The BJ's One+ Mastercard and the Amazon Prime Visa credit card are two popular options for consumers seeking rewards and benefits tied to their shopping habits. Both cards offer unique advantages, but they cater to different retail ecosystems. Let's compare them side by side:

BJ’s One+ vs. Amazon Card: General Comparison

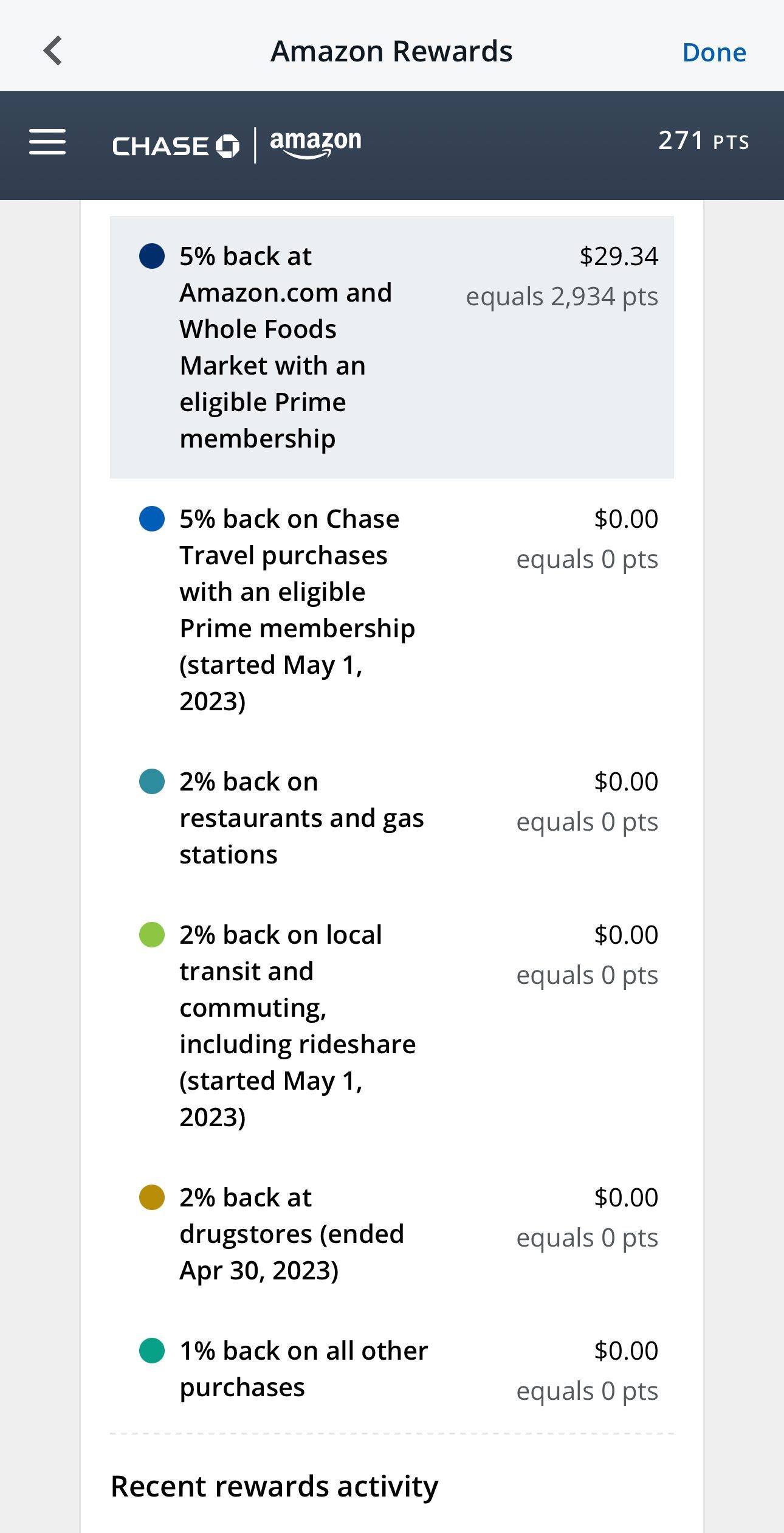

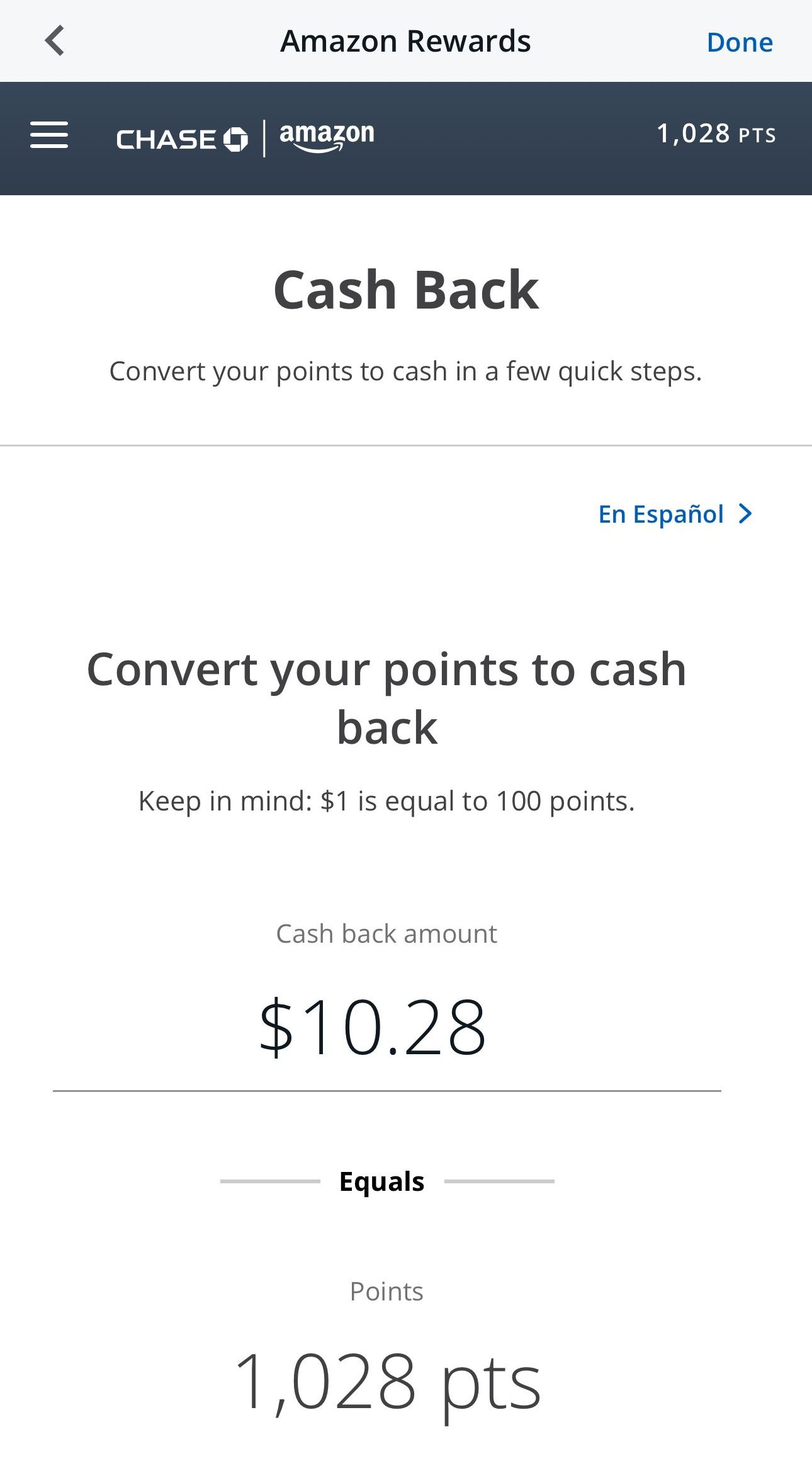

The BJ's One+ Mastercard, issued by Capital One, offers a solid cashback program for shoppers who frequently visit BJ's and want competitive rewards in other spending categories as well. Meanwhile, the Amazon Prime Visa credit card, issued by Chase, is designed specifically for Amazon shoppers looking to maximize their rewards.

While both cards have no annual fee, it's essential to consider the membership requirements of each warehouse club. The BJ's One+ Mastercard is tied to BJ's Wholesale Club, while the Prime Visa requires an Amazon Prime subscription.

When comparing the two, the key differentiator is the retail ecosystem they serve. The BJ's One+ Mastercard is ideal for individuals who prioritize bulk shopping at BJ's Wholesale Club, while the Prime Visa card is better suited for those heavily invested in the Amazon and Whole Foods shopping experience.

|

| |

|---|---|---|

Prime Visa Card | BJ's One+ Mastercard | |

Annual Fee | $0 ($139 Amazon Prime subscription required) | $0 ($110 Club+ Membership required) |

Rewards | 5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases | 5% cash back on BJs Purchases, 2% cash back on other purchases |

Welcome bonus | Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

| Up to 5% back in rewards based on your card tier |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 19.49% – 28.24% Variable | 19.24% – 29.24% |

Read Review | Read Review |

Top Offers

Top Offers

Top Offers From Our Partners

BJ's One+ vs. Amazon Cashback: Which Card Gives More?

