Morningstar Investor | Yahoo Finance Gold | |

Price | $249 ($20.75 / month) | $479.40 ($39.95 / month) |

Best Features | ||

Our Rating |

(4.5/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this breakdown, we’re putting Yahoo Finance Gold and Morningstar Investor head-to-head.

Whether you’re into expert stock picks or proven rankings, we’ll show you which platform gives you more power to level up your investing game.

-

Stock Screening Tools

Morningstar offers a stock screener that allows filtering based on key metrics like valuation, growth, profitability, and economic moat.

The tool is tailored more towards fundamental analysis, helping long-term investors identify undervalued stocks with strong growth potential.

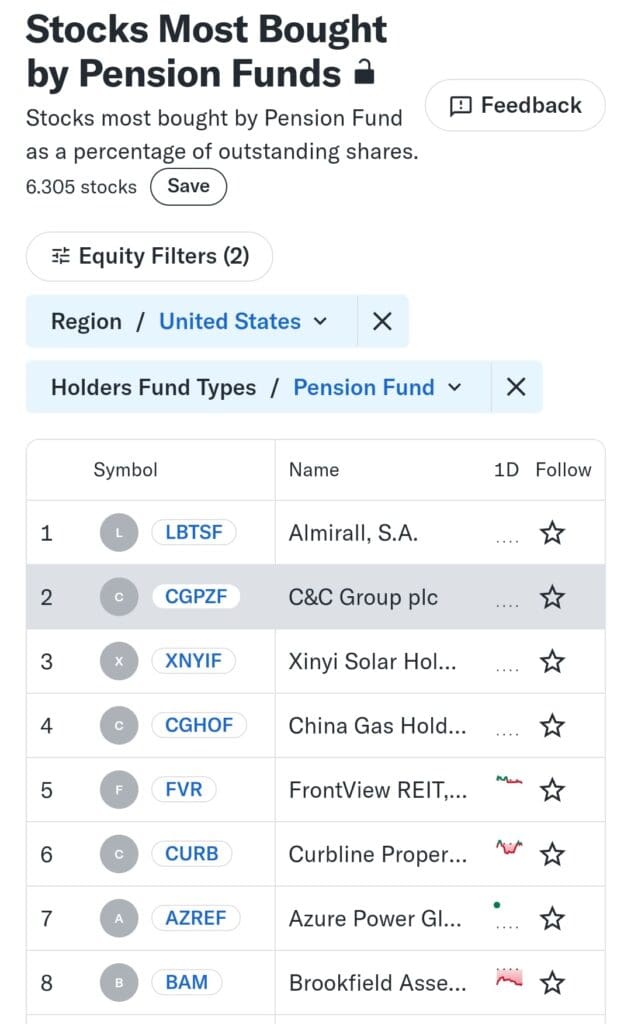

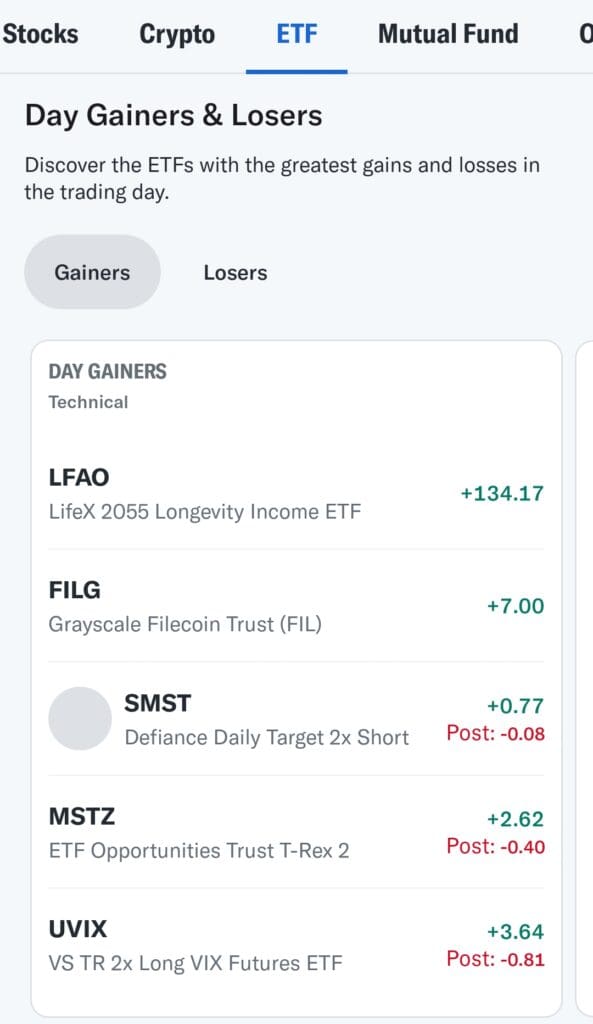

On the other hand, Yahoo Finance Gold is one of the top technical stock screeners. You can screen based on analyst ratings and even track hedge fund and institutional activity.

