Citibank offers a variety of banking product services, with credit cards being one of its top products.

As one of the largest issuers of credit cards, Citi has a pool of different types of credit cards targeting both individuals and small business consumers. These cards also offer multiple perks and benefits such as cash backs, airline miles, and its proprietary rewards program known as ThankYou points. Whether you are looking for cash back credit cards, travel reward points, or to collect miles from your best airline, you are guaranteed to find a Citi credit card for your specific needs.

Here are The Smart Investor Select’s picks for Citi credit cards:

Card | Rewards | Bonus | Annual Fee | Best For | Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $0 | Cashback |

|---|---|---|---|---|---|

Citi Strata Premier℠ Credit Card | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 75,000 points

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

| $95 | Travel Rewards | |

Costco Anywhere Visa® Card by Citi | 1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| None

| $0 ($60 Costco membership fee required) | Shopping | |

Citi Simplicity® Card | None | None | $0 | Balance Transfers | |

Citi® Diamond Preferred® Card |

None | None | $0 | 0% Intro | |

Citi® Secured Mastercard® | None | None | $0 | Bad Credit | |

| Best Buy Credit Card | 1-5%

5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases

|

None

10% back in rewards on your first day of purchase

| $0 | Store |

Citi® / AAdvantage® Platinum Select® World Elite Mastercard | 1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

| 50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

| $99 (waived for the first 12 months)

| American Airlines Flyers | |

| Citi Custom Cash℠ Card | 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| $0 | No Annual Fee |

Citi® Double Cash Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

- Tab Title

If you're looking for a credit card that offers simple, flat-rate cash back rewards on all your purchases with no annual fee, the Citi Double Cash Card is a great choice. You can earn 1% cash back on every purchase, plus another 1% when you make a payment. With flexible redemption options, this card offers great potential for maximizing your rewards.

The card is also great for those who are looking to transfer their balance since it offers a outstanding intro APR of 18 months on balance transfers (18.74% – 28.74% (Variable) after that).

- Rewards Plan: 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

- APR: 18.74% – 28.74% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: 3%

- Sign Up bonus: $200 cash back after spending $1,500 on purchases in the first 6 months

- 0% APR Introductory Rate period: 18 months on balance transfers

- Simple and Generous Rewards System

- 0% Intro APR

- Fee Waiver on First Late Payment

- No Annual Fee

- Average Cashback Rate

- Balance Transfer Fee

- Foreign Transaction Fee

- Is there a limit to cash back rewards? No limit in place

- Can I get car rental insurance with Citi Double Cash? Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance.

- What are the income requirements? No out and out income requirements and normally you will not have to provide proof of income.

- Does cash back rewards expire? They don’t expire once you keep your account open.

- Does card Citi Double Cash Credit Card offer pre approval? Yes, pre-approval is a possibility.

- What is the initial credit limit? It will normally be at least $500.

- How do I redeem cash back? You will be able to redeem the cashback points through direct deposit, check, or as a statement credit. You can also use them in other ways, such as spending on gift cards, Amazon.com, and on travel.

- What purchases don't earn cash back? All purchases earn cashback

- Should You Move to Citi Double Cash Card? If you like predictability and want an incentive to meet your payment commitments.

- How to maximize rewards on Citi Double Cash ? Make sure that you make your minimum due payments.

- Top Reasons NOT to get the Citi Double Cash? If you want a higher cashback rate you may need to look for another card.

Citi Strata Premier℠ Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

With the Citi Strata Premier card, you'll earn unlimited 10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases. The points can be redeemed through the Citibank Thankyou Network, which allows for combining points. They also can be used for things other than traveling, such as merchandise and gift cards.

As a sign-up bonus, you'll get 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com. It also has travel insurance that covers canceled or delayed flights and baggage delay insurance, and it doesn't have a foreign transaction fee. These features help give you peace of mind while traveling at home and abroad.

However, the card has an annual fee of $95 – so make sure the benefits you get to cover the card fee.

- Rewards Plan: 10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

- APR: 21.24% – 29.24% (Variable)

- Annual fee: $95

- Balance Transfer Fee: $5 or 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

