Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- No Fees

- No Credit Check

- No Rewards Program

- Need Chime Spending Account

Rewards Plan

Sign up Bonus

Our Rating

PROS

- No Fees

- No Credit Check

CONS

- No Rewards Program

- Need Chime Spending Account

APR

N/A

Annual Fee

$0

0% Intro

N/A

Credit Requirements

No Credit – Poor

- Our Verdict

- FAQ

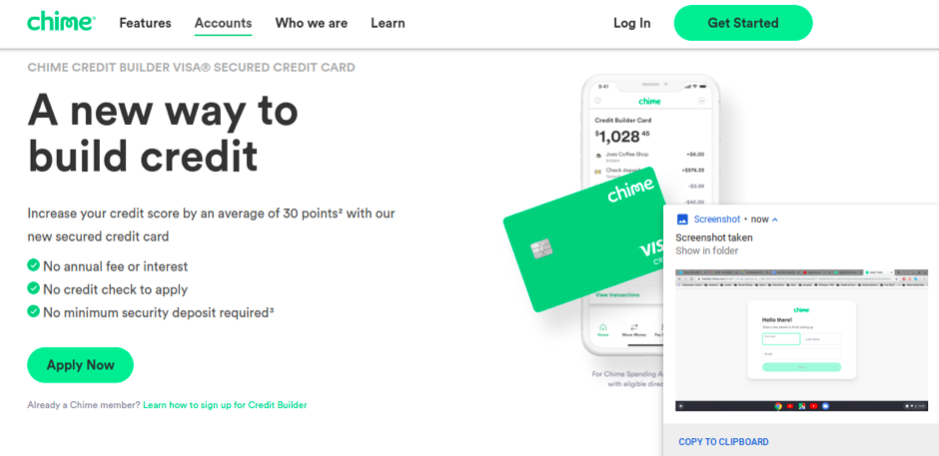

The Secured Chime Credit Builder Visa® Credit Card is a cost-effective option for individuals looking to build their credit profile. This card stands out for its lack of fees and absence of annual interest charges.

The card targets those with poor or average credit scores, making it accessible to individuals with a problematic credit history or no credit at all. It reports to all three major credit bureaus, aiding in building or repairing credit.

If you use your security deposit to pay your monthly statement, you'll need to add more funds to your account to keep your credit limit the same. For example, if you have a $300 deposit and use $150 to pay your Chime Credit Builder Card, your limit will drop to $150 the following month until you replenish the deposit.

However, it lacks rewards, cannot be converted to an unsecured card, and may not suit those seeking a higher credit limit without the need for additional deposits. To apply for the card, you must have a Chime spending account.

Does the card report payments to all credit bureaus?

Chime does report payment activity to all the credit bureaus, which helps to build or rebuild your credit.

What are the top reasons not to get it?

The top reason not to get the Chime card is that you don’t want to open a Spending account. The Chime card is an integrated product, which requires transfers from a Chime Spending account. So, if you are happy with your current checking account and simply want a credit card, this is not the right choice for you.

How long should I use the card until my credit score goes up?

This will depend on your circumstances and financial habits. However, Chime reports that its customers see an average increase of 30 points in approximately three months

Can I add an authorized user?

Chime doesn't allow second users on their credit cards, so it is not possible to add an authorized user to these accounts.

Does Chime offer a good digital experience?

Chime has a great reputation for its digital experience. All its products are integrated and you can use the desktop interface or app to manage your accounts. This makes it easy to transfer funds or even start to build up your savings as you work on your credit score.

How long does it take to get approval?

Once you are a Chime customer, you can typically get a Credit Builder card within seven business days.

Table of Contents

Pros & Cons

Let’s take a closer look at the pros and cons of the Chime Credit Builder Card:

Pros | Cons |

|---|---|

Many Fees Are Waived

| Need Funds to Set Your Credit Limit |

Reports Your Activity to Credit Bureaus | You Need a Chime Spending Account |

No Minimum Security Deposit | No Rewards Program |

No Credit Check | Limited Benefits |

Flexible Credit Limit | No Option to Upgrade to Another Card |

Access to ATMs | ATM Withdrawal Fees |

- Many Fees Are Waived

One of the most attractive benefits of this card is there are no fees at all. This means no annual fee, no interest, no foreign transaction fees. So, you don’t need to worry about racking up charges that will compromise your finances and credit.