The Smart Money and Analyst Ratings screeners are particularly useful for tracking institutional sentiment.

Overall, While Morningstar excels for fundamental long-term screening, Yahoo Finance Gold provides more comprehensive options, including technical and institutional-based filters, making it more versatile.

-

Fundamental Analysis Tools

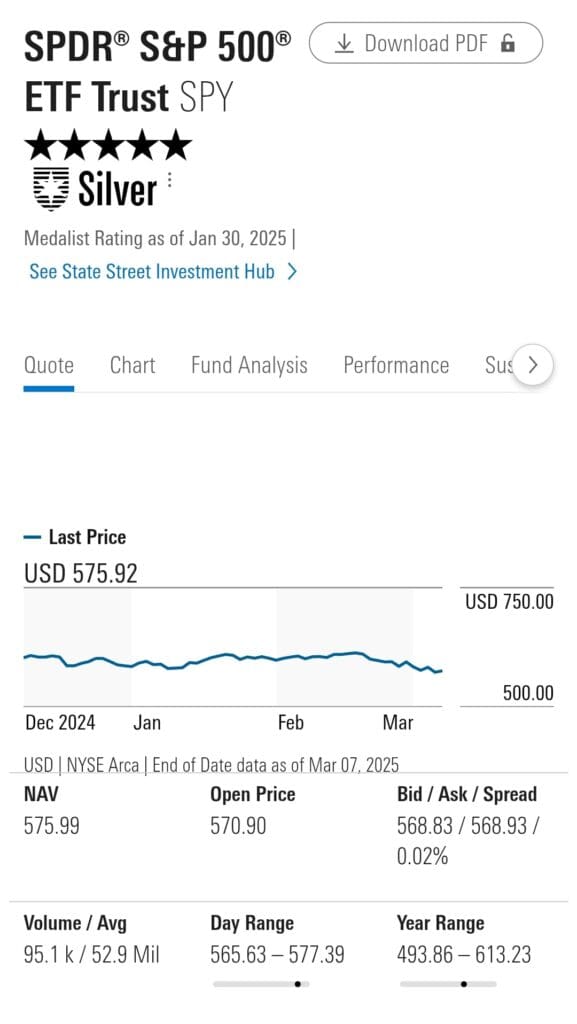

We reviewed the fundamental analysis tools on both platforms, and Morningstar Investor stands out for its in-depth company research.

It provides Fair Value Estimates, Economic Moat Ratings, and detailed stock reports from independent analysts.

These reports focus on long-term growth potential and competitive advantages, making it an ideal tool for value investors.

