Table of Content

Key Takeaways

- A credit card balance transfer allows you to consolidate all of your credit card debt into one card. This is typically done with credit cards that have a 0% introductory interest rate for a certain period.

- Balance transfer usually involves paying fees, ranging from 3% to 5%. This can add up to a considerable amount if you are dealing with a large card balance.

- The main alternative to a credit card balance transfer is getting a personal loan, but you can also borrow money from your retirement, life insurance or home equity.

What Is A Balance Transfer?

A credit card balance transfer lets you consolidate your existing credit card debts into one and involves the transfer of debt from one account to another.

If done wisely, consumers paying off high-interest debt can save a lot on interest payments. Debt transferred to a credit card with a 0% introductory APR on balance transfers, for example, might be paid off interest-free.

However, there are some expenses and restrictions associated with balance transfers. In most cases, you'll have to pay a balance transfer fee ranging from 3% to 5% of the total transferred. In addition, you might not be able to transfer your entire balance if your balance transfer card's limit is low.

Before you decide to do it or not, find out all you can about it. Know how it works, the pros & cons of transferring a balance, how much it would cost you, and if at all, what effects it will have on your credit rating. Read on as we discuss these issues.

How Balance Transfer Can Save Interest?

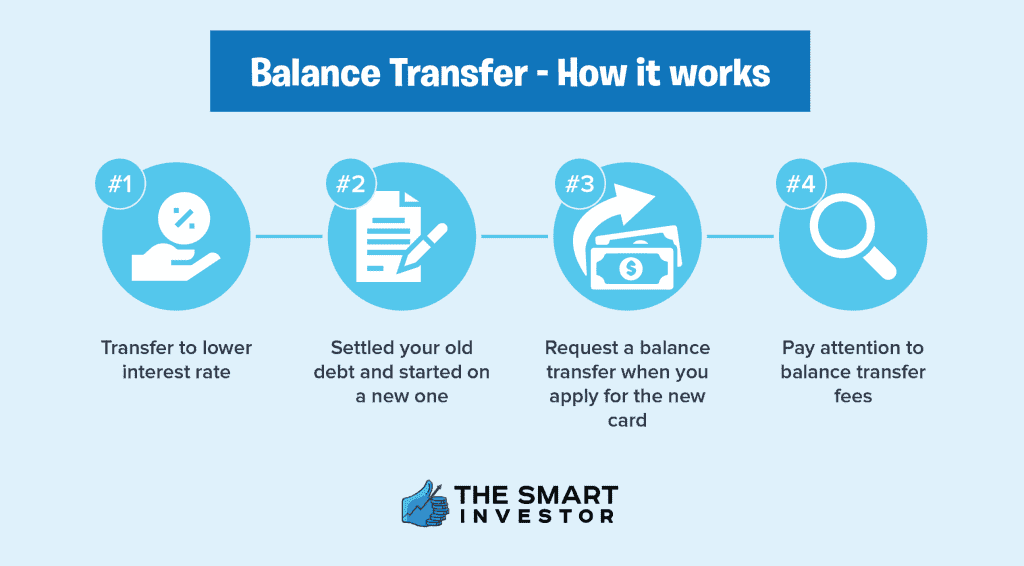

The principle behind balance transfer is very basic. Transfer your existing high-interest card balances to a new card with a lower interest rate. This way, you technically lesser the rate you are supposed to pay.

Effectively, this means that your new card has paid off the balance of your old card or old loan. You have settled your old debt and started a new one on your new card. You then can begin paying off the balance of the new card. You would find this supposedly easier to do because of the significantly lowered interest rate.

How To Transfer Credit Card Balance - Example

As an illustration, let's take a look at this scenario. Assuming you have a credit card balance of $20,000 with an interest rate of 15% annually. Using the simplest premise, you would probably pay $476 per month to pay it off in 5 years.

It could be more because some credit card companies compute the minimum required payment differently. If you double your monthly payment, it would take you a little bit over 2 years to wipe off the debt. In any case, your interest charges would run up to more than $3,400 in total.

Amount | Rate | Term | Monthly Payment |

|---|---|---|---|

$20,000 | 15% | 60 months | $475 |

$20,000 | 15% | 24 months | $969 |

If you transfer that balance to a card that offers 0% interest for 15 months, the figures will go down. (We'll tell you more about the zero percent offer in a moment.)

Suppose you can continue to pay twice the minimum amount; you'll pay off the debt in 22 months. The other good thing is you'll only pay about $266 in interest and save close to $2,000!

It is that simple.

How To Transfer Credit Card Balance?

Here are the main important things to consider and the steps to take when applying for a balance transfer:

-

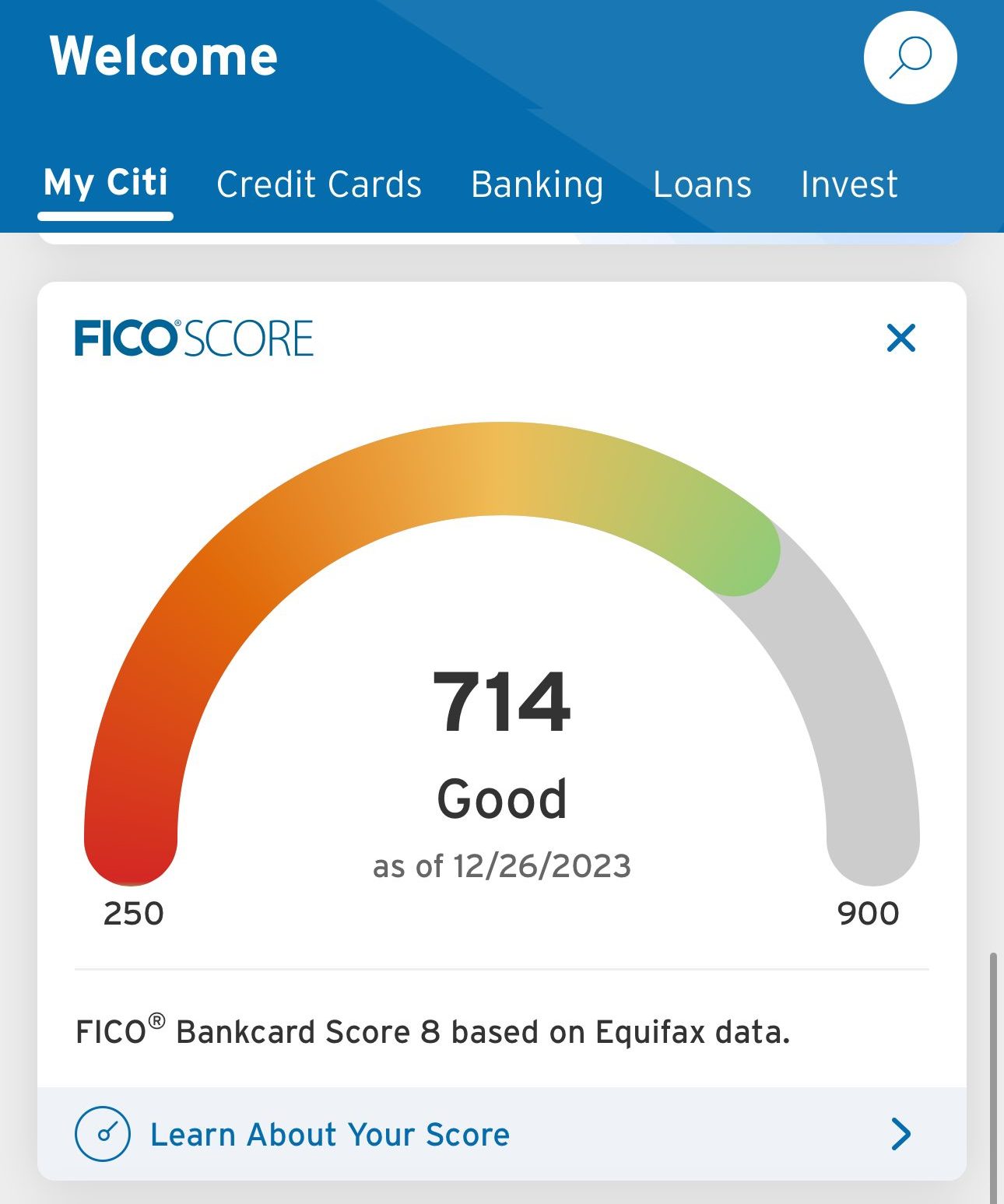

Check Your Credit Score First

Cards with zero percent offer usually require an applicant to have a good credit standing before they approve. See where you stand before making a choice and sending out an application. You can track your score with most of the big banks and credit cards. Here's how it looks like on Citi:

-

Decide How Much You Want to Transfer

You have complete control over the amount you want to transfer. You can transfer all of the balance or transfer only a portion of it. Partial transfers are sometimes more beneficial since you can make use of the 0% intro period.

Determine how much you can afford to pay for the 0% and for the old regular rate. To find out the proper transfer amount, compute the monthly payments you can afford. Then multiply that by the number of months covering the introductory period.

-

Do a Careful Comparison of Credit Card Offers

Credit card companies try to outdo each other with balance transfer offers at any given time. Finding the one that would give you the best financial advantage begins with listing the ones you are eligible for. Then do computations to determine the savings that each one will give.

You have to take into account the card's given interest rate, transfer fee and introductory period, as applicable. Many make the mistake of focusing only on one feature, usually the length of the introductory period. It is prudent to consider the overall impact of all probable costs.

Card | 0% Intro | Balance Transfer Fee |

| Chase Freedom Unlimited® | 15 months on purchases and balance transfers | $5 or 5% |

|---|---|---|---|

| Citi® Double Cash Card | 18 months on balance transfers | $5 or 5% |

| Citi Simplicity® Card | 12 months on purchases and 21 months on balance transfers | $5 or 5% (whichever is greater) |

| Wells Fargo Active Cash | 15 months on purchases and qualifying balance transfers | $5 or 5% (the greater) |

| BankAmericard® credit card | 21 billing cycles on purchases and balance transfers made within the first 60 days | 3% or $10, whichever is greater |

| Capital One SavorOne Rewards | 15 months on purchases and balance transfers | 3% |

-

Make a Sensible Payoff Plan

If you are going to do a balance transfer, you must do it strategically. Designate your new card for a specific purpose and have an exit strategy beforehand. Many sites offer an online credit card payoff calculator that can help you make a payment schedule.

You can find out how much you must pay every month to fully pay the balance within the introductory period. You can also see how much you can save by paying a slightly bigger amount.

-

Manage Your Debt

A balance transfer feature is actually a very good debt management tool. The right card can alleviate interest costs. Ultimately, you can settle your total debt at the lowest available cost. This applies to the different reasons for availing of a balance transfer. You may be preparing to purchase a big-ticket item or planning to pay off a revolving balance or consolidate debt.

From another angle, a balance transfer can also be a way to save money. If your bank’s interest rate is high, you might temporarily transfer funds to cover your card payments. This can be financially beneficial, especially during the card’s introductory period. Just be cautious—this strategy could tempt you to spend more than you intend.

-

Consider 0% Intro Period

The availability of the 0% interest in balance transfer is not a permanent card feature. You should, therefore, keep in mind that you will probably have to pay regular interest when the introductory period is over.

If you are fortunate to be able to do another transfer down the road at zero percent, good for you. Hoping that it will always be available might just lead to disappointment.

You can find out how to transfer on your issuer's website. For example, here's how to start the process on Bank Of America credit card:

-

Keep Healthy Financial Habits

If you use your new card to make purchases and revolve your credit, you will not have a grace period. Unless your card has a 0% feature on all purchases, your purchases will accrue interest. Good financial sense dictates that you should not pay more for anything than what you have to, so be cautious.

Use a different card for your purchases, preferably one that gives you rewards for usage. You may use your balance transfer card only if you have wiped off your transferred amount.

Balance Transfer Fees

After just a few minutes, you may already be thinking that the balance transfer is a good idea. In a lot of cases, it is. Just remember there is another cost involved. They call it the balance transfer fee.

A balance transfer fee is a fee imposed by the card company where you are transferring your balance. They will compute based on the amount of debt transferred to the new card. The common transfer charge, as popularly quoted is: “3% or $5, whichever is greater”.

This means the card company will bill a straight 3% on the total amount you're transferred. Also, they will charge it upfront; that is, immediately after shifting your debt to the new card. Feel free to negotiate the balance transfer fee, but take into account your tools are limited in case your credit score is not high enough.

Balance Transfer Fees - Example

Yes, three percent may not be a big deal by itself but consider its impact to a large balance. For example, for a $10,000 transfer, you'll be paying $300 as a transfer fee. So instead of saving around $1,500, you are down to $1,200. Although this may still seem good, it's not as attractive as initially projected.

Some card companies waive the balance transfer fee over a certain period. Others do not charge any fee at all. You need to look at each card's offer to find which ones do not collect a transfer fee.

Top Offers

How Credit Card Balance Transfer Affect Credit Score

The good news is, a balance transfer itself will not hurt your credit standing. Credit scoring companies do not specifically use them to evaluate your creditworthiness. Card companies do not normally note the transfers on their credit reports.

However, a balance transfer can change your financial profile and may affect your credit score. There are three possible impacts of the transfer.

- 1. Credit Utilization

A balance transfer can modify your credit utilization ratio. The credit utilization ratio is a key element of the ‘Amounts Owed' or your total credit card balances. Credit scoring companies score the credit utilization of your card separately. Then they calculate your total utilization in whole.

If you don't cancel the original card, your overall utilization will go down. On account level, how the new card's utilization level compares against the old card will depend on their credit limits. If the limit is higher, you will have a lower utilization ratio compared to the old one.

This chart created with Experian data shows that those with an average to good credit score have an average credit utilization ratio of the optimum 33%. This ratio drops significantly for those with very good and excellent scores.

At the other end of the scale, the chart shows that those with poor credit scores typically have a very high credit utilization ratio, with an average of 73%. This will be a massive factor in lending decisions for those in this group.

- 2. Overspending Due To Low Interest

If you use a balance transfer to avoid debt payments or support bad spending habits, it will inevitably hurt your score.

In the past, consumers jumped from 0% credit cards to 0% credit cards to avoid accrued interest. The practice was just to delay the unavoidable and prevent interest charges from accruing.

You have to realize that you will have to pay anything you charge to your card, sooner or later. The ‘wise' folks who played the 0% game soon learned the hard way. The zero percent offers dried up during the crunch and card companies forced them to pay up.

Many of them were unable to pay the balances on their cards especially given the weight of steep financing charges. A big number defaulted on their payments and ruined their credit scores.

Balance Transfer Card Vs Personal Loan

For borrowers who are not sure about their ability to pay off their debts within a year or who may only want to pay the minimum repayment via a balance transfer credit card, personal loans may be the best choice.

Personal loans are an excellent way to quickly improve your credit score because, in the eyes of the FICO scoring formula, it is a more favorable form of debt than credit cards.

Transferring the balance to another credit card if often a quick and easy way to repay debts, as the process usually involves filling out a credit card application form and some information about your existing credit card account.

Balance Transfer vs Cash Advance

Credit cards are a convenient tool for spending and earning rewards. But you can also use them for balance transfers or cash advances.

Both cash advances and balance transfers allow credit card customers to access their credit lines for cold hard cash. Although they sound alike, be aware of some key differences between them.

You will assume more credit card debt in the matching cash advance and balance transfer. But one of them is the lesser of two evils.

Bottom Line: Should I Make a Balance Transfer?

If you can pay off a balance in three months or less, or if you don't qualify for a decent 0% APR deal, paying off your debt as soon as possible may be the best and most cost-effective option. A personal loan could be a suitable match if you want a greater limit and don't mind paying interest; you can pre-qualify for one to see how much you could borrow and what interest rate you could get before accepting an offer.

However, if you need months to pay off high-interest debt and have excellent enough credit to qualify for a card with a 0% introductory APR on balance transfers, a balance transfer is the best option. Such a card could save you a lot of money on interest, providing you an advantage when it comes to paying off your debt.

Credit Card Balance Transfer - FAQs

Credit card companies let you transfer balances between cards, but only if the parties involved agree to the transaction.

Therefore, you may indeed transfer the responsibility of your credit card arrears to another person if they are willing to use your account as the source of the balance transfer for the new card or an existing card.

You cannot be sure their card provides identical terms. However, if their credit status is better than yours, they may get better conditions, thereby reducing the burden of transferring debts at the same time.

If you have a high-interest credit card balance, you may want to consider transferring it, but you should think about it carefully before doing so. If you have a solid credit score and are confident that you will qualify for a lower rate card or a card with a promotional rate, you might save a lot of money on interest payments. Transferring to a card that rewards you for transferring a significant sum during the initial period can also be a good choice.

If your credit isn't flawless, however, you might have trouble getting a card with a better rate. You could want to consider a consolidation loan, which may have a cheaper interest rate. However, you must be careful not to choose a lengthier loan period, as this will increase the debt's final cost.

You cannot use your credit card for paying another credit card bill. You can, however, consolidate debt. You can do this by transferring your existing balance to a different credit card. With a balance transfer, you can effectively limit interest charges, but you will likely need to pay transfer fees.

You can also use a prepaid cash advance from a credit card to pay off debt on another card. However, keep in mind that this typically comes with a higher APR, usually around 25% or more. While this method can help consolidate your debt in a pinch, it's always best to pay off the full amount if you can.