- 0% APR Introductory Rate period: None

- Sign-Up Bonus

- No Foreign Transaction Fee

- Thank you Points + No Limit

- Protection & Free Credit Score

- $95 Annual Fee

- No Intro 0% APR

- Balance Transfer Fee

- Complicated Rewards Structure and Redemption

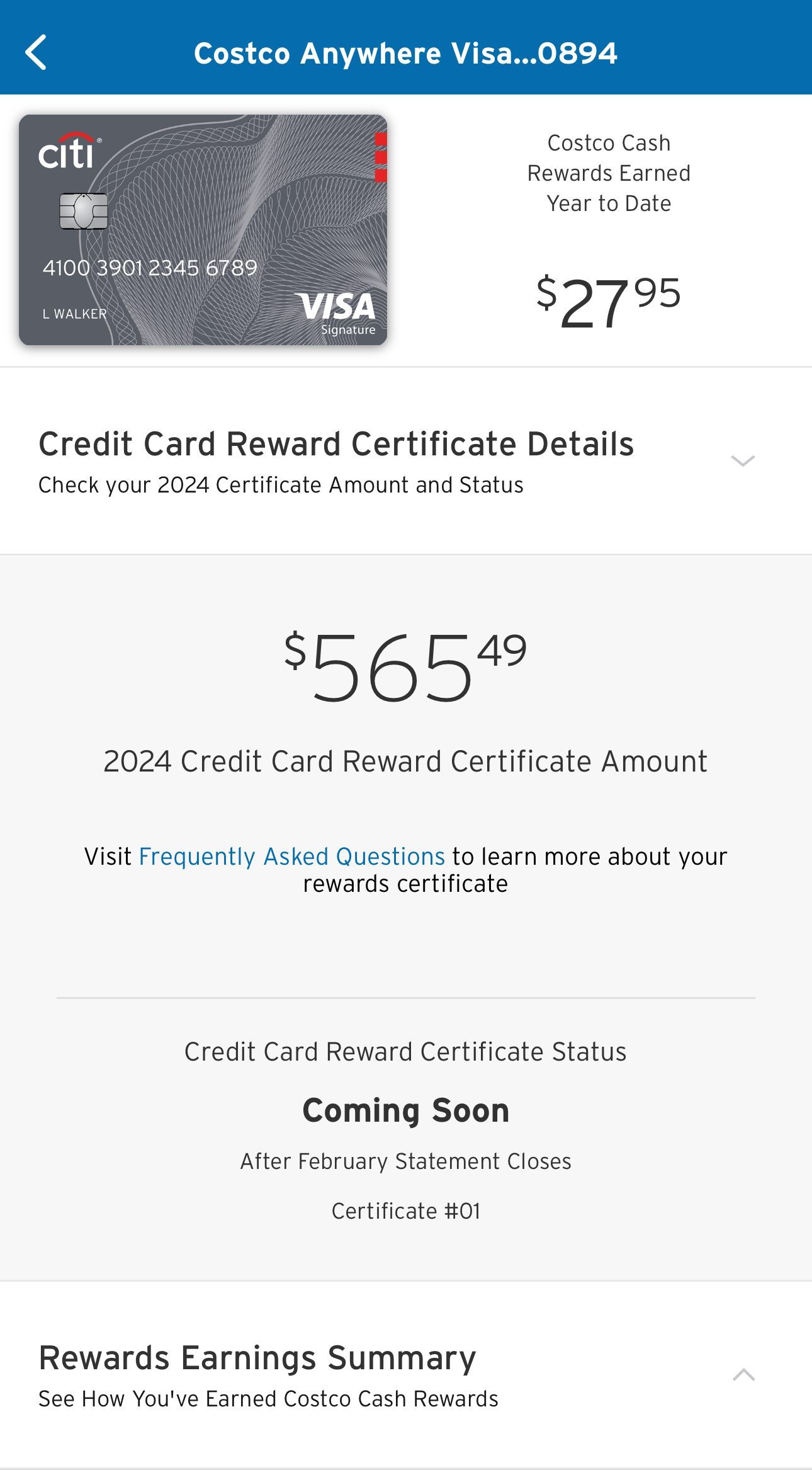

Costco Anywhere Visa® Card by Citi

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

This card is an amazing choice for regular Costco shoppers who want to earn a highly competitive cashback rewards, and one of the best shopping cards available. Costco Anywhere Card does not charge any fee on foreign transactions and does not charge any annual fee. The card offers 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases.

To enjoy all these benefits, all you need to do is pay your annual Costco membership fee to maintain your card account. Some of the limitations attached to this card usage include; limited cashback redemption option and a cap on gas rewards.

- Rewards Plan: 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

- APR: 19.99% – 27.99% (Variable)

- Annual fee: $0 ($60 Costco membership fee required)

- Balance Transfer Fee: 3% or 5$

- Foreign Transaction Fee: $0

- Sign Up bonus: None

- 0% APR Introductory Rate period: N/A

- Cashback on Costco, Gas, Restaurants and Travel and Other Spending

- No Annual Fee

- No Foreign Transaction Fee

- Extended Manufacturer Warranty, Travel Perks

- Redemption Restrictions

- No Sign-Up Bonus or 0% APR Introductory Rate

- There are Better Cashback Cards

- High APR

What’s the initial credit limit?

The initial credit limit for the Costco Anywhere visa is $500, but some cardholders have been offered an initial limit as high as $10,000.

What are the top reasons not to get the Costco card?

The top reason to not get the Costco Anywhere card is if you can get better rewards on a different tier card. There are some cards out there that offer 5% on one or two categories, which provides greater flexibility.

How’s the card customer service availability?

Citi has phone lines that are open 24/7, so you can access support at any time.

How much should I spend to cover the card fees?

There is no annual fee, However, you do need to have a Costco membership for the Costco Anywhere, but presumably, you’ll already have this covered.

