Robinhood | Wealthfront | |

Monthly Fee | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | Annual 0.25% (Automated investing only) |

Account Types | Brokerage, Retirement, Crypto | Brokerage, Retirement, College 529s |

Savings APY | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. | 4.25% |

Minimum Deposit | $0 | $500 |

Best For | Active Traders, Tech Savvy Investors | Minimal Decision-Making Investing , Financial Planning, Low Cost Banking |

Read Review | Read Review |

Wealthfront vs Robinhood Investing Features

Wealthfront is ideal for passive investors seeking automated, long-term financial planning with low fees, while Robinhood is best suited for active traders and investors looking for a broad range of trading options and direct control over their investments.

Robinhood | Wealthfront | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | 1,500 stocks, ETFs, and REITs |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares | stocks, ETFs and REITs |

Financial Planning | No | Yes |

Automated Investing | No | Yes |

Paper Trading | Yes | No |

Tax Loss Harvesting | No | Yes |

IPO Access | Yes | No |

-

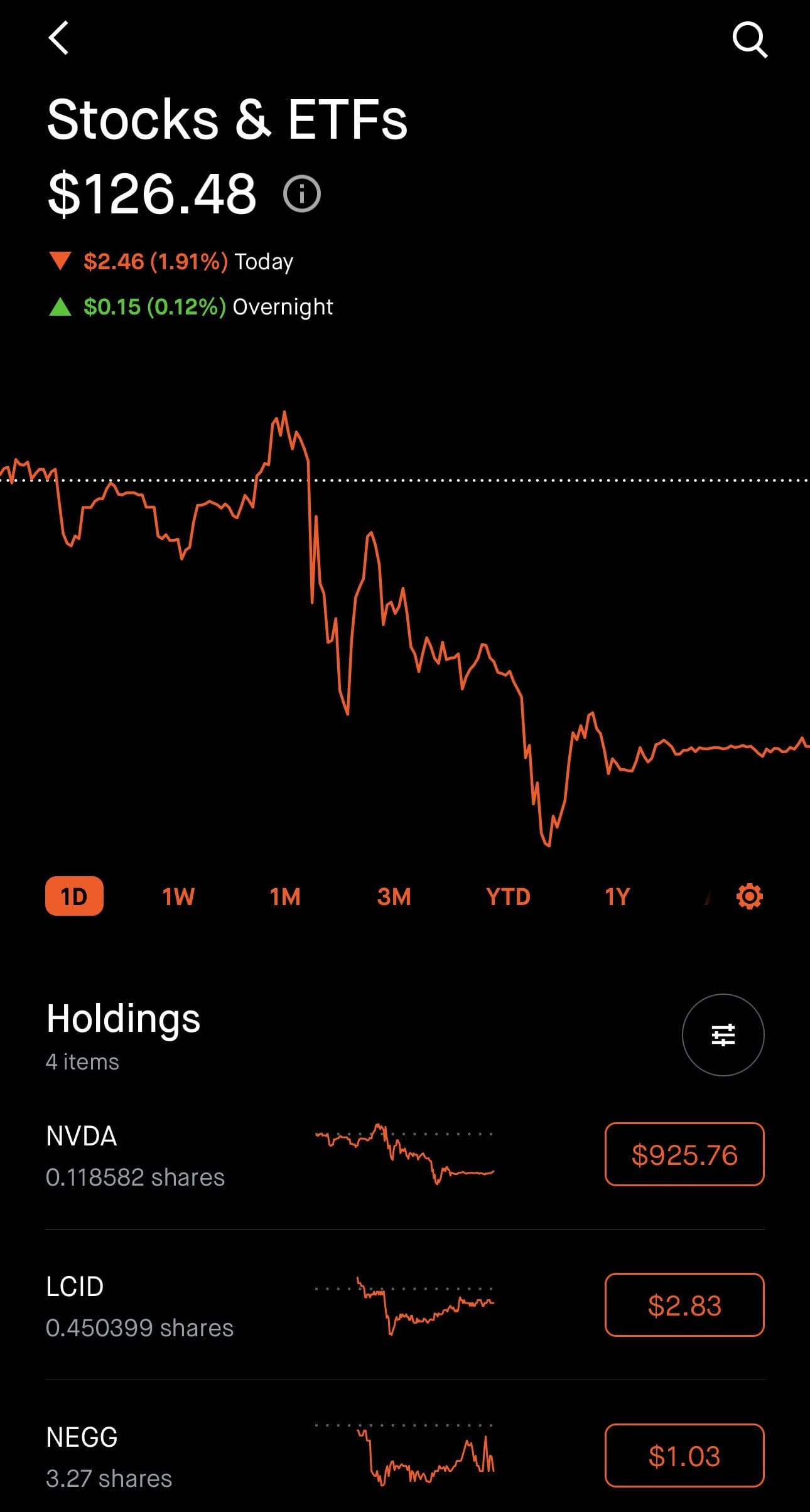

Self Investing And Trading Options

When it comes to self- investing, there is no doubt that Robinhood offers much more options for both beginners and advanced traders and investors.

Robinhood intuitive interface allows users to trade a variety of assets, including stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. One of Robinhood’s standout features is its commission-free trading, which was a pioneering move when introduced in 2013.

It also offers various technical indicators such as moving averages and relative strength index (RSI), enabling users to perform more detailed technical analysis directly within the platform.

Trading options on Robinhood is straightforward. After setting up and funding an options account, users can easily search for securities and execute trades through a streamlined process on the app.

