Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Sign-Up Bonus

- No Annual Fee

- Minimum Redemption

- There Are Better Travel Rewards Cards

Rewards Plan

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

Sign up Bonus

Our Rating

PROS

- Sign-Up Bonus

- No Annual Fee

CONS

- Minimum Redemption

- There Are Better Travel Rewards Cards

APR

17.99% - 27.99% Variable

Annual Fee

$0

0% Intro

15 billing cycles on purchases and balance transfers

Credit Requirements

Good – Excellent

- Our Verdict

- FAQ

Bank of America® Travel Rewards credit card is a straightforward rewards card that doesn’t shift spending categories for higher bonuses. It offers flexibility with its travel rewards and simplicity for those who don’t want to jump through hoops in order to earn or spend their rewards.

The card has no annual fee or foreign transaction fees, making it a great option for everyday spending. You’ll earn unlimited 1.5 points for every $1 spent on all purchases, with no expiration on points. Plus, it offers 0% intro APR for the first 15 billing cycles on purchases and balance transfers, then 17.99% – 27.99% Variable

In addition, you can earn 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases.

The redemption options include statement credits for travel or dining, cash back, or gift cards. While the card offers flexibility in redemption, it falls short in comparison to other travel cards when it comes to point transferability and travel perks.

How do I redeem points?

You are able to redeem these points as a statement credit to pay for the likes of travel and dining purchases or you can redeem them as cash or in the form of gift cards.

Does it offer pre-approval?

Yes, pre-approval is an option when you are applying to get a Bank of America Travel Rewards Card. This allows you to avoid a hard credit check.

How hard is it to get a Bank of America Travel Rewards Card?

The card isn't considered as one of the best premium travel cards, so it is not very hard for you to get the Bank of America Travel Rewards Card. You just need to look at the pre-qualification process and see where you might fall short.

What are the top reasons NOT to get it?

If you do not travel a lot then the Bank of America Travel Rewards Card is not really going to be a good fit for you, as there are more suitable options.

In this Review..

Pros & Cons

Now, let's explore the pros and cons of the BofA Travel Rewards card and determine if it's a good fit for your wallet.

Pros | Cons |

|---|---|

Preferred Rewards Boost

| Balance Transfer Fee |

Sign-Up Bonus | Low Points Rewards Ratio |

No Foreign Transaction Fee | Limited Travel Benefits |

Flexible Redemption Options | No Point Transferability |

No Annual Fee | |

0% Intro APR |

- Sign-Up Bonus

You can get 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

- No Foreign Transaction Fee

Bank of America Travel Rewards Credit Card has no transaction fees while traveling in another country.

- Preferred Rewards, No Expiration

Bank of America has a program for all of its credit cards in which cardholders can earn between 25%-75% more rewards with their cards. To qualify for this reward you need at least $20,000 combined with Bank of America or Merrill Lynch accounts.

- Flexible Redemption Options

Cardholders can redeem points for a statement credit to cover various travel and dining purchases, enhancing flexibility in utilizing earned rewards.

- No Annual Fee

Bank of America Travel Rewards Credit Card has no annual fee, so you won’t have to meet spending thresholds to pay off it off. You can start earning rewards as soon as you get the card.

- 0% Intro APR

A 0% introductory APR for 15 billing cycles on purchases and balance transfers (made within the first 60 days) provides a temporary interest-free period, beneficial for those planning significant purchases or balance transfers.

- Balance Transfer Fee

There is a balance transfer fee of 3% or $10 (the greater).

- Low Points Rewards Ratio

The 1.5X ratio is lower compared to other travel cards. Also, the card lacks bonus categories to boost reward earnings, potentially limiting the appeal for users who prefer cards with specialized rewards in specific spending areas.

- Limited Travel Benefits

The card falls short in terms of travel perks, lacking the premium features offered by some competitors, making it less attractive for frequent or luxury travelers.

- No Point Transferability

Unlike some other travel cards, the Bank of America Travel Rewards card does not allow users to transfer points to airline or hotel partners, limiting options for maximizing point value.

