Table Of Content

Both American Express and Citi are among the top credit card providers. While Amex cards are considered more luxury, Citi also offers some good options, especially if you already managing a bank account with Citi.

Here's a comparison between each issuer's options, breakdown by category – cashback, points rewards, 0% intro, or travel card.

Amex vs. Citibank: Which Offers Better Cashback Card?

If you're in the market for a cashback card, there are plenty of options that come with a generous welcome bonus and 0% introductory APR. However, the reward structure is the key factor to consider. Here's a look at the main differences:

The Blue Cash Everyday® and Blue Cash Preferred® cards from American Express cater to those who spend heavily on groceries. While the Blue Cash Preferred card offering higher rewards, it charges an annual fee of $95 ($0 intro for the first year).

The Citi Double Cash Card is the only card offering flat rate cashback which is better for those who prefer to earn cash back on all purchases without any restrictions.

The Citi Custom Cash Card, on the other hand, is ideal for those who have variable spending patterns and want to leverage higher cashback. However, its cap is wuite low so this is not for big spenders.

|  | |||

|---|---|---|---|---|

Blue Cash Preferred® Card from American Express | Blue Cash Everyday® Card from American Express | Citi® Double Cash Card | Citi Custom Cash℠ Card | |

Annual Fee | $95 ($0 intro for the first year) | $0 | $0 | $0 |

Rewards | 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| 1-3%

3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%

| 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

|

Welcome bonus | $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $200

$200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

|

0% Intro APR | 12 months on purchases and balance transfers

| 15 months on purchases and balance transfers from the date of account opening | 18 months on balance transfers | 15 months on purchases and balance transfers |

Foreign Transaction Fee | 2.70% | 2.7% | 3% | 3% |

Purchase APR | 18.49% – 29.49% Variable | 18.49% – 29.49% Variable | 18.74% – 28.74% (Variable) | 18.49% – 28.49% (Variable) |

Read Review | Read Review | Read Review | Read Review |

Platinum Card or Citi Premier: Which Travel Card Wins?

When it comes to premium travel credit cards, Citibank offers a mid-tier travel card – the Citi Strata Premier card. While a nice welcome bonus and rewards can be redeemed through Citi ThankYou portal, additional travel benefits are limited.

Platinum Card holders enjoy numerous exclusive benefits. These include Marriott Bonvoy Gold Elite status for hotel perks and a complimentary Priority Pass Select membership, providing access to over 1,400 lounges worldwide.

Additional perks include preferred event seating, a $100 experience credit for bookings through The Hotel Collection, up to $200 in annual hotel credits, $240 in digital entertainment credits, $155 in Walmart+ credits, $200 in airline fee credits, and $189 for CLEAR® Plus memberships.

Citi Strata Premier Credit Card | The Platinum Card® from American Express | |

Annual Fee | $95 | $695 |

Rewards | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

Welcome bonus | 75,000 points

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

| 80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.24% – 29.24% (Variable) | See Pay Over Time APR |

Read Review | Read Review |

Points Rewards: Amex Gold or Citi Rewards+

Despite the higher annual fee, we think the Amex Gold might be the most appealing option. It offers a better rewards structure than the Premium Rewards card, along with added perks like baggage insurance (up to $500 for checked bags and $1,250 for carry-ons), a $100 experience credit, and $120 in annual Uber and dining credits ($10 per month for each).

The Citi Rewards+® Card is known for its unique “round up” feature, where each purchase is rounded up to the nearest 10 points. It offers a generous rewards structure, but additional benefits are limited compared to the Amex Gold card.

