The Chase Sapphire Reserve is a versatile travel rewards card, while the Delta SkyMiles Platinum is more airline-focused. Let's compare them side by side.

Chase Reserve vs. Delta Platinum: General Comparison

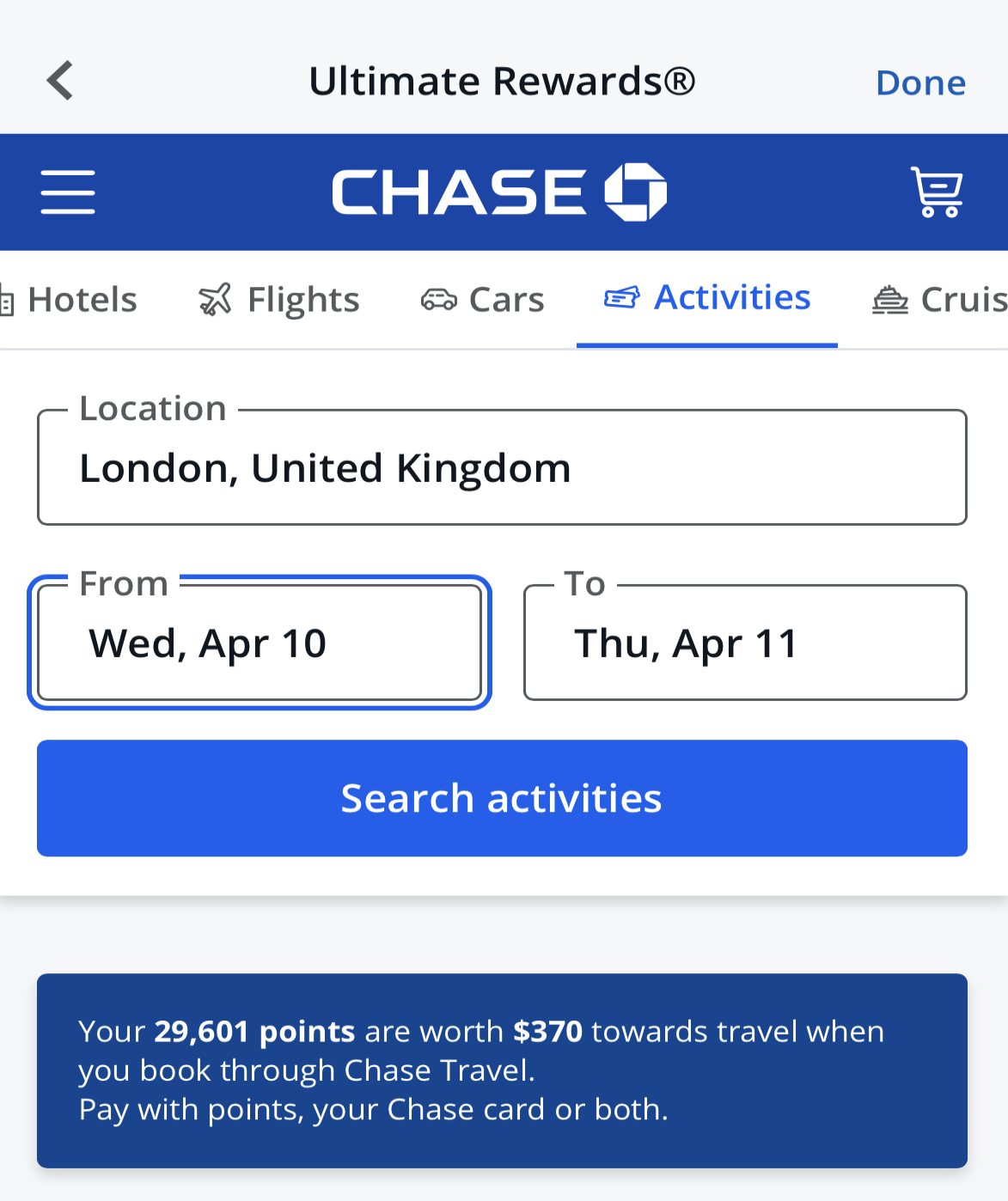

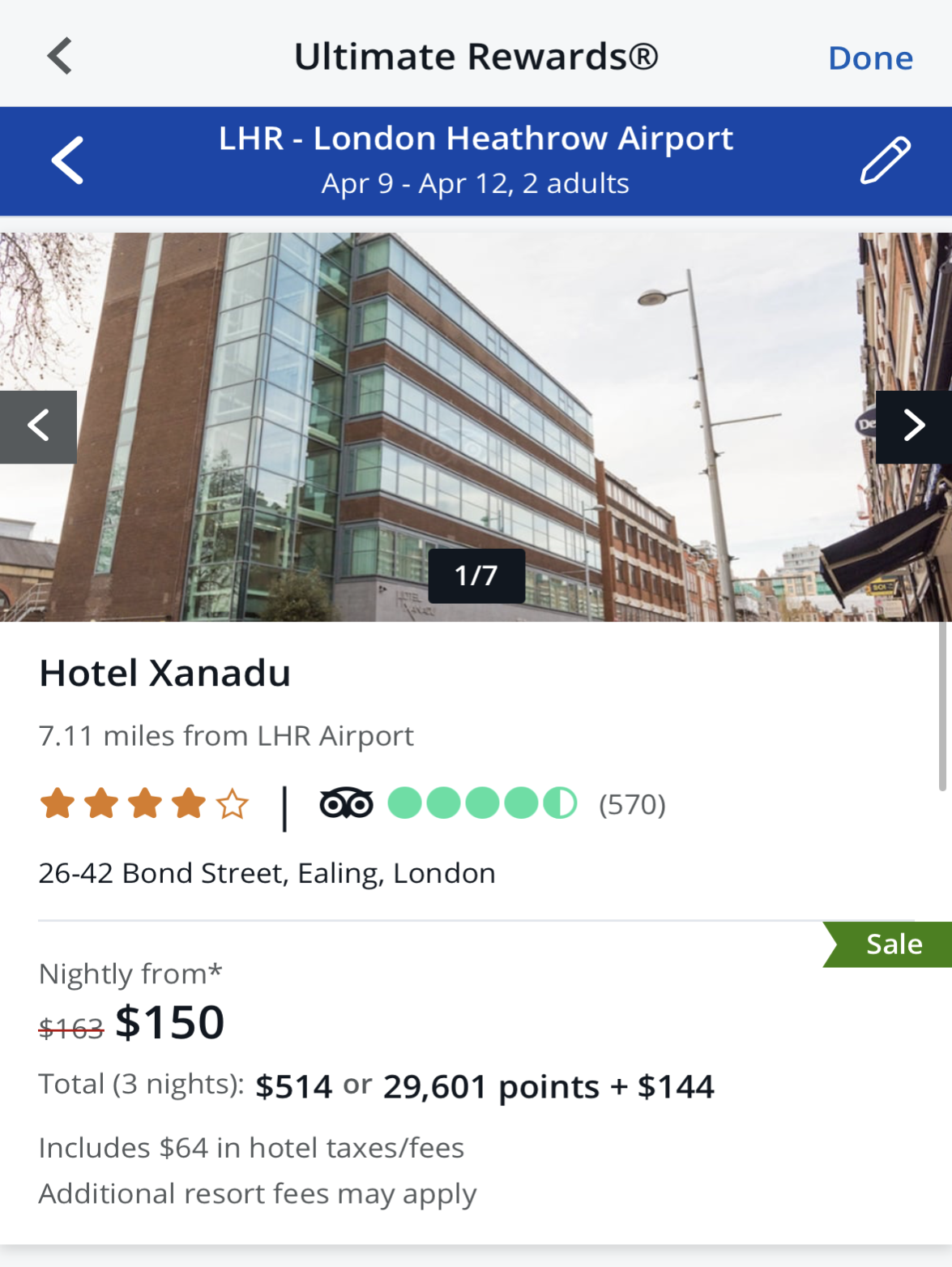

The Chase Sapphire Reserve offers a broad range of benefits, including a $300 annual travel credit, Priority Pass airport lounge access, and a Global Entry/TSA PreCheck fee credit. Its flexible points system allows users to redeem points for travel through the Chase Ultimate Rewards portal or transfer them to various airline and hotel partners.

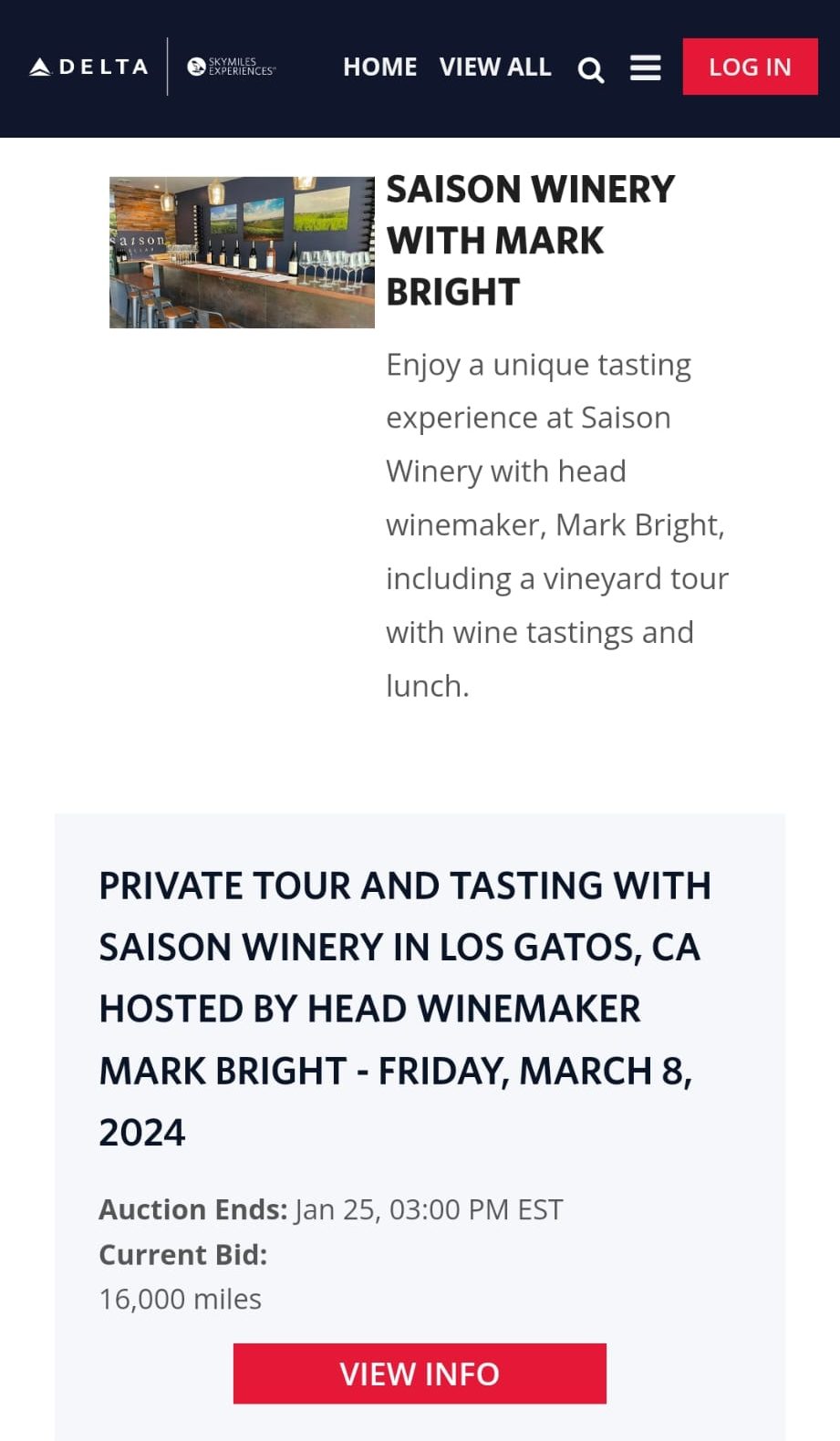

On the other hand, the Delta SkyMiles Platinum is tailored for frequent Delta Airlines travelers. It comes with perks such as a free checked bag, Delta stays credit, rishare and Resy statement credits, priority boarding, and discounted access to Delta Sky Club lounges

Here's a side by side comparison of the cards main features:

Delta SkyMiles Platinum | Chase Sapphire Reserve | |

Annual Fee | $350. See Rates and Fees. | $550 |

Rewards | 3X Miles on Delta purchases and purchases made directly with hotels, 2X Miles at restaurants worldwide including takeout and delivery in the U.S., and at U.S. supermarkets and 1X Miles on all other eligible purchases. | 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. |

Welcome bonus |

50,000 bonus miles after you spend $3,000 in your first six months. | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 20.99%-29.99% Variable

| 22.49%–29.49% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: A Side-by-Side Analysis

When it comes to earning points rewards, Chase Sapphire Reserve is the winner, mainly due to its high points rewards ratio on travel purchases. But, if you plan to use the card for airline and everyday spending only or you have another hotel card, the reward difference is significantly lower.

Spend Per Category | Delta SkyMiles Platinum | Chase Sapphire Reserve |

$15,000 – U.S Supermarkets | 30,000 miles | 15,000 points |

$5,000 – Restaurants | 10,000 miles | 15,000 points |

$6,000 – Hotels | 18,000 miles | 60,000 points |

$8,000 – Airline

| 24,000 miles | 40,000 points |

$4,000 – Gas | 4,000 miles | 4,000 points |

Total Points | 86,000 miles | 134,000 points |

Estimated Redemption Value | 1 mile = ~1.3 cents

| 1 point ~ 1 – 1.5 cents |

Estimated Annual Value | $1,118 | $1,340 – $2,010 |

Travel And Airline Benefits: Comparison

While both the Delta Platinum card and the Chase Sapphire Reserve, the Reserve card is the clear winner when it comes to extra perks. It offers perks such as annual travel credit, complimentary lounge access and 50% more when redeeming points for travel.

On the flip side, the perks associated with the Delta card are focused specifically on Delta-related privileges, encompassing an annual companion certificate, a complimentary first checked bag, statement credits and a 20% rebate on inflight purchases.

Delta SkyMiles Platinum

- Annual Companion Certificate: You’ll receive a round-trip companion certificate for Main Cabin domestic, Caribbean, or Central American roundtrip flights each year after renewal of your card.

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

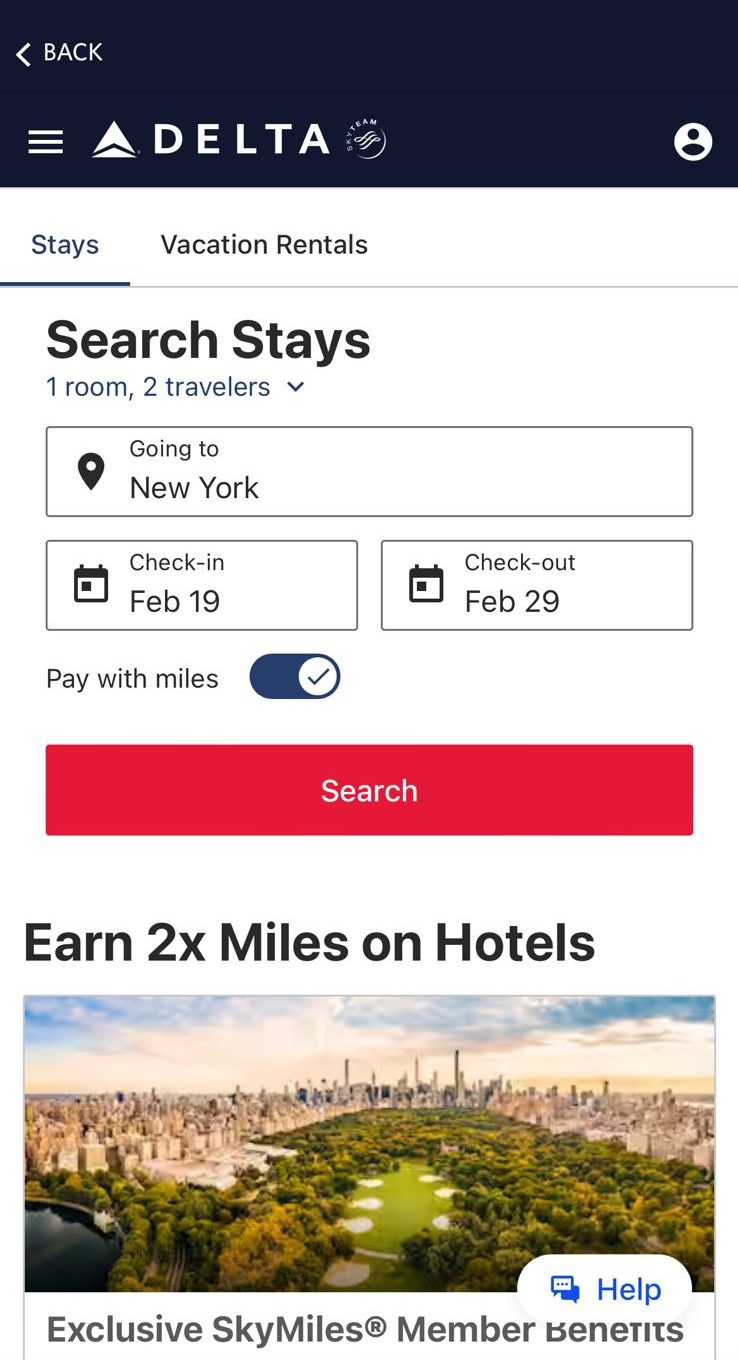

- $150 Delta Stays Credit: Receive a $150 Delta Stays Credit annually on eligible prepaid Delta Stays bookings on delta.com.

- Hertz Five Star® Status: Enroll in the Hertz Gold Plus Rewards program and enjoy Hertz Five Star Status.

- $120 Resy Credit: Enjoy a $120 Resy Credit, earning up to $10 in monthly statement credits on eligible Resy purchases.

- $120 Rideshare Credit: Get a $120 Rideshare Credit, with up to $10 back in statement credits each month on U.S. rideshare purchases with select providers when you use your Delta SkyMiles Platinum American Express Card. nrollment Required.

- Complimentary Upgrade list: Even if you're not a Medallion Member, you'll be added to the Complimentary Upgrade list after Delta SkyMiles Medallion Members and Reserve Card Members if you have an eligible ticket.

- Up to $100 Fee Credit for Global Entry or TSA PreCheck®: Get reimbursed for the application fee for Global Entry or TSA PreCheck every 4 years.

- 20% Back on In–flight Purchases: Receive a 20% statement credit on eligible Delta in-flight purchases of food and beverages.

- MQD Boost: Receive $2,500 Medallion® Qualification Dollars each Medallion Qualification Year and get closer to Status with MQD Headstart.

- MQD on Purchases: Earn $1 Medallion® Qualification Dollar for each $20 of purchases made on your Delta SkyMiles® Platinum American Express Card in a calendar year and get a boost toward achieving elevated Medallion Status for next Medallion Year.

- ShopRunner: Enjoy free 2-day shipping at 100+ online stores when you enroll in complimentary ShopRunner membership with your Delta Platinum card.

Terms apply to American Express benefits and offers.

Chase Sapphire Reserve

- $300 Annual Travel Credit: Receive up to $300 in statement credit each year for various travel purchases.

- 50% More Value for Travel Redemption: Redeem points for travel and get 50% more value, e.g., 60,000 points are worth $900.

- Complimentary Airport Lounge Access: Enjoy free access to over 1,300 airport lounges worldwide for you and up to two guests.

- Global Entry/TSA PreCheck/NEXUS Fee Credit: Receive up to $100 in statement credit every four years for application fees.

- 24/7 Customer Service: Access dedicated customer service specialists around the clock.

- Lyft Pink Membership: Get 2 complimentary years of Lyft Pink All Access, including discounts and rewards.

- DoorDash DashPass Subscription: Enjoy a year of $0 delivery fees and lower service fees on eligible orders.

- Monthly DoorDash Credit: Receive $5 in DoorDash credits each month through Dec 31, 2024.

- Instacart Membership: Get 1 year of complimentary Instacart+ for grocery delivery.

- Monthly Instacart Credit: Instacart+ members earn up to $15 in statement credits each month through July 2024.

- Priority Pass Select Membership: Access 1,300+ VIP airport lounges worldwide.

- Luxury Hotel & Resort Collection: Receive room upgrades, daily breakfast, late checkout, and other benefits at select hotels and resorts.

- 10x on Peloton Purchases: Earn 10x total points on Peloton equipment and accessories over $150 through March 31, 2025.

Insurance Benefits: Chase Reserve vs. Delta Platinum

Both cards have the following travel insurance perks and protections:

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Travel and Emergency Assistance Services: Benefit from legal and medical referrals or other travel emergency assistance if you encounter a problem away from home, with responsibility for the cost of obtained goods or services.

- Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

However, there are a protection that is available only for the Chase Sapphire Reserve card:

- Trip Cancellation and Interruption Insurance: Buying a round-trip with your s Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

- Travel Accident Insurance: Pay for your air, bus, train, or cruise transportation with your card to be eligible for accidental death or dismemberment coverage.

Emergency Evacuation and Transportation: If you or a family member experience an injury or sickness during a trip far from home requiring emergency evacuation, coverage is provided for medical services and transportation.

Roadside Assistance: Call for a tow, jumpstart, tire change, locksmith, or gas in case of a roadside emergency.

Emergency Medical and Dental Benefit: When 100 miles or more from home on a trip.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Chase Sapphire Reserve?

You might prefer the Chase Sapphire Reserve over the Delta Platinum card in the following situations:

You Want Better Points Rewards Ratio – as we illustrated on our points rewards comparison, the Reserve card offers more points for the same spend, especially if you spend on travel.

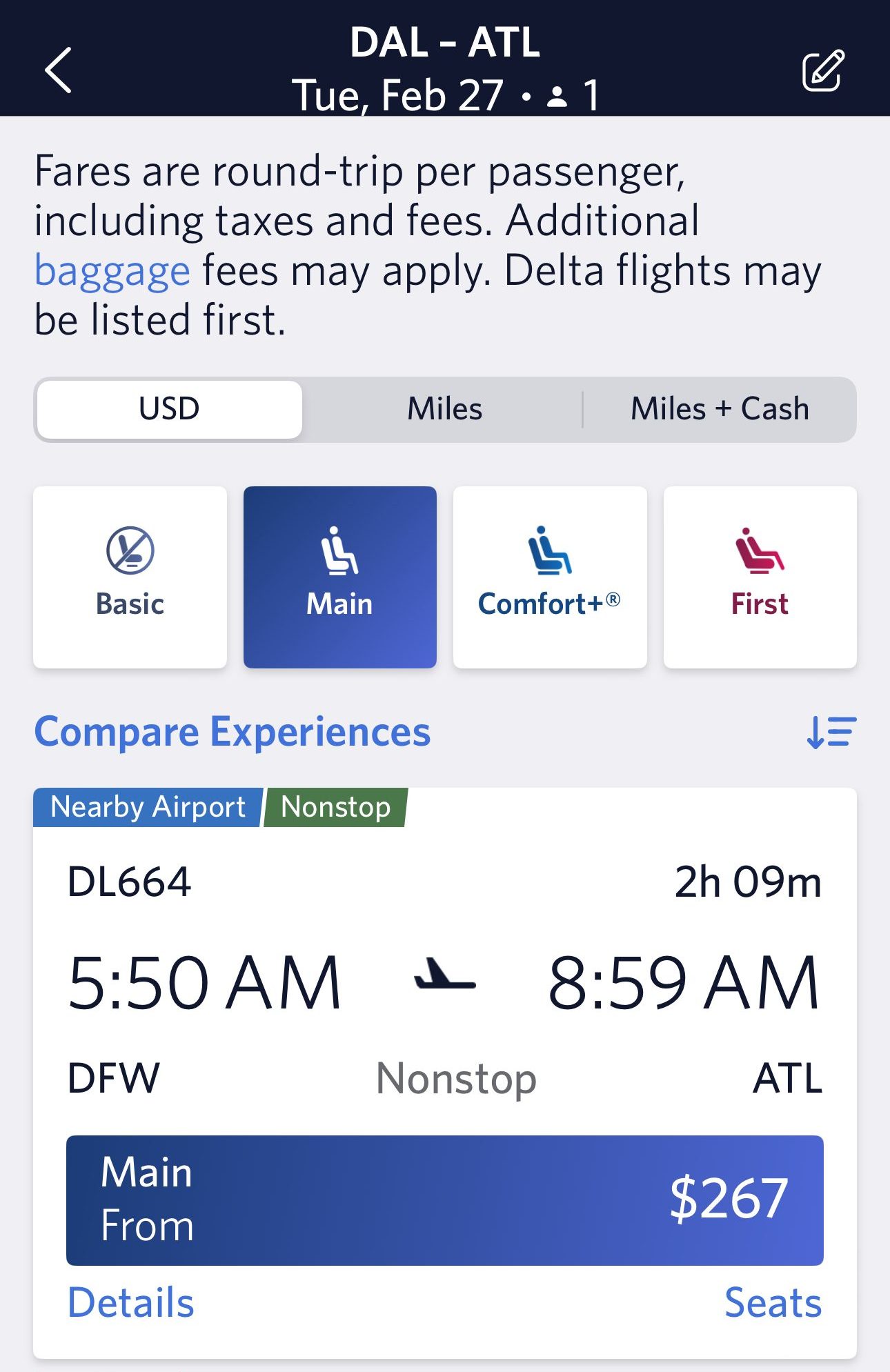

Multiple Redemption Options: Opt for the Chase Sapphire Reserve if you value flexibility in redeeming rewards, as its points system allows you to use points for a wide range of travel expenses, not limited to a specific airline, providing a more versatile and customizable travel experience.

You Value Airport Lounge Access: The Chase Sapphire Reserve provides access to Priority Pass Select airport lounges worldwide, which gives you access to a wider variety of lounges than the Delta SkyMiles Platinum's access to Delta Sky Clubs and Centurion Lounges.

You Want Better Travel Insurance: the Chase Sapphire Reserve offers more protections and broader travel insurance coverage than the Delta Platinum card, so it may be a better fit if you're looking to maximize your insurance.

When You Might Want the Delta Platinum Card?

You might prefer the Delta Platinum card over the Chase Sapphire Reserve in the following situations:

You Fly Delta Frequently: Choose the Delta SkyMiles Platinum if you are a frequent Delta Airlines traveler, as the card offers specific benefits like a free checked bag, priority boarding, and discounted Delta SkyClub access, enhancing your overall experience with the airline.

You Want A Lower Annual Fee: If you're seeking a reduced annual fee, the Delta card offers a more economical option compared to the Reserve card. If your priority is airline travel benefits over general travel perks and you aim to cut down on annual costs, it might be a more suitable choice.

You Want To Leverage Companion Travel: Opt for the Delta SkyMiles Platinum if you often travel with a companion, as the annual companion certificate can provide significant savings, but rememeber that you'll get this perk upon renewal means you should hold the card at least 1 year.

Compare The Alternatives

If you're looking for a travel credit card with airline rewards – there are some good alternatives you may want to consider:

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Chase Sapphire Reserve Card

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Comparison

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Card Is Best?

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Is Better?

The Chase Sapphire Reserve offers more versatile travel rewards and redemption options. But if you need airline perks, the Delta Reserve wins.

Chase Sapphire Reserve vs. Delta SkyMiles Reserve: Comparison

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: How They Compare?

While both cards offer premium travel perks, the Chase Reserve is the winner as it provides better travel perks and more redemption options.

Bank of America Premium Rewards Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Hilton Amex Aspire offers excellent value for hotel perks, while the Chase Reserve card is best for flexibility and redemption options.

Chase Sapphire Reserve vs. Hilton Amex Aspire: Side By Side Comparison

While having higher annual fee, the Chase Sapphire Reserve is a clear winner with much higher total cashback and better premium travel perks.

Both Citi/AAdvantage Executive and Chase Sapphire Reserve offer great cashback value, but the latter is our winner. Here's why:

Citi/AAdvantage Executive World Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Chase Sapphire Reserve card stands out as the superior choice, delivering greater annual cashback value and luxurious travel benefits.

Chase Sapphire Reserve vs. Emirates Skywards Premium World Elite Mastercard: Which Card Is Best?

Despite being a pricier card, the Chase Sapphire Reserve is our top choice because of its generous cashback system and luxury travel perks.

U.S. Bank Altitude Reserve Visa Infinite vs. Chase Sapphire Reserve: How They Compare?

Compare Delta SkyMiles Platinum Card

While the Delta SkyMiles Reserve card has a high annual fee, it offers better airline and travel benefits than the Platinum card.

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Delta SkyMiles Platinum is the winner with higher cashback value and better travel and airline benefits. But, it has higher annual fee.

Southwest Rapid Rewards Priority vs. Delta SkyMiles Platinum: Side By Side Comparison

While having the same annual fee, we think the Delta SkyMiles Platinum is a better choice than the United Quest card. Here's why.

United Quest vs. Delta SkyMiles Platinum: Side By Side Comparison

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.