Rental car insurance cards will give you special car rental insurance, so you don’t have to pay the rental car company for car insurance.

Most rental car companies make you pay high prices for insurance and some form of car insurance is required to use a rental car, so you will be stuck paying for it either way. If you use car insurance on your credit card, you typically have to pay for the rental car on the credit card and then the fees as well.

The primary driver must be the one driving the rental car, and you’ll also need to decide whether to decline the Collision Damage Waiver (CDW). Opting out of CDW allows you to use your credit card’s coverage instead of the rental company’s.

Here’s our 2025 pick for the best credit cards offering rental car insurance:

Card | Rewards | Bonus | Annual Fee | Best For |

| Capital One Venture X Rewards Credit Card | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

| $395 | Review |

|---|---|---|---|---|---|

| American Express® Gold Card | 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| 100,000 points

100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

| $325 (Rates & Fees) | Review |

| Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| $550 | Review |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

Earn 60,000 bonus miles after qualifying purchases

| $95 ($0 first year)

| Review |

| The Platinum Card® from American Express | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

| $695 (Rates & Fees) | Review |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| $95

| Review |

| Hilton Honors Aspire American Express Card | 3x – 14x

14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases

| 175,000 points

175,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership.

| $550 | Review |

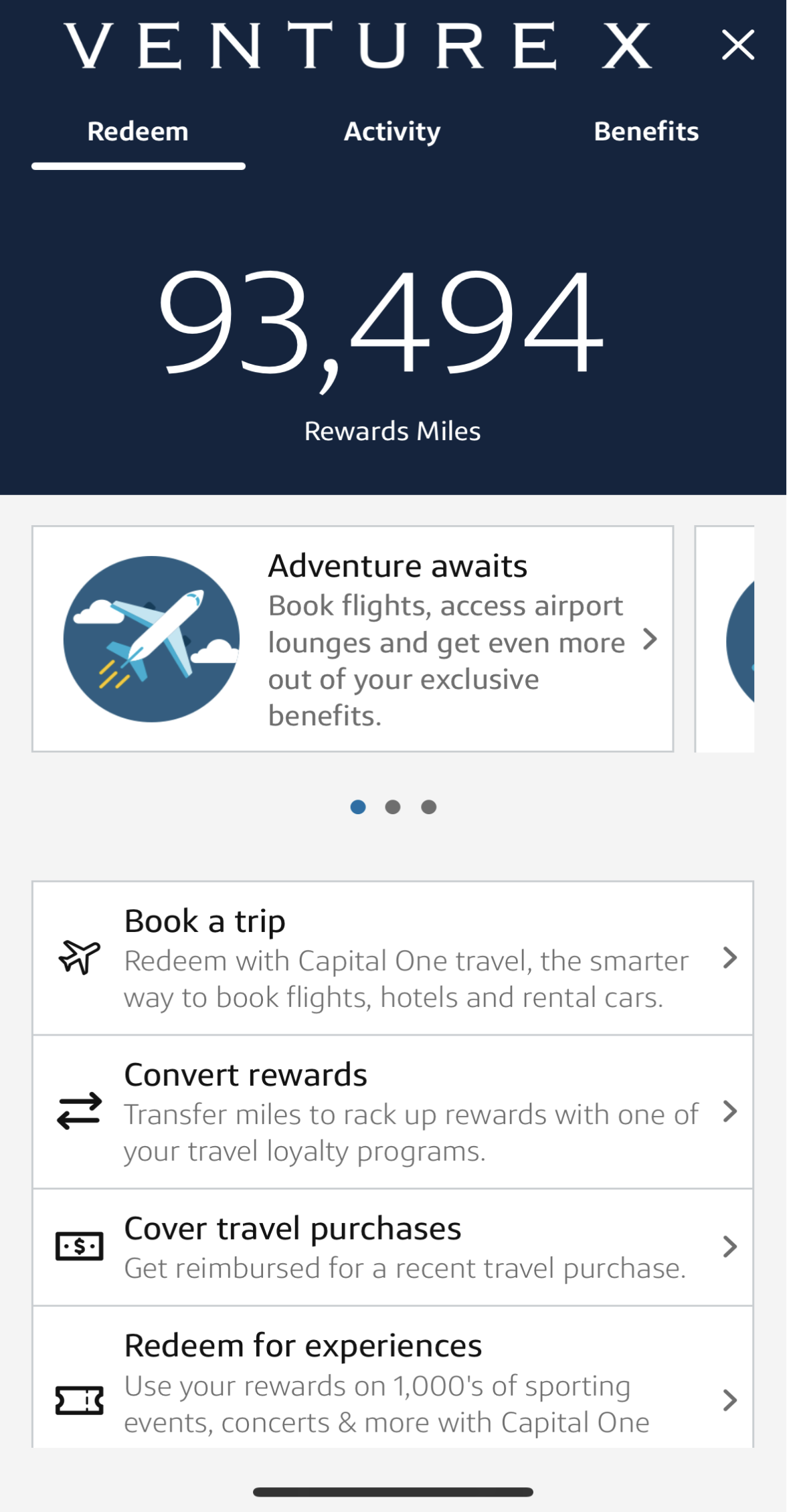

Capital One Venture X Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Venture X Rewards Credit Card is a premium travel card that can be a good fit for travelers who want extra travel perks like airport lounge access, travel insurance protection, and special rental car privileges, in addition to better rewards rates. It has quite high annual fee ($395)

