Table Of Content

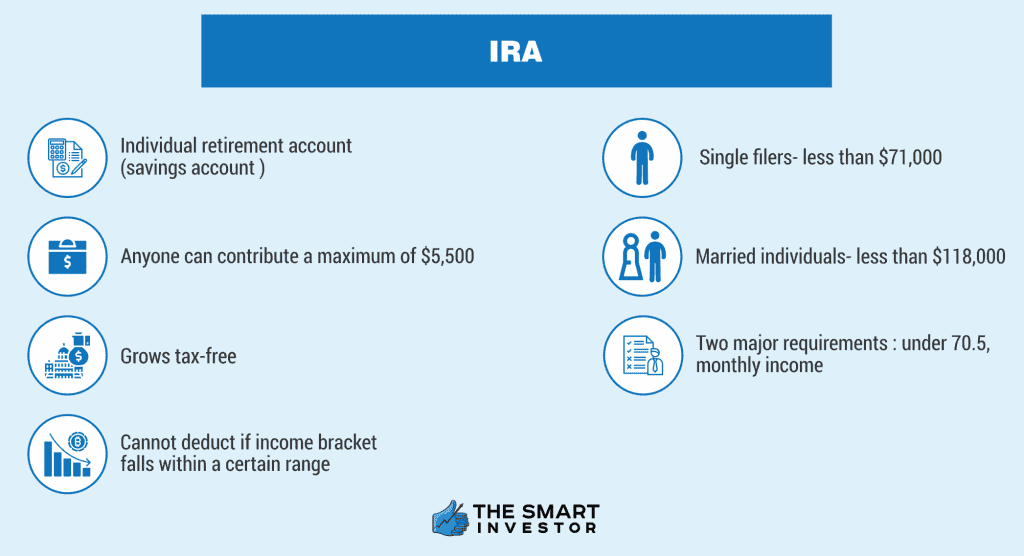

IRA stands for an individual retirement account and this is a savings account in which people put some money for “rainy days” – retirement. These accounts offer some tax advantages and there are two main types – Traditional and Roth IRA.

To have an IRA you must meet two major requirements – you should be under the age of 70.5 and also have a monthly income.

Your IRA will invest the money you have put into the account in various business opportunities – stocks, bonds, and make a profit for you.

Can We Consider IRA As An Investment?

IRAs are not only a savings account – you can invest the money in various endeavors. According to most experts, they offer a wider range of investment opportunities compared to 401(k). For example, you can buy individual stocks, but this is very time-consuming. You can also invest in bonds or you can trade.

If you are not one of those people who feel really confident about financial markets and investing, or you don't have enough time, put your money in mutual funds. They will take care of everything.

Different Types of IRA

First, let's take a look at Traditional IRAs and their specifics:

-

Traditional IRA

With a traditional IRA, you can contribute up to $6,500 per year (as of 2023) or $7,500 per year if you're over age 50. You can make contributions up until the tax-filing deadline, which is typically April 15th of the following year.

Contributions to a traditional IRA are made with pre-tax dollars, which means that you can deduct the amount you contribute from your taxable income for the year. This can lower your overall tax bill, especially if you're in a higher tax bracket.

The money in a traditional IRA grows tax-deferred, meaning you won't pay taxes on any investment gains until you start taking withdrawals during retirement. Once you reach age 72 (or age 70 ½ if you reached that age before January 1, 2020), you must start taking required minimum distributions (RMDs) from your traditional IRA, which are taxed as ordinary income.

-

Roth IRA

With a Roth IRA, you can also contribute up to $6,500 per year (as of 2023) or $7,500 per year if you're over age 50. However, the rules for Roth IRAs are a bit different than traditional IRAs.

Contributions to a Roth IRA are made with after-tax dollars, meaning you won't get an immediate tax deduction for your contributions. However, once you reach retirement age (currently age 59 ½), you can withdraw your money tax-free, including any investment gains.

