Wealthfront

Annual Advisory Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- FAQ

Wealthfront is considered one of the best robo advisors with low cost auto portfolio management. The platform offers a number of brokerage account options with curated portfolios that have been designed by financial experts.

If you’re a passive investor, Wealthfront allows you to access index funds, ETFs, crypto, and low cost bond ETFs. There are even portfolio lines of credit, tax loss harvesting and auto rebalancing.

While the account minimum is a little higher compared to some of the other top robo advisors, Wealthfront does offer an excellent feature set that includes smart beta tools, risk parity and U.S direct indexing.

This platform is a solid option for hands off investors or investors who want more control over the asset allocation of their portfolio. But, certain features such as tax loss harvesting are not available with some account types and there are only crypto trusts rather than purchasing coins or tokens.

What is Wealthfront?

Wealthfront is an automated investment service, or robo-advisor, that offers financial planning, investment management, and banking services.

How's Wealthfront customer service ?

I can reach out to the team via the online form or on weekdays, there is phone support 8 am to 5 pm PT. If I use the helpline, I do need to work through a couple of menu options, but then I’m put through to a product specialist who is ready to answer my specific questions.

Does Wealthfront offer human financial advisors?

No, Wealthfront is a fully automated service and does not offer access to human financial advisors.

How much does Wealthfront charge?

Wealthfront charges an annual advisory fee of 0.25% of the assets under management.

What types of accounts can I open with Wealthfront?

Wealthfront offers individual and joint taxable accounts, traditional and Roth IRAs, SEP IRAs, and 529 college savings plans.

How often does Wealthfront rebalance portfolios?

Wealthfront rebalances portfolios automatically whenever the asset allocation drifts significantly from the target allocation.

Is Wealthfront safe to use?

Yes, Wealthfront is a registered investment advisor with the SEC and uses bank-level security measures to protect your data and investments.

Pros | Cons |

|---|---|

Automated Investing | No Human Advisors |

Comprehensive Financial Planning | High Account Minimums for Certain Features |

User-Friendly Interface | Limited Investment Options |

Tax Efficiency | Fees |

High-Interest Cash Accounts |

Wealthfront Features I Mostly Liked

Here are the key features that I found most appealing in Wealthfront:

-

Easy Use Goal Planning

Another feature of Wealthfront that helped me was the goal planning. This is integrated into the other features of the platform, but it is worthy of note on its own behalf.

Having goals in place is vital for your financial health in the short, medium and long term. But, monitoring and tracking your goals can be tricky.

This is where Wealthfront shines. I can set multiple goals according to my current plans. For example, I set one for retirement, another for buying a new car etc. The platform makes it easy to set each individual goal and I can then track them in my dashboard.

As you can see in the screenshot above, you can enter the amount you’ll need, how much you can put away each month and your projected timeframe. Wealthfront will then alert you to whether you’re on track or if you need to make some adjustments.

-

Automated Financial Planning For Specific Goals

Whether you’re a Wealthfront client or not, you can use the platform’s free Path tool to get an overview of your finances.

I connected my financial accounts, including my credit cards, mortgage, and investments, to get a bird' s-eye view of my cash flow, income, and debt. This allowed me to plan my short—and long-term financial goals.

While this is not unique and there are other tools out there, this is a great free option even if you decide you don’t want to use Wealthfront for your investments.

I used Path to set goals and track my progress. The feature uses academic research to create projections adjusted for inflation, financial market changes, etc.