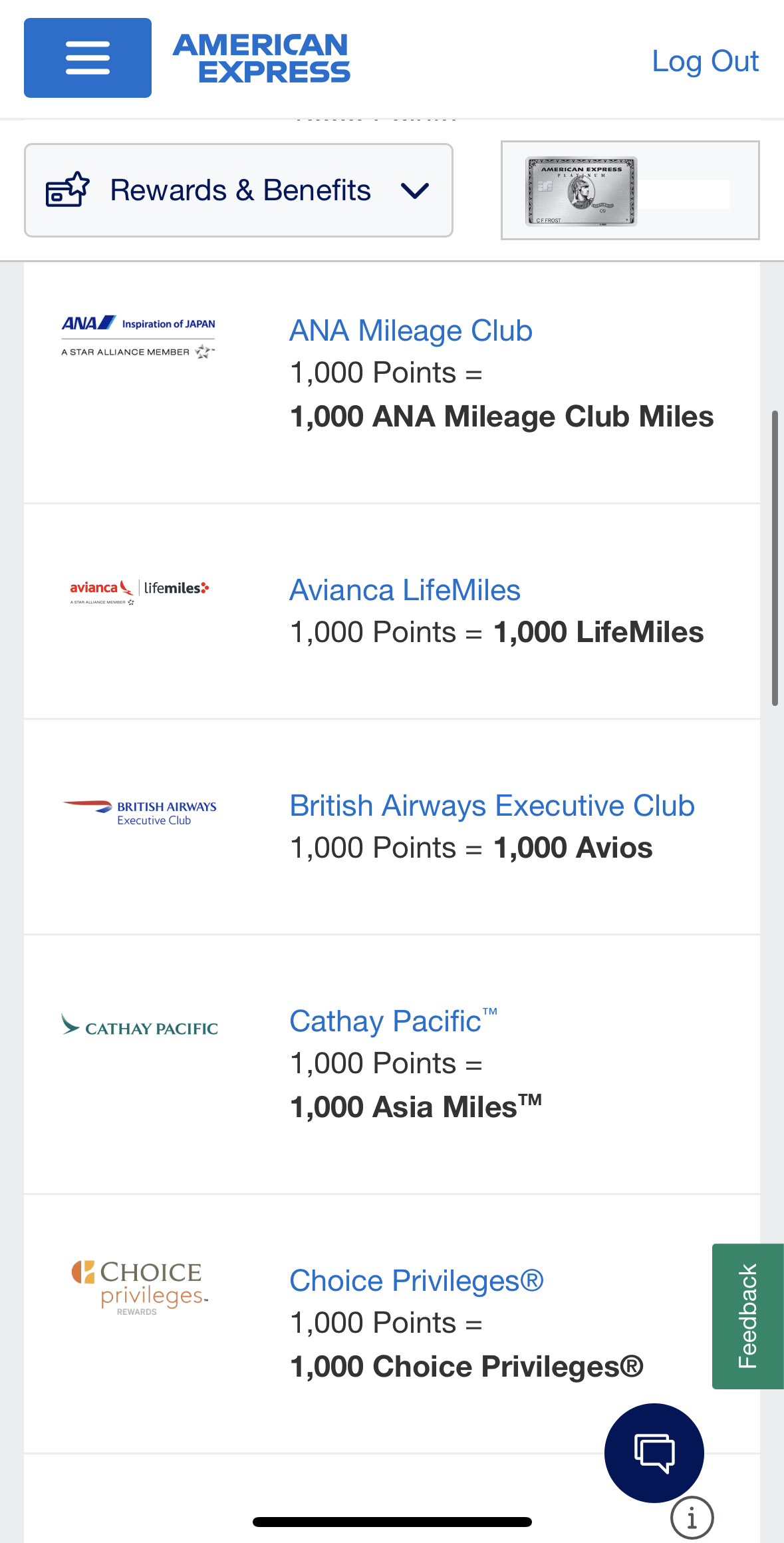

The Amex Gold Card's Membership Rewards points offer extensive flexibility, especially with the option to transfer points to over 20 airline and hotel partners. The Citi Rewards+® Card’s ThankYou® Points travel partners are limited, but there are many other redemption options.

| ||

|---|---|---|

American Express® Gold Card | Citi Rewards+® Card | |

Annual Fee | $325 | $0 |

Rewards | 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| 1X – 5X

Earn 5X points on rental car, hotel and attraction purchases booked through cititravel.com (ends 12/31/2025), 2X points at supermarkets and gas stations (on up to $6,000 in purchases per year, then 1X points) with 1X points on all other purchases

|

Welcome bonus | 60,000 points

60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership

| 20,000 points

Earn 20,000 bonus points after spending $1,500 within the first 3 months of account opening (redeemable for $200 in gift cards or travel rewards at thankyou.com)

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | None | 3% |

Purchase APR | See Pay Over Time APR | 17.99% – 27.99% (Variable) |

Read Review | Read Review |

0% Intro APR: Citi Simplcity vs. Diamond vs. Amex Everyday

If you need a balance transfer card with a long 0% introductory APR, several cards stand out for offering some of the longest terms in the industry. Citi provides two strong options—the Simplicity card and the Diamond Preferred card—while the Amex Everyday card is a notable competitor.

For balance transfers, Citibank clearly leads the category with its extended 0% introductory APR terms. However, the Amex Everyday card offers a lower balance transfer fee compared to Citibank’s options and includes rewards on purchases, which Citi’s balance transfer cards do not offer.

This makes the Amex Everyday card an attractive choice for those looking to earn rewards while paying down their balance.

