Coinbase Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%.

-

Overview

- FAQ

Coinbase is one of the most popular cryptocurrency exchanges in the U.S., known for its user-friendly interface and wide range of supported cryptocurrencies. It allows users to buy, sell, and store +250 cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin.

What sets Coinbase apart is its simplicity, making it a great choice for beginners. The platform supports various payment methods, such as bank transfers, PayPal, and debit/credit cards, making it easy to fund your account.

Security is another highlight of Coinbase. The platform uses advanced features like two-factor authentication (2FA) and cold storage to protect user funds.

However, Coinbase's fees are higher compared to some competitors, especially for smaller transactions. Also, users have reported issues with customer service, including long response times.

Can I transfer crypto from Coinbase to another wallet?

Yes, you can transfer cryptocurrency from Coinbase to another wallet. Simply go to your Coinbase account, select the crypto you want to send, enter the recipient's wallet address, and confirm the transaction. Remember that network fees may apply.

How long does it take to withdraw funds from Coinbase?

Withdrawal times on Coinbase vary depending on your chosen method. Bank transfers can take 1-3 business days, while PayPal and debit card withdrawals are typically faster, sometimes processing instantly. Crypto withdrawals depend on network conditions.

Can I use Coinbase for retirement accounts?

Coinbase does not directly offer retirement accounts, but you can access crypto through services like Alto CryptoIRA, which allows you to invest in crypto assets within a self-directed IRA. Check with Alto for eligibility and fees.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Higher Fees |

User-Friendly Interface | Limited Advanced Features for Experienced Traders |

Strong Security Features | Customer Support Challenges |

Regulatory Compliance | Limited Privacy |

Mobile and Desktop Accessibility | Crypto Withdrawal Network Fees |

Educational Resource |

Supported Cryptocurrencies & Assets

Coinbase supports a wide variety of cryptocurrencies, offering +250 digital assets.

This includes popular coins like Bitcoin and Ethereum, as well as a range of altcoins, stablecoins, and even tokens associated with decentralized finance (DeFi) projects.

The platform also supports NFTs through its dedicated marketplace, allowing users to create, buy, and sell digital collectibles.

In addition to cryptocurrencies, Coinbase supports stablecoins like USD Coin (USDC), which is pegged to the U.S. dollar and can be used for stable transactions or earning rewards.

Coinbase’s Legal Issues & Trustworthiness

In 2023, the SEC filed a lawsuit against Coinbase, accusing the platform of operating as an unregistered securities exchange, broker, and clearing agency.

This lawsuit is related to the SEC’s stance on classifying certain cryptocurrencies as securities, which could have widespread implications for the crypto industry.

Coinbase disputes these claims and is working to clarify the regulatory framework around cryptocurrencies in the U.S.

Main Features For Crypto Investors

Here are the key features that I found most appealing in Coinbase:

-

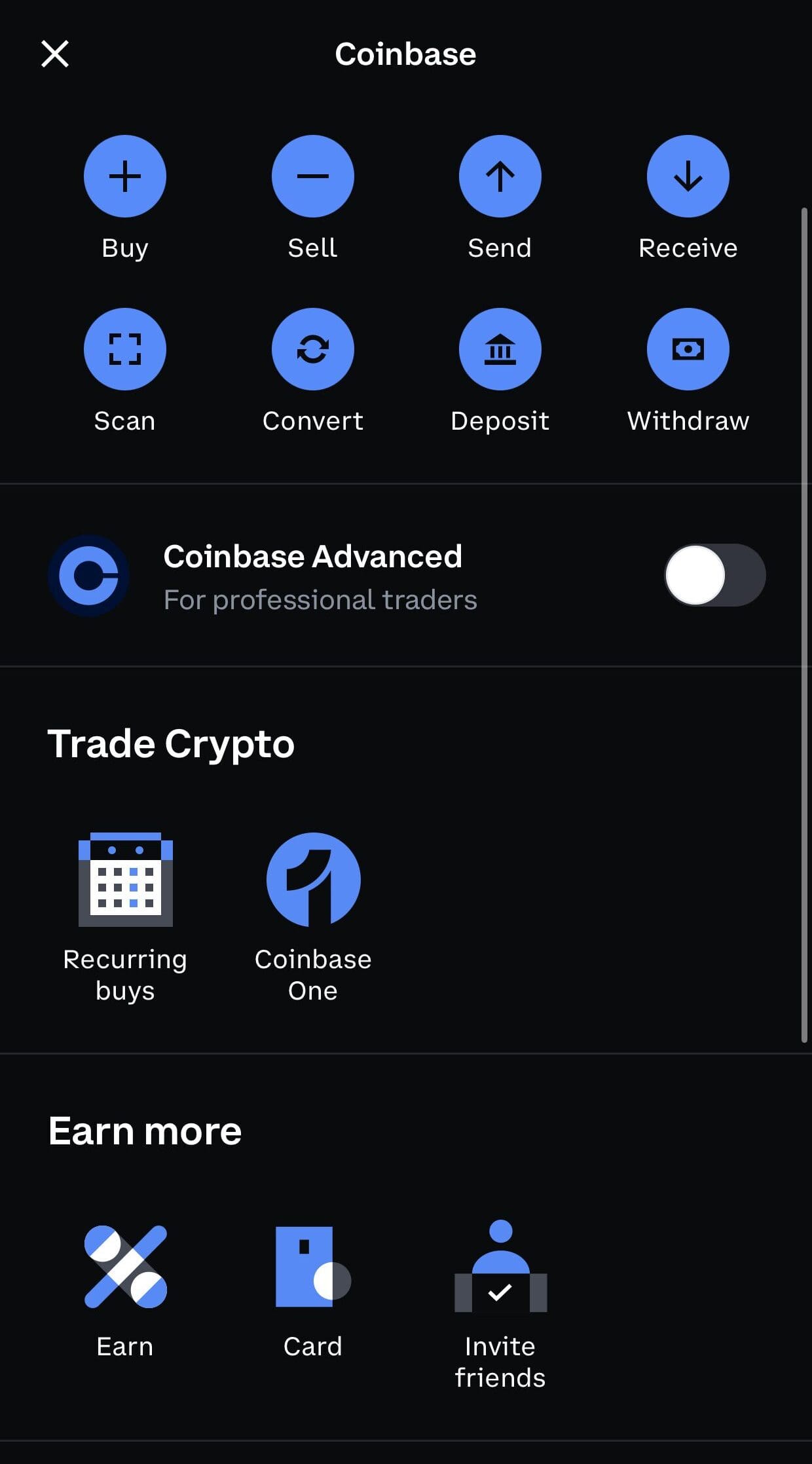

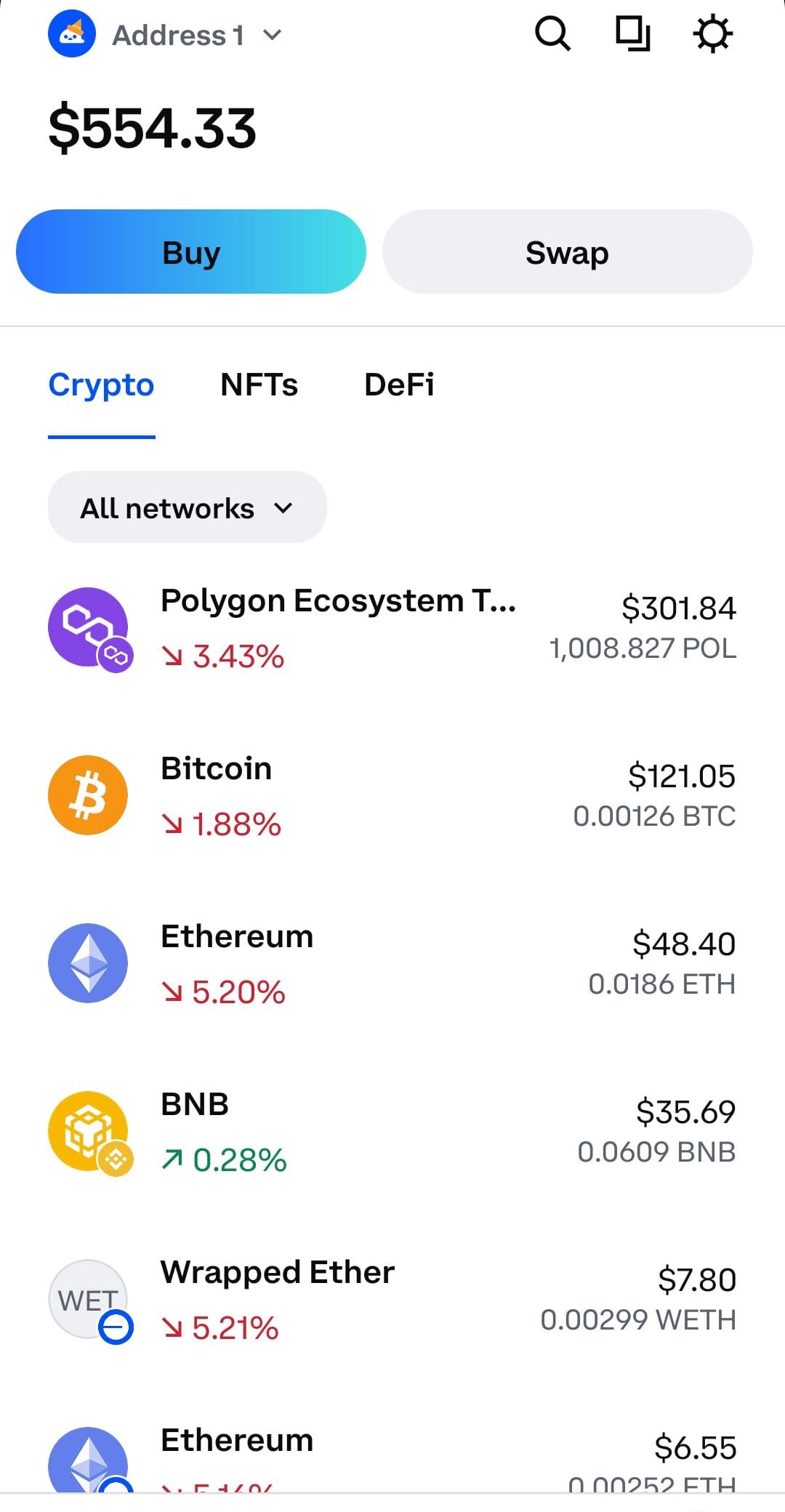

Simple Interface for Newbies, Less Enticing for Experts

Coinbase offers a very beginner-friendly user interface, making it easy to buy, sell, and store cryptocurrencies.

The platform is designed to be intuitive, with clear options for purchasing or converting digital assets.

Beginners can easily navigate the site or mobile app to complete transactions with minimal technical knowledge.

For advanced traders, Coinbase also offers an “Advanced Trade” platform with more complex features like real-time charts and order types (market, limit, stop).

While the basic version is streamlined, the mobile app mirrors the desktop functionality, providing a seamless experience on-the-go.

This flexibility allows users to transition from beginner to more advanced trading as they gain experience.

-

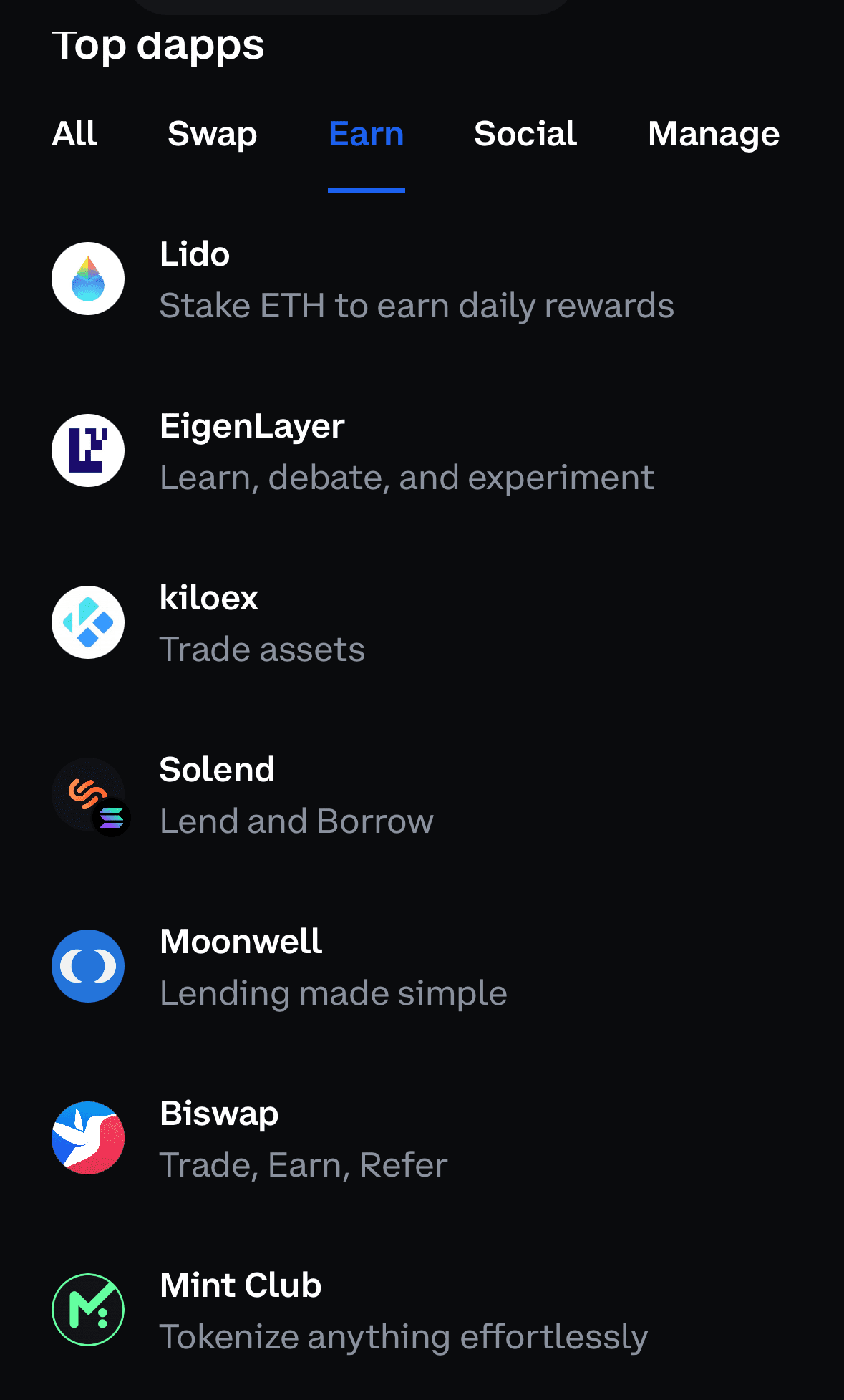

Coinbase and Web3: Exploring NFTs and Decentralized Innovation

Coinbase makes it easy for users to explore the world of NFTs and Web3 applications.

The platform offers access to a native NFT marketplace where users can buy, sell, and create NFTs. It supports popular blockchains like Ethereum and Solana, enabling seamless NFT transactions.

Coinbase also integrates with decentralized finance (DeFi) apps and provides a self-custody wallet for managing Web3 assets securely.

For users interested in blockchain gaming, Coinbase allows interactions with various game-related NFTs and assets.

Through its wallet, users can connect to decentralized apps (dApps) and participate in Web3 activities like yield farming or lending.

This focus on Web3 ensures that Coinbase stays at the forefront of blockchain innovation

-

Coinbase Fees & Costs: Transparency Comes at a Price

Coinbase charges various fees that depend on the transaction method, asset type, and platform you use. Here's a breakdown:

- Card Payments: Up to 3.99% for purchasing crypto using a debit or credit card.

- Bank Transfers: 1.49% fee for purchases made with a linked bank account via ACH transfer.

- Advanced Trade: Fees are lower here, with taker fees ranging from 0.05% to 0.60% depending on your 30-day trading volume.

- Spread Fee: Coinbase typically charges a 0.5% spread fee on both crypto purchases and sales, which is the difference between the buy and sell price.

- Withdrawal Fees: You may also incur network fees for cryptocurrency withdrawals, particularly when blockchain networks are congested.

Spot Trading Fees | Future Trading Fees |

|---|---|

$0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | 0.40% – 0.60%

0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.04%.

|

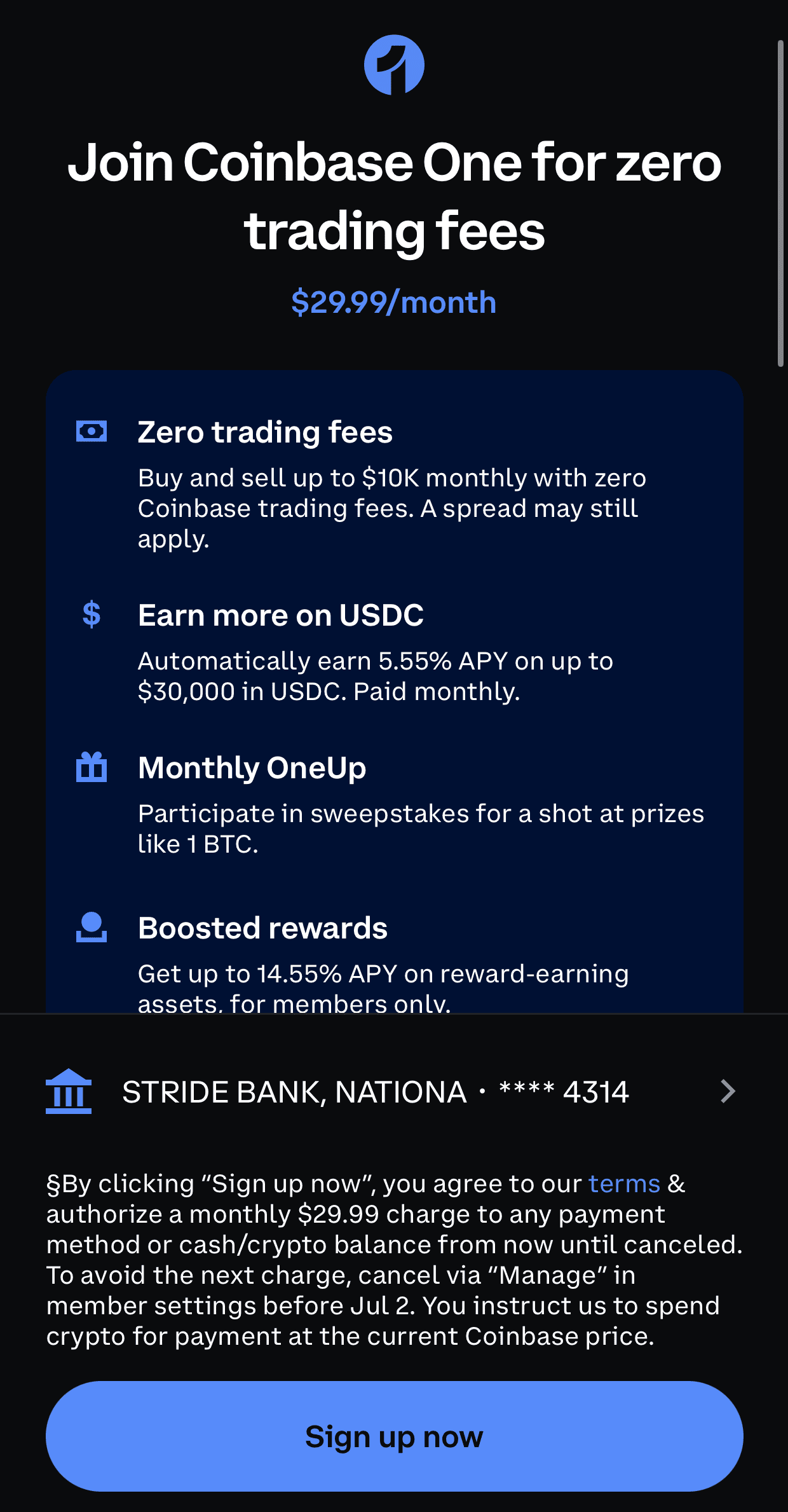

For users who want to avoid high fees, Coinbase offers Coinbase One, a subscription service at $29.99 per month, which includes zero fees on trades up to $10,000 per month.

-

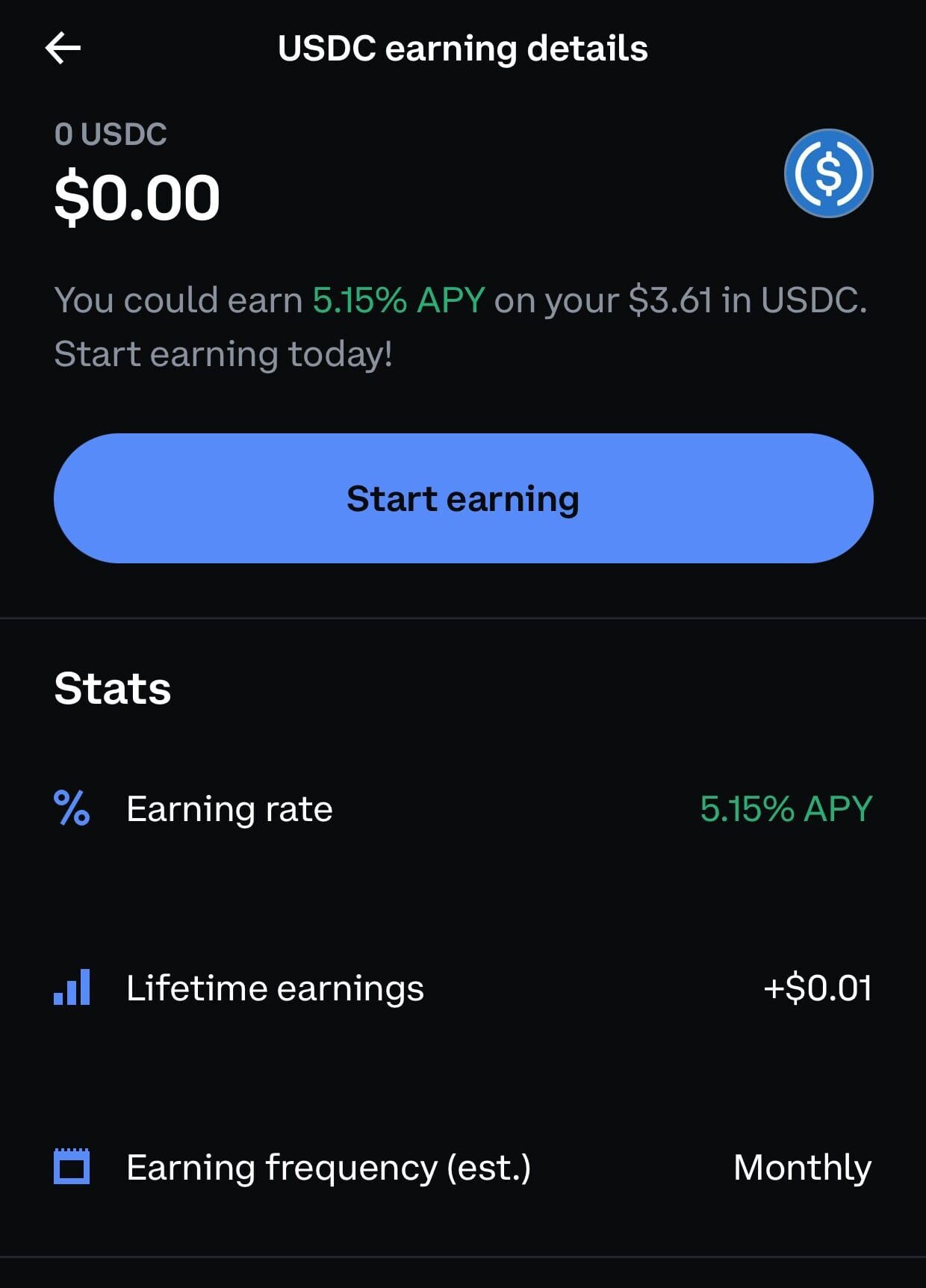

Coinbase Staking: Earn Rewards on Your Crypto

Coinbase offers users the chance to stake certain cryptocurrencies like Ethereum, Cardano, and Solana to earn passive income.

Staking involves locking your crypto in the network to help secure the blockchain, and in return, you receive rewards in the form of more crypto.

Coinbase also provides staking rewards on select coins, with APY of up to 5% (always check updated rates). This is a simple way to grow your holdings without having to actively trade.

Staking is available directly from your Coinbase account, making it easy to earn rewards while holding your assets long-term.

-

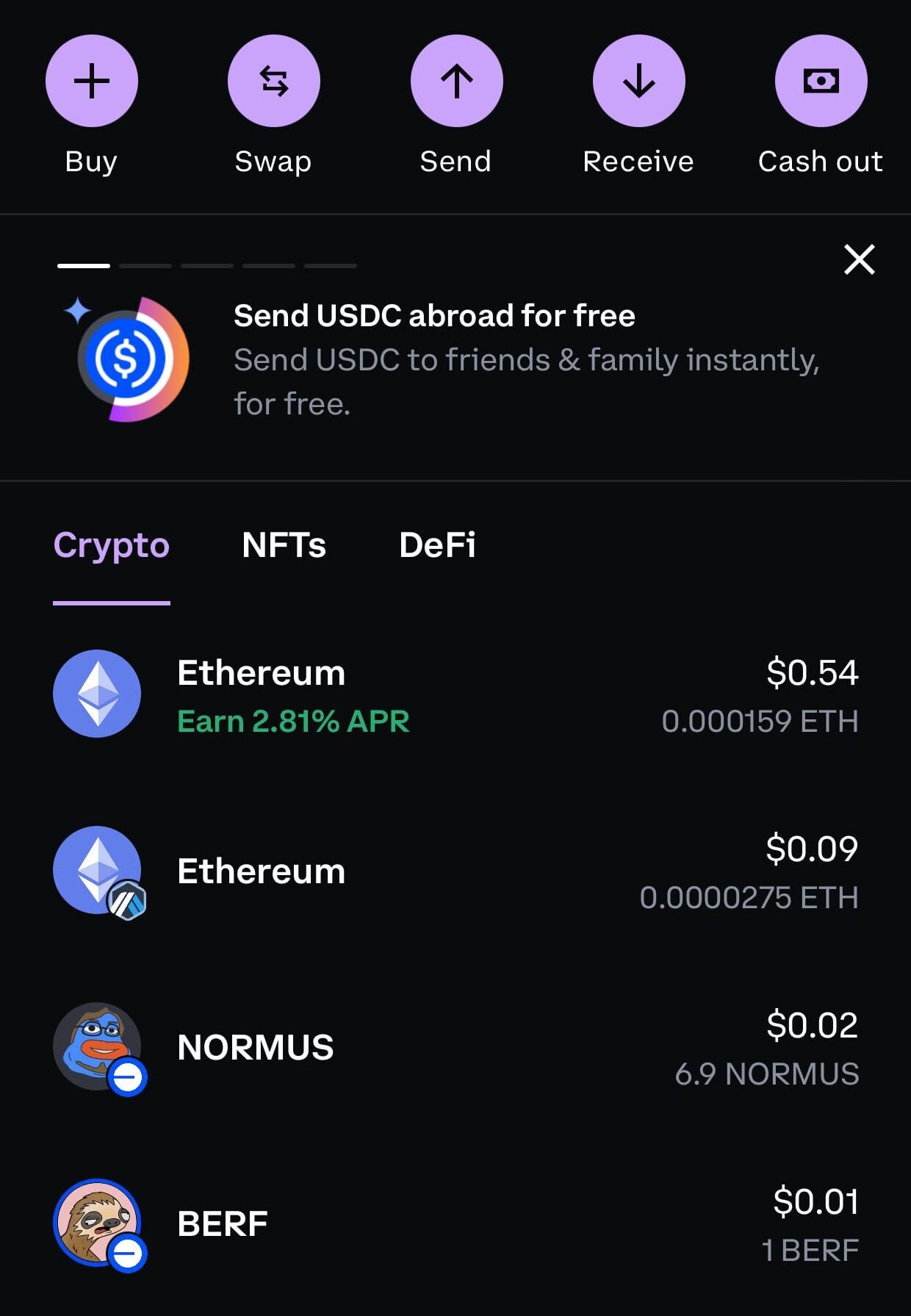

Coinbase Wallet: A Self-Custody Solution for Your Crypto

The Coinbase Wallet is a self-custody wallet that gives users full control over their cryptocurrency.

Unlike Coinbase’s main exchange platform, where Coinbase holds your private keys, the wallet lets you store and manage your assets independently.

It supports a wide range of cryptocurrencies and NFTs, allowing users to connect to decentralized apps (dApps) and participate in Web3 activities.

Users can also use the wallet for safe, off-exchange storage of their crypto assets and interact with platforms in the DeFi space.

Coinbase Wallet provides an added layer of security, offering a recovery phrase to help you regain access if needed.

-

Coinbase One: Premium Features for Frequent Traders

Coinbase One is a premium subscription service that offers several key benefits for active traders. For a monthly fee of $29.99, users can access the following:

- Zero Fees: Trade up to $10,000 worth of crypto each month without any trading fees. This is especially beneficial for regular traders looking to reduce transaction costs.

- Priority Customer Support: Enjoy 24/7 priority support, ensuring faster response times and quicker resolutions to any issues or inquiries.

- Enhanced Staking Rewards: Subscribers get boosted rewards for staking certain cryptocurrencies on the platform.

- $1 Million Account Protection: Coinbase One members are covered with $1 million account protection, providing an added layer of security for your crypto assets.

Coinbase Free Plan | Coinbase One | |

|---|---|---|

Monthly Fee | Free | $29.99/month |

Trading Fees | High (up to 3.99%) | Zero fees up to $10,000/month |

Customer Support | Standard support | Priority 24/7 support |

Staking Rewards | Standard | Enhanced rewards |

Account Protection | Standard | $1 million protection |

-

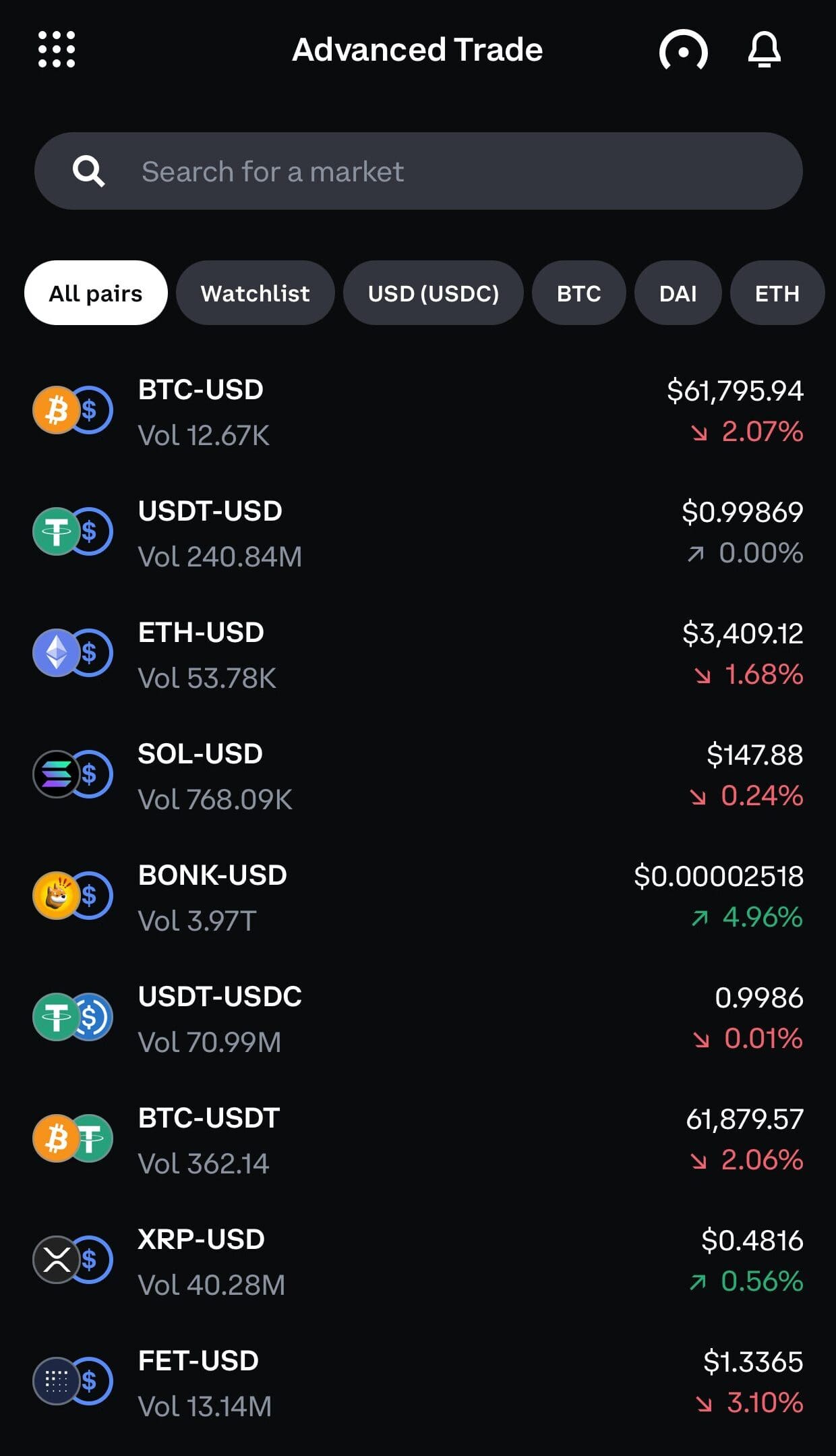

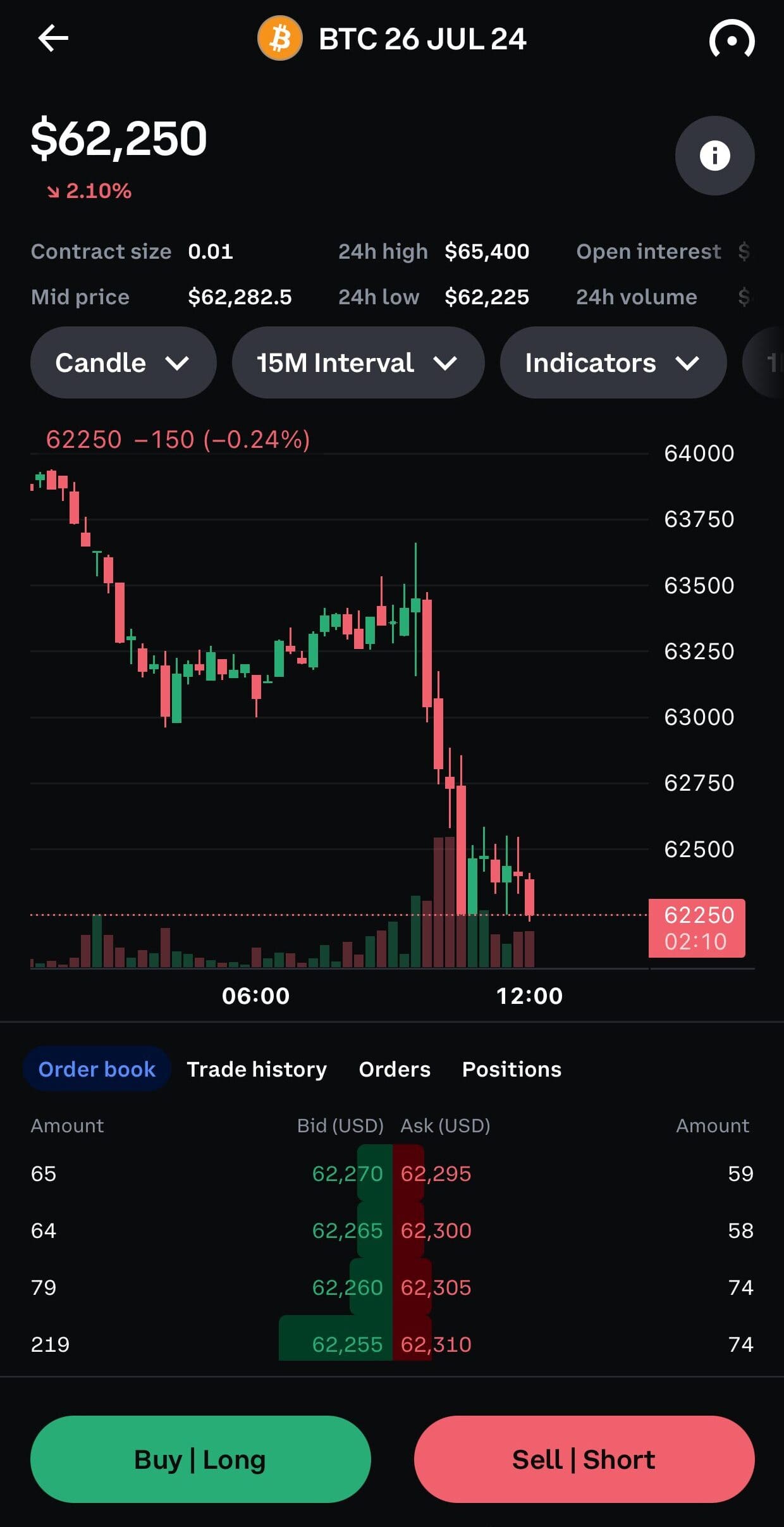

Coinbase Advanced Trade: Trading Tools For Professionals

Coinbase Advanced Trade is designed for active and professional traders who need more advanced features than the basic Coinbase platform.

It provides powerful tools and lower fees, making it ideal for those who are experienced in cryptocurrency trading:

- Lower Trading Fees: Coinbase Advanced Trade offers lower fees than the regular Coinbase platform, with fees based on a user’s 30-day trading volume.

- Advanced Charting Tools: It provides advanced charting features powered by TradingView, giving traders access to technical analysis tools like real-time price charts, indicators, and drawing tools.

- More Order Types: Users can place limit, market, and stop orders, giving them greater control over trades.

- Faster Execution: The platform allows for faster execution of orders compared to Coinbase's basic platform, making it ideal for high-volume traders.

- Real-Time Data: Users get real-time order books and market depth, which is crucial for traders looking to track price movements and make informed decisions.

Let's break it down in a table and compare it with Coinbase One:

Coinbase Advanced Trade | Coinbase One | |

|---|---|---|

Monthly Fee | Free | $29.99/month |

Trading Fees | Lower fees (0.05% – 0.60% based on 30-day volume) | Zero fees up to $10,000/month |

Customer Support | Standard support | Priority 24/7 support |

Advanced Tools | Advanced charting, real-time data, custom orders | Basic features |

Staking Rewards | Standard | Enhanced rewards |

Account Protection | Standard | $1 million protection |

-

Coinbase Deposit & Withdrawal Methods: Fast and Convenient

Coinbase offers a variety of deposit and withdrawal methods to make funding your account and withdrawing assets as smooth as possible.

Users can deposit funds through bank transfers (ACH), debit/credit cards, PayPal, and even Apple Pay.

Withdrawals are similarly flexible, with options for bank accounts, PayPal, or converting crypto to fiat.

ACH deposits are typically free, but debit card deposits come with higher fees, and wire transfers can incur charges.

The platform supports various fiat currencies, including USD, EUR, and GBP.

While most withdrawals are processed quickly, bank transfers can take a few business days, and crypto withdrawals depend on network conditions, which may vary in speed and cost.

-

Regulated & Insured: A Look at Its Coinbase Security Features

Security is a top priority for Coinbase, which implements multiple layers of protection for users.

The platform uses strong encryption to secure transactions and personal data. Two-factor authentication (2FA) is required for account access, and withdrawal whitelisting ensures funds are only sent to approved addresses.

Coinbase also complies with Know Your Customer (KYC) regulations, ensuring that all users verify their identity before trading.

For added protection, the platform stores 98% of user funds in cold storage, away from online threats.

While Coinbase is not FDIC-insured for crypto holdings, it offers crime insurance for digital assets held on the platform, though this doesn't cover user account breaches.

Regulatory-wise, Coinbase is licensed and follows compliance measures in multiple jurisdictions.

-

Coinbase Futures & Margin Trading

Coinbase offers Futures and Margin Trading on its platform, allowing users to amplify their trading positions by borrowing funds.

Futures trading enables you to enter contracts that speculate on the future price of assets like Bitcoin or Ethereum.

With margin trading, you can borrow funds to increase the size of your trade, enabling higher potential profits, but with the risk of greater losses.

These features are available for more experienced traders and can provide greater flexibility and leverage in volatile markets.

-

Coinbase OTC: Perfect for High-Volume Crypto Traders

Coinbase’s Over-The-Counter (OTC) service is designed for high-net-worth individuals and institutional clients who want to execute large crypto trades privately.

OTC allows you to trade large volumes without impacting the market price, which can happen with smaller trades on the open market.

The service provides personalized trading with dedicated account managers, ensuring the best prices and execution for larger orders.

This is ideal for users dealing with millions of dollars in assets who need discretion and more tailored support.

Is Coinbase Exchange Available In The US?

Yes, Coinbase is available in the United States and is one of the largest cryptocurrency exchanges operating there.

It is accessible in most states, although some features may not be available in all regions due to state-specific regulations. For example, certain services like staking or specific cryptocurrencies might be restricted in some states.

As of now, Coinbase is not available in the following states:

- Hawaii

- New York

- Texas

- North Carolina

These states have specific regulatory or legal challenges that prevent Coinbase from offering all of its services, though you may still be able to access limited features.

When Coinbase May Be a Good Choice? When Not?

Coinbase, like any financial service, may not suit every user’s needs.

Below, we outline the types of investors who could benefit from Coinbase and those who might prefer an alternative:

When Coinbase May Be a Good Choice | Who Should Look Elsewhere |

|---|---|

Beginners Looking for Simplicity | Experienced Traders Needing Advanced Tools |

Casual Traders | Traders Who Want Lower Fees |

Investors Prioritizing Security | Privacy-Conscious Users |

Users Interested in NFTs & Web3 | |

Traders Looking for Educational Resources |

4 Simple Steps to Set Up the Coinbase Account

Let's see the main steps when setting up an account with Coinbase:

-

1. Sign Up for Coinbase

To get started with Coinbase, visit their website or download the mobile app.

You’ll need to provide your email address, create a strong password, and choose your country of residence.

Make sure the email you use is secure, as Coinbase will send important notifications and verification links to this address.

Our tips:

🔹 Consider using a password manager to create a strong, random password.

🔹 Check the country’s regulations in your region, as some services might not be available everywhere.

-

2. Complete KYC Verification

After signing up, Coinbase requires you to verify your identity to comply with regulatory requirements (KYC – Know Your Customer).

You will be prompted to upload a government-issued ID, like a driver’s license or passport, and sometimes a selfie for additional verification.

The verification process can take anywhere from a few minutes to a few days, depending on the volume of users.

Our tips:

🔹 Have your ID ready and ensure it’s legible for a smoother verification process.

🔹 If you're using your phone, take good quality photos with clear lighting to avoid delays.

-

3. Link a Payment Method

To buy crypto, you'll need to link a payment method, such as a bank account, debit card, or PayPal.

Bank accounts (ACH) typically have lower fees, while debit card payments are faster but come with higher fees.

Choose the option that best suits your needs based on speed and cost.

Our tips:

🔹 For faster transactions, link your debit card or PayPal, but be mindful of higher fees.

🔹 Bank account transfers may take several business days, so plan accordingly for quicker purchases.

🔹Some regions may have limited payment options, so be sure to check what’s available in your area.

-

4. Fund Your Account & Start Trading

Once your payment method is linked and your account is verified, you can deposit funds.

You can use your linked payment method to buy crypto or transfer funds from your bank account.

After funding your account, you can start trading on Coinbase.

Our tips:

🔹 Start with small transactions to familiarize yourself with the platform.

🔹 Review the transaction fees before making a purchase to avoid unexpected costs.

🔹 Keep track of your purchases and fees, as they can add up, especially with small transactions.

FAQ

Yes, Coinbase allows users to buy cryptocurrency using a credit card. However, using a credit card comes with higher fees compared to other payment methods like bank transfers. Be aware of the 3.99% fee when buying with a credit card.

If you forget your password, Coinbase allows you to reset it through the email address associated with your account. Simply follow the instructions in the password reset email to regain access.

Yes, Coinbase allows users to buy, sell, and trade NFTs directly on its platform. You can access Coinbase’s NFT marketplace to explore, create, and trade unique digital assets such as art and collectibles.

Explore Crypto Wallets

How We Rated Crypto Exchanges: Review Methodology

At The Smart Investor, we evaluated crypto exchanges based on their overall value, security, and trading experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to traders and investors, including fees, security, liquidity, and available assets. Each exchange was rated based on the following criteria:

- Fees & Costs (15%): We prioritized exchanges with low trading fees, competitive spreads, and transparent pricing. Some platforms had hidden withdrawal fees or costly trading structures.

- User Experience & Interface (15%): A fast, intuitive, and well-designed platform scored highest. Some exchanges felt clunky or slow, impacting trade execution and overall experience.

- Security & Regulation (20%): We favored exchanges with strong encryption, two-factor authentication (2FA), cold storage, and regulatory compliance. Some lacked proper security, making them high-risk.

- Trading Tools & Features (30%): The best exchanges offered advanced charting, real-time market data, order types (limit, stop-loss), and automation tools. Some lacked depth, limiting professional traders.

- Supported Cryptocurrencies (10%): We rated exchanges higher if they supported a broad range of cryptocurrencies, including major coins, altcoins, and stablecoins. Some had limited selections, restricting options.

- Liquidity & Execution Speed (5%): Exchanges with high liquidity, deep order books, and fast execution times scored highest. Lower-rated platforms had frequent slippage or delays.

- Additional Features (5%): We favored exchanges with staking, lending, fiat on-ramps, NFT marketplaces, and DeFi integration. Some lacked these extras, making them less versatile.