling price, it would mean:

- You’ll make $5,000 profit from your original funds

- You’ll make $5,000 profit from the funds that you “borrowed”

Your total earnings now come to $10,000 and your $5,000 starting capital gave you a 300% return.

However, in the same scenario but this time, the shares move the other way and decrease to $0, it would mean:

- You’ll register a loss of $5,000 from your original funds

- You’ll get a loss of $5,000 from the funds that you borrowed.

This would bring your total losses to $10,000.

The Main Risk: Margin Calls

Let’s go back to our example that you only have $5,000 in your account before the transaction. What will happen in such a case?

The brokerage firm will make a margin call to the investor. This will happen when the investments in the account and the cash fall in value and go below the minimum maintenance margin account. The investor should deposit additional funds and might have to sell a portion of the portfolio to fund the margin call.

If the investor doesn’t fund the account after the broker made the margin call, the brokerage firm will sell some of the stocks in the account themselves to make up for the gap. Take note that the investor does not need to give his go signal for this to happen: the broker has the right to do this if the investor does not meet the margin call.

One more thing to consider is the margin fees.

The broker will apply the normal trade fee to the opening and closing volume of a margin position. However, the margin fees will depend on the total value of the order.

They can go from as low as one percent to as high as 10 percent annually depending on the broker and account size. Of course, when you pay margin interest, no matter how small, you decrease your investment returns.

Margin Calls – What Are The Benefits?

A margin account can provide many advantages. As we’ve said, it allows an investor or a trader to potentially double their position sizes so they can have an opportunity to earn more. On top of this, a margin account lets you short-sell, giving the margin trader an edge over cash traders. The margin account also provides margin traders with other advanced option trading strategies that cash traders have no access to.

Another advantage of a margin account is that they give traders more flexibility on the issue of settlement dates. Cash account traders usually wait for two business days after making a sale for settlement, that is, for cash to be available on their account. Margin traders don’t have to wait for days because they can use their available credit to make trades immediately after making a sale even if the cash proceeds have not cleared their accounts yet.

Cash Vs. Margin Account: Which is Better For You?

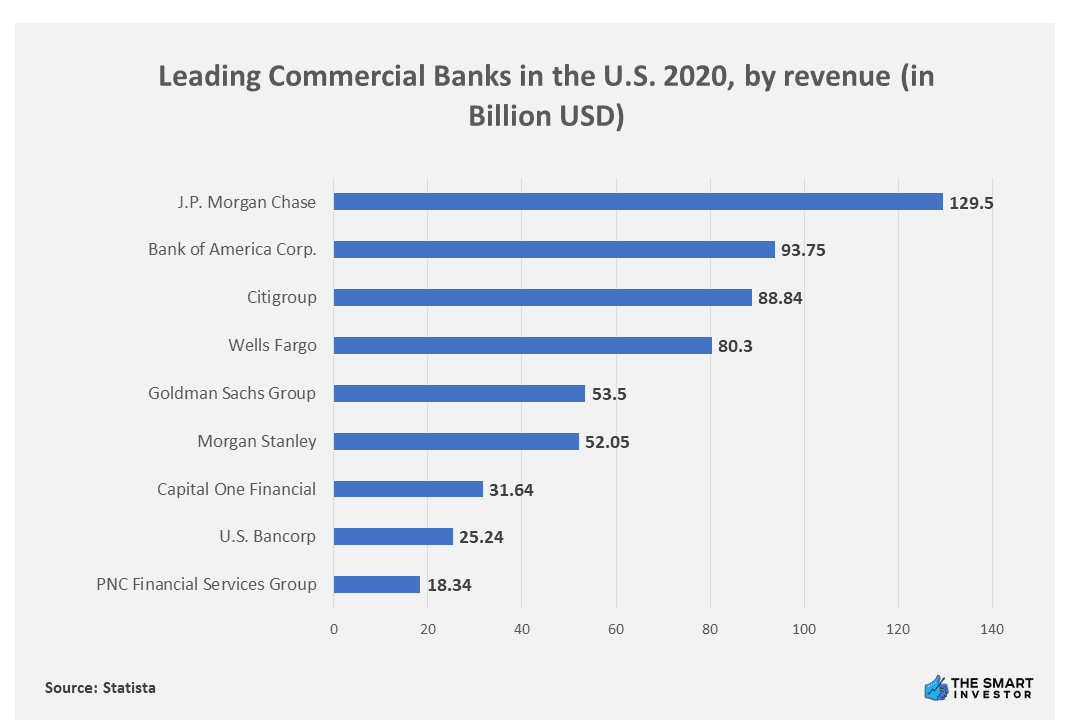

Data compiled by Statista in 2020 of the top 10 largest banks in the United States by revenue ranked JPMorgan Chase in the first position with $129.5 billion. Bank of America Corp took the second position with $93.75 billion, a notable 38.13% short of JPMorgan’s. From the bottom-up, PNC Finance Service Group took 10th place with $18.34 billion in revenue.

Now, as an investor, you have to make a smart choice between the two. If you pick a cash account, you’d better have the will power to ignore the advantages of having a margin at your disposal. That’s probably the most basic decision that an investor has to deal with in this matter especially for one who does not want to think about margins.

However, most investors would really consider getting a margin account and just use it responsibly. You can get a lot of flexibility from a margin account in some situations so the key is having the discipline in the amount of leverage that you use. Just remember to control the use of your margin account and don’t put your entire account at risk. This way, your margin account will serve you well.

A brokerage account may scare beginning investors. And understanding the difference between cash and margin accounts is one of the more intricate aspects of the journey. Having an open eye on the risks, you can intelligently pick the right account for your investing needs.