- Reports Your Activity to Credit Bureaus

Another great advantage of this card is that Chime reports your card activity to all three of the major credit bureaus. This will help you to build your credit, making it easier to apply for credit in the future.

- No Minimum Security Deposit

You can set your own credit limit with no minimum deposit. Your limit will be equal to the deposit in your Chime Spending Account.

The only restriction is that you need at least one direct deposit to your Spending Account within a year of your application date. This should be $200 or more.

- No Credit Check

Unlike most cards, there are no credit check requirements to apply for the Chime Credit Builder Card. The only restriction is that you need to have a Chime Spending Account that will link to your card.

- Flexible Credit Limit

Cardholders have the flexibility to choose their credit limit, ranging up to $10,000, providing some control over their spending capacity.

- Access to ATMs

The card allows users to make cash withdrawals at ATMs, providing additional convenience for those who may need access to physical currency.

- Need Funds to Set Your Credit Limit

You will need some funds to use as a deposit and set your credit limit. So, if you are short of cash, this card will not provide great benefits for you.

- You Need a Chime Spending Account

This card is designed to work with a Chime Spending Account. So, you must open an account first.

- No Rewards Program

The card lacks a rewards program, meaning users won't earn cash back or points on their purchases, potentially making it less appealing for those seeking additional benefits.

- Limited Benefits

While it comes with basic Visa benefits, the card lacks additional perks such as cell phone protection or purchase protection that are offered by some other credit cards.

- No Option to Upgrade to Another Card

Chime does not offer an upgrade to a standard credit card, once you have established a better credit score.

- ATM Withdrawal Fees

While the card provides access to cash through ATMs, using an out-of-network ATM incurs a $2.50 withdrawal fee, which could be a drawback for users who frequently rely on ATMs outside the network.

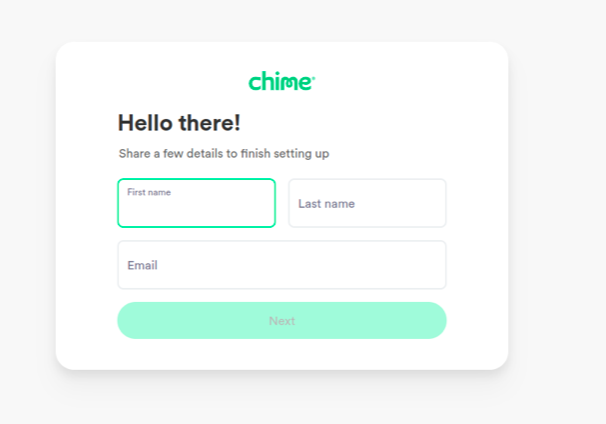

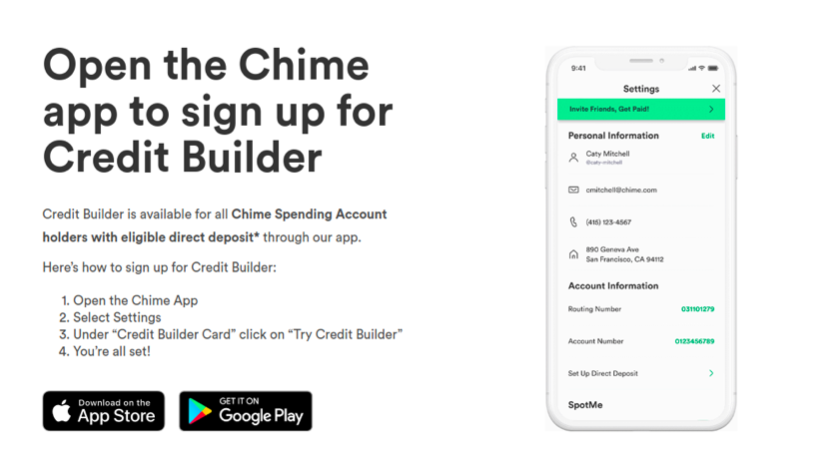

How To Apply For Chime® Credit Builder?

