Table Of Content

The Chase Ultimate Rewards program provides points for using compatible credit cards to earn rewards. This program has a great reputation, but it may seem a little overwhelming for the uninitiated.

So, here we’ll delve into Ultimate Rewards in more detail and how you can transfer rewards between accounts.

Which Chase Cards Have Transferable Points?

Although there are approximately 10 Chase cards that offer Ultimate Rewards points, there are only three that specifically earn points that are eligible for point transfers: The Chase Sapphire Reserve,The Chase Sapphire Preferred and the Chase Ink Business Preferred.

The Chase Sapphire Reserve offers up to 10 points for every dollar you spend, with a tiered reward structure weighted towards Chase Dining purchases, and car rentals and hotel stays booked via the Chase platform. This is an ideal card for those who enjoy traveling and eating out, particularly if you’re happy to book your travel purchases via the Chase platform.

The Chase Sapphire Preferred card also has a tiered reward structure weighted towards travel and dining including take out and eligible delivery services, and select streaming services and online grocery purchases. However, the maximum points you can earn is lower than the Sapphire Reserve at five per dollar.

The last Chase card with transferable points is the Ink Business Preferred. This card offers three points per dollar on travel, shipping, advertising with search engines and social media sites and cable, internet and phone services up to an annual spending cap with one point per dollar on all other purchases.

Card | Rewards | Annual Fee | Transferable Points? | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| $95

| Yes |

|---|---|---|---|---|

| 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $0 | No | |

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $0 | No | ||

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| $550 | Yes | ||

Chase Ink Business Preferred® | 1X – 3X

3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year, 1 point per $1 on all other purchases

| $95 | Yes |

Earning Points Through Ultimate Rewards Program

When you use Chase branded reward cards and make purchases, you’ll earn Ultimate Rewards Points. The rate is a minimum of one point per dollar, but many of the cards provide additional reward points when you buy items in specific categories.

For example, you may earn one point per dollar as a base rate, but your card may offer two points for gas station purchases and three points for travel purchases. You may also receive a points bonus if you meet spending requirements within a set period of opening a new card account.

You can accumulate these points and redeem them for cash back, gift cards, travel, Amazon purchases or even “experiences”, which provide access to special events. However, the specific redemption methods and values can vary according to which card you have.

In real terms, you need to do very little to use the Ultimate Rewards program. If you choose the right card that fits with your typical spending habits and patterns, you can simply use the card for your purchases and you will simply accumulate points.

Chase will calculate your points and add them to your account every month. You can log in to your account dashboard at any time to check your points balance, so you can decide if you have sufficient points for your preferred redemption.

How to Transfer Chase Points to Travel Partners?

