The Southwest Rapid Rewards Priority and Delta SkyMiles Platinum are both premium credit cards offered by major U.S. airlines, each catering to a different airline loyalty program.

Let's compare them side by side – key features, benefits and drawbacks.

General Comparison

The Southwest Rapid Rewards Priority Card is affiliated with Southwest Airlines, known for its extensive domestic network. The card offers significant perks for frequent Southwest flyers. Cardholders enjoy an annual $75 Southwest travel credit, four upgraded boardings per year, and 7,500 anniversary points.

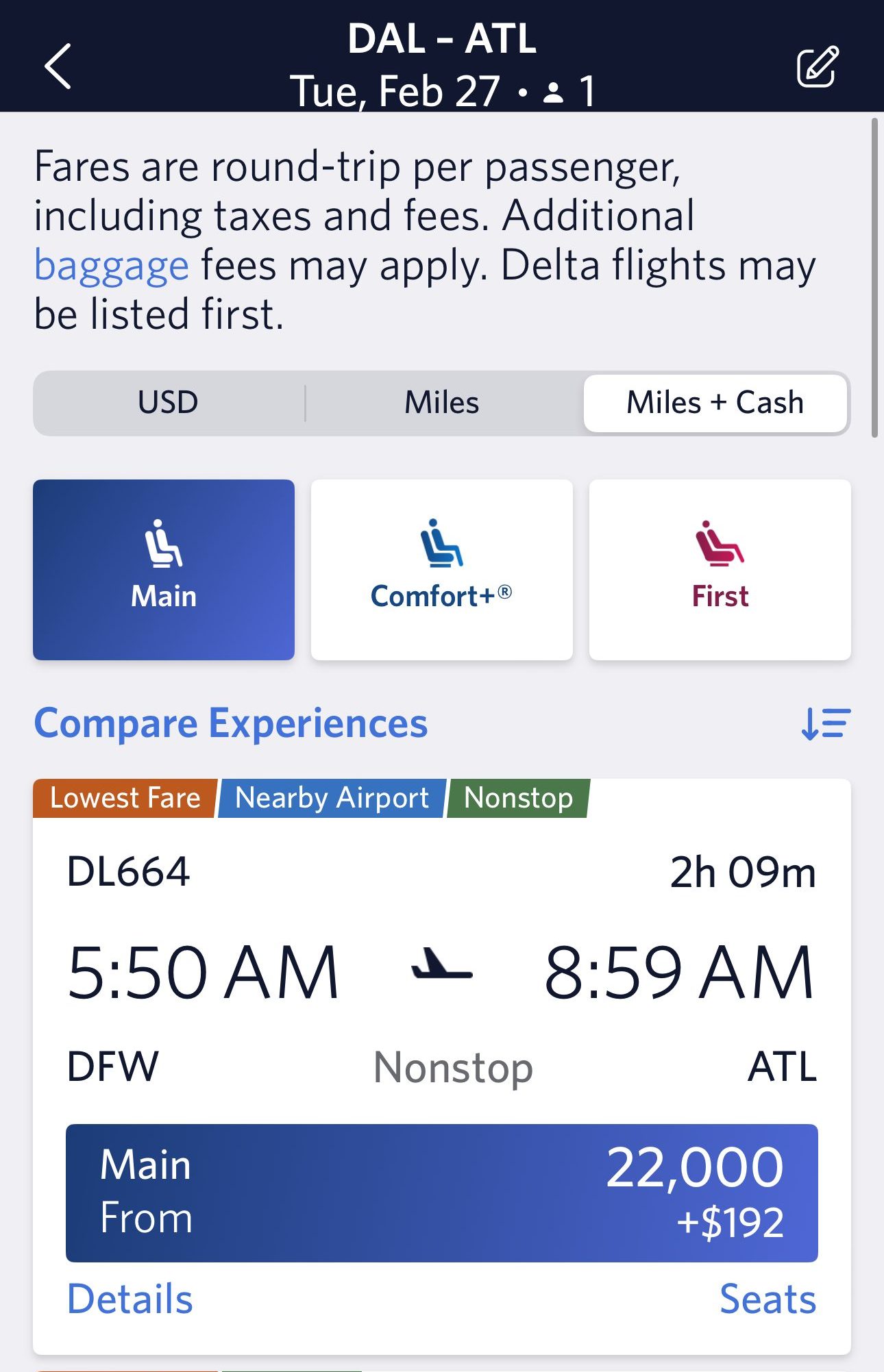

On the other hand, the Delta SkyMiles Platinum Card is associated with Delta Air Lines, a major player in the global aviation industry. Cardholders benefit for Delta and rideshare, first checked bag free, a Global Entry or TSA PreCheck fee credit, and an annual companion certificate for Main Cabin domestic, Caribbean, or Central American roundtrip flights.

