For residents of Washington currently searching for an outstanding savings account, we have carefully compiled a variety of the best savings accounts available in Washington.

Here's the list in short:

Bank/Institution | Savings APY | Our Rating |

|---|---|---|

Live Oak Personal Savings | 4.00%

|

(4.5/5) |

Ally High-Yield Savings Account | 3.40%

|

(4.5/5) |

Discover Online Savings Account | 3.50% |

(4.5/5) |

Laurel Road High Yield Savings | 3.80% |

(4.5/5) |

LendingClub High-Yield Savings | 4.20% |

(4.5/5) |

Marcus by Goldman Sachs | 3.65% |

(4.4/5) |

CIT Bank Platinum Savings | Up to 3.85%

|

(4.5/5) |

Prime Alliance Bank Savings | 4.05% |

(4.3/5) |

Whether you're saving for a rainy day in Seattle or planning your next outdoor adventure in the Cascades, it's essential to understand how each savings account compares in terms of features, flexibility, and long-term value.

Now, let’s break down each product to see what it offers—and hear what our experts really think

Live Oak Personal Savings

Savings APY

Minimum Deposit

Our Rating

Promotion

-

Our Verdict

- Features

- FAQ

Live Oak Bank’s Personal Savings Account is a solid option for Washington residents seeking a fully online, no-frills account with competitive interest and excellent digital tools.

With no monthly fees, no minimum balance, and a high $250,000 daily transfer limit, it’s well-suited for tech-savvy savers who don’t rely on cash deposits or ATM access.

While the lack of in-person support may be a drawback for some, the streamlined user experience and solid APY make it a worthy contender in the Evergreen State.

If you’re comfortable managing your savings entirely online, Live Oak is a smart, low-maintenance choice.

- No monthly maintenance fees

- No minimum balance requirements

- Daily interest compounding

- High $250K daily transfer limit

- Mobile check deposit via app

- User-friendly online and mobile access

- Savings calculator tool included

- Simple 3-step online account setup

Can I deposit cash into my Live Oak savings account?

No, Live Oak does not accept cash deposits. You’ll need to use an external bank account to transfer funds electronically.

How do I withdraw money from my Live Oak savings account?

You can withdraw funds using an ACH transfer to a linked external bank account, typically processed within 1–2 business days.

Does Live Oak provide an ATM card for the savings account?

No, Live Oak does not issue ATM cards for personal savings accounts.

Is there a minimum balance required to earn interest?

You only need a balance of one cent to earn interest on your savings.

Can I open a joint savings account with Live Oak?

Yes, you can add a co-owner either during the application process or later from your account dashboard.

Ally High-Yield Savings Account

Savings APY

Minimum Deposit

Our Rating

Fees

-

Our Verdict

- Features

- FAQ

Washington-based customers have the opportunity to leverage the Ally High-Yield savings account, which is enriched with a plethora of appealing features. This account possesses a high APY of 3.40% , thereby making it an extraordinarily lucrative savings alternative.

In addition, the absence of monthly maintenance charges and minimum balance conditions ensures that unnecessary expenditures do not deplete your savings.

The account promises round-the-clock customer service, ensuring support is available whenever needed. Ally also offers resources to help you manage your savings.

The “Round Ups” feature is also noteworthy, allowing automatic transfers from your Interest Checking account to the High-Yield Savings Account whenever transactions are rounded to the nearest dollar.

- No monthly maintenance fees

- No minimum balance requirements

- Daily compounded interest for higher yield

- 24/7 customer support access

- Savings buckets for goal tracking

- “Safe to Save” smart analysis tool

- Round Ups from checking to savings

- Remote check & direct deposit options

Can I deposit cash into my Ally High Yield Savings Account?

No, Ally does not support cash deposits. You’ll need to deposit cash into another bank first and then transfer it.

How often is interest calculated and paid?

Interest is compounded daily and paid monthly, maximizing your earning potential over time.

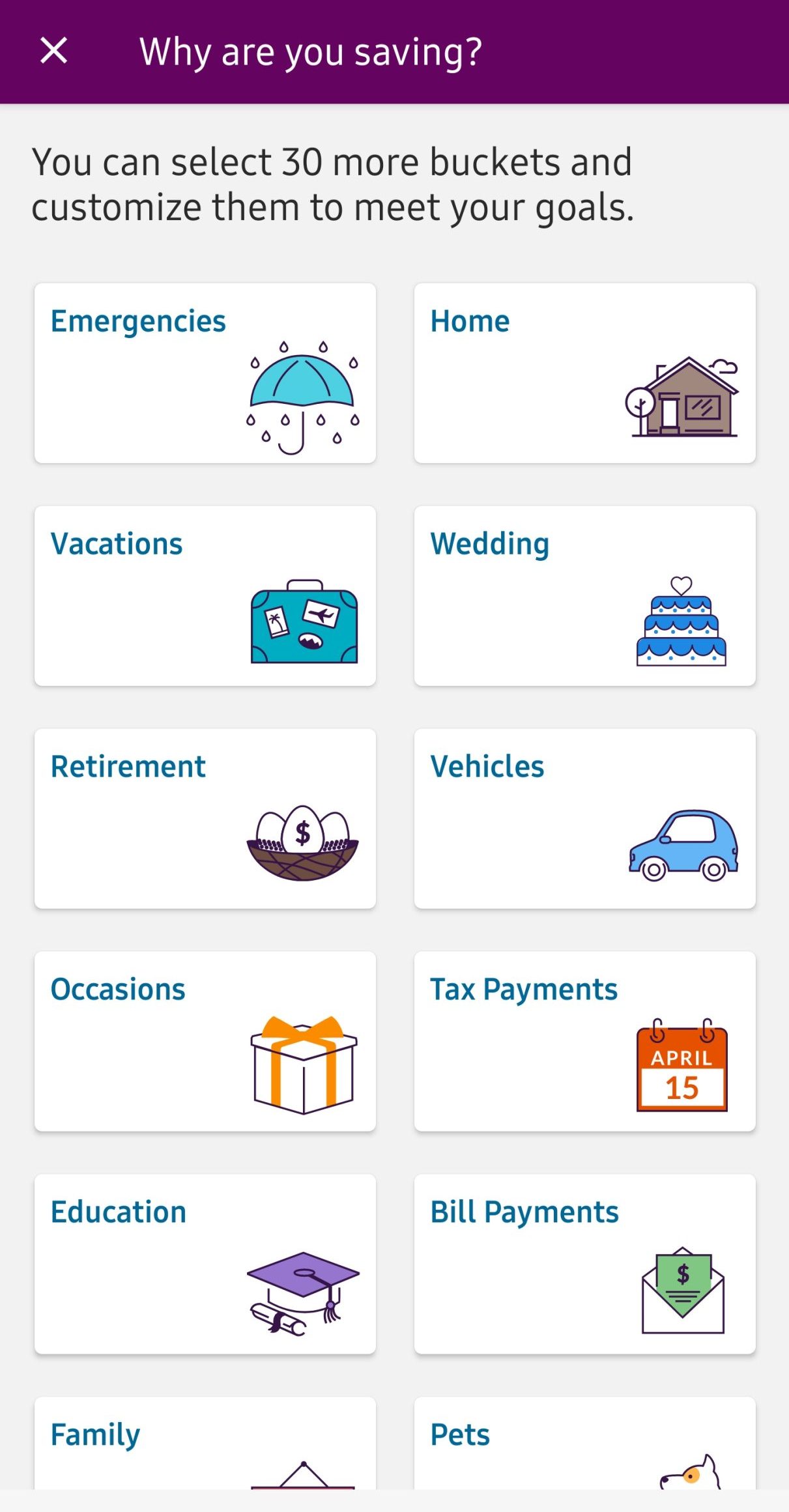

What are Ally’s savings buckets?

Buckets allow you to divide your savings into categories like “Vacation” or “Emergency Fund” within one account.

What is the “Safe to Save” feature?

It analyzes your linked checking account to suggest safe amounts you can transfer to savings without affecting spending needs.

Can I get an ATM card with the Ally savings account?

Yes, Ally provides an ATM card for convenient withdrawals from your savings account.

CIT Bank Platinum Savings

APY Savings

Minimum Deposit

Our Rating

Promotion

-

Our Verdict

- Features

- FAQ

The CIT Platinum Savings account is a great choice for Washington residents seeking a high-yield savings account.

By maintaining a minimum balance of $5,000 or more, you can take advantage of one of the market's highest APYs.

