Yahoo Finance (Free Plan)

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Yahoo Finance Free plan is a solid starting point for investors and traders looking for market data, stock tracking, and news updates—without paying for a subscription.

It offers real-time stock quotes, breaking news, stock and ETF screeners, customizable watchlists, and portfolio tracking.

Users can follow stocks, ETFs, and cryptocurrencies while setting unlimited alerts for price changes. The free plan also provides basic stock charts and financial statements, allowing investors to analyze companies at a high level.

While the free plan is useful, it lacks premium stock ratings, detailed research reports, and in-depth financial analysis. Active traders might find the basic charting tools too limited.

- Basic stock & ETF screener

- Real-time stock quotes & news

- Follow stocks, ETFs, and crypto

- Basic technical analysis tools

- Custom watchlists & alerts

- Link brokerage portfolios

- Join investor conversations

- Company profiles & key statistics

- Earnings & economic event calendar

- Top movers & trending stocks

- Cryptocurrency market tracker

- Stock market heat maps

- Free real-time stock quotes

- Basic stock & ETF screener

- Unlimited watchlists & alerts

- Follow stocks, ETFs, crypto

- Access earnings & economic data

- No premium stock ratings

- Limited technical charting tools

- No AI-based trade insights

- Lacks in-depth research reports

- No personalized stock ideas

Yahoo Finance Market Research Tools & Analysis

Yahoo Finance is the ultimate choice of casual investors and anyone who tracks the market on a daily or weekly basis. Here are the primary tools for investors:

-

Basic Stock & ETF Screener

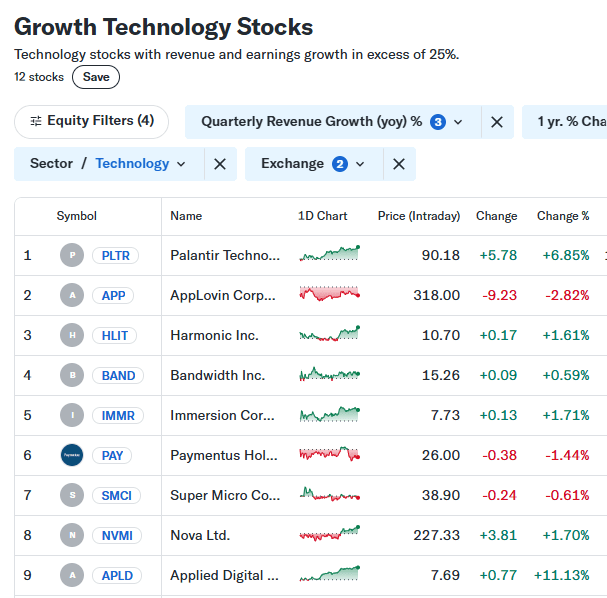

The Yahoo Finance Stock & ETF Screener is one of the best free screening tools that helps investors and traders find stocks and ETFs that match their investment criteria.

Instead of manually searching for opportunities, you can filter thousands of stocks and ETFs based on fundamental, technical, and financial metrics—all without needing a premium subscription.

- For stock investors, the stock screener allows filtering by market cap, day gainers, sector, region, market cap, price, small caps stocks, and more.

- For ETF investors, the ETF screener helps find top-performing ETFs by category, expense ratio, fund net assets, region, annual return, Morningstar performance, volume and more.