Here's a side by side comparison of the cards main features:

Delta SkyMiles Platinum | Southwest Rapid Rewards Priority | |

Annual Fee | $350. See Rates and Fees. | $149 |

Rewards | 3X Miles on Delta purchases and purchases made directly with hotels, 2X Miles at restaurants worldwide including takeout and delivery in the U.S., and at U.S. supermarkets and 1X Miles on all other eligible purchases. | 3X points on Southwest purchases, 2X points on Southwest’s Rapid Rewards hotel and car rental partners, local transit and commuting (including rideshares) and internet, cable phone and select streaming services; 1X points on all other purchases |

Welcome bonus |

50,000 bonus miles after you spend $3,000 in your first six months. | 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 20.99%-29.99% Variable

| 21.24% – 28.24% variable APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: A Side-by-Side Analysis

Based on our analysis, the Delta Platinum card is the clear winner here. It accumulated more points for the same spend and its estimated annual redemption value is higher than the Southwest Priority card:

Spend Per Category | Delta SkyMiles Platinum | Southwest Priority Card |

$15,000 – U.S Supermarkets | 30,000 miles | 15,000 points |

$5,000 – Restaurants | 10,000 miles | 5,000 points |

$6,000 – Hotels | 18,000 miles | 12,000 points |

$8,000 – Airline

| 24,000 miles | 24,000 points |

$4,000 – Gas | 4,000 miles | 4,000 points |

Total Points | 86,000 miles | 60,000 points |

Estimated Redemption Value | 1 mile = ~1.3 cents

| 1 point = ~1.3 cents

|

Estimated Annual Value | $1,118 | $780 |

The Delta Platinum Card offers diverse redemption options for travel enthusiasts. Earn and redeem miles for Delta flights, upgrades, and partner airlines. Enjoy exclusive access to Delta Sky Club lounges. Flexible options include hotel stays, car rentals, and merchandise through Delta's SkyMiles Marketplace.

The Southwest Premier card lets you redeem points for flights without any blackout dates, providing flexibility in your travel plans. These points not only cover ticket expenses but also include taxes and fees.

Moreover, you have the option to use your points for international flights, hotel accommodations, car rentals, and gift cards, giving you a variety of choices for making the most of your rewards.

Travel And Airline Benefits: Comparison

While the Delta SkyMiles Platinum card and the Southwest Priority card provide premium perks, the Delta Platinum card offers a more extensive range, including TSA PreCheck, Resy, and rideshare statement credits and an annual companion certificate.

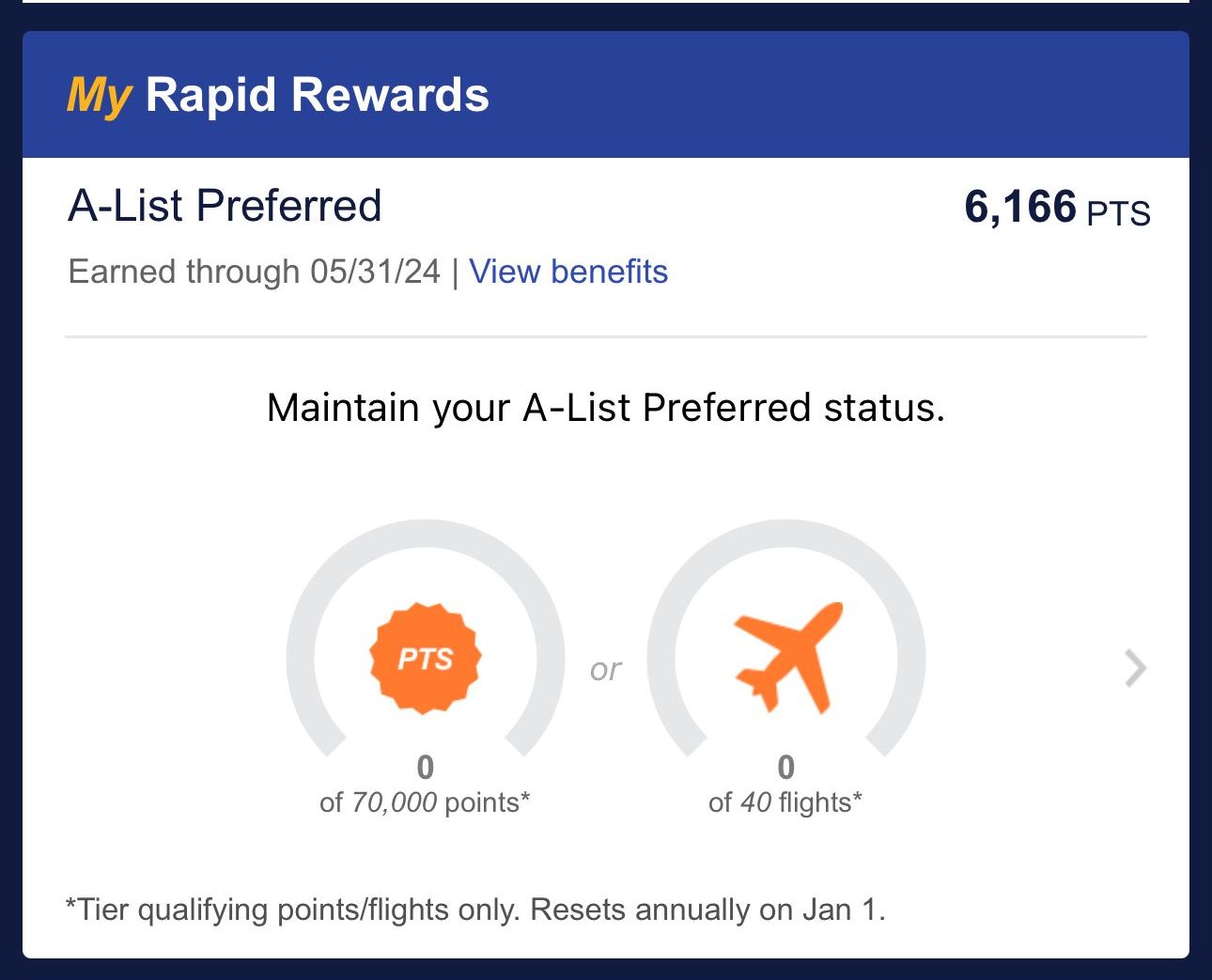

Southwest offers annual travel credit as well as upgraded boarding and TQPs toward A list status upon required spending.

Delta SkyMiles Platinum

- Annual Companion Certificate: You’ll receive a round-trip companion certificate for Main Cabin domestic, Caribbean, or Central American roundtrip flights each year after renewal of your card.

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

- Up to $100 Fee Credit for Global Entry or TSA PreCheck®: Get reimbursed for the application fee for Global Entry or TSA PreCheck every 4 years.

- 20% Back on In–flight Purchases: Receive a 20% statement credit on eligible Delta in-flight purchases of food and beverages.

- ShopRunner: Enjoy free 2-day shipping at 100+ online stores when you enroll in complimentary ShopRunner membership with your Delta Platinum card.

- $150 Delta Stays Credit: Receive a $150 Delta Stays Credit annually on eligible prepaid Delta Stays bookings on delta.com.

- Hertz Five Star® Status: Enroll in the Hertz Gold Plus Rewards program and enjoy Hertz Five Star Status.

- $120 Resy Credit: Enjoy a $120 Resy Credit, earning up to $10 in monthly statement credits on eligible Resy purchases.

- $120 Rideshare Credit: Get a $120 Rideshare Credit, with up to $10 back in statement credits each month on U.S. rideshare purchases with select providers when you use your Delta SkyMiles Platinum American Express Card. nrollment Required.

- Complimentary Upgrade list: Even if you're not a Medallion Member, you'll be added to the Complimentary Upgrade list after Delta SkyMiles Medallion Members and Reserve Card Members if you have an eligible ticket.

- MQD Boost: Receive $2,500 Medallion® Qualification Dollars each Medallion Qualification Year and get closer to Status with MQD Headstart.

- MQD on Purchases: Earn $1 Medallion® Qualification Dollar for each $20 of purchases made on your Delta SkyMiles® Platinum American Express Card in a calendar year and get a boost toward achieving elevated Medallion Status for next Medallion Year.

Terms apply to American Express benefits and offers.

Southwest Rapid Rewards Priority

7,500 Points Annually: Cardholders receive 7,500 bonus points every year on their Cardmember anniversary, adding a consistent boost to their Southwest Rapid Rewards balance.

$75 Southwest Annual Travel Credit: This credit helps offset the annual fee, providing cardholders with a yearly $75 credit for eligible Southwest travel expenses.

4 Upgraded Boardings per Year: Enjoy enhanced travel experience with four upgraded boardings per year when available.

- Unlimited Tier Qualifying Points (TQPs): For every $10,000 spent, earn 1,500 TQPs toward A-List status, with no limit on the amount of TQPs you can accumulate.

