American Airlines offers a variety of credit cards designed to suit the needs of different travelers, giving you the chance to earn rewards and enjoy exclusive benefits.

These cards open the door to valuable travel perks, making them a great choice for frequent flyers with American Airlines.

They often come with attractive sign-up bonuses, allowing you to rack up a good amount of miles from the get-go. Plus, American Airlines credit cards typically offer travel-related benefits like priority boarding, discounts on in-flight purchases, and travel insurance coverage.

In this article, we'll break down the top American Airlines credit cards for 2025:

Card | Rewards | Bonus | Annual Fee |

| 1X – 2X

2 AAdvantage miles per dollar on grocery stores and eligible American Airlines purchases, and 1 mile per dollar on other purchases

| 15,000 miles

15,000 bonus miles after spending $1,000 on purchases within the first three months

| $0 |

|---|---|---|---|---|

| 1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

| 50,000 miles

50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

| $99 (waived for the first 12 months)

| |

| 1X – 10X

10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

| 70,000 miles

70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

| $525 |

American Airlines AAdvantage® MileUp® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The American Airlines AAdvantage® MileUp® Card card is ideal for infrequent American Airlines flyers who want to enjoy AAdvantage miles and earn rewards on everyday purchases. This, combined with the fact that there is no annual fee, makes it an appealing card for people who are new to travel rewards.

However, there are other travel rewards credit cards available if you're willing to pay an annual fee. Depending on the cardholder's credit history, travel needs, and frequency, a potential cardholder may want to look into other options before applying for the American Airlines AAdvantage MileUp Card.

Since the majority of travel cards have an annual fee, this one can be a good option if you prefer a card with no annual fee.

- Rewards Plan: 2 AAdvantage miles per dollar on grocery stores and eligible American Airlines purchases, and 1 mile per dollar on other purchases

- APR: 19.99% – 28.99% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

- 0% APR Introductory Rate:None

- No Annual Fee

- Rewards & Sign up Bonus

- No Rewards Cap

- Citi Travel Options

- 25% off on in-flight food and drinks

- No Extra Benefits

- Average Rewards Rate

- Foreign Transaction Fee

- High APR

Who should consider getting the AAdvantage MileUp card?

Individuals interested in earning and redeeming AAdvantage miles for award flights without an annual fee.

Is the AAdvantage MileUp card suitable for frequent American Airlines flyers?

While it lacks certain premium benefits, the AAdvantage MileUp card can be a solid choice for those who prioritize earning miles without an annual fee.

Which other American Airlines card is recommended for additional benefits?

The AAdvantage Platinum Select card is suggested for those seeking more features, including free checked bags and priority boarding, despite having a $99 annual fee (waived for the first 12 months)

Can the AAdvantage MileUp card holders earn elite status?

Yes, cardholders can earn Loyalty Points toward elite status by making purchases on the card.

What is the significance of Loyalty Points earned with the AAdvantage MileUp card?

Loyalty Points contribute to elite status with American Airlines, allowing cardholders to achieve Gold status by strategically using the card for various purchases.

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

With the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® cardholders earn Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases..

The card offers a nice sign-up bonus of 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening. . There's no limit to the number of miles you can earn.

There are many additional perks you're eligible that can make flying a little bit less of a hassle since such as a free checked bag, preferred boarding and discounts on inflight food and beverage.

However, the card comes with annual fee and the standard variable APR for purchases is 19.99% – 29.99% (Variable) based on your creditworthiness

- APR: 19.99% – 29.99% (Variable)

- Annual fee: $99 (waived for the first 12 months)

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

- Sign Up bonus: 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

- 0% APR Introductory Rate period: N/A

- Sign up Bonus

- Great Rewards For AA Flyers

- No Limit on Miles Earned

- Wide Network of Airlines

- Free Checked bag and Preferred Boarding

- Annual Fee

- High Fees For Reward Changes

- Travel on Many Partner Airlines Can’t be Redeemed Online

- Blackout Dates on Some Rewards

Does it have a rewards limit?

No – the AAdvantage Platinum card doesn't specify a maximum number of miles you can earn, so you can accumulate as many rewards as you like throughout the year.

Can I get car rental insurance?