When booking hotels and rental cars through Capital One Travel, the Venture X earns 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases.

In addition, new applicants can earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening, and there is no foreign transaction fee.

- Rewards Plan: 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

- APR: 19.99% – 28.99% (Variable)

- Annual fee: $395

- Balance Transfer Fee: 3% for promotional APR offers, none for balances transferred at regular APR

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Statement Credit For Travel

- Better Rewards Rate, Sign-Up Bonus

- Capital One Travel Portal

- No Foreign Transaction Fee

- $395 Annual Fee

- No Upgrading or Elite Status

- Smaller Network

What are the income requirements?

Neither issuer specifies a minimum income, but you will need excellent credit for the Venture X. Your income will be a factor for consideration, but it will not be the sole factor. If proof of income is required to support your application, the card issuers will contact you with a list of acceptable documents.

Can you get pre approval?

Capital One requires that you complete a full application for the Venture X, which will involve a hard credit pull.

What is the initial credit limit?

You can expect an initial credit limit of $5,000 to $30,000 with the Capital One Venture X.

How much is 10,000 miles worth?

The average value of Capital One miles is one cent per mile. This means that 10,000 miles would be worth $100. However, it may be possible to get a higher redemption rate with partner programs.

How’s the card customer service availability?

Capital One has a customer service line that is available 24/7, so you can access help at any time of the day or night

How long does it take for approval?

Capital One aims to give an approval decision within a few minutes, unless additional information is required to support your application. In this case, it can take a further 7 to 10 days. After approval, you should receive your card within 10 days.