Is it hard to get the Costco card?

To qualify for the Costco Anywhere card, you must have excellent credit and a low income-to-debt ratio.

Can I get pre approved?

Citi does not support Costco Anywhere card pre-approval. You'll need to fill out a full application, which will include a hard credit pull.

Citi Simplicity® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

If you need a card that will give you the freedom to pay off you debt without pesky fees, Simplicity by Citi offers you a perfect solution.

The main benefit the card offers is the long 0% intro APR – it applies for 12 months on purchases and 21 months on balance transfers (18.74% – 29.49% (Variable) after that), so the card can be a perfect fit if you need to payoff your debt or in case you plan a big purchase soon.

- APR: 18.74% – 29.49% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: 3%

- Rewards Plan: None

- Sign Up bonus: None

- 0% APR Introductory Rate period: 12 months on purchases and 21 months on balance transfers

- No Annual Fee

- Long 0% intro APR

- Citi Perks

- No Rewards System

- 5% Balance Transfer Fee

Citi® Secured Mastercard®

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The Citi® Secured Mastercard® stands out from other secured credit cards. It’s specifically designed for individuals with no credit history or limited credit, but it’s not available to those with poor credit. If you qualify, it’s a great option, as it has no annual fee and reports all card activity to the three major credit bureaus.

The Citi Secured Mastercard offers no rewards. Some of the benefits you can get from using this card include; free FICO score access, account alerts and flexible payment due date. However, there is a high annual percentage, which is one of the disadvantages of using this card.

- APR: 21.24% – 29.24% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 3%

- Foreign Transaction Fee: 3%

- Rewards Plan: None

- Sign Up bonus: None

- 0% APR Introductory Rate period: None

- Build Your Credit

- No Annual Fee

- Protection

- No Rewards/Intro 0% APR Periods / Sign Up Bonus

- High APR

- Deposit Needed

Citi® Diamond Preferred® Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Citi Diamond Preferred Card is highlighted for its impressive 0% introductory APR offer for 21 months on balance transfers and 12 months on purchases , and ongoing APR of 17.49% – 28.24% (Variable). This can be beneficial for individuals seeking to pay off existing high-interest debt.

Pros include the extended introductory APR periods, a potentially lower ongoing APR compared to the average, and no annual fee. Additionally, the card allows flexibility with payment due dates and provides a free FICO credit score online.

However, the card lacks a rewards program, making it less appealing for long-term use, especially for those interested in earning cash back or travel points. The balance transfer fee ($5 or 5% (the greater)) is relatively high compared to other balance transfer cards.

- APR: 17.49% – 28.24% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (the greater)

- Foreign Transaction Fee: 3%

- Rewards Plan: None

- Sign Up bonus: None

- 0% APR Introductory Rate period: 21 months on balance transfers and 12 months on purchases

- Extended Introductory APR

- No Annual Fee

- Flexibility with Payment Due Dates

- Free FICO Credit Score

- No Rewards Program

- High Balance Transfer Fee

- No Welcome Offer

Can I apply for the Citi Diamond Preferred Card with average credit?

While it may be difficult, it's possible to get approved with fair credit for the Citi Diamond card, as long as you meet other criteria.

Can I transfer balances at any time to qualify for the introductory APR?

To qualify for the introductory APR on balance transfers, transfers must be completed within four months of account opening.

Are there any specific perks for Citi Diamond Preferred cardholders?

Yes, cardholders have access to Citi-specific perks like Citi Flex Loans, Citi Entertainment, and Citi Easy Deals.

Can I choose my payment due date with this card?

Yes, cardholders have the flexibility to select their preferred payment due date.

What is the balance transfer fee for the card?

The balance transfer fee is $5 or 5% (the greater).

Best Buy Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The Best Buy Visa Card is a store rewards card that provides excellent benefits to frequent Best Buy customers. This is a Visa card, and it is accepted everywhere Visa is accepted, so you are not limited to using it at Best Buy.

Cardholders earn 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases.

This card is great in the right situation and for Best Buy big spenders. If that doesn't describe you, you might want to look for other rewards cards with better perks.

- APR: 15.99% – 31.49% variable

- Annual fee: $0

- Balance Transfer Fee: $15 or 5%

- Foreign Transaction Fee: N/A

- Rewards Plan: 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases

- Sign Up bonus:10% back in rewards on your first day of purchase

- 0% APR Introductory Rate period: N/A

- High Rewards on Best Buy

- No Foreign Transaction Fee

- Debt Protection Plan

- Fraud Protection

- Annual Fee

- Not For Everyday Purchases

- Redemption Restrictions

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

With the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® cardholders earn Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.. The card offers a nice sign-up bonus of 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening. There's no limit to the number of miles you can earn.

