The JetBlue Plus Card and the Southwest Rapid Rewards Premier Card are two distinct travel credit cards catering to different airlines, JetBlue and Southwest, respectively. Both cards offer unique benefits tailored to their respective target audiences' preferences and travel patterns.

General Comparison

Both cards charge similar annual fees, don't charge foreign transaction fees, and offer benefits tailored for each airline company. The JetBlue Plus card shines when it comes to points rewards and 0% intro APR, while the Southwest Rapid Rewards Premier card offers better extra perks.

Here's a side-by-side comparison of the card's main features:

Southwest Rapid Rewards Premier | The JetBlue Plus Card | |

Annual Fee | $99 | $99 |

Rewards |

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

| 6X points on JetBlue purchases, 2X points at restaurants and grocery stores and 1X points on all other purchases |

Welcome bonus | 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

| 50,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days |

0% Intro APR | N/A | 12 billing cycles on balance transfers |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.49%–28.49% variable

| 21.24% – 29.99% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Airline Miles Rewards Analysis: Which Card Is Better?

When we analyze the amount of points cardholders can get for each card for the same spend, we can see that the JetBlue Plus Card is a clear winner. It earns many more points for the same spend, and the card points estimated annual worth is higher than the Southwest Rapid Rewards Premier Card.

Spend Per Category | Southwest Rapid Rewards Premier | The JetBlue Plus Card |

$10,000 – U.S Supermarkets | 10,000 points | 20,000 points |

$4,000 – Restaurants

| 4,000 points | 8,000 points |

$5,000 – Airline | 15,000 points | 30,000 points |

$4,000 – Hotels | 8,000 points | 4,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 41,000 points | 66,000 points |