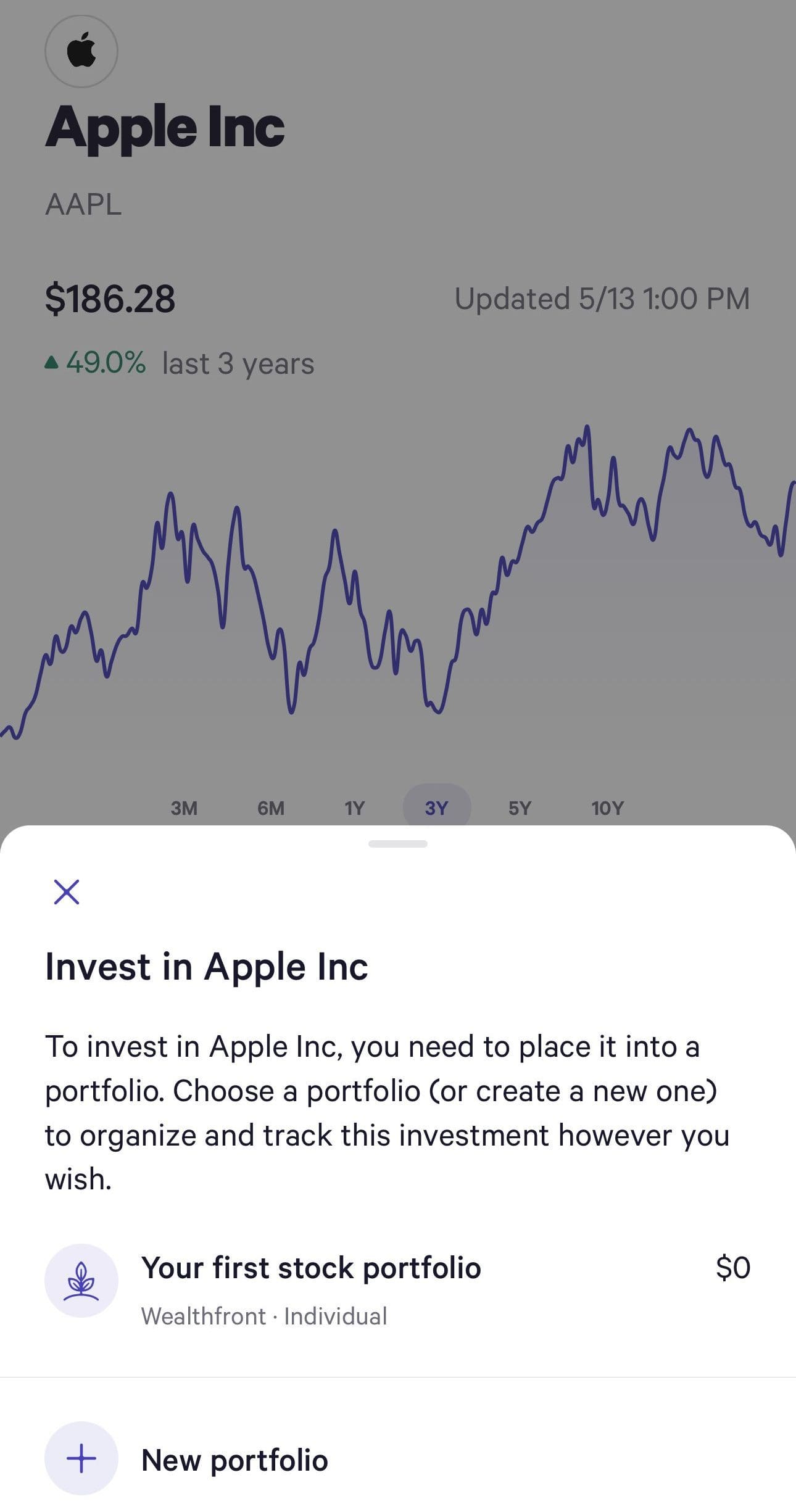

Wealthfront self-investing platform is more modest compared to Robinhhood, but still have many options for those who prefer a hands-on approach, allows users to directly buy and sell individual stocks and ETFs through a user-friendly interface.

Wealthfront’s self-directed trading option is seamlessly integrated