If your daily balance falls below $5,000, the APY will drop to 0.25%. Compared to other online savings accounts, this rate is highly competitive.

Additionally, this account has no monthly fees, and you can conveniently manage it through the CIT Bank app.

The app enables you to check your balance, transfer funds, and deposit checks effortlessly using the mobile deposit feature. CIT Bank operates as a division of First-Citizens Bank & Trust Company.

- Up to 4.10% APY with $5,000+

- No monthly maintenance fees

- Open an account with just $100

- FDIC insured up to $250,000

- Remote check deposit via mobile app

- 24/7 online banking access

- Multiple free deposit options (ACH, mobile check, mail)

- Free ACH withdrawals and mailed checks

How can I deposit money into my account?

You can deposit via ACH transfers, mobile check deposit, mailed checks, or wire transfers.

Can I withdraw cash from an ATM with this account?

No, the Platinum Savings account does not come with ATM access. You’ll need to transfer funds to another account.

Is my money FDIC insured?

Yes, funds are insured by the FDIC up to $250,000 per depositor.

How long does it take for deposits to clear?

Most deposits clear within 1–2 business days, depending on the method used.

Does CIT Bank have physical locations?

No, CIT is an online-only bank, so it doesn’t offer in-person service at branches.

What happens if my balance drops below $5,000?

Your APY drops significantly from 4.10% to just 0.25% if your balance falls below $5,000.

Discover Online Savings Account

APY Savings

Minimum Deposit

Our Rating

Fees

-

Our Verdict

- Features

- FAQ

For residents of Washington looking to optimally expand their savings without requiring a physical banking branch, the Discover Bank Online Savings account is a splendid choice.

The interest is calculated daily and credited to your account every month. A highlight of this account is that it doesn't involve any maintenance fees.

Furthermore, Discover Bank offers a handy mobile application for Android and Apple device users. This application facilitates seamless transactions, including money transfers, balance inquiries, viewing recent account transactions, and checking deposits.

If you possess a Discover checking account, automatic transfers to your savings account can be arranged, making increasing your savings more straightforward.

However, it does not extend the provision of an ATM card, and the tools offered are comparatively basic.

- High APY – Over 5x National Average

- No Minimum Balance Requirement

- No Monthly Maintenance Fees

- Minimal Miscellaneous Fees

- 24/7 U.S.-Based Customer Support

- Easy Mobile App with Check Deposit

- Automatic Savings Transfers Available

- Interest Compounded Daily, Paid Monthly

Is there an ATM card with the Discover savings account?

No, the savings account does not include an ATM card, so you'll need to use online transfers or request checks to access funds.

How can I deposit checks into my Discover account?

You can deposit checks using Discover’s mobile app or by mailing them directly to the bank. Mobile check deposit is the most convenient method.

Can I withdraw cash directly from the account?

Not directly—since there’s no ATM access, you’ll need to transfer funds to a linked account or request a mailed official bank check.

Is interest paid daily or monthly?

Interest is compounded daily but credited to your account monthly, which helps maximize your long-term earnings.

Does Discover support direct deposit into savings?

Yes, you can set up direct deposit from your employer or benefits provider directly into your Discover online savings account.

Laurel Road High Yield Savings

Savings APY

Minimum Deposit

Our Rating

Fees

-

Our Verdict

- Features

- FAQ

Laurel Road High Yield Savings' service isn't limited to Washington's citizens but also delivers an extraordinary interest rate of 3.80% APY, free from any obligation of a minimum deposit or regular fees.

The arrangement offers versatility, allowing you to deposit funds into your account through various methods, such as transfers, wire transfers, direct deposit, mobile check deposit, or traditional mail checks.

As your security and tranquility are paramount, know that the FDIC safeguards your investments.

Laurel Road initially centered its operations around student loans. However, their offerings have diversified to include online banking services such as savings and checking accounts, personal loans, and mortgages.

- 3.80% APY – among market leaders

- No monthly maintenance fees

- No minimum opening deposit required

- Daily compounding, monthly interest payouts

- Multiple deposit options (ACH, wire, mobile check)

- FDIC insured up to $250,000

- Accessible online in all 50 states + PR

- Owned by KeyBank – established backing

Can I get an ATM card with this savings account?

No, Laurel Road does not provide an ATM card for this savings account.

How do I deposit money into the account?