If you primarily shop for groceries and fuel at BJ's, the BJ's One+ Mastercard is the better option for cashback.

Its more favorable points and rewards structure leads to a higher estimated annual cashback compared to the Amazon Prime Visa card.

Here’s our breakdown:

|

| |

|---|---|---|

Spend Per Category | Prime Visa Card | BJ's One+ Mastercard |

$15,000 – U.S Supermarkets | $150 | $750 |

$5,000 – Amazon | $200 | $100 |

$5,000 – Restaurants | $100 | $100 |

$4,000 – Travel

| $200 | $80 |

$4,000 – Gas | $80 | $80 |

Estimated Annual Cashback | $730 | $1,010 |

* Assuming all supermarkets made via BJ

Additional Benefits: BJ’s One+ vs. Amazon Card

Both cards offer some extra perks for cardholders – but the Amazon card offers a broader set of perks and protections:

Prime Visa Card

- Prime Card Bonus: Unlock an impressive 10% back or more on select products, enhancing the allure for Amazon Prime members and ensuring the card proves exceptionally rewarding for frequent shoppers.

- Baggage Delay Insurance: In the unfortunate event of delayed baggage, this benefit steps in to cover essential expenses, ensuring a smoother travel experience with financial support.

- Extended Warranty Protection: Enjoy extended warranty protection on purchases made with the Amazon card, extending coverage beyond the manufacturer's warranty for added peace of mind.

- Lost Luggage Reimbursement: If your luggage goes astray during travel, the card provides reimbursement for essential items, alleviating the inconvenience of lost belongings and easing the impact on your journey.

- Roadside Dispatch®: Access a 24/7 roadside assistance hotline through the Amazon card, offering services such as towing, tire changes, and more in case of vehicle breakdowns, ensuring you stay on the move with confidence.

- Travel Accident Insurance: Cardholders benefit from travel accident insurance, offering financial coverage in the unfortunate event of accidental death or dismemberment while traveling, enhancing overall travel security.

- Travel and Emergency Assistance: This feature provides access to a range of emergency services while traveling, offering crucial support in unforeseen situations to ensure a smoother experience away from home.

- Purchase Protection: The Amazon card delivers purchase protection against damage or theft for eligible purchases made with the card, reinforcing the security of your acquisitions and providing added assurance.

BJ's One+ Mastercard

Fuel Savings: Enjoy a discount of 15 cents per gallon when refueling at BJ's Gas, providing significant savings for frequent drivers.

World Mastercard Status: Elevate your credit card experience with World Mastercard privileges, offering a range of exclusive benefits and perks for cardholders.

Rewards That Last: Enjoy the perk of rewards that never expire, allowing cardholders the flexibility to accumulate and redeem cash back at their convenience.

Limitless Earnings: With no annual cap on rewards, users can consistently earn cash back on their purchases without worrying about reaching a maximum limit, providing ongoing value for their spending.

Top Offers

Top Offers From Our Partners

Top Offers

Compare The Alternatives

If you're looking for a store credit card with great rewards for online shopping – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Target Red Card | Apple Credit Card | Amazon Prime Rewards Visa Signature Card | |

Annual Fee | $0 | $0

| $0 ($139 Amazon Prime subscription required)

|

Rewards | 1% – 5%

5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

|

1-5%

5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

|

Welcome bonus | None | N/A |

$150

Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 28.95% Variable | 15.99% – 26.99% Variable

| 19.49% – 28.24% Variable

|

Compare Amazon Prime Visa Card

My Best Buy Visa Card is cheaper than the Amazon card, which requires a membership. But, it doesn't mean Amazon wins – here's why.

The Amazon Prime Visa card offers high cashback for avid online shoppers. However, Costco is the winner when it comes to everyday spending.

If you're a geek of both Amazon and Apple and not sure which card is better for your needs, we think we can help – there is a clear winner.

While Target RedCard offers a less attractive cashback rewards ratio than Amazon, it still may be a better option for some. Let's compare

Both the Prime Visa and the Capital One Walmart card offer similar cashback rewards ratios.

Here's why Walmart is our winner: Prime Visa vs: Capital One Walmart Rewards

Compare BJ's One+ Mastercard

BJ's One+ Mastercard our winner when it comes to cashback, but Costco card offers flexibility and many categories with higher cashback ratio.

BJ's One+ Mastercard vs Costco Anywhere Visa Card: Which Shopping Card Is Best?