with its other financial services, including automated portfolios and cash management, offering a holistic investment experience.

-

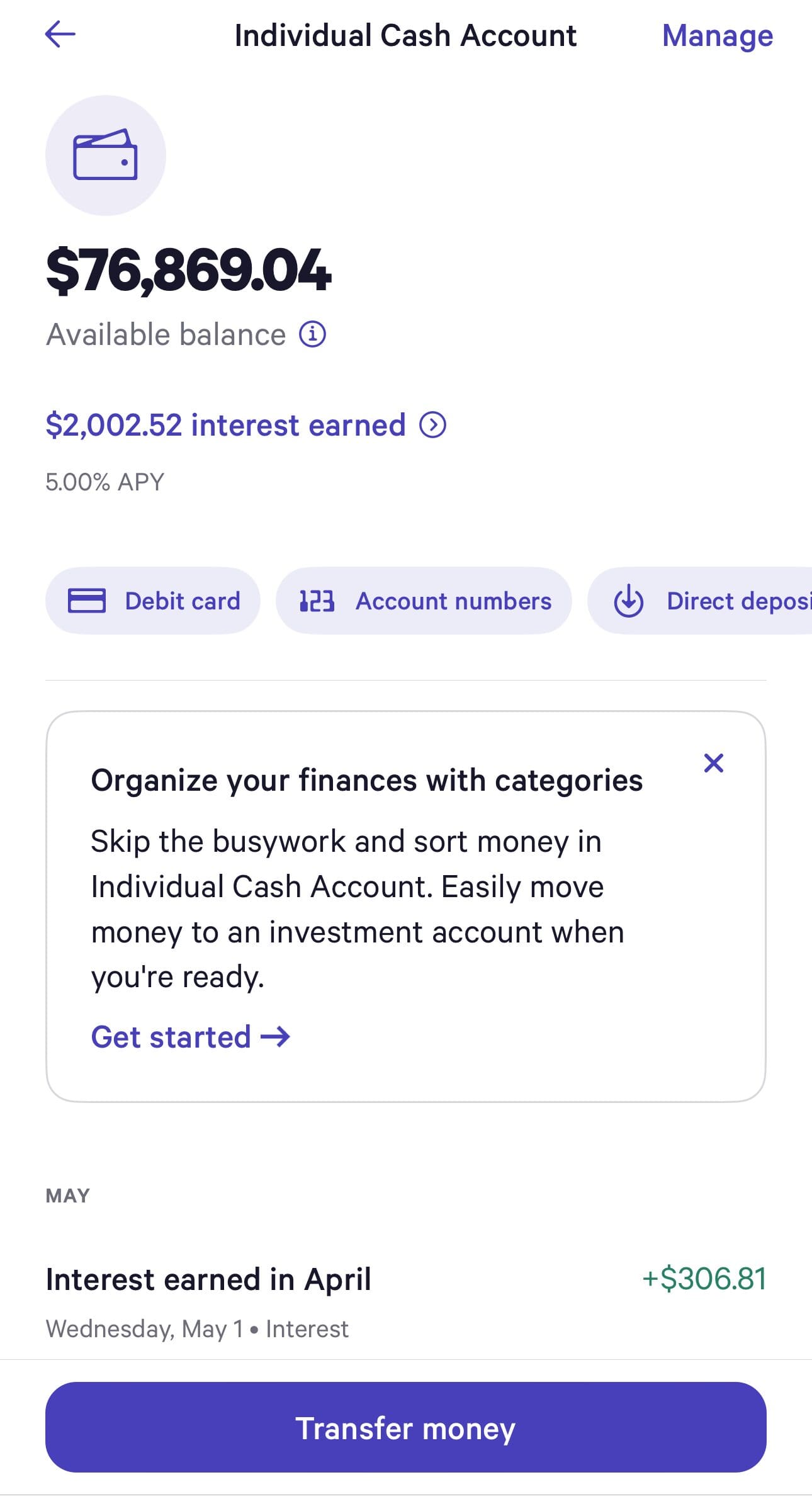

Cash Management And Banking Options

When it comes to banking, each app has its own benefits. Wealthfront offers better checking account features, while Robinhood offers a cash card.

