Table of Content

If you’ve been buying things from brick-and-mortar or online stores using your credit card, chances are that you’ve experienced cases when you needed to resolve an issue or dispute a transaction with a merchant.

Maybe you’ve tried to return a product (rather unsuccessfully) or did not receive the goods or services that you paid for, or perhaps there are charges on your card that you did not make. All of these cases may warrant a credit card chargeback.

A card chargeback is a remedy to get a refund for an amount in dispute that cardholders can resort to after directly talking with a merchant becomes fruitless.

This is a formal process but most card companies made the system consumer-friendly that there is hardly a need to get the help of a legal professional to do it.

Key Takeaways

- Credit card chargeback essentially represents a reversal of the credit card transaction. Credit card holders have this option in case they tried and failed to return the product, or if they did not receive the goods and services they paid for.

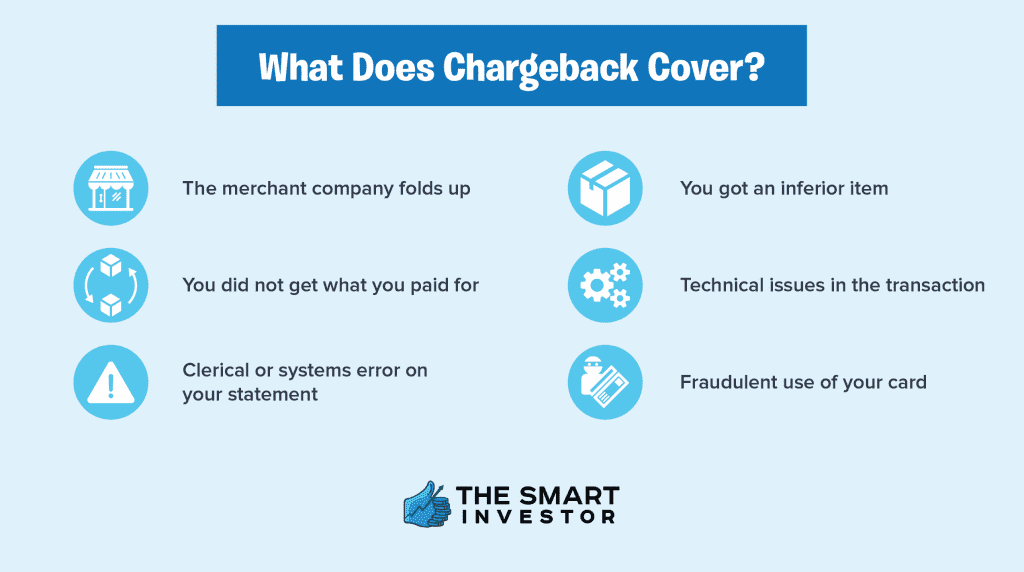

- Chargeback covers several situations such as: if the merchant company closes down and there is a problem with a product, or if a client gets an inferior item or did not get the product at all. This also covers the fraudulent use of credit cards.

- Generally speaking, customers have between 60 to 120 days to file a chargeback claim. After that, the merchant has 45 days to respond, if they wish to dispute this claim.

What Is A Chargeback?

In its most simple definition, it means a reversal of a credit card sales transaction. The Visa card 2016 chargeback management guide describes that a chargeback “provides an issuer a way to return a disputed transaction.”

The system pushes the debt for the item you initially purchased back up the transaction line: from you, then to your card issuer, to the merchant’s bank and finally back to the merchant. All these steps will go through the transaction processor’s network. It will delete the charge from your bill as the cardholder and, through the middleman, ‘charges back’ the amount to the original merchant.

It’s a powerful weapon for the consumer. In a valid chargeback, the cardholder gets his money back while the merchant loses a sale and shoulders the cost of processing the chargeback.

You may also think of this as a financial ‘street justice’ because an unscrupulous merchant that has too many chargebacks will have to pay additional charges from credit card processing companies.

What Does Chargeback Cover?

You can use chargeback for any of the following situations:

- The merchant company folds up. The store or merchant where you purchased your product closed down and there is an issue on your product.

- You got an inferior item. The goods you received were not according to what the seller described or it is downright defective or faulty.

- You did not get what you paid for. The merchant was not able to deliver the goods you purchased or services you paid for as they have promised and they refuse to refund your money.

- Technical issues in the transaction. There was an error in the transaction, or the store affected it even with an expired authorization.

- Clerical or systems error on your statement. The card company has charged you or billed you several times for the same transaction or billed you for a higher/incorrect amount.

- Fraudulent use of your card. Your account might have been a victim of fraud, or there are purchases that you did not make nor authorize.

Can I Ask For Chargeback Due To Bad Service?

Customers can file a credit card chargeback for bad service, but some restrictions determine if it will be awarded.

The customer needs to have made a purchase on their credit card of at least $50 and the transaction must have taken place within their home state or within 100 miles of their current billing address. The exception to this is if the transaction was online.

However, the main restriction for bad service credit card chargebacks is that the customer needs to show they have made a good faith effort in resolving the dispute before they initiate the chargeback.

What's The Timeframe to File a Chargeback Claim?

On the average, you can file for a chargeback claim between 60 and 120 days from the time you made the purchase with your card. After filing, the merchants have about 45 days to respond should they wish to dispute the claim. These are the general rules that the credit card processing company has set but they will differ according to the card you’ve used in the transaction.

Expect Visa, Mastercard, American Express, and Discover to each have their own rules and timelines. If a merchant submits a response, the merchant’s bank will investigate and make a decision. In some cases, arbitration may be required, which can extend the process considerably.

Credit Card Chargeback vs Refund

While they may appear similar, there are some crucial differences between a credit card chargeback and a refund. Although in both cases, the customer gets their money back, as the merchant, you will incur additional fees with a chargeback.

Additionally, chargebacks are monitored by the payment processor. If the chargeback ratio for a merchant exceeds a specific threshold, which is typically 1%, it can have serious consequences including higher fees, larger reserve requirements, fines or even termination of the account.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

How Does The Chargeback Process Goes?

As you already know, the chargeback process can be tedious and long, so take it into account. You may notice that this is not the usual process but we suggest that you try the following steps first:

1. Check the Merchant’s T&C Regarding Returns and Refunds

You might get a representative from the card company who may not be totally familiar with the company’s contracts, policies, or terms and conditions. If you arm yourself with the knowledge about the merchant’s conditions, you can simply cite the specific provisions where you are basing your claim upon.

This would mean reading through the merchant’s contracts, receipts, and other related documentation to see if you are actually entitled to a refund based on your situation. You should mention this fact to the merchant as you present your case.

2. Ask The Merchant For a Refund

The initial step to resolve your billing issue is to first try approaching the merchant directly.

Many customer-oriented companies have policies requiring them to refund a customer’s money if they are unsatisfied with the service or product.

Some of them will even give a refund if you’ve had a negative experience with their company.If it doesn’t work because the merchant is not able or not willing to give a refund, you may be able to get store credits instead. You can use it to purchase other products or services from the store but you don’t have to agree if you don’t want to.

Let’s look at the normal process of a chargeback:

1. The cardholder files a chargeback – The chargeback process begins when a dissatisfied customer files a chargeback request with the card company.

2. The card company will then review the chargeback request – Every chargeback request should have a reason code. The reason code specifies the very reason why a cardholder is disputing a transaction such as “Goods or services not as described.” Every code has its own conditions such as filing time limits, supporting documents, etc. The card issuer will go over the chargeback claim to make sure that it meets all the regulations and requirements.

3. The issuer will take the appropriate action – If the issuer sees that the cardholder’s claim is valid, they will deduct the funds from the merchant’s bank account and credit them to the cardholder’s account. They will then send a notice of the chargeback to the merchant’s bank (acquirer). If the cardholder doesn’t have a legitimate claim, the issuer simply voids the request.

4. The acquirer will review the chargeback and then takes action – The two biggest card networks, namely Mastercard and Visa, have created many chargeback rights. One of them is to give merchants the right to dispute an illegitimate chargeback. If someone makes an inaccurate chargeback claim, the merchant can attempt to regain their profits that the card company unjustly took from them. Also, If the acquirer has possession of compelling evidence to dispute the chargeback, the bank will favor the merchant. If there’s none, the acquirer will pass the chargeback to the merchant.

5. The merchant will review the chargeback and then takes action – If the chargeback request has merit, the merchant might have no recourse but to accept the losses. However, if the merchant has adequate and compelling evidence to show that the chargeback is not valid, the merchant can re-present the chargeback to the issuer for their review.

6. The acquirer will re-present the chargeback – The next step will involve the acquirer to dispute the chargeback on behalf of the merchant. They call this process ‘representment’.

7. The issuer will review the evidence presented and then takes action – If the merchant was able to present compelling evidence to successfully refute the cardholder’s claim, the card company will post the transaction again to the cardholder’s account. They will deposit the corresponding funds back to the merchant’s account. These are the funds that they originally deposited into the merchant’s account and subsequently removed with the chargeback.

However, if the merchant is not able to present a convincing case and fails to refute the cardholder’s claim, the chargeback will remain as it is. They will permanently remove the transaction amount from the merchant’s bank account and reflect it in the consumer’s card statement.

Improper Instances of Chargebacks

Some cardholders resort to chargebacks for a varied range of illegitimate reasons. In such cases, your chargeback won't approve and you'll have to deal with the consequences.

Here are a few:

- Going through the bank seems to be easier and more efficient

Few people would want to go through a Customer Service Department of their merchants. Many people try to file a chargeback because they think it is simpler, quicker and there’s no need to ‘confront’ salespeople.

The truth is, most merchants would want to keep doing business with you for a long time and they will try to do what they can to resolve your complaints quickly to make you a satisfied customer.

- Buyer’s remorse gets the better of you

This happens when a buyer realizes she made an impulsive purchase but does not want to return the item or cancel the service. If you keep the merchandise and also get a refund, technically, that is shoplifting or stealing.

- A family member made the purchase without the cardholder’s knowledge

Even if you are ignorant of the transaction, the person who did the shopping gave his consent to it. Therefore, you can’t call the bank to request a chargeback for the reason that you did not authorize the purchase.

- You’re clueless about the merchant’s refund options and how to go about them

Some cardholders resort to chargebacks because they misunderstand merchant terms and conditions on some offers. Banks would need a valid chargeback request to refund your money.

They can’t order the merchant to cancel your magazine subscription or give you a detailed specification of the product you bought. You should ask the merchant directly if you have questions or want your money back.

- You can’t recall having made the purchase

We can easily forget a particular transaction, especially if we buy a lot of things in a binge and don’t keep records.

So, if you have a doubt about a transaction, you should contact your merchant directly. Most credit card statements will list the phone number or email address of the merchant. It won’t take ten minutes to know everything about a particular transaction.

How to Avoid Credit Card Chargebacks?

While many consider credit card chargebacks as a cost of doing business, there are some ways that you can employ to avoid them. The first is to ensure that you have open communication with your customers. Have a clear returns policy and verbally explain this to your customers.

Make sure to clearly describe your products or services so customers know exactly what to expect when they receive their order. And don't forget about excellent customer service—responding to inquiries quickly gives customers the chance to resolve any issues before they consider filing a chargeback.

Chargeback Codes

Check out the official Visa and Mastercard chargeback codes list for the most common issues. The card companies present these codes and the additional guidelines to the merchant while processing the chargeback claims.

Top Offers

Top Offers

Top Offers From Our Partners

Credit Card Chargebacks FAQs

How long does credit card chargeback take?

When a chargeback claim is filed, the issuing bank will review the claim to determine its validity. This process can take up to six weeks. Visa allows the issuing banks up to 30 days for review and if the claim is valid, it is forwarded to the payment processor who will notify the merchant.

What is a credit card chargeback fee?

If there is a chargeback claim, merchants are charged a chargeback fee by their payment processor. This fee can be $20 to $100, but the more chargebacks you have, the higher the fees. Since the charge is removed from the customer’s credit card, as the merchant, you are also responsible for refunding the money from the purchase.

Is it possible to refuse a chargeback?

For a variety of reasons, a chargeback may be declined. You must produce a compelling statement stating that you did not make the charges and that you need your money returned whenever you file a chargeback. Typically, the fees will be distinct from what you normally spend your money on.

You may also be required to establish that the charges were completed in a state or region to which you did not travel. The bank may reject your chargeback if you don't have enough evidence. Merchants may also show the bank proof that the charge was made by you.

How many chargebacks are you permitted to make?

The number of chargebacks you can make is determined by your bank or credit card issuer. Most organizations, on the other hand, only allow a maximum of 1% of all transactions. This equates to around one chargeback for every 100 successful purchases.

If you wish to increase the number of chargebacks, phone the credit card company or go to an office in person. If you try to get too many chargebacks, they may flag your account as fraud and refuse to work with you in the future.

If you truly need more chargebacks, make sure you have as much documentation as possible to indicate that there was a fraud and that you need to file more disputes.

What happens if a chargeback is unsuccessful?

You will not be able to recover the disputed funds if a chargeback is unsuccessful. They will still appear on your account, and you will be responsible for paying them as part of your credit card bill. You are usually not allowed to submit another dispute for the same charges once one has been denied.

If you believe there has been an error and your dispute has been denied, you should contact the corporation directly or visit an office in person if one exists.