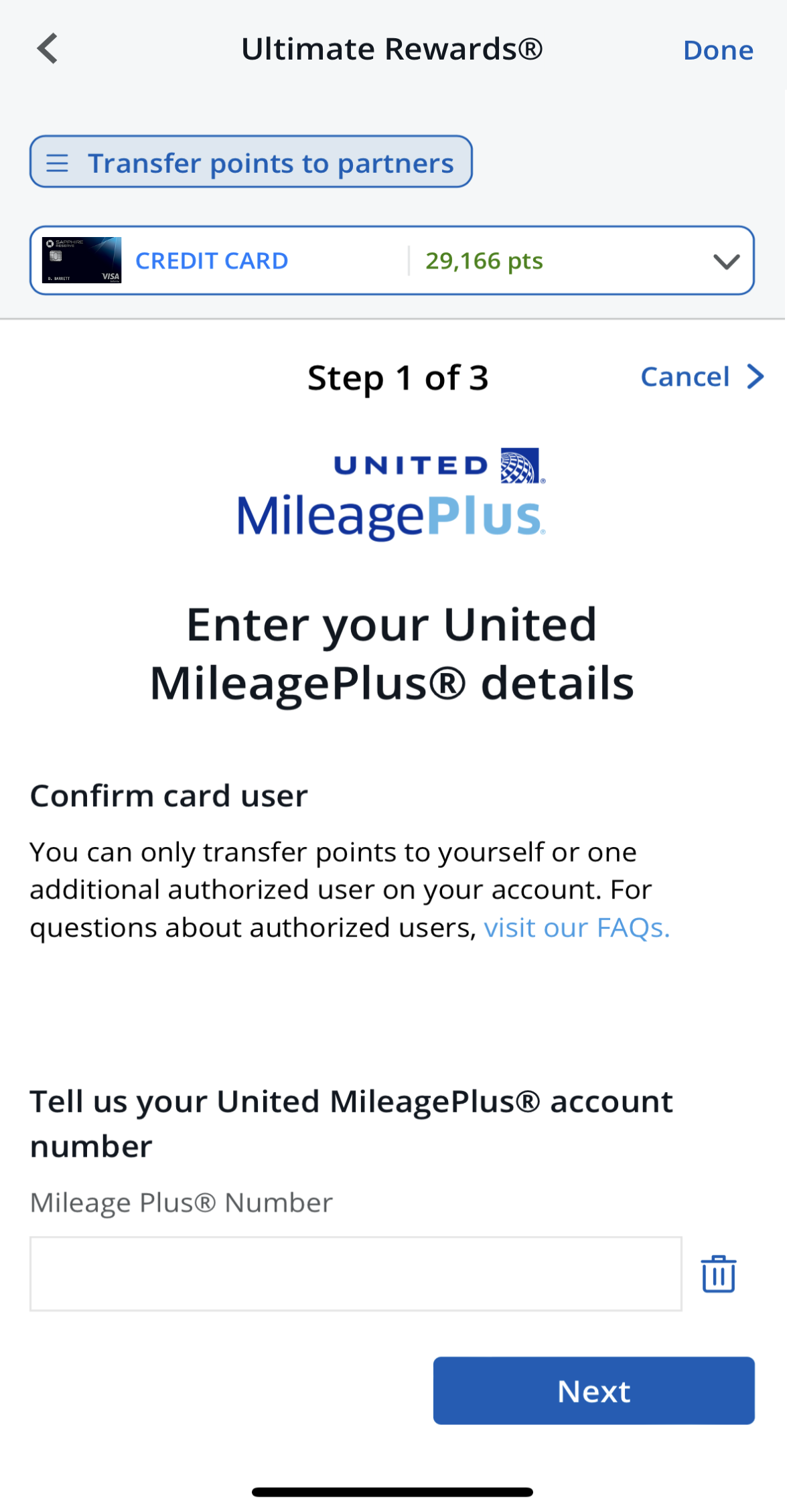

If you’ve decided to transfer some or all of your accumulated Chase points to a Chase travel partner, there are some simple steps to complete the process.