Top Offers

Top Offers From Our Partners

Calculate Miles: How Much You Can Earn?

If you travel frequently, your card can definitely help you rack up miles rewards, along with other great benefits. But how much can you actually earn?

To figure that out, we need to calculate the miles based on the card's terms and your spending in each category. Since everyone’s spending habits vary, it's important to adjust these calculations based on your specific breakdown.

| |

|---|---|

Spend Per Category | Bank of America® Travel Rewards |

$15,000 – U.S Supermarkets | 22,500 points |

$3,000 – Restaurants

| 4,500 points |

$1,500 – Airline | 2,250 points |

$1,500 – Hotels | 2,250 points |

$4,000 – Gas | 6,000 points |

Annual Points | 37,500 points |

Estimated Points Redemption Value | 1 point ~ 0.6 – 1 cent |

Estimated Annual Value | $225 – $375 |

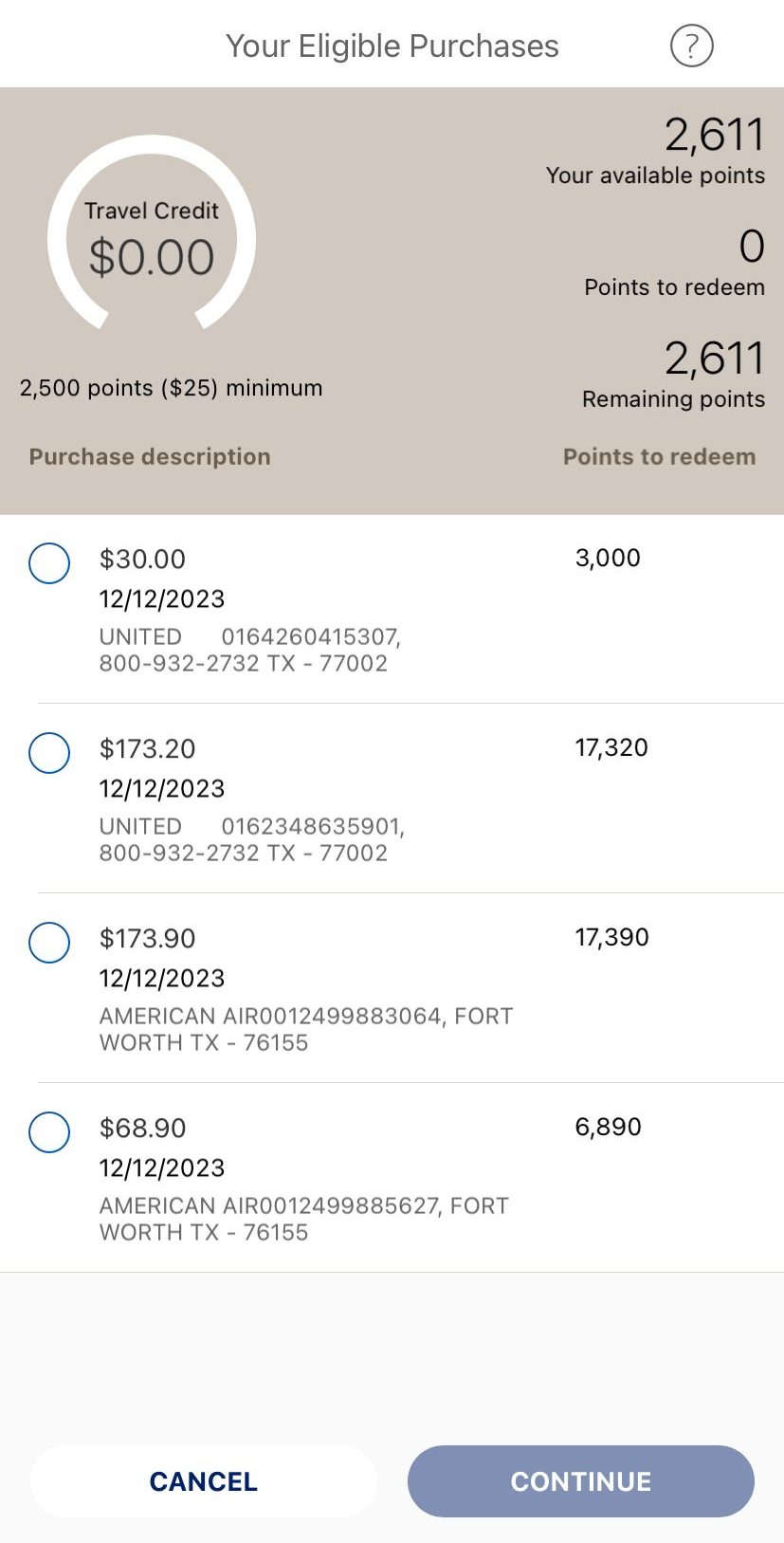

How to Redeem Your Miles Rewards?

With the Bofa travel rewards, cardholders earn 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points.

Bank of America offers you to use your rewards to:

- Book your trip without any blackout dates, restrictions or specific websites.

- Redeem as a statement credit to pay for your travel or dining purchases. This includes restaurants including takeout, baggage fees, vacation rentals, hotels and flights.

Best Ways to Maximize Miles Rewards

Here are some pointers to help you make the most of your Travel Rewards Card:

Join Preferred Rewards: If you meet the membership requirements, joining Preferred Rewards will increase your rewards. You would earn an additional 25% as a Gold Preferred Rewards member. In the above scenario, this would increase your monthly rewards from $30.90 to $38.62, a $92 increase per year.

Link Accounts: Overdraft protection is available by linking your Bank of America checking account. If you want to avoid the embarrassment of declined purchases, you can link your checking account to your credit card, which will trigger an automatic transfer if you are nearing the limit on your card.

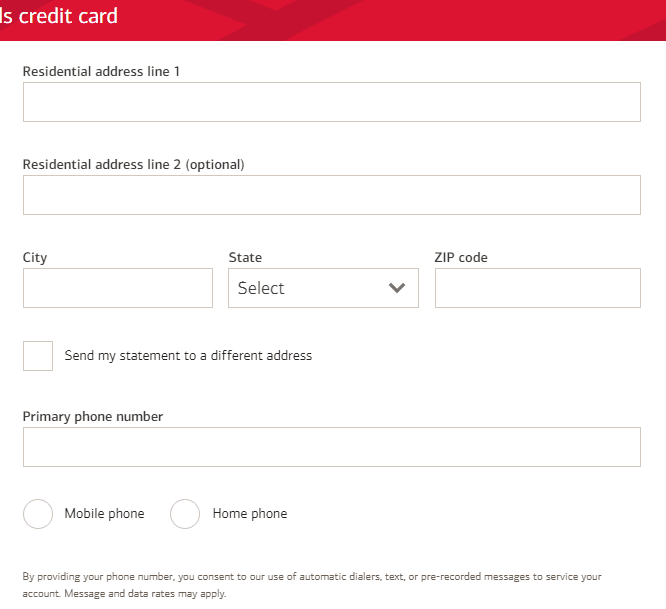

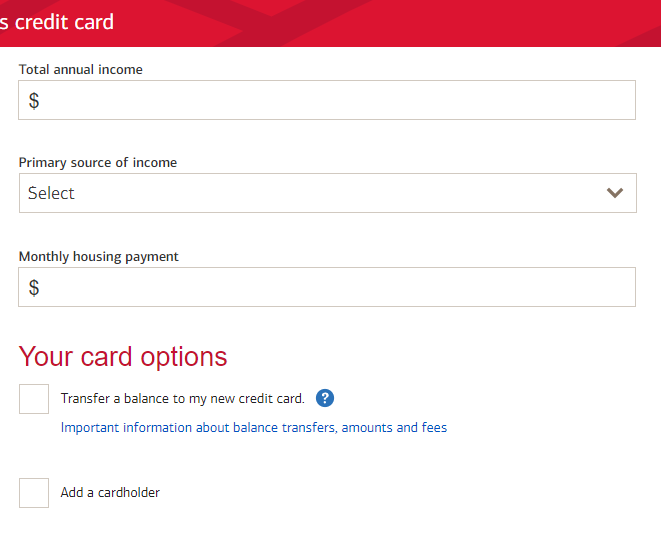

How To Apply For BofA Travel Rewards Card?

