Table Of Content

Full service brokers, also known as traditional brokers, provide a variety of services. Along with providing a stock trading platform, they also provide research and advisory, investment banking, sales, and asset management under one umbrella, as well as any other service requested by the individual based on the stock broker's requirements and offerings.

The popularity of the internet has grown exponentially as a result of the rise of digitalization. Discount brokers were born as a result of the internet revolution. They do not have a physical presence, unlike traditional brokers. They only offer a trading platform online.

Furthermore, discount brokers do not typically provide investment advice as a service, though they may provide research and educational tools. It is a platform for ‘do-it-yourselfers.

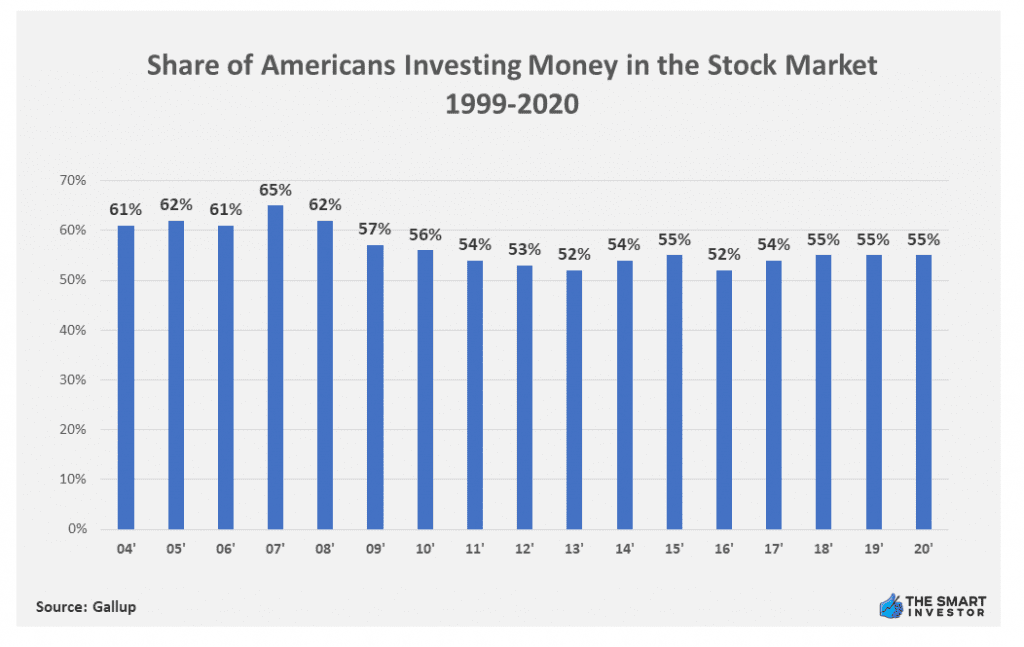

The percentage of Americans investing in stocks has remained steady since 1999, according to a report by

Here’s our guide to the various types of brokerages, their services and how much you might have to pay for them.

What Is a Brokerage Account?

You can liken a brokerage account to a savings account – but this time, you put money into the account so you can use it exclusively for investing in just about any type of instrument available in the market. You can

3. Robo-Advisors

You could say that the full-service brokers and the online discount brokers occupy the two extreme ends of the brokerage spectrum and the Robo-advisors would sit in the middle. A Robo-advisor is an online financial advisor that will help you build an automated portfolio of investments, but everything is through their online interface. It will not grant you access to any human advisor.

Similar to a full-service broker, a Robo-advisor will choose investments and perform trades on behalf of their customers. The disadvantage is, it relies only on a computer program and there is no human intervention that can fully customize each portfolio to fit each individual customer.

Full-service Broker Vs Discount/Online Brokers

One distinct difference between a full-service broker and a discount broker is the amount of commission they charge. A discount broker charges lower commissions when executing buy or sell orders than full-service brokers, who typically charge higher commissions. To justify higher commissions, full-service brokers offer investment advice to their clients based on their trade performance analysis.

In addition, when comparing the mode of operation, discount brokers operate more on the online platforms than full-service brokers who have a physical location for their clients. As such, they also go by the name of traditional brokers.

Another difference is the type of clients they target. Due to their nature of service like providing personal consultation and higher fidelity research and tax planning, full-service brokers often target high net worth clientele. On the flipside, discount brokers offer their service to all types of people regardless of capital.

Management

The other benefits of “full-service” brokers are that they do more than just facilitate the buying and selling of instruments for their customers. They also offer a wide range of products and services that may include financial, retirement and estate planning, investing and tax advice and regular investment updates.

If you have a trained, skilled, and experienced full-service broker in your team who is looking out for your best interest, you can save a bunch of time, energy, and anxiety while potentially generating (through your portfolio) sizeable income large enough to comfortably cover his fees and commissions.

A dedicated broker has a deep focus on the job – his world is primarily and dominantly Wall Street. His responsibility includes researching companies, keeping himself on top of the stock market, making money for his clients – all of which may be beyond your time, skill, training or interest to do effectively.

Just remember that full-service brokers may also fall into the possibility of conflicts of interest. There may be some whose priority is to pad their pockets rather than growing your portfolio to its fullest. In such a case, they may sell your investment products with a bias towards making money for their investment firm than for you.

If you want a more hands-on approach, you can go via online trading because it can give you total control of your portfolio.

You can make trades as often as you can during trading hours unlike when you have to make your trades through your broker. You can also do your own analysis, search for different views and insights and be responsible for all your investment and trading strategies.

Many online traders equipped themselves by attending free classes, reading all the relevant books they can get their hands on at the library and spent countless hours of their time to learn how to use online trading tools for their benefit. Some of them became so successful in trading online that, within a few months into it, they quit their regular jobs to focus full time into trading. But before you get dreamy and all, just remember that there are also a number of them who lost thousands of dollars in just a few days of trading.

If you don’t find yourself in the shoes of an online trader but would prefer rather to receive personalized advice and guidance, then it would be better if you stick with a traditional brokerage.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Fees

Don’t forget that personalized advice and service always come with higher fees so, traditional brokerages often charge 1%-2% based on the assets they manage. This means that you have to pay around $1,000 to $2,000 per year for a $100,000 portfolio. Your investments should be able to earn more than that amount every year if you want to have something left over for yourself. And that’s as long as you keep the brokerage in your employ. You should carefully consider the brokerage fees in your equation especially if the purpose of your investment is for your retirement.

The good news about online investing companies is that their fees tend to be lower. You can immediately see the difference when you check the reduction in their transaction costs as compared to the fees you pay with traditional brick-and-mortar firms. Here’s the truth: web-based trading platforms charge a mere fraction of what you’ll otherwise pay to a personal broker.

Risk

A broker is someone who has the license and training to conduct stock trading in your behalf and is capable of explaining to you the pros and cons of investing in a specific stock, mutual fund, bond or other instruments. Brokers are there to help you materially lessen your risk in investing.

Online trading has revolutionized the stock market trading by making it easier for new investors to enter and opened the doors from the restrictive entry conditions of long ago.

This situation has its pros and cons. Those who enter without the necessary experience or preparation may get into serious financial trouble if they act haphazardly. The stock market, by nature, is cruelly unpredictable so anybody who ventures into it should know what he’s doing to avoid losing even the shirt off his back.

A report by Gallup shows that a majority of Americans consider real estate as their best long-term investment from a pool of several investment options. Real estate leads the list of preferred long-term investments by 35%, against stocks at 21%, gold at 16%, and Savings accounts at 17%.

Flexibility

To talk to your traditional broker, you usually have to make an appointment, either online, through phone or in person, just so you can instruct him to trade. The time it takes to set up a meeting is, at best, an inconvenience on your part. But since time is of the essence in stock trading, the delay can cost you money or lose some important opportunities.

With online trading, the response is very fast – you can execute a trade in a blink of an eye. Many online trading websites provide stock quotes and trade information that help you see how your investments are performing in real-time. They even have accurate computations that update how the market is presently doing. You can also receive real-time quotes, stock market news and analysis, invest in fractional or penny stocks, and a lot more.

Investing Tools

Both online brokers and full-service brokers can give you access to a variety of tools for your stock market trading research.

You can find several online firms that offer professional, state-of-the-art research for free. These tools are very helpful and let you make intelligent decisions about your finances. In contrast, brokers do extensive market research for their clients so, you can save a lot of time and effort. An excellent broker assumes the role of an adviser or mentor to their customers, relying on their own trading experiences to influence the investment decisions and doing extensive, focused research into the market.

Minimum Opening Balance

Here’s the catch: full-service brokers usually pick clients who have several thousands of dollars to work with. For some, you need to have at least $5,000 for a full-service broker to accept your account.

But, when it comes to online brokers, you only need a few hundred dollars to open a new online brokerage account. Most of them require a small minimum amount to let you open a new online account. This can be as low as $500. It depends, of course, on which broker you want to open an account with.

Summary

| Full-service Broker | Discount/Online Brokers | |

|---|---|---|

| Management | Service of trained, skilled, and experienced brokers | You are responsible for your own analysis, get insights and invest |

| Fees | Numerous and high | Few and low |

| Risk | Brokers are professionals who help substantially control your risk | Higher risk especially for novice traders |

| Flexibility | You are dependent on your broker | You depend only on your own |

| Investing Tools | Variety of tools for research | Variety of tools for research |

| Minimum opening balance | Initial opening of several thousands of dollars, about $5K and up | Low initial opening, About $500 + |

How To Choose Between Them?

The choice between a full-service broker or a discount service is just the tip of the iceberg. There are still other factors to consider when picking a broker to help you in your investment journey such as customer service, charges, fees, investment options and more.

Just remember that whether you go traditional or modern online, no single broker is perfect for every investor. It all depends on your personal needs and preferences, so you carefully have to balance the costs against the benefits of each broker, and meticulously compare the level of services and features they both offer.

Consider these 3 factors:

- Time. Think of how much time you have to manage your account. Do you have enough time for it? Do you perceive it as a hobby or as a main business?

- Knowledge. Carefully assess your knowledge level on the matter before you start trading on your own. Can you confidently use the tools and resources to use the data and information to make smart decisions with your investment money?

- Money. If you’re setting off with a small budget, it’s a good move to start on your own. But, if we’re talking about a humongous capital, help from professionals is almost always necessary.

For the majority of investors, the more practical choice would be a discount broker. Primarily because of the prohibitive cost of a full-service broker, an investor must be able to generate sufficient income just to afford their services. On the other hand, going with a discount broker while learning how to use them efficiently and effectively wouldn’t put too much strain on the investment capital.

So, you’ll be spending less but you’ll be educating yourself in the process. Also, you can find a reputable broker who can serve your trading requirements and also teach you at the same time. Simply open an account and choose the level of service that you want. Later on, you can change this level of service according to your level of need.

Spend regular time reviewing your investments just to make sure that you are on the right track income-wise and still within the comfortable level of risk that you’ve set. Be sure to read all the messages your full-service or discount broker sends you as some of them may contain fee information that may drastically affect your account and return on investments.

Which Broker is Best for Beginners?

There are many brokers that are ideal for beginners, and you should look out for the following features in your preferred beginner-friendly broker:

Check for brokers that charge minimal brokerage fees and commissions. Though you might think high fees may mean better services, it may also be a sign they are ripping you.

Check for a broker that offers a wide variety of investment offers. You do not want to miss an opportunity because a broker does not provide a specific investment option.

Education resources should be on top of your list. Since you are a beginner, accessing these resources will set you in the right direction. Another must-have is the ease of use. Utilities like the platform, tools, customer care, and learning resources – must be highly accessible.

Where Do Robo Advisors Fit?

Investors looking to benefit from automation will find Robo advisors a good choice. Also, due to this automation, beginner investors can start trading effortlessly since they do not need to select or execute trades manually.

In addition, since they offer little to no human interactions, Robo advisors have low fees, and are a perfect choice if you are looking to cut down on brokerage fees.

If you find passive investment a good strategy for your investment, Robo advisors also come in handy. However, active traders who like to speculate, control their trades, and take high risks may feel restrained when using Robo advisors.

Are Online Brokers Safe?

Due to the nature of activities online brokers engage in, they attract loads of potential threats. As a result, they must implement high-end encryption of data to ascertain end-to-end connections are tamper-free.

Besides, online brokers must register with the Financial Industry Regulatory Authority (FINRA), which ensures there is integrity in service delivery of brokerages. To check if your broker is registered, visit the FINRA broker check page.

In addition, a reputable broker must register with Security Exchange Commission (SEC). Though it does not guarantee safety, it is one way to foster transparency and credibility. You can search your broker at the SEC – EDGAR Company Search page.

FAQs

What Does a Full-Service Broker Cost?

Generally, the cost of a full-service broker depends on the brokerage. On average, they charge a staggering figure of $150 -$200 per fully completed transaction.

However, this can also be different for brokers who charge annual fees. A typical annual charge ranges from 1% to 1.5% of the total assets under the broker management. Though these charges may be over 150% higher than the discount broker's fees, they tend to be more reliable for an investor who does not wish to do the heavy lifting, especially researching the best performing portfolios, which can be strenuous and complex.

How much do online brokers cost?

Broker fees for most brokerages average around $40 – $150 when managing a cash account for stock and options. This cost includes charges like minimum deposit fees, stock trade fees, mutual fund travel fee, options base fee, options per contract fee, futures per contract fee, and broker-assisted trade fee.

However, the cost is different for margin accounts as the fees are in percentages of the invested amount. For most brokerages, the fee tends to decrease as the investment size increases. For instance, for investment under $24,999.99, the charges vary from 1.5% to 10% for most brokers. In comparison, investment above $1,000,000 charge between 0.75% and 6%.

How to switch online brokers?

The easiest way to switch online brokers is to sell all your investment in the account and transfer the funds to your new broker. Since the process is straightforward, you may not need external help unless your investment has a complex setup.

An alternative involves taking advantage of the Automated Customer Account Transfer Service (ACATS) or an in-kind transfer. Here you will ask help from your new broker to initiate the process to completion. You should note, though, it may attract transfer fees. This method is ideal for an investor with high holdings.

When the full-service broker was the only option?

The full-service broker was the only option till the 1970s. Before then, there were high regulations on the Walls Street. Stock and securities businesses were only for the elite.

As a result, trade execution was overpriced and overcomplicated. With now less complex and lower fees discount brokers or synonymous online brokers, the full-service brokers face competition from the fees perspective to the general public inclusion. In this case, trading is available 24/7, and traders can access trading virtually from any location around the world.