The U.S. Bank Altitude Reserve Visa Infinite and The Platinum Card® from American Express are both luxury travel credit cards offering premium rewards and benefits for cardholders. Let's compare them side by side:

General Comparison

The Platinum Card® from American Express is a premium credit card offering a plethora of benefits, though it comes with a steep $695 annual fee. Platinum Card® from American Express

Cardholders enjoy extensive airport lounge access, elite status perks, and exclusive travel benefits, making it a favorite among luxury travel enthusiasts. The elevated annual fee, niche perks, and less competitive reward rates may deter some applicants, especially those seeking simplicity in travel rewards rather than high-end experiences.

The Altitude Reserve stands out because it offers great travel benefits. You get free Priority Pass Select membership for airport lounges and a good system for earning points.

The U.S. Bank Altitude Reserve Visa Infinite Card gives you rewards for spending on travel and when you use mobile wallets like Apple Pay or Google Pay. If you regularly use the card, especially with mobile wallets, you can gather a lot of points. Although it has an annual fee of $400, you get a $325 travel credit, making it appealing for frequent travelers who enjoy luxury perks.

But, it's a bit different from other top travel cards because you can't transfer your points to airline or hotel loyalty programs, making it unique in how you can redeem your rewards.

Here's a comparison of the card's main features:

The Amex Platinum Card | U.S. Bank Altitude Reserve | |

Annual Fee | $695. See Rates and Fees. | $400 |

Rewards | 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. | 5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on eligible travel purchases and mobile wallet spending and 1 point per dollar on all other eligible net purchases |

Welcome bonus | 80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. | 50,000 points worth $750 on travel after spending $4,500 in the first 90 days of account opening |

0% Intro APR | None | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | 21.24% – 29.24% APR Variable | 16.24% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Rewards: Which Card Gives More?

Based on our analysis, if you're looking at how many points you get for what you spend, the Amex Platinum card is the better option. It gives you more points for the same amount spent, resulting in a higher estimated yearly value.

However, if you're someone who mainly uses a mobile wallet to make payments, the Altitude Reserve card might be a better fit. It gives you more points for all kinds of spending when you use a mobile wallet. So, the decision between the two cards can change a lot depending on how you usually pay for things.

Spend Per Category | The Platinum Card | U.S. Bank Altitude Reserve |

$10,000 – U.S Supermarkets | 10,000 points | 10,000 points |

$5,000 – Restaurants | 5,000 points | 5,000 points |

$6,000 – Hotels | 30,000 points | 30,000 points |

$8,000 – Airline

| 40,000 points | 24,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 89,000 points | 73,000 miles |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 point = ~1 – 1.5 cent |

Estimated Annual Value | $534 – $1,424 | $730 – 1,095 |

Travel And Airline Benefits: Comparison

If you're looking for extra travel goodies, the Amex Platinum card is the way to go. It gives you all sorts of cool stuff like valuable statement credits, Marriot Bonvoy Gold Elite status, and a bunch of other awesome perks.

The Amex Platinum Card

- Marriott Bonvoy Gold Elite Status: Cardholders are eligible for complimentary enrollment in Marriott Bonvoy Gold Elite status, providing access to a range of exclusive hotel perks and benefits.

- Priority Pass: Platinum Card members receive a complimentary Priority Pass Select membership, granting access to over 1,400 lounges worldwide (excluding Priority Pass restaurant lounges).

- Up to $200 Uber Cash: Enjoy up to $200 in Uber Cash, along with Uber VIP status for top-rated drivers, without the need to meet minimum ride requirements.

- Up to $100 Fee Credit for Global Entry or TSA PreCheck®: The Platinum card offers this reimbursement, one credit for every four years.

- Preferred Seating: Experience preferred seating at sporting and cultural events, subject to availability.

- Up to $100 Experience Credit: Receive a $100 experience credit when booking The Hotel Collection through American Express Travel for stays of at least two nights.

- Extra Cards: Add supplementary cards to your account at no additional cost, allowing others to earn rewards on their purchases.

- Signature Perks at Upscale Hotels: Enjoy exclusive signature perks at upscale hotels within the Amex Hotel Collection when booking through American Express Travel.

- $200 Hotel Credits: Receive up to $200 in hotel credits annually (Fine Hotels + Resorts or The Hotel Collection) when staying for a minimum of two nights through American Express Travel.

- $240 Digital Entertainment Credit: Obtain up to $240 per year (or $20 per month) in statement credits for subscriptions to The New York Times, Peacock, or SiriusXM when using your card for payment.

- $155 Walmart+ Credit: Cardholders can receive up to $155 in Walmart+ credits by utilizing their card for monthly Walmart+ membership payments.

- $200 Airline Fee Credit: Benefit from up to $200 in airline fee credits per year when charging incidental travel fees from selected airlines to your card.

- Dedicated Service Team: Access a 24/7 customer service team for swift issue resolution and assistance.

- Equinox Membership Credit: Receive up to $300 in statement credit for eligible Equinox memberships when enrolling and paying with your card, subject to auto-renewal.

- CLEAR® Plus Membership Credit: Get up to $189 back per year when using your card to pay for a CLEAR® Plus membership.

Terms apply to American Express benefits and offers.

U.S. Bank Altitude Reserve Visa Infinite

Airport Lounge Access: Enjoy complimentary Priority Pass™ Select membership, providing 8 free visits to over 1,300 airport VIP lounges worldwide.

Pay Over Time with U.S. Bank ExtendPay® Plan: New cardmembers can benefit from a $0 fee offer on ExtendPay Plans opened within the first 60 days after account opening.

Visa Infinite® Luxury Hotel Collection: Access an exclusive collection of benefits at some of the world's most prestigious hotels.

TSA PreCheck® or Global Entry®: Receive up to $100 in statement credits to cover your application fee once every four years.

$325 Annual Credit: Get up to $325 in annual credits through reimbursement for eligible travel, dining, takeout, and restaurant delivery purchases.

Visa Infinite perks: Visa Infinite credit cards offer a range of benefits, including purchase protection, extended warranty, and return coverage. In emergencies, cardholders have access to services like roadside assistance, emergency card replacement, and cash disbursement within hours. Travel perks include trip cancellation reimbursement, lost luggage coverage, and auto rental collision damage waiver.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Amex Platinum Card?

You might lean towards the Amex Platinum card because:

Better Points Rewards: Based on our analysis, we can see that the Amex Platinum provides more points for the same spend and has a higher points rewards ratio compared to the U.S. Bank Altitude Reserve card, as long as you don't regularly pay with a mobile wallet.

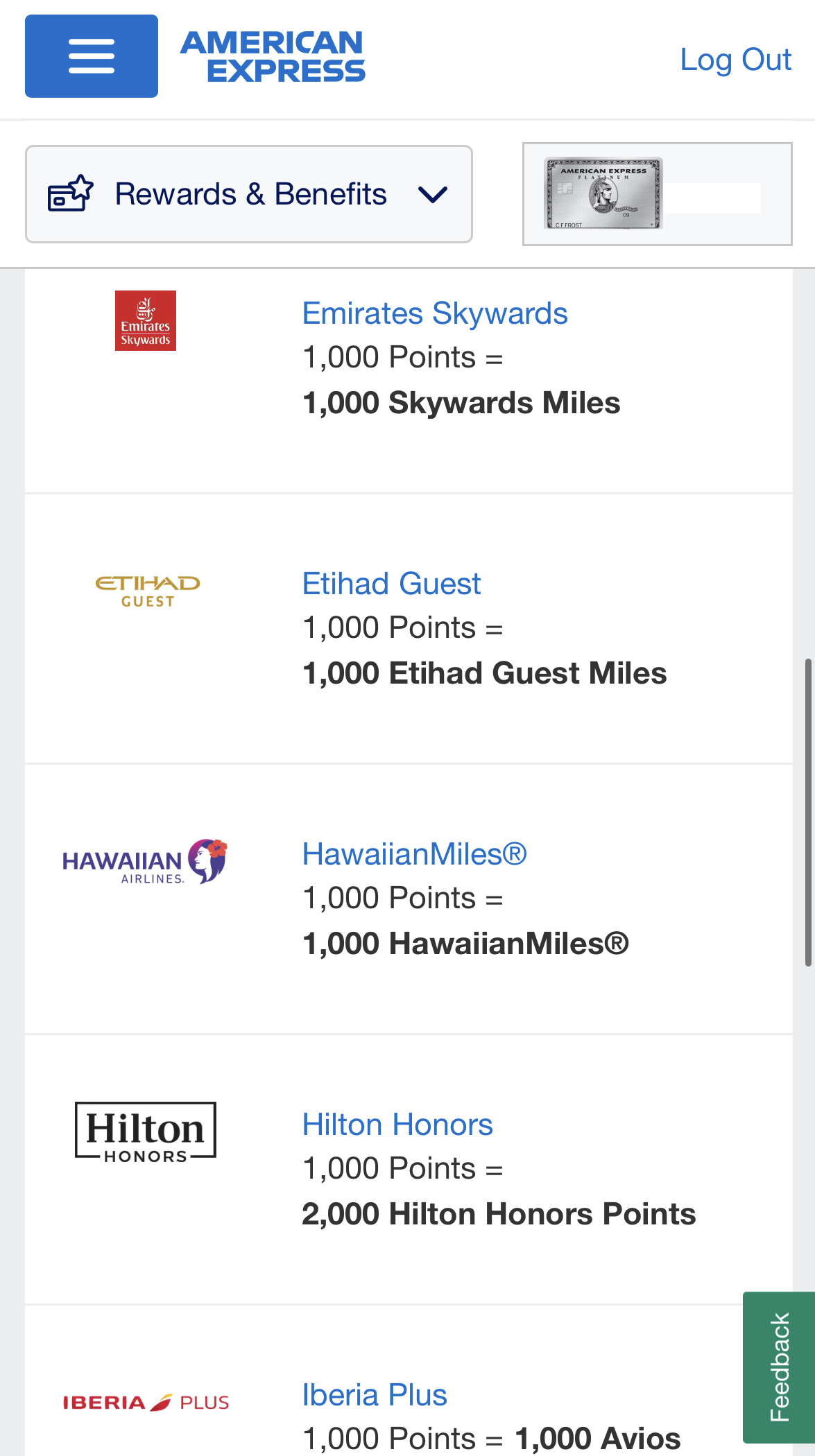

You Want To Transfer Your Points: With the Amex Platinum, you can transfer your points to a range of premium airline and hotel partners, something you can't do with the U.S. Bank Altitude Reserve card.

Better Extra Perks: The Amex Platinum card offers a variety of additional benefits that have a higher value compared to the U.S. Bank Altitude Reserve card. It includes Mrriot Gold Status, various statement credits, and Amex Hotel Coillection Perks.

Diverse Redemption Options: If you prefer having a variety of redemption choices, the Amex Platinum offers more flexibility with its Amex Membership program, letting you use points for various travel expenses and not just tied to specific categories.

When You Might Prefer The U.S. Bank Altitude Reserve?

You might lean towards the U.S. Bank Altitude Reserve Visa Infinite card because:

For Those Who Love Mobile Wallets: If you're the kind of person who enjoys using mobile wallets such as Apple Pay or Google Pay, go for the Altitude Reserve. It gives you more points for these transactions compared to the Amex Platinum.

If You Want to Save on Annual Fees: If you're looking to cut down on expenses, consider the Altitude Reserve. It has a lower annual fee compared to the Amex Platinum, making it a good choice for those who want premium perks without the hefty cost.

Compare The Alternatives

If you're looking for a luxury credit card with travel rewards – there are some good alternatives you may want to consider:

American Express® Gold Card | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $250 | $550 | $395 |

Rewards |

1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

60,000 points

60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | None | $0 | $0

|

Purchase APR | 21.24% – 29.24% Variable

| 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare U.S. Bank Altitude Reserve Visa Infinite

While the U.S. Bank Altitude Reserve offers better travel perks than the Altitude Connect, we don't think it is worth the higher annual fee.

Despite being a pricier card, the Chase Sapphire Reserve is our top choice because of its generous cashback system and luxury travel perks.

U.S. Bank Altitude Reserve Visa Infinite vs. Chase Sapphire Reserve: How They Compare?

While having the similar annual fees, the Capital One Venture X offers more cashback for the same spend and better travel perks.

U.S. Bank Altitude Reserve Visa Infinite vs. Capital One Venture X: How They Compare?

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Luxury Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card

The Amex Platinum card is a clear winner as it offers much higher annual cashback value, luxury travel perks, and various travel protections.

Amex Platinum Card vs. Emirates Skywards Premium World Elite Mastercard: How They Compare?