-

Real-Time Quotes and News

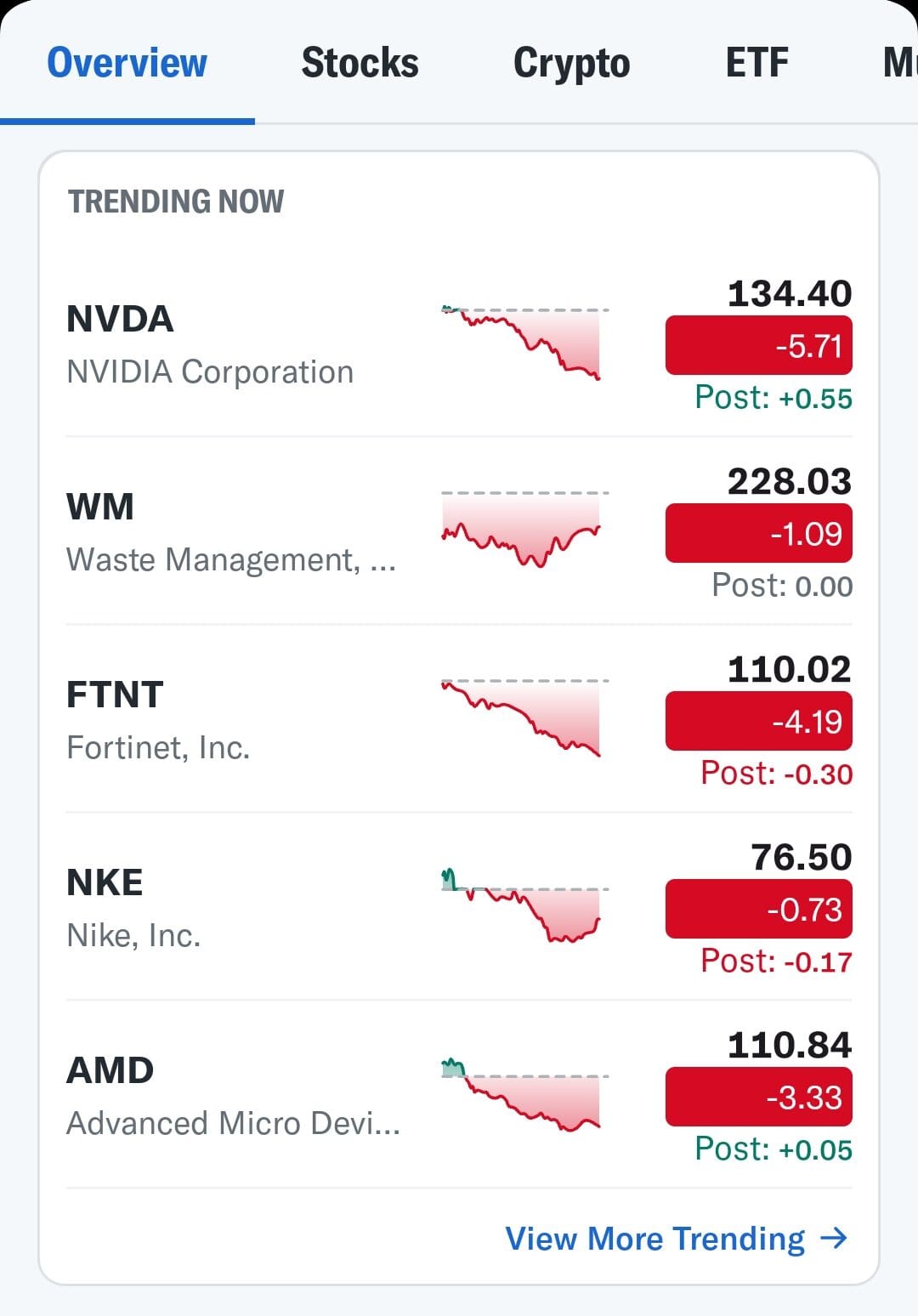

With real-time stock quotes and financial news, investors and traders can track market movements as they happen.

Unlike delayed data, which can be 15 minutes or more behind, real-time quotes let you see live stock price changes and react quickly.

This is crucial for day traders and active investors who rely on up-to-the-minute updates to make informed trades.

Yahoo Finance also provides breaking news alerts, so you’ll stay updated on major events like earnings reports, economic indicators, or company announcements that can impact stock prices.

-

Follow Stocks, ETFs, Crypto, and More

Yahoo Finance’s follow feature lets you track stocks, ETFs, cryptocurrencies, commodities, and other investments all in one place.

Instead of jumping between different websites or apps, you can easily add assets to your watchlist and monitor their performance, price movements, and news updates.

For long-term investors, this feature helps keep track of your portfolio holdings and analyze market trends over time.

Day traders can follow stocks they plan to trade and stay ahead of short-term price movements.

-

Basic Technical Analysis Tools

Yahoo Finance provides interactive stock charts with basic technical analysis tools for spotting trends, support/resistance levels, and price movements.

You can choose from different timeframes, from intraday charts for day trading to long-term charts for investing.

While it’s not as advanced as paid charting tools, the free version allows traders to analyze stock performance visually and spot potential breakout or pullback points.

This is useful for momentum traders, swing traders, and long-term investors who rely on chart patterns to make decisions.

