The Southwest Rapid Rewards Plus® Credit Card and the Southwest Rapid Rewards Premier® Credit Card are two popular travel rewards cards offered by Chase Bank in partnership with Southwest Airlines.

Both cards are geared towards frequent Southwest flyers, but they have some key differences.

General Comparison

The Southwest Rapid Rewards Plus card is the basic option with a lower annual fee. It's a solid choice for budget-conscious travelers who still want to earn Southwest Rapid Rewards points.

On the other hand, the Southwest Rapid Rewards Premier card comes with a higher annual fee but offers more benefits – cardholders are able to accumulate more points on Southwest and other purchases, earn more points on card member anniversary and TQPs toward A-List elite status.

Southwest Rapid Rewards Plus | Southwest Rapid Rewards Premier | |

Annual Fee | $69 | $99 |

Rewards | 2X points on Southwest purchases, Southwesthotel and car rental partners, local transit and commuting (including ride-shares),internet, cable, phone and select streaming services, and 1X points on all other purchases |

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

Welcome bonus | 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening |

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 3% | 21.49%–28.49% variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Southwest Premier vs Plus: Point Rewards Analysis

The Southwest Premier card offers a better point rewards ratio than the Plus card. In our analysis, we can see the impact of this. Based on this spend, Premier cardholders earn more points and its estimated annual redemption value is higher.

Spend Per Category | Rapid Rewards Plus | Rapid Rewards Premier |

$10,000 – U.S Supermarkets | 10,000 points | 10,000 points |

$4,000 – Restaurants

| 4,000 points | 4,000 points |

$4,000 – Airline | 8,000 points | 12,000 points |

$5,000 – Hotels | 5,000 points | 10,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 31,000 points | 40,000 points |

Redemption Value (Estimated) | 1 point = ~1.3 cents

| 1 point = ~1.3 cents

|

Estimated Annual Value | $403 | $520 |

With both cards, you can use points for flights with no blackout dates, allowing flexible travel. Points cover ticket costs, taxes, and fees. Additionally, you can redeem points for international flights, hotel stays, car rentals, and gift cards.

Which Benefits Of You'll Get On Both Cards?

There are some additional types of perks that you will see with both of these cards:

25% Back on Inflight Purchases: Receive a 25% rebate on inflight purchases, making onboard snacks, drinks, and entertainment more affordable for travelers.