Robinhood | Wealthfront | |

|---|---|---|

Savings APY | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. | 4.25% |

Wealthfront offers a high-yield cash account that functions similarly to an interest-bearing checking account, providing a competitive interest rate on balances.

This account allows for direct deposits, bill payments, and mobile check deposits, making it a versatile tool for managing everyday finances. Additionally, the cash account is linked to a network of fee-free ATMs, enhancing its accessibility for users.

For those looking to borrow, Wealthfront offers a portfolio line of credit for users with substantial investment balances, providing a flexible and low-interest borrowing option.

Robinhood offers a cash management account that operates similarly to an online checking account, providing users with a Robinhood Cash Card issued by Sutton Bank. However, only Robinhood Gold customers are eligible for the higher APY.

This account includes features like round-ups and bonuses for everyday expenses such as groceries, bills, and checks.

The Robinhood cash back card gives 3% cash back on purchases:

Wealthfront: Which Features Are Unique?

Here are some of the features that investors can find only with Wealthfront:

-

Advanced Automated Investing

Wealthfront’s automated investing service offers a streamlined and efficient way to manage your investments using advanced algorithms. Based on comprehensive questionnaire responses, Wealthfront creates a customized portfolio composed of low-cost index funds.

Also, Welathfront offers portfolios are crafted using Modern Portfolio Theory to optimize returns based on individual risk tolerance. For example, classic portfolios, direct indexing, automated bond portfolios, and smart beta portfolios For accounts with over $500,000.

Wealthfront also offers additional customization options. Customers can adjust their portfolios by choosing from hundreds of ETFs and even searching by niche, such as crypto, growth, value, clean energy, or tech.