-

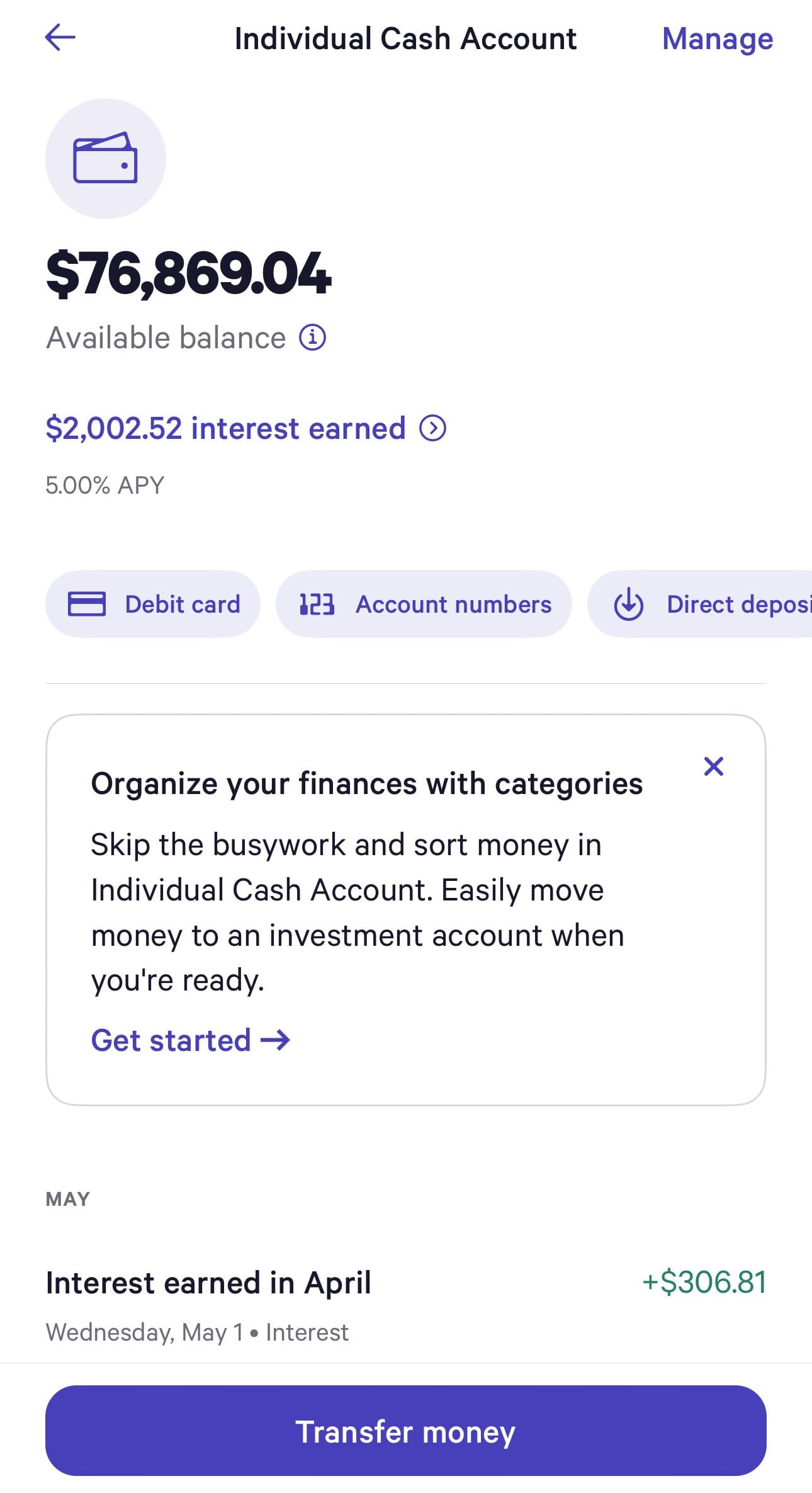

Cash Management Account

Wealthfront Cash is a combination of a standard checking account and a high interest savings account. I can enjoy all the features of a typical checking account, but I can also earn an impressive APY of 4.25%, as of December 2025.

There are no monthly maintenance fees or ATM charges and you only need $1 to open your account. I can even use the account to pay my bills or make direct purchases using PayPal, Apple Pay, Google Pay, Cash App or Venmo.

As an added bonus, you don’t even need to open a Wealthfront robo advisor investment account to be able to open a Wealthfront Cash account. This means that you can enjoy great rates on all of your cash and use the free tools to improve your financial health even if you’re not ready to start your investment journey just yet.

-

Create Personal Savings Plan

Setting up your savings plan, formerly known as “Autopilot,” is another Wealthfront feature set, and it is designed to work in concert with Path.

I deposited my paycheck with Wealthfront and the algorithm will determine the best use of my dollars. This is a fantastic feature that can help me to allocate funds to where I can earn the best risk adjusted returns.

So, if you’re lacking investing confidence and are unsure about where you put your excess funds after you’ve boosted your emergency fund, Autopilot can be a highly effective option.

