The Citi/AAdvantage Executive World Elite Mastercard and The Platinum Card® from American Express are both premium travel credit cards that offer a variety of benefits, including airport lounge access, travel credits, and high earning rates.

However, there are some key differences between the two cards that you should consider before deciding which one is right for you.

General Comparison

The Citi/AAdvantage Executive card is geared towards American Airlines enthusiasts, providing exclusive perks for loyal flyers. It offers Admirals Club membership, granting access to airport lounges worldwide, statement credits and priority check-in, boarding, and free checked bags, enhancing the overall flying experience.

On the other hand, the Amex Platinum card is renowned for its versatility, offering a broader spectrum of travel benefits. It provides access to the extensive American Express Global Lounge Collection, various statement credits, and multiple additional benefits.

Here's a comparison of the card's main features:

The Amex Platinum Card | Citi/AAdvantage Executive World Elite | |

Annual Fee | $695. See Rates and Fees. | $525 |

Rewards | 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. | 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

|

Welcome bonus | 80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. | 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 in purchases within the first 3 months of account opening |

0% Intro APR | None | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | 21.24% – 29.24% APR Variable | 21.24% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

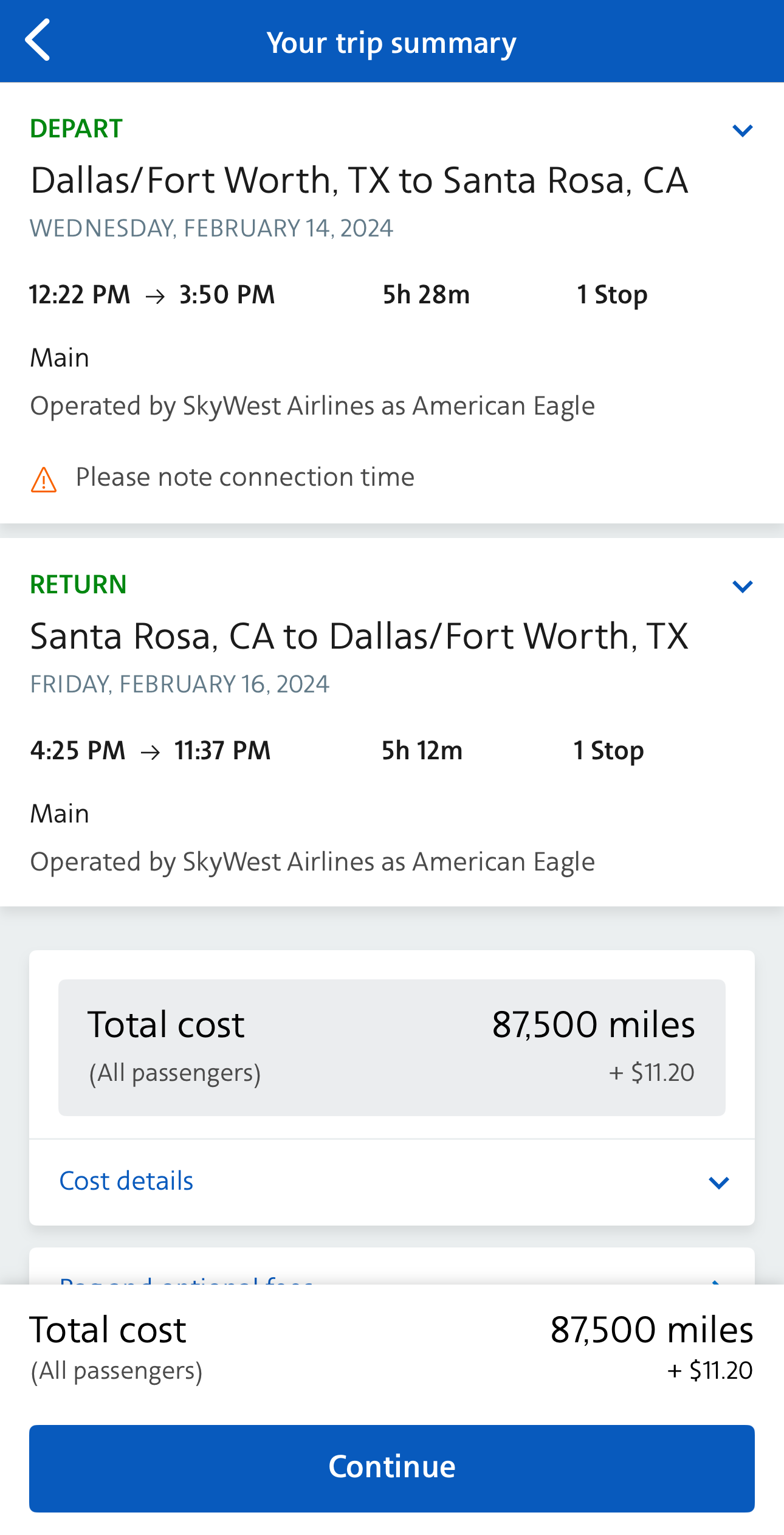

Compare Rewards: Which Card Gives More?