- 1.

The Chime Credit Builder Card is only available for Chime Spending Account clients. If you don’t already have a Spending Account you will need to sign up for this first. Once your account is open, you can proceed with your Credit Builder Card application.

- 2.

You can begin the application process online. Simply click the green “Apply Now” button to start.

- 3.

You’ll need to then provide your name and a valid email address.

- 4.

You can also apply using the Chime app. The application link is under settings. You’ll see a “Try Credit Builder” under the Credit Builder Card tab.

How It Compared To Other Credit Building Cards?

Compared to traditional secured credit cards, the Chime Credit Builder Visa offers a distinctive advantage by allowing users to pay their monthly balance with their security deposit.

This feature is not commonly found among secured cards and provides a practical approach to managing credit utilization. However, it comes with the caveat that the credit limit is reduced until the deposit is replenished, potentially impacting spending flexibility.

The Chime Credit Builder Visa doesn’t offer a rewards program, which could be a downside for those looking for cash back or other perks. Some other secured credit cards, like the Discover it® Secured Credit Card, do offer cash back rewards, making them a more attractive option for users who want to earn benefits while building credit.

Moreover, the Chime Credit Builder Visa does not provide a direct pathway to convert to an unsecured card, a feature offered by some other secured cards. Cards like the Capital One Secured Mastercard, for example, offer the opportunity for users to transition to an unsecured card after demonstrating responsible credit behavior.

Compare The Alternatives

There are more cards to build credit with – here are some good alternatives to the Chime card:

|

|

| |

|---|---|---|---|

Chime Credit Builder | Capital One Journey | Discover It Student Cash Back | |

Annual Fee | $0 | $0

| $0

|

Rewards |

None

None

|

Up to 1.25%

earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%

|

1-5%

5% cash back on activated rotating category purchases (up to $1,500 in purchases each quarter, then 1%) and 1% on all other purchases

|

Welcome bonus |

None

None

|

None

$5 per month for 12 months on select streaming subscriptions when you pay on time

|

Match Bonus

Discover will automatically match all cash back you earn at the end of your first year with the card without a minimum spending requirement or maximum rewards.

|

Foreign Transaction Fee | 0%

| None

| $0

|

Purchase APR | N/A

| 29.99% (Variable)

| 16.99% – 25.99% Variable

|

FAQ

Chime does not have any income requirements for the Credit Builder credit card. You will need to open a Chime Spending account, but this does not require a credit check. This means that you will not need to prove your income to access the Chime banking services.

This is not necessary for Chime, but to determine your credit limit, Upgrade may require that you provide proof of income.

The only pre approval you need for the Chime card is to open up a Chime Spending account, but this does not require a credit check. It is not possible to open a Chime card account without having a Spending account.

Your initial Chime credit limit will be determined by how much you transfer to your Credit Builder account. You can transfer as little or as much as you like and then use the card as you would a prepaid debit card.

Compare Chime Credit Builder Card

Both Chime and Upgrade cards are new in the view, offers great features for beginners who don't established their credit yet. Which one wins?

The Chime card is more flexible and has no credit check, whereas Capital One opens up possibilities for transitioning to an unsecured card.

Chime Credit Builder Secured Visa vs. Capital One Secured Mastercard: Comparison

Chime is our winner as it offers no credit check and no foreign transaction fees, unlike the Citi Secured which is a more conservative card.

Chime Credit Builder Secured Visa vs. Citi Secured Mastercard: Comparison

Top Offers

Top Offers From Our Partners

The secured Chime Credit Builder Visa® Credit Card is issued by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your card for its issuing bank.

Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A.; Members FDIC. The secured Credit Builder card issued by Stride Bank, N.A.