Table Of Content

In February 2024, Capital One agreed to acquire Discover Financial Services for over $35 billion, bringing together two of the largest credit card companies in the U.S.

However, the deal doesn't include a credit card merger of both companies, so customers may still debate between both banks. Whether you're looking for a travel, cashback, or 0% intro card, here are the options for both offers, side by side.

Discover vs. Capital One: Which Offers Better Cashback Card?

When it comes to cashback cards, both Citi and Capital One offer more than a single option.

For those who are looking for a cashback card with no annual fee, Discover offers the Discover it® Chrome Gas & Restaurants as well as the Discover It Cash Back. All of them offer rewards and also 0% intro APR.

The Discover It Cash Back card is famous for its rotating quarterly categories, where cardholders can earn 5% cash back on up to $1,500 in purchases each quarter after activation. These categories change every three months and can include expenses like groceries, gas stations, restaurants, and Amazon.com.

The Discover it® Chrome Gas & Restaurants card is designed for individuals who spend primarily on gas and dining. Lastly, the Capital One Quicksilver Card provides a straightforward 1.5% cash back on every purchase (lower than Discover's cards, but there is no cap).

If you're willing to pay an annual fee, the Savor card may be the best option in terms of rewards, as it offers 1% – 4% , depending on the category – with no limit, and the highest welcome offers between all cards. However, it doesn't include 0% intro APR, similar to the no annual fee cashback cards.

| ||||

|---|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Capital One Savor | Discover It Cash Back | Discover it® Chrome Gas & Restaurants | |

Annual Fee | $0 | $95 | $0 | $0 |

Rewards | 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases

|

Welcome bonus | $200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

| $300

$300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

| Cashback Match

All cash back earned at the end of the first 12 months is matched.

| Cashback Match

Discover matches all cash back you earn at the end of your first year

|

0% Intro APR | 15 months on balance transfers and purchases | None | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers |

Foreign Transaction Fee | $0 | $0 | $0 | 0% |

Purchase APR | 19.74% – 29.74% (Variable) | 19.99% – 29.99% Variable | 18.74% – 27.74% Variable APR | 18.74% – 27.74% Variable APR |

Read Review | Read Review | Read Review | Read Review |

Which Bank Has the Edge in Travel Cards?

Discover offers a low-tier credit card, which is mainly relevant for those who travel rarely, while Capital One offers a mid-tier card as well as a luxury credit card, the Venture X card.

The main benefit of the Discover card is the 0% intro APR, which is not available through Capital One.

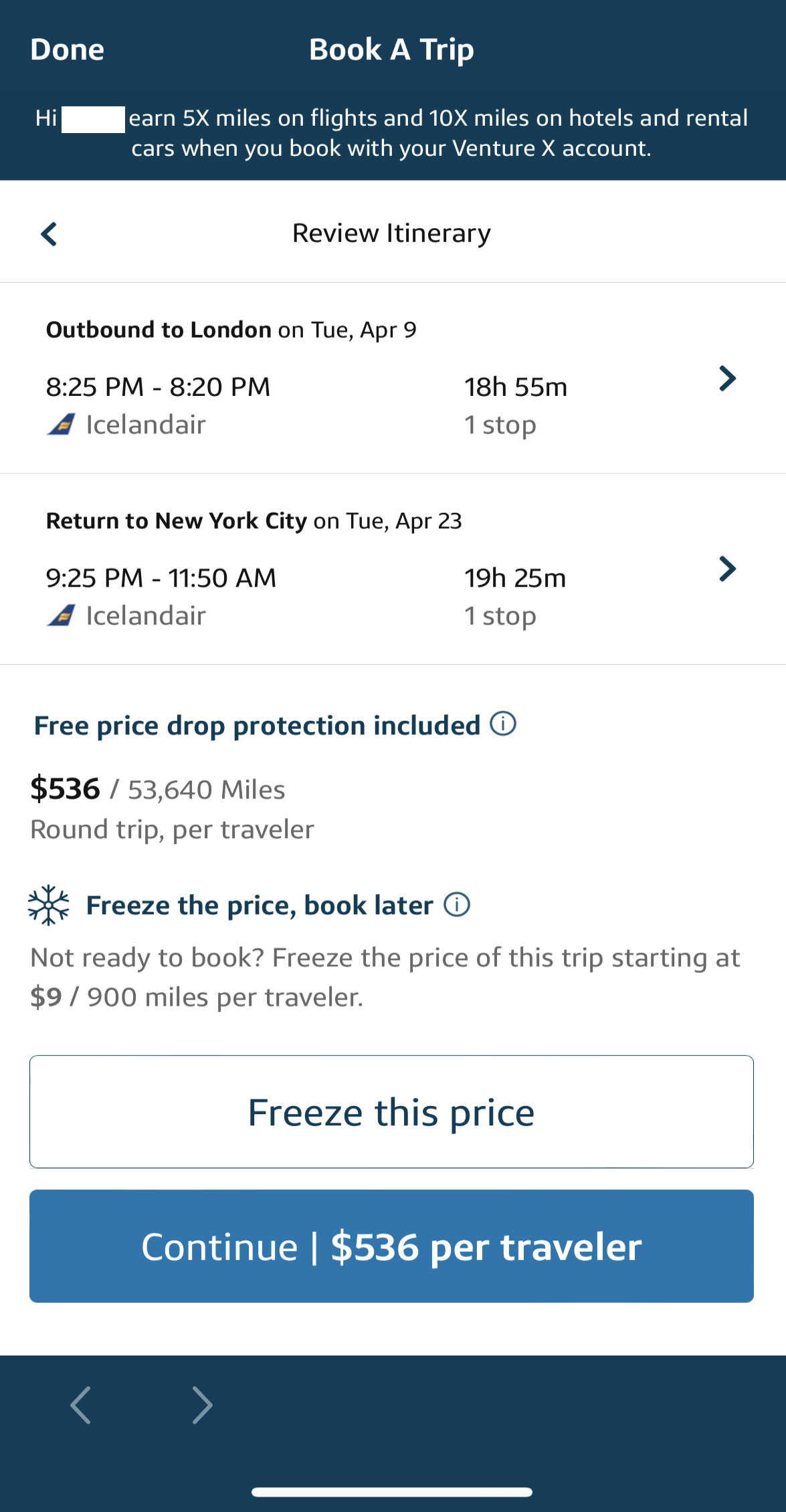

However, the Venture card may be the best card between them. It provides lounge access benefits (2 times a year), price drop protection through Capital One Travel, up to a $100 credit for Global Entry or TSA PreCheck®, and Hertz® Five Star status.

If you want to travel luxury, the Venture X card offers several benefits, including a $300 annual travel credit, a 10,000-mile anniversary bonus, and complimentary access to over 1,300 airport lounges worldwide.

Discover it Miles | Capital One Venture | Capital One Venture X | |

Annual Fee | $0 | $95 | $395 |

Rewards | 1.5X

unlimited 1.5x miles for every dollar spent on all purchases

| 2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus | Discover Match®

Discover matches your first year miles automatically.

| 75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Membership Club | Redeem As Statement Credit | Capital One Travel | Capital One Travel |

0% Intro APR | 15 months on purchases and balance transfers | N/A | N/A |

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 18.74% – 27.74% Variable APR | 19.99% – 29.74% (Variable) | 19.99% – 29.74% (Variable) |

Read Review | Read Review | Read Review |

0% Intro APR: Capital One SavorOne or NHL Discover it?

When it comes to balance transfer cards with a 0% intro fee, both Discover and Capital One offer various cards that provide this.

Two main competitors are the Capital One SavorOne and the Discover NHL card. They have no significant difference, and both offer the same terms.

However, it is worth mentioning the SavorOne card carries a lower balance transfer fee, which makes it a bit more attractive.

Capital One SavorOne Cash Rewards | NHL Discover it | |

Annual Fee | $0 | $0 |

Rewards |

1% – 8%

unlimited 3% cash back on dining, entertainment, popular streaming services, and grocery store purchases (excluding superstores like Walmart® and Target®). You’ll also earn 1% on all other purchases. Plus, you get 10% cash back on purchases through Uber and Uber Eats, 8% on Capital One Entertainment purchases, and 5% on hotels and rental cars booked through Capital One Travel

| 1% – 5%

5% cash back on spending in the quarterly bonus categories and 1% on all other purchases |

0% Intro APR | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers |

Balance Transfer Fee | 3% | 5% |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 19.74% – 29.74% (Variable) | 18.74% – 27.74% |

Read Review | Read Review |

What If I Need A Secured Card To Build Credit?

When comparing secured cards by both banks, the Discover it Secured card is our choice.

If earning rewards while building credit is important, Discover it® Secured has a clear advantage with its cash back program and first-year Cashback Match. This is what most users search for.

For those who prioritize flexibility in the security deposit and a straightforward path to increase their credit line, the Capital One Platinum Secured Credit Card is more suitable.

Discover it® Secured

| Capital One Platinum Secured Credit Card | |

Annual Fee | $0 | $0 |

Rewards | 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

| N/A |

Welcome bonus | Cashback Match™

Discover will match all the cash back you’ve earned at the end of your first year.

| N/A |

Security Deposit | Your credit line will equal your deposit amount, starting at $200 | $49, $99 or $200 minimum refundable deposit

|

Purchase APR | 28.24% Variable | 29.99% (Variable) |

Read Review | Read Review |

Additional Cards To Consider

Another teo cards worth mentioning is the Capital One QuicksilverOne Cash Rewards card and the Discover it® Student Chrome card .

The Discover it® Student Chrome card is designed for students, offering rewards on gas and dining, a GPA-based statement credit, and no annual fee. Plus, its Cashback Match feature at the end of the first year can double the rewards for new cardholders, making it a great choice for students who want to build credit and earn rewards.

On the other hand, the Capital One QuicksilverOne Cash Rewards card offers a straightforward 1.5% cash back on all purchases, making it a good option for those who prefer a simple, consistent rewards structure. While it has an annual fee, it comes with credit monitoring tools and the possibility of a credit line increase after making timely payments.

Discover it® Student Chrome | Capital One QuicksilverOne Cash Rewards | |

Annual Fee | $0 | $39 |

Rewards | 1-2%

2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products

| 1.5% – 5%

Unlimited 1.5% cash back on all purchases and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply)

|

Welcome bonus | Match Bonus

Discover will match all cash back earned at the end of your first year

| N/A

|

Credit Score | Fair | Fair |

Foreign Transaction Fee | $0 | 3% |

Purchase APR | 18.24% – 27.24% Variable | 30.74% (Variable) |

Read Review | Read Review |

Bottom Line

Both Capital One and Bank Of America offer a variety of cards for almost any purpose.

However, Capital One is the leader and offer more options for consumers, especially when it comes to travel credit cards as it offers premium and luxury travel cards with access to Capital One Travel.