What Is Benzinga?

Benzinga is a market research and news platform offering financial data, stock quotes, expert commentary, and trading tools for both casual investors and active traders.

It provides a mix of real-time updates, insider trade tracking, economic calendars, and analyst ratings to help users stay informed and analyze market trends.

While the Free Plan offers timely news, watchlists, and basic stock data, Benzinga subscription adds features like advanced charting, custom alerts, screeners, and exclusive research reports.

Each tier caters to different investor needs—from news-followers to momentum traders and long-term stock pickers.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Benzinga Pro – Basic | $37

$367 ($30.58 / month) if paid annually | 14-day free trial |

Benzinga Pro – Streamlined | $147

$1,497 ($124.75 / month) if paid annually | 14-day free trial |

Benzinga Pro – Essential | $197

$1,997 ($166.42 / month) if paid annually | 14-day free trial |

Benzinga Edge | $19

$228 if paid annually

| $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

How to Use Benzinga Analysis Tools: Tips & Examples

Benzinga provides a variety of tools for analyzing stocks, ETFs, and market events. Below are five ways to effectively use Benzinga for investment research and decision-making:

1. Use Real-Time News to Track Market Moves

Benzinga's newsfeed is one of its core strengths. Unlike traditional financial sites that update with delay, Benzinga (especially in Pro plans) provides real-time headlines on earnings, analyst upgrades, macroeconomic events, and breaking news.

- Filter by ticker, sector, or keyword to cut through noise and find relevant updates using Benzinga Pro Essential’s advanced feed.

- Follow earnings beats or analyst upgrades as they happen to assess whether a stock may rally or pull back.

- React quickly to economic data releases like CPI or Fed meetings that can impact entire market sectors.

-

Example & Tip

You’re watching Tesla (TSLA). A sudden analyst upgrade appears in the Benzinga feed with a raised price target and bullish commentary.

This gives you an edge in evaluating immediate investor sentiment before the stock reacts.

Use news filtering combined with watchlist alerts to stay on top of the names you’re actively tracking—especially helpful for earnings season.

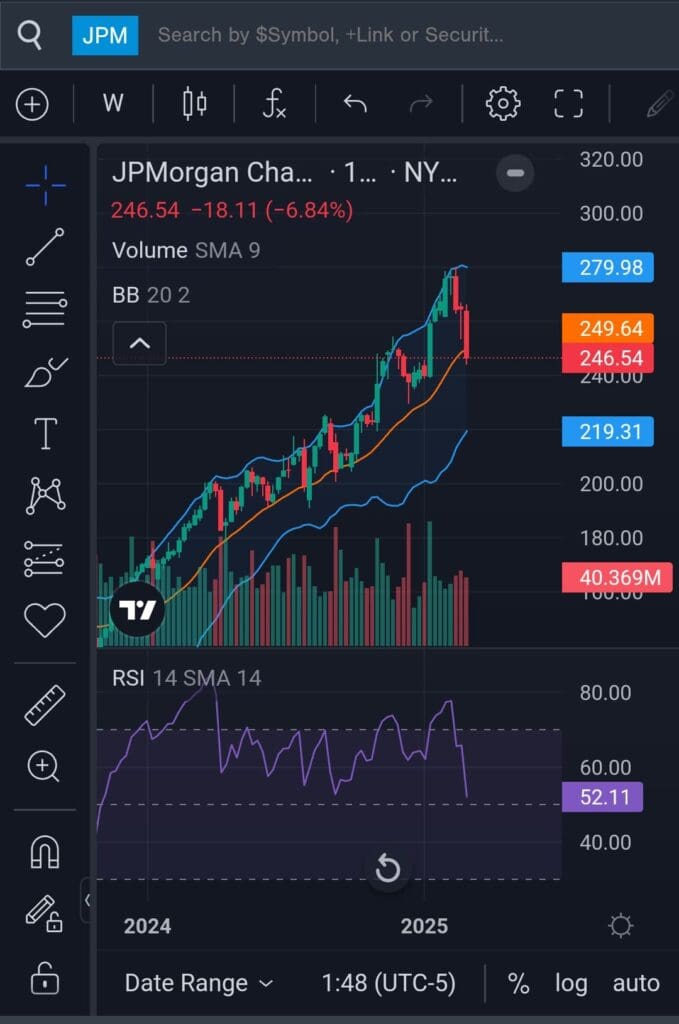

2. Analyze Stocks Using Technical Charts and Indicators

Benzinga’s charting tools help visualize price action, trend strength, and technical setups. Benzinga free users get access to basic charting with two indicators, while Pro Essential unlocks full customization.

Overlay indicators like RSI, MACD, or Bollinger Bands to evaluate momentum, volatility, and support/resistance levels.

Switch timeframes (from intraday to multi-month) to spot both short-term breakouts and long-term trends.

Use Chart of the Day (Edge) for curated technical setups with entry/exit suggestions.

-

Example & Tip

A swing trader reviewing AMD finds that the RSI has moved above 70 and volume is spiking—Benzinga charts confirm this is a possible overbought breakout.

Stick to 2–3 indicators that match your strategy to avoid noise—use volume, moving averages, and RSI for trend and momentum confirmation.

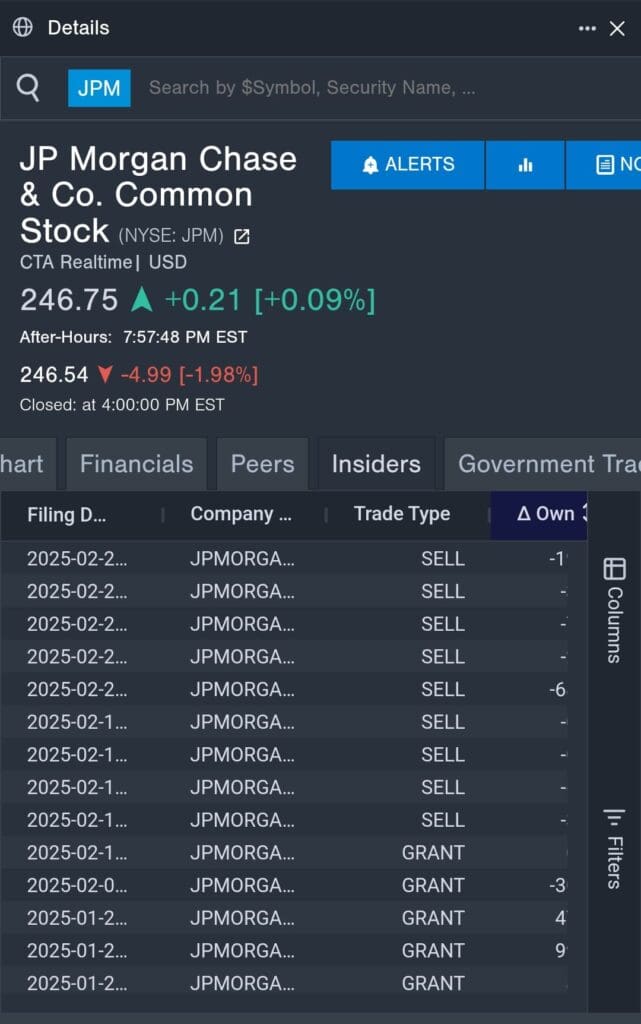

3. Track Insider and Institutional Activity for Clues

Insider and institutional trades can signal major confidence—or concern—from those closest to the company or with deep resources.

See executive buys and sells with the Insider Tracker, giving you insight into how leadership views future prospects.

Monitor hedge fund trades and big block moves with Smart Money Movers (Edge), helping you align with institutional momentum.

Track government trades to spot what politicians are buying and selling ahead of regulation or earnings moves.

-

Example & Tip

Benzinga shows a CFO buying $500K of shares ahead of a product launch. This insider move may hint at positive internal expectations not yet priced in.

Combine insider buying with news or earnings momentum—if both align, it often confirms a strong setup worth watching.

4. Review Analyst Ratings and Price Targets for Stock Sentiment

Benzinga compiles analyst opinions to give investors a snapshot of Wall Street sentiment, including upgrades, downgrades, and price targets.

Track trends in analyst sentiment to spot shifting outlooks—especially helpful ahead of earnings or product launches.

Compare price targets against the current share price to find stocks that may be undervalued or overbought.

Use historical rating data to see if analyst confidence is building or weakening over time.

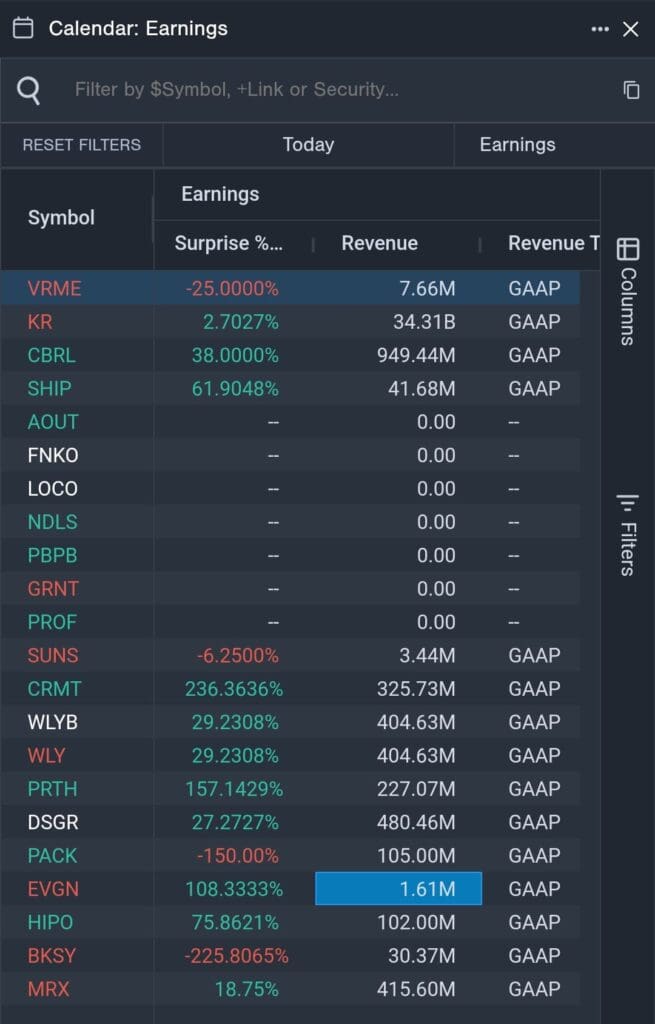

5. Explore Earnings, Economic Calendars & Event Catalysts

Timing is critical. Benzinga’s calendars help you prepare for key financial events that could impact your portfolio.

Use the earnings calendar to track company results and analyst expectations—ideal for earnings plays or sector rotation setups.

Follow economic data (jobs reports, Fed meetings, inflation updates) that drive market sentiment across sectors.

Set alerts around key events so you never miss opportunities tied to high-impact releases.

-

Example & Tip

You’re holding a banking ETF. Benzinga alerts you to a surprise Fed rate hike in the upcoming FOMC calendar—giving you time to rebalance or hedge.

Even long-term investors should monitor event calendars—economic shifts can create short-term volatility that opens up strong entry points.

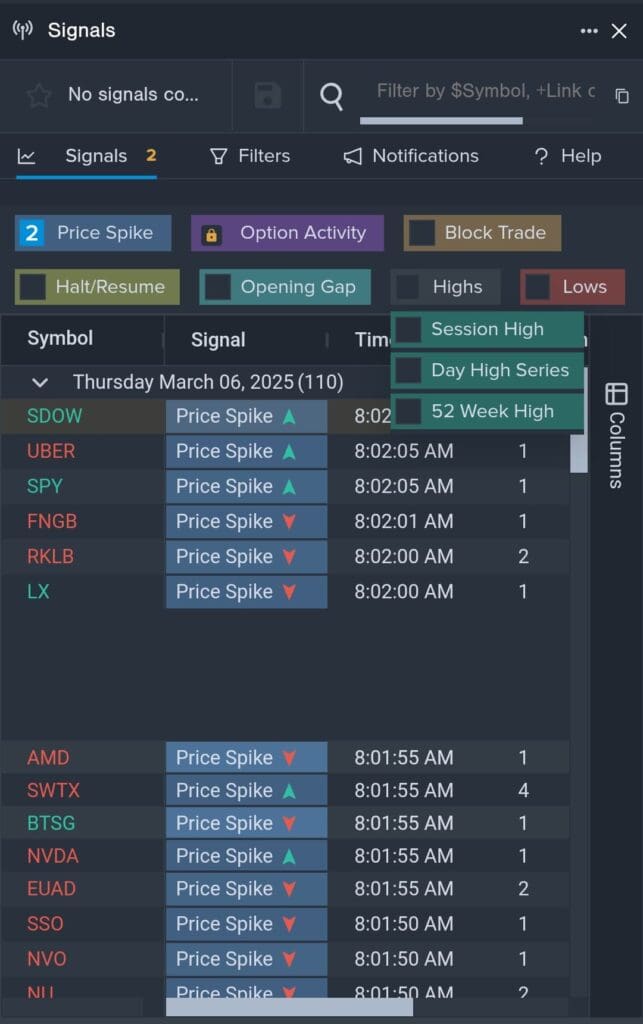

6. Use the Unusual Options Activity Tracker to Spot Big Trades

Available in the Benzinga Pro Essential and Edge plans, the Unusual Options Activity tool highlights large or unexpected trades in the options market—often a sign of institutional moves or insider knowledge.

Track high-volume options trades that deviate from normal patterns, like large call buys or put spreads.

Identify early signals of potential price moves in stocks with rising speculative interest.

Follow contract types and expiration dates to understand how aggressive the positioning is.

-

Example & Tip

You notice heavy call volume on Ford (F) with strike prices far above the current level, expiring in two weeks—suggesting traders are betting on a short-term upside breakout.

Look for large option trades with high open interest changes and short expirations—they often indicate near-term catalysts.

7. Use the Real-Time Stock Screener for Fast Filtering

The Pro Essential plan includes a real-time stock screener that updates dynamically, helping you filter stocks based on fundamental and technical criteria as they happen.

Screen for price movements, gaps, volatility, or volume spikes across sectors or custom watchlists.

Filter stocks based on RSI, moving averages, or market cap to match your trading strategy.

Track top gainers, losers, or breakout setups in real time without switching platforms.

-

Example & Tip

During market open, you screen for S&P 500 stocks with RSI >70, price up over 3%, and above 50-day moving average—narrowing in on potential breakout trades.

Customize your screener to match a trading style (e.g., momentum, reversal, value) and use saved presets to react quickly during volatile sessions.

8. Explore the IPO Calendar to Track New Market Opportunities

Benzinga’s IPO Calendar (available on both Free and Pro plans) helps you stay ahead of newly listed companies and potential breakout plays.

View upcoming IPOs, recent debuts, and pricing details across sectors.

Track IPO performance post-listing to evaluate momentum or investor interest.

Use it to prepare for earnings announcements and lock-up expirations that could affect price.

FAQ

Benzinga can serve both, but the Free and Pro plans lean more toward short-term, news-driven trading. Benzinga Edge is better suited for long-term investors seeking curated stock picks and insider insights.

You can use the web version of Benzinga via a mobile browser with the free plan, but mobile app access is only available for Benzinga Pro subscribers.

While Benzinga allows users to track portfolios through brokerage integration, it does not currently support executing trades directly from the platform.

Yes, in the Pro Essential plan, the real-time screener includes filters for metrics like moving averages, volatility, and basic fundamentals, though it lacks deeper custom metrics like PEG or ROE.

No, Benzinga does not offer proprietary valuation models or fair value estimates. For this, investors typically use platforms like Morningstar or GuruFocus.v

Only Benzinga Pro plans offer the ability to save screeners and watchlists. Export functionality for data is not available, even in paid tiers.