Citi Simplicity® Card | Citi® Diamond Preferred® Card | American Express EveryDay® Card | |

Annual Fee | $0 | $0 | $0 |

Rewards | None |

None | 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

0% Intro APR | 12 months on purchases and 21 months on balance transfers | 21 months on balance transfers and 12 months on purchases | 15 months on purchases and balance transfers |

Balance Transfer Fee | $5 or 5% (whichever is greater) | $5 or 5% (the greater) | $5 or 3%, whichever is greater |

Foreign Transaction Fee | 3% | 3% | 2.7% |

Purchase APR | 18.74% – 29.49% (Variable) | 17.49% – 28.24% (Variable) | 17.74% – 28.74% Variable |

Read Review | Read Review | Read Review |

Airline Cards: Delta By Amex Or American Airlines By Citi?

When it comes to co-branded airline cards, American Express partners with Delta, while Citi partners with American Airlines. Besides the following cards featured in the table, there are additional cards for low, mid and high tier users, each tier provides increasing levels of benefits.

For example, besides welcome bonus and rewards, the Delta SkyMiles® Gold American Express Card offers free checked bag, priority boarding, and a 20% in-flight purchase discount. Delta SkyMiles can be redeemed for flights, seat upgrades, SkyMiles Experiences, and more.

The Delta SkyMiles® Reserve Amex card customers get complimentary access to Delta Centurion® Lounge, Annual Companion Certificate, Delta Sky Club® Access, $150 Delta Stays Credit, $120 Resy Credit, MQD boost, advanced protections and more.

Citi offers a range of American Airlines AAdvantage cards, including the low-tier American Airlines AAdvantage MileUp℠ Card, the mid-tier Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®, and the high-tier Citi® / AAdvantage® Executive World Elite™ Mastercard®. The Executive card comes with premium benefits like up to $120 back on eligible Grubhub purchases, Admirals Club® Membership, enhanced airport perks, a free first checked bag, and more.

Naturally, the choice between Delta and American Airlines cards depends on your flying habits and loyalty.

Delta SkyMiles® Gold American Express Card | Citi® / AAdvantage® Platinum Select® World Elite Mastercard® | Delta SkyMiles® Reserve American Express | AAdvantage® Executive World Elite Mastercard® | |

Annual Fee | $150, $0 intro first year | $99 (waived for the first 12 months)

| $650 | $525 |

Rewards | 1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| 1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

| 1X – 10X

10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

|

Welcome bonus | 50,000 Miles

Earn 50,000 bonus miles after you spend $2,000 in purchases on your new card in your first 6 months of card membership.

| 50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

| 70,000 miles

Earn 70,000 bonus miles after you spend $5,000 in eligible purchases on your new card in your first six months of card membership.

| 70,000 miles

70,000 American Airlines AAdvantage® bonus miles after spending $7,000 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0 | $0 | $0 |

Read Review | Read Review | Read Review | Read Review |

Additional Cards To Consider

Amex also partnered with hotel chains such as Hilton and Marriot, enhancing its travel options.

The Hilton Honors cardholders enjoy complimentary Hilton Honors Silver status, providing benefits like a 20% bonus on base points and late check-out. Points can be redeemed for free nights at Hilton properties worldwide, experiences, car rentals, and more.

The Marriott Bonvoy Brilliant® American Express® Card is tailored for luxury travelers and Marriott enthusiasts. Cardholders receive automatic Marriott Bonvoy Gold Elite status, granting benefits like room upgrades, late checkout, enhanced earning rates on stays, Priority pass, up to $300 in statement credits for Marriott purchases and various protections.

Lastly, the most popular Citi co-branded card is Costco, offering extensive benefits for those who shop at Costco and use the card for everyday purchases. While the additional benefits are limited, customers may save thousands of dollars every year if they buy frequently in Costco.

Hilton Honors American Express Card

| Costco Anywhere Visa® Card by Citi | Marriott Bonvoy Brilliant® American Express® Card | |

Annual Fee | $0 | $0 ($60 Costco membership fee required) | $650 |

Rewards | 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

Welcome bonus | 100,000 points

100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| None

| 95,000 points

95,000 Marriott Bonvoy points after spending $6,000 within the first 6 months of card membership.

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 20.24% – 29.24% variable APR | 19.99% – 27.99% (Variable) | 20.24% – 29.24% Variable |

Read Review | Read Review | Read Review |

Bottom Line

Both Amex and Citibank offer a variety of cards for almost any purpose.

Despite Citibank covering most of the important categories for customers, Amex is a clear leader in practically every category, especially when it comes to travel credit cards and luxury benefits for cardholders.