1. Log In: The first thing you’ll need to do is log into the Ultimate Rewards site with your unique credentials.

2. Select the Card: If you have multiple Chase cards, you’ll need to select which one you want to transfer points from.

3. Click Transfer to Travel Partners: You’ll find this option under the Earn/Use drop down menus.

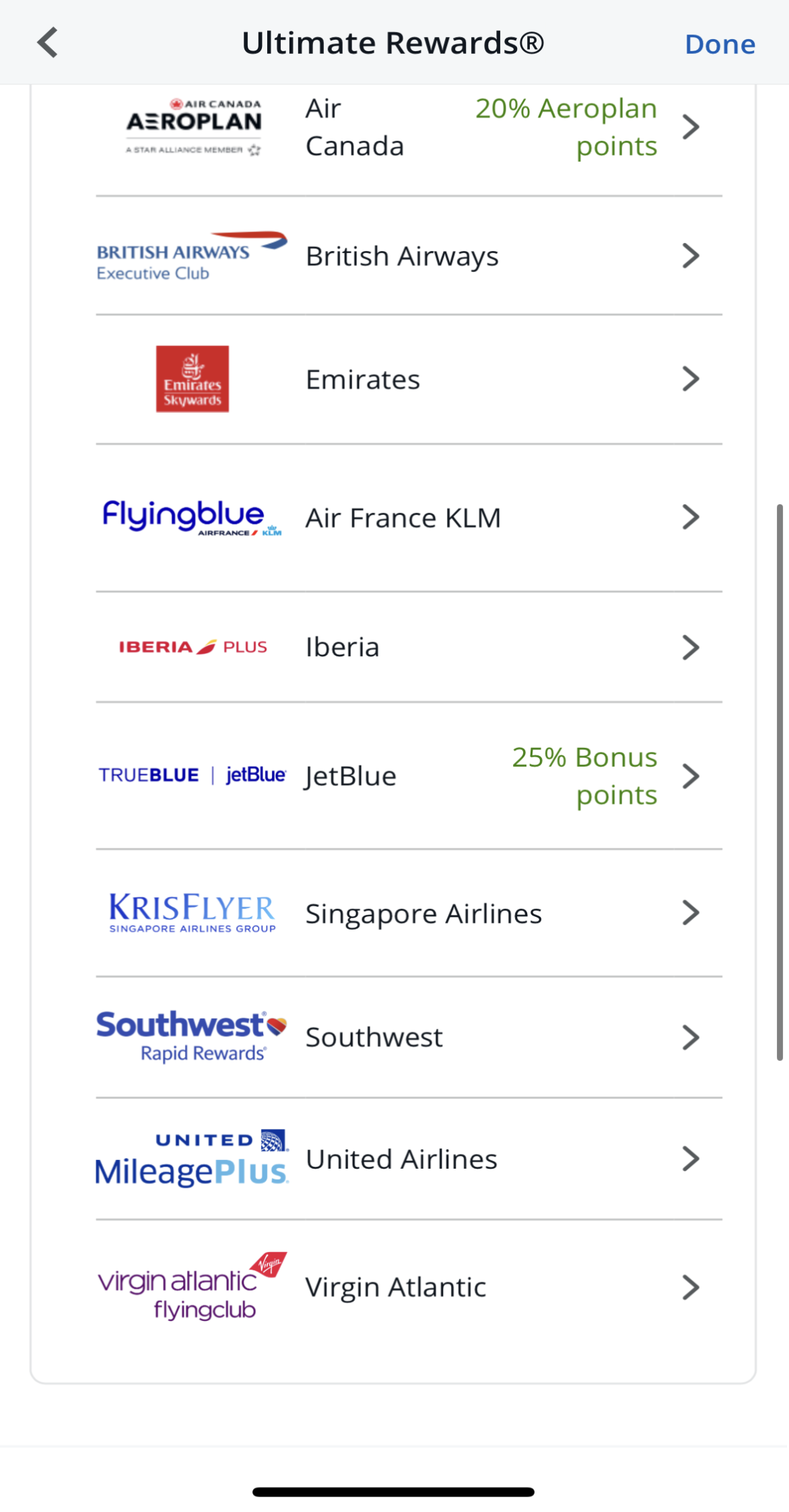

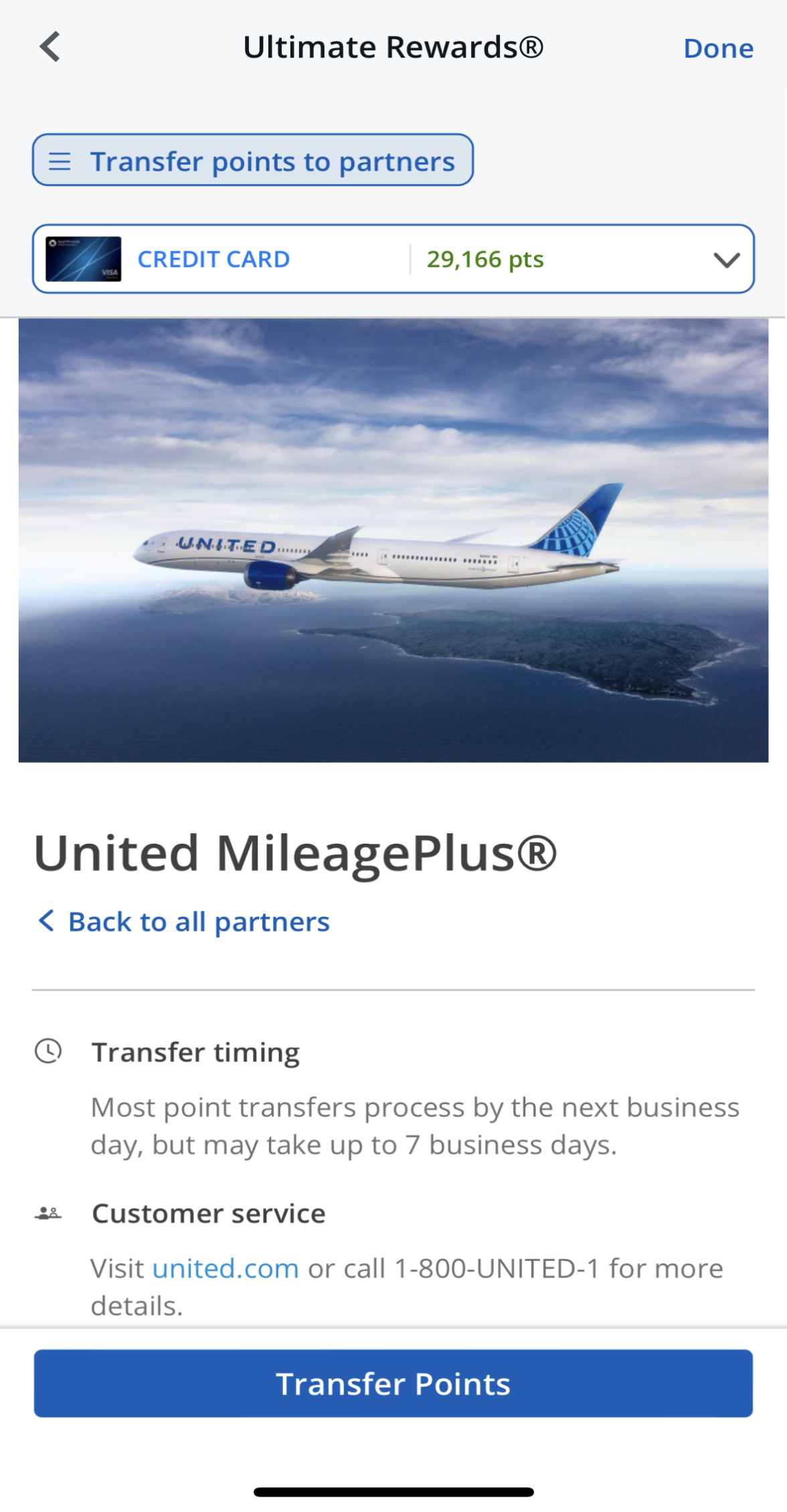

4. Choose the Partner Program: Click on the airline or hotel partner program you wish to use and select “transfer points.”

5. Add Your Partner Program Number: If you’ve not already added your hotel rewards number or frequent flyer number to your account, you’ll need to add this when you see the prompt. At this stage, you can also save your number to make transfers quicker next time.

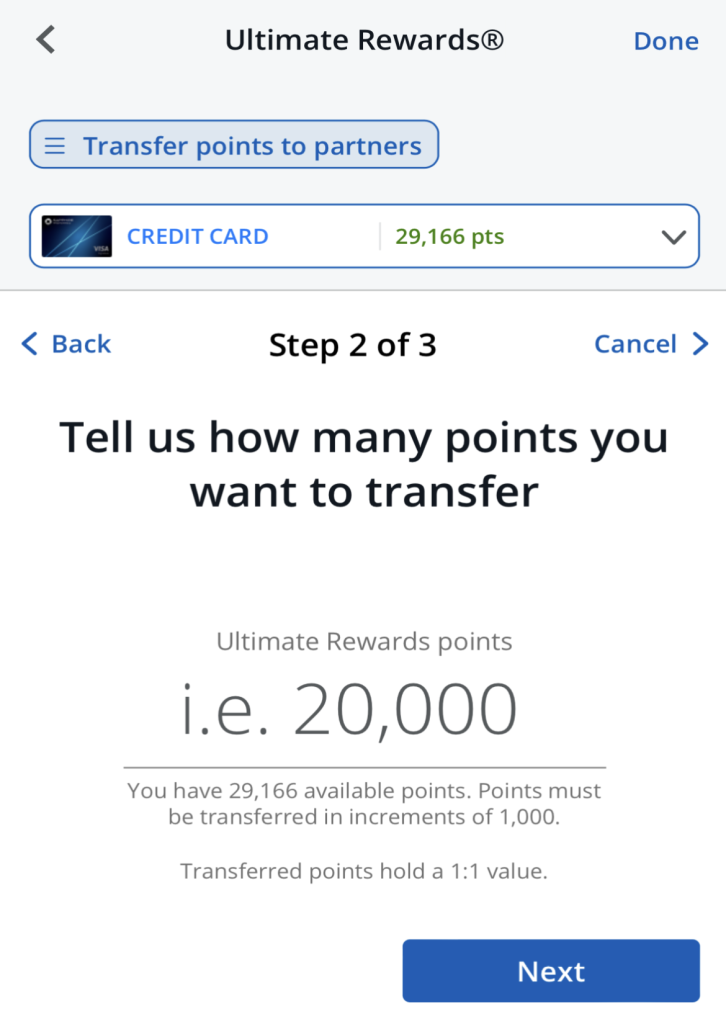

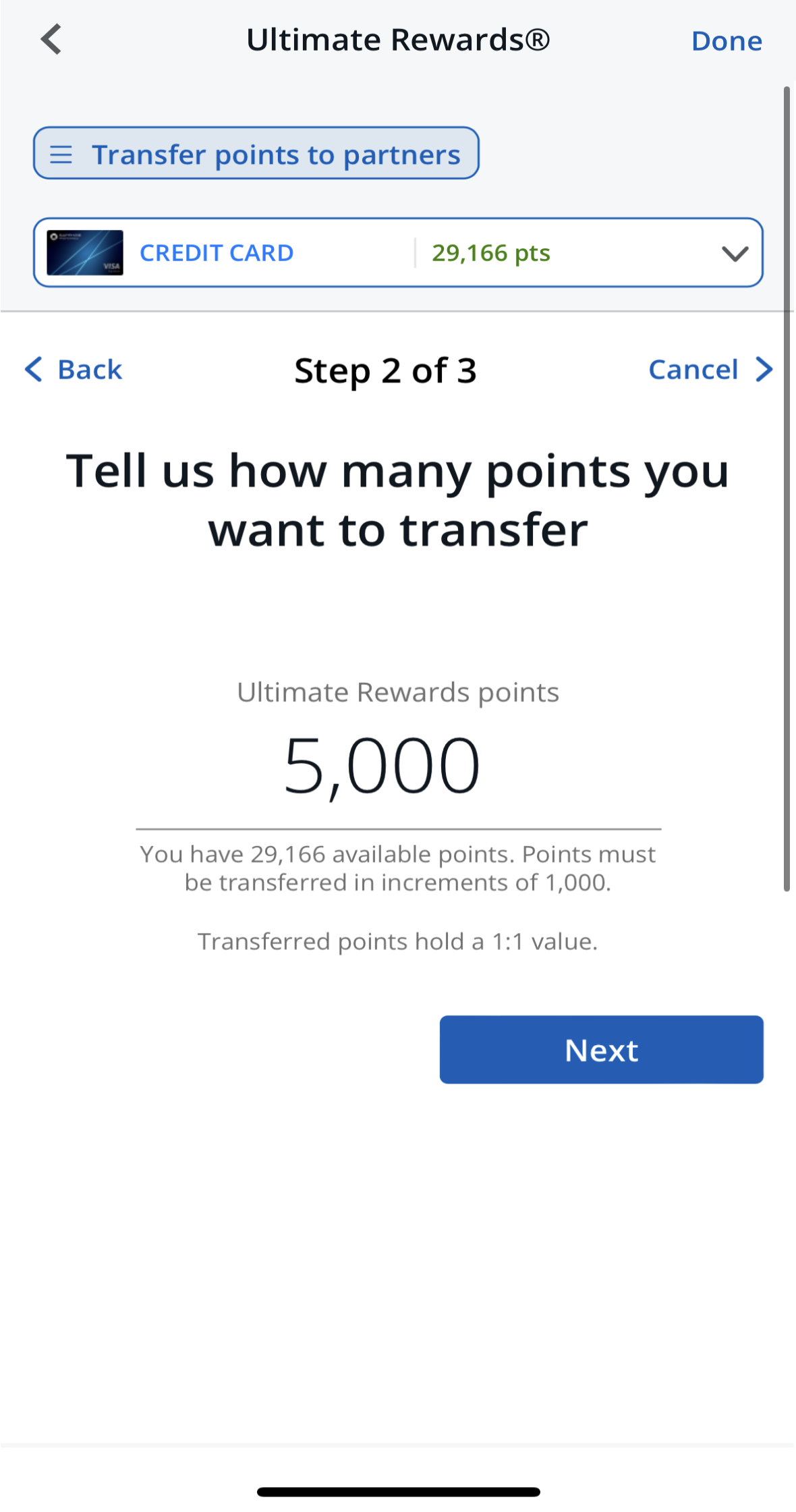

6. Indicate the Number of Points: Once your hotel or airline account is linked to your Ultimate Rewards account, you will need to indicate how many points you want to transfer. Your transfer points must be in increments of 1,000. You will then need to confirm the number you entered to complete the transfer.

7. Go to the Program Website: After the transfer is complete, you can go to the website for the airline or hotel program to check your updated balance and book your flight or hotel stay.

Combining Points Between Chase Cards

Although you can only transfer points to partnership programs if you have one of three Chase cards, one of the attractive aspects of this program is that you can combine points between your Chase cards.

This means that if you have other Chase cards, you can move your points over to maximize your benefits on Chase Sapphire Reserve, Sapphire Preferred or Ink Business Preferred and then transfer a higher point amount to the partnership program.

Alternatively, you can simply combine the points for your cards for a higher accumulation value for a specific redemption.