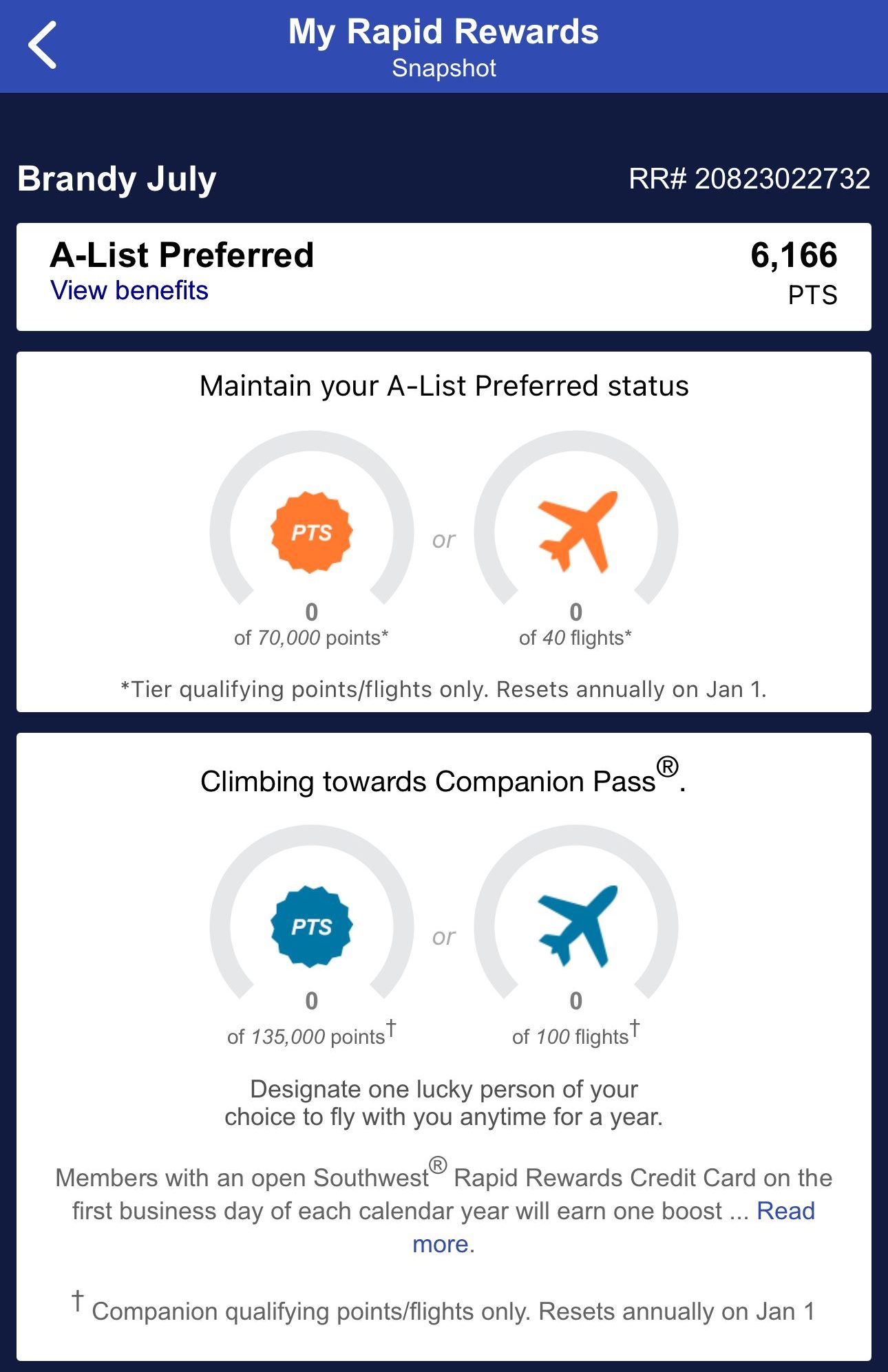

10,000 Companion Pass Qualifying Points Boost: The card provides an annual boost of 10,000 Companion Pass qualifying points, bringing cardholders closer to earning the highly coveted Southwest Companion Pass.

- 2 EarlyBird Check-In® Each Year: Enjoy the convenience of two EarlyBird Check-Ins per year, allowing cardholders to secure earlier boarding positions and increase their chances of obtaining preferred seating on Southwest flights. This perk contributes to a smoother and more comfortable travel experience.

DoorDash Benefits: Cardholders receive a complimentary one-year DashPass membership, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders through DoorDash and Caviar.

Lost Luggage Reimbursement: Receive coverage up to $3,000 per passenger for lost or damaged checked or carry-on luggage.

Baggage Delay Insurance: Get reimbursed for essential purchases (up to $100 per day for 3 days) in case of baggage delays over 6 hours.

Extended Warranty Protection: Extend the manufacturer's warranty by an additional year on eligible warranties of three years or less.

Purchase Protection: Enjoy coverage for new purchases against damage or theft for 120 days, up to $500 per claim and $50,000 per account, providing added security for your acquisitions.

Which Benefits Are Unique For Each Card?

There are some additional types of perks which available specifically for each card:

Southwest Rapid Rewards Plus

3,000 Points Annually: Cardholders receive 3,000 bonus points every year on their Cardmember anniversary, adding a consistent boost to their Southwest Rapid Rewards balance.

Southwest Rapid Rewards Premier

6,000 Points Annually on Cardmember Anniversary: Cardholders receive an additional 6,000 bonus points every year on their Cardmember anniversary, further enhancing the annual point accumulation and boosting the overall rewards potential.

- Unlimited Tier Qualifying Points (TQPs): For every $10,000 spent, earn 1,500 TQPs toward A-List status, with no limit on the amount of TQPs you can accumulate, facilitating progress towards elite status and associated benefits.

When You Might Want the Southwest Premier Card?

You Might Prefer the Southwest Rapid Rewards Premier over the Plus card if:

Frequent Traveler with Southwest Partners: If you frequently use Southwest's hotel and car rental partners, the Rapid Rewards Premier card could be more advantageous. It offers an additional 1 point per $1 on Rapid Rewards Hotel and Car Rental Partner purchases, providing extra rewards for your travel-related expenses.