Unlike the Citi AAdvantage® Executive World Elite Mastercard®, The Citi AAdvantage Platinum Select card does not offer rental car insurance.

What are the card income requirements?

it is possible to obtain the Citi AAdvantage card with good to excellent credit. However, there are no stated income requirements. Your credit score will be used to determine your eligibility, while your income will determine your credit limit upon approval.

Do the miles expire?

There is an expiration on AAdvantage miles, but this is only if you have 18 months of account inactivity. So, if you keep your account active, you should not have any problems with miles expiring.

Can I redeem for flights with airline partners?

American Airlines has limited redemption options for other airlines. You can use your AAdvantage miles for JetBlue flights, but otherwise you are limited to American Airlines flights.

How much is 10,000 miles worth?

Aadvantage miles have a lower average redemption compared to most airline cards, estimated value at 1.27 cents per mile. This means that 10,000 miles could be worth $127 with the Aadvantage Executive World Elite.

AAdvantage® Executive World Elite Mastercard®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Citi® / AAdvantage® Executive World Elite Mastercard® provides benefits similar to other luxury airline cards, but its primary focus is American Airlines.

Cardholders earn 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases.

You'll get a decent welcome bonus as well as a slew of extras like Admirals Club membership, a free first checked bag, TSA PreCheck or global entry reimbursement, and no foreign transaction fees.

This makes this card a good option if you like American Airlines and have other reward cards for the majority of your other purchases. Aside from the high annual fee ($525), cardholders who don't fly frequently or need this card for everyday spending rewards should look for another card.

- Rewards Plan: 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

- APR: 19.99% – 28.99% (Variable)

- Annual fee: $525

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

- 0% APR Introductory Rate: N/A

- Admirals Club Membership

- Reimbursement for TSA PreCheck or Global Entry

- Free First Checked Bag

- Enhanced Airport Experience

- Dedicated Concierge

- Non-Flight Benefits are Limited

- Few Non-Travel Perks

- Annual Fee

- There is no insurance coverage

Can I get car rental insurance?

Unfortunately, the AAdvantage Executive doesn't offer a rental car insurance.

What are the card income requirements?

it is possible to obtain the Citi AAdvantage card with good to excellent credit. However, there are no stated income requirements. Your credit score will be used to determine your eligibility, while your income will determine your credit limit upon approval.

Do the miles expire?

There is an expiration date for AAdvantage miles, but only if your account has been inactive for 18 months. As a result, as long as you keep your account active, you should not have any issues with miles expiring.

Can I redeem for flights with airline partners?

Other airlines have few redemption options with American Airlines. You can use your AAdvantage miles on JetBlue flights, but only on American Airlines flights.

Can I get pre approved?

Citi does occasionally offer pre approval mail outs for its cards, but if you haven’t received a mailer, the online application does not allow for pre approval and you will need to complete a full application, which will involve a hard credit pull

How much is 10,000 miles worth?

The average redemption value of AAdvantage miles is 1.27 cents per mile. This means that 10,000 miles with the United Club Infinite could be worth $200 and $127 with the AAadvantage Executive World Elite.

Pick The Right American Airlines Card

How To Choose Between American Airlines Cards?

There are many different American airlines cards to choose from and some might be more suited to other people. Check out this list and tips to help you choose the best one for yourself.

- Always check the annual fee. Some cards have higher fees than others. You want to make sure you can earn enough benefits and rewards to make up the annual fee. If you aren’t willing to pay the annual fee, you might need to choose another card with lower fees to help you with your finances.

- Every card will have different rewards. You want to make sure you are getting a card with the rewards and points you will use the most. Most of the cards will give you 2 miles for every dollar spent on American Airlines. You will also get one mile for every dollar you spend on other purchases.

- Sign up bonuses. Some cards will have better bonuses than others. Some will also only offer the sign-up bonus during certain times of the year or during promotions. Always make sure you are getting the sign-up bonus as it will give you a good chunk of miles to use from the beginning.

- Free checked bags. Some cards will offer free checked bags and others will not. If you fly often, you will need to have free checked bags as these costs can add up if you are flying several times a year and save on AA bagagge fees.