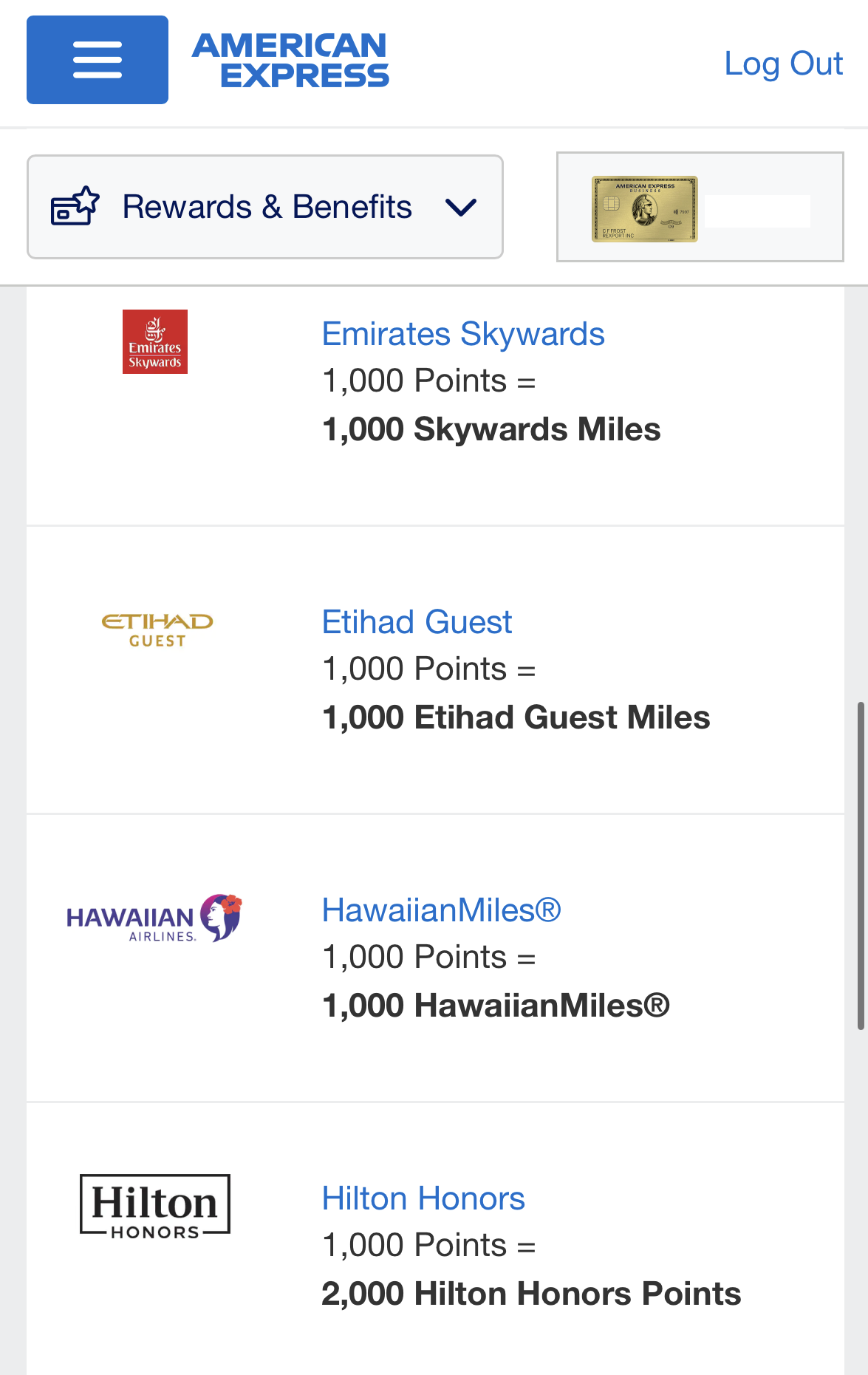

American Express® Gold Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The American Express® Gold Card is a credit account that offers a myriad of benefits to clients.

First-timers stand a chance to earn 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership.

In terms of rewards, you can earn 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases.

Other premium benefits include dedicated service team, up to $120 in Uber Cash (enrollment required), preferred seating at sporting and cultural events, and baggage insurance for up to $500 for checked baggage and $1,250 for carry on.

- APR: See Pay Over Time APR

- Annual fee: $325

- Balance Transfer Fee: N/a

- Foreign Transaction Fee: None

- Rewards Plan: 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

- Welcome bonus: 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

- 0% APR Introductory Rate: N/A

- Welcome Bonus + Premium Point Rewards Rate

- No Foreign Transaction Fees

- Special Gold Status Perks

- $325 Annual Fee

- High Requirements

- Is there a limit to rewards? There is a cap on getting the premium rate of cashback on certain types of purchases.

- Can I get car rental insurance with Amex Gold Card? Yes, you will get it automatically once you decline the car insurance from the rental company and you pay the full rental charge using this card.

- What are Amex Gold Card income requirements? There is no out and out income requirement outlined by Amex when it comes to the Gold card.

- Does card Amex Gold points expire? They do not have an expiration date.

- How do I redeem cash back on Amex? There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

- What purchases don't earn rewards? The minimum rate is 1 point for every $1 spent.

- Should You Move to Amex Gold Card? If you need a versatile card that covers a wide range of purchases, with a main focus on travel-related purchases and perks.

- Why did Amex deny me? You might not have met one of the requirements. You can ask the customer support team if there is something you can do to change this eventuality. Otherwise, you can look for an alternative card.

- How to maximize rewards on Amex Gold Card? Use it for a versatile range of purchases, make sure you are aware of the different perks and credit that you get with this card.

- Top Reasons NOT to get the Gold Card? If you do not travel a lot.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? The credit limit will usually be at least $5,000.