- 25% Back on Inflight Purchases: Receive a 25% rebate on inflight purchases, making onboard snacks, drinks, and entertainment more affordable for travelers.

- 10,000 Companion Pass Qualifying Points Boost: The card provides an annual boost of 10,000 Companion Pass qualifying points, bringing cardholders closer to earning the highly coveted Southwest Companion Pass.

- DoorDash Benefits: Cardholders receive a complimentary one-year DashPass membership, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders through DoorDash and Caviar.

Travel Insurance And Protections: Comparison

Also under this category, the Delta SkyMiles is the winner as it offers broader travel insurance and protections:

Delta SkyMiles Platinum

- Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

Terms apply to American Express benefits and offers.

Southwest Rapid Rewards Priority

- Lost Luggage Reimbursement: Receive coverage up to $3,000 per passenger for lost or damaged checked or carry-on luggage.

- Baggage Delay Insurance: Get reimbursed for essential purchases (up to $100 per day for 3 days) in case of baggage delays over 6 hours.

- Extended Warranty Protection: Extend the manufacturer's warranty by an additional year on eligible warranties of three years or less.

- Purchase Protection: Enjoy coverage for new purchases against damage or theft for 120 days, up to $500 per claim and $50,000 per account, providing added security for your acquisitions.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Southwest Priority Card?

You might prefer the Southwest Rapid Rewards Priority card over the Delta Platinum card in the following situations:

You Want Lower Annual Fee: The Southwest Rapid Rewards Priority card has an annual fee of $149, while the Delta SkyMiles Platinum card has an annual fee of $350. If you're looking for a card with a lower annual fee, then the Southwest Rapid Rewards Priority card is the clear winner.

Preference for Southwest Airlines: If you have a strong preference for flying with Southwest Airlines due to their route network, customer service, or other factors, the Southwest Rapid Rewards Priority card aligns well with your loyalty, offering benefits that enhance the overall Southwest travel experience.

Frequent Domestic Traveler: If you primarily travel within the United States and prefer a card with perks tailored to domestic flights, such as upgraded boardings and an annual Southwest travel credit, the Southwest Rapid Rewards Priority may be the better choice for you.

When You Might Want the Delta Platinum Card?

You might prefer the Delta Platinum if:

- Higher Point Rewards Ratio: Based on our analysis, the Delta Platinum card offer better point rewards ratio and higher value for the same spend.

- Better Travel Insurance: If comprehensive travel insurance is a priority, the Delta SkyMiles Platinum offers various travel-related protections, including trip cancellation/interruption insurance and baggage insurance, making it a preferred choice for those who value enhanced coverage during their travels.

- Delta Extra Travel Benefits: If you frequently fly with Delta and prioritize additional travel benefits such as priority boarding, a Global Entry or TSA PreCheck fee credit, and an annual companion certificate for a domestic main cabin round-trip flight, the Delta SkyMiles Platinum provides a more comprehensive set of perks tailored to Delta loyalists.

Compare The Alternatives

If you're looking for a premium travel credit card with airline rewards – there are some good alternatives you may want to consider:

Capital One Venture X | Chase Sapphire Reserve® | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $395 | $550 | $99 (waived for the first 12 months)

|

Rewards |

1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases |

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. |

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening |

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 19.99% – 29.99% (Variable) | 22.49%–29.49% variable | 21.24% – 29.99% (Variable) |

Compare Southwest Rapid Rewards Priority

If you're looking for airline travel rewards, there is a clear winner. But what about other premium travel benefits?

Here's our comparison: Delta SkyMiles Gold vs Southwest Rapid Rewards Priority

We think the Southwest Rapid Rewards Premier wins – it's cheaper and there is no significant difference in points rewards or airline perks.

Southwest Rapid Rewards Premier vs Priority: Side By Side Comparison

The United Quest card offers better airline benefits, but we don't think it worth the higher annual fee, unless you're a frequent flyer.

Compare Delta SkyMiles Platinum Card

While the Delta SkyMiles Reserve card has a high annual fee, it offers better airline and travel benefits than the Platinum card.

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Chase Reserve wins on cashback rates, travel perks, and insurance. Is it worth the annual fee difference? We think it does – here's why.

Chase Sapphire Reserve vs. Delta SkyMiles Platinum: Side By Side Comparison

While having the same annual fee, we think the Delta SkyMiles Platinum is a better choice than the United Quest card. Here's why.

United Quest vs. Delta SkyMiles Platinum: Side By Side Comparison