Another key difference between Roth IRAs and traditional IRAs is that Roth IRAs do not have required minimum distributions (RMDs). This means that you can leave your money in your account to grow tax-free for as long as you like, without having to worry about taking withdrawals and paying taxes on them.

-

Simple IRA

This is a type of retirement plan offered by employers and the abbreviation stands for a Savings Incentive Match Plan for Employees.

Usually, small businesses offer this option and the reasons they prefer it over 401(k), for example, is that it's cheaper. The employer may contribute 2% flat of the employee's salary whether they wish or not. In addition, the employee himself can contribute to the plan up to 3% of their salary.

This year the contribution limit is $12,500 per year. Sometimes employers allow their employees to make additional catch-up contributions up to $3,000. This makes $15,500a year.

-

SEP IRA

A Simplified Employee Pension (SEP) IRA is a type of Traditional IRA and is a retirement plan perfect for small businesses and self-employed professionals. Businesses owners can make tax-free contributions for all their employees as well as themselves. The maximum an employer can contribute to an employee account is 25% of their annual salary. Self-employed can contribute as much as 20% of their net earnings.

Currently, the maximum contributions a person can make annually to a SEP IRA is $54,000 which remains unchanged from last year. Unlike SIMPLE IRAs, these accounts do not offer catch-up contributions, but I wouldn't be so disappointed given the substantially higher limits.

-

Inherited IRA

This type of IRA is designed for beneficiaries of an IRA account, typically received after the original account holder passes away. The rules for withdrawals and tax treatment depend on several factors, including the relationship between the beneficiary and the original account holder.

Top Offers From Our Partners

![]()

What Are The Main Difference Between IRA Plans?

The main differences between the different types of IRA plans are related to how contributions and withdrawals are taxed, as well as the rules and requirements associated with each plan. Here's a summary of the main differences:

Traditional IRA: Contributions are made with pre-tax dollars, meaning you get an immediate tax deduction for your contributions. Withdrawals during retirement are taxed as ordinary income. You must start taking required minimum distributions (RMDs) from your traditional IRA by age 72 (or age 70 ½ if you reached that age before January 1, 2020).

Roth IRA: Contributions are made with after-tax dollars, meaning you don't get an immediate tax deduction for your contributions. However, withdrawals during retirement, including any investment gains, are tax-free. There are no required minimum distributions (RMDs) for Roth IRAs.

SEP IRA: This type of IRA is designed for self-employed individuals and small business owners. Contributions are made with pre-tax dollars, and withdrawals during retirement are taxed as ordinary income. You can contribute up to 25% of your income or $66,000 (whichever is less) to a SEP IRA.

Simple IRA: This type of IRA is also designed for small businesses. Employees can contribute up to $15,500 per year, and employers are required to match contributions up to a certain percentage. Contributions are made with pre-tax dollars, and withdrawals during retirement are taxed as ordinary income.

Inherited IRA: This type of IRA is designed for beneficiaries of an IRA account, typically received after the original account holder passes away. The rules for withdrawals and tax treatment depend on several factors, including the relationship between the beneficiary and the original account holder.

What Are The Main Benefits Of Each IRA Plan?

Each type of IRA account has its own benefits, depending on your personal financial situation and goals. Here are some of the main benefits of each type of IRA

Main Benefits | |

|---|---|

Traditional IRA | Contributions are tax-deductible, Money grows tax-deferred |

Roth IRA | Withdrawals during retirement are tax-free, Not required to take minimum distributions during retirement |

SEP And Simple IRA | Designed for small businesses, Offer higher contribution limits |

Inherited IRA | Receive and manage retirement assets, Stretch out distributions over your lifetime |

-

Traditional IRA

The main benefit of a traditional IRA is that contributions are tax-deductible, meaning you can lower your taxable income for the year by contributing to your IRA. This can result in a lower tax bill for the year and help you save more for retirement.

Another benefit of a traditional IRA is that your money grows tax-deferred, meaning you don't have to pay taxes on any investment gains until you start taking withdrawals during retirement. This can help your money grow faster over time, potentially resulting in a larger nest egg for retirement.

-

Roth IRA

The main benefit of a Roth IRA is that your withdrawals during retirement are tax-free, including any investment gains. This can be a huge advantage if you expect to be in a higher tax bracket during retirement, or if you want more flexibility in how you manage your retirement income.

Another benefit of a Roth IRA is that you're not required to take minimum distributions during retirement, meaning you can leave your money in the account to grow tax-free for as long as you like. This can be especially beneficial if you don't need the money right away and want to pass on your savings to your heirs.

-

SEP And Simple IRA

The main benefit of SEP and Simple IRAs is that they're designed for small businesses, making it easier for self-employed individuals and small business owners to save for retirement. Contributions are tax-deductible, and the plans are often easier and less expensive to set up than traditional 401(k) plans.

Another benefit of SEP and Simple IRAs is that they offer higher contribution limits than traditional and Roth IRAs, allowing you to save more for retirement each year.

-

Inherited IRA

The main benefit of an inherited IRA is that it allows you to receive and manage retirement assets from a deceased loved one. Depending on the type of IRA and the age of the original account holder at the time of their death, you may be able to take distributions over your lifetime, potentially providing a source of income for many years.

Another benefit of an inherited IRA is that you have the option to stretch out distributions over your lifetime, potentially minimizing the tax impact of withdrawals and helping you make the most of the inheritance.

Tax-Free Contributions

Now that you know about the $6,500 limit, let's mention the specific conditions under which this amount of money is tax-free.

According to the Internal Revenue Service (IRS), there are two factors which determine whether this amount can be deducted from your taxable income or not – adjusted gross income (AGI) and participation in an employer-sponsored retirement account. Here we have several scenarios:

- For people who are not married and their company provides them with a retirement account, if you want to make tax-free contributions to your IRA, your AGI should be $62,000 or less.

- If you are married and the company you work for does not offer a retirement plan to you, then you can deduct the $6,000 from your taxable income. However, if your spouse's company offers a retirement plan to him/her, then to take advantage of the tax deduction your family adjusted gross income should not exceed $193,000. You should also file your taxes together.

- If you are married and both of you are covered up by your employer, you can deduct the annual contributions from your taxes only if your AGI does not exceed $103,000.

Having a retirement plan provided by your company does not necessarily mean that you can't have your personal IRA. Simply, the annual contributions might not be tax-free. You'd better advise your tax consultant to see if the contributions to your personal IRA will be tax-deductible.

Is There A Difference When It Comes To Withdrawals?

Under normal conditions, an individual cannot make withdrawals from a traditional IRA before the age of 59.5. If you make a withdrawal, say when you are 49, then a 10% early distribution penalty will be imposed.

Also, you may have to pay state taxes on these amounts of money. However, there are some exceptions to the rule. You can make penalty-free withdrawals before the age of 59.5 under some conditions:

- In case of death of the owner

- In case of unreimbursed medical expenses

- Permanent disability of the owner

- Qualified educational expenses

- To cover health insurance premiums if the owner is unemployed.

You should also know that after the age of 70.5, you have to start making regular distributions from your IRA – Required Minimum Distributions (RMD). If you don't do that, you will have to pay a penalty.

Because Roth IRAs do not have required minimum distributions (RMDs), you can leave your money in your account to grow tax-free for as long as you like, without having to worry about taking withdrawals and paying taxes on them.

Withdrawals from SEP and Simple IRAs are taxed as ordinary income, and may be subject to a 10% early withdrawal penalty if you withdraw money before age 59 ½, unless you qualify for an exception.

Required Minimum Distributions (RMD)

If you are an owner of a Traditional IRA, you have to start making regular distributions when your reach age 70.5. You can either withdraw the whole amount in the account or make regular distributions. The company that holds your account usually calculates your RMD, but if you want to have an idea, try this one:

- Check out the balance of your IRA on 31 December last year

- Find the distribution factor corresponding to your age (the older the person, the lower the factor)

- Divide the balance by the distribution factor