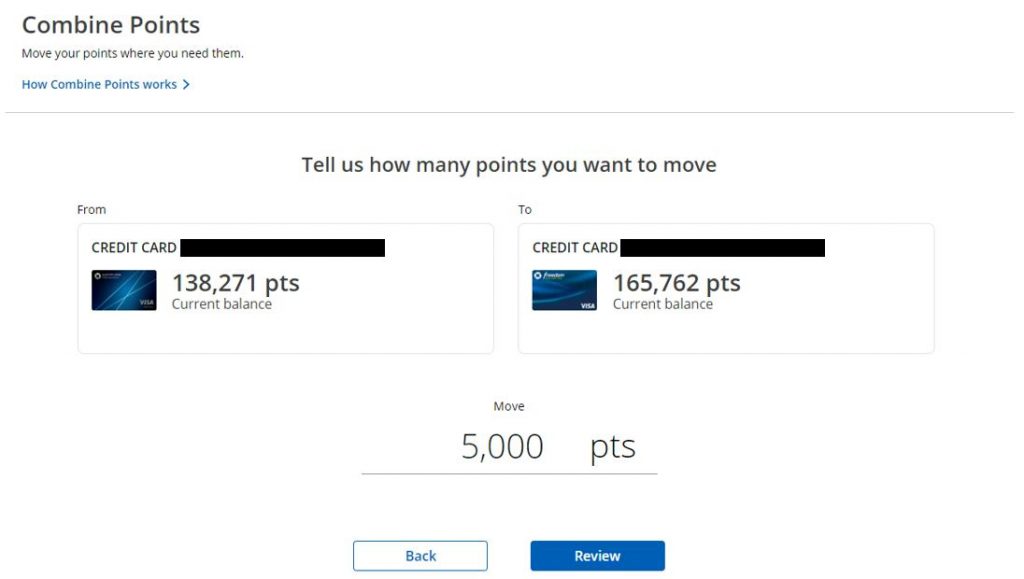

This is quite simple to do in a few steps:

1. Log In: The first step is to log into your Chase dashboard, where you can see all your Chase cards and products.

2. Find the Card: In the menu bar, you can see the points that you’ve earned on specific cards. If you hover over the available points, you will be able to see a drop down menu.

3. Choose how many points to convert: you'll be able to see all the points you currently have and choose how much exactly you would like to combine

4. Review and confirm: When you click review, you can start to consolidate all your points under one card. Generally, it is a good idea to combine your points to your Chase Sapphire Reserve, as this will allow you to transfer to a partnership program or redeem them at a higher rate via the Chase portal.

How to Transfer Chase Points to Another Person?

Chase also allows you to transfer your Ultimate Rewards points to another person. If you have family members, friends or a spouse who has a Chase credit card, it may be beneficial to pool your points.

For example, if you’re planning a family vacation, several family members could transfer their points to one person who will then book the trip.

This could be particularly important if one family member has a Chase Sapphire Preferred or Reserve card and can use the points with their airline loyalty program to get a better deal on the flights.

Transferring to Another Person’s Account – Restrictions

However, Chase does have some restrictions about sharing your Ultimate Rewards points with other people. Firstly, you can move your points to the account of one member of your household.

Alternatively, you can move your points to the loyalty program of one member of your household, but this person also needs to be an authorized user on one of your accounts. You will need to designate this authorized user and they will be the only person where you can transfer to their loyalty account.

Chase has this policy to minimize the risk of fraudulent activity. If you’re found to have misused the program in any way, such as selling your points or transferring them to an ineligible third party account, Chase will close your account.

If It's Your First Time – You Should Call Chase

For this reason, the first time that you want to transfer points to another person’s account, you will need to call the Chase customer support line. You’ll need to explain that you’d like to combine your points and Chase will need the card number of your household member.

After the call, your household member’s account will appear on your dashboard as an eligible account to transfer points. You can then select this as a transfer request as per the other transfer methods detailed above.

How To Transfer Chase Points to United?

United is one of the most well known airline loyalty programs and it has an easy-to-use booking tool and offers reasonable baggage fees.

When you book award tickets, you will need to pay carrier imposed taxes and fees, but United keeps your out of pocket costs reasonably low. If you transfer your points to United, there is the option to book flights with over 40 airlines including the Star Alliance group.

This program works great with a variety of itineraries, especially round trips. United lets you visit multiple destinations without any extra miles.

For instance, if you’re flying from the U.S. to London, then from London to Rome, and finally back to the U.S., you won’t pay additional miles for the London to Rome leg of your trip.

How To Transfer Chase Points to Southwest?

The Southwest Rapid Rewards program is one of the easiest Ultimate Rewards partners to use.

Unlike most other programs that use a fixed number to determine the flight cost, Rapid Rewards calculates the required rewards needed according to the cash price of the flight. This does eliminate the potential to increase the value of your rewards, but the platform is remarkably easy to use.

There are no blackout dates, so you can use your points for any available seat and you can expect a typical value of 1.5 cents per reward point. Additionally, transferring your Ultimate Rewards points will help you to achieve elite status.

How To Transfer Chase Points to JetBlue?

JetBlue’s rewards program is similar to Southwest’s, where the number of TrueBlue points needed is based on the price of your flight. It’s especially great for travelers heading within the U.S. or to the Caribbean and Central America.

On average, TrueBlue points are worth about 1.3 cents each, although the value can vary by flight. You can easily book flights online without needing to call customer service. Plus, flight costs are often better than what you’d find using the Chase travel portal.

How To Transfer Chase Points to British Airways?

The British Airways program called the Executive Clubis an interesting Chase airline partner. The best values from this program typically come from the nonstop flights, particularly in economy class.

Unlike many other programs that charge a fixed number of points, BA uses a distance based chart. This means that flights can work out cheaper for you. For example, if you fly from the U.S to Europe, non stop flights can be as little as 13,000 points each way.

Another major benefit of this program is its cancellation policy. There is a maximum charge to cancel a ticket and redeposit your miles. If the fees and taxes on an award ticket are less than the maximum charge, you’ll only lose the fees and tax amount.

How To Transfer Chase Points to Emirates?

Emirates has been a Chase Ultimate Rewards partner for over three years and it provides a useful option in limited circumstances.

However, there are some drawbacks including the cost in miles for premium cabin awards is higher than if you previously booked via partners, but this feature is no longer available.

Emirates did cut its fuel surcharges in 2020, which does make award ticket pricing more attractive. Emirates also makes more award space available to frequent flyers, so you’re not likely to need to scroll through months of availability to find your travel dates.

So, while you may pay more miles compared to previous iterations of the program, there is a far greater availability range, particularly for first class and business class Emirates flights.

Sign Up for

Our Newsletter

and special member-only perks.

Should You Transfer Chase Points or Use the Chase Travel Portal?

If you have one of the cards that allows points transfers to partner programs, you’ll have a decision to make about whether you should transfer your points or use the Chase Travel Portal. Chase has 14 transfer partners, which includes airlines and hotel programs.

So, you’ll need to think about which one is best for you. Generally, you can transfer points on a 1:1 basis. This means that you’ll get one mile or point in the partner loyalty program for every Ultimate Rewards point you transfer.

However, the exact value of your points will depend on the program that you transfer to and how you are redeeming the points within the program.

Reasons to Transfer Points

- Boost Program Balance

If you’re already enrolled in a partnership program and want to boost your balance to pay for a particular deal, transferring your Ultimate Rewards points can be very helpful.

- Airline Perks

If you qualify for airline perks, it may be worthwhile to transfer your Chase points, so you can book flights directly and access the airline perks, such as free checked bags or priority boarding.

- Fixed Awards Charts

Another reason to transfer to a partnership program is that their awards charts tend to be fixed. This means that the cost of a hotel room or flight tends to be fairly consistent, even if the cash price is fluctuating.

This can make it easier to plan the cost of your vacation, regardless of how inflation is impacting prices.

Reasons to Transfer Points | Reasons to Use the Chase Travel Portal |

|---|---|

Boost Program Balance

| You’re Not Brand Loyal |

Airline Perks | You May Need to Pay Extra |

Fixed Awards Charts | You Book Well in Advance

|

Reasons to Use the Chase Travel Portal

- You’re Not Brand Loyal

If you don’t have an existing relationship with an airline and simply prefer to look for the best deals, you may be better using the Chase Travel Portal.

You can use this as you would a discount travel website to search for flights, hotels, cruises, car rentals and other travel related purchases for specific dates or destinations.

- You May Need to Pay Extra

One of the nice features of the Chase Travel Portal is that you can pay for your purchase with points, cash or a combination of the two.

This means that if you haven’t accumulated sufficient points, you can still book your trip, using an alternative payment method to cover the difference.

- You Book Well in Advance

Typically the closer to the departure date, the higher the cash rate. So, if you tend to book well in advance, you may be able to snag a really good deal via the Chase Travel Portal.

When is it a Good Idea to Transfer Points Between Accounts?

There are several scenarios where it is a good idea to transfer points between accounts. These include:

- Another card offers better redemptions: If you’ve qualified for a new Chase credit card that offers better redemption rates than your older card, it is a good idea to transfer your points to the new card.

For example, if you have a Chase Freedom Flex card, but you’ve recently qualified for a Chase Sapphire Reserve, you could get an average of 1.5 cents per point with the Sapphire Reserve compared to 1 cent per point with the Freedom card.

- You’re closing an account: If you’re closing out one of your Chase credit card accounts, be sure to transfer any accumulated Ultimate Rewards points from that card to your other Chase cards. This will ensure that you don’t lose any accumulated rewards when the account closure goes through.

- You want to transfer points to a partner program: As we discussed earlier, there are limited Chase credit cards that allow you to transfer points to a partner program. So, if you want to boost your airline miles balance, it is a good idea to pool all your points into an appropriate card account and then transfer more points to the partner program.

When is it Not a Good Idea to Transfer Points Between Accounts?

There are also scenarios where it may not be a good idea to transfer points between accounts.

- The account is fairly new: Chase is very vigilant about Ultimate Rewards bad practice and fraud. So, if you’ve got a fairly new account and are planning on transferring all the points and then closing out the account, Chase may see it as a manipulation of the system and could close all your Chase card accounts.

- The other account holder is not a member of your household: Chase doesn’t permit transfers to third party accounts. You can only transfer points between account holders in the same household. So, don’t try to game the system and transfer to someone outside your household or you could put both accounts at risk.

- If you’ve been offered money: Selling points is forbidden and even if someone has offered you money for your points, it is not a good idea to initiate a transfer.

Sign Up for

Our Newsletter

and special member-only perks.

FAQs

Delta Skymiles is not a partnership program for Chase Ultimate Rewards.

However, you can still use your Ultimate rewards points to book a Delta operated flight due to the transfer partners AirFrance/KLM Flying Blue and Virgin Atlantic Flying Club.

American Airlines is not a transfer partner, but British Airways and Iberia are. This means that you can transfer your points to these programs and book via their partnership with American Airlines.

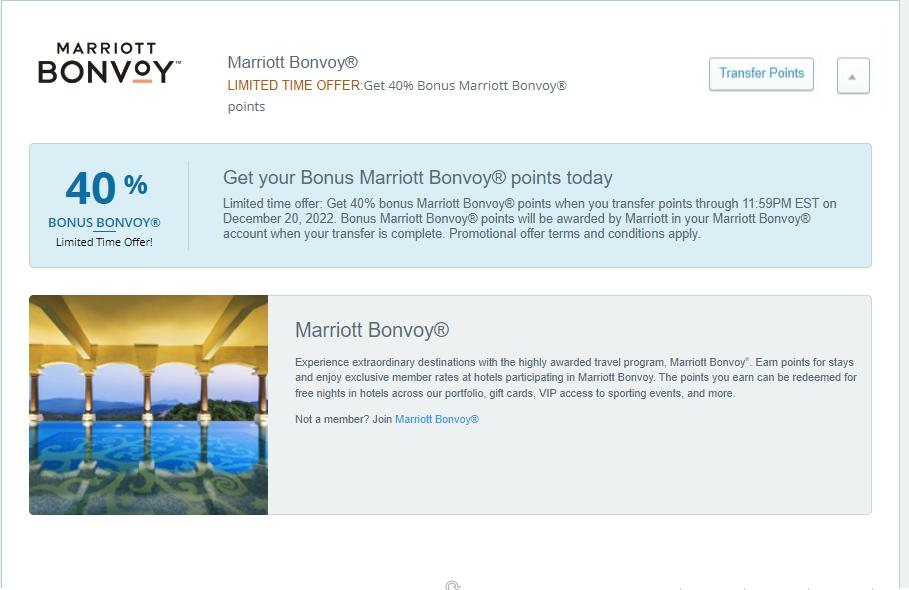

Simply select Marriott Rewards from the menu after you click “transfer to travel partners”. You can then designate how many points you wish to transfer.

Chase does allow you to transfer points to the Chase accounts of other members of your household. You’ll need to call Chase and provide the card number of your family member or housemate.

Just choose Hyatt from the list of travel partners under the “transfer to travel partners” menu and designate the number of points you want to transfer.

Yes, if you call Chase and provide the Chase card number for your spouse. You can then select your spouse’s account under the transfer points menu.

Yes, you can transfer your points between accounts and you can access the higher redemption values offered with the Chase Reserve card.

Yes, if you’re the cardholder for both cards, you can transfer the points you’ve accumulated on your Chase Freedom card to your Chase Sapphire. Simply click the drop down bar on your card when you log in to the Chase dashboard.

You’ll need to link your online account to your Ultimate Rewards and this will allow you to transfer your Chase Amazon points to your Ultimate Rewards account.