-

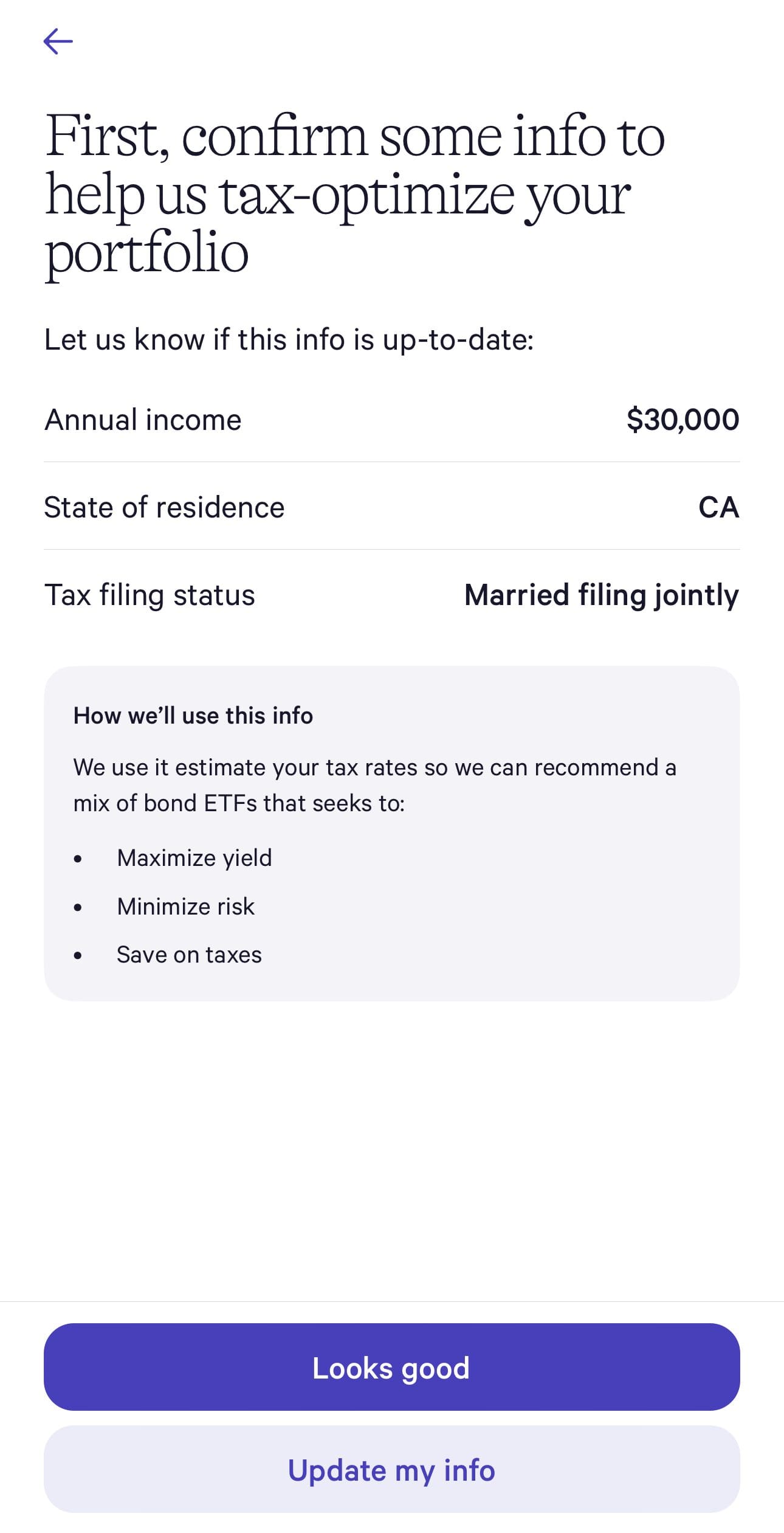

Tax Loss Harvesting

If you open an individual or joint brokerage account, you can access the tax loss harvesting feature.

With this feature, Wealthfront will replace any securities that have suffered a loss, reinvesting funds into other assets that align with your portfolio targets. You can then write off your losses on your next tax return, which should lower your tax obligations.

So, even if I end up selling some of your assets at a loss, I can use this to offset any taxable income I may have generated with my other investments or my regular income.

-

Socially Responsible Portfolios

If you want to make an impact with your money, you’re sure to appreciate the Wealthfront socially responsible portfolios. These rely on Blackrock funds tracking socially responsible indexes as defined by MSCI.

Depending on your specific risk tolerance, the robo advisor will create a portfolio of US stocks, municipal bonds, US bonds, emerging market stocks, foreign developed stocks and TIPS for diversity.

So, I can still enjoy the hands off investing approach that Wealthfront is best known for without compromising on my ethics. I can feel good about supporting companies that are socially responsible and enjoy decent returns.

-

A Choice of Retirement Savings Accounts

Unlike many robo advisor platforms, Wealthfront offers a choice of different retirement savings accounts that are all equipped with rebalancing to help maximize your returns and stay on track with your goals.

At any time, I can check my dashboard to see my progress towards my retirement goal. In this screenshot above, you can see that Wealthfront is letting me know that I’m on track for my retirement date and may even exceed my retirement goal.