There are many additional perks you're eligible that can make flying a little bit less of a hassle since such as a free checked bag, preferred boarding and discounts on inflight food and beverage. However, the card comes with annual fee of $99 (waived for the first 12 months) and the standard variable APR for purchases is 20.74% – 29.74% (Variable) based on your creditworthiness

- APR: 20.74% – 29.74% (Variable)

- Annual fee: $99 (waived for the first 12 months)

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

- Sign Up bonus: 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

- 0% APR Introductory Rate period: N/A

- Sign up Bonus

- Great Rewards For AA Flyers

- No Limit on Miles Earned

- Wide Network of Airlines

- Free Checked bag and Preferred Boarding

- Annual Fee

- High Fees For Reward Changes

- Travel on Many Partner Airlines Can’t be Redeemed Online

- Blackout Dates on Some Rewards

Does it have a rewards limit?

No – the AAdvantage Platinum card doesn't specify a maximum number of miles you can earn, so you can accumulate as many rewards as you like throughout the year.

Can I get car rental insurance?

Unlike the Citi AAdvantage® Executive World Elite Mastercard®, The Citi AAdvantage Platinum Select card does not offer rental car insurance.

What are the card income requirements?

it is possible to obtain the Citi AAdvantage card with good to excellent credit. However, there are no stated income requirements. Your credit score will be used to determine your eligibility, while your income will determine your credit limit upon approval.

Do the miles expire?

There is an expiration on AAdvantage miles, but this is only if you have 18 months of account inactivity. So, if you keep your account active, you should not have any problems with miles expiring.

Can I redeem for flights with airline partners?

American Airlines has limited redemption options for other airlines. You can use your AAdvantage miles for JetBlue flights, but otherwise you are limited to American Airlines flights.

How much is 10,000 miles worth?

Aadvantage miles have a lower average redemption compared to most airline cards, estimated value at 1.27 cents per mile. This means that 10,000 miles could be worth $127 with the Aadvantage Executive World Elite.

Citi Custom Cash℠ Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Citi Custom Cash℠ Card is a good option for those for aren't spending too much on their card and mainly focus on a specific category.

The rewards rate is pretty high for such cardholders – 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter. In addition, new applicants are eligible for a sign up bonus of $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back).

The card has no annual fee and provide generous 0% intro APR for new cardholders.

- APR: 18.49% – 28.49% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (the greater)

- Foreign Transaction Fee: 3%

- Rewards Plan: 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

- Sign Up bonus: $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- High Cash Back Rate

- 0% Intro APR

- Sign-Up Bonus

- No Annual Fee

- Balance Transfer Fee

- Low Cap on Higher Cashback

- Foreign Transaction Fee

Can I get car rental insurance with Citi Custom Cash Card?

Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance.

Is there a cash-back rewards limit?

Besides the cap on specific categories, there is no limit in place with this card on how many total rewards you can earn. Therefore, people who will be spending large sums on purchases can ideally take advantage of this offering.

What is the initial credit limit?

The initial credit limit will usually be $500 for this card. The exact limit that will be in place will depend on your financial situation (can be much higher).

Should You Move to Citi Custom Cash Card?

If you don't tend to spend more than $1,000 – $1,500 every month and you tend to spend them on specific categories, this card can be a perfect fit due to the high cashback on the your top category.

What purchases don't earn cash back?

All purchases earn cashback as a result of using this card. Therefore, you will be able to take a very flexible approach and know that you will always be able to earn reward no matter the type of purchase.

How to maximize rewards on Citi Custom Cash Card?

Make sure that you avail of the signup bonus and that you maximize the 5% cashback offering each cycle. This will allow you to get the best bang for your buck.

Citi Credit Cards Types

Citi has different types of credit cards, with each card packed with multiple perks and benefits such as cash backs, 0% introductory interest rate, airline rewards, and other forms of cash and points rewards.

If you are a Citi customer, and you are looking for a new Citi credit card, here are the best Citi credit cards to consider:

Citi® Premier Card (Best for sign-up bonus)

The Citi Premier card is the best Citi credit card for a sign-up bonus. This card earns 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com.

Cardholders also get 10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases. This card has an annual charge of $95 , and there are no charges on foreign transaction fees.

Citi® Double Cash Card (Best for cash back rewards)

This Citi Double Cash card offers one of the most generous cash-back rates in the credit card market. It earns double cash back for every purchase. You get 2% cash back on everything you buy; 1% cash back when you buy and other 1% when you for the purchase. Cardholders get a 0% APR period for the first 18 months.

Once this period lapses, the APR changes to a variable rate of 18.74% – 28.74% (Variable). This card can be used for credit card consolidation if you are looking to combine your credit card debts since it offers o% intro APR for 18 months on balance transfers. Cardholders do not pay an annual fee for the Citi Double Cash Card.

Costco Anywhere Visa by Citi® (Best for Costco Members)

The Costco Anywhere Visa by Citi® card is designed exclusively for Costco members, and it earns cash points for every purchase made at Costco. It gives cardholders a 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases.

Although this card does not charge an annual fee, cardholders require a Costco membership card to get the Costco Anywhere Visa Citi card. The Costco membership card requires an annual membership subscription. Costco Anywhere Visa has no foreign transaction fees.

