As a beginner in investing, having the right tools can make a big difference. Free stock screeners are a great way to filter stocks based on your preferences, making it easier to spot the best opportunities.

Let’s take a look at the top free stock screeners for beginners to help you get started.

Investing.com

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

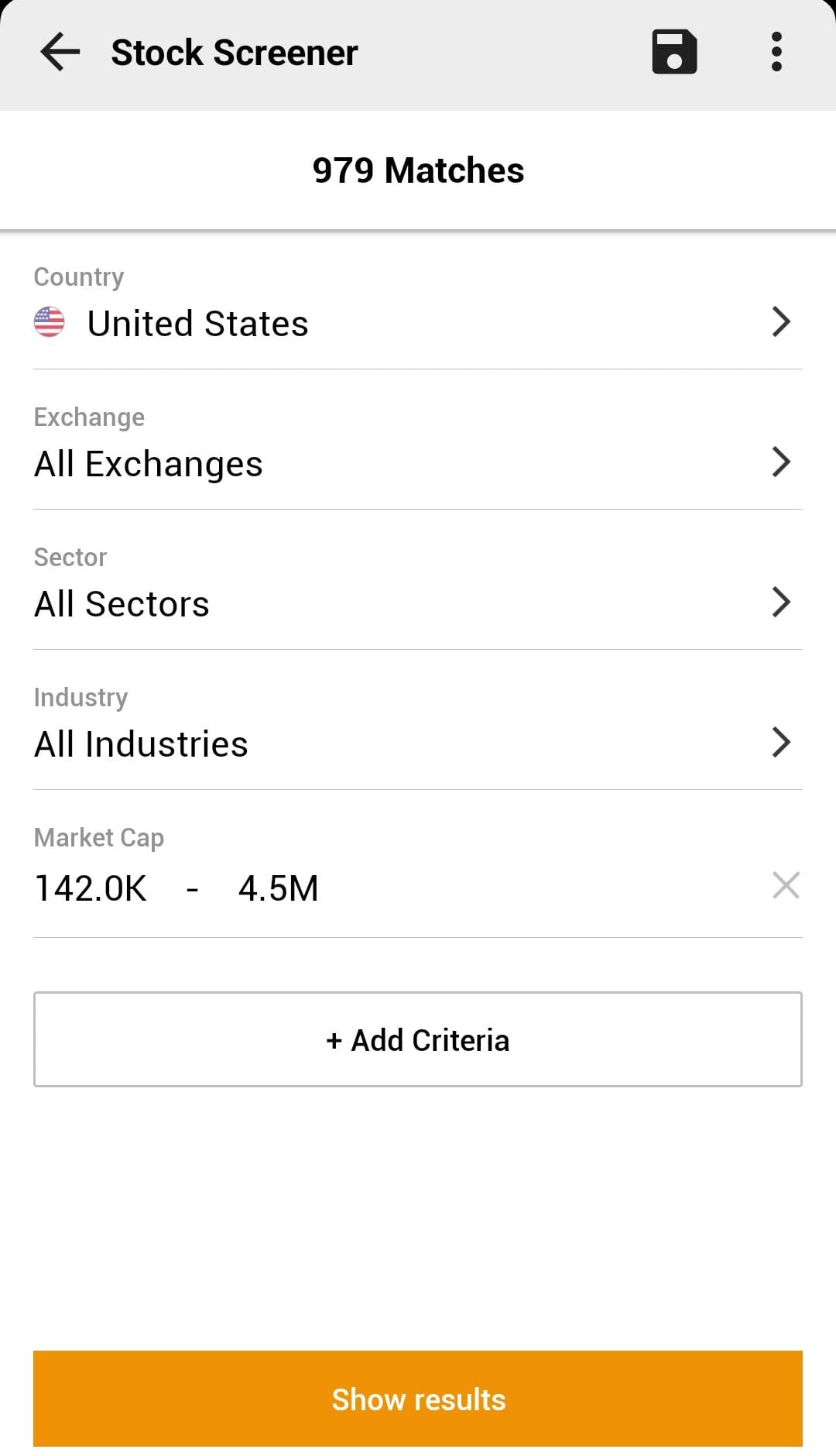

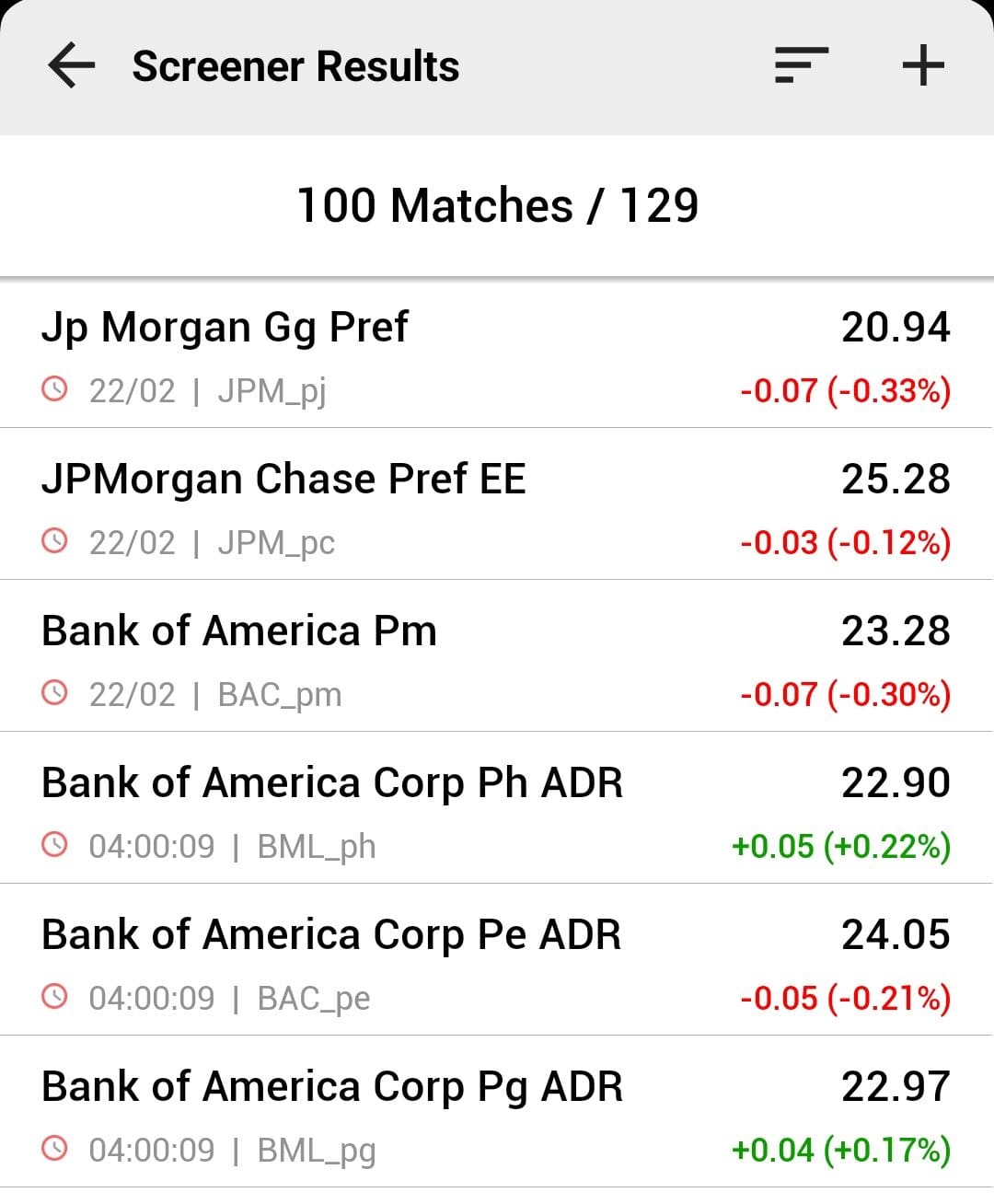

Investing.com’s Free Stock Screener helps beginners find stocks based on filters like sector, market cap, valuation ratios and more, while sorting through thousands of stocks quickly.

We included it in our list because it’s easy to use, covers global markets, and provides real-time data for many assets, but the free version has limited screening options, missing advanced filters like AI-driven insights.

Besides free screener, Investing.com also provides comprehensive stock research tools, real-time market data, financial news, earnings reports, and interactive charts.

- Stock Screener

- Stock Analyst Ratings

- Real-Time Market Data

- Interactive Financial Charts

- Technical Analysis Summary

- Company Financials Data

- Portfolio Management

- Financial News & Analysis

- Economic Calendar

- Alerts & Notifications

- Currency Converter

- Basic Fundamental Data

Zacks

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

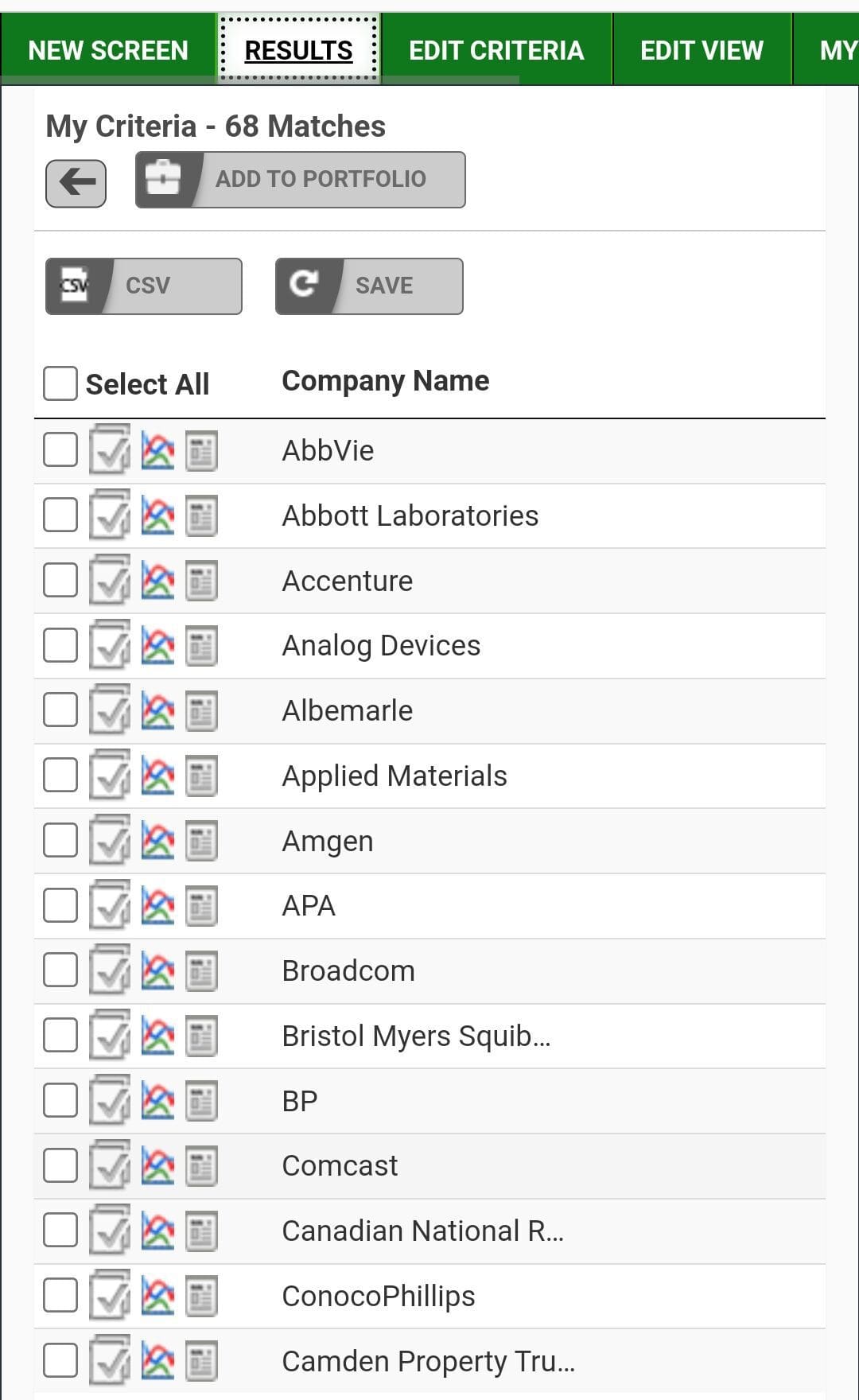

Zacks’ free stock screener is a great tool for beginners looking to filter stocks based on key metrics like Zacks Rank, industry, valuation, and earnings trends.

It’s easy to use and helps investors quickly identify potential opportunities using one of the most trusted stock ranking systems.

However, the free version lacks customization options and access to premium screening criteria.

Besides free screener, Zacks offers access to stock rankings, research tools, expert-selected stock picks and exclusive trading strategies.

- Zacks Rank Stock Ratings

- Stock Screener & Filters

- ETF & Mutual Fund Screener

- Style Scores (Value/Growth)

- Basic Stock Charting Tools

- Portfolio Tracker & Alerts

- Profit from the Pros Newsletter

- Industry Rank & Market Trends

- Stock Forecasts & Price Targets

- Dividend Stock Research

- Economic & Earnings Calendar

- Bull & Bear of the Day

MarketBeat

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

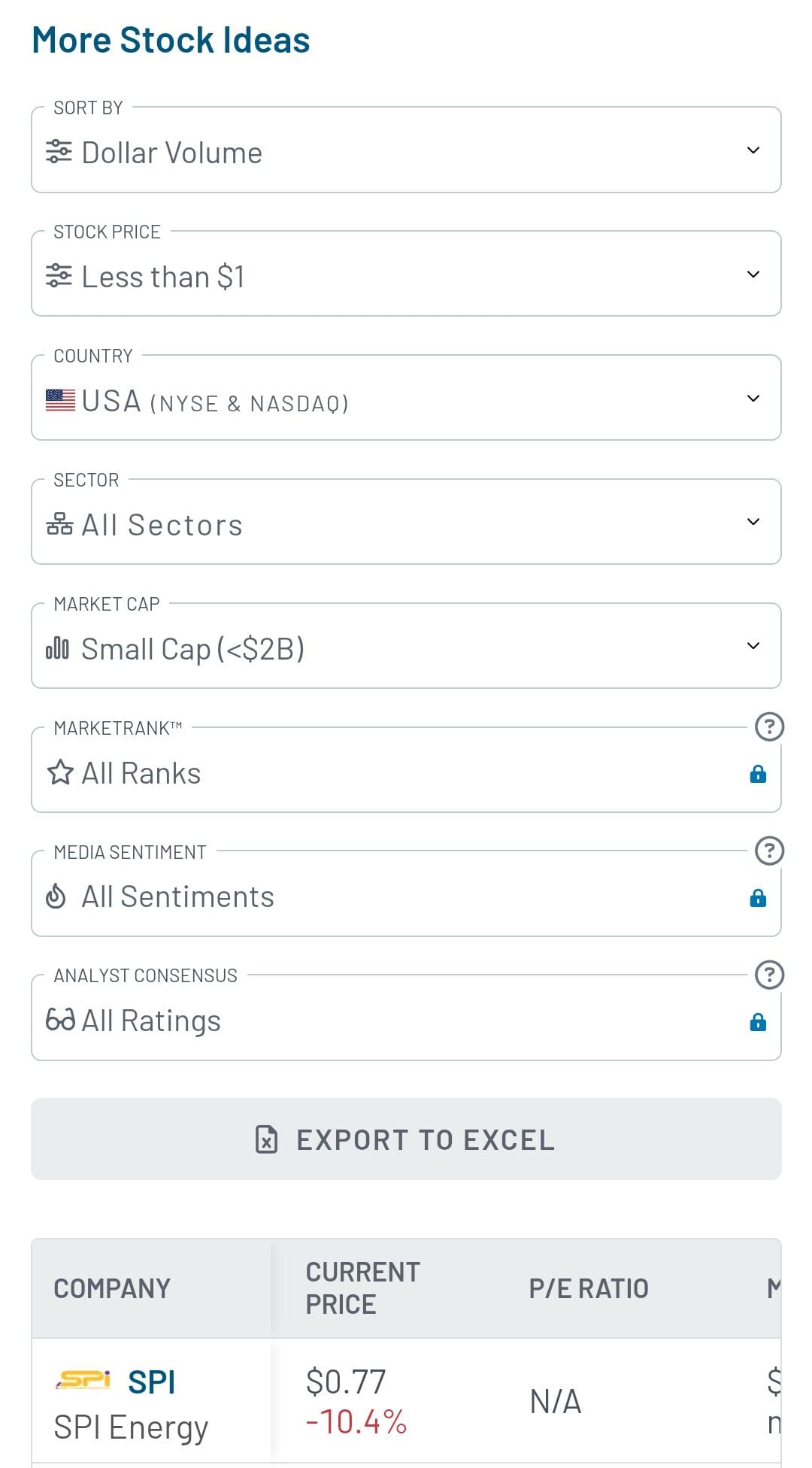

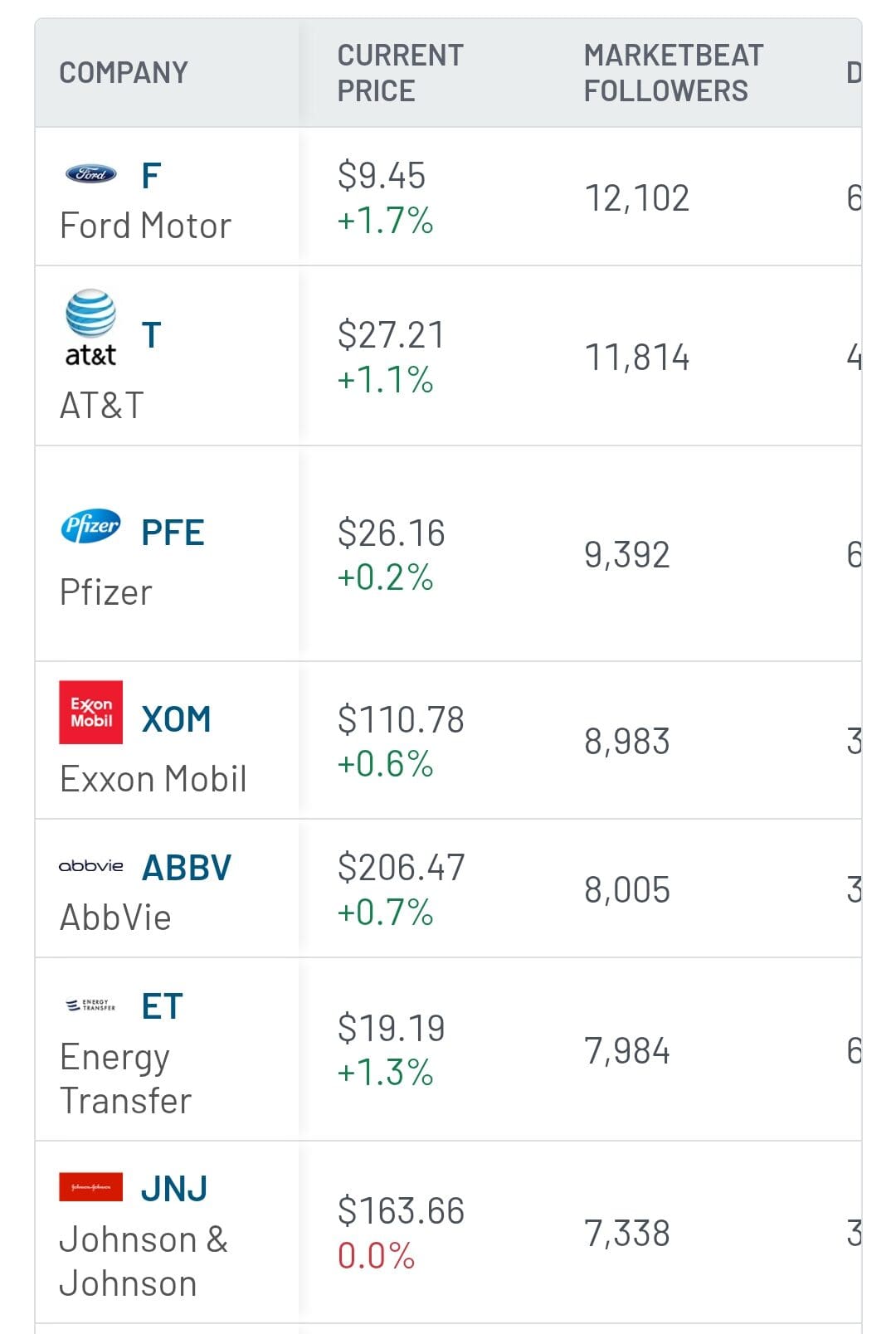

MarketBeat’s free stock screener is a great tool for investors looking to filter stocks based on analyst ratings, valuation, earnings growth, and insider trading activity.

It allows users to quickly identify stocks that meet specific criteria, making stock research easier for beginners and experienced investors alike.

Besides free screener, MarketBeat provides investors with analyst ratings, financial data, market news, and portfolio tracking tools.

MarketBeat’s premium plans offer enhanced stock screening with more filters, MarketRank™ stock rankings, and real-time data updates.