- Every card will have different APRs. You need to try to get the lowest one you qualify for so you aren’t stuck paying high fees.

AA Card: What Are The Requirements?

For the Citi Advantage cards, you will need a score of at least 660. However, you have more odds of being approved if you have a score of 700 or higher. The credit company will also check your debt-to-income ratio. If your debt is much higher than your income, you might not be able to qualify for a credit card.

American Airline credit cards can be hard to approve because of the high credit scores needed to get the card. If you have been pre-approved, you have better odds of being approved.

Can I Have More Than One American Airlines Card?

You can have multiple AAdvantage cards to earn bonus miles, but keep in mind that they all offer similar benefits and come with an annual fee. If you decide to get more than one, make sure the rewards from both cards offset the annual fees.

Also, be sure to link all your cards to the same account so you can maximize your miles and points, ensuring everything goes toward the same balance.

How's AAdvantage Loyalty Program Work ?

American Airlines' loyalty program, AAdvantage, stands as a cornerstone of rewarding travel experiences for its members. AAdvantage is designed to recognize and appreciate the loyalty of American Airlines customers, offering a plethora of benefits that extend across the airline's vast network.

At the heart of AAdvantage is the accumulation of miles, earned through flights, credit card transactions, and partner activities. These miles serve as a versatile currency, redeemable for flights, upgrades, hotel stays, car rentals, and various other travel-related expenses. The program also frequently offers bonus miles and promotions, accelerating the rate at which members can amass rewards.

A key feature of AAdvantage is its tiered elite status system, which includes levels such as Gold, Platinum, Platinum Pro, and Executive Platinum. Achieving elite status brings an array of exclusive privileges, such as priority check-in, enhanced seat selection, complimentary upgrades, and access to Admirals Club lounges. Elite members also earn bonus miles on flights, amplifying their rewards.

AAdvantage embraces a global perspective by partnering with airlines, hotels, car rental companies, and retail brands worldwide. This extensive network provides members with diverse opportunities to earn and redeem miles, making AAdvantage a comprehensive loyalty program.

How to Redeem For Flights on American Airlines?

If you have an American Airlines credit card, your main question is probably how you can redeem all your points for free or discounted flights. You can use your American Airlines miles to get free travel on American Airlines, American Eagle, and many partner airlines. This gives you access to over 1,000 flight destinations worldwide. This is a great way to travel to places all over the world at a cheaper price.

Once you have your flight booked, you can also use the miles you have on upgrades. This includes American Airlines and partner airlines such as British Airways and Iberia. You can upgrade to first-class or comfort plus to make your flight more comfortable. You might also be able to get free drinks and food on the flight.

Once you’re at your destination, you can use your miles to rent a car, book hotel rooms, or do vacation activities. This is a great way to save money while traveling because you will be able to get nicer cars and hotels for a much cheaper price. Vacation activities you get discounts for are available in over 500 destinations.

Use The Admirals Club Perks

Admirals Club is also another way you can use your miles. You will use them to buy a membership to the club and gain many perks. This makes long layers and being at the airport much more fun. You can enjoy snacks, house drinks, made-to-order specialties, and personal travel assistance. Some of the clubs at the certain airport even have showers and business suites to help you work while on the go.

If you like to fly in a certain seat while flying, you can use your miles to buy main cabin seats. You can choose the seat you want before boarding the plane to make sure you have all the comfort you need.

You can also use your miles to buy luxury experiences. One of these includes Five Star Essentials. This is a personalized service as you navigate through the airport including someone taking your luggage for you and escorting you through security all the way to the gate. They will also meet you at priority check-in to help you load your luggage and find your seat quickly. American Airlines workers will also help you with car service coordination and help you find transportation after you have landed in your new destination.

Can I Redeem For Flights on Partner Airlines?

Yes, American Airlines allows you to redeem flights on partner airlines, but often at different prices than what you would be able to find if you flew directly with American Airlines. Partner airlines are also available in two separate categories.

One world Airline Partners include:

- Alaska Airlines

- British Airways

- Cathay Pacific

- Finnair

- Iberia

- Japan Airlines

- Malaysia Airlines

- Qantas

- Qatar Airways

- Royal Air Maroc

- Royal Jordanian Airlines

- S7 Airlines

- SriLankan Airlines

These often offer better deals where you can find easy ways to book flights for good prices. Keep in mind that the longer the flight and the further away from the destination, the more miles you will need to use.

Top Offers

Top Offers From Our Partners

More Airline Partner Available

There is also other airline partner you can use your miles on, but the process might look a little differently. In some cases, you will need to book through the other airline’s website, or you will need to use a voucher instead of booking directly on aa.com.

Other airline partners include:

- Air Tahiti Nui

- Cape Air

- China Southern Airlines

- Etihad Airways

- Fiji Airways

- GOL Airlines

- Hawaiian Airlines

- JetBlue

- Silver Airways

These airlines will often take more of your miles because they are partners, but not in the Oneworld category. Always check the American Airlines website before you choose a flight or an airline partner.

In most cases, you will book your flight with partner airlines directly on aa.com. If the option is not on the list below, you will have to book through the other airline’s website or you will need to call American Airlines directly. These include:

- Air Tahiti Nui

- Alaska Airlines

- American Airlines

- British Airways

- Cape Air

- Cathay Pacific

- Fiji Airways

- Finnair

- Hawaiian Airlines

- Iberia

- Japan Airlines

- JetBlue

- Malaysia Airlines

- Qantas Airways

- Qatar Airways

- Royal Air Maroc

- Royal Jordanian Airlines

- S7 Airlines

- Silver Airways

- SriLankan Airlines

Top Offers

Top Offers

Top Offers From Our Partners

How Many Miles For a Free Flight?

This depends on where you want to go and your destination airport. It also depends on the level of miles you want to use as there are several options including MileSAAver and AAnytime Level 1, Level 2, etc. The number of miles you use will also depend on the cabin you want to book whether it be the main cabin, premium economy, or business/first class.

Flying around the United States will be fewer miles with flights starting around 7,500 miles for the smallest flight level and then it going up to 15,000 for Alaska and 22,500 miles for Hawaii. These are the main cabin prices.

For the MileSAAver category in the main cabin, you can get a flight to the Caribbean for 15,000 miles or to the northern part of South America for 20,000 miles. The further you fly, the more miles you will spend as Europe starts at 30,000 and Asia starts at 35,000.

What Else I Can Redeem AA Miles?

If you don’t want to use your miles to redeem a flight, there are many other things you can use your miles for. You can also redeem AA miles for a flight and then add things onto the flight with your miles such as upgraded seats or access to the flying clubs in the hotel.

- If you don’t want to use the miles for flights, you can always use them to rent a car. You will need to book the car with your credit card that’s linked to the American Airlines account. You can book a car on your next vacation, or you can rent a car from your hometown and drive it to your next destination.

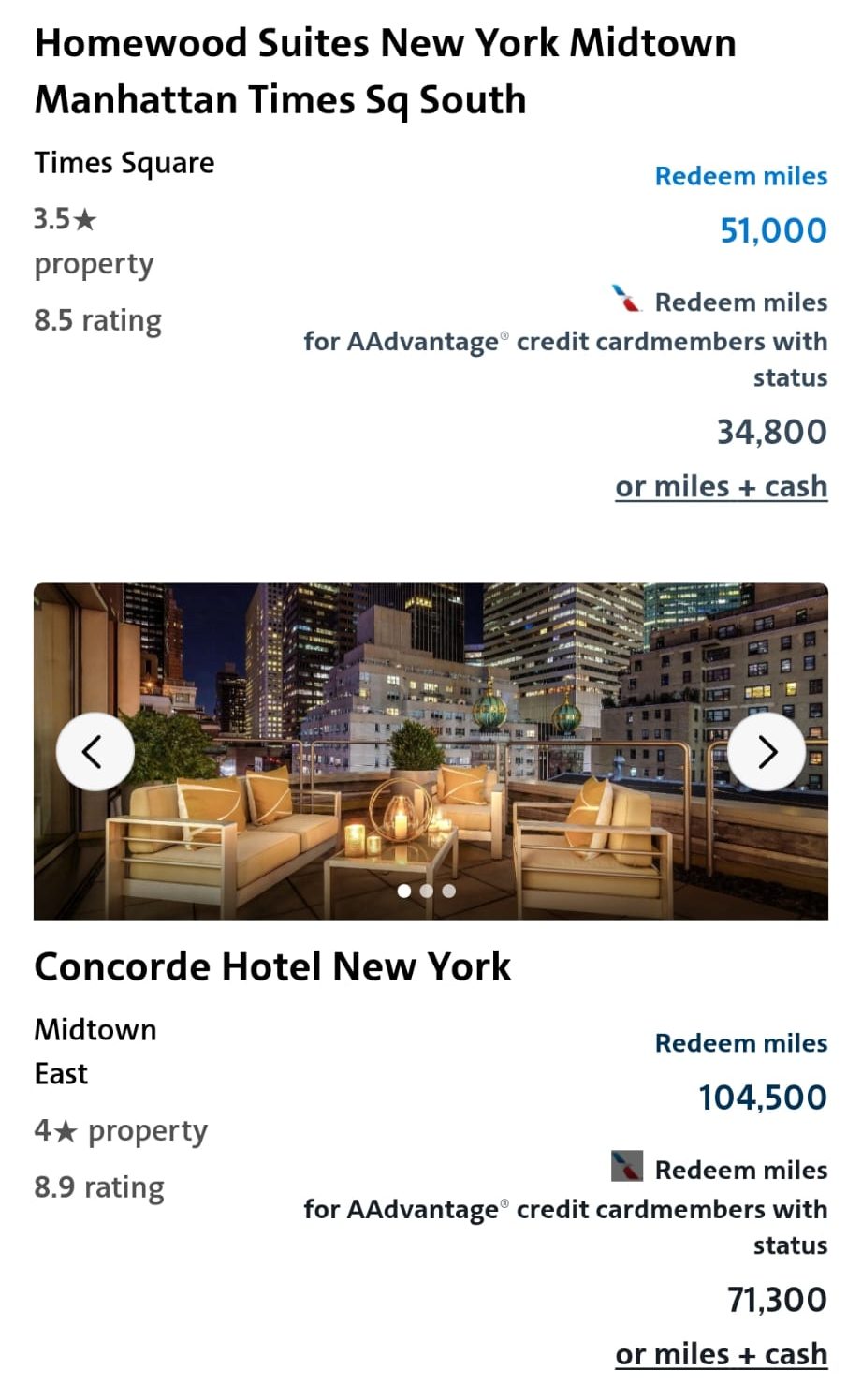

- You might also want to redeem your miles to book hotels. You can also redeem points to upgrade hotel rooms to suites or nicer rooms. You might also be able to use your points to get a late checkout or other hotel perks.

- You can also shop on points.com to buy items such as newspapers, gift cards, magazines, and other items. This isn’t the most lucrative way to redeem points but you can use it if there are some items you have been wanting that are available on the website.

- You can also use your miles to book entire vacation packages. This even includes activities at over 500 destinations across the world. This might include activities such as snorkeling, swimming, skiing, or whatever your destination has available.

- Some also choose to use their miles to donate to charity. There are many options donating including opportunities to donate to fighting hunger and improving housing for struggling communities. You can also donate miles to environmental programs or programs that support veterans and military members.

Do American Airlines Miles Have an Expiration Date?

Yes, American Airlines have expiration dates on their miles. They will begin to expire 18 months after no activity. If you are an occasional flyer, this doesn’t seem like very much time. You will need to take steps to prevent them from expiring. If you have a member on your program that is under 21 years old, their miles never expire.

Keep in mind that mileage activity means redeeming or earning miles. You can even take a cheap flight just to keep the miles from expiring or redeem your miles for something other than flying.

How to Maximize American Airlines Cards?

As with any credit card, you want to be able to maximize your points and card to make sure you are taking back your annual fee and to ensure you are using all the opportunities available to you.

Here are 6 of the best tips to make sure you are making the most out of your American Airline card:

- Earn the welcome bonus. Make sure you spend $2,500 in the first 3 months so you can earn an additional 50,000 miles. This will help you bring in a ton of points to redeem when you are traveling next.

- Free checked bag and in-flight food and drink discount. If you are an Elite Mastercard holder, you can get your first checked bag for free. Your companions will also get their checked bag for free as well as 25% off on food and beverage purchases.