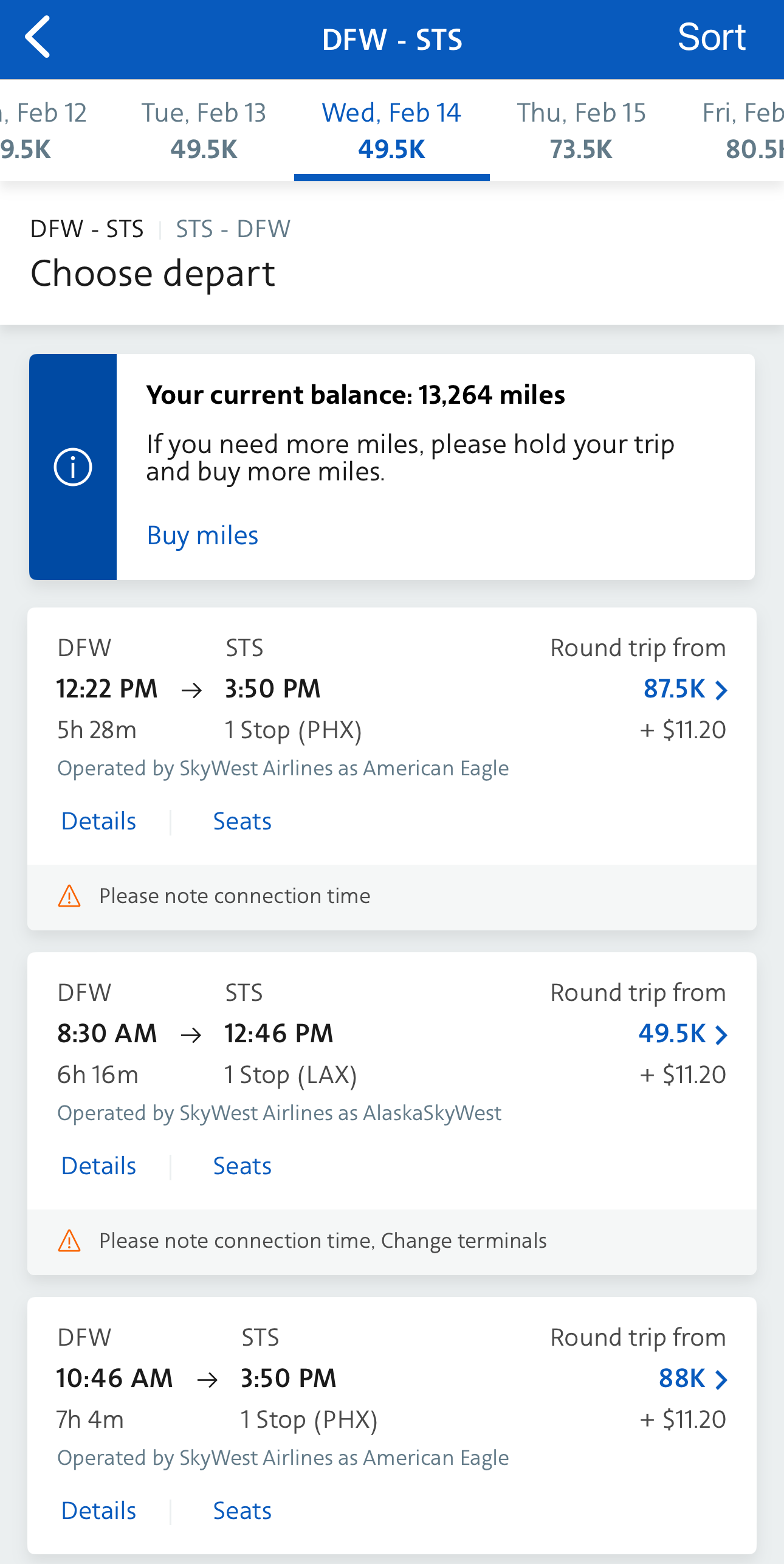

Citi®/AAdvantage Platinum Select World Elite Mastercard (Best for airline travel)

The Citi®/AAdvantage Platinum Select® World Elite Mastercard credit card is one of the top-tier credit cards for American airlines that can help you earn cash back and premium benefits if you are a frequent American Airlines flyer.

Cardholders get 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening. Cardholders get Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases..

Cardholders enjoy various travel perks including a membership to the American Admiral Club lounges, TSA PreCheck credit, priority boarding and check-in, and waived fees on the first checked bag.

Citi Secured Mastercard (Best for credit building)

If you are looking to build your credit, the Citi Secured Mastercard is a good pick. This card does not offer rewards, and it is mainly designed for people with a limited credit history or people with bad credit who are looking to improve their credit score.

The repayment history is reported to credit bureaus and entered into the credit report. Once approved, users are required to deposit $200 to $2,500, which acts as security for the credit. This card does not charge an annual fee.

