Rewards Plan

Welcome Bonus

Credit Rating

0% Intro

Annual Fee

APR

- 0% Introductory APR

- Access to FICO Score

- No Rewards

- Limited Benefits

Rewards Plan

Welcome Bonus

0% Intro

PROS

- 0% Introductory APR

- Access to FICO Score

CONS

- No Rewards

- Limited Benefits

APR

14.99% to 24.99% Variable

Annual Fee

$0

Balance Transfer Fee

3% or $10, whichever is greater

Credit Requirements

Good - Excellent

- Our Verdict

- Pros & Cons

- FAQ

In essence, the BankAmericard is a balance transfer card offering up to 21 months at 0% APR. This can be highly beneficial for those who are carrying a credit card balance or planning a large purchase. However, the card does lack many of the bells and whistles offered with competing cards. You won’t earn any ongoing rewards or access any insurances or other benefits.

If you need to pay down a credit card balance, you might be willing to trade off some rewards. However, it’s definitely worth comparing the BankAmericard with other options to find the best fit for you. While you might get a slightly shorter 0% APR period, the ongoing rewards could make up for it in the long run.

- 0% APR Introductory Promotion

- No Penalty APR

- Access to FICO Score

- No Rewards

- No Late Fee Waiver

- Limited Benefits

What are card income requirements?

There are no official income requirements for the BankAmericard. While your income will be evaluated when you make an application, there are other factors that are considered when making an approval decision.

Can I get pre-approved?

Bank of America does have a pre-approval process for many of its card options including the BankAmericard. You can get pre approved via online banking, mobile app offer or in your local branch.

How do I redeem rewards?

There are no rewards offered with the BankAmericard.

In this Review

Pros and Cons

Just like any other credit card, the BankAmericard has some advantages and disadvantages:

Pros | Cons |

|---|---|

0% APR Introductory Promotion | No Rewards |

No Penalty APR | No Late Fee Waiver |

Access to Your FICO Score | Limited Other Benefits |

- 0% APR Introductory Promotion

The main benefit of this card is that you can enjoy 0% APR on purchases and balance transfers for 21 billing cycles. This is one of the longest 0% APR cards available.

However, you do need to make any balance transfers within 60 days of opening your account and the 3% balance transfer fee still applies. This is one of the most generous 0% APR introductory promotions on the market.

- No Penalty APR

Unlike many credit cards, if you make a late payment, you won’t incur an automatic increase in your interest rate or APR. However, late fees will still apply to late payments.

The current late fee is up to $40, so it is an excellent idea to ensure that you make your payments on time every month.

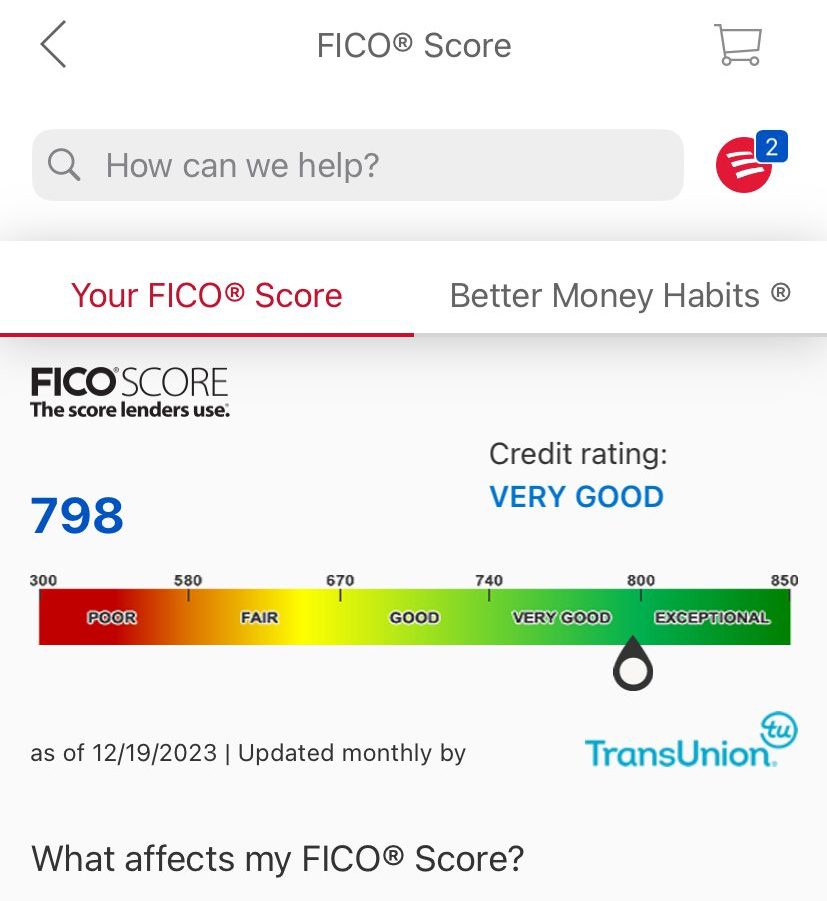

- Access to Your FICO Score

Bank of America cardholders can access their FICO score for free within the app. This is an opt-in feature, but it’s a useful tool to track how your financial habits are affecting your score. Since this card is meant to help you pay down debt without paying interest, you can easily see how making progress on your balance can positively impact your credit score.