- Board your flight first. You always get preferred boarding, so make sure to take advantage of it rather than waiting in line to board. This will also ensure you get enough space in the overhead bin, so you aren’t stuck checking your small bags when you don’t need to.

- Earn miles when you use your card. You will get 2 miles for every dollar spent at gas stations, restaurants, and other American airlines purchases. Some purchases will only give you one dollar per purchase.

- Use your miles to fly on partner airlines. If you want to go to a faraway destination, you don’t have to choose another airline and spend an arm and leg to get there. You can use your miles on American Airline partner airlines to help get you where you want to go.

- Get American Airlines flight discounts. If you spend $20,000 on the card in one year, you will be able to earn a $125 flight discount.

Is it Possible to Transfer AA Miles to a Family Member?

You can use redeem miles for other people in your flight party as you can add them to the reservation and book multiple tickets. Just make sure you are putting more than one person on the flight reservation so the system will know you are using miles and points for more than one person or for more people other than yourself.

You can book flights for other people using your miles as well without flying with them. You will need to have their personal information and itinerary available so you can book it quickly and efficiently.

How Much Are AAdvantage Miles Worth?

Most of the miles are worth about 1 cent each. Some people say the miles get to be about 1.2 cents each depending on how you use them. This is about the same as most of the credit card companies have that offer mile values. Delta has an average of about 1.3 cents and Alaska has a value of about 1.1 cents. If you are going by the business value, the value will be about 2.5 cents each.

Depending on when you use the miles, it will depend on the exact value you get from the miles. Studies have shown that the best times to use the miles are about 15 days before business class. They even go up to 3.7 cents each mile.

For the main cabin, the value is 1.2 cents 180 days before departure and for holiday travel. They are only worth about 1 cent every 15 days before departure.

FAQs About American Airlines Cards

The main way to get the elite status on AAdvantage is to earn EQMs. These are based on a percentage of the actual miles you fly and will be based on the airline and the booking code. You also have EQSs which are earned on eligible flight segments which can be earned by American Airlines or their partner airlines.

EQDs are also needed to get elite status. You will earn these based on the cost of the ticket which is calculated by the base fare plus the carrier-imposed fees. If you use a Oneworld partner, the flight will be based on the flight distance not the actual cost of the ticket.

If you want to see if you have been pre-approved, you can fill out the application and they will do a soft pull of your credit. If you submit the official application, they will do a hard pull of your credit to see if you are approved before they give you the credit card.

This depends on your personal life and your goals. If you travel often and want to take advantage of American Airlines and their partner airlines, the credit card can definitely be worth it. Just make sure you take advantage of all the perks and benefits.

Yes. You can contact them about any questions or concerns you have. You can visit the aa.com website to fill out concern forms and you can call 800-433-7300 to talk to a representative. You can also enroll in the program online on your own or do it directly at the airline counter.

Yes, the AAdvantage program is free. It is the loyalty program and frequent flyer program for American Airlines. You don’t need a credit card if you just want to use the frequent miles, but you will need to keep track of your number so you can enter it in when you buy flights.

How We Picked The Best American Airlines Credit Cards: Methodology

To identify the best American Airlines credit cards, our team researched various cards, focusing on American Airlines. We rated these cards based on four key categories tailored for consumers seeking American Airlines rewards:

American Airlines Rewards & Benefits (50%): We evaluate the rewards program specific to American Airlines, including miles earned per dollar spent on American Airlines purchases, bonus categories for accelerated rewards, and redemption options such as free flights, upgrades, or lounge access. Cards offering generous rewards rates, versatile redemption choices, and valuable benefits like companion passes or priority boarding score higher in this category.

Card Features & Offers (50%): This category assesses additional features that enhance the overall value of the card for American Airlines travelers, such as annual or foreign transaction fees , free checked bags, priority check-in, and discounts on in-flight purchases. Cards offering a comprehensive range of benefits without excessive fees earn higher scores.

This comprehensive evaluation ensures that the best American Airlines credit cards offer valuable rewards, benefits, and a seamless user experience for consumers seeking to maximize their travel with American Airlines.