GuruFocus Premium | TipRanks Premium | |

Price | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | $359 ($30 / month)

No monthly plan |

Best Features | ||

Our Rating |

(4.6/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this article, we’ll compare TipRanks Premium and GuruFocus Premium, two of the best apps for stock recommendations based on expert insights.

We’ll walk you through their stock screening capabilities, research tools, portfolio analysis features, and expert-driven insights to help you decide which service better supports your investing approach.

-

Stock Screening Tools

GuruFocus Premium offers more advanced stock screening through its All-in-One Screener, which has over 500 metrics, historical financial filters, and backtesting capabilities.

It also includes value-based screeners like Buffett-Munger and Dividend Kings, which are ideal for long-term investors.

TipRanks Premium provides a strong stock and ETF screener focused on smart score, analyst ratings, insider trading, and hedge fund activity.

It includes preset screens like top smart score stocks and technical screeners with filters like P/E ratio, sentiment indicators, and dividend yield.

However, it has fewer customization options compared to GuruFocus.

-

Fundamental Analysis Tools

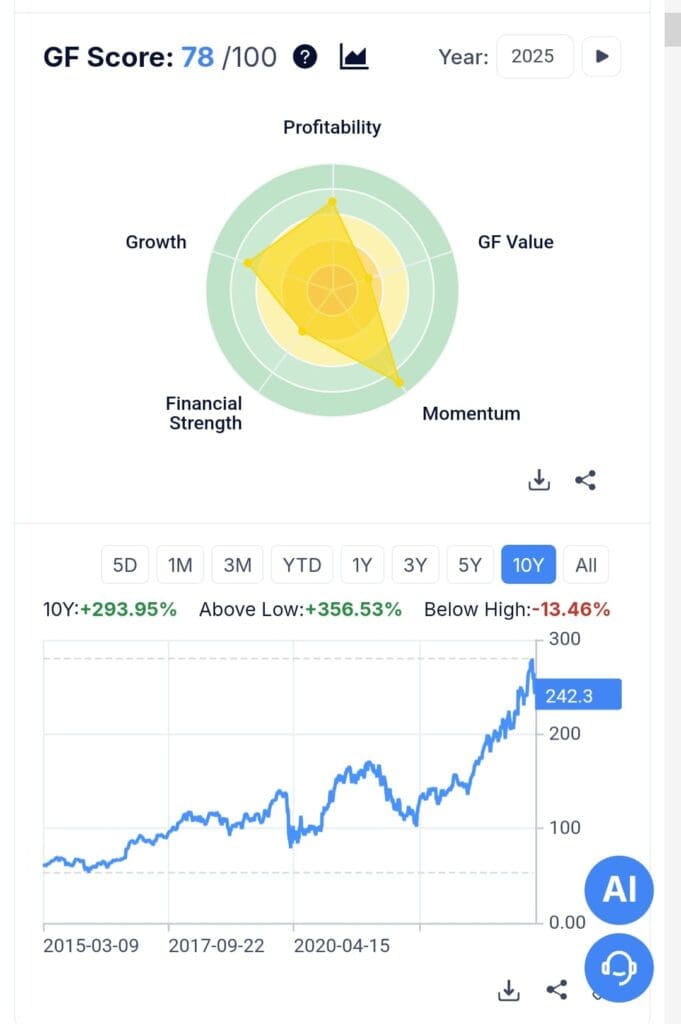

GuruFocus Premium excels in fundamental analysis with 30 years of financial statements, GF Score ratings, valuation models like the Line of GF Value, Peter Lynch charts, and deep financial breakdowns.

It also offers stock comparisons and peer analysis using financial ratios.

TipRanks Premium includes financial breakdowns and smart score rankings, but it focuses more on combining analyst insights with sentiment data than on deep financial reporting.

It lacks long-term valuation models and full customization of financial views.

-

Stock Picks & Recommendations

TipRanks Premium is stronger for users seeking regularly updated, expert-driven stock picks.

TipRanks Premium emphasizes expert-driven picks, such as top analyst stocks, top insider stocks, and smart score stocks, helping users discover picks based on analyst success rates and insider activity. These picks update frequently and can be filtered by strategy.