You can fund your account via ACH transfer, wire transfer, direct deposit, mobile check deposit, or mailed checks.

Is my money safe with Laurel Road?

Yes, deposits are FDIC insured up to $250,000 per depositor through KeyBank.

Are there physical branches I can visit?

No, Laurel Road is an online-only bank with no physical branch locations.

Is customer service available 24/7?

Customer support is available during set hours on weekdays, but not 24/7.

Who owns Laurel Road?

Laurel Road is a digital brand owned by KeyBank, a major U.S. financial institution.

LendingClub High-Yield Savings

APY Savings

Minimum Deposit

Our Rating

Fees

-

Our Verdict

- Features

- FAQ

The LendingClub Savings account is an attractive option for individuals in Washington who intend to save. It boasts a highly competitive interest rate, superseding what is typically offered by many banks.

The current earning rate is 4.20% on all funds deposited.

Moreover, the account carries no monthly charges, and there is no need to maintain a certain balance following the initial deposit of $100.

Additionally, the account comes with an easily accessible card that is valid at ATMs. By using MoneyPass and SUM networks, you can conveniently withdraw cash sans any ATM charges. However, note that certain ATM providers may levy a fee.

All banking procedures, including account management, depositing checks through mobile platforms, and making bill payments, can be easily executed online or via the mobile application.

- 4.40% APY on all balances

- No monthly maintenance fees

- ATM card for free withdrawals

- No minimum balance after opening

- Mobile check deposit available

- Built-in finance toolkit for budgeting

- Custom alerts & travel notifications

- Free internal and external transfers

Does LendingClub charge any monthly fees?

No, there are no monthly maintenance fees associated with the High Yield Savings account.

Is there an ATM card with this account?

Yes, you’ll receive an ATM card that works at MoneyPass and SUM networks with no fees from LendingClub.

Are there any fees for transferring money?

Internal and external ACH transfers are free, but outgoing wire transfers may incur a fee.

What tools are available to manage finances?

LendingClub offers a finance toolkit that lets you track budgets, spending trends, and link external accounts.

Can I open a joint account?

Yes, you can apply for a joint account during the application process or add a co-owner after opening.

How can I deposit funds into my account?

You can deposit through ACH transfers, mobile check deposit, or select ATM machines.

Marcus by Goldman Sachs

Savings APY

Minimum Deposit

Our Rating

Fees

-

Our Verdict

- Features

- FAQ

The High-Yield Online Savings Account by Marcus by Goldman Sachs is undeniably among the top-tier choices for high-yield savings accounts. At this moment, it presents a pleasing APY of 3.65% on all account balances.

There are no initial charges for establishing a savings account with Marcus or ongoing charges for account upkeep, services, or money transfers. Furthermore, fulfilling any conditions regarding minimum deposits or balances is unnecessary.

This strategic initiative was designed to expand their services beyond the scope of investment banking and to provide invaluable financial management tools to individuals nationwide.

- 3.75% APY – well above average

- No monthly maintenance or service fees

- No minimum deposit or balance requirements

- Same-day transfers up to $100,000

- FDIC insured up to $250,000

- Savings calculator to project earnings

- Strong app experience (iOS rating: 4.9)

- Max balance limit of $1M per account

Can I deposit checks using the Marcus mobile app?

No, Marcus does not currently support mobile check deposit. Checks must be mailed or funds transferred electronically.

How fast can I transfer funds to another bank?

Marcus allows same-day transfers up to $100,000 to linked external accounts, depending on the receiving bank.

Can I use Marcus as my primary bank?

Not ideally. Marcus does not offer a checking account, so it’s best used as a secondary savings platform.

Does Marcus offer any promotional bonuses?

No, Marcus currently does not offer sign-up bonuses or promotional rates for new customers.

How do I fund my Marcus account after opening?

You can fund it via external bank transfer, wire, mailed check, or set it up during the application process.

Prime Alliance Bank Savings

Savings APY

Minimum Deposit

Our Rating

Fees

-

Our Verdict

- Features

- FAQ

With the personal savings account from Prime Alliance Bank, you can access an attractive Annual Percentage Yield (APY) of 4.05%.

It also offers numerous attributes designed to facilitate efficient money management. This account is particularly distinctive because it does not entail monthly service charges or demand a minimum balance, thereby distinguishing itself from its competitors.