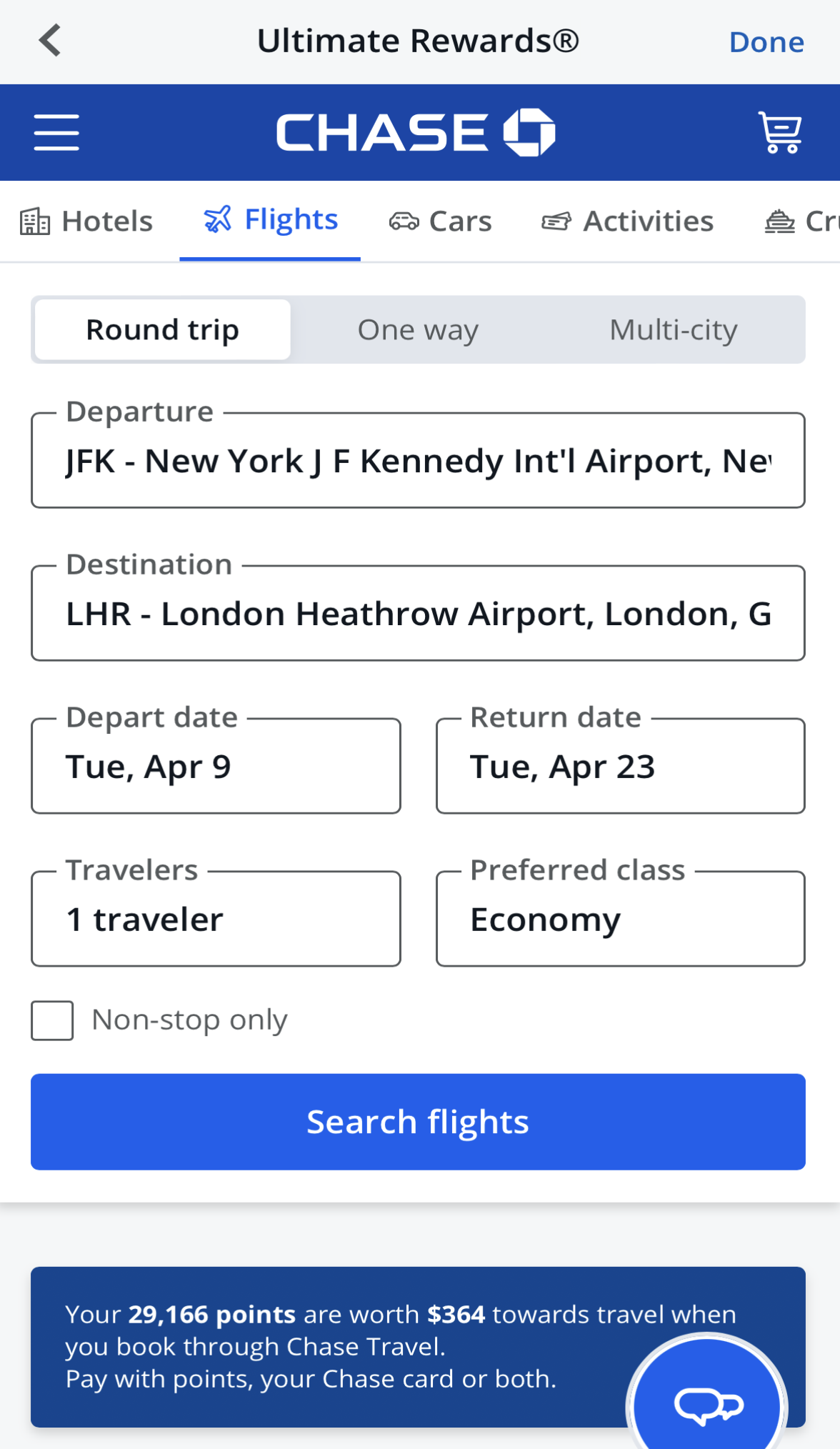

Chase Sapphire Reserve®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Chase Sapphire Reserve® card is a premium travel card that offers many benefits that your average reward card does not. You'll receive , which is about $750 in travel rewards if booked through Chase Ultimate Rewards.

In addition, you earn5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

However, due to the high annual fee ($550) – you should make sure your regular spending habits fits to this card and you'll be able to cover the high annual cost. If that's not the case – the Chase Sapphire Preferred is a good alternative.

- APR: 19.99%–28.49% variable

- Annual fee: $550

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

- Sign Up bonus: Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: N/A

- Points Rewards

- Sign Up Bonus

- More Ultimate Chase Rewards

- No Foreign Transaction Fee

- Airport Lounge Access

- Annual Fee

- No 0% Introductory APR

- Balance Transfer Fee

- Chase Restrictions

- Can I get car rental insurance with a Sapphire Reserve card? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

- What are Sapphire Reserve card income requirements? There are no transparent income requirements, but it is usually expected that your annual income is at least $30,000 and you may be asked for proof of income.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, a statement credit, and gift cards.

- What purchases don't earn cash back with the Sapphire Reserve? All purchases will earn you cashback with this card.

- Should You Move to a Sapphire Reserve card? If you travel a lot then this is a great option for you. It's recommended to understand your spending habits and compare the Reserve card with other premium travel cards such as the Amex platinum card.

- Why did Chase deny me? What to Do Next? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get Sapphire Reserve card? It is harder to get this card than some of the other Chase credit cards. However, if you have a credit score of at least 720 then you will be in with a good chance of getting approval.