-

Automated Investment Portfolios

The automated investment portfolios are a great option for those who lack the experience or inclination to create their own. These portfolios have been created by the Wealthfront management team including industry experts such as Dr Burton Malkiel.

I can choose low cost index funds, modern portfolio theory or other asset classes to suit my specific risk preferences. I can simply “add automated index investing” from the menu options captured in the screenshot above when I log into the dashboard.

All of the portfolios have been created to offer diversification, so I don’t need to worry about anything. The asset allocation percentages are determined by my risk score and the type of portfolio I’ve selected.

For example, here's one of the most popular options: mid cap fast growers.

-

Portfolio Customization: Research & Add Stocks And ETFs

Unlike some of the other leading robo advisor platforms with automated portfolios, Wealthfront also allows some customization. In fact, the Wealthfront customization features are some of the best.

You just need to pick your portfolio from the list of four main portfolio types; classic, automated bond, direct stock indexing or socially responsible. You can then customize by adding or subtracting ETFs.

I can choose from hundreds of ETFs and even search via niche such as crypto, growth, value, clean energy or tech as you can see in this screenshot.

Wealthfront will handle my trades and will regularly rebalance the investments to ensure my preferred asset allocation.

Alternatively, I can create my own portfolio from scratch by searching for stocks and ETFs that appeal to me, as you can see on this screenshot.

You can also bring over a portfolio from a brokerage account. Wealthfront will then manage and rebalance your new portfolio through the auto portfolio option.

Wealthfront’s Lesser-Known Tools That Stand Out

Besides the main features I use regularly, there are additional features for investors and savers:

-

US Direct Indexing

This was formerly known as stock level tax loss harvesting, but essentially this feature is available to those with a minimum investment fund of $100,000. According to Wealthfront, the platform works to harvest more losses by searching for individual stocks on the US stock index with price changes. This can be an effective tool for those who may have an excessive tax burden from their investment strategies.

While this is only an option for higher value portfolios, if you do start to quickly grow your fund, it could be an invaluable feature to lower your tax bill.

-

Risk Parity

This Wealthfront approach uses asset allocation strategies to further boost your risk adjusted returns. As with the US Direct Indexing feature, you will need a minimum $100,000 portfolio to access Risk Parity.

This methodology involves allocating across several asset classes to equalize the risk contributions from each asset class. Unlike other investing approaches that focus on the expected return, Risk Parity can offer superior returns by leveraging low risk assets to balance high risk assets. This allows you to invest in riskier assets that you may have previously discounted, as the risk is offset.

Of course, with this feature, you don’t need to calculate all of this for yourself, as the Wealthfront robo advisor does all the work for you.

-

Easy To Use App

While the Wealthfront desktop platform is well established, many of us like to manage our money on the go.

Fortunately, the Wealthfront app is fantastic. It is available for Android and iOS devices with high ratings on both platforms.

Also, the Wealthfront user interface is extremely intuitive, making it easy to perform activities such as transfer funds:

You can even access full information on the various assets, so you can research without needing to be tied to your computer.

-

Lines of Credit

If you have at least $25,000 invested in your Wealthfront account, you can access a line of credit. Wealthfront allows you to borrow up to 30% of the value of your portfolio less any credit checks or fees. The great thing about this feature is that the application takes less than a minute to complete, so I can access the additional funds almost immediately.

The rates for the lines of credit are also competitive and reasonable.

-

Alerts And Notifications

Wealthfront offers a variety of push notifications and alerts to keep clients informed and engaged with their accounts.

These notifications include real-time alerts about changes in their account balances, recent transactions, and portfolio performance. Wealthfront notifies clients about any rewards or benefits they are eligible for, such as referral bonuses or new promotional offers.

Also, Wealthfront’s Autopilot notifications keep clients informed about automatic transfers, or important changes on their investing plan.

-

Automated Bond Ladder

Wealthfront’s Automated Bond Ladder helps you earn more on your extra cash by investing in US Treasuries, which are exempt from state and local income taxes. This means you keep more of your interest earnings compared to most savings accounts and some CDs.

A bond ladder is a portfolio of bonds with varying maturity dates. This strategy locks in current yields, providing steady income while preserving capital. Wealthfront’s software analyzes hundreds of Treasuries to build an optimized portfolio for you, reinvests interest automatically, and keeps your taxes low.

With Wealthfront’s app, you can easily choose your investment duration, from six months to six years. The app provides estimated yields, compares Treasuries for the best returns, and keeps your ladder balanced as bonds mature. This allows you to benefit from today’s rates even if interest rates drop in the future.