- No Rewards

Although this card does offer a fantastic 0% APR introductory period, there are no ongoing rewards.

This means that you won’t earn any points, miles or cash back regardless of how much you spend or how you use your card.

- No Late Fee Waiver

While there is no penalty APR, if you do make a late payment, you will still get hit with a late payment fee.

- Limited Other Benefits

There are a few perks with this card, but outside of the 0% APR promotion, there are few other benefits.

Who is the BankAmericard Best For?

The BankAmericard is primarily a balance transfer card. If you make your balance transfers within 60 days of opening your account, you can enjoy 21 months without any interest payments. This will provide a decent amount of breathing space to pay down your existing credit card debt.

The card could also be a good option if you’re planning on making a large purchase. The 0% APR also applies to purchases, so you can spread the cost of your purchase by up to 21 months without paying any interest.

However, there are alternative cards that offer a shorter 0% intro period – but provide rewards and cash back. Here are some examples:

Card | 0% Intro | Rewards | Annual Fee |  | 15 months on balance transfers and purchases

Go to APR after that will be 18.99% – 28.99% (Variable)

| 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

| $0 |

|---|---|---|---|---|

| 15 months on purchases and balance transfers

G o to APR after that will be 17.99% – 26.99% Variable

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| $0 | |

| 15 months on purchases and balance transfers

G o to APR after that will be 17.99% – 27.99% (Variable)

| 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $0 | |

| 15 months on purchases and qualifying balance transfers

G o to APR after that will be 18.99%, 23.99%, or 28.99% Variable

| 2%

2% cash rewards on purchases (unlimited)

| $0 | |

| 15 months on purchases and balance transfers

Go to APR after that will be 18.74% – 28.24% variable

| 1-5%

| $0 | |

| 15 months on purchases and balance transfers from the date of account opening

Go to APR after that will be 19.99%-28.99% Variable

| 1-3%

3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%

|

$0 (Rates & Fees) | |

| 15 billing cycles on purchases

Go to APR after that will be 17.99% – 27.99% Variable APR on purchases and balance transfers

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $0 | |

| 18 billing cycles for purchases, 60 days on balance transfers

Go to APR after that will be 17.99% – 27.99% Variable

| 1.5%

unlimited 1.5% cash back on all purchases

|

$0 |

Tips for Using the BankAmericard

Although this card is quite straightforward, there are some tips which can help you increase its potential value. These include:

-

Sign Up For Your FICO Score

Access to your FICO is an opt in service, but you can access your score for free if you sign up. Being able to monitor your FICO score is helpful when you’re on the journey to pay down your debt.

You can watch to see the impact your positive actions are having on your score and your credit.

-

Collate All Your Balance Transfer Information Quickly

You’ll only have 60 days to make any balance transfers to your new BankAmericard to benefit from the 0% APR. Since it can take some time for balance transfers to post to your account, it is a good idea to have all the details collated quickly, so as soon as your new card arrives, you can action the transfers.

FAQs

How hard is it to get a BankAmericard?

You do need to have good to excellent credit to qualify for the BankAmericard, but there are few other restrictions. So, if you have decent credit, you should not have any great difficulties qualifying for this card.

When it may not be a good idea?

The BankAmericard is not a good idea if you’re interested in earning rewards for your purchases. You won’t earn any points, miles or cash back regardless of how you use the card.

Does the card provide travel insurance?

Unfortunately, the BankAmericard does not offer any travel insurance benefits.

Top Offers

Compare BankAmericard

The BofA Unlimited Cash rewards is the clear winner when comparing it with Bank Americard – here's our side-by-side comparison

The BankAmericard and the Citi Simplicity card don't offer rewards or welcome bonuses, only a long 0% intro APR.

BankAmericard is the winner, offering a longer 0% intro period on purchases than the Reflect card and a lower APR.

Here's our comparison: BankAmericard vs. Wells Fargo Reflect Card

In terms of 0% intro APR, the BankAmericard outshines the Diamond Preferred card. But what about other benefits?

Here's our comparison: BankAmericard vs. Citi Diamond Preferred Card