It may be surprising, but when comparing point rewards – the Citi/AAdvantage Executive is the winner on our analysis . However, keep in mind that Amex Platinum redemption options are better compared to the American Airlines.

Spend Per Category | The Platinum Card | Citi/AAdvantage Executive World Elite |

$10,000 – U.S Supermarkets | 10,000 points | 10,000 miles |

$5,000 – Restaurants | 5,000 points | 5,000 miles |

$6,000 – Hotels | 30,000 points | 60,000 miles |

$8,000 – Airline

| 40,000 points | 32,000 miles |

$4,000 – Gas | 4,000 points | 4,000 miles |

Total Points | 89,000 points | 111,000 miles |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 point = ~1.5 cents |

Estimated Annual Value | $534 – $1,424 | $1,665 |

The Citi/AAdvantage Executive World Elite card lets you redeem miles for various travel options like flights, hotel stays, and car rentals. You can also use miles for merchandise, gift cards, or cash back, giving you flexibility.

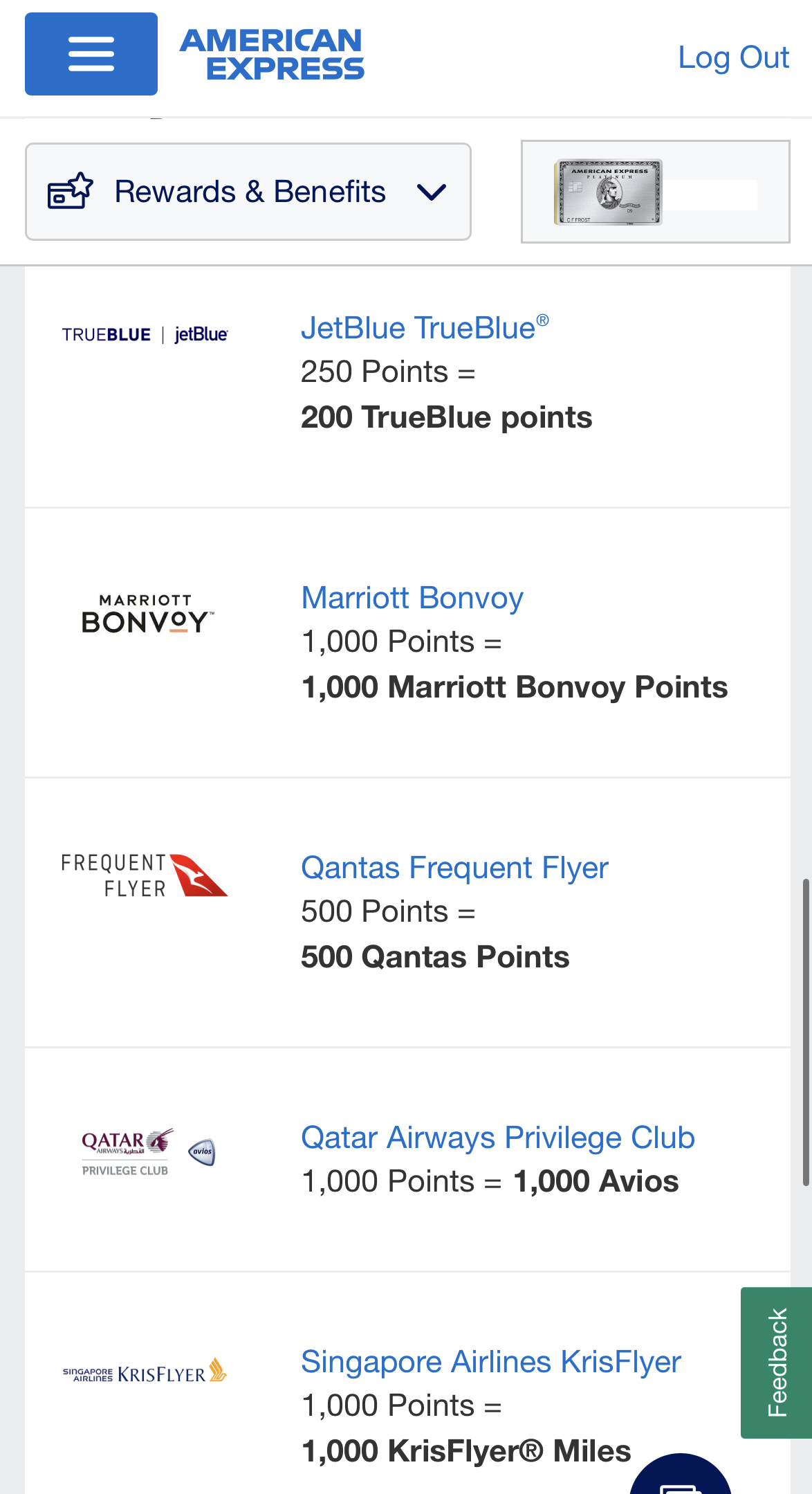

The Amex Platinum card offers diverse redemption options for its points. You can use points to book flights, hotels, and car rentals through Amex Travel, giving flexibility in travel choices.

Alternatively, redeem points for statement credits on eligible purchases or for shopping at popular retailers. The card also allows transfers to various airline and hotel loyalty programs, enhancing travel possibilities.

Travel And Airline Benefits: Comparison

When it comes to extra travel perks and benefits, the Amex Platinum card is the clear winner.

The Citi/AAdvantage Executive offers enticing benefits such as Admiral club membership and statement credits for Lyft, Avis and Grubhub.

However, the Amex platinum card offers higher value statement credits including hotel, airline, Equinox, Uber and Walmart, Marriot Gold Elite status and lounge access.

The Amex Platinum Card

- Marriott Bonvoy Gold Elite Status: Cardholders are eligible for complimentary enrollment in Marriott Bonvoy Gold Elite status, providing access to a range of exclusive hotel perks and benefits.

- Priority Pass: Platinum Card members receive a complimentary Priority Pass Select membership, granting access to over 1,400 lounges worldwide (excluding Priority Pass restaurant lounges).

- Dedicated Service Team: Access a 24/7 customer service team for swift issue resolution and assistance.

- Up to $200 Uber Cash: Enjoy up to $200 in Uber Cash, along with Uber VIP status for top-rated drivers, without the need to meet minimum ride requirements.

- Up to $100 Fee Credit for Global Entry or TSA PreCheck®: The Platinum card offers this reimbursement, one credit for every four years.

- Preferred Seating: Experience preferred seating at sporting and cultural events, subject to availability.

- $100 Experience Credit: Receive a $100 experience credit when booking The Hotel Collection through American Express Travel for stays of at least two nights.

- Extra Cards: Add supplementary cards to your account at no additional cost, allowing others to earn rewards on their purchases.

- Signature Perks at Upscale Hotels: Enjoy exclusive signature perks at upscale hotels within the Amex Hotel Collection when booking through American Express Travel.

- Up to $200 Hotel Credits: Receive up to $200 in hotel credits annually (Fine Hotels + Resorts or The Hotel Collection) when staying for a minimum of two nights through American Express Travel.

- $240 Digital Entertainment Credit: Obtain up to $240 per year (or $20 per month) in statement credits for subscriptions to The New York Times, Peacock, or SiriusXM when using your card for payment.

- $155 Walmart+ Credit: Cardholders can receive up to $155 in Walmart+ credits by utilizing their card for monthly Walmart+ membership payments.

- $200 Airline Fee Credit: Benefit from up to $200 in airline fee credits per year when charging incidental travel fees from selected airlines to your card.

- Equinox Membership Credit: Receive up to $300 in statement credit for eligible Equinox memberships when enrolling and paying with your card, subject to auto-renewal.

- CLEAR® Plus Membership Credit: Get up to $189 back per year when using your card to pay for a CLEAR® Plus membership.

Terms apply to American Express benefits and offers.

Citi/AAdvantage Executive World Elite

- First Checked Bag Free: Enjoy the benefit of a complimentary first checked bag on domestic American Airline itineraries for yourself and up to 8 companions traveling with you on the same reservation.

- Enhanced Airport Experience: Receive priority check-in, screening, and boarding privileges for you and up to eight travel companions on the same reservation, enhancing your overall airport experience.

- Admirals Club® Membership: Gain access to nearly 100 Admirals Club® and partner lounges worldwide, with the flexibility to bring immediate family or up to 2 guests.

- Dedicated Concierge: Access a dedicated concierge service for expert assistance with foreign and domestic travel, shopping, dining, household, and entertainment needs.

- TSA PreCheck® or Global Entry Application Fee Credit: Get a statement credit, up to $100 every 4 years, as reimbursement for your application fee for Global Entry or TSA PreCheck®.

- 25% Savings on Inflight Food and Beverage: Receive a 25% savings on food and beverage purchases when using your card on American Airlines flights.

- Up to $120 in Lyft Credits: Earn a $10 Lyft credit after taking 3 eligible rides in a calendar month, for a total of up to $120 Lyft credits annually.

- Up to $120 Back on Eligible Avis® and Budget Car Rentals: Earn $1 statement credit per $1 spent on eligible Avis® and Budget car rental purchases, up to $120 every calendar year.

- Up to $120 Back on Eligible Grubhub Purchases: Earn a statement credit of up to $10 per monthly billing statement on eligible Grubhub purchases, totaling up to $120 every 12 billing statements.

- Loyalty Points Bonuses: Earn a 10,000 Loyalty Points bonus after reaching 50,000 Loyalty Points in a status qualification year, and an additional 10,000 Loyalty Points bonus after reaching 90,000 Loyalty Points in the same status qualification year.

Travel Insurance And Protections: Comparison

Overall, the Amex Platinum card coverage is better than the Citi Executive card. Here are the common protections for both cards:

$0 Liability On Unauthorized Charges: ensuring you are not held responsible for charges you did not authorize.

Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations

Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

Trip Cancellation and Interruption Insurance: Buying a round-trip with your s Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

However, there is a protection that is available only for the Amex Platinum card:

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Citi/AAdvantage Executive?

You might prefer the Citi/AAdvantage Executive over the Amex Platinum card in the following situations:

Dedicated American Airlines Traveler: If you are a dedicated American Airlines traveler, consistently flying with the airline and valuing benefits like Admirals Club membership, priority boarding, and free checked bags, the Citi/AAdvantage Executive World Elite card may be preferable due to its airline-specific perks tailored to enhance your experience with American Airlines.

- You're Focused on Earning Miles: if your main focus is to earn miles, the AAdvantage Executive card earns more points and higher miles rewards value according to our analysis.

Prefer Lower Annual Fee for Specific Benefits: If you find that the benefits offered by the Citi/AAdvantage Executive World Elite align closely with your travel preferences and needs, and you prefer a card with a lower annual fee, the Citi card might be a more cost-effective option compared to the Amex Platinum, which comes with a higher annual fee and a broader range of perks that may not all be relevant to your travel habits.

When You Might Want the Amex Platinum Card?

You might prefer the Amex Platinum card over the Citi/AAdvantage Executive if:

You Want Better Redemption Options: For individuals who prefer flexibility in redeeming rewards, the Amex Platinum's Membership Rewards program, allowing points transfer to various airline and hotel partners, provides versatility. This flexibility is particularly advantageous if you frequently travel with different airlines or prefer a range of accommodation options.

You Want Better Travel Perks: While the Executive card offers great travel perks – the Amex Platinum card benefits are even better; there are more statement credits with higher value compared to the Executive card, as well as other enticing perks.

You Want Better Travel Insurance: For those seeking comprehensive travel insurance coverage, including trip cancellation and interruption insurance, baggage insurance, and car rental loss and damage insurance, the Amex Platinum's coverage may be more extensive. If these insurance features align with your travel protection needs, the Amex Platinum could be the preferred choice.

You're Versatile Traveler Across Airlines: If your travel involves multiple airlines and you value access to a diverse range of airport lounges, the Amex Platinum is preferable. With its extensive American Express Global Lounge Collection, including Centurion Lounges and Priority Pass, it offers a broader spectrum of lounge options beyond American Airlines.

Compare The Alternatives

If you're looking for a premium travel credit card with airline rewards – there are some good alternatives you may want to consider:

Capital One Venture X | Chase Sapphire Reserve® | Delta SkyMiles® Reserve American Express | |

Annual Fee | $395 | $550 | $650. See Rates and Fees. |

Rewards |

1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases |

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus |

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening |

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 60,000 miles

Earn 60,000 bonus miles after you spend $5,000 in purchases on your new card in your first six months

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 19.99% – 29.99% (Variable) | 22.49%–29.49% variable | 20.99%-29.99% Variable |

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Luxury Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The Amex Platinum card is a clear winner as it offers much higher annual cashback value, luxury travel perks, and various travel protections.

Amex Platinum Card vs. Emirates Skywards Premium World Elite Mastercard: How They Compare?

The Amex Platinum is our winner due to its higher annual cashback value, redemption options, and better luxury perks than the Altitude Reserve.

U.S. Bank Altitude Reserve Visa Infinite vs. Amex Platinum Card: How They Compare?

Compare Citi/AAdvantage Executive World Elite

The Citi/AAdvantage Executive offers better cashback value and perks than the Platinum Select, but usually it doesn't worth the annual fee.

Citi/AAdvantage Executive World Elite vs. Citi/AAdvantage Platinum Select

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two?

Here's our analysis: United Club Infinite vs AAdvantage Executive Elite Mastercard

The AAdvantage Executive is a clear winner when it comes to cashback value. But the Delta SkyMiles Reserve wins at premium airline perks.

Citi/AAdvantage Executive World Elite vs. Delta SkyMiles Reserve: Compare Cards

Both Citi/AAdvantage Executive and Chase Sapphire Reserve offer great cashback value, but the latter is our winner. Here's why.

Citi/AAdvantage Executive World Elite vs. Chase Sapphire Reserve: Compare Cards