Crypto.com OnChain

Wallet Type

Hot Wallet

Supported Coins

Our Rating

Swap Fee

-

Overview

- FAQ

The Crypto.com on-chain (formerly DeFi Wallet) is a non-custodial crypto wallet that gives users full control over their private keys and digital assets. Unlike custodial wallets, where an exchange holds your funds, this wallet allows you to store, swap, and earn rewards on 700+ tokens while keeping your assets completely in your hands.

With support for 28 blockchains, including Bitcoin, Ethereum, and Solana, the wallet provides secure access to decentralized apps (dApps), NFT marketplaces, and DeFi lending platforms.

Users can stake tokens like Ethereum and CRO to earn rewards or lend assets via integrated DeFi protocols such as Aave and Compound.

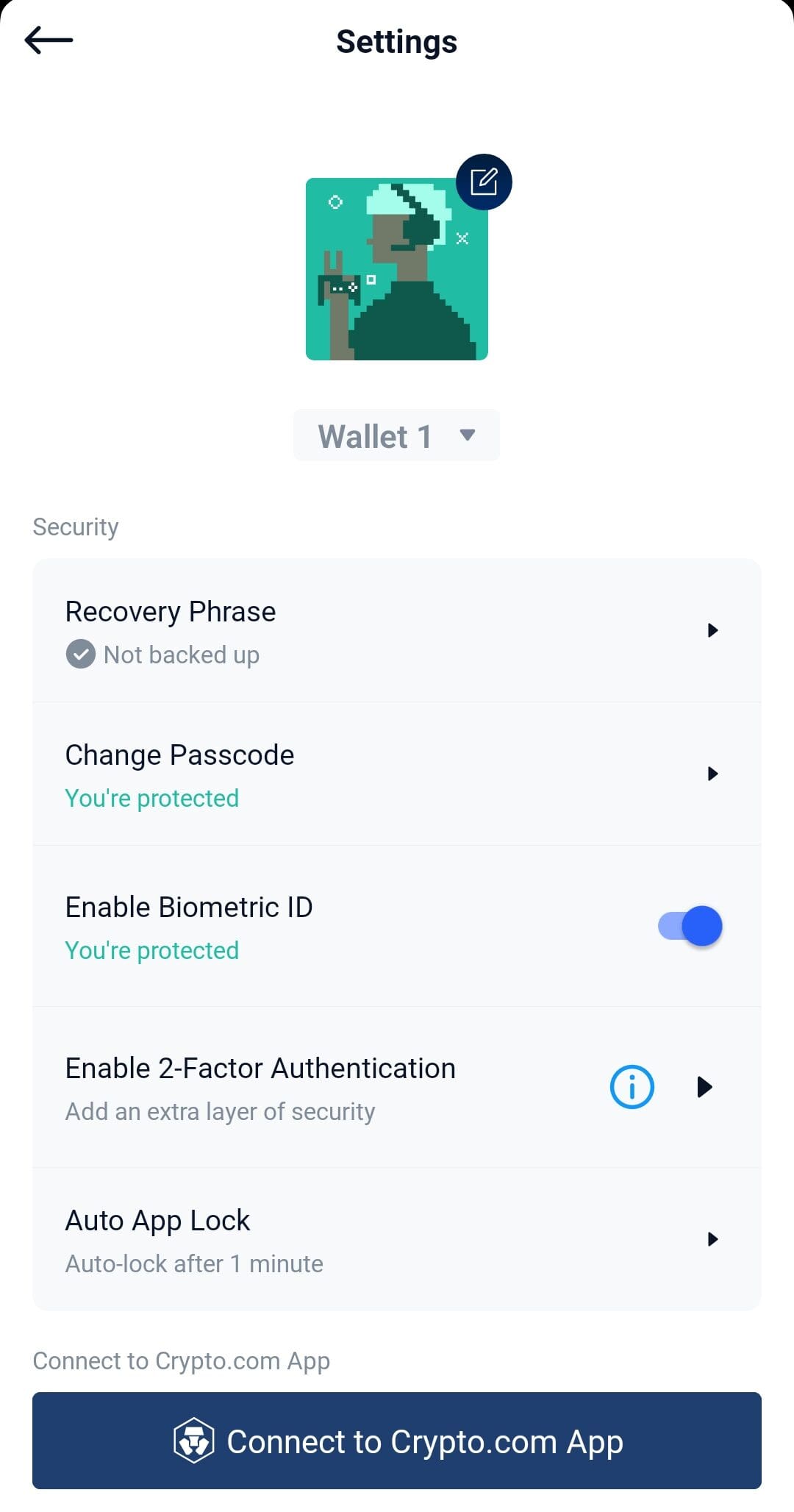

Security is a top priority, with features like biometric login, two-factor authentication (2FA), and encrypted private key storage. However, as a non-custodial wallet, you are solely responsible for your security—losing your recovery phrase means permanent loss of funds.

While it offers greater financial privacy with no identity verification required, users must pay gas fees for transactions and manage their own security.

Available as a mobile app and browser extension, the Crypto.com Onchain t is a solid choice for crypto users who want full control and access to DeFi features but requires careful management.

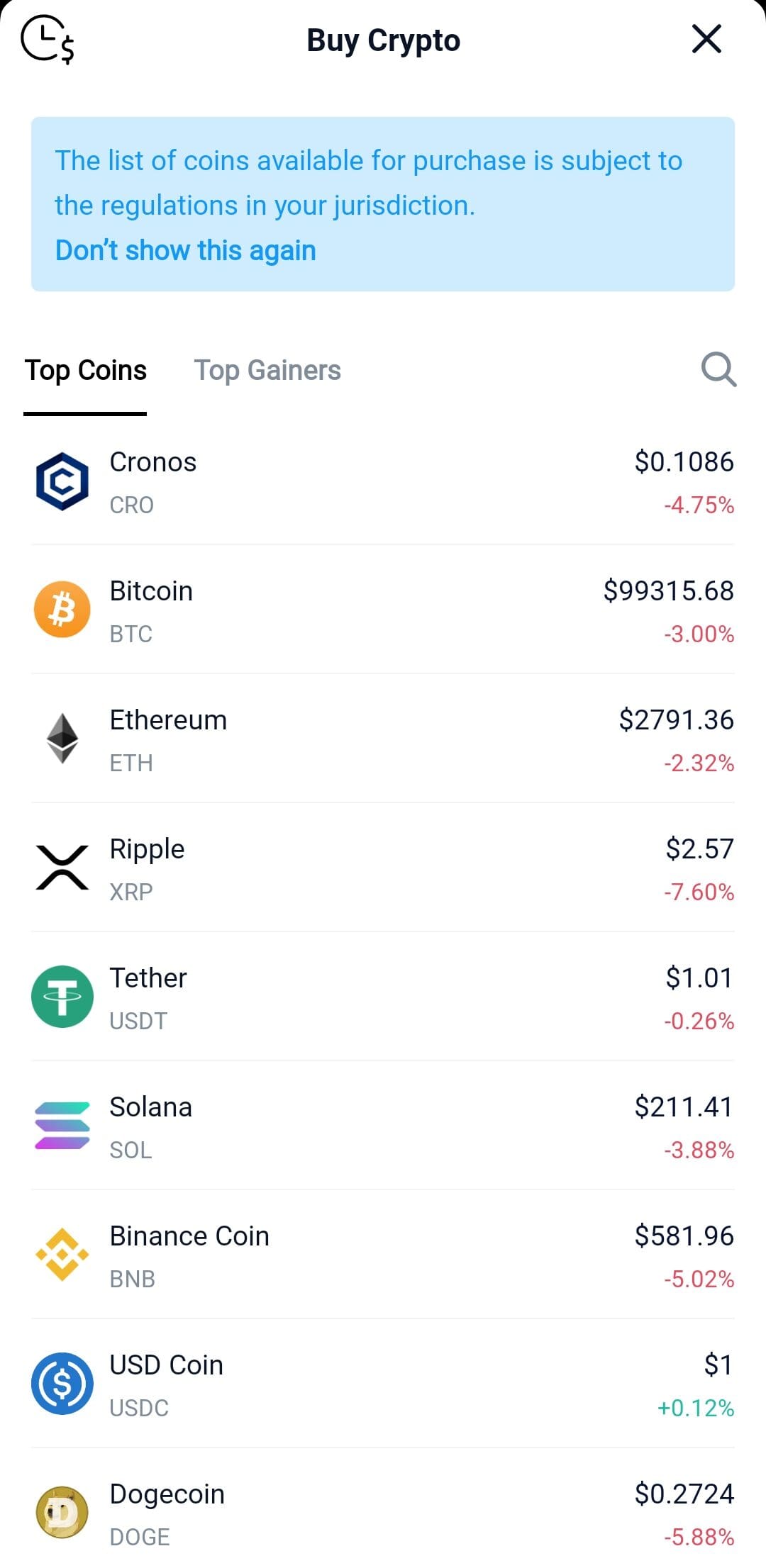

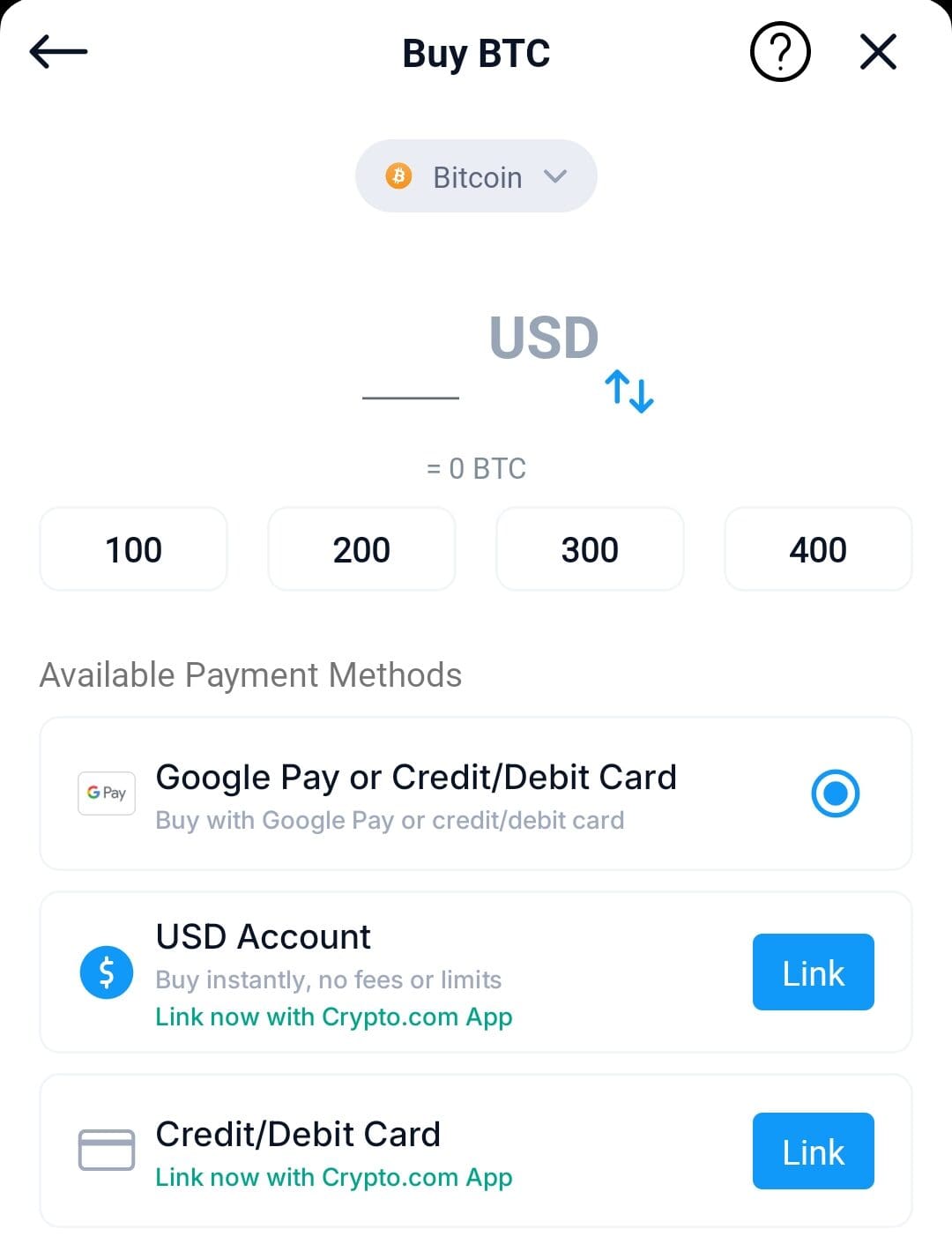

Can I buy crypto directly from the Crypto.com DeFi Wallet?

No, the wallet does not support fiat-to-crypto purchases. However, you can connect it to the Crypto.com App Wallet to buy crypto with fiat and then transfer it to your DeFi Wallet.

What happens if I forget my wallet passcode?

If you forget your passcode, you can reset it using your recovery phrase. If you lose both your passcode and recovery phrase, you will permanently lose access to your funds.

Can I recover my wallet if I delete the app?

Yes, you can reinstall the app and recover your wallet using your recovery phrase. Always back up your phrase before deleting the app to avoid losing access.

How long do transactions take on the Crypto.com DeFi Wallet?

Transaction times vary based on network congestion and the blockchain used. Ethereum transactions, for example, can take a few seconds to several minutes depending on gas fees and network activity.

Pros | Cons |

|---|---|

Full Control & Privacy | No Recovery When Losing Private Keys Or Recovery Phrase |

Supports 1,000+ Cryptocurrencies & NFTs | Gas Fees Can Be High |

DeFi Integration & Staking Rewards | No Multi-Signature Support |

NFT Storage & Marketplace Access | 0.05% Service Fee on DeFi Earnings |

Enhanced Security Features | More Complex Than Custodial Wallets |

Cross-Chain Swapping | |

Multi-Platform Access

|

What Cryptocurrencies & Other Assets Can You Store?

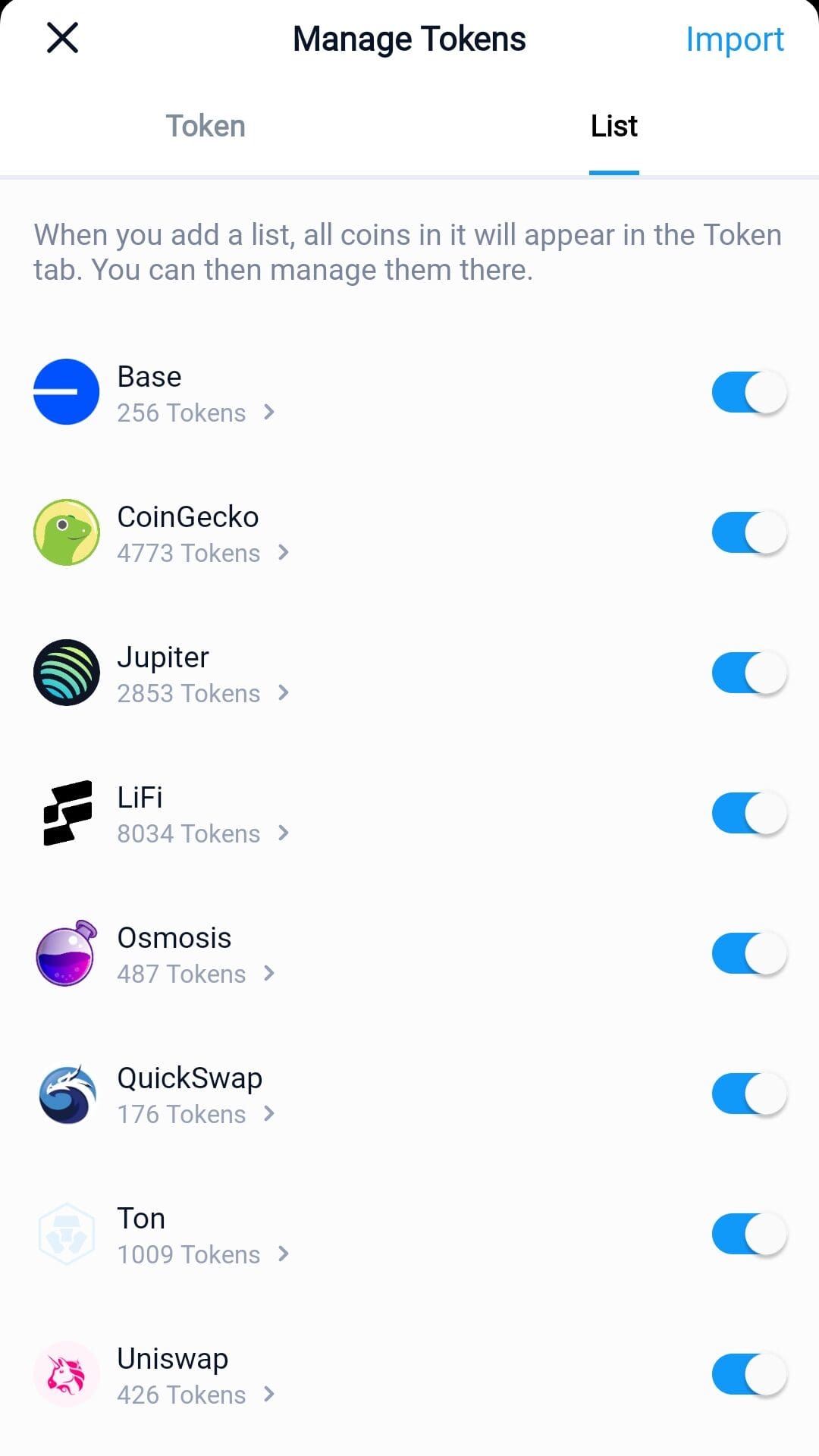

The Crypto.com Onchain supports a wide range of cryptocurrencies, stablecoins, and NFTs, making it a versatile choice for crypto users.

It allows you to store, swap, and manage over 1,000 digital assets across 28 different blockchains, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Binance Smart Chain (BSC).

The wallet also supports stablecoins like USDC, USDT, DAI, and Pax Dollar (USDP), which are useful for transactions and earning interest through staking or DeFi lending.

If you’re interested in staking, you can earn rewards on tokens like CRO (Crypto.com Coin), Ethereum, Polkadot (DOT), and Cardano (ADA).

For NFT collectors, the Crypto.com DeFi Wallet supports Ethereum and Polygon-based NFTs. You can store, view, and manage NFTs directly from the wallet and buy them from marketplaces like OpenSea, Crypto.com NFT, and Ebisu’s Bay.

Main Features For Crypto Investors

Here are the key features that I found most appealing in Crypto.com Onchain:

-

How Safe is Crypto.com Wallet?

Security is a top priority for any crypto wallet, and the Crypto.com Onchain includes several advanced features to protect your digital assets. It offers biometric authentication (fingerprint & Face ID), two-factor authentication (2FA), and encrypted private key storage to prevent unauthorized access.

Unlike some wallets, Crypto.com does not currently offer multi-signature support, meaning access relies solely on your passcode and recovery phrase.

However, the wallet integrates with Ledger, a cold storage (offline) option that significantly enhances security by keeping your private keys offline.

Because the wallet is non-custodial, you are the only one with access to your private keys. That means if you lose your recovery phrase, your funds are gone forever.

-

Staking & Earning Rewards: Grow Your Crypto

The Crypto.com Onchain offers multiple ways to earn passive income on your digital assets.

Users can stake popular tokens like Ethereum (ETH), CRO, Cardano (ADA), Polkadot (DOT), and Avalanche (AVAX) to receive rewards.

Another way to earn is DeFi lending, where you can deposit assets into lending pools on decentralized finance platforms like Aave and Compound.

These platforms allow others to borrow crypto, and you earn interest in return—similar to how a bank pays interest on savings.

The wallet provides flexible staking options, meaning you can choose your commitment period (e.g., 1 month, 3 months, or no lock-up). Longer commitments usually yield higher rewards.

-

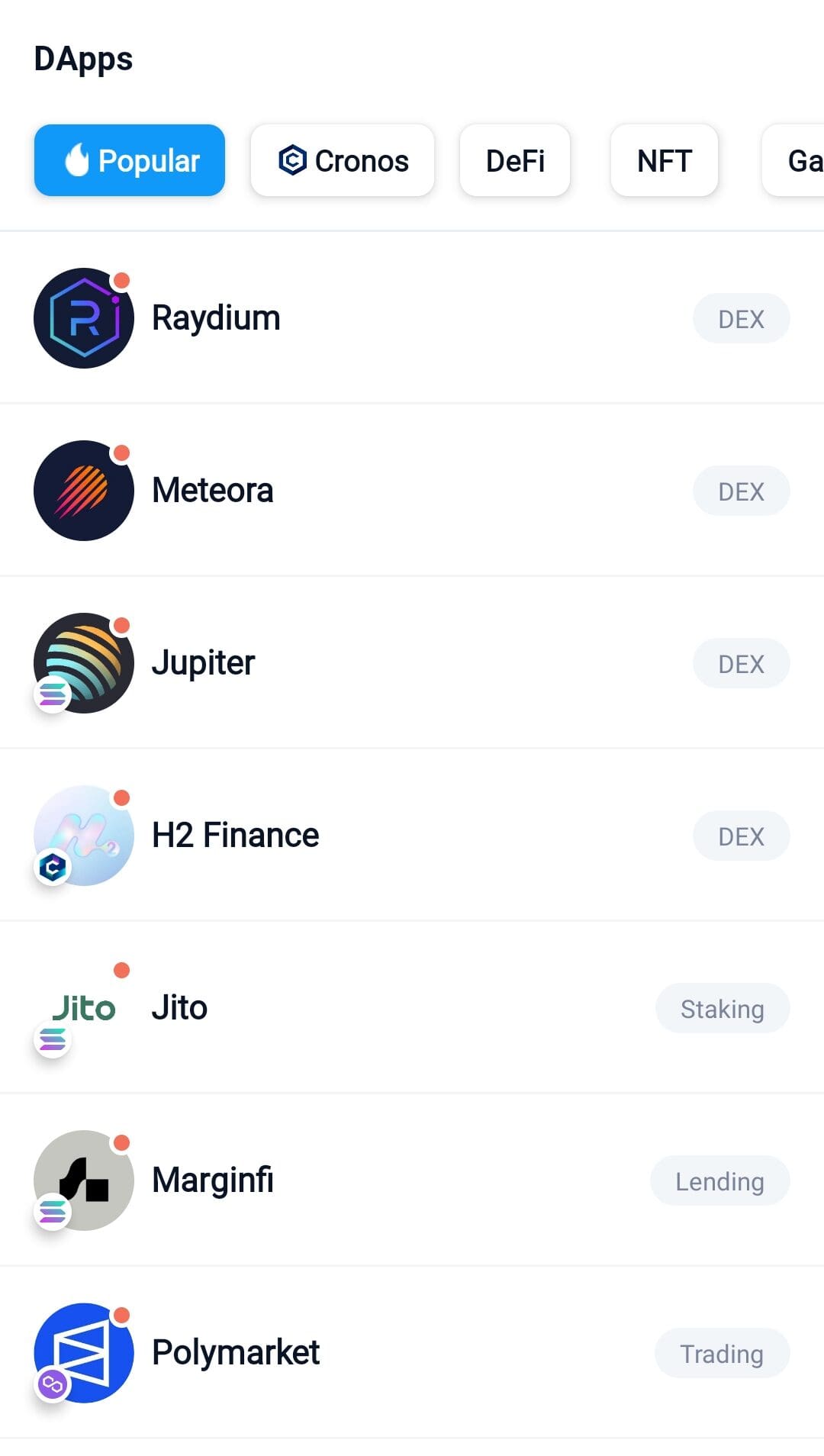

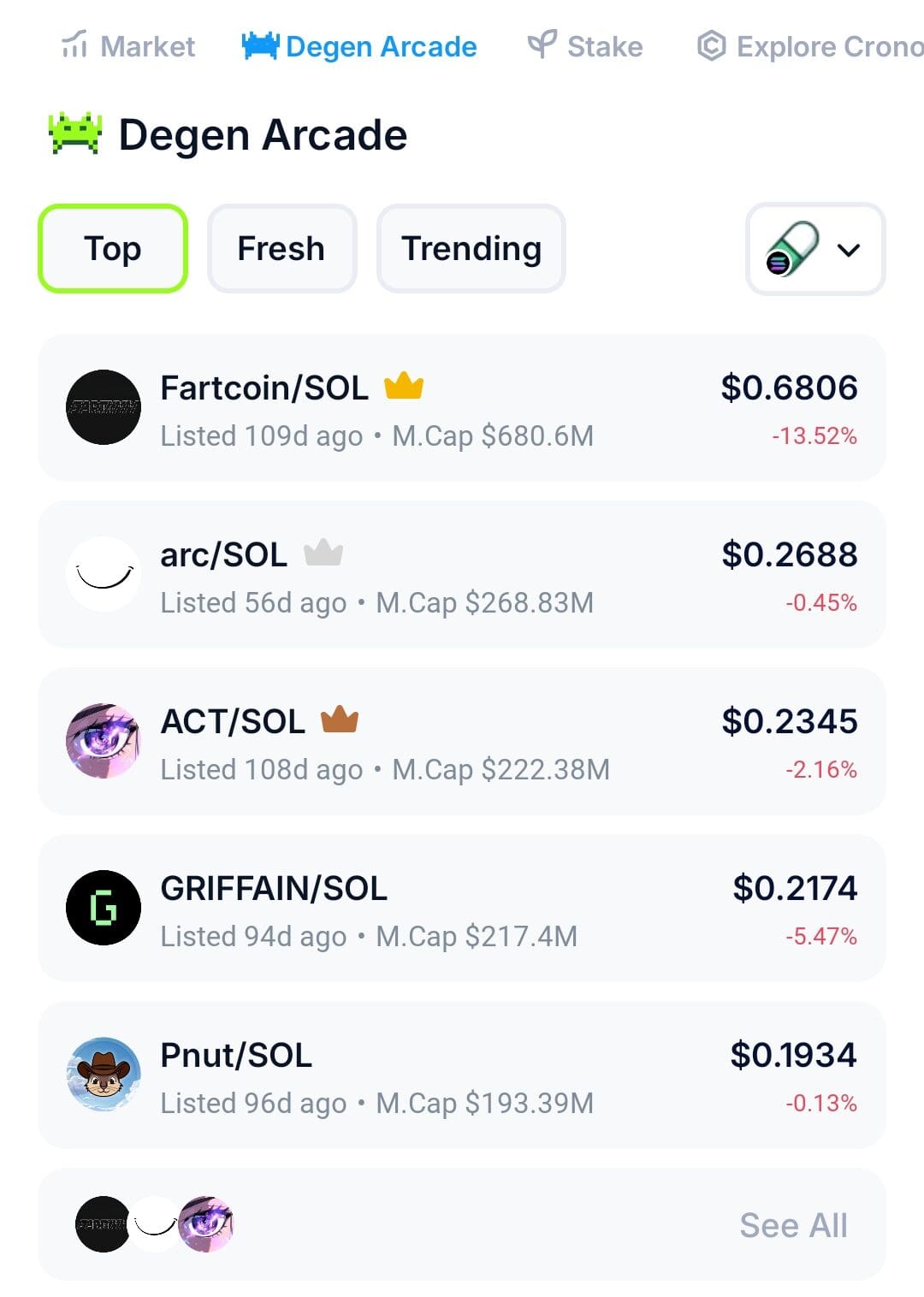

Web3 & dApp Integration: Access Web3 Directly from Your Wallet

The Crypto.com OnChain Wallet is built for Web3 and decentralized applications (dApps), allowing users to interact with DeFi platforms, NFT marketplaces, and blockchain-based games directly from the wallet.

With support for Ethereum, Binance Smart Chain, Polygon, and other Web3 networks, users can seamlessly access staking, lending, borrowing, and decentralized trading without leaving their wallets.

By integrating with popular dApps like Uniswap, Aave, Compound, OpenSea, and Axie Infinity, the wallet makes it easy to participate in decentralized finance (DeFi), yield farming, and NFT trading.

-

Trade, Swap, and Lend: How the Crypto.com Wallet Connects to DeFi

The Crypto.com Onchain is well-integrated with the Crypto.com ecosystem while maintaining full support for external DeFi platforms.

Users can easily transfer funds from the Crypto.com App Wallet to the DeFi Wallet for staking, swapping, and lending. However, moving funds removes anonymity because the Crypto.com App Wallet requires identity verification (KYC).

The wallet also connects with decentralized exchanges (DEXs) like Uniswap and 1inch, allowing users to swap tokens across different blockchains.

Additionally, the wallet integrates with hardware wallets like Ledger, adding an extra security layer for users who prefer cold storage.

-

Fees & Costs: What You Need to Know

The Crypto.com Wallet itself is free to use, but transactions still incur fees based on blockchain network costs. These include:

- Gas Fees: Required for transactions on Ethereum, Solana, and other blockchains. Fees vary based on network congestion.

- Swap Fees: The wallet charges a 0.3% service fee for swaps using the 1inch protocol but offers free swaps for other integrated protocols.

- DeFi Service Fees: If you use DeFi earning features, Crypto.com takes a 0.05% cut of your rewards.

- No Custodial Fees: Unlike centralized wallets, you don’t pay withdrawal or deposit fees since you control your own keys.

One of the biggest challenges in crypto transactions is high and unpredictable gas fees, especially on the Ethereum network.

The Crypto.com DeFi Wallet includes an ETH Gas Meter, which monitors Ethereum network traffic in real time and provides fee estimates before you make a transaction.

Can You Deposit & Withdraw Fiat in Crypto.com DeFi Wallet?

The Crypto.com DeFi Wallet does not support direct fiat deposits or withdrawals, meaning you cannot send money from a bank account or withdraw it as cash.

To withdraw crypto into fiat, you must send your funds from the DeFi Wallet to the Crypto.com App Wallet and then sell your crypto for cash. From there, you can transfer the funds to your bank account.

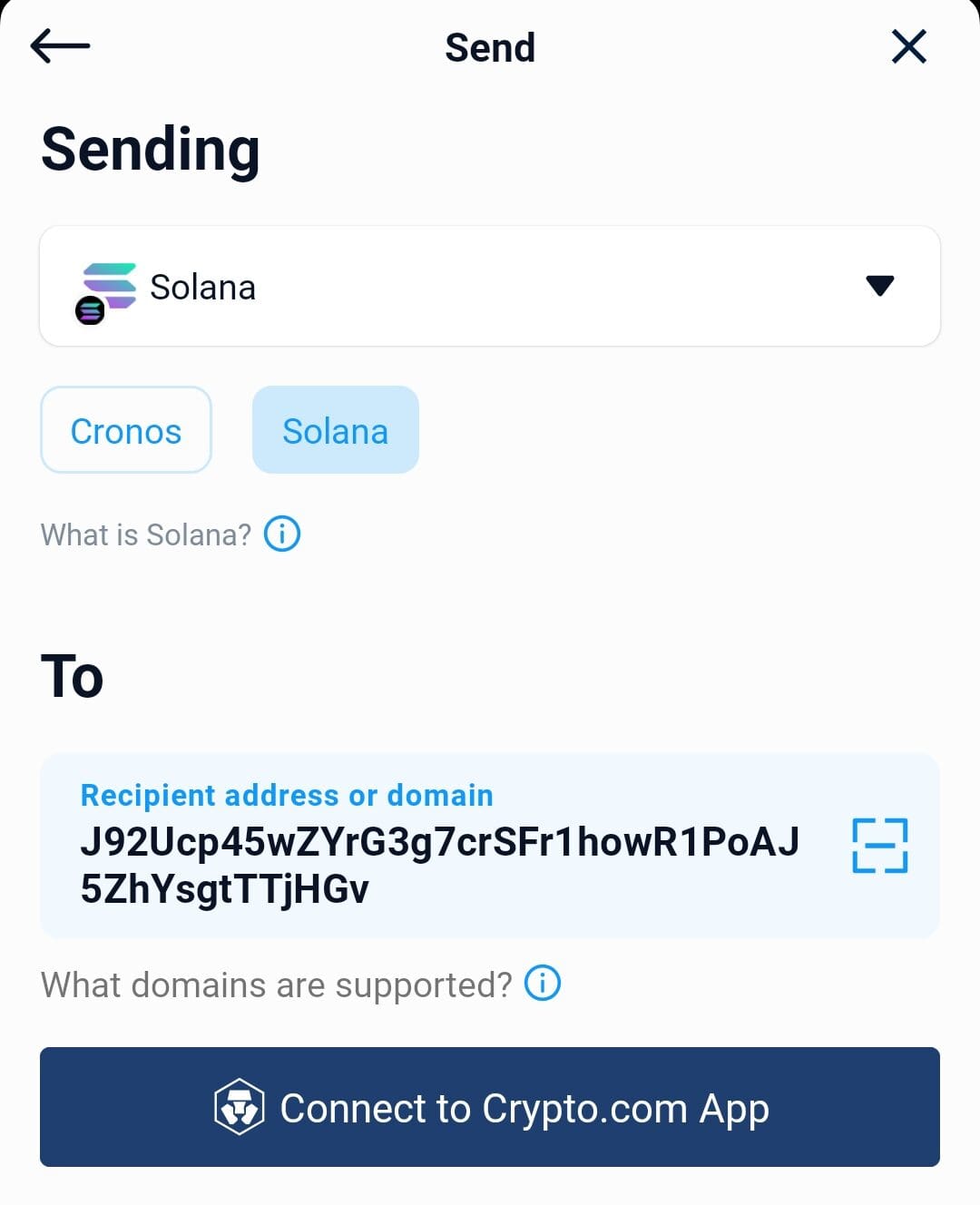

How to Send & Receive Crypto in Crypto.com DeFi Wallet

The Crypto.com DeFi Wallet makes it easy to send and receive crypto from other wallets or exchanges.

- To send crypto, enter the recipient’s wallet address, select the token, and confirm the transaction with the required gas fee.

- To receive crypto, simply copy your wallet address and share it with the sender.

However, buying and selling crypto with fiat is not directly supported in the DeFi Wallet. If you want to buy crypto with cash, you need to use the Crypto.com App Wallet, purchase the assets, and then transfer them to your DeFi Wallet.

How to Set Up the Crypto.com Wallet?

Setting up the Crypto.com Onchain is simple, but since it’s a non-custodial wallet, you’ll need to take extra precautions to secure your funds. Follow these steps to get started.

-

1. Download & Install the Wallet

Start by downloading the Crypto.com Onchain from the Google Play Store (Android) or Apple App Store (iOS).

If you prefer desktop access, you can also install the browser extension for Chrome, Edge, or Brave. Once installed, open the app and tap “Create a New Wallet” to start the setup process.

Our tips:

🔹 Only download from official sources to avoid scams or phishing apps.

🔹 The wallet does not require KYC (identity verification), so you can remain anonymous.

🔹 If you want to link it to the Crypto.com App Wallet, you’ll need to verify your identity later.

-

2. Create a Passcode & Enable Security Features

You’ll be asked to set a six-digit passcode to secure your wallet. After this, you can enable biometric authentication (Face ID or fingerprint) and two-factor authentication (2FA) for extra security.

Our tips:

🔹 Use a strong passcode that’s hard to guess.

🔹 Enabling biometric login (Face ID or fingerprint) makes it easier and safer to access your wallet.

🔹 Enable 2FA with an app like Google Authenticator or Authy—this adds another layer of protection

-

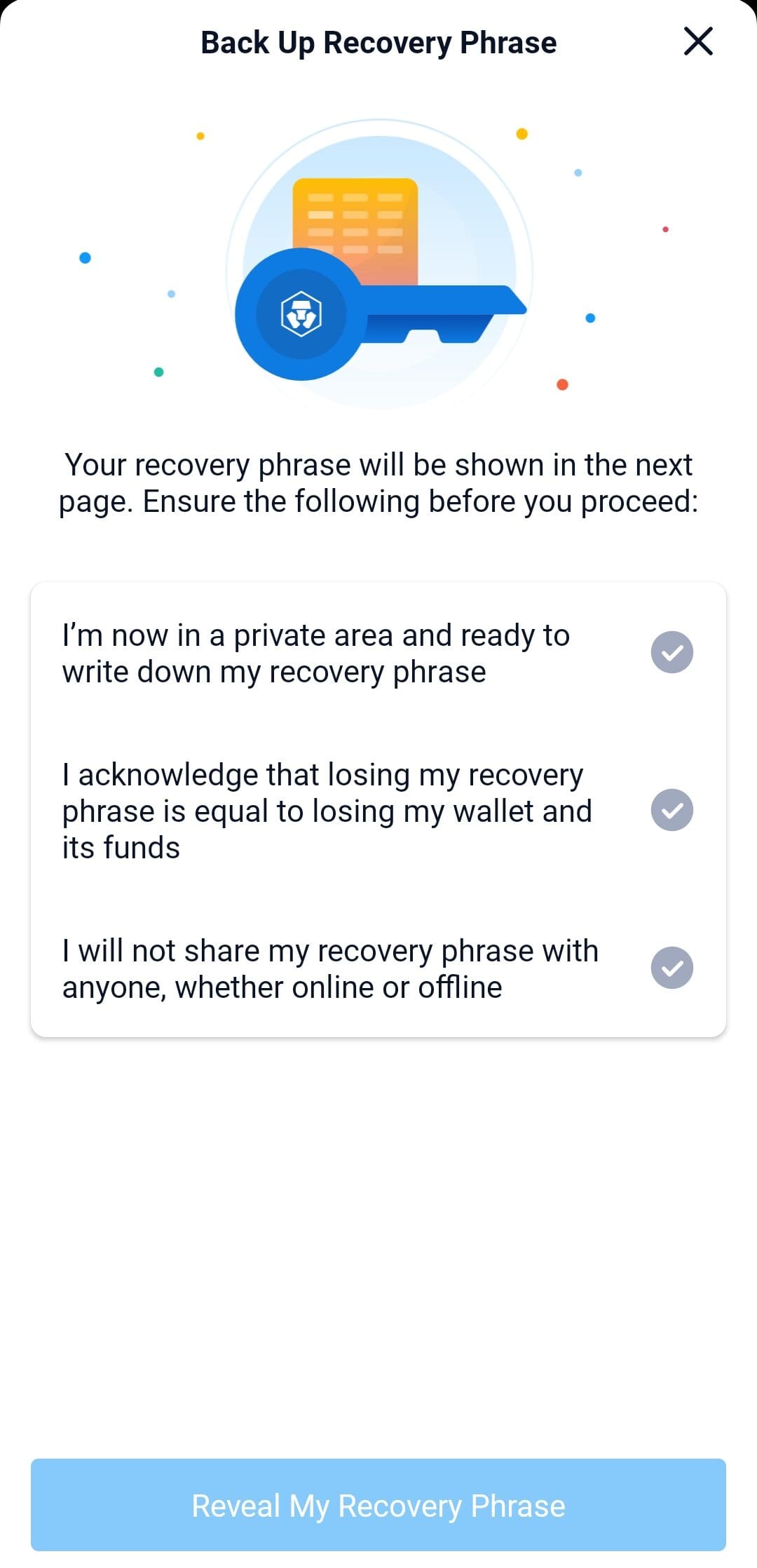

3. Backup Your Recovery Phrase

The most crucial step is backing up your 12, 18, or 24-word recovery phrase. This phrase is your master key—it allows you to recover your wallet if you lose access to your device.

If you ever need to recover your wallet on a new device, simply re-enter your recovery phrase to restore your funds.

Our tips:

🔹 Test your backup by re-entering the recovery phrase when prompted.

🔹 Never share your recovery phrase with anyone—even Crypto.com support can’t help if you lose it.

🔹 Write it down on paper and store it somewhere safe—avoid saving it digitally to prevent hacking.

-

4. Personalize & Start Using Your Wallet

Once your wallet is set up, you can name it, choose an avatar, and explore features like swapping, staking, and NFT storage.

You can also connect it to dApps (decentralized apps) or the Crypto.com App Wallet for easy transfers

Our tips:

🔹 Test small transactions first before making large transfers.

🔹 If you plan to use DeFi features like staking or lending, check fees and gas costs beforehand.

🔹 Enable notifications to stay updated on security alerts and transactions.

Your Crypto.com DeFi Wallet is now ready—you have full control over your crypto assets!

FAQ

Since this is a non-custodial wallet, Crypto.com cannot recover lost funds or reset passwords. However, you can find guides and FAQs on the Crypto.com website for general support.

Yes, the wallet is completely free to download and use. However, you will still need to pay network (gas) fees when sending transactions, swapping tokens, or interacting with DeFi applications.

Yes! The wallet allows you to connect to decentralized apps (dApps), including blockchain games, lending platforms, and NFT marketplaces like OpenSea and Uniswap.

Yes, as long as you safeguard your private keys and recovery phrase. The wallet includes biometric login, 2FA, and encrypted key storage, but ultimate security is your responsibility.

Explore Crypto Wallets

How We Rated Crypto Wallets: Review Methodology

At The Smart Investor, we evaluated crypto wallets based on their overall value, security, and usability compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to crypto users, including fees, security, supported assets, and ease of use. Each wallet was rated based on the following criteria:

- Fees & Costs (20%): We prioritized wallets with low or no transaction fees, transparent pricing, and reasonable network fees. Some wallets had hidden costs for transfers, swaps, or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate wallet with smooth transactions and clear features scored highest. Some had confusing layouts or lacked essential functionality.

- Security & Privacy (20%): We favored wallets with strong encryption, private key control, 2FA, and cold storage support. Some had weak security features, making them riskier for holding assets.

- Automated Features (15%): The best wallets offered staking, yield farming, automated swaps, and AI-driven portfolio management. Others lacked automation or charged high fees for these services.

- Supported Cryptocurrencies (10%): Wallets that supported a wide range of cryptocurrencies, including major coins and altcoins, scored highest. Some only supported a handful of assets, limiting flexibility.

- Compatibility & Integration (10%): We rated wallets higher if they supported multiple blockchains, hardware wallet integration, and DeFi apps. Some lacked interoperability, restricting advanced users.

- Additional Features (5%): We favored wallets that offered buying/selling options, NFT support, fiat on-ramps, and seamless exchange integration. Many lacked these extras, making them less versatile.