| ||

|---|---|---|

Seeking Alpha Premium | Morningstar Investor | |

Price | $299 ($24.90 / month)

No monthly subscription | $249 ($20.75 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.5/5) |

Read Review | Read Review |

Compare Stock Analysis & Screening Features

In this article, we’ll compare Seeking Alpha Premium and Morningstar Investor, two of the best tools for fundamental analysis.

We’ll walk you through their stock research tools, screeners, portfolio analysis capabilities, and fund insights to help you decide which platform aligns better with your investing approach.

-

Stock Screening Tools

Seeking Alpha Premium has the edge for dynamic and algorithm-driven stock screening, while Morningstar is better for traditional, long-term filtering.

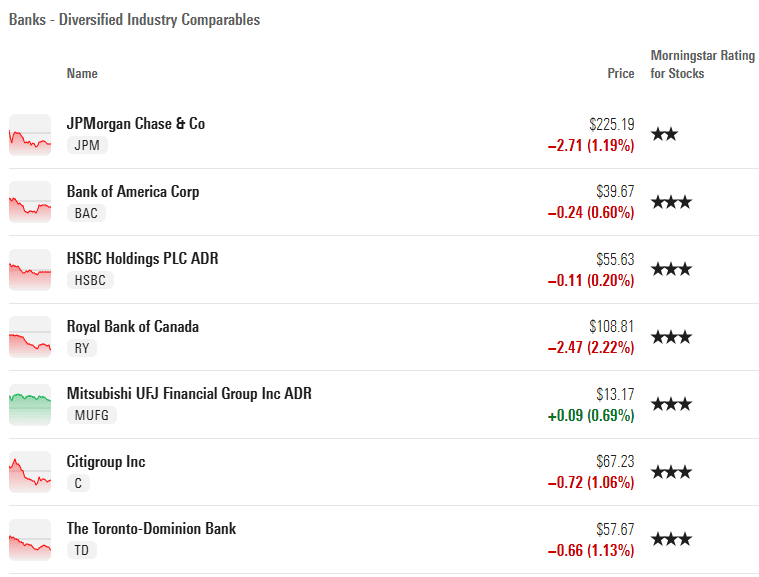

Morningstar Investor offers three separate screeners for stocks, mutual funds, and ETFs. While its stock screener includes valuation, sector, and moat ratings, it emphasizes long-term fundamentals rather than data-driven scoring systems.

It’s ideal for finding undervalued or high-quality investments but lacks Quant-based automation.

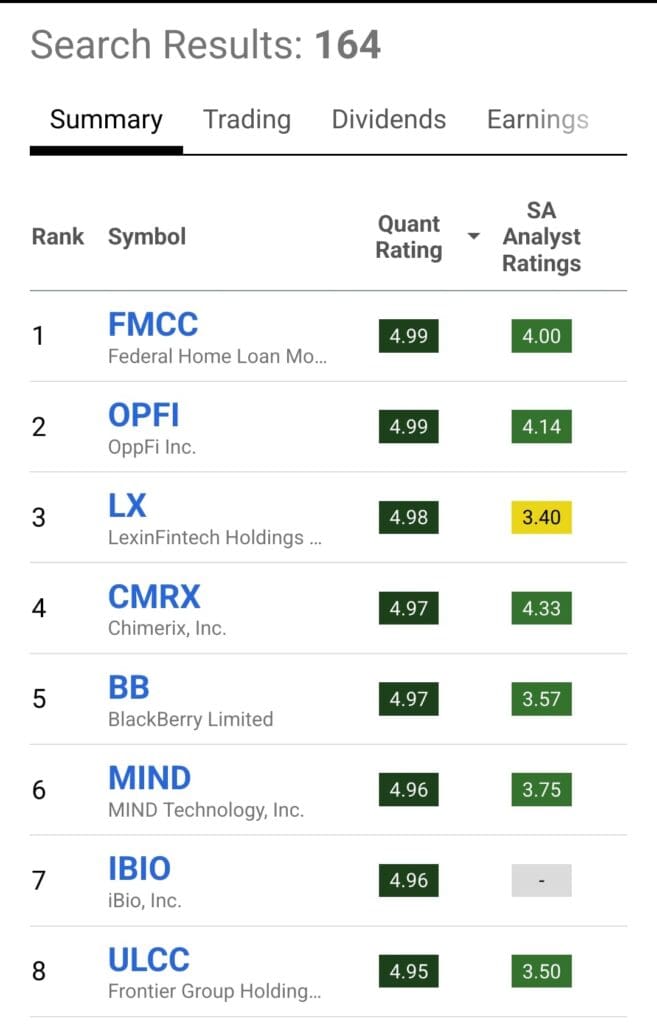

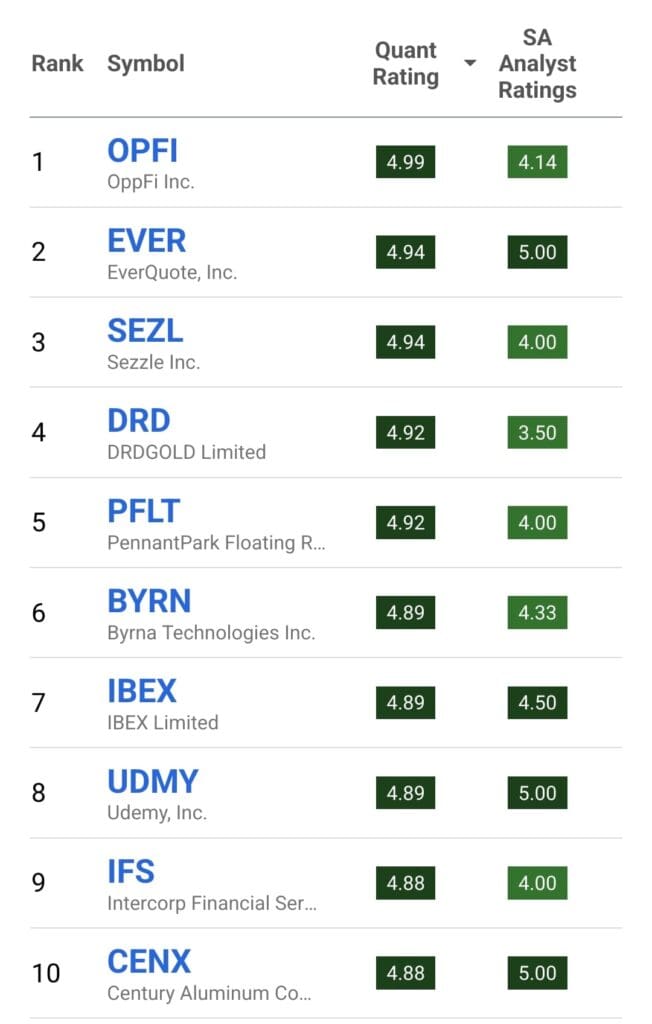

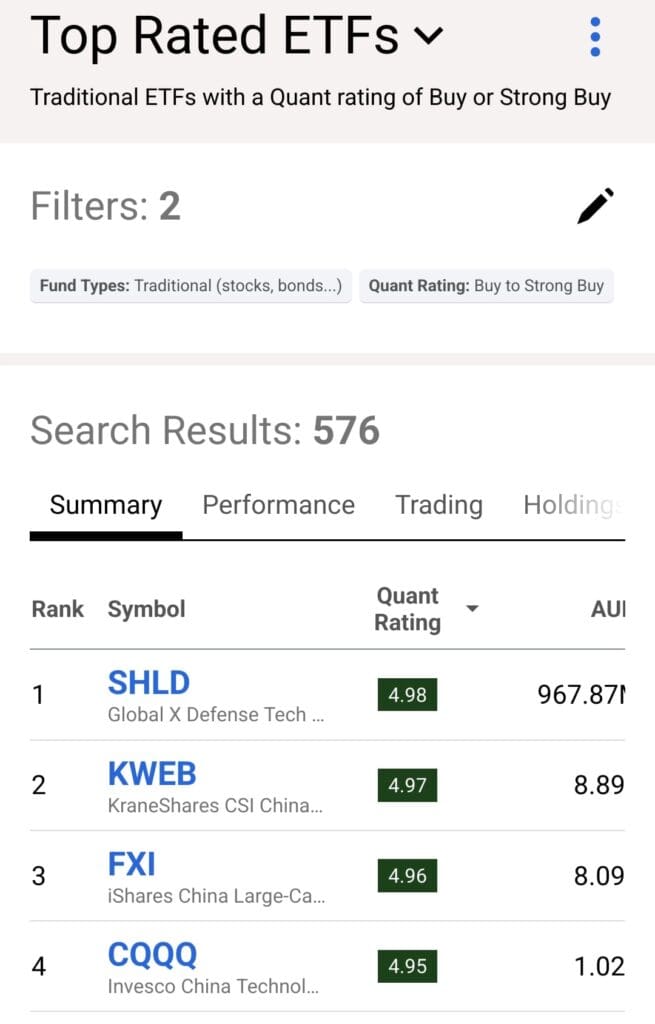

Seeking Alpha Premium provides a robust stock and ETF screener with filters based on valuation, growth, profitability, dividends, and momentum.

A unique feature is the ability to screen using Quant Ratings and Factor Grades, which helps investors instantly locate high-potential stocks like Strong Buys. It also supports ETF filtering by performance and sector.

-

Fundamental Analysis Tools

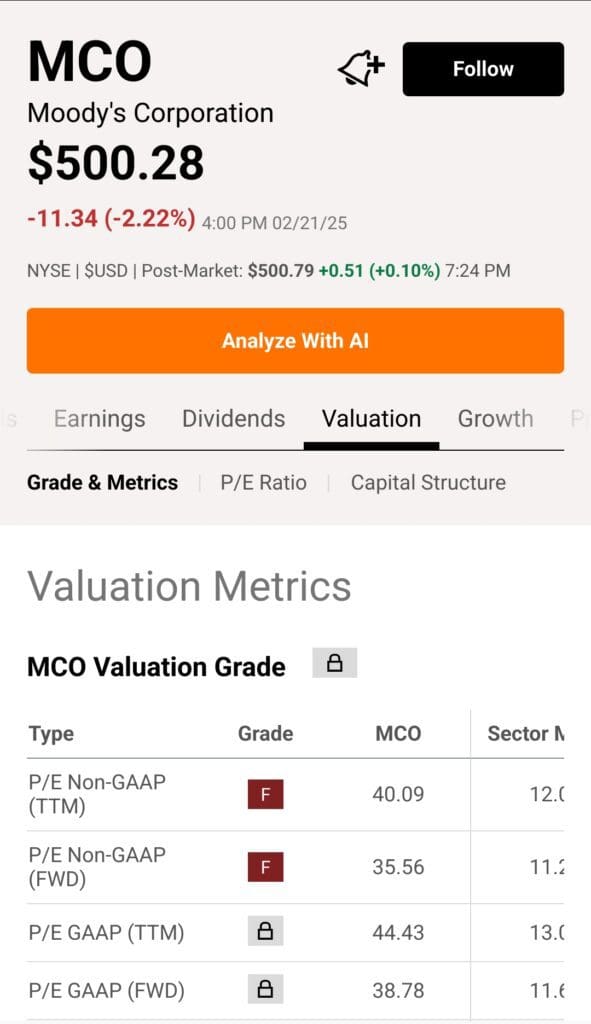

Morningstar offers stronger analyst reports and valuation depth, but Seeking Alpha is better for actionable, data-driven insights and a broader range of stock coverage.

Seeking Alpha Premium provides interactive financials, valuation metrics, earnings projections, dividend safety scores, and full transcripts of earnings calls.

Its Quant Ratings and Factor Grades add a layer of automated stock evaluation based on valuation, growth, and profitability.

Unlimited premium articles from analysts offer diverse viewpoints, though with variable quality.

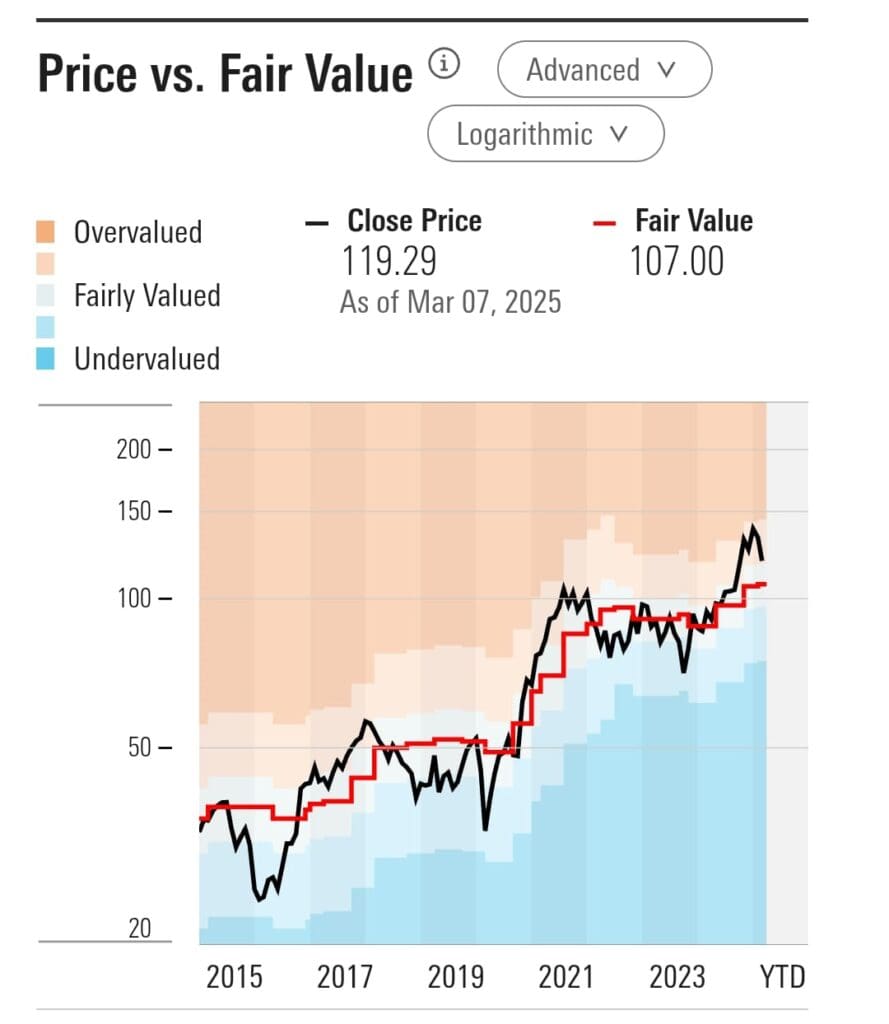

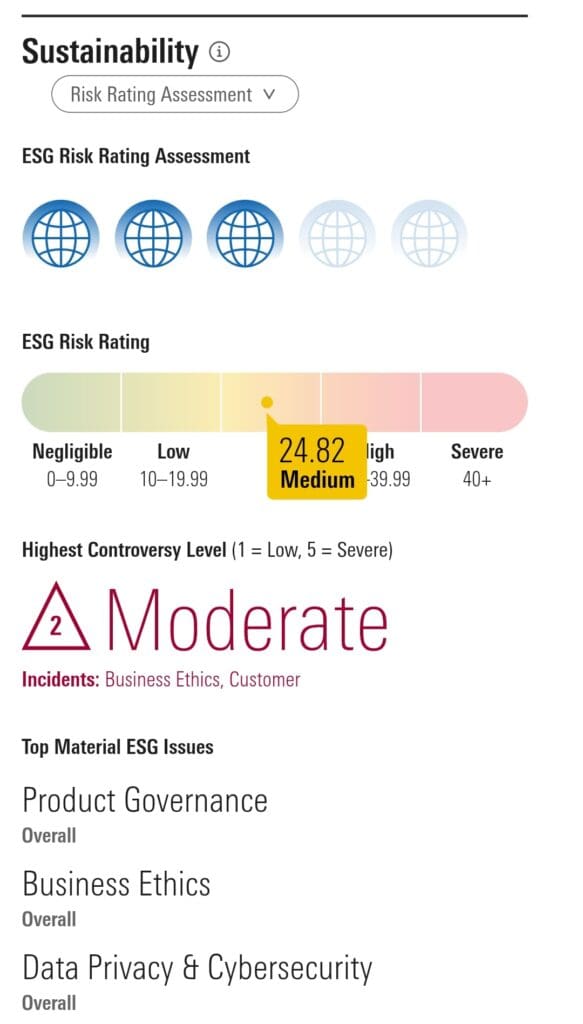

Morningstar Investor focuses on deep, structured company research with fair value estimates, economic moat ratings, and independent analyst-driven reports.

It includes ESG scores, sector trends, and fund manager analysis. While its updates may be slower, the quality of insight and consistency of ratings is often higher.

-

Stock Picks & Recommendations

Seeking Alpha, especially with Alpha Picks or its curated lists, is more geared toward investors looking for apps with stock ideas and less manual digging.

Seeking Alpha Premium does not provide curated stock picks by default, but its Alpha Picks add-on service offers hand-selected stocks based on Quant Ratings.

Premium members can still use the Top Rated Stocks, Dividend Monsters, and thematic lists (growth, small-cap, etc.) to find suggestions tailored to their strategy.

Morningstar does not focus on handpicked stock recommendations but instead relies on star ratings and analyst reports to guide investors toward undervalued or high-quality companies.

-

Market Sentiment Analysis

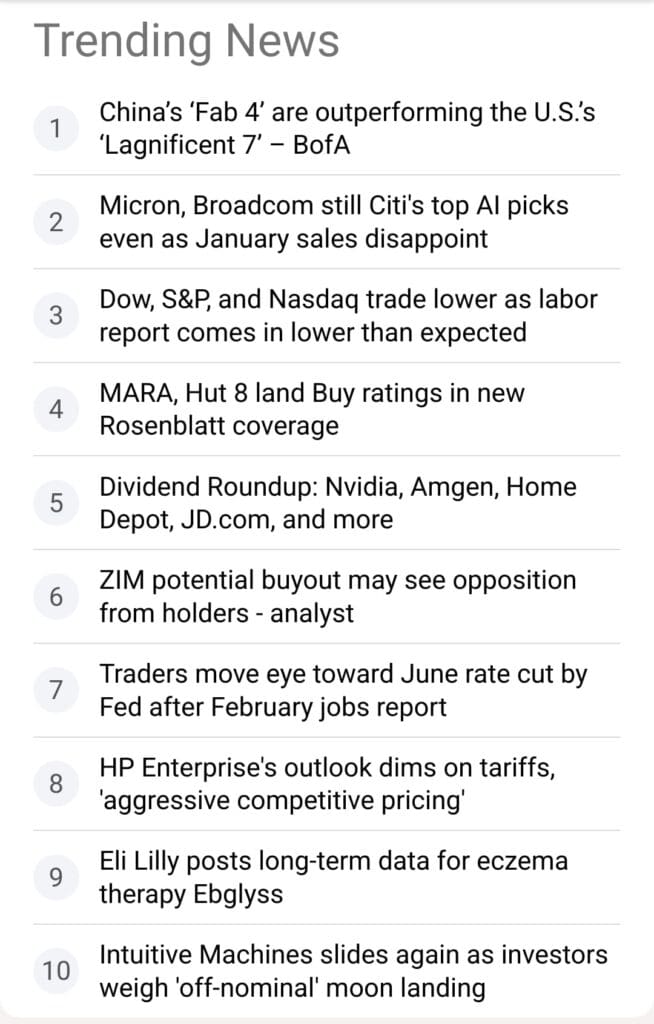

Seeking Alpha Premium offers a robust news dashboard covering breaking market news, earnings reports, and real-time updates on followed stocks.

Users also benefit from author performance tracking and article discussions, allowing them to engage with investing communities and monitor sentiment through written commentary.

Morningstar provides market commentary, sector insights, and macroeconomic updates but does not emphasize real-time news or social interactions.

-

Portfolio Analysis & Alerts

Morningstar provides more comprehensive portfolio analysis, while Seeking Alpha is stronger on real-time alerts and risk flagging.

Morningstar’s Portfolio X-Ray provides deeper asset allocation, sector exposure, and overlap analysis. Its Fee Analyzer and Risk Style tools help optimize long-term returns, though alerts are email-based and not real-time.

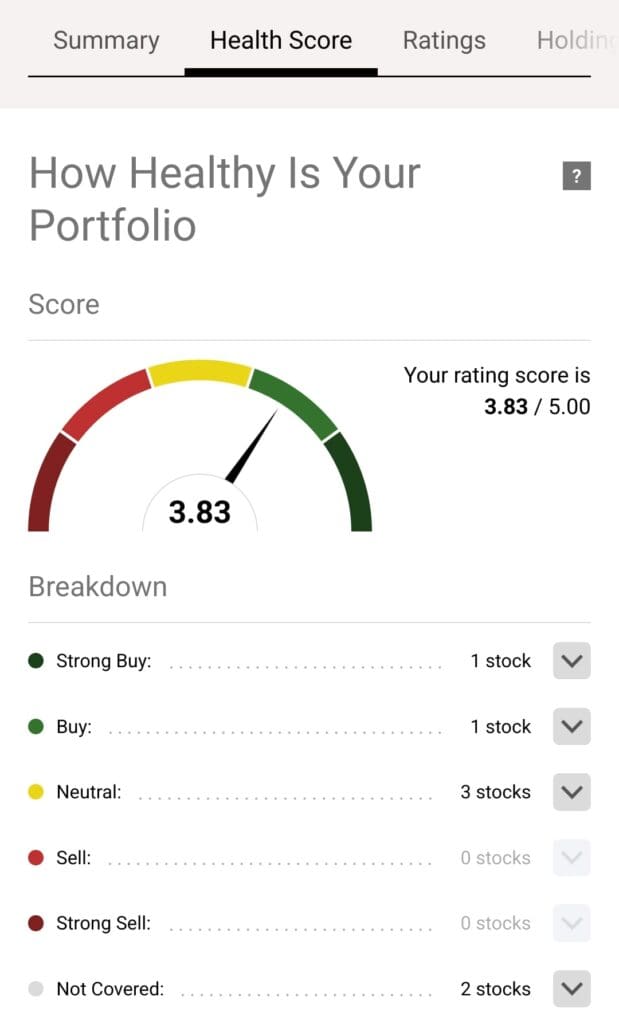

Seeking Alpha Premium offers a Portfolio Health Check that flags overvalued holdings, dividend risk, and weak fundamentals.

Users receive real-time alerts on stock downgrades, earnings revisions, and risk warnings. However, it lacks automated portfolio rebalancing.

-

Technical Analysis Options

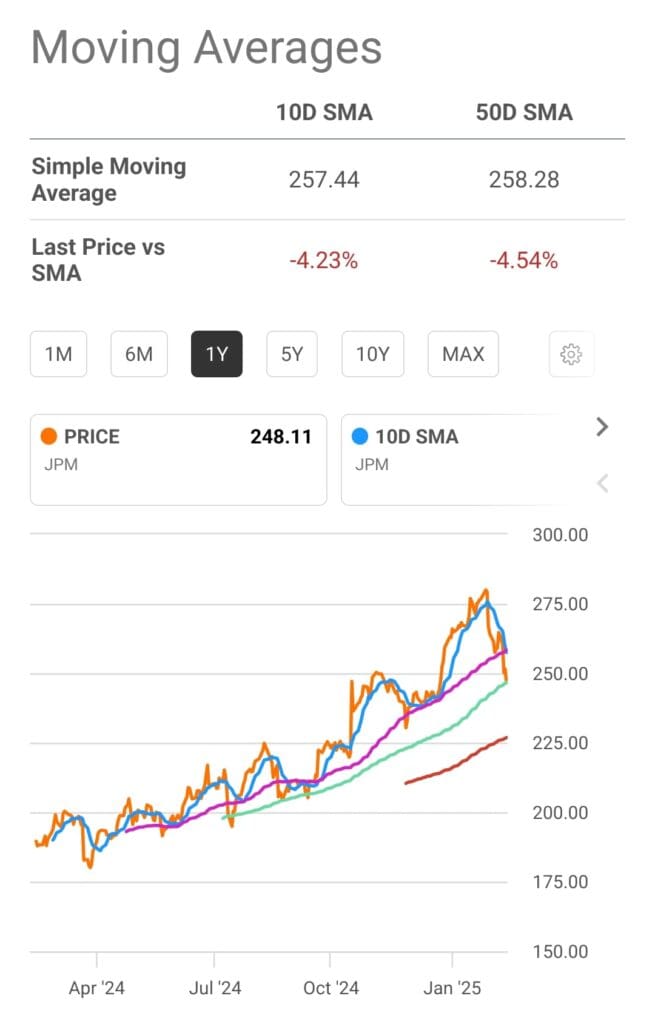

Both platforms are limited in technical analysis, but Morningstar offers slightly more in terms of long-term charting tools.

Seeking Alpha Premium includes basic charts and performance visuals but lacks advanced indicators or technical overlays, limiting its usefulness for active traders.

Morningstar provides interactive charts with overlays like moving averages and RSI. Still, it doesn’t cater to technical traders looking for advanced tools such as MACD or pattern recognition.

-

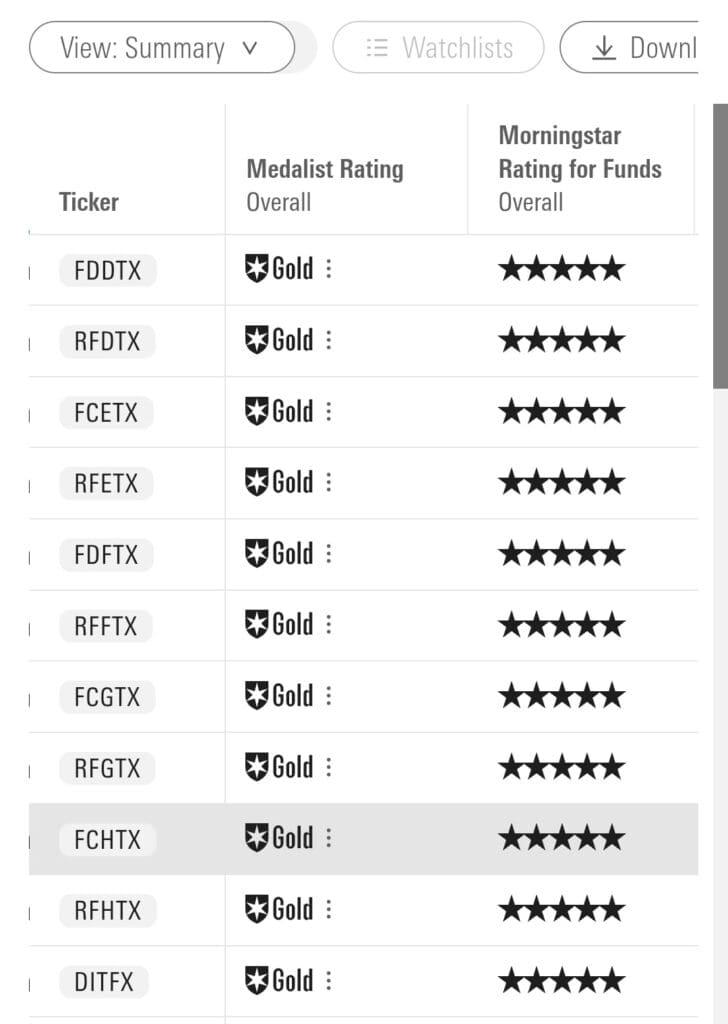

ETF, Bonds & Fund Analysis Tools

Morningstar excels in this category with in-depth ETF, mutual fund, and bond research. Tools include the Medalist Rating, fund manager insights, expense analysis, and ESG ratings.

Seeking Alpha Premium offers ETF rankings by sector, performance, and Quant Ratings. However, it lacks bond and mutual fund analysis entirely.

Which Investors May Prefer Seeking Alpha Premium?

Investors who value data-driven stock analysis, timely updates, and a wide range of expert opinions may prefer Seeking Alpha Premium.

Active Stock Researchers: Ideal for those who want algorithm-based ratings, Factor Grades, and customizable screeners to spot high-potential stocks.

Dividend-Focused Investors: Offers tools like dividend safety scores, payout history, and lists of reliable income stocks.

News-Driven Traders: Real-time alerts, earnings call transcripts, and market news help users stay ahead of market events.

DIY Investors: Unlimited access to premium articles and author insights supports investors who rely on diverse opinions and fundamental data.

This platform is great for hands-on investors seeking actionable stock-level insights and ongoing portfolio oversight.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Who Should Consider Morningstar Investor?

Morningstar Investor is well-suited for long-term investors who prefer deep analysis, structured ratings, and portfolio planning tools.

ETF & Fund Investors: Extensive mutual fund and ETF analysis, including Medalist Ratings and manager track records, helps users build diversified portfolios.

Long-Term Value Investors: Fair value estimates and economic moat ratings support those focused on intrinsic value and competitive advantage.

Portfolio Optimizers: Portfolio X-Ray, fee analysis, and overlap detection are valuable for optimizing asset allocation and reducing hidden costs.

Retirement-Focused Investors: Offers retirement fund comparisons and glide path analysis for building future-ready portfolios.

Morningstar is ideal for investors who want research depth, reliable fundamentals, and comprehensive portfolio tools.

Plan | Annual Subscription | Promotion |

|---|---|---|

Morningstar Investor | $249 ($20.75 / month) | 7-Day free trial |

Bottom Line

Seeking Alpha Premium shines for hands-on investors who want real-time updates, stock-level insights, and data-driven tools like Quant Ratings. It’s best for those researching individual stocks or tracking dividends.

Morningstar Investor, on the other hand, is ideal for long-term planners, offering powerful portfolio management, mutual fund analysis, and fair value insights.

While Seeking Alpha is more dynamic and news-focused, Morningstar delivers structured, in-depth research and is better suited for ETF, fund, and retirement-focused investors.