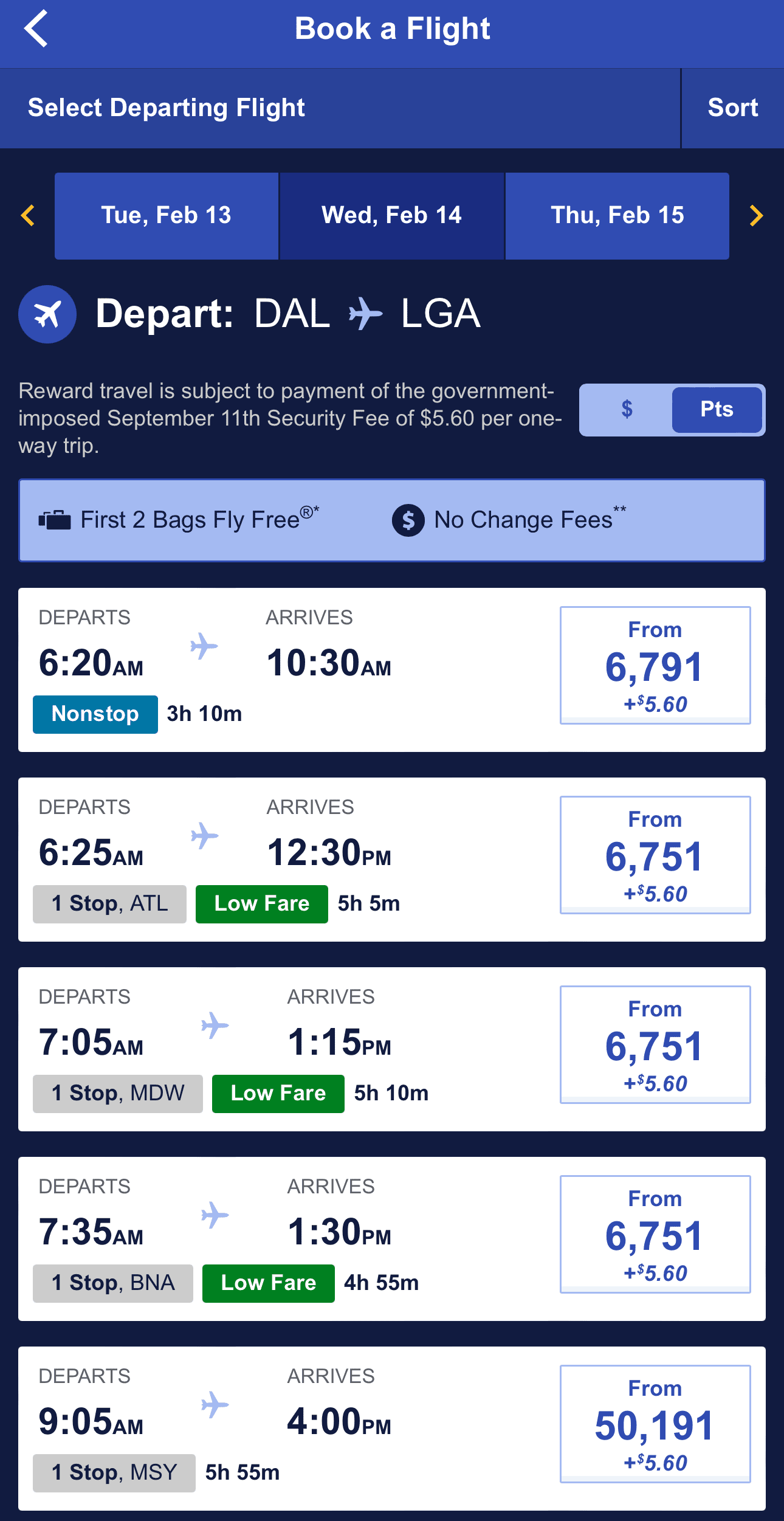

Desire for A-List Status: If you value perks like priority boarding and priority check-in, the Rapid Rewards Premier card is a better choice. It earns you tier qualifying points towards A-List and A-List Preferred status, helping you achieve elite status with Southwest for a more enhanced travel experience.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Southwest Plus Card?

You Might Prefer the Southwest Rapid Rewards Plus if:

Cost-Conscious Travelers: The Southwest Rapid Rewards Plus card is a better choice for individuals who prioritize a lower annual fee. If you want to enjoy the benefits of a Southwest credit card without committing to a higher cost, the Plus card offers a more budget-friendly option.

Infrequent Travelers: If you don't travel as frequently or don't often use Southwest's hotel and car rental partners, the additional benefits of the Premier card may not justify the higher annual fee. In such cases, the Rapid Rewards Plus card provides a straightforward way to earn points on Southwest purchases without the added cost.

Compare The Alternatives

If you're in search of a travel credit card offering airline rewards, there are several compelling alternatives worth exploring:

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Southwest Rapid Rewards Premier

We think the Southwest Rapid Rewards Premier wins – it's cheaper and there is no significant difference in points rewards or airline perks.

Southwest Rapid Rewards Premier vs Priority: Side By Side Comparison

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the Southwest Premier card extra travel perks are better, the JetBlue Plus Card is our winner in this comparison. Here's why.

JetBlue Plus Card vs Southwest Rapid Rewards Premier: Side By Side Comparison

Both cards have similar annual cashback value and diverse airline benefits. While there is no clear winner, each card has its unique perks.

Frontier World Mastercard vs. Southwest Rapid Rewards Premier: Side By Side Comparison

Both Alaska and Southwest Premier have similar annual cashback values. While there is no clear winner, each card has its own unique perks.

Alaska Airlines Visa Signature vs Southwest Rapid Rewards Premier: Comparison