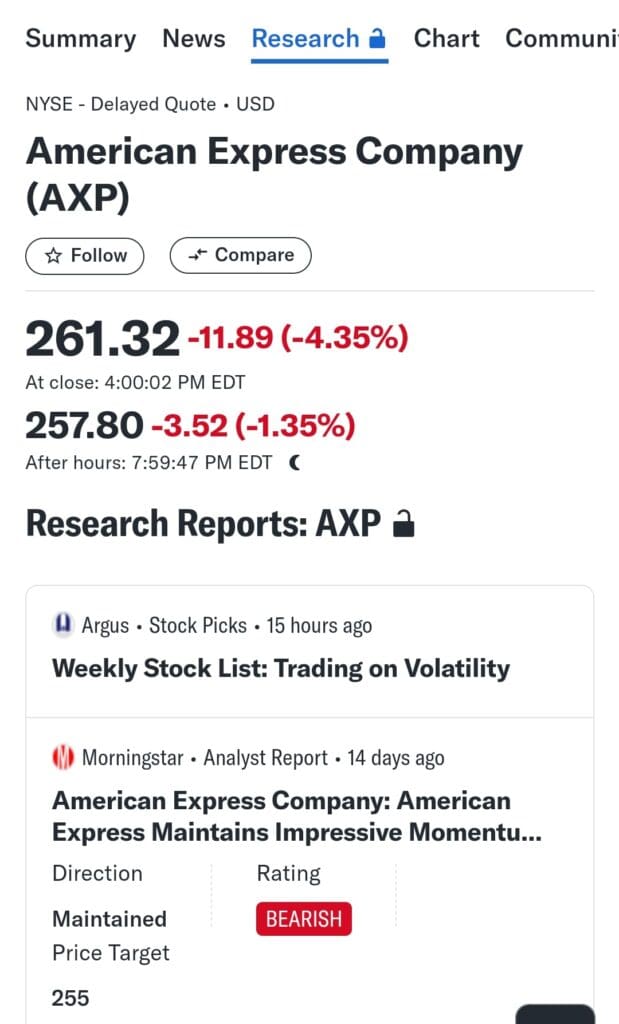

Yahoo Finance Gold also offers comprehensive research, including Morningstar stock ratings and Argus Research stock picks, along with 40 years of financial data.

While Morningstar's research is more independent and focused on long-term fundamentals, Yahoo Finance Gold provides more real-time stock analysis and a mix of expert-backed insights.

-

Stock Picks & Recommendations

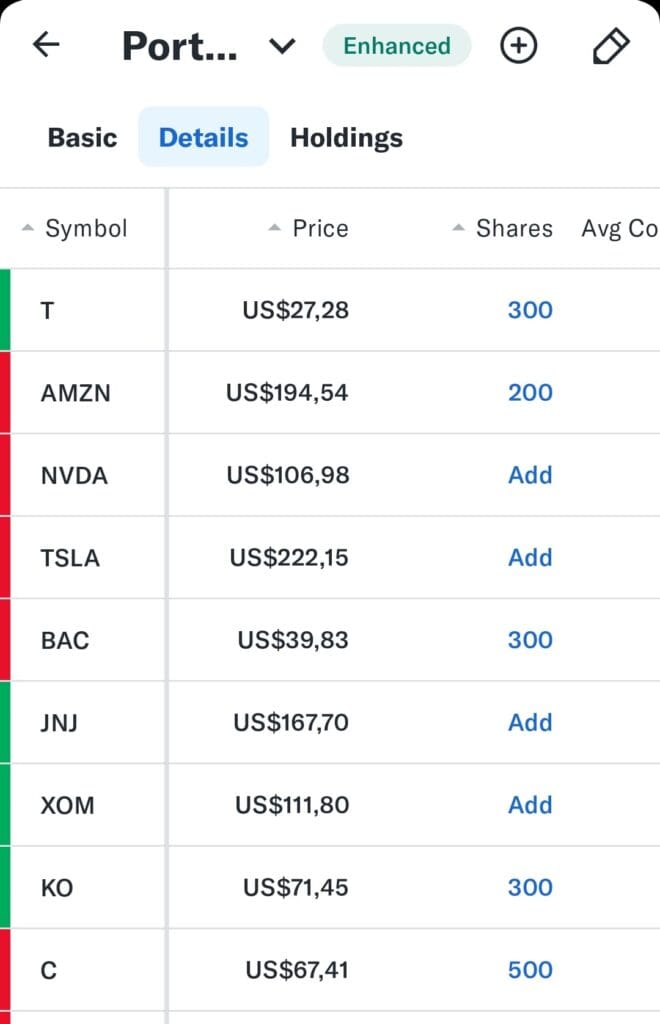

Morningstar Investor offers independent, analyst-driven recommendations based on long-term fundamentals, using tools like its Medalist and Five-Star ratings.

It helps investors select stocks with strong growth potential based on thorough analysis, but there is no AI or automated recommendation system.

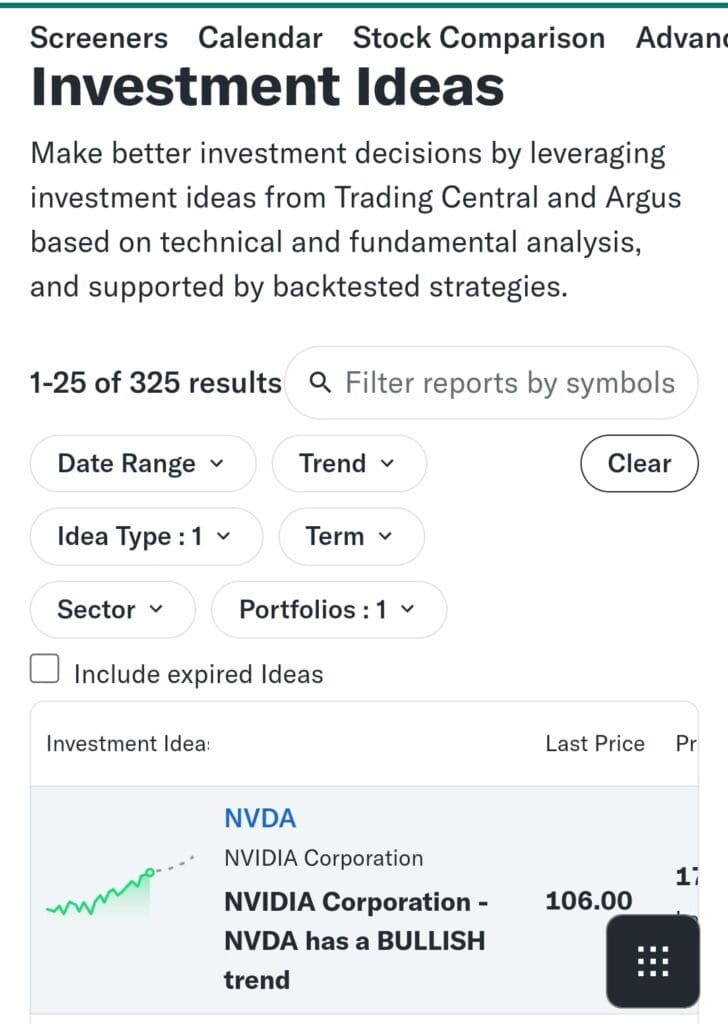

Yahoo Finance Gold stands out with its Personalized Trade Ideas, which are tailored based on market trends, technical signals, and analyst insights.

It also gives access to Argus Research’s stock picks, which provide actionable recommendations backed by in-depth analysis.

Overall, Yahoo Finance Gold provides a more flexible and actionable recommendation system with real-time trade ideas, making it better for investors looking for personalized, up-to-date recommendations.

-

Market Sentiment Analysis

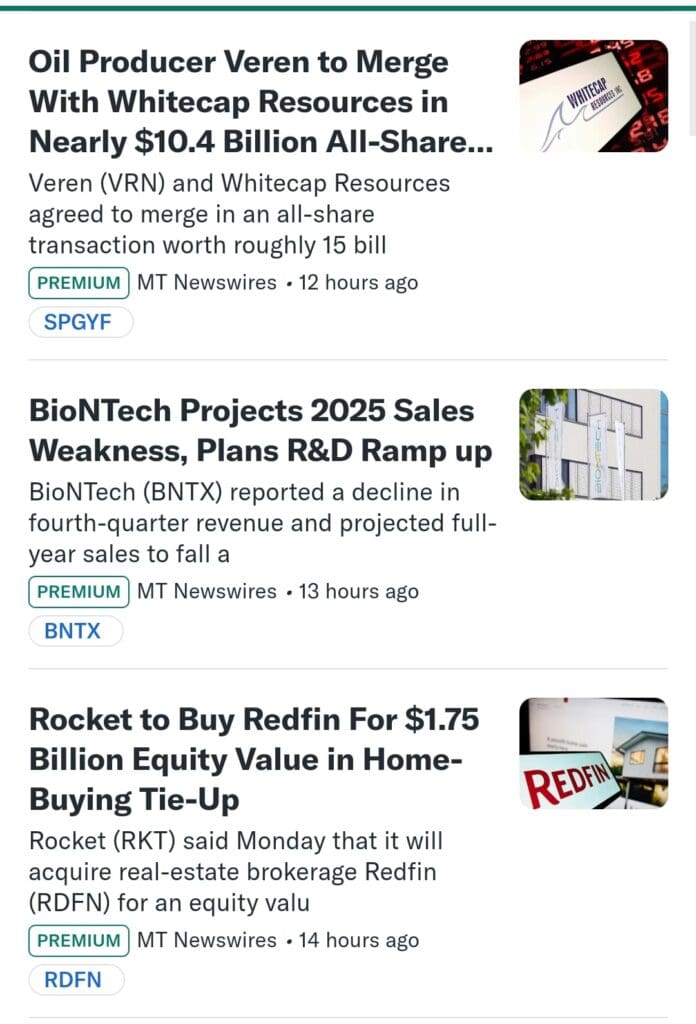

Yahoo Finance Gold excels in this area with its real-time news feeds, Smart Money screener, and features that track institutional buying and selling trends.

It also integrates news from premium sources like Financial Times, giving it an edge in tracking market sentiment and breaking news.

The inclusion of social features like analyst ratings and tickers further enhances Yahoo’s offerings.