Redemption Value (Estimated) | 1 point = ~1.3 cents

| 1 point = ~1.4 cents

|

Estimated Annual Value | $533 | $924 |

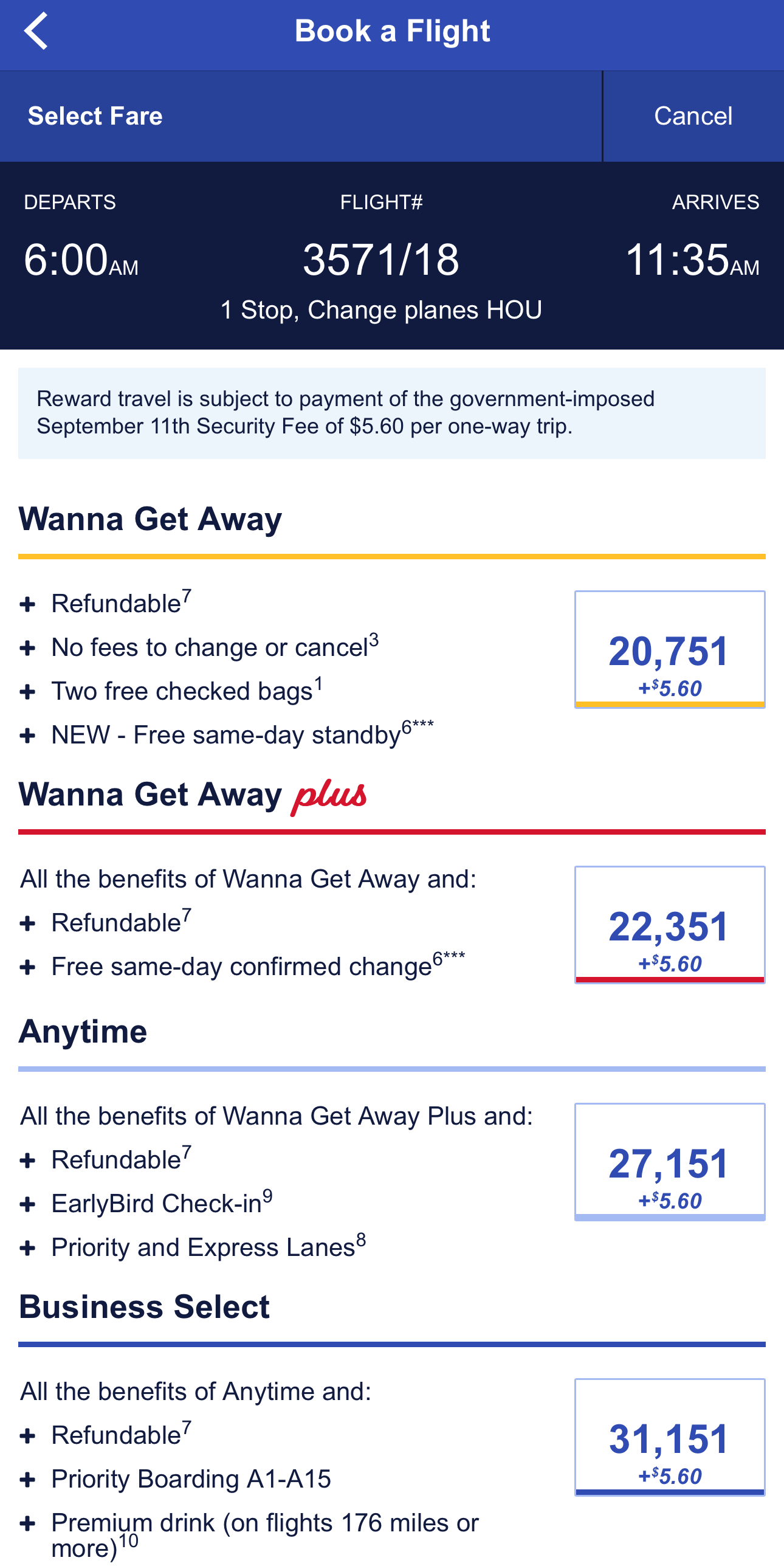

With Southwest Premier card, you can use points for flights with no blackout dates, allowing flexible travel. Points cover ticket costs, taxes, and fees. Additionally, you can redeem points for international flights, hotel stays, car rentals, and gift cards.

The JetBlue Plus Card lets you earn points for every purchase, and you can redeem them for flights on JetBlue. It's like collecting miles to get free flights.

You also have the flexibility to use points for hotel stays or car rentals if you prefer. Plus, there are no blackout dates, so you can book your travel whenever suits you.

Airline And Travel Benefits: Comparison

The Southwest Rapid Rewards Premier card stands out as the superior choice for additional travel and airline benefits, primarily attributed to its extensive protections and comprehensive travel insurance offerings:

Southwest Rapid Rewards Premier

- 25% Back on Inflight Purchases: Receive a 25% rebate on inflight purchases, making onboard snacks, drinks, and entertainment more affordable for travelers.

6,000 Points Annually on Cardmember Anniversary: Cardholders receive an additional 6,000 bonus points every year on their Cardmember anniversary, further enhancing the annual point accumulation and boosting the overall rewards potential.

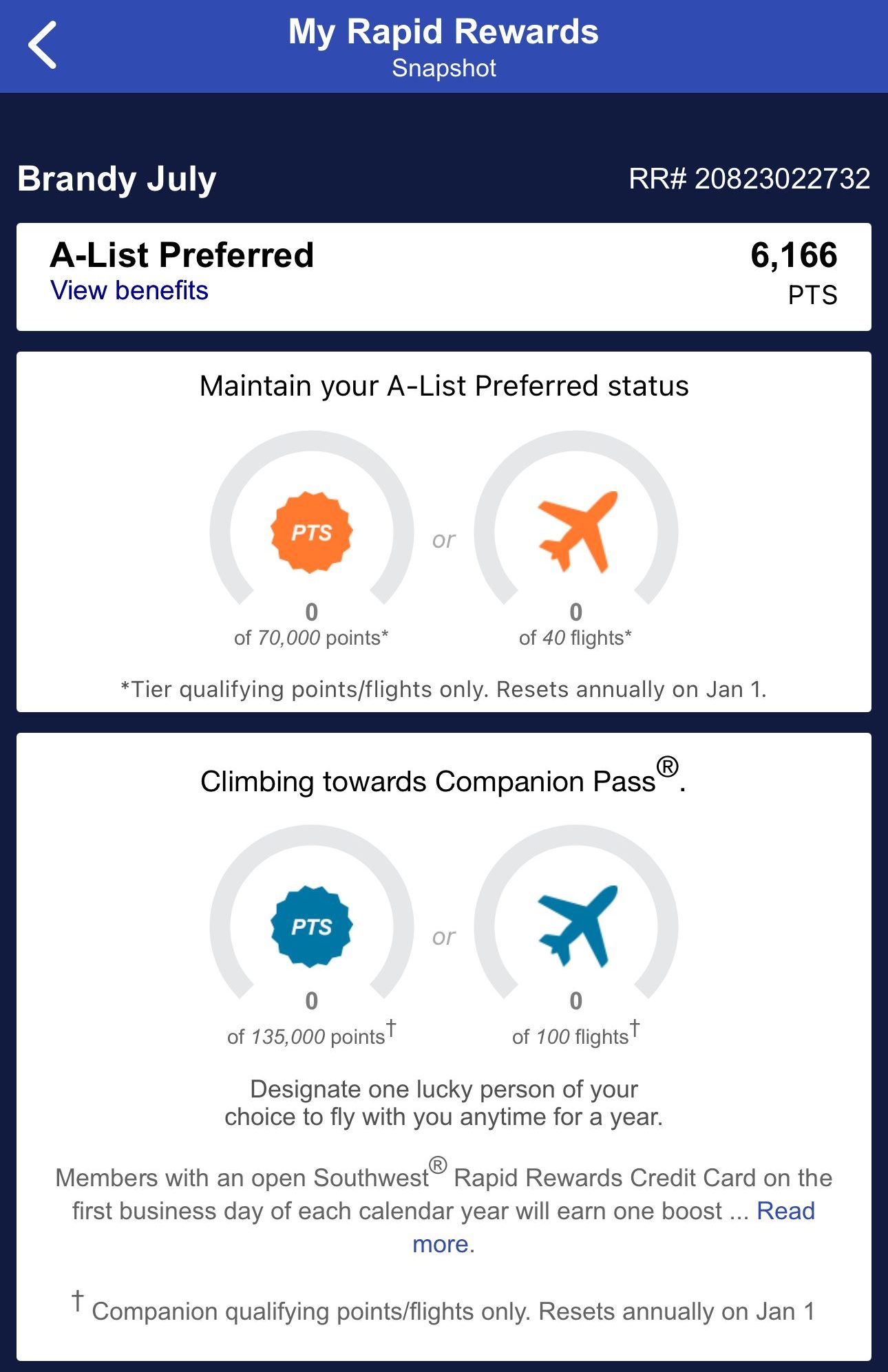

- Unlimited Tier Qualifying Points (TQPs): For every $10,000 spent, earn 1,500 TQPs toward A-List status, with no limit on the amount of TQPs you can accumulate, facilitating progress towards elite status and associated benefits.

- 10,000 Companion Pass Qualifying Points Boost: The card provides an annual boost of 10,000 Companion Pass qualifying points, bringing cardholders closer to earning the highly coveted Southwest Companion Pass.

- 2 EarlyBird Check-In® Each Year: Enjoy the convenience of two EarlyBird Check-Ins per year, allowing cardholders to secure earlier boarding positions.

- DoorDash Benefits: Cardholders receive a complimentary one-year DashPass membership.

- Lost Luggage Reimbursement: Receive coverage up to $3,000 per passenger for lost or damaged checked or carry-on luggage.

- Baggage Delay Insurance: Get reimbursed for essential purchases (up to $100 per day for 3 days) in case of baggage delays over 6 hours.

- Extended Warranty Protection: Extend the manufacturer's warranty by an additional year on eligible warranties of three years or less.

- Purchase Protection: Enjoy coverage for new purchases against damage or theft for 120 days, up to $500 per claim and $50,000 per account, providing added security for your acquisitions.

JetBlue Plus Card

Free First Checked Bag: Enjoy the benefit of a free first checked bag for yourself and up to three eligible travel companions on JetBlue-operated flights.

10% Points Back: Receive a 10% points rebate after redeeming points for and traveling on a JetBlue-operated Award Flight, adding value to your rewards.

$100 Statement Credit: Get a $100 statement credit annually when you use your JetBlue Plus Card to purchase a JetBlue Vacations package totaling $100 or more.

Cash + Points: Flexibility is at your fingertips with the Cash + Points option, allowing you to pay for your flight using a combination of dollars and TrueBlue points, starting with as few as 500 points.

- Points Payback: With Points Payback, you can redeem your points for a statement credit, providing additional flexibility and the opportunity to recoup up to $1,000 annually.

- In-flight savings: Enjoy a 50% discount on eligible purchases made in-flight on JetBlue-operated flights.

- Fraud protection: Benefit from $0 Fraud Liability, ensuring you are not held accountable for unauthorized charges on your JetBlue Card.

When You Might Prefer The JetBlue Plus Card?

You might prefer the JetBlue Plus card in the following situations:

You are a Regular JetBlue Flyer: If JetBlue is your preferred airline and you fly with them regularly, the JetBlue Plus Card is the more advantageous choice, providing tailored perks and rewards for frequent JetBlue travelers.

Enhanced Points Rewards: Our analysis indicates that the JetBlue Plus Card yields more points per expenditure, particularly on flight-related expenses, making it a more rewarding option for your spending habits.

Exclusive 0% Intro APR for Balance Transfers: If you require a 0% introductory APR specifically for balance transfers, the JetBlue Plus Card is the sole option offering this feature, catering to your financial needs while providing the benefits of a JetBlue-focused card.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Southwest Premier Card?

You might prefer the Southwest Rapid Rewards Premier card in the following situations:

Better Travel Insurance And Protections: The Southwest Rapid Rewards Premiercard offers a avriety of protections you won't be able to get with the JetBlue Plus card, so if you prioritize this aspect – the Gold card may be a better option.

You Want Wider Domestic Route Network: Opt for the Southwest Rapid Rewards Premier Card if your travel preferences align with Southwest's extensive domestic route network. Southwest provides a significantly higher number of daily flights compared to JetBlue, servicing a much larger array of destinations.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

| |||

|---|---|---|---|

United℠ Explorer Card | Delta SkyMiles® Gold American Express Card | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $95 ($0 first year) | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0. See Rates and Fees. | $0 |

Purchase APR | 21.99% – 28.99% variable | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

Compare Southwest Rapid Rewards Premier

We think the Southwest Rapid Rewards Premier wins – it's cheaper and there is no significant difference in points rewards or airline perks.

Southwest Rapid Rewards Premier vs Priority: Side By Side Comparison

If you're a frequent flyer, the Premier card has the edge so that you can cover the annual fee difference. If not, the Plus card is enough.

Southwest Rapid Rewards Plus vs Premier: Side By Side Comparison

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

Both cards have similar annual cashback value and diverse airline benefits. While there is no clear winner, each card has its unique perks.

Frontier World Mastercard vs. Southwest Rapid Rewards Premier: Side By Side Comparison

Both Alaska and Southwest Premier have similar annual cashback values. While there is no clear winner, each card has its own unique perks.

Alaska Airlines Visa Signature vs Southwest Rapid Rewards Premier: Comparison

Compare JetBlue Plus Card

If you tend to fly at least twice a year with JetBlue – the plus card is our winner, with a higher cashback rate and enticing airline perks.

The JetBlue Card vs The JetBlue Plus Card: How They Compare?

If you're looking for an airline card, both American Airlines and JetBlue cards can be a perfect choice, depends on your needs. Here are our thoughts.

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

While the airline benefits are pretty similar, The JetBlue Plus Card is a clear winner due to much higher cashback rates than the Alaska card.

Alaska Airlines Visa Signature vs JetBlue Plus Card: Which Airline Card Wins

While the airline perks are quite comparable, the JetBlue Plus Card emerges as the preferred choice thanks to higher cashback rates.

Citi/ AAdvantage Platinum Select vs JetBlue Plus Card: Side By Side Comparison

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison