Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Sign-Up Bonus

- Cashback Rewards

- Cap on Rewards

- Balance Transfer Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Sign-Up Bonus

- Cashback Rewards

CONS

- Cap on Rewards

- Balance Transfer Fee

APR

17.99% - 27.99% Variable APR on purchases and balance transfers

Annual Fee

$0

0% Intro

15 billing cycles on purchases

Credit Requirements

Good – Excellent Credit

- Our Verdict

- FAQ

If you are looking to have a bit more control over what categories in which you are going to be earning rewards, the Bank of America® Customized Cash Rewards credit card could be for you.

You will be able to get 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%) Another great advantage of this card is that you do not have to pay an annual fee.

However, its limitations, such as a quarterly spending cap and modest welcome offer, may make it less attractive compared to other cash back cards, particularly for frequent international travelers.

This card could be a great fit if you like the flexibility to customize your rewards, letting you pick your own 3% cashback category. Its standout feature is the customizable rewards structure, which is especially appealing for Bank of America customers and Preferred Rewards members who can unlock even higher cashback rates.

Can I get pre-approved for Bank of America Customized Cash Rewards?

Yes, you can get pre-approved for a Bank of America Cash Rewards Card through the website, which allows you to avoid getting a hard credit check straight away.

What is the initial credit limit?

The initial credit limit when you get a Bank of America Cash Rewards Card will normally be at least $500. The exact limit depends on your financial situation.

What are the top reasons NOT to get it?

If you spend a considerable amount on relevant purchases each month then the Bank of America Cash Rewards Card might not be the best fit for you as you might earn higher cashback rates on certain purchases with another card.

What purchases don't earn cash back?

All purchases are covered when you are using the Bank of America Cash Rewards Card to make purchases. This allows you to have a great level of coverage.

In this Review..

Pros & Cons

Let's explore the advantages and disadvantages of the BofA Customized Cash Reward card to determine if it aligns with your wallet's preferences and needs.

Pros | Cons |

|---|---|

Sign-Up Bonus

| Cap on Rewards |

0% Intro APR | Balance Transfer Fee |

Preferred Rewards Bonus | Foreign Transaction Fee |

Flexible Rewards Categories | Few Additional Benefits |

No Annual Fee |

- Sign-Up Bonus

Bank of America Customized Cash Rewards offers a $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

- 0% Intro APR

If you are looking to save money on interest, the Bank of America Customized Cash Rewards offers a 0% introductory rate for 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. on balance transfers (17.99% – 27.99% Variable APR on purchases and balance transfers

after the intro period).

- Preferred Rewards Bonus

If you also qualify for the Bank of America Customized Preferred Rewards Program your rewards can go 25% to 75% further. To be a part of this program you need to have $20,000 to over $100,000 in a Bank of America account.

- Flexible Rewards Categories

The Bank of America Customized Cash Rewards credit card allows users to choose their bonus cash back category, providing flexibility to align rewards with individual spending habits.

- No Annual Fee

Bank of America Customized Cash Rewards does not have an annual fee. You can start putting cash back in your pocket immediately.

- Cap on Rewards

The category has a spending limit per quarter. If you are a big spender and that amount is not hard to hit, then your rewards are limited.

- Balance Transfer Fee

There is a balance transfer fee of 3% or $10 if you want to take advantage of the introductory 0% APR rate. The fee is incurred when you transfer debts from one or more credit cards to your Bank of America Customized Cash Reward.

- Foreign Transaction Fee

Bank of America Customized Cash Reward has a 3% fee for each transaction in another country. If you are traveling outside of the US, you may want to leave this card at home.

- Few Additional Benefits

The card lacks standout perks beyond the rewards program, limiting its appeal for users seeking additional cardholder benefits.

Top Offers

Simulate Your Rewards: How Much You Earn?

Figuring out how rewards stack up with different cards and spending categories can be a helpful exercise. Here's a breakdown of the rewards offered by the Customized Cash Rewards card:

Just keep in mind that these numbers are based on general spending categories, so you'll want to adjust them according to your personal spending habits for a more accurate estimate.

| |

|---|---|

Spend Per Category | Bank of America Customized Cash Rewards |

$15,000 – U.S Supermarkets | $250 |

$3,000 – Restaurants

| $30 |

$1,500 – Airline | $15 |

$1,500 – Hotels | $15 |

$4,000 – Gas | $120 (3% preffered category) |

Estimated Annual Value | $530 |

Cash back can be redeemed for a statement credit, a check, a direct deposit into a Bank of America® checking or savings account, an eligible 529 account, or a contribution to a Merrill account. You can also sign up for automatic redemption.

Get The Most Of Your Customized Cash Rewards

With the Customized cash rewards card, cardholders earn 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%).

Here are some pointers to help you make the most of your Cash Rewards card:

- Hit the quarterly cap: to get the most out of the premium cashback reward rates, make sure to hit the quarterly cap on purchases each month.

- Be Aware of Exclusions: Certain major grocery stores are not eligible for the premium cashback rates.

- Maximize the Signup Offer: Make sure to take advantage of the signup offer before it expires.

For example, applying for a balance transfer within the app was straightforward, and the promotional rates provided a tangible benefit for managing our credit balances:

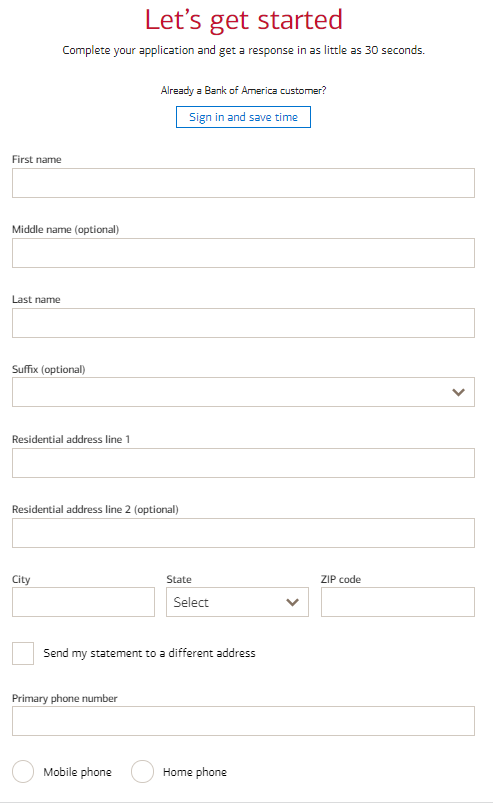

How To Apply For BofA Customized Cash Rewards ?

- 1.

Visit the Bank of America Customized Cash Rewards Card homepage and click “Apply Now.”

- 2.

This takes you to the next page, where you can fill in your “Personal Information” such as your Names, date of birth, etc.

- 3.

The next step is your financial details – you’ll need to share some details about your income and more relevant info such as employment status and annual income.

- 4.

Then click on “Continue” to complete the process.

How It Compared To Other Bank Of America Cards?

While the Customized Cash Rewards offers flexibility and competitive rewards rates, it's essential to consider how it compares to other Bank of America cards.

Compared to the Bank of America Travel Rewards credit card, which focuses on travel-related rewards, the Customized Cash Rewards card is more versatile, catering to high rewrads ratio on specific categories.

However, the Travel Rewards card might be more suitable for frequent travelers or those who spend on many categories. This is also relevant if we compare it with the BofA Unlimited Cash Rewards, which offers unlimited 1.5% cash back on all purchases.

In contrast to the Bank of America Premium Rewards credit card, which provides premium benefits and a higher annual fee, the Customized Cash Rewards card is a no-annual-fee option with a focus on customizable cash back. The Premium Rewards card may be more appealing for those seeking extensive travel perks.

Is the Customized Cash Rewards Card Right for You?

Bank of America Customized Cash Rewards is great for card holders that like to control what spending category they want to get the most cash back from and spend a big portion of the budget on a specific category.

For example, if you are on the road frequently, choosing gas as your spending category will get you the most cash back on this card.

Current Bank of America Customized customers will find the most rewards with this card if they qualify for Bank of America Preferred Rewards Program.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Bank Of America Cash Reward card:

|

|

| |

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 18.99% – 28.99% (Variable)

| 19.99%-28.99% Variable

| 19.74%–27.99% variable

|

FAQ

There is no cap in place when it comes to earning rewards through the Customized Cash Rewards Card when making different types of purchases.

The Bank of America Customized Cash Rewards Card does not carry any out and out income requirements and normally you will not have to provide proof of income.

If you spend a lot on everyday purchases then the Bank of America Cash Rewards Card can be a good fit for you as all types of purchases earn rewards.

Compare BofA Customized Cash Rewards

Both cards have no annual fee, but when it comes top redemption value – the Customized Cash Rewards gives you more. Here's our analysis.

Bank of America Travel Rewards vs Customized Cash Rewards Card

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited

The BofA Customized Cash Rewards and the Chase Freedom Flex have many features in common, but there is a clear winner when comparing them.

Citi Custom Cash Card and the BofA Customized Cash Rewards have similar reward structures but some significant differences. How they compare?