Prime Alliance Bank, established in 2004 and based in Utah, offers a wide range of financial services. This broad selection encompasses personal checking and savings accounts, money market accounts, certificates of deposit (CDs), and retirement accounts.

- 4.15% APY on savings and money market

- No monthly maintenance fees

- No minimum balance requirement

- Unlimited deposits allowed

- Mobile check deposit with app

- Up to 6 withdrawals/transfers monthly

Does the savings account come with an ATM card?

No, the savings account does not include ATM access; withdrawals are done online or through transfers.

How often is interest compounded?

Interest is compounded daily and paid monthly, helping you grow your savings faster.

Can I deposit checks through the app?

Yes, the mobile app allows you to deposit checks directly into your savings account.

Is Prime Alliance Bank available nationwide?

Yes, it's available online in all 50 states, but it only has one physical branch in Utah.

Does Prime Alliance Bank offer IRAs?

Yes, it offers IRA CDs, which can help with retirement savings and may offer tax benefits.

Can I Find Better Savings Accounts In Washington?

Undeniably, it is quite probable. The previously referred savings account is just part of a wide array of account types that are obtainable both in Washington and nationwide. Banks and credit unions showcase a plethora of options for your examination.

When considering opening a savings account, it's a good idea to research interest rates and factor in the elements most relevant to your situation.

These may include the bank's reputation, the availability of mobile banking, or savings tools that can help you grow your savings.

Initial deposit

Monthly contribution

Period (years)

APY

-

Interest earned

-

Contributions

-

Initial deposit

Total savings

* Make sure to adjust APY and deposit

If you retain an existing banking association, it would be judicious to inquire about any particular promotions they may have designed for you.

Bearing that in mind, the following savings accounts are definitively excellent selections. They afford competitive APY and are typically devoid of monthly fees. Furthermore, each account imparts unique features to suit a variety of savers.

These options could be notably suitable for diverse individuals, such as neophyte investors, those needing a holistic bank, or those who appreciate the ease of online banking over the conventional visit to a physical branch.

Alternative Savings Accounts To Consider

A broad spectrum of institutions, comprising of banks and credit unions, offer an array of alternatives for those endeavoring to safeguard their earnings.

As mentioned earlier, a wide assortment of options prevails both on the scale of Washington state and nationally. The ensuing table presents some of the principal choices presently available for individuals interested in a savings account.

Bank/Institution | Savings APY | Minimum Deposit |

|---|---|---|

Upgrade | 3.42%

| $0 |

Capital One | 3.50% | $0 |

Wealthfront | 4.25% | $0 |

CIT Platinum Savings | Up to 3.85%

| $5,000 |

Citizens Access | 3.50% | $0.01 |

Ivy Bank High Yield Savings | 4.25% | $2,500 |

Synchrony High Yield Savings | 3.80% | $0 |

Bread Financial Savings | 4.25% | $100 |

Rising Bank High Yield Savings | 4.20%

| $1,000 |

UFB Premier Savings Account | up to 3.9%

| $0 |

Related Posts

Compare Savings Account Side By Side

Best Savings Accounts In Washington: Methodology

The Smart Investor team thoroughly researched various banks and credit unions to uncover the best savings accounts in Washington . We focused on essential factors such as interest rates, minimum deposit requirements, and fees. Here's how we rated them:

- Rates And Terms (40%): We examined the savings rates offered by Washington -based banks and credit unions, considering any unique terms and conditions. Institutions offering competitive rates, reasonable minimum deposit requirements, and minimal fees received higher scores in this category.

- Savings Account Features (30%): This category assessed the range of features tailored to Washington savers, including methods for saving and transferring money, withdrawal options, and any special promotions specific to the state. Banks providing a diverse array of Washington -centric options earned higher scores.

- Customer Experience (20%): We evaluated the ease of opening an account, the responsiveness of customer service, the usability of mobile apps (tested by our team), and the bank's policies for assisting Washington Savings accounts offering seamless account opening processes, efficient customer service, and user-friendly digital platforms received better ratings.

- Bank Reputation (10%): We considered the reputation of each Washington -based bank or credit union, taking into account ratings from JD Power, TrustPilot, and local Better Business Bureau reviews. Institutions with positive reputations and satisfied Washington customers received higher scores.