-

Tax Loss Harvesting

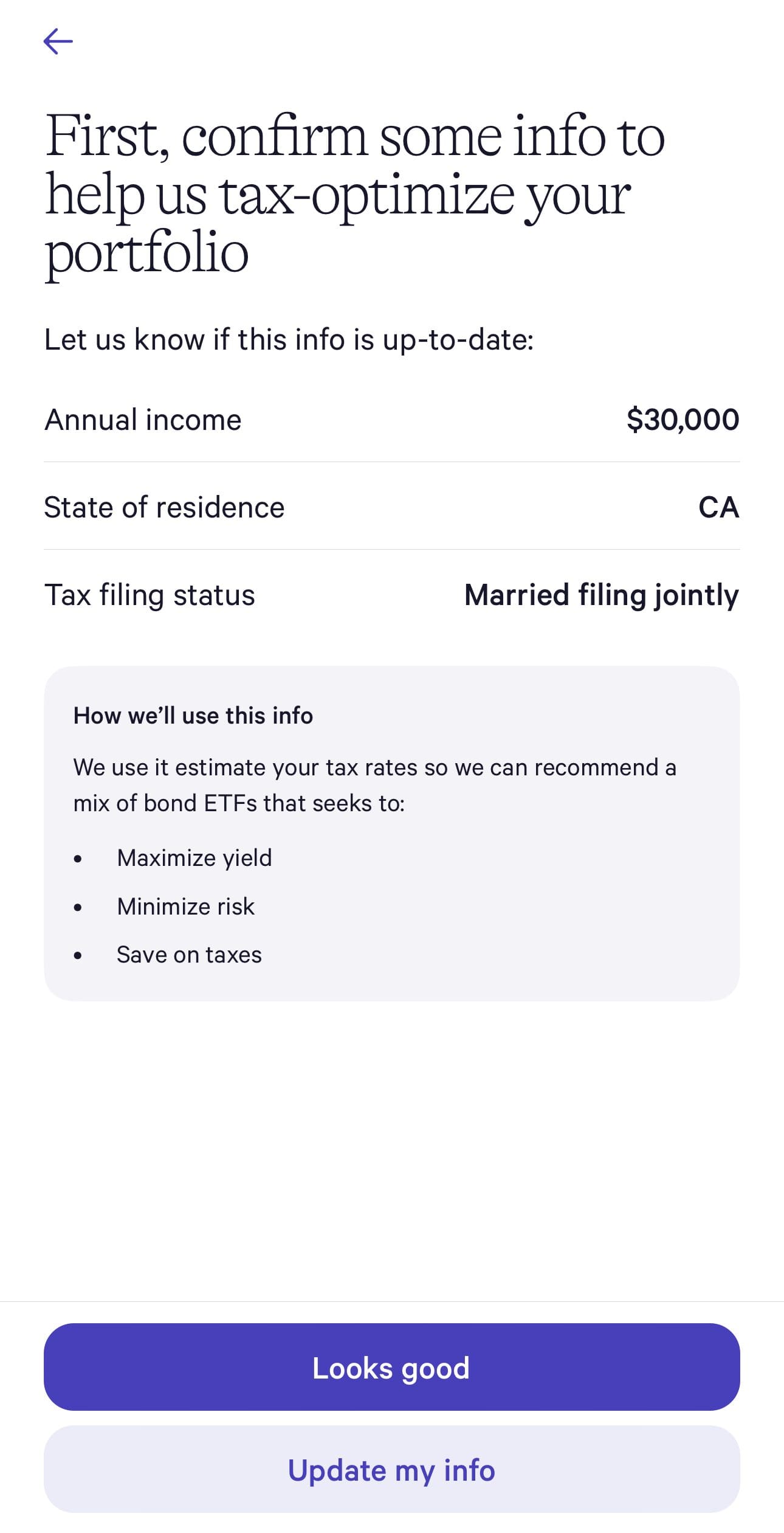

Wealthfront offers daily tax-loss harvesting, which is more frequent than the traditional year-end approach. By continuously monitoring your portfolio, the platform identifies opportunities to realize losses throughout the year, potentially capturing more tax benefits.

For accounts with over $100,000, Wealthfront extends this service to U.S. Direct Indexing, which includes individual stock holdings, allowing for even more granular tax-loss harvesting.

-

Savings And Goal Planning

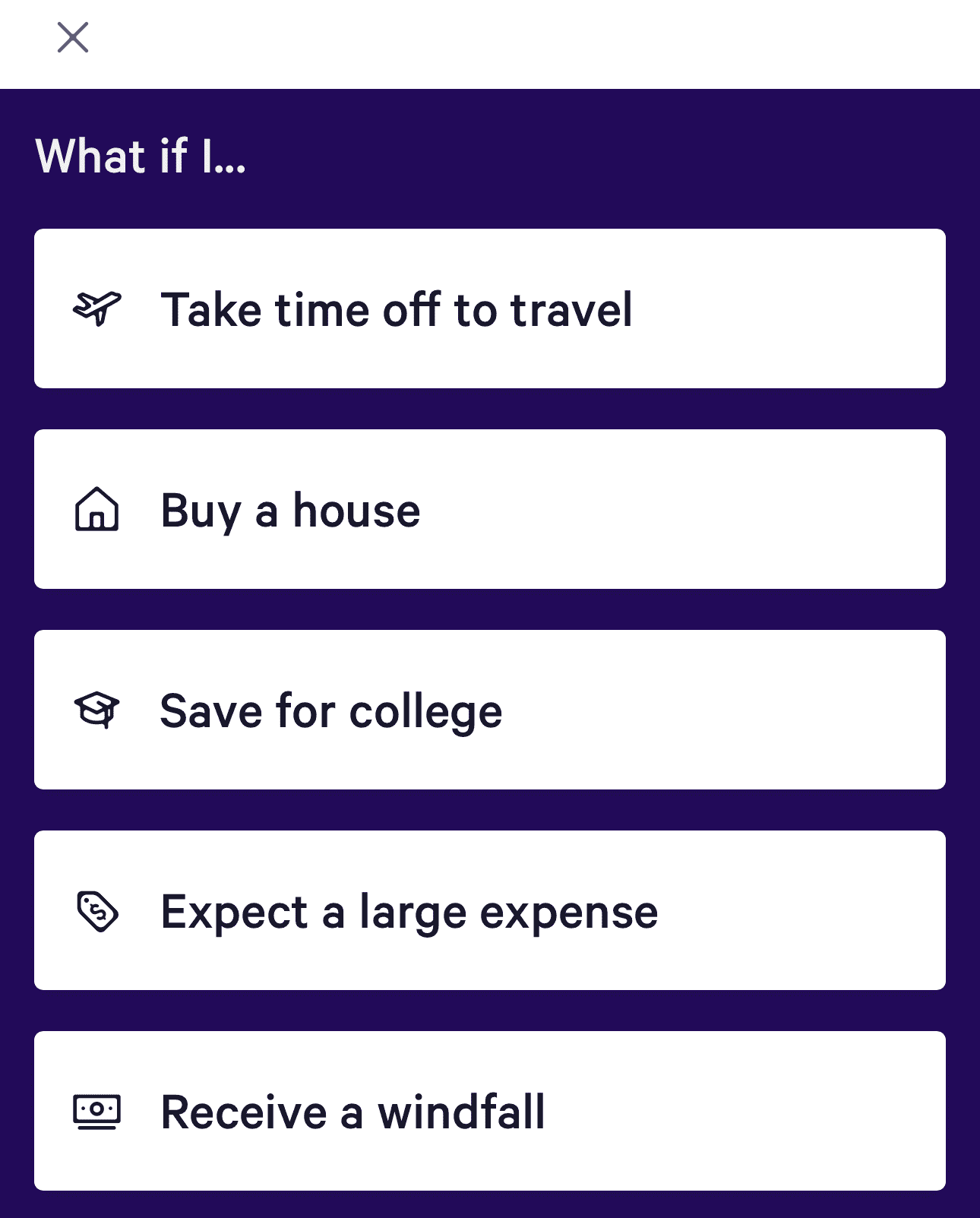

Wealthfront offers comprehensive savings and goal planning tools designed to help users achieve their financial objectives.

Wealthfront’s goal planning encompasses various life milestones, such as retirement, home buying, saving for college, and travel. The platform uses data from sources like the U.S. Census Bureau, Bureau of Labor Statistics, and Department of Education to project future expenses and income needs accurately.

Path feature allows users to link all their financial accounts, providing a complete view of their finances and enabling precise goal tracking.

Robinhood: Which Features Are Unique?

Here are some of the features that investors can find only with Robinhood:

-

Robinhood Gold

Robinhood Gold is a premium subscription service that enhances the basic features of the Robinhood platform.

One of its main features is access to margin trading, allowing users to borrow money to invest, with a reduced interest rate.

Another notable feature is the larger instant deposits, enabling users to access up to $50,000 immediately after making a deposit, compared to lower limits for standard accounts.

Lastly, Robinhood Gold subscribers gain access to advanced research reports from Morningstar and an option for 3% match on eligible contributions to a Robinhood IRA.

-

Charting and IPO Access

Robinhood offers IPO access, allowing everyday investors to participate in initial public offerings before the stock becomes available on the public market.

To participate, users can request shares of an upcoming IPO directly through the Robinhood app. The allocation of shares depends on demand and availability, and there are no additional fees for participating in IPOs through Robinhood.

-

Direct Access to Cryptocurrencies

Robinhood provides direct access to cryptocurrencies, allowing users to buy, sell, and hold a variety of digital assets through its platform. Robinhood supports trading for popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and several others.

Robinhood also includes a crypto wallet feature, enabling users to store and transfer their digital assets securely. The wallet supports funding with USD Coin (USDC) and allows connections to decentralized apps (dApps) to earn yields on crypto holdings.

Bottom Line

On the bottom line, if you're looking for active trading, Robinhood may be better, while if you're mainly interested in automated investing, Wealthfront may be better.

Wealthfront suits investors looking for a hands-off, automated approach to portfolio management. It offers strong goal-planning capabilities and the ability to customize investments to a high degree.

Robinhood's ease of use and minimal fees make it ideal for individuals seeking to experiment with smaller investments in stocks and cryptocurrencies without incurring high costs.

Compare Robinhood Side By Side

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab vs. Robinhood: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood : Compare Brokerage Accounts

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

Robinhood is best for traders looking for easy, cost-free trading, while Stash is great for beginner investors who need a financial management tool

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity.

Wealtfront vs. Competitors: How Does It Stack Up?

Wealthfront is the winner in investing and banking options, while Empower stands out for personal finance tools and tailored advisory services

Wealthfront and Acorns offers advanced automated investing options, appealing investing features and banking options. Here's our comparison: