TradingView Free Plan

Monthly Subscription

Promotion

30-day free trial when upgrading

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The TradingView Free Plan is a solid option for traders and investors who need powerful charts, stock and crypto screeners, and market data without paying for a subscription.

It offers Supercharts with customizable indicators, multiple timeframes, and smart drawing tools, making it a great choice for technical analysis.

The stock, ETF, bond, and crypto screeners help users filter assets based on fundamental and technical criteria, while the heatmaps provide a quick visual of market trends.

For traders looking to improve their strategy, the paper trading feature allows simulated trades, and the bar replay tool lets users analyze historical price action.

However, there are some limitations—real-time stock data is delayed, users can set only one alert, and only three indicators per chart are allowed. Backtesting is limited, and premium analysis tools require a paid plan.

- Supercharts & technical analysis

- Stock, ETF & bond screeners

- Crypto screener & heatmaps

- Fundamental stock analysis

- Trading & paper trading

- Trading alerts system

- Pine Script custom coding

- Social trading & community

- Economic & earnings calendars

- Market summary & hotlists

- Mobile & web-based access

- Pre-market & after-hours data

- Powerful free charting tools

- Stock & crypto screeners

- Paper trading simulation

- Custom Pine Script coding

- Strong social trading features

- Delayed real-time stock data

- Only one active alert

- Limited indicators per chart

- Backtesting restrictions

- Premium features require paid plan

How To Research Stocks & Analyze Charts?

While it may be a bit difficult for beginners, TradingView is one of the best options in the market for technical analysis and stock research. Here what we tested:

-

Supercharts: Technical Analysis & Indicators

TradingView’s Supercharts are a powerful tool that gives traders an easy way to analyze price action with a clean and flexible interface.

When we tested it, the charts loaded quickly, even when switching between different timeframes and asset types. The customization options are impressive – you can adjust layouts, add indicators, and change chart types effortlessly.

TradingView is packed with technical analysis tools, making it one of the best platforms for traders who rely on indicators and chart patterns.

When we tested the free plan options, we found over 400 built-in indicators and strategies, covering everything from moving averages and Bollinger Bands to MACD and RSI.

Drawing tools are another highlight—TradingView offers 110+ smart drawing tools, including Fibonacci retracements, trendlines, and Gann fans.

The multi-timeframe analysis is also impressive, allowing traders to see how an asset behaves across different time horizons.

-

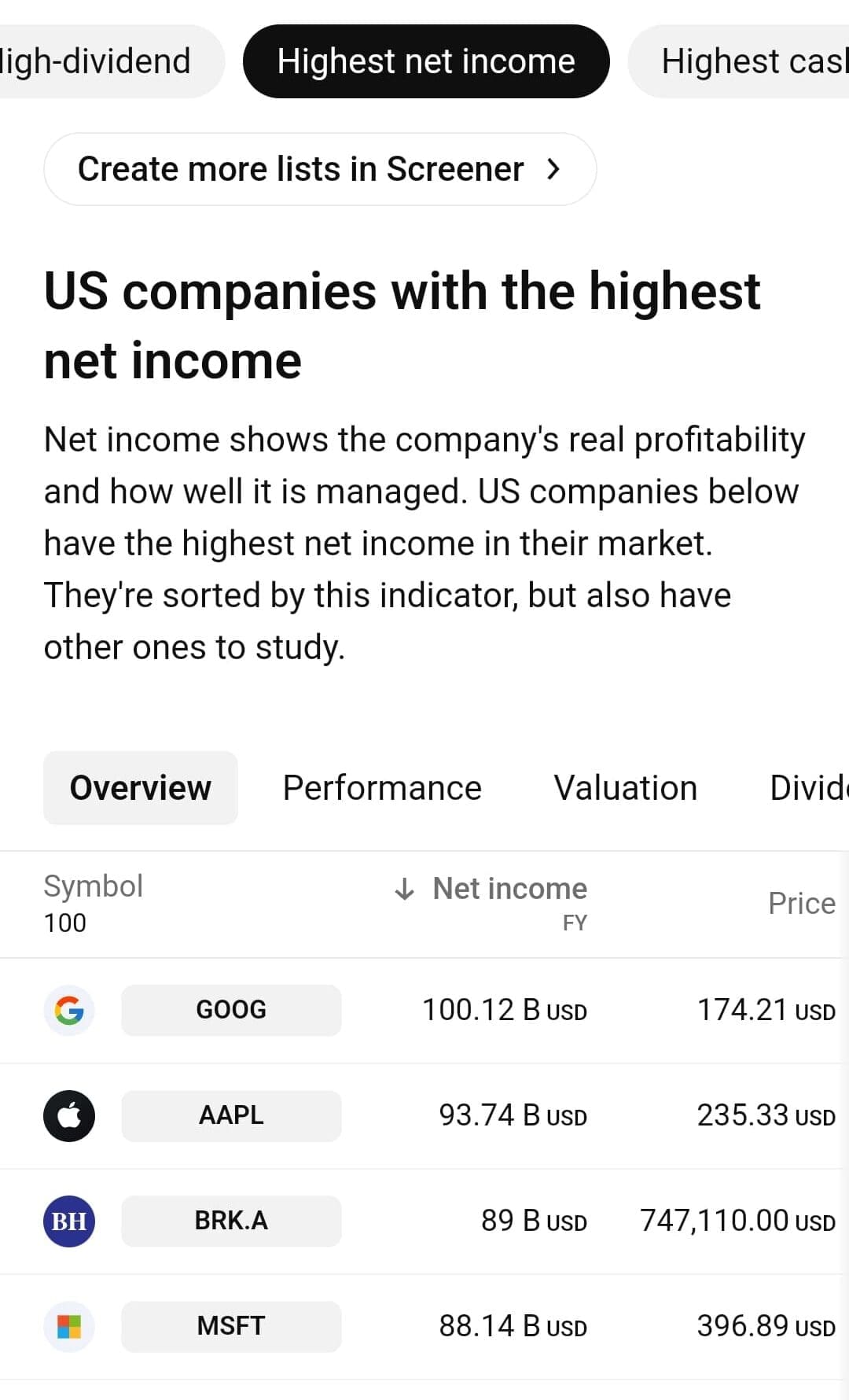

Stock, ETF, Bonds & Crypto Screeners

TradingView’s screening tools are one of its most powerful technical stock screeners, allowing traders to filter and analyze thousands of assets in real time.

Even in the Free plan, you can access screeners for stocks, ETFs, bonds, and crypto, each with a unique set of filters designed to help users identify investment opportunities:

-

Stock Screener

TradingView’s Stock Screener is a versatile tool that helps investors and traders filter stocks based on a wide range of fundamental and technical metrics.

We tested it by sorting stocks by market cap, sector, valuation, growth, technical and analyst ratings, which worked smoothly.

Additionally, performance metrics like beta, PEG ratio, and ROE help assess risk and profitability. However, the free plan restricts real-time data and advanced filters.

-

Bond Screener

The Bond Screener in TradingView helps investors filter and analyze bonds based on essential criteria.

We used it to track bond type, issuer, yield-to-maturity (YTM), and coupon rates, which made it easy to compare different fixed-income investments.

The screener includes data on coupon type, payment frequency, maturity dates, and outstanding amounts, allowing bond investors to evaluate income potential and risk exposure.

-

ETF Screener

The ETF Screener is ideal for investors looking for diversified fund options. We tested it by filtering ETFs based on asset class, focus, region, and brand, making it easy to find sector-specific or international funds.

The screener also provides key financial metrics like NAV total return, AUM, expense ratio, and management style. Free users have restricted access to real-time NAV updates and advanced performance filters.

-

Crypto Screener

TradingView’s Crypto Screener is a must-have for digital asset traders. We tested it by filtering cryptocurrencies based on market cap, rank, and volume, which helped identify trending assets.

Additional filters, like fully diluted market cap, volume-to-market cap ratio, and transaction volume in USD, provide deeper insights into liquidity and activity.

-

Fundamental Analysis Tools

While it’s widely known for technical analysis, TradingView offers a robust set of fundamental analysis tools for stock traders and investors.

The Fundamentals Overview provides financial statements, key statistics, and dividend history. Users can track earnings reports, revenue growth, and profitability metrics:

There’s a stock forum discussion section, where traders share insights and trade ideas. The options chain provides real-time contract pricing, and corporate bond listings show fixed-income investment opportunities.

For news and sentiment analysis, TradingView aggregates press releases, insider trading activity, ESG and regulatory updates, and analyst insights, though Free plan users have limited access to certain news sources:

The Technical Analysis Summary combines popular indicators like Moving Averages, Oscillators, and Pivots, giving a quick overview of a stock’s momentum. Additionally, the forecast tool summarizes analyst ratings from multiple sources.

While ETF and bond data are available, they have more limited tools than stocks.

-

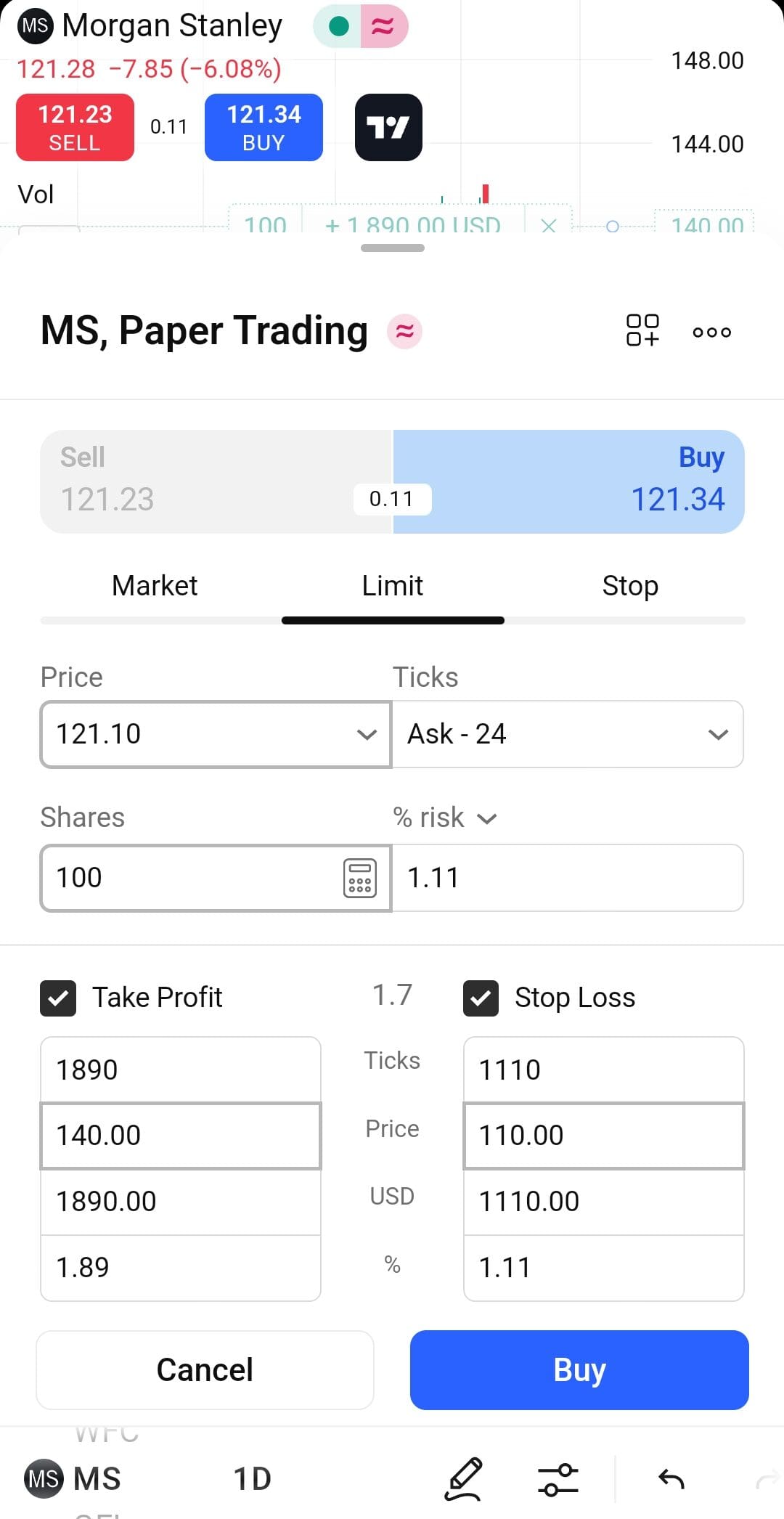

Trading & Paper Trading

TradingView isn’t just for charting—it also allows users to trade directly from charts with supported brokers.

For traders who use real accounts, TradingView integrates with selected brokers, allowing direct trading from the chart.

We tested the Free plan’s Paper Trading feature, which lets traders practice buying and selling assets with virtual money. It’s a great way to get comfortable with order execution before risking real capital.

The paper trading experience is highly realistic, supporting market, limit, stop, and stop-limit orders. Order modifications are easy, and performance tracking helps users understand how their strategies perform over time.

-

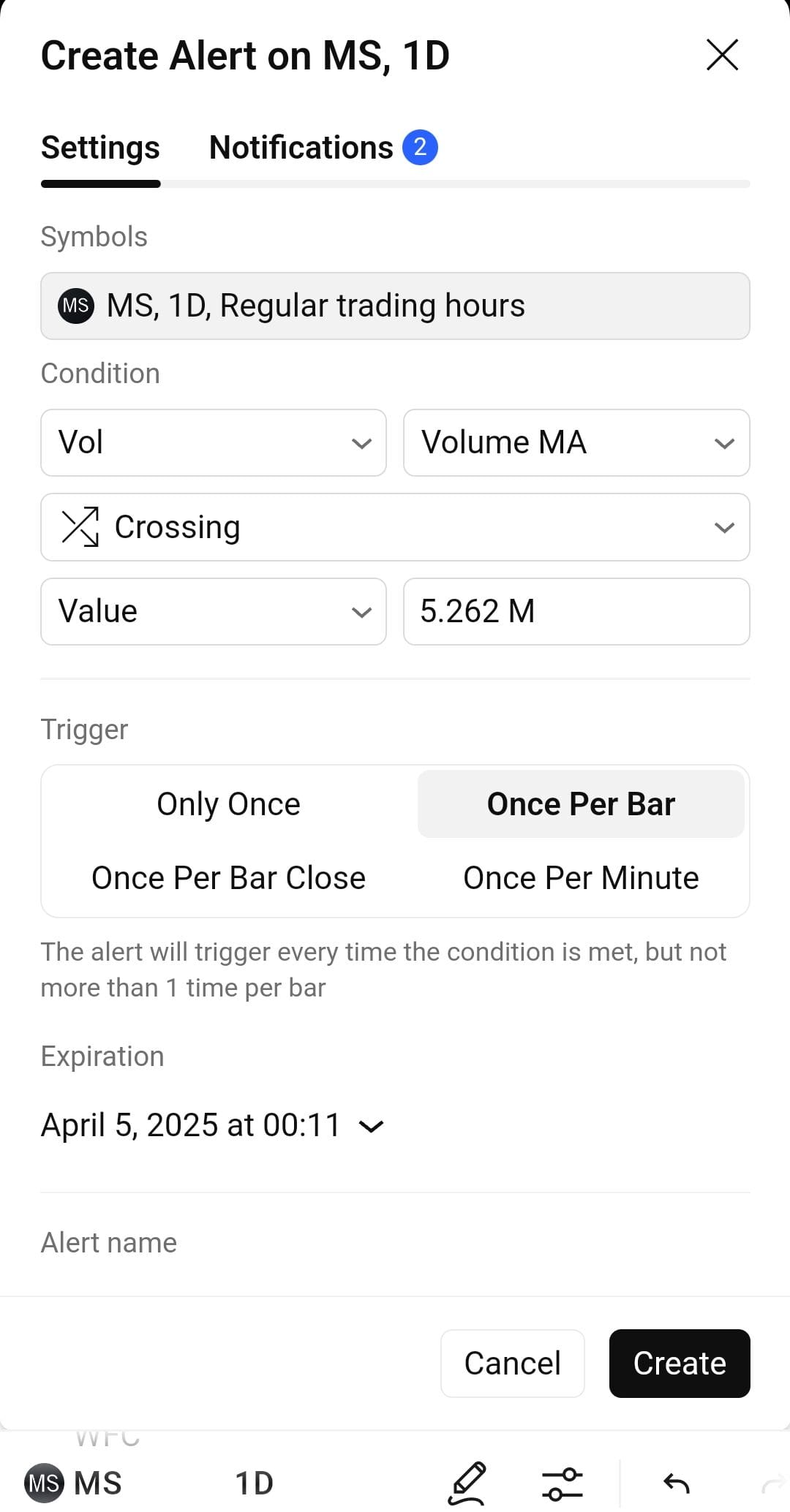

Trading Alerts

Trading alerts are one of the most valuable features in TradingView, and even in the Free plan, you get a solid experience.