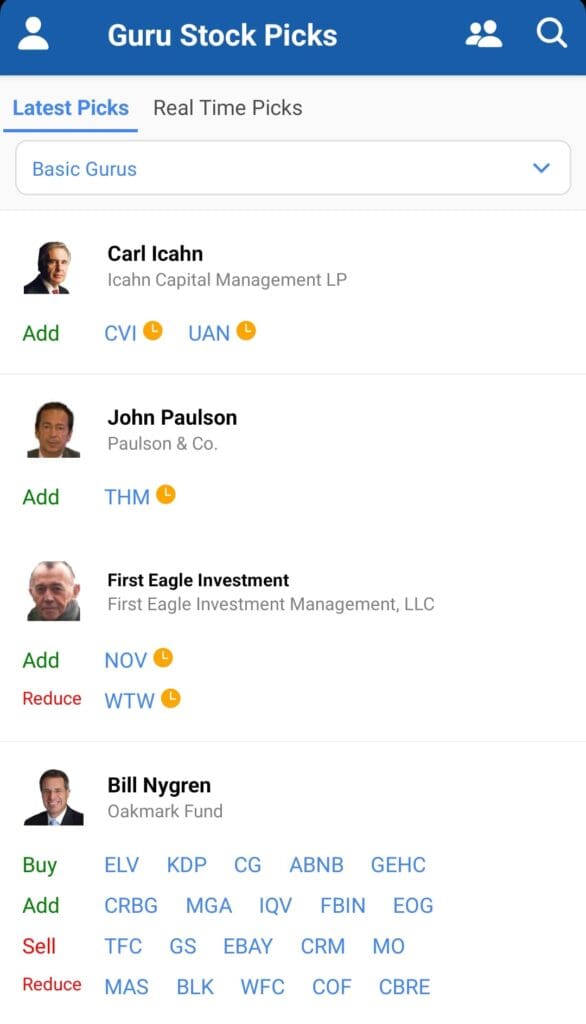

GuruFocus Premium curates model portfolios and consensus guru picks based on hedge fund and value investing strategies. While not as real-time or analyst-focused, they are grounded in proven long-term investing philosophies.

-

Market Sentiment Analysis

TipRanks Premium has more market sentiment features, but neither platform provides full real-time news or social interaction.

TipRanks Premium includes sentiment indicators from bloggers, investors, and news sentiment tied to each stock, but it lacks real-time breaking news and live social feeds. Users can track expert activity but not broader market buzz.

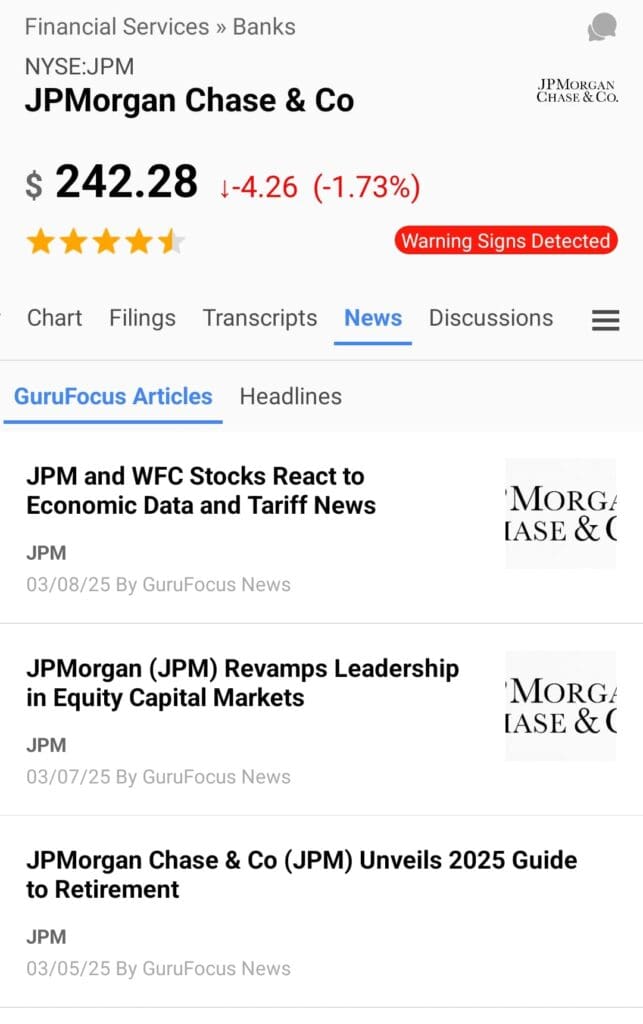

GuruFocus Premium provides financial news by sector and economic indicators but does not support breaking news alerts or real-time sentiment tracking.