- How to Use Sapphire Reserve card Benefits? To maximize rewards, you should take advantage of the high dining and travel-related cashback redemption rates and generally use them for these types of expenses.

- Top Reasons NOT to get the Sapphire Reserve card? If you do not travel a lot or you don’t want to pay the large annual fee.

- Does travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does it offer pre-approval? Yes, you can get pre-approved for this card.

- What is the initial credit limit? The usual minimum credit limit for this card is $10,000.

- Is there a limit to rewards? No limit

United Quest Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

This card is more suited to regular travelers who can easily offset the $250 annual fee. However, this higher fee does provide some nice perks. This includes up to $125 in statement credit per year as reimbursement for United purchases. While the fee is higher compared to the Explorer card, the benefits you can get with the Quest card are much more extensive.

You’ll also get first and second checked bags free for you and a travel companion, reimbursement for Nexus, TSA PreCheck or Global Entry application fees, priority boarding, and two 5,000 mile anniversary bonuses. If you book a United or United Express award flight with your miles, you’ll get miles back in your account up to two times per anniversary year.

The United Quest card has a multi tiered reward structure. You’ll earn 3 miles per $1 spent on United purchases immediately after earning your $125 annual United purchase credit, 2 miles on all other travel and select streaming services, 1 mile on all other purchases.

- Rewards Plan: 3 miles per $1 spent on United purchases immediately after earning your $125 annual United purchase credit, 2 miles on all other travel and select streaming services, 1 mile on all other purchases

- APR: 20.24%–28.74% variable

- Annual fee: $250

- Balance Transfer Fee: 5$ or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 70,000 bonus miles + 1,000 Premier qualifying points (PQP) after qualifying purchases.

- 0% APR Introductory Rate: N/A

- Free Checked Bag & Priority Boarding

- United Club Passes

- No Foreign Transaction Fee

- Premium Upgrades

- Mileage Rewards & Sign-Up Bonus

- Global Entry/TSA PreCheck Credit

- Access to the Luxury Hotel & Resort Collection

- Annual Fee

- No Lounge Access

The United Quest card offers auto rental collision damage waiver protection. If you charge the entire rental and decline the collision insurance from the rental company, you’ll enjoy primary coverage against collision damage or theft.

The Quest card requires good to excellent credit, but Chase does not disclose any minimum income requirements. However, Chase will use your income to determine your credit limit, which may require proof of income.

Yes, Chase uses the Star Alliance network of airlines for its rewards program. So, while you may get additional perks for using your miles for United flights, you can use your miles for flights with a number of other airlines including SkyWest, Trans States, Air Canada, Aer Lingus, Lufthansa, and GoJet.

While Chase does send out pre-approval letters for some of its cards on occasion, pre-approval is not available, and you must submit an application and have Chase pull your credit.

The Platinum Card® from American Express

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Special Perks

- Pros & Cons

- FAQ

The Platinum Card® from American Express is one of the best luxury cards available, offering extra ordinary benefits especially when it comes to travel.

The card offers 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. Terms Apply.

Also, you can enjoy welcome bonus of 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

Lastly, there are a lot of extra premium perks such as dedicated service team, up to $200 in Uber Cash (enrollment required), preferred seating at sporting and cultural events and baggage insurance for up to $500 for checked baggage and $1,250 for carry on.

- Up to $200 hotel credit per year when you book select prepaid hotels using your Platinum card via American Express Travel. Enrollment Required.

- Up to $240 or $20 per month in Digital Entertainment Credit when you pay for one or more The New York Times, Peacock, SiriusXM or Audible products with your card. Enrollment Required.

- Up to $155 in Walmart+ credit. When you use your card to pay for your monthly Walmart+ membership, you’ll get the full cost back every month. Enrollment Required.

- Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Up to $300 back every year for eligible Equinox memberships when you enroll and pay using your card.

- Up to $189 back per year when you use your card to pay for a CLEAR® membership. Enrollment Required.

- Welcome Bonus + Premium Point Rewards Rate (Terms Apply)

- No Foreign Transaction Fees

- Special Premium Status Perks

- High Annual Fee

- High Requirements

- Why did Amex Platinum Card deny me? What to Do Next? You might not have met one of the requirements. You can ask the customer support team if there is something you can do to change this eventuality. Otherwise, you can look for an alternative card.

- How hard is it to get Amex Platinum Card? You need to meet the credit score and income requirements, which are higher than a lot of other cards.

- What is the initial credit limit? The minimum credit limit you will get with this card will be $5,000.

- How do I redeem cash back? There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

- What purchases don't earn cash back? Every type of purchase through this card will earn cashback points.