- 1.

Visit the Bank of America Travel Rewards Card homepage and click “Apply Now.”

- 2.

This takes you to the next page, where you can fill in your “Personal Information” such as your Names, date of birth, etc.

- 3.

The next step is your financial details – you’ll need to share some details about your income and more relevant info such as employment status and annual income.

- 4.

Then click on “Continue” to complete the process.

How It Compared To Other Bank of America Cards?

The Bank of America Travel Rewards credit card stands out in comparison to other Bank of America cards, each catering to different preferences and financial needs.

One of the main competitor is the the Bank of America Premium Rewards credit card that targets more avid travelers, offering enhanced travel benefits, statement credits for travel-related purchases, and a generous sign-up bonus. It comes with a higher annual fee but compensates with premium perks like airport lounge access and travel insurance.

Among its notable counterparts is the Bank of America Customize Cash Rewards credit card, which focuses on cash back rewards, allowing users to earn cash back in categories of their choice, including gas, online shopping, dining, travel, and more.

The Bank of America Premium Rewards elite credit card is the most premium travel card of BofA, offering premium rewards such as lounge access, statement credits and higher points rewrads ratio. However, its annual fee is very high – $550.

Overall, the Bank of America Travel Rewards card appeal lies in its simplicity, no annual fee, and the potential for boosted rewards through the Preferred Rewards program. For those seeking a basic travel rewards card without the complexity of bonus categories, it may be the right chocie amonf BofA credit cards.

Is the BoFa Travel Rewards Card Right For You?

Bank of America Travel Rewards Credit Card is a great card for frequent travelers who want to earn rewards on their spending but do not want to pay an annual fee.

This card is also great for those who qualify for Bank of America’s Preferred Rewards Program. Bank of America Travel Rewards Credit cardholders can make the rewards go much further if they qualify for the Preferred Program. This card is straightforward and simple in its rewards and redemption structure.

Many customers can appreciate the flexibility of redeeming rewards without having to use special carriers. Also there are fewer restrictions and blackout dates. This card comes with a nice 0% introductory rate that cardholders can use to save some money on interest.

There are better rewards cards available, but many of them come with annual fees and different programs that require cardholders to jump through hoops in order to maximize their rewards.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the BoFa Travel Rewards:

|

|

| |

|---|---|---|---|

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Card | |

Annual Fee | $0 | $95 | $95

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 17.99% – 27.99% Variable

| 19.99% – 28.99% (Variable)

| 19.74%–27.99% variable

|

FAQ

To maximize the rewards from the Bank of America Travel Rewards Card, you should use the points for travel-related or dining purchases, maximize the signup offer, and use in conjunction with another card.

Perhaps you did not meet all of the requirements. You can ask the customer service team what you need to do to get accepted or you can look at other card options. You can also take a look on the best Bank of America credit cards to find an alternative.

If you travel frequently and will use the rewards on travel-related purchases then the Bank of America Travel Rewards Card could be the ideal fit for your situation.

Compare Bank of America Travel Rewards

Both cards have no annual fee, but when it comes top redemption value – the Customized Cash Rewards gives you more. Here's our analysis.

Bank of America Travel Rewards vs Customized Cash Rewards Card

The BofA Premium Rewards is the winner when it comes to travel benefits, but there are cases when you'll prefer the BofA Travel Rewards.

Bank of America Premium Rewards vs. Travel Rewards: Comparison

If you're looking for an basic travel card, the Discover it Miles is better on our opinion. Here are our thoughts – and a full comparison.

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?