-

Portfolio Analysis & Alerts

TipRanks Premium includes portfolio tracking for up to three portfolios, featuring smart score summaries, analyst ratings, insider activity, and hedge fund sentiment.

It also offers personalized alerts for earnings, dividends, and strategy-relevant stock moves.

GuruFocus Premium does not provide built-in personal portfolio tracking. It offers alerts only for stock screener criteria, value screen matches, and economic indicators.

-

Technical Analysis Options

TipRanks Premium offers more relevant tools for technical traders, though still limited overall.

TipRanks Premium supports basic charting tools (candlesticks, RSI, MACD), smart score overlays, and technical screeners. However, it lacks advanced chart patterns, drawing tools, and scripting features.

GuruFocus Premium offers customizable financial charts and can overlay valuation metrics, but is not designed for technical trading.

-

ETF, Bonds & Fund Analysis Tools

Neither platform excels in bond or ETF analysis, though GuruFocus offers slightly better mutual fund data.

TipRanks Premium offers basic ETF screening using smart score and analyst sentiment, but lacks deeper ETF or bond analysis. It does not include bond-specific tools.

GuruFocus Premium supports mutual fund holdings and institutional tracking but does not offer bond analysis or detailed ETF breakdowns.

Which Investors May Prefer TipRanks Premium

Investors who value expert opinions and sentiment-driven signals will benefit most from TipRanks’ paid subscription features and tools.

Analyst-Focused Investors: Those who rely on top analyst ratings, success scores, and price targets to shape stock decisions.

Insider & Hedge Fund Watchers: Users who track insider buying or hedge fund activity for potential stock moves.

Portfolio Builders: Retail investors seeking stock ideas, portfolio tracking, and alerts tailored to their holdings.

Dividend & Smart Score Seekers: Those who want high-yield picks filtered by smart score and analyst conviction.

TipRanks suits those who prefer curated stock ideas backed by data, expert picks, and sentiment overlays rather than raw financial data alone.

Plan | Annual Subscription | Promotion |

|---|---|---|

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

Which Investors May Prefer GuruFocus Premium

GuruFocus subscription is ideal for investors who want to prioritize deep financial analysis, long-term value, and institutional strategies tracking.

Value-Oriented Investors: Perfect for those using Buffett-style or Peter Lynch strategies to identify undervalued companies.

Guru Trackers: Investors who follow hedge fund managers and want real-time access to aggregated guru portfolios.

Fundamental Analysts: Users who rely on 30-year financials, custom valuation ratios, and advanced screeners for research.

Dividend-Focused Portfolios: Those who analyze dividend sustainability, history, and yield forecasts over time.

GuruFocus is best for patient, detail-driven investors who seek high-quality insights based on financial strength and valuation—not short-term signals.

Plan | Annual Subscription | Promotion |

|---|---|---|

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | 7-day free trial + 30-day money-back guarantee |

GuruFocus Premium Plus | $1,348 ($112.33/ month)

No monthly plan, price for US citizens, price change by region | 7-day free trial + 30-day money-back guarantee |

GuruFocus Professional | $2,398 ($199/ month)

No monthly plan, price for US citizens, price change by region | 7-day free trial + 30-day money-back guarantee |

Bottom Line

TipRanks Premium excels in stock discovery using smart scores, analyst insights, and sentiment data, making it ideal for idea generation and expert-backed picks.

GuruFocus Premium shines in deep fundamental analysis, long-term valuation models, and guru portfolio tracking.

If you’re focused on expert sentiment and portfolio tools, TipRanks fits best. For value investors and financial deep-divers, GuruFocus delivers a richer research experience.