-

Invest In Specific Stocks & ETFs

Wealthfront offers a tailored approach to investing by allowing clients to invest in specific stocks and ETFs alongside their automated portfolio management services.

Clients can select individual stocks to add to their portfolio, allowing them to invest in companies they believe in or want to support.

Wealthfront also provides access to a wide range of ETFs, enabling clients to diversify their portfolios across various asset classes, sectors, and geographies. For example, clients can invest in Vanguard S&P 500 fund, VOO:

-

Excellent Learning Resources

In addition to its customer support team, Wealthfront also has an array of learning resources that can help you to expand your knowledge base and discover the answer to many common questions for yourself.

There is a help center with a FAQ section, a blog and a number of educational articles and videos. I’ve accessed some fantastic tools including risk assessment tools along with guides for financial health, home planning, IPO and equity. You can even find an IRA contributions calculator. I personally love the Wealthfront YouTube channel, which has hundreds of videos.

These resources cover the basics of how to use the platform and general investing right through to financial planning and taxation.

What Can Be Improved

While Wealthfront offers many valuable features, there are some areas where improvements could enhance the user experience. Here are a few key areas where Wealthfront could benefit from enhancements:

-

Lack of Human Component

One area that is a little lacking is that Wealthfront has no “human” component. While it is possible to call the helpline, the hours are not around the clock, so you are truly dealing with a “robo” advisor, with its pros and cons.

If you lack investing experience, you may feel hesitant about having limited options to speak to a person if you have a query. You’ll need to rely on the resource center.

-

Account Minimums And Fees

Finally, while there are minimal fees, Wealthfront could improve its account minimums. To access the broad range of features, you need a fairly high-value portfolio, which may be out of reach for the typical investor.

While you can enjoy fee-free services on the banking platform, you’ll need to save your pennies to access all the investing features.

-

Overwhelming Financial View

Another potential downside of Wealthfront is that the financial view can be a little overwhelming. The platform offers a sophisticated view, even if you’re not using the investing side.

I needed to go through a bit of a learning curve to leverage the full potential of this feature.

Which Type of Investor is Best Suited to Wealthfront?

Wealthfront offers a range of features designed to cater to different types of investors. Here’s a closer look at the types of investors who would benefit the most from using Wealthfront.

- Investors Look For Minimal Decision-Making – Wealthfront is a good option for investors who want to minimize the number of financial decisions. You can essentially set and forget your portfolio and goals, and simply check in periodically to see how you’re doing.

- Customers Who Need Low-Cost, Convenient Banking Services —This platform is also a great option if you want convenient, free banking services with access to an impressive savings rate. You don’t need to fully explore the investing side of the platform; you can use Wealthfront to pay your bills and move money as you would with a conventional account.

- Beginners – Wealthfront is also a good option for the aspirational investor. If you’re looking to get started on your investing journey but are not sure about how it will fit into your current finances, this platform can be extremely helpful.

Bottom Line

Overall, Wealthfront is a solid choice for the serious investor who wants to take a hands off approach or the complete newbie who is trying to get to grips with their finances. There are minimal fees and some great features to explore.

Wealtfront vs. Competitors: How Does It Stack Up?

Wealthfront is the winner in investing and banking options, while Empower stands out for personal finance tools and tailored advisory services

Wealthfront and Acorns offers advanced automated investing options, appealing investing features and banking options. Here's our comparison:

Review Brokerage Accounts

How We Rated Brokerage Accounts: Review Methodology

At The Smart Investor, we evaluated brokerage account platforms based on their overall value, features, and user experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to investors, including fees, trading tools, investment options, and security. Each platform was rated based on the following criteria:

- Fees & Commissions (20%): We prioritized commission-free trading and low-margin rates. The best platforms had zero hidden fees, while others charged for inactivity or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate platform with smooth execution scored highest. Some apps felt outdated or laggy, impacting the experience.

- Trading Tools & Features (30%): We favored platforms with real-time data, smart order types, and special features that support smart investing. Some lacked depth, making it harder for active traders.

- Automated Investing (10%) : The best platforms offered AI-driven portfolios, robo-advisors, and automatic rebalancing. Some lacked automation or charged high fees for managed accounts.

- Investment Options (10%): Platforms with stocks, ETFs, options, crypto, and fractional shares scored highest. A few lacked key asset classes or international access.

- Account Types (5%): The best platforms supported taxable accounts, IRAs, and custodial options. Some lacked flexibility, limiting investment strategies.

- Cash Management & Banking Features (5%): We favored platforms with high-interest cash accounts, debit cards, and seamless banking. Many lacked competitive rates or useful features.