- Should You Move to Amex Platinum Card? It is a good fit if you spend a lot of money on travel-related expenses and want to avail yourself of some great travel perks.

Chase Sapphire Preferred® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Sapphire Preferred® Card is a travel rewards card issued by Chase Bank. This is a very popular travel rewards card because it offers a large sign-up bonus and the card is built around traveling.

Many travel rewards cards have higher annual fees for the same kind of rewards. The card offers a sign-up bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

This card is on our top spot in regards to the best traveling and dining cards as they offer you more points compared to other cards – 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

- Rewards Plan: 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

- APR: 19.74%–27.99% variable

- Annual fee: $95

- Balance Transfer Fee: 5% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Point Sign-Up Bonus

- Bonus Points

- No Blackout Dates

- 25% More through Ultimate Chase Rewards

- No Foreign Transaction Fee

- $95 Annual Fee

- Low Merchandise Rewards

- No Introductory 0%

- Balance Transfer Fee – 5% or $5, whichever is greater

- Does the travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does card Chase Sapphire Preferred offer pre-approval? Yes, you are able to pre-qualify for this card.

- What is the initial credit limit? The minimum credit limit that you can get with this card type is usually $5,000.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

- What purchases don't earn cash back? All purchases will earn cashback through this card.

- Should You Move to Chase Sapphire Preferred card? If you travel frequently and do not want to pay a large annual fee.

- Why did the Chase deny me? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get a Chase Sapphire Preferred card? If you meet all of the requirements, then it is relatively straightforward to get a Chase Sapphire Preferred card. The requirements are easier compared to Chase Sapphire Reserve card.

- Is there a limit to rewards/cash back on the Chase Sapphire Preferred card? No limit

- Can I get car rental insurance with a Chase Sapphire Preferred card? how? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

Hilton Honors Aspire American Express Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Hilton Honors American Express Aspire Card is a premium hotel credit card offering exclusive benefits, caters to frequent Hilton guests, providing substantial benefits that can outweigh the card's annual fee.

It offers 14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases .

Also, the welcome offer includes 175,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership. .

With an annual fee of $550, the card provides Hilton Diamond status for as long as it's held, one free weekend night, up to $400 in Hilton resort credits, and up to $200 in airline credits annually.

- APR: 19.99%-28.99% Variable

- Annual fee: $550

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: 14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases

- Sign Up bonus: 175,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership.

- 0% APR Introductory Rate period: N/A

- Hilton diamond status

- Travel credits

- One free weekend night

- Cellphone protection

- High annual fee

- Enrollment required for some benefits

- Airline credits are capped at $50 per quarter

What kind of travel protections does the Hilton Aspire Card provide?

The card offers travel protections, including trip delay reimbursement, trip cancellation, and interruption insurance, providing coverage for eligible situations when travel is charged to the card.

Can I share Hilton Honors points with family members?

Yes, Hilton Honors offers points pooling, allowing up to ten friends and family members to combine and share points.

What benefits does Hilton Diamond status provide?

Hilton Diamond status offers perks such as bonus points, lounge access, free breakfast, and room upgrades.

How many reward nights can I earn annually?

Cardholders can earn up to three reward nights each year – one at the account opening, one on the cardmember anniversary, and an additional night with qualifying spending.

Can I use the airline credits for any airline purchases?

The card provides up to $200 in annual airline credits, distributed as $50 per quarter, for eligible airfare purchases directly from airlines or through AmexTravel.com.

How do I use the annual free weekend night award?

The free weekend night can be redeemed at almost any Hilton property worldwide, providing flexibility for your stay.

Rental Car Insurance Issuer Limitations

Each rental car insurance provider offers great benefits, but they often come with limitations, like specific rental periods.

For example, while you might be able to keep a rental car for months, most credit card insurance plans only cover rentals for a few days or weeks. Be sure to read the fine print when applying for a credit card to avoid exceeding the allowed rental period.

American Express doesn’t offer car insurance directly. They only offer it as an add-on. This comes at a cheaper price in most cases, but you need to remember to enroll in the program before you rent a car.

Most Chase credit cards offer rental insurance and they are some of the best on the market. They also come with many other benefits including travel perks.

Citi doesn’t offer car insurance anymore for rental cars. You might still be able to be covered through Citi though through Mastercard or Visa. Just double-check before you sign up for the rental car.

Wells Fargo offers rental car insurance for the actual cash value of the car. Most of their options are only secondary coverage.

Bank of American offers secondary coverage for some of their credit cards. Most of the cash reward programs do not offer this benefit.

Discover doesn’t offer rental car insurance as an option anymore, so it’s best to pick another credit card.

Capital One gives you the actual cash value of your vehicle. However, you only get secondary coverage and you can only use the rental car for 15 days

One of the primary distinctions is that some cards provide primary coverage while others do not. You should consider whether this is important to you and choose a credit card based on whether you want primary or secondary coverage. Primary insurance coverage is available with both the Chase Sapphire Preferred® and the United℠ Explorer card.

You might also want to take advantage of the other travel benefits you receive as part of the evaluation. Think about which card will provide you with the most perks and benefits. When determining the worth of a car insurance card, you should consider more than just the car insurance benefits. You should take into account everything you learn from the card.

Primary vs. Secondary Coverage: What's The Difference?

Almost all credit cards that offer rental car insurance coverage will also offer secondary coverage. This is extra coverage that will kick in after your personal car insurance policy covers everything it can. This means you need to file a claim with your own car insurance company before you submit a claim with the credit card insurance provider.

If you don’t have personal car insurance since you don’t normally drive or own a car, then the secondary coverage will cover most of the accidents.

You might also have a credit card that offers primary insurance. This means you will file the accident claim right away directly through the credit card company.

Usually, the credit card company will give you a number to call to submit your claim. This means the credit card will pay for the costs of the accident and injuries directly rather than you need to go through your personal car insurance company.

You might want to consider getting a car rental credit card with primary coverage if you don’t have personal car insurance. Keep in mind that you can only not have personal car insurance if you don’t drive or own a car. Otherwise, you need to show the car rental company that you have your own insurance.

Look For Car Rental Collision Damage Waiver

All credit cards with rental car insurance should include a CDW or a Collision Damage Waiver. This releases you from the financial responsibility of the car getting damaged or there is an issue of theft. Rental car companies will sell you this policy at a cost of around $20 a day, but sometimes it may be less.

If you have this on your credit card policy, you get to avoid all these extra costs. Sometimes your own auto insurance might also cover you for this. Trying to avoid buying this policy will make it much easier for you to rent a car.

Always decline this policy when you are getting it from the car insurance company. Since your credit card company has it, there is no need for you to pay for it twice.

If you want a comprehensive travel insurance, you can also consider credit cards with good travel insurance.

What Coverage is Included? (and What’s Not)

There are many coverages that are included and many that are not. You need to make sure that whatever is not covered, you have personal insurance or something similar to help you make sure that all your injuries and damages to property are covered so you don’t need to worry about outstanding medical bills and other bills that could affect your quality of life.

Also, keep in mind the specific conditions depends on your credit card company and the benefits each card provides, so check that out before to make sure you're covered.

In most cases, the coverage includes:

- Collision damage waiver

This is the most expensive damage offered at the rental counter and the one that makes renting a car outrageously expensive. Having it provided by your credit card company will save you tons of money.

- Administrative fees

This can cover a wide variety of things including fees from the company or other labor fees that need to be paid for workers.

- Towing expenses

If you get into an accident the car cannot be driven off the scene, your credit card company will pay for the car to be towed, which can be very costly.

- Loss of use

This pays the rental car company for the time they don’t have the car and cannot use it due to accident repairs or other problems with the car.

There are many things that are not covered that you need to keep in mind in case you get into an accident and might have costs that come from your own wallet.

Things not typically included are:

- Liability and injury concerns

Your credit card is not typically in charge of paying for damage to property other than the rental car, people you hurt, or related lawsuits.

Your personal insurance will usually cover these things though, so you don’t need to worry about paying them out of pocket.

- Ambulance and medical costs

If someone in the car needs an ambulance or emergency medical care, the credit card does not pay for this.

However, if you have personal medical insurance, you will be able to use it to cover these costs instead.

- Loss or theft of personal belongings

If the car happens to be broken into and your things get taken, the rental car insurance company will not pay for the damages.

You might want to check if your personal car insurance covers this as some do and some do not.

What is the Main Difference Between Car Rental Insurance Cards?

One of the main differences is that some cards offer primary coverage while others do not. You need to consider if this is important to you and choose a credit card based on whether you want primary coverage or just secondary. The Chase Sapphire Preferred Card and the United Explorer Card both offer primary insurance coverage.

Primary insurance coverage is also easier to use because you can call the credit card company directly rather than wait for your personal car insurance company. Travel credit cards also usually offer car rental insurance. If you travel often and also rent cars when you travel, you might want to choose one of those as you will get maximum travel benefits.

Some rental car insurance cards, such as many offered by American Express, allow you to do add-on coverage rather than having the coverage directly included with the card. You will need to enroll in the program and have your account automatically charged each time you rent a car.