We tested the system by setting alerts for stock price breakouts, RSI overbought signals, and trendline touches, and it worked reliably every time – see how many options you have:

You can choose from 13 alert conditions, such as crossing a specific price level, price increasing by a certain percentage, or moving average crossovers.

The alerts are cloud-based, so they run on TradingView’s servers even when you're offline.

Here's how to create an alert:

Notifications can be sent via email, desktop pop-ups, or mobile push notifications – a huge plus for traders who aren’t always at their desks.

However, free users can set only one active alert at a time, which is very limiting for active traders.

-

Pine Script® – Custom Indicators & Strategies

One of TradingView’s most powerful features is Pine Script®, a coding language specifically designed for creating custom indicators and trading strategies.

Unlike other trading platforms that require complex programming, Pine Script® is lightweight and intuitive – you can write just a few lines of code to create an indicator that would take hundreds of lines in other languages.

TradingView provides an integrated editor with syntax highlighting and debugging tools, making it beginner-friendly. You can customize everything from moving averages and oscillators to fully automated trading strategies.

The platform also offers a public library of over 100,000 Pine Script® indicators, allowing users to modify existing scripts or create their own.

-

Heatmaps – Visual Market Insights

TradingView’s heatmaps provide a visual snapshot of market performance, making it easier to spot trends and opportunities at a glance.

We tested the Stock, ETF, and Crypto Heatmaps, and they quickly displayed real-time market movements using color-coded indicators—green for gains, red for losses.

The Stock Heatmap lets you filter by sector, market cap, and performance, making it easy to see which industries are leading or lagging.

The best part? You can click on any asset to open its chart instantly, making the heatmap a powerful starting point for deeper analysis.

-

Social Trading & Community

TradingView is more than just a charting platform—it’s a social network for traders.

We explored the community features, and it’s clear why so many traders use it to share ideas. Users can publish trading ideas, comment on charts, and interact with other traders in real-time.

One of the best aspects is the public scripts library, where you can find over 100,000 Pine Script® indicators created by other traders. Instead of coding your own tools, you can simply apply a custom indicator made by someone else.

The community also shares market analysis, trade setups, and educational content, making it a great place for learning.

-

Economic & Earnings Calendars

The Economic Calendar and Earnings Calendar in TradingView Premium provide traders with real-time access to key financial events that impact global markets.

The economic calendar tracks major events like Federal Reserve meetings, GDP releases, and inflation reports, allowing traders to anticipate market volatility.

Events are categorized by importance, with detailed forecasts and historical data for trend analysis.

The Earnings Calendar is essential for stock traders, offering real-time insights into earnings dates, EPS estimates, and revenue forecasts.

Users can filter by sector, market cap, and past earnings reactions, helping them prepare for price swings before and after reports.

Additional Features & Tools

TradingView Free Plan offers a solid range of tools beyond charts and screeners, providing traders with valuable insights and analysis. Here are additional features and tools available in the free version:

- Market Summary: Offers a quick overview of major indices, forex, crypto, and commodities, helping users stay updated on market trends.

- Hotlists: Provides lists of top gainers, losers, and most volatile stocks in real-time, helping traders find potential opportunities.

- Web-based Platform: No need for downloads—TradingView runs entirely in a browser, with data syncing across multiple devices.

- Mobile App Access: Available on iOS and Android, allowing traders to analyze charts, set alerts, and access watchlists on the go.

- Pre-Market & After-Hours Data: Free users can access extended trading session data for U.S. stocks, though with some delay.

- Sparks: A bite-sized news feature that highlights trending market events and quick insights.

- Custom Layouts: Free users can save one custom chart layout, which syncs across devices for easy access.

Limitations: What You Can’t Do with TradingView Free

While TradingView’s Free Plan is one of the best options for beginner traders and casual investors, it does come with some notable limitations:

-

Stock Ratings & Fundamental Analysis Are Basic

While TradingView provides fundamental data like earnings reports, revenue growth, and analyst ratings, Free users don’t get full access to deep stock analysis tools.

Competitors like Yahoo Finance (Premium) and Zacks offer more detailed stock screening, fair value estimates, and in-depth financial analysis.

Additionally, ETF and bond data are more limited compared to Morningstar, which specializes in detailed fund ratings. If you’re an investor looking for deep fundamental research, the Free plan may not be enough.

-

Limited Charting & Indicators Per Chart

TradingView is known for its Supercharts, but Free users are limited to just three indicators per chart.

If you're using a strategy that requires multiple moving averages, oscillators, or volume-based indicators, this restriction can feel frustrating. Premium plans allow up to 25 indicators per chart, making them a better choice for advanced traders.

-

Limited Real-Time Data & Delayed Market Prices

One of the biggest downsides of the Free plan is delayed stock market data, especially for U.S. exchanges.

While crypto prices update in real-time, stocks, ETFs, and other assets often lag by several minutes unless you pay for data feeds. This is a major issue for day traders who rely on up-to-the-second price movements.

Is TradingView Right for Your Trading Style?

TradingView’s Free Plan is a great starting point for many traders and investors, but it’s not for everyone. It works best for those who don’t need advanced tools or real-time data.

Here are four types of users who might find it a good fit:

Beginner Traders: Ideal for those just starting with stock or crypto trading, offering easy-to-use charts, screeners, and community insights without overwhelming complexity.

- Investors Rely on Technical Analysis: even with the free plan, the technical analysis tools are just great.

Swing Traders: Since swing trading focuses on multi-day trends, the Free plan’s delayed stock data isn't a big issue, and it provides enough technical indicators to analyze setups.

Social Traders & Analysts: The Free plan allows users to share trade ideas, follow other traders, and participate in discussions without needing premium features.

Who Needs More Than TradingView Free?

While TradingView’s Free Plan is great for some traders, it has limitations that make it a poor fit for those who need advanced tools and real-time data.

Here are types of users who may find it lacking:

Day Traders: The Free plan has delayed stock data, limited indicators, and only one active alert, making it unsuitable for those who rely on real-time price movements.

Options Traders: The options chain tool is basic, and the Free plan lacks real-time volatility analysis, Greeks, and options flow data, which are essential for serious options trading.

Fundamental Investors: Stock ratings, analyst reports, and financial data are limited, making platforms like Morningstar or Zacks better for deep fundamental analysis.

- Investors Want Stock recommendations: investors who want to see recommendations, ranking of stocks, or stock picks will prefer other platforms.

TradingView Free vs Higher Tiers: Worth To Upgrade?

The TradingView Free Plan offers basic charting, stock screeners, and delayed market data, making it a solid choice for beginner traders and investors. However, paid plans provide more advanced tools and real-time data.

The Essential, Plus and Premium plans progressively unlock more indicators per chart, multiple alerts, faster data updates, and advanced features like multiple chart layouts, second-based timeframes, and custom scripting.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Trading View Essential | $14.95

$108 ($9 / month) if paid annually | 30-day free trial |

Trading View Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Trading View Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Trading View Expert | $119.95

$1,199 ($99.95 / month) if paid annually | N/A |

Trading View Ultimate | $239.95

$2,399 ($199.95 / month) if paid annually | N/A |

The expert and ultimate plans are for professional traders and usually not for reatil investors or single day traders.

FAQ

Yes, but only with supported brokers. The Free plan allows account linking but limits advanced order types and real-time execution features available in paid plans.

Yes, TradingView is accessible globally, though some data feeds and broker integrations are region-specific.

Yes, you can view charts without signing in, but saving layouts, setting alerts, and using screeners requires a free account.

Yes, but the data may be delayed. Real-time extended hours data requires a paid subscription.

No, data exporting (like CSV file downloads) is only available in paid plans.

Free users can create one watchlist but can track unlimited assets within it. Multiple watchlists require a paid plan.

No, automated trading execution requires a paid plan and a compatible broker integration.

Not really. While it offers solid basic tools, serious traders will need real-time data, more alerts, and deep backtesting, which require a paid plan.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.