- Stock research reports

- Analyst forecast ratings

- Dividend and earnings data

- Insider trade tracking

- Short interest insights

- Options chain analysis

- Stock comparison tool

- Market calendars

- Portfolio tracking

- Stock market heatmaps

- Trending stocks data

- MarketBeat mobile app

Stock Analysis

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

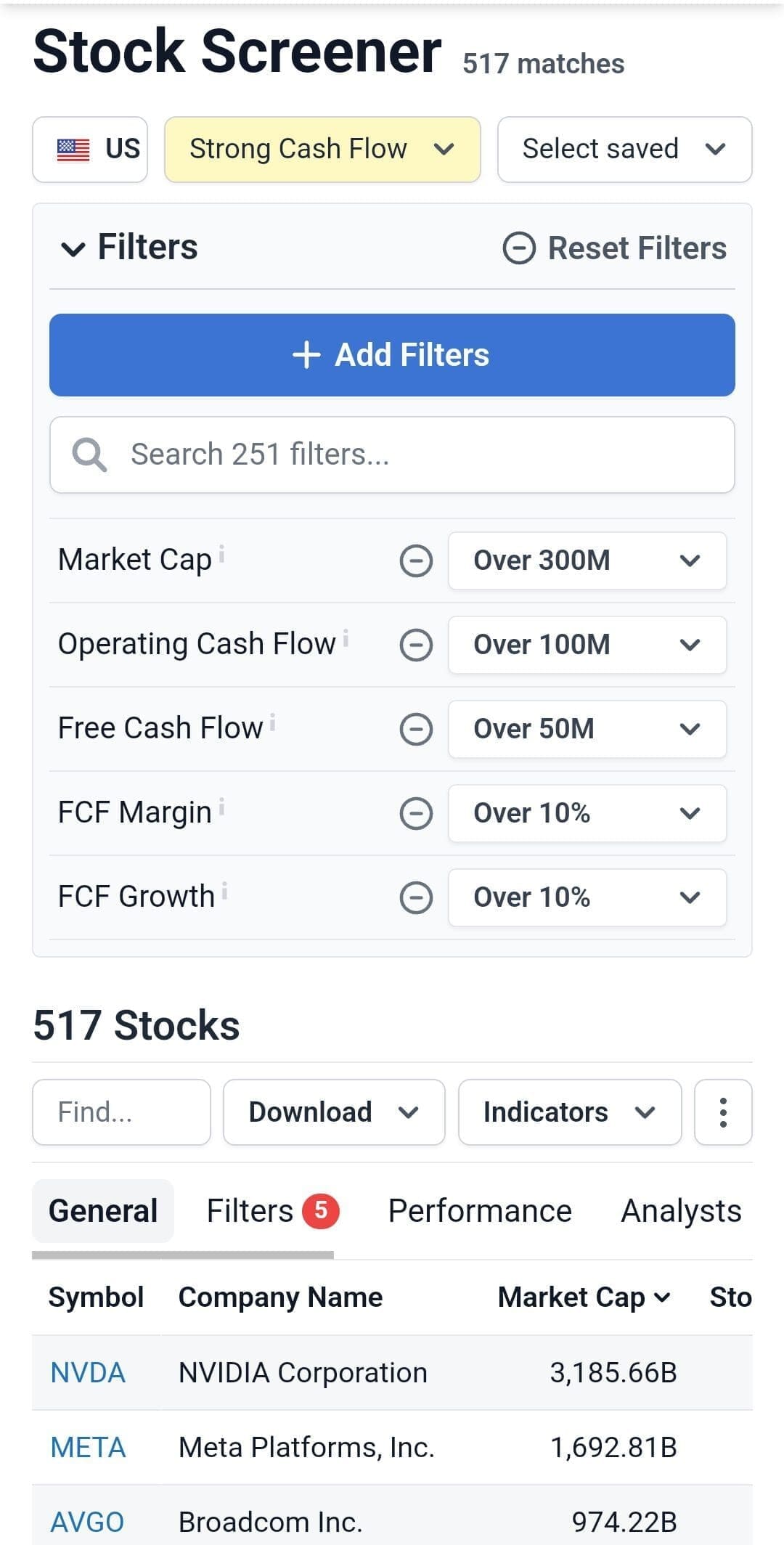

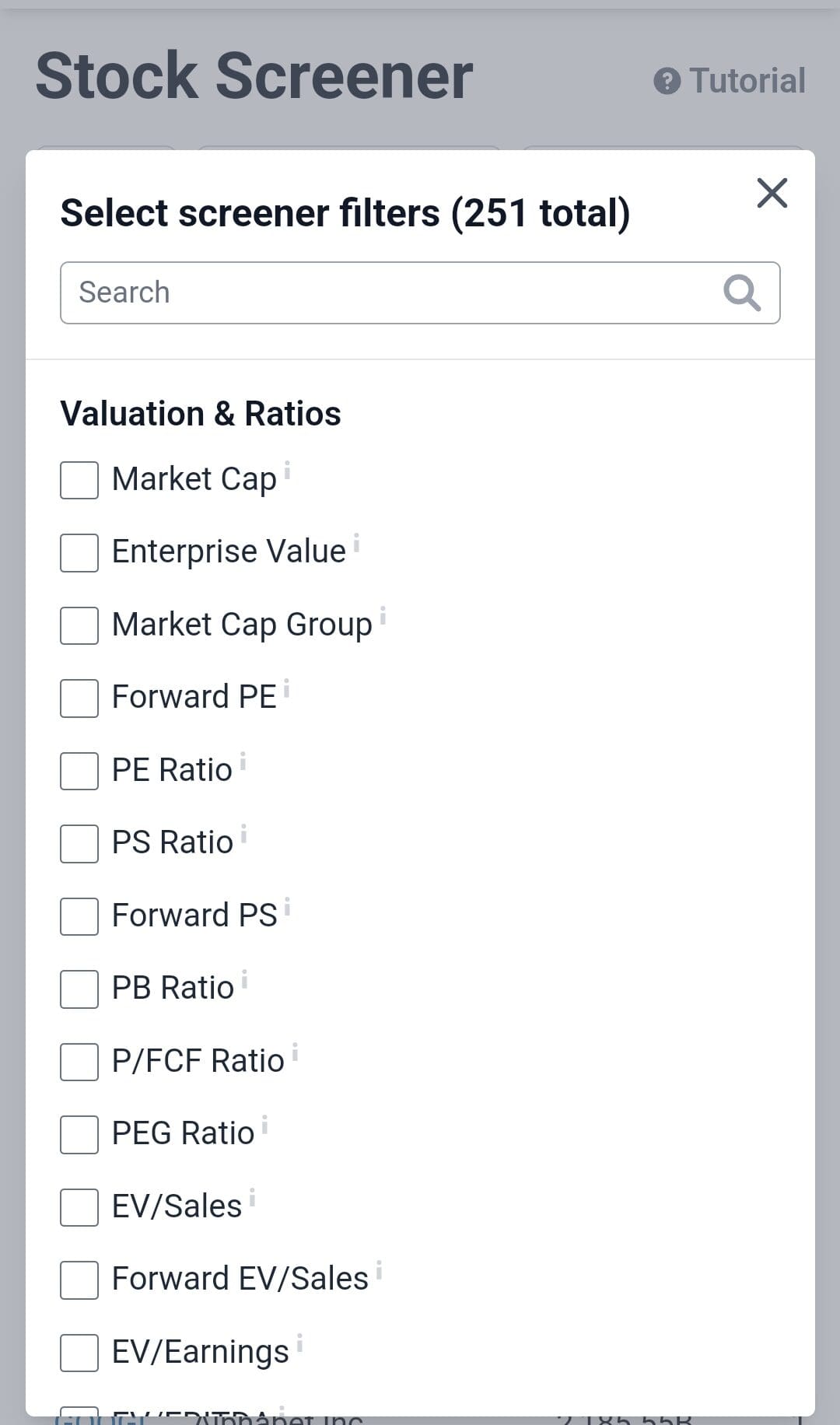

We included Stock Analysis in our list of free stock screeners for beginners because it provides an easy-to-use platform with basic stock filtering, financial data, and earnings insights at no cost.

Beginners can explore stocks based on key metrics like market cap, sector, and valuation ratios, making it a useful starting point for research.

Besides its free stock screener, Stock Analysis is has great user interface providing comprehensive financial data, earnings reports, stock performance tracking, and valuation insights.

- Stock screener

- ETF screener

- Stock analysis tools

- Technical charting

- Watchlist tracking

- IPO tracking

- Stock comparison

- Stock market news

- Earnings calendar

- Trending stocks

- ETF provider insights

- Financial statement analysis

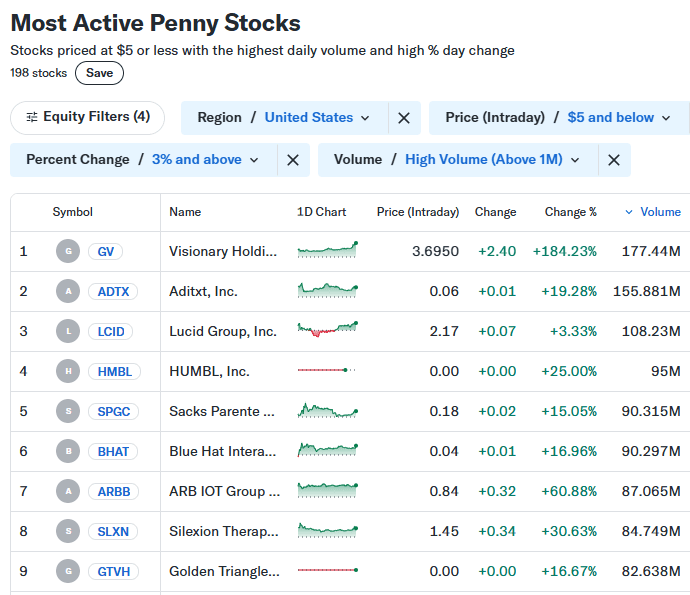

Yahoo Finance

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

The Yahoo Finance Free Stock Screener is a simple yet effective tool for beginners to filter stocks based on market cap, dividend yield, P/E ratio, and other fundamental metrics.

It’s easy to use and helps new investors identify potential opportunities without needing advanced knowledge.

We believe it deserves a spot on our list because it offers a user-friendly interface, real-time data, and customizable filters.

However, the free version lacks analyst ratings, technical pattern recognition, and premium stock research, which are available in paid plans.

- Basic stock & ETF screener

- Real-time stock quotes & news

- Follow stocks, ETFs, and crypto

- Basic technical analysis tools

- Custom watchlists & alerts

- Link brokerage portfolios

- Join investor conversations

- Company profiles & key statistics

- Earnings & economic event calendar

- Top movers & trending stocks

- Cryptocurrency market tracker

- Stock market heat maps

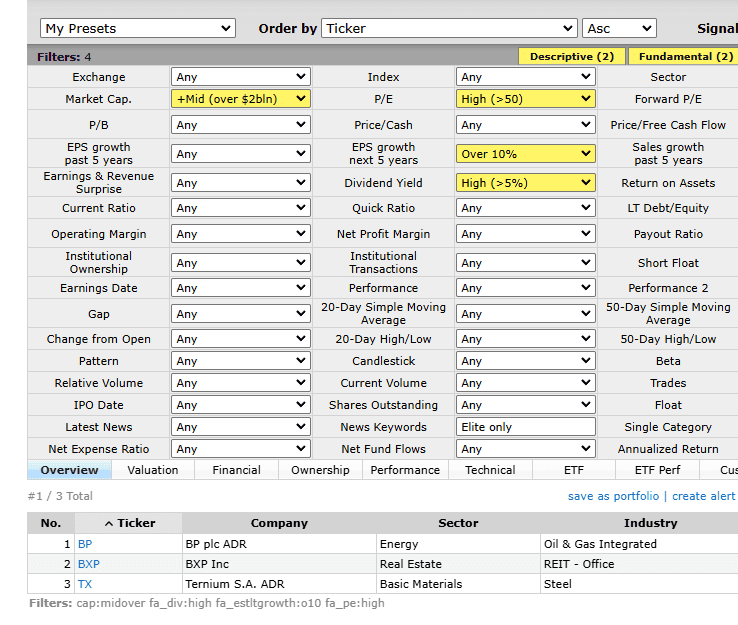

Finviz

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

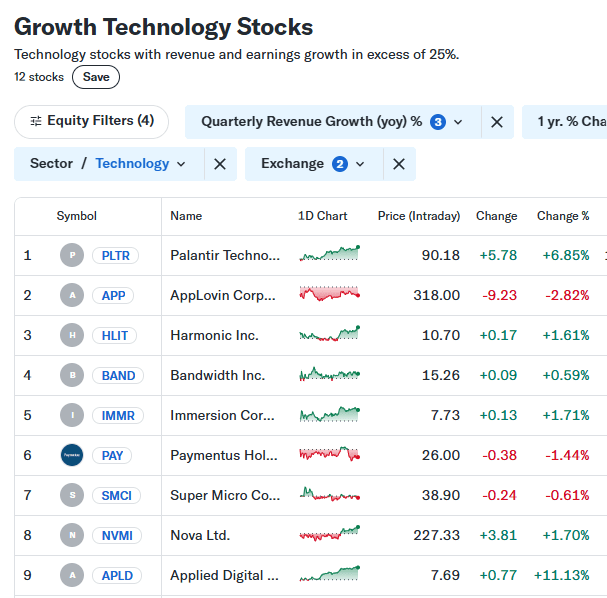

Finviz is a user-friendly stock screener that helps beginners filter stocks based on technical and fundamental criteria. It provides an easy way to explore market trends, track performance, and identify potential investments.

We included it in our Free Stock Screeners list because it’s fast, intuitive, and requires no signup to access key market data.

However, the free version has some limitations, including delayed data, static charts, and no real-time alerts.

Besides its powerful free stock screener, Finviz stands out with visual market heatmaps, technical and fundamental filters, insider trading data, and news aggregation.

- Stock screener filters

- Technical analysis tools

- Momentum stock filters

- Fundamental stock analysis

- Stock key financial data

- Basic charting tools

- Stock heatmaps

- News aggregator feed

- Insider trading data

- Portfolio tracking

- 3-year financial statements

- Futures & forex overview

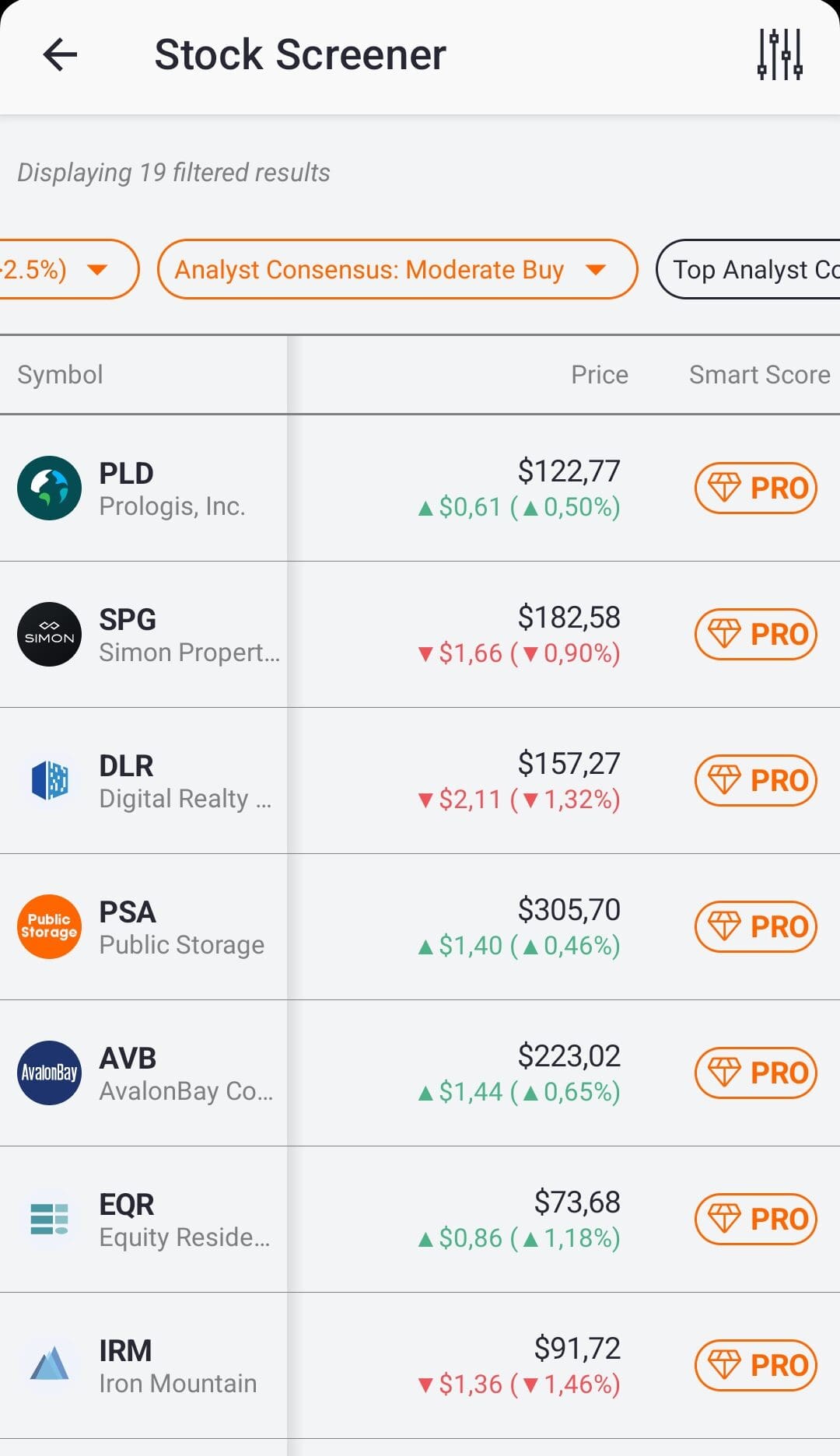

TipRanks

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

We included TipRanks in our Free Stock Screeners for Beginners because it offers an intuitive tool that helps investors filter stocks based on key metrics like analyst ratings, market cap, P/E ratio, and sentiment analysis.

However, the free version lacks smart score rankings, top analysts’ price targets, and insider trading insights, limiting deeper analysis.

Besides its free stock screener, TipRanks stands out with data-driven investment insights, including smart score rankings, analyst ratings, hedge fund activity, insider trading data, and stock sentiment analysis.

- Stock & ETF Screener

- Portfolio Overview

- Momentum Index

- Stock & ETF Comparison

- Dividend Tracking Tools

- Market News & Insights

- Earnings & IPO Calendars

- Technical Indicators

- Investor Sentiment Tools

- ETF Analysis Features

- Personalized News Feed

- Economic Event Tracking

WallStreetZen

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

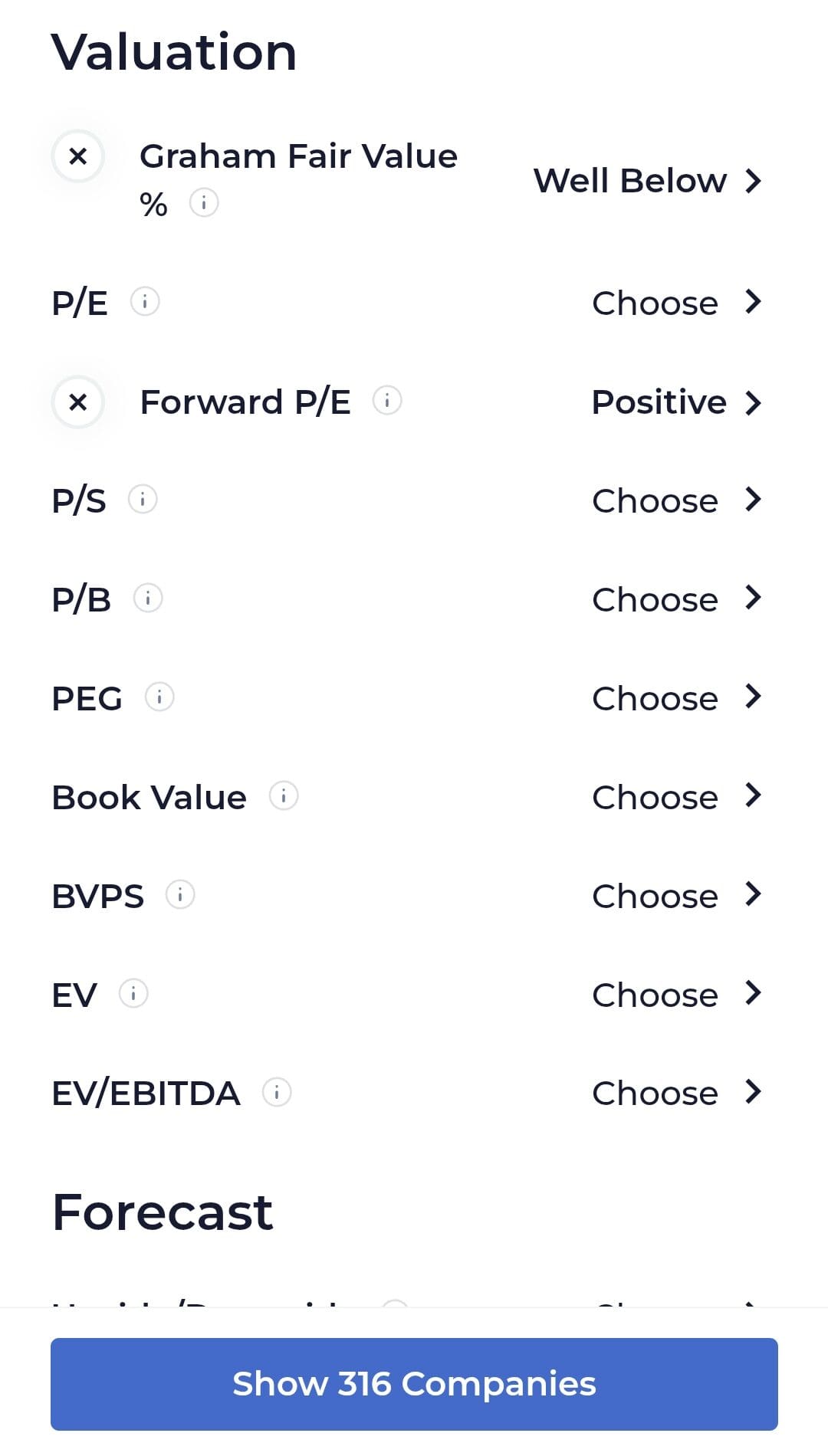

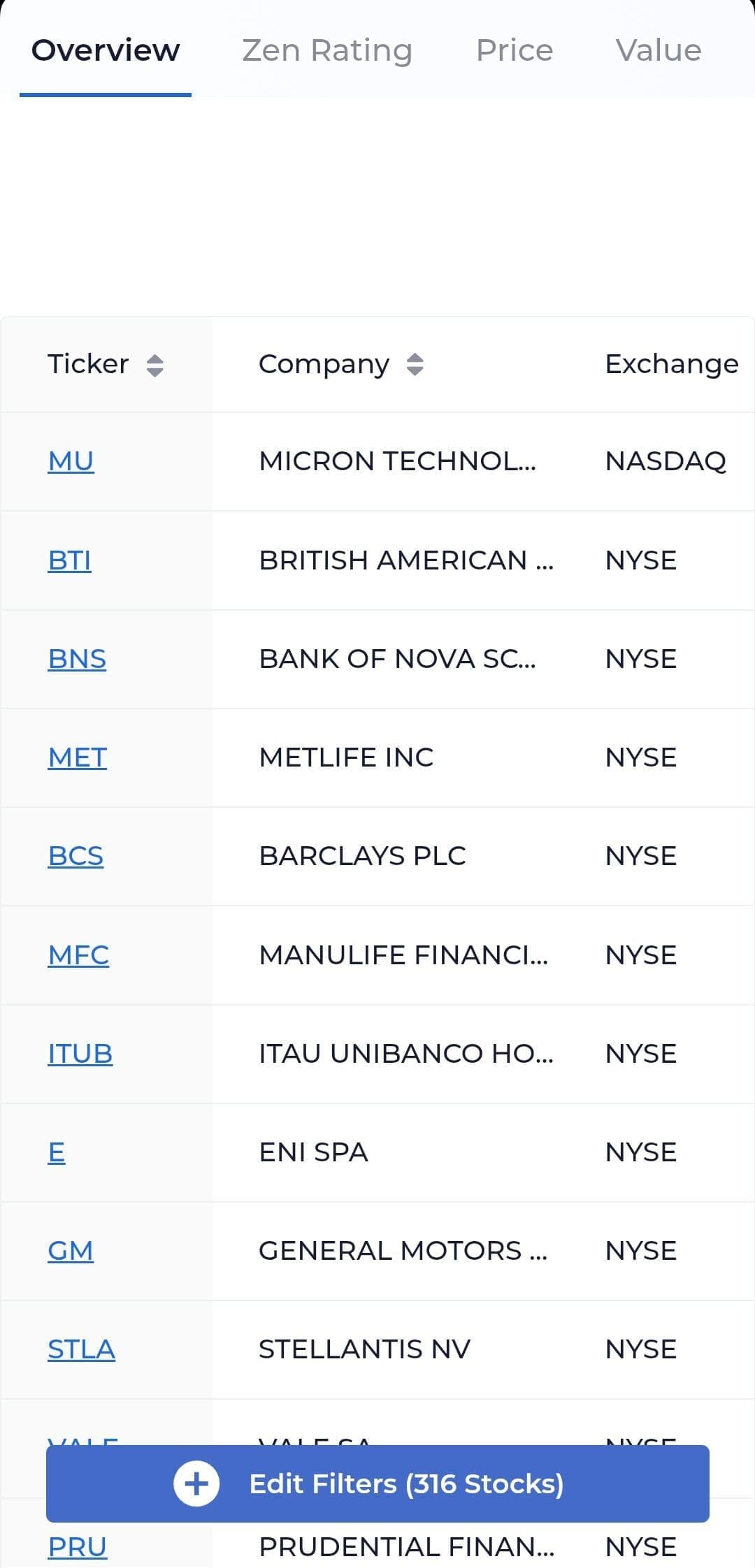

WallStreetZen’s free stock screener is a great tool for beginners, offering an easy way to filter stocks based on key financial metrics, growth potential, and analyst ratings.

The platform simplifies stock research with its intuitive interface and Zen Ratings system, making it accessible for new investors. We included it in our list because it balances simplicity with powerful insights.

Besides its free stock screener, WallStreetZen also provides Zen Ratings, exclusive stock lists, in-depth due diligence checks, and top analyst rankings. Its unique approach combines AI-driven insights with fundamental analysis

- Stock Idea Lists

- Due Diligence Score

- Stock Screener

- Top Performing Analysts

- Zen Ratings System

- Stock Forecasts

- Earnings & Dividends Calendar

- Insider Transactions Tracker

- 52-Week Highs & Lows

- Most Active Stocks List

- Buy The Dip Stocks

- Real-Time Watchlist Updates

What Is a Stock Screener and Why Is It Good for Beginners?

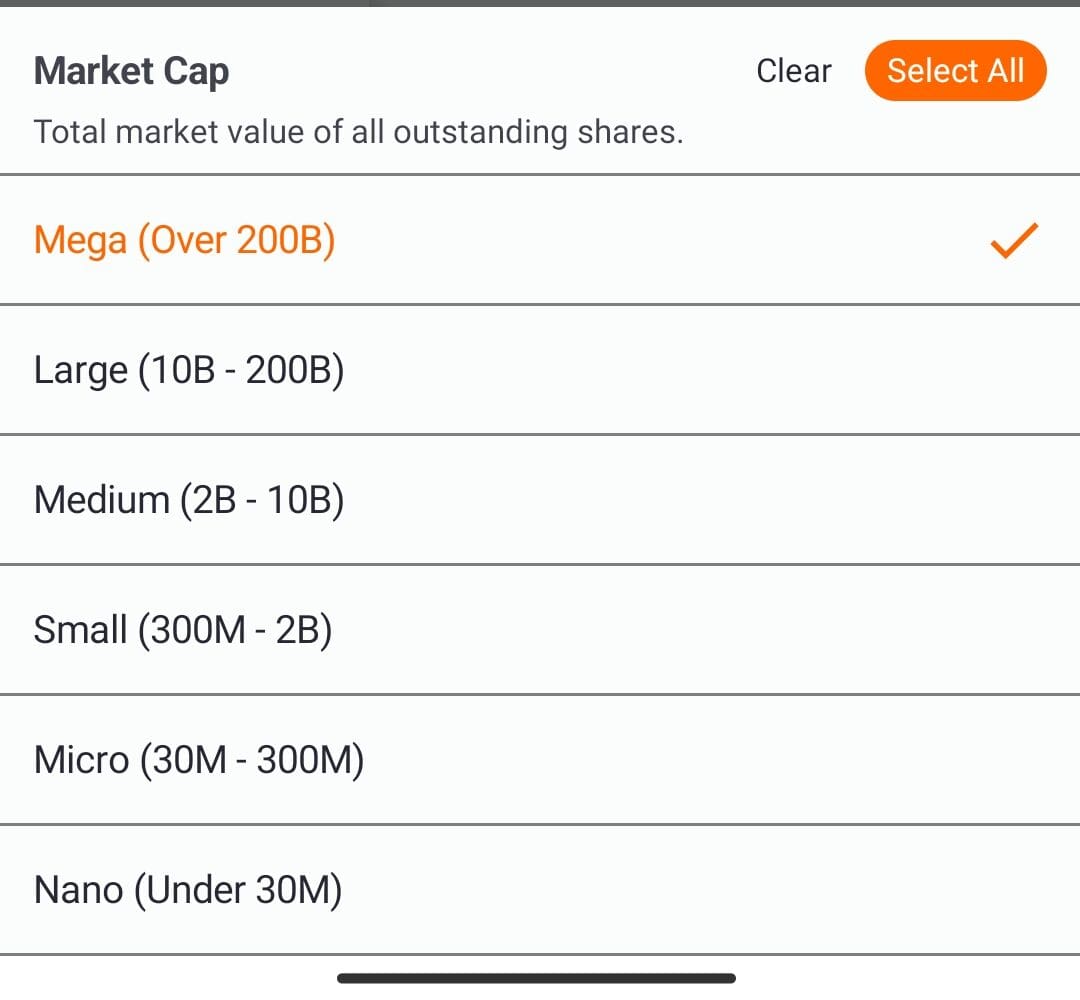

A stock screener is an online tool that helps investors filter stocks based on specific criteria such as price, market capitalization, dividend yield, P/E ratio, and more.

It acts like a search engine for stocks, allowing users to quickly narrow down thousands of options to a handful of promising investment opportunities.

For beginners, stock screeners, especially free ones, are invaluable because they simplify the research process and provide a structured way to analyze the stock market without requiring deep financial expertise.

Free Stock Screener for Beginners: What to Look For?

A free stock screener is an essential tool for beginners to filter and analyze stocks without paying for premium services. When choosing a free stock screener, consider these key features:

- User-Friendly Interface – A simple, easy-to-navigate design helps beginners quickly understand and use the tool.

- Basic Fundamental Filters – Must include essential metrics like P/E ratio, market cap, dividend yield, and revenue growth.

- Technical Indicators – Look for basic indicators such as moving averages, RSI, and volume trends for analyzing price movements.

- Customizable Filters – The ability to adjust screening criteria based on individual investment goals (e.g., value stocks, growth stocks).

- Pre-Set Screening Options – Some screeners offer ready-made filters for common investing strategies, perfect for beginners.

- Real-Time or Near Real-Time Data – While free tools may have some delay, a good screener should still provide timely updates.

- Stock Charts & Visuals – Interactive charts and data visualization make analysis easier for new investors.

- Watchlist & Alerts – Some screeners allow users to save favorite stocks and set alerts for price changes or news updates.

- Market Coverage – Ensure the screener covers stocks from major exchanges like NYSE, NASDAQ, and international markets if needed.

By focusing on these features, beginners can find a free stock screener that simplifies stock research and improves their investment decisions.

7 Things Beginners Can Do with a Free Stock Screener

A free stock screener is a powerful tool for beginners to filter and analyze stocks based on specific criteria.

Here are seven ways new investors can use a stock screener to improve their decision-making:

-

Find Undervalued Stocks (Value Investing)

Beginners can search for stocks trading below their intrinsic value by using filters like low P/E ratio, high earnings growth, and strong book value.

-

Discover High-Growth Stocks

For those interested in growth investing, a screener can filter stocks with high revenue and earnings-per-share (EPS) growth.

For example, screening for tech stocks with revenue growth above 20% might highlight companies like Nvidia (NVDA).

-

Identify Dividend Stocks for Passive Income

Investors looking for stable, income-generating stocks can screen for high dividend yield and strong payout ratios.

For instance, screening for dividend yields above 4% might lead to stocks like AT&T (T) or Procter & Gamble (PG).

-

Spot Momentum Stocks for Short-Term Gains

A stock screener can help identify stocks with high trading volume and upward price momentum, useful for swing traders.

Filtering for RSI above 70 and a 10% price increase in the last month might highlight trending stocks.

-

Compare Stocks Within a Sector

Beginners can use stock screeners to analyze companies within the same industry.

For example, filtering for automobile stocks with a P/E ratio under 15 could help compare Ford (F) and General Motors (GM).

-

Avoid Risky & Overhyped Stocks

By filtering out stocks with high debt, declining earnings, or extreme volatility, beginners can avoid risky investments.

For example, avoiding companies with a debt-to-equity ratio above 2 can reduce exposure to financially unstable firms.

Hidden Limitations of Free Stock Screeners

Free stock screeners are valuable tools for beginners, but they come with certain limitations that investors should be aware of.

Delayed Data Updates – Many free screeners provide delayed stock prices instead of real-time data, making them less effective for day trading.

Limited Customization – Free versions often lack advanced filters, preventing investors from applying highly specific screening criteria.

No Advanced Technical Analysis – While basic indicators like RSI and moving averages are available, free screeners usually lack in-depth charting tools, backtesting, or AI-driven insights.

Restricted Access to International Markets – Many free stock screeners focus primarily on U.S. stocks, offering limited coverage of international exchanges.

Ads & Limited Saved Screens – Free screeners often come with ads, and they may restrict the number of custom screens or watchlists a user can save.

Less Reliable Financial Data – Some free screeners may pull data from sources with inconsistencies or missing financial details, making fundamental analysis less accurate.

While free stock screeners are great for basic research, serious investors may need paid versions for real-time data, advanced screening tools, and broader market access.

FAQ

They use predefined filters and stock market data to help investors quickly find stocks that match their investment criteria, such as undervalued stocks or high-growth companies.

Yes, but they may have limitations like delayed data, fewer filters, and less in-depth analysis compared to paid versions.

Look for basic fundamental and technical filters, charting tools, watchlists, and easy-to-use interfaces.

Free screeners are not ideal for day trading due to delayed data and limited real-time filtering, but they can still help find volatile stocks.

Some free stock screeners allow limited customization, but full flexibility in screening criteria is typically a premium feature.

Yes, many free stock screeners allow filtering by dividend yield, payout ratio, and dividend growth.

Upgrade if you need real-time data, advanced filters, backtesting, international stock access, or in-depth analysis tools.