They will charge you a single flat cost for car rentals rather than per day costs as the rental company does. This can save you valuable time and money when renting a car.

When Should You Consider Rental Car Insurance Cards?

Car rental insurance cards are important if you rent cars often for personal use or business. Car rentals are notoriously expensive and are one of the main reasons that people choose not to travel as often as they can.

If you don’t have travel enough because of high car rental costs, you might want to consider getting one of these cards to help you fund the costs of your trips. Always weigh the pros and cons before choosing a car rental insurance card.

How to Choose Rental Car Insurance Cards?

There are several ways you can choose a rental car insurance card. As discussed previously, you might want to choose a card with primary coverage if you want auto insurance coverage and if you don’t have car insurance, to begin with.

Before choosing a rental car insurance card:

- See if the card offers primary or secondary. Some only offer secondary, and some will offer both. Secondary cards will give you more options and you will have many different cards to choose from if you decide to go this route.

- See if the card offers other travel perks that could make your vacation cheaper. Many cards offer all kinds of rewards. Not just ones that pertain to car rentals. You can earn rewards for airlines, hotels, and many other travel-related things to make your next trip cheaper in every aspect.

- Make sure to check any drawbacks such as any fees or per day charges.

- See if the coverage is valid only for the cardholder or for other drivers as well.

- Weigh the annual fees against the benefits. Make sure the annual fee can be covered by your benefits. You don’t want to be stuck paying a huge fee and not be able to get it back through benefits.

- Look at welcome bonuses and minimum spending requirements. Some cards will offer a welcome bonus and have spending requirements you need to meet before getting benefits. Make sure to pay attention to this so you can ensure you are getting all the benefits advertised.

There are no right or wrong answers when it comes to finding a car rental insurance card. You need to get one that best fits your needs and will give you all the options you need. Always weigh cards against each other before choosing one so you know all the pros and cons of what you are getting.

How Do You Evaluate The Worth of a Rental Car Insurance Card?

As mentioned briefly above, it’s important to make sure your benefits can cover the annual fee of the credit card. Luxury cards have fees as high as $500 a year. You need to calculate how much money you will need to spend and the rewards you will receive in a dollar amount.

For example, some travel cards offer free companion flights, and they might have a $250 annual fee. If you use the flight on a choice that’s more than $250, you have already made the money back that you spent on the annual fee.

You also need to look at the issues that directly concern rental car insurance. For example, look at the flat fee they charge you when you want to rent a car. It might be between $20 to $45.

Most rental car companies charge a one-time fee, not per day. This drastically saves you money as rental car companies will charge you the insurance fee per day. This simple fee will make the rental car insurance card worth it.

You might also want to use the other travel perks you get within the evaluation. Consider which card will give you the most perks and benefits. When evaluating the worth of the car insurance card, you don’t want to only take into account the car insurance benefits. You want to make sure you are considering everything you get from the card.

If you travel often and you need to use airline miles or hotel discounts, this will make the annual fee of the card worth it because you will be getting all the money back in the form of discounts and points.

How We Picked The Best Rental Insurance Cards: Methodology

To identify the best credit cards for rental car insurance, our team meticulously researched offerings from various issuers, focusing on major banks and financial institutions. We rated these cards based on four key categories tailored for consumers seeking rental car insurance benefits:

Rental Car Insurance Coverage (40%): We evaluate the extent of rental car insurance coverage provided by the credit card, including collision damage waiver (CDW) coverage, theft protection, and secondary or primary coverage status. Cards offering comprehensive insurance coverage with minimal exclusions and high coverage limits score higher in this category.

Features & Benefits (30%): This category assesses additional features that enhance the overall value of the card, such as absence of fees, travel rewards, emergency roadside assistance, travel insurance benefits, and APR. Cards offering a comprehensive range of benefits without excessive fees earn higher scores.

Cardholder Experience (20%): We examine the ease of application, customer service quality, and online account management tools. Cards with streamlined application processes, responsive customer support, and user-friendly mobile apps or online portals receive higher ratings, ensuring a seamless experience for cardholders with excellent credit.

Issuer Reputation (10%): We scrutinize each issuer's reputation, considering customer feedback, financial stability, and regulatory standing. Issuers with positive reviews from cardholders and a track record of providing excellent rental car insurance benefits and customer service receive higher ratings in this category.

This comprehensive evaluation ensures that the best credit cards for rental car insurance offer reliable coverage, valuable benefits, and a seamless claims process for consumers seeking peace of mind when renting vehicles.