Morningstar Investor focuses more on fundamental analysis and lacks extensive social features or real-time sentiment tracking.

-

Portfolio Analysis & Alerts

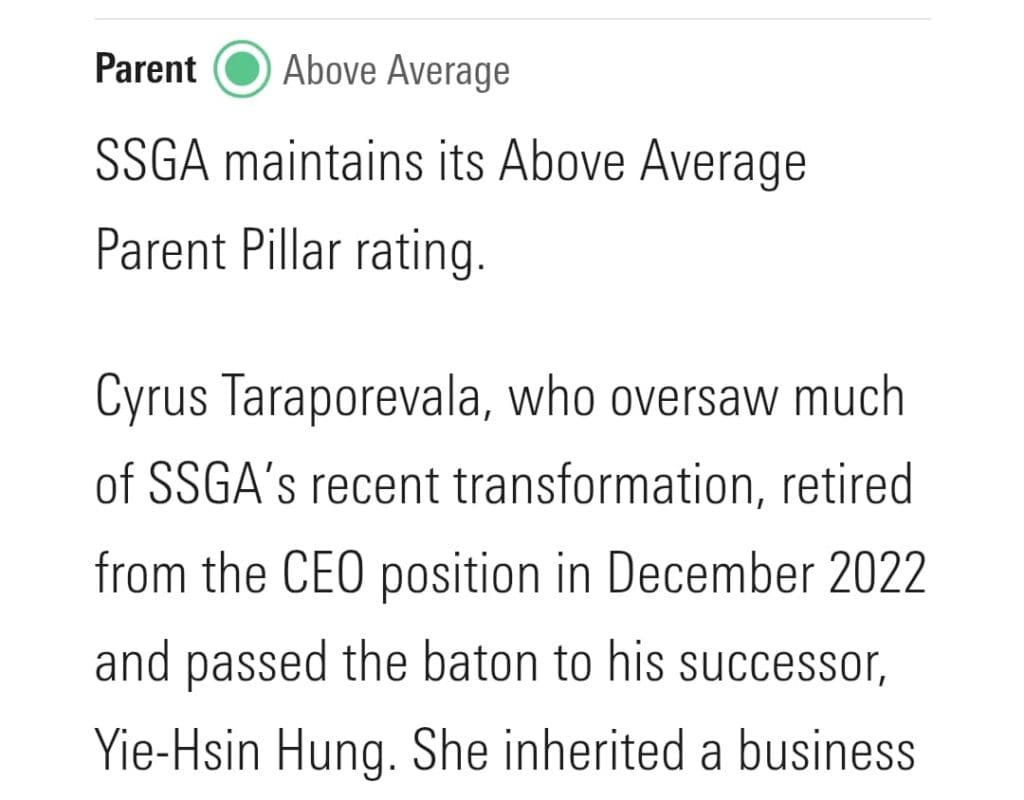

Morningstar Investor offers a robust Portfolio X-Ray tool that provides detailed insights into asset allocation, sector exposure, and portfolio overlaps.

This is useful for long-term investors who want to ensure their portfolio is well-diversified. It also offers a fee analyzer and risk analysis tools to help optimize a portfolio’s performance.

On the alert side, Morningstar’s email-based alerts notify you about changes in valuation or analyst ratings, though they are not real-time.

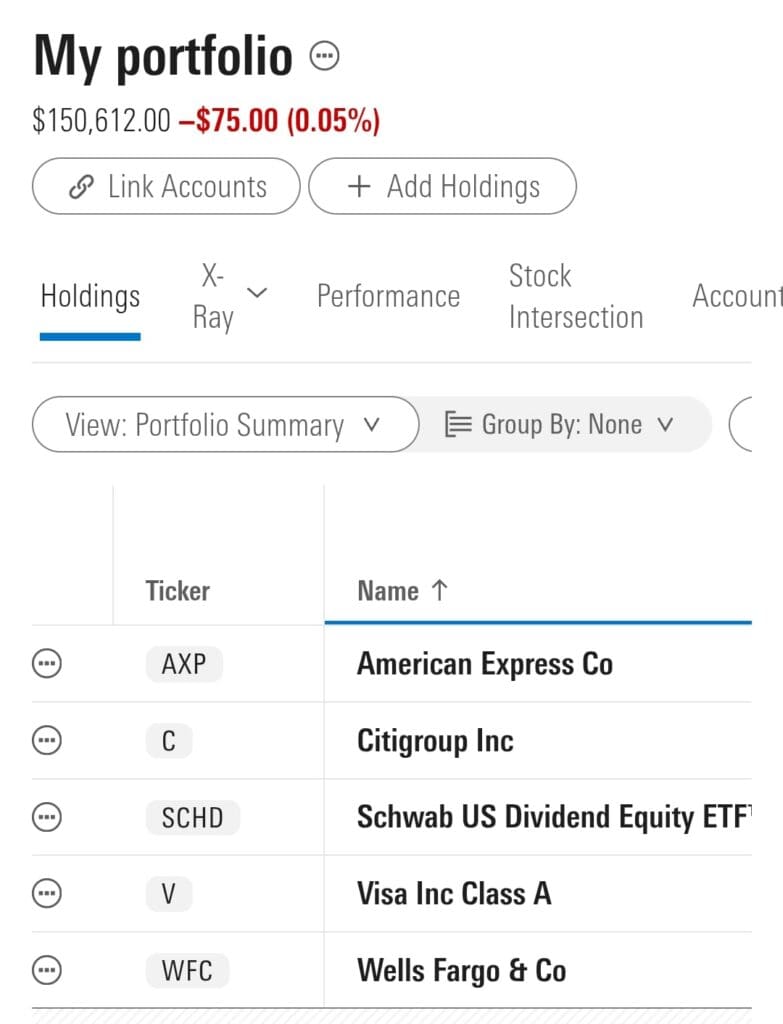

Yahoo Finance Gold, on the other hand, provides more dynamic alerting with real-time notifications for price movements, analyst ratings, and technical patterns.

Overall, Morningstar excels in portfolio analysis tools, but Yahoo Finance Gold offers a more immediate and versatile alert system, making it better for active investors.

-

Technical Analysis Options

Morningstar Investor offers basic charting with trendlines, moving averages, and RSI overlays, which are great for long-term investors looking to track multi-year trends.

However, it lacks advanced technical indicators such as MACD, Fibonacci retracements, or real-time volume analysis, which makes it less suitable for active traders.

In contrast, Yahoo Finance Gold provides more advanced charting options, including 50+ technical chart patterns, custom annotations, and technical event tracking.

Therefore, Yahoo Finance Gold is the clear winner here, offering far more advanced technical analysis tools for traders compared to Morningstar's more basic offering.

-

ETF, Bonds & Fund Analysis Tools

Morningstar Investor specializes in mutual fund and ETF research and offers detailed analyses of cost, risk, and manager performance.

Its mutual fund screener is among the top fund screeners in the market.

Yahoo Finance Gold also offers a strong ETF screener with technical analysis options, but its biggest strength lies in tracking institutional holdings and Smart Money sentiment, which is more relevant for active traders looking to track funds and ETFs based on institutional behavior.

Which Investors May Prefer Morningstar Investor?

Morningstar Investor is ideal for long-term investors looking for in-depth research and portfolio management tools. Here's who would benefit most:

Long-Term Stock Investors: Investors focused on fair value estimates and economic moat ratings for assessing a company's long-term potential.

Fund & ETF Investors: Those seeking comprehensive fund analysis, including detailed screener options and fund manager performance.

Dividend & Income Investors: Investors who prioritize dividend sustainability and income growth through detailed yield and dividend analysis.

DIY Portfolio Managers: Investors managing their portfolios who need insights into diversification, risk, and long-term performance tracking.

Plan | Annual Subscription | Promotion |

|---|---|---|

Morningstar Investor | $249 ($20.75 / month) | 7-Day free trial |

Which Investors May Prefer Yahoo Finance Gold?

Yahoo Finance premium subscription caters to investors needing deep data and real-time market insights for active decision-making. Here's who would benefit:

Active Traders: Traders seeking advanced charting tools, real-time price alerts, and technical pattern analysis for fast decisions.

Institutional Sentiment Investors: Those looking to track hedge fund and institutional movements via the Smart Money and Top Holdings Screeners.

Long-Term Investors: Investors who require access to 40 years of financial data and personalized trade ideas to enhance research.

Research-Oriented Investors: Those who value premium news sources and access to in-depth stock ratings and analyst reports.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Bottom Line

Morningstar Investor excels in long-term, fundamental research with deep insights into stock valuations, ETFs, and mutual funds. It’s perfect for value investors and those seeking detailed portfolio analysis tools.

Yahoo Finance Gold, on the other hand, shines with real-time data, advanced charting, and institutional sentiment tracking, making it ideal for active traders and investors focused on market trends.