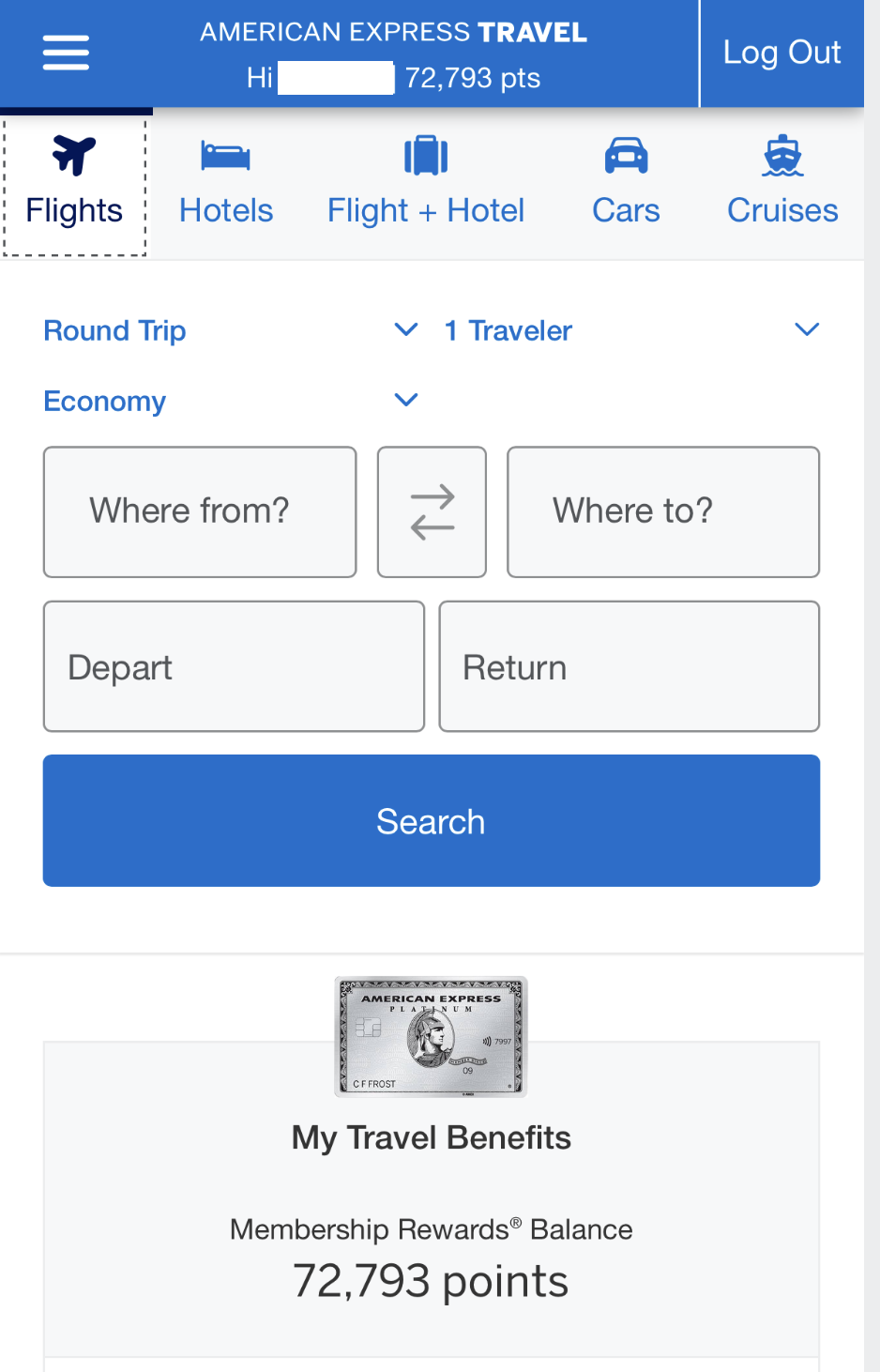

When it comes to premium credit cards, the The Platinum Card® from American Express and the Capital One Venture X are two heavyweights vying for the top spot in the hearts of discerning travelers and card enthusiasts.

In this comprehensive comparison, we'll dive into the key features, benefits, and perks offered by these elite credit cards to help you make an informed choice.

General Comparison: Amex Platinum vs. Venture X

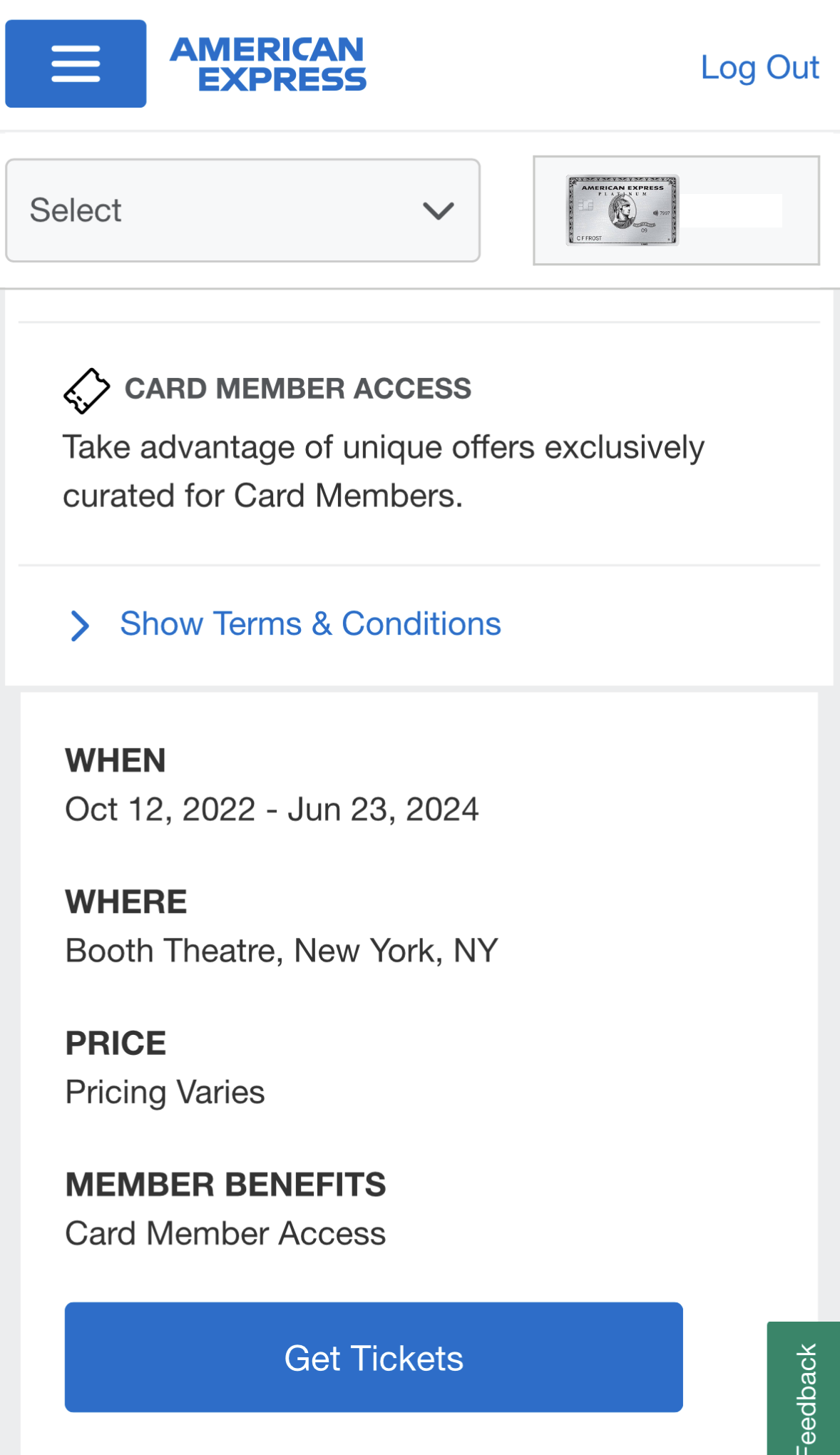

The Amex Platinum Card, offered by American Express, is renowned for its extensive list of travel perks. It provides access to airport lounges worldwide, offers statement credits for travel-related expenses, and includes valuable benefits like travel insurance and concierge services.

Meanwhile, the Capital One Venture X is Capital One's response to the premium card market, aiming to compete with its own set of high-value rewards, travel credits, and perks.

The Amex Platinum Card | Capital One Venture X | |

Annual Fee | $695. See Rates and Fees. | $395 |

Rewards | 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. Terms Apply. | 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases |

Welcome bonus | 80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. | 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening |

0% Intro APR | None | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | 21.24% – 29.24% APR Variable | 19.99% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Rewards: Which Card Gives More?

When it comes to points rewards, the main difference between the cards is the rewards ratio for hotels – Capital One offers a much better rewards rate.

If you spend a lot of money on hotels, you'll probably earn more miles with the Venture X card.

Spend Per Category | The Platinum Card® | Capital One Venture X |

$10,000 – U.S Supermarkets | 10,000 points | 20,000 miles |

$5,000 – Restaurants | 5,000 points | 10,000 miles |

$6,000 – Hotels | 30,000 points | 60,000 miles |

$8,000 – Airline

| 40,000 points | 40,000 miles |

$4,000 – Gas | 4,000 points | 8,000 miles |

Total Points | 89,000 points | 138,000 miles |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 mile ~ 1 cent |

Estimated Annual Value | $534 – $1,424 | $1,380 |

Travel Benefits: Amex Platinum vs. Capital One Venture X

There are some additional types of perks that you will see with both of these cards. Both the Venture X and the Platinum card offers a variety of credit statements, which can be great for different types of customers.

The Amex Platinum Card

- Marriott Bonvoy Gold Elite Status: Cardholders can enroll in complimentary Marriott Bonvoy Gold Elite status, which comes with various hotel perks and benefits.

- $100 Fee Credit for Global Entry or TSA PreCheck®: Get reimbursed for the application fee for Global Entry or TSA PreCheck every 4 years.

- Priority Pass: Platinum Card members receive a complimentary Priority Pass Select membership, granting access to over 1,400 lounges worldwide (excluding Priority Pass restaurant lounges).

- Dedicated Service Team: Access to a 24/7 customer service team for quick issue resolution.

- Uber Cash: Cardholders can receive up to $200 in Uber Cash (or $120 for Gold Card members) and become an Uber VIP for top-rated drivers without meeting minimum ride requirements.

- Preferred Seating: Enjoy preferred seating at sporting and cultural events (subject to availability).

- Up to $100 Experience Credit: Receive a $100 experience credit when reserving The Hotel Collection through American Express Travel for stays of at least two nights.

- Extra Cards: Add additional cards to your account at no extra cost, allowing others to earn rewards on their purchases.

- Signature Perks at Upscale Hotels: Enjoy signature perks at upscale hotels part of the Amex Hotel Collection when booking through American Express Travel.

- Hotel Credits: Receive up to $200 in hotel credits (Fine Hotels + Resorts or The Hotel Collection) annually when staying for a minimum of two nights through American Express Travel.

- Digital Entertainment Credit: Get up to $240 per year (or $20 per month) in statement credits for subscriptions to The New York Times, Peacock, or SiriusXM when paying with your card.

- Walmart+ Credit: Cardholders can receive up to $155 in Walmart+ credits by using their card to pay for their monthly Walmart+ membership.

- Airline Fee Credit: Get up to $200 in airline fee credits per year when charging incidental travel fees from selected airlines to your card.

- Equinox Membership Credit: Receive up to $300 in statement credit for eligible Equinox memberships when enrolling and paying with your card, subject to auto-renewal.

- CLEAR® Plus Membership Credit: Get up to $189 back per year when using your card to pay for a CLEAR® Plus membership.

Terms apply to American Express benefits and offers.

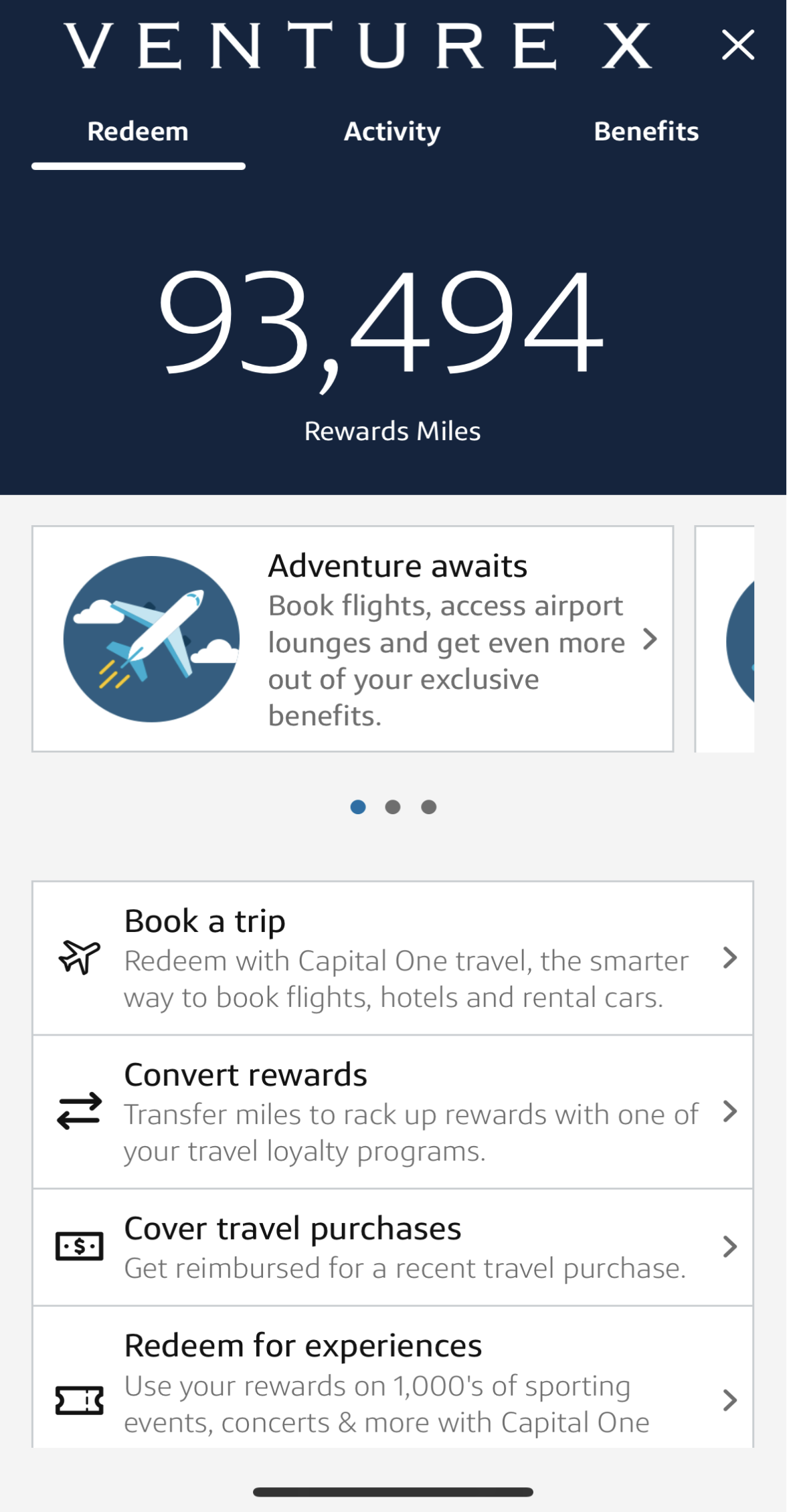

Capital One Venture X

- Premier Collection: With the Capital One Venture X card, you can enjoy a $100 experience credit, daily breakfast for two, and premium benefits, along with earning 10X miles on hotel stays booked through Capital One Travel.

- Complimentary PRIOR Subscription: Cardholders receive a complimentary PRIOR Subscription worth $149, offering access to extraordinary travel experiences and destination guides.

- Capital One Dining and Entertainment: Enjoy exclusive reservations at award-winning restaurants and access to culinary experiences, as well as exclusive pre-sales, tickets, and more for music, sports, and dining events.

- Capital One Lounges: Cardholders can escape airport crowds by accessing all-inclusive Lounges with unlimited complimentary access for themselves and two guests per visit.

- Hertz Gold Plus Rewards President's Circle® status: Venture X cardholders are eligible for complimentary Hertz President’s Circle status, allowing them to skip the rental counter, choose from a wide selection of cars, and receive guaranteed upgrades.

- 10,000 Miles Anniversary Bonus: Cardholders receive 10,000 bonus miles (equal to $100 towards travel) every year, starting on their first anniversary.

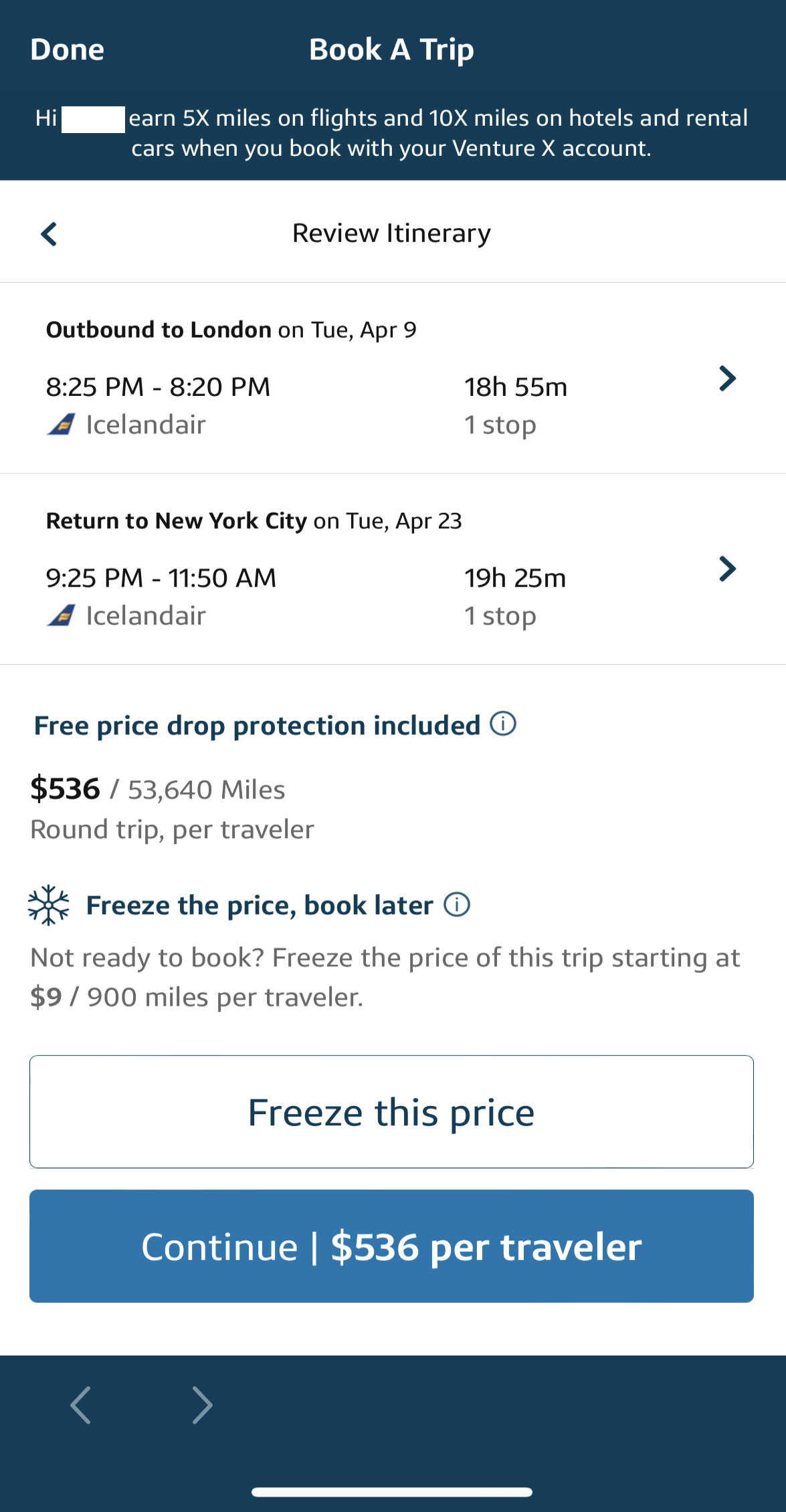

- Annual Travel Credit: Get a $300 annual credit for bookings through Capital One Travel, offering competitive prices on a wide range of travel options.

- Global Entry or TSA PreCheck® Credit: Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Partner Lounge Network: Enjoy unlimited access for yourself and two guests to over 1,300 lounges worldwide from Priority Pass™ and Plaza Premium Group.

- Lifestyle Collection: Unlock premium benefits with every hotel stay, including a $50 experience credit, room upgrades when available, and earning 10X miles on hotel stays booked through Capital One Travel.

- Miles Redemption: Use your Venture X miles to cover various travel expenses, such as flights, hotels, rental cars, and transfer miles to a choice of 15+ travel loyalty programs.

- Referrals Bonus: Refer friends and family to apply for a Venture X card and earn up to 100,000 bonus miles when they're approved.

- Free Additional Cardholders: Add cardholders to your account for free, allowing them to enjoy benefits while you earn rewards on their spending.

- Visa Infinite concierge: A Visa Infinite concierge will help make the reservation and more, like line up live stage shows, music or sporting event tickets.

Insurance Benefits

Both cards offer similar insurance and protections, but the Platinum card's protections are broader than you can with the Venture X card.

Unlike the Platinum card, which publicly discloses coverage amounts to provide customers with a clear understanding of their protections, the Venture X card does not follow the same practice.

Top Offers

Top Offers From Our Partners

Top Offers

The Amex Platinum Card

- Fraud Protection: You're protected from fraudulent charges, and if you spot any suspicious transactions, simply contact Amex.

- Baggage Insurance: When you use your card to purchase your fare, you'll have baggage insurance covering up to $500 for checked baggage and $1,250 for carry-on if they're lost, stolen, or damaged.

- Cell Phone Protection: Get reimbursed for cell phone repair or replacement (including cracked screens) up to $800 per claim, with a maximum of 2 approved claims per 12-month period, provided your cell phone line is on a wireless bill paid by your Eligible Card Account, subject to a $50 deductible.

- Return Protection: You can return eligible purchases to Amex if the seller won't accept them, within 90 days from the date of purchase, for a refund of up to $300 per item, with a maximum of $1,000 per calendar year per Card account, when purchased entirely with your eligible Amex Card.

- Purchase Protection: Covered Purchases made with your Eligible Card are protected for up to 90 days from the purchase date.

- Extended Warranty: For Covered Purchases, your Eligible Card extends the original manufacturer's warranty by up to one additional year, applicable to warranties of 5 years or less, up to $10,000 per item and $50,000 per calendar year.

- Car Rental Loss and Damage Insurance: When you use your Eligible Card to reserve and pay for the entire rental, and decline the rental company's CDW, you're covered for Damage to or Theft of a Rental Vehicle in a Covered Territory, with some exclusions and restrictions.

- Trip Delay Insurance: If your round-trip is paid for entirely with your Eligible Card and a covered reason delays your trip more than 6 hours, Trip Delay Insurance can reimburse certain additional expenses, up to $500 per trip, with a maximum of 2 claims per Eligible Card per 12 consecutive months.

- Trip Cancellation and Interruption Insurance: When you purchase a round-trip with your Eligible Card and a covered reason cancels or interrupts your trip, you can reimburse non-refundable expenses, up to $10,000 per trip and up to $20,000 per Eligible Card per 12 consecutive months, subject to terms and conditions.

Terms apply to American Express benefits and offers.

Capital One Venture X

Extended Warranty Protection: Eligible items purchased with your Venture X card can receive additional warranty protection at no charge.

Cell Phone Protection: Pay your cell phone bill with your Venture X card to get reimbursed up to $800 if your phone is stolen or damaged (certain terms and conditions apply).

Return Protection: Enjoy 90 days of Return Protection for qualifying purchases made with your Venture X card.

Travel Accident Insurance: Automatic insurance coverage for covered losses at no extra charge when you use your Venture X card to purchase your travel fare.

Auto Rental Collision Damage Waiver: Rent an eligible vehicle with your card and you could be covered for damage due to collision or theft.

- Cancel Worry-Free: The Venture X card offers trip cancellation and interruption coverage, allowing cardholders to change their travel dates as needed for qualifying events, providing peace of mind when plans change unexpectedly.

Main Drawbacks: Comparison

American Express Platinum Card

- Annual Fee

The Amex Platinum card comes with a significantly higher annual fee compared to the Capital One Venture X card. Cardholders should carefully consider whether the added benefits justify the cost.

- Limited Rental Car Benefits

While the Amex Platinum card offers car rental privileges through Hertz, the Capital One Venture X card provides complimentary Hertz President's Circle status, offering additional perks.

Capital One Venture X

- Limited Membership Rewards

The Amex Platinum card earns Membership Rewards points, which can be more versatile and valuable for travelers who can maximize point transfers to various airline, hotel partners and other experiences.

- Less Statement Credits

Unlike the Amex Platinum card, the Capital One Venture X card does not provide a statement credit for CLEAR® membership fees, Equinox or Walmart+.

When You Might Want the Amex Platinum?

You might prefer the Amex Platinum card over the Capital One Venture X card in the following situations:

- You Want Comprehensive Travel Benefits: The Amex Platinum card provides extensive travel credits, including airline fee credits, hotel credits, and more. If you can maximize these credits, they can offset the card's annual fee and provide significant value.

- You Prefer Transferable Points: The Amex Platinum card earns Membership Rewards points, which are transferable to more diverse airline and hotel loyalty programs. If you enjoy leveraging these transfer options for maximizing rewards and travel value, the Amex Platinum card is more suitable.

- You Seek Hotel Elite Status: The Amex Platinum card offers Marriott Bonvoy Gold Elite status, which can be beneficial if you frequently stay at Marriott properties. The Venture X card does not offer hotel elite status.

- You Enjoy Exclusive Events: The Amex Platinum card often provides access to exclusive events, presales, and offers in various categories, including dining, entertainment, and sports.

- Entertainment and Digital Credits: If you spend on digital entertainment services like The New York Times, Peacock, or SiriusXM, and you want to offset these expenses with statement credits, the Platinum card offers up to $240 per year in this category.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Capital One Venture X?

You might prefer the Capital One Venture X card over the Amex Platinum card in the following scenarios:

- You Want Lower Annual Fee: If you're looking for premium travel benefits but have a lower tolerance for annual fees, the Venture X card's lower annual fee could be more appealing. It provides several travel perks without the higher costs associated with the Amex Platinum card.

- You Want Simplicity and Flexibility: If you prefer a simple rewards structure with miles with a fixed redemption value, the Capital One Venture X card offers straightforward earning and redemption options. You don't have to navigate complex point transfer programs.

- You Are A Fan Of Dining and Entertainment: The Venture X card offers a range of dining and entertainment benefits, including exclusive restaurant reservations and culinary experiences, which may be more appealing if you dine out frequently or enjoy entertainment events.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

Marriott Bonvoy Brilliant® American Express® Card

| Chase Sapphire Reserve® | Delta SkyMiles® Reserve American Express | |

Annual Fee | $650. See Rates & Fees | $550 | $650. See Rates & Fees |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus | 95,000 points

95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 60,000 miles

Earn 60,000 bonus miles after you spend $5,000 in purchases on your new card in your first six months

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 20.99% – 29.99% Variable

| 22.49%–29.49% variable | 20.99%-29.99% Variable |

Compare Capital One Venture X Card

The Venture X card outshines the Venture card with superior rewards and premium travel perks. Is It worth the annual fee difference?

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Which Card Is Best?

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Which Card Is Best?

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : How They Compare?

While having the similar annual fees, the Capital One Venture X offers more cashback for the same spend and better travel perks

U.S. Bank Altitude Reserve Visa Infinite vs. Capital One Venture X: How They Compare?

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Luxury Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card

The Amex Platinum card is a clear winner as it offers much higher annual cashback value, luxury travel perks, and various travel protections.

Amex Platinum Card vs. Emirates Skywards Premium World Elite Mastercard: How They Compare?

The Amex Platinum is our winner due to its higher annual cashback value, redemption options, and better luxury perks than the Altitude Reserve.

U.S. Bank Altitude Reserve Visa Infinite vs. Amex Platinum Card: How They Compare?

Related Posts

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.