Citi Simplicity Card (Best for balance transfers)

If you need a card that will give you the enough time to pay off debt or funding a new purchase, Simplicity by Citi offers you a perfect solution. This card offers a very long 0% intro APR of 12 months on purchases and 21 months on balance transfers

You need a credit score of between 690 to 850 to qualify for this card, and. As a bonus, there are no late fees or annual fees when using this card ever.

Citi Custom Cash Card (Best for rotating categories)

The Citi custom cash is ideal for those who are looking to get a higher cashback on specific categories. Once you sign up for this card, Citi rewards you with $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back). Cardholders also get 1-5%.

Similar to more Citi cards, the Citi Custom Cash Card also offers other perks such as contactless pay, digital wallets, automatic account alerts, $0 liability on unauthorized charges and free access to your FICO® Score.

Citi Rewards+® Card (best for everyday purchases)

The Citi Rewards + Card is the best credit card if you are looking to collect points for everyday purchases. This card rewards you Earn 5X points on rental car, hotel and attraction purchases booked through cititravel.com (ends 12/31/2025), 2X points at supermarkets and gas stations (on up to $6,000 in purchases per year, then 1X points) with 1X points on all other purchases.

Once you sign up for the Citi Rewards+ card, Citi rewards you with Earn 20,000 bonus points after spending $1,500 within the first 3 months of account opening (redeemable for $200 in gift cards or travel rewards at thankyou.com). The Citi Rewards + Card offers 0% introductory APR for 15 months on purchases and balance transfers. The APR increases a variable rate of 17.99% – 27.99% (Variable). The issuer also charges a fee of 3% on the transfer amount. This card does not have an annual fee.

How's Citi Rewards Program Work?

Citi offers various rewards to its cardholders including cash back and ThankYou point rewards. This makes Citi reward programs as competitive as other reward programs in the credit card industry such as Chase Ultimate Rewards and Amex Membership Rewards. If you are looking to get your first Citi credit card, consider a card with these rewards:

Citi ThankYou Rewards

This rewards program lets banking and credit card customers collect points when they make purchases using a qualifying card. Depending on the card, you may qualify for signup bonuses, and earn 5x to 3x points for every dollar spent on a specific purchase category. These points do not expire, and you can earn as many points as you want.

Each ThankYou point is worth 0.8 to 1 cent depending on the redemption option you choose and the Citi credit card you have. You can redeem your ThankYou points for cash rewards, travel rewards, or gift cards from top retailers such as Amazon, eBay, Best Buy, and Live Nation. If you want to redeem your points for airline miles or hotel stays, check the ThankYou Travel center for active offers.

Citi also allows you maximize the value of your rewards by transferring them to a participating transfer partner. These partners mostly comprise Airline and hotel, travel partners. You can convert your points at a transfer rate of 1:1, with 1000 point increments.

Citi Redemption Options

From airline tickets to gift cards, there are endless opportunities for turning your cash back and Thank-you points into actual rewards.

To see the available redemption options, go to Citi’s ThankYou website. Log in your account, and click on redemption categories at the top bar. The main redemption options include:

- Gift cards – You can trade your ThankYou points for gift cards that you can use in over 100 local and international stores. You can use the gift cards to shop across various categories such as accessories, apparel, hotel and dining, health and beauty, and electronics.

Depending on the store, you can redeem your points at the ratio of 1:1.

- Shop with points – Use your ThankYou points to pay for purchases directly at participating stores. When shopping with points, check the partner websites on ThankYou websites, and link the preferred retailer’s website and your ThankYou account.

Pick the preferred product you want to buy, and add to cart. Choose to pay using ThankYou Points and select the number of points required, and complete the purchase.

- Travel rewards – Use your points to pay for airline tickets, car rentals, cruise lines, and hotel stays and dining. The value of each ThankYou point may vary from 0.5 cents to 1 cent, depending on the time of travel, cost of travel, and length of travel.

If you hold a qualifying Citi card, either Citi Premier Card or Citi Prestige Card, you can transfer your ThankYou points to participating travel loyalty programs on a 1:1 transfer ratio.

- Other ways to redeem – There are a dozen other ways to redeem your Citi reward points. One of these redemption options is to use your ThankYou points to make a charitable contribution.

If you are currently paying your student loan or mortgage, you can use your points to pay back the outstanding balance with a check to your lender of up to $1000. You can also get cash rewards in $50 and $100 denominations, with no limits on the number of rewards you can redeem.

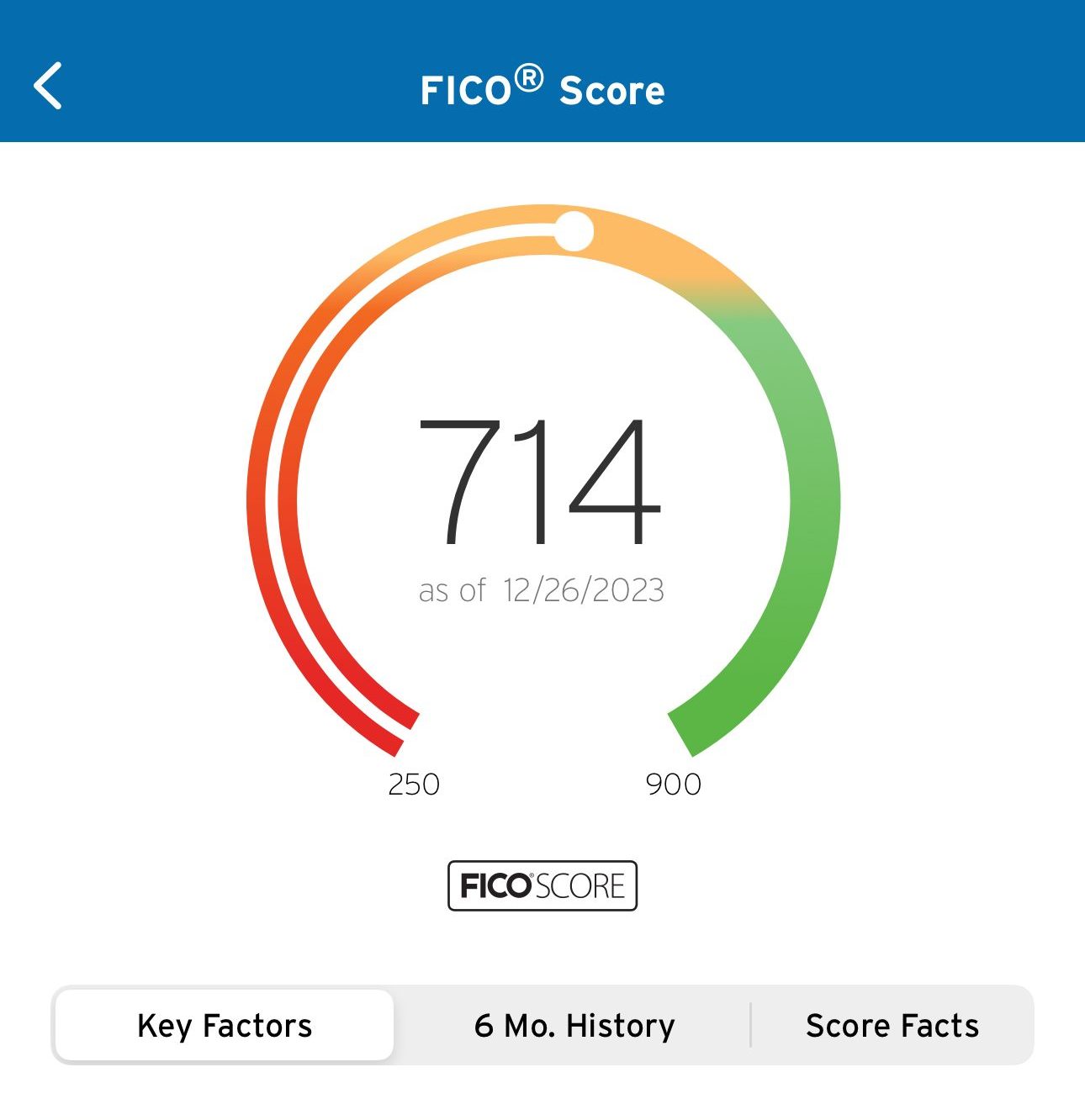

What Credit Score Will I Need in Order to Get Approved?

When considering credit card applications, Citi uses credit scores as one of the main factors in deciding whether or not to approve the application.

Although Citi does not publish the specific credit scores needed to be approved for any of the cards, you should expect to have an excellent credit score to be approved for one of Citi’s top-tier credit cards. Here are the credit scores you will need to get a Citi credit card:

- Cards For Excellent credit (750+) – With a credit score above 750, you are eligible for all of Citi's credit cards, assuming that you pass other credit approval requirements. Specifically, this credit score can make you eligible for a rewards card such as Citi Double Cash Card, Citi Rewards+ , Costco Anywhere Visa card, and Citi/AAdvantage Executive World Elite Mastercard.

- Cards For Good credit (700-749) – A good credit score makes you eligible for some of Citi's attractive credit offerings such as Citi Premier Card, Citi Simplicity Card, and even the Citi Double Cash. If you have a good credit score, you can prequalify for any of the Citi cards to see where you stand.

- Cards For Fair credit (640- 699) – A fair credit score makes you eligible for one of Citi's store cards that can be used in the participating stores. Examples of these store cards include Best Buy and Staples.

- Cards For Bad Credit (below 640) – If you have a limited credit history or bad credit, you are eligible for the Citi Secured Mastercard. This credit card is ideal is you are looking to rebuild your credit. However, you will need to make a deposit of $200 to $2,500, which will be equal to your credit limit.

Top Offers

Top Offers

Top Offers From Our Partners

How To Activate Citi Card?

To activate your Citi card, call the activation phone number provided on the sticker affixed to the card or the one mentioned in the accompanying documentation.

Follow the automated prompts and enter the required information, such as the card number and your personal details. Alternatively, you may activate the card online by visiting the official Citibank website, logging into your account, and following the activation instructions.

Once activated, your Citi card is ready for use, enabling you to enjoy its benefits and make purchases with confidence.

Can I Add An Authorized User?

Yes, you can add an authorized user to your Citi card. Simply contact Citi's customer service or log in to your online account to add an authorized user. You'll need to provide their personal information, such as name and address.

Once added, the authorized user will receive a separate card linked to your account. As the primary cardholder, you'll be responsible for any charges made by the authorized user, but this can be a convenient way to share the benefits of your Citi card and earn rewards on their purchases.

How to Maximize Citi Rewards?

The Citi rewards program is one of the most generous programs for credit cardholders looking for lucrative points that can be redeemed for travel, gift cards, statement credit, or other rewards. If you are looking to get the most value from your credit cards, here are handy tips to help you maximize the cash back offers and ThankYou points:

- Sign Up Bonus

For example, if you sign up for a Citi Premier Card, you earn 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com. Assuming a transfer rate of 1:1, the sign-up bonus is worth about $600. The value may be higher if you transfer the points to one of Citi's participating loyalty programs.

Even with an annual fee of $95, the sign-up bonus makes the Citi Premier Card worth it. If you are applying for a new Citi credit card, pick the card with the highest sign-up offers. Most of Citi's top-tier credit cards offer a generous sign-up bonus in the first few months of use.

- Pick the Card With the Highest Rewards

Citi has a wide range of credit cards that earn cash back offers and ThankYou points. Each card earns different rewards on unique categories. Getting one or two Citi credit cards can help you earn ThankYou points and cash back in different categories and increase your rewards. It is also depends on your goals and spending behavior.

For example, the Citi® / AAdvantage® Platinum Select® Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases. which can be great for frequent flyers. In comparison, The Citi Custom Cash Credit Card earns 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter which is great if you can leverage the high cash back in specific categories.

Signing up for these two cards, and using them for everyday purchases can help you collect bonus points in different categories and boost your total rewards.

Top Offers

Top Offers From Our Partners

- Transfer Points to a Partner Loyalty Program

If you want to get the most out of your points, you can transfer them to one of Citi’s transfer partners. This list includes retail and airline partners. Examples of partner airlines that accept ThankYou points include JetBlue, Emirates, Virgin Atlantic, Singapore Airlines, Air France.

These partners have excellent offers for domestic and international flights to popular destinations such as Hawaii, Europe, and Mexico. Most of the partner airline alliances offer a transfer ratio of 1:1, and each point will give you 1 mile in the program. These rates may vary, and you should get the current rates before transferring your ThankYou points.

How Many Citi Credit Cards Can I have at One Time?

There are no limits on the number of Citi credit cards you can have at any one time. If you meet the income and credit requirements for a card, you can have several Citi cards in your wallet. However, Citi has various credit card application rules that you should consider:

- Rule 1/8: Apply for only one credit card application every 8 days.

- Rule 2/65: Apply for only two credit card applications every 65 days.

- Rule 1/90: Apply for only business credit card once every 90 days.

- 24 Month Rule: You only get a sign-up bonus for a Citi credit card once every 24 months.

How Do I Cancel a Citi Credit Card?

You can cancel your Citi credit card by phone or via your Citi online account.

If you want to cancel your Citi card by phone, call the bank representative at 800-950-5114. The representative will require you to provide your credit card details to close the card. However, the bank's representative will try to convince you to retain the card, and you may be forwarded to the customer retention department to try and persuade you against the decision.

If you prefer to cancel the credit card without calling the bank, log in to your account at citi.com using your assigned credentials. On the dashboard, scroll down and click “contact us” and then go to “chat with Citi”. Once a chat box pops up, ask the live chat support to cancel your credit card.

Top Offers

Top Offers

Top Offers From Our Partners

How We Picked The Best Citibank Credit Cards: Methodology

To select the best Citibank credit cards, our team thoroughly researched various offerings from Citibank, analyzing their features and benefits across two key categories:

Rewards Program (50%): We evaluate the rewards structure, including the type of rewards offered (points, cash back, or miles), earning rates per dollar spent, bonus categories for accelerated rewards, and flexibility in redemption options. Citibank cards with generous rewards rates, diverse redemption choices, and valuable sign-up bonuses receive higher scores in this category.

Card Features & Benefits (50%): This category assesses additional features that enhance the overall value of the card, such as introductory APR offers, absence of foreign transaction fees, complimentary airport lounge access, travel credits, purchase protection, and extended warranty coverage. Citibank cards offering a wide range of benefits without excessive fees earn higher scores.

This comprehensive evaluation ensures that the best Citibank credit cards offer valuable rewards, benefits, and a seamless user experience while maintaining a positive reputation, catering to the preferences of cardholders seeking Citibank products.