-

Create Watchlists + Unlimited Alerts

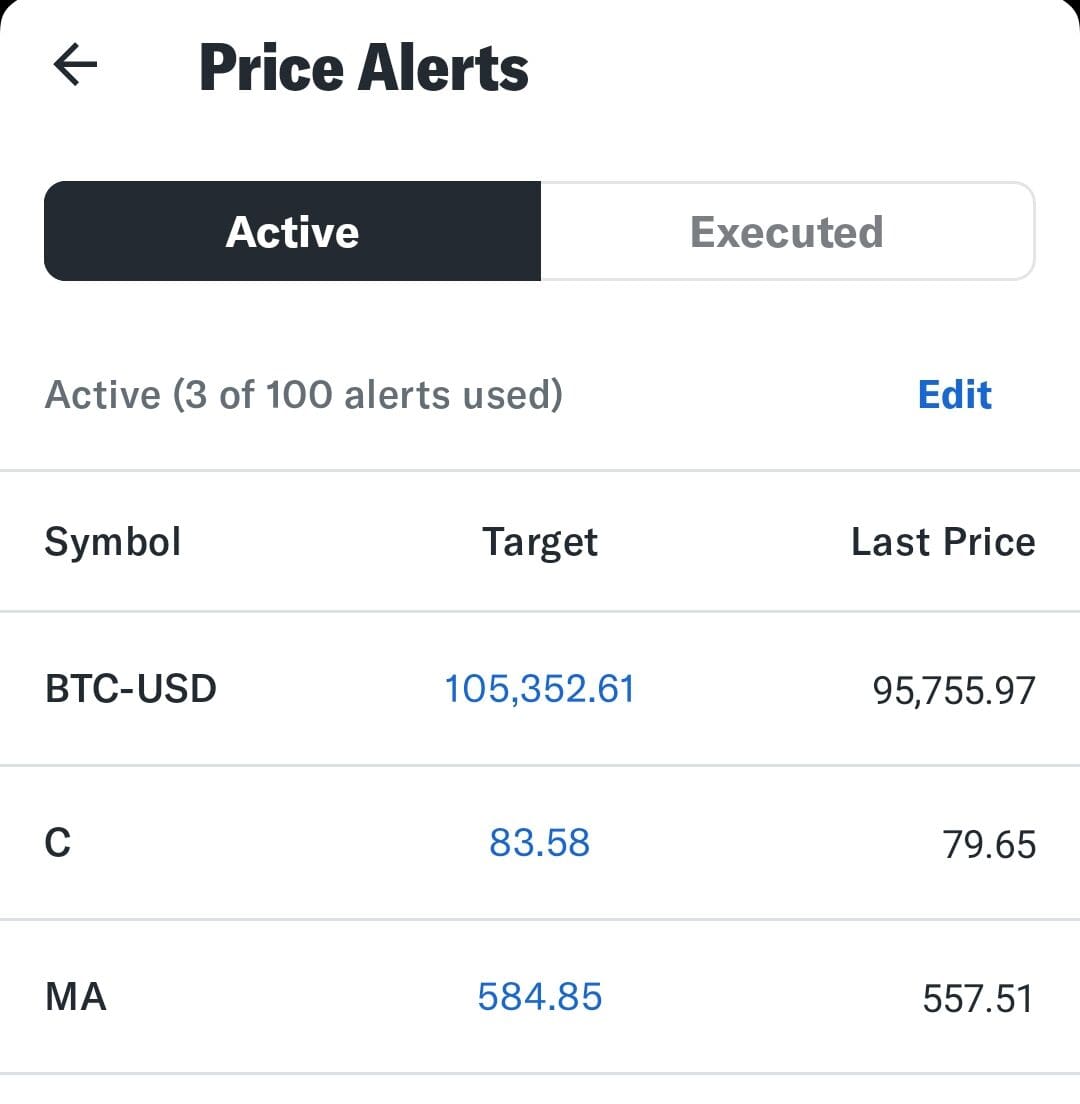

Yahoo Finance lets you build custom watchlists to track stocks, ETFs, crypto, and other investments. With unlimited price alerts, you’ll get real-time notifications when a stock hits a specific price point.

This is perfect for investors who don’t want to check the market all day but still want to react quickly.

For swing traders, setting alerts on stocks that reach key technical levels can help time entries and exits.

Long-term investors can use alerts to buy stocks at their target price.

-

Link Portfolios for a 360° View

With Yahoo Finance, you can connect your brokerage accounts to get a full view of your investments in one place.

Instead of manually tracking your stocks across different accounts, you’ll see your portfolio’s total value, gains/losses, and asset allocation in real time.

For example, if you have stocks in Fidelity, an IRA in Vanguard, and crypto in Coinbase, you can link all three to Yahoo Finance and track your total portfolio performance in one dashboard.

-

Join Conversations & Share Ideas

Yahoo Finance lets you join discussions with other investors and traders, helping you gain insights, share opinions, and discuss stock trends.

This feature is useful for staying updated on sentiment around specific stocks.

While it’s important to do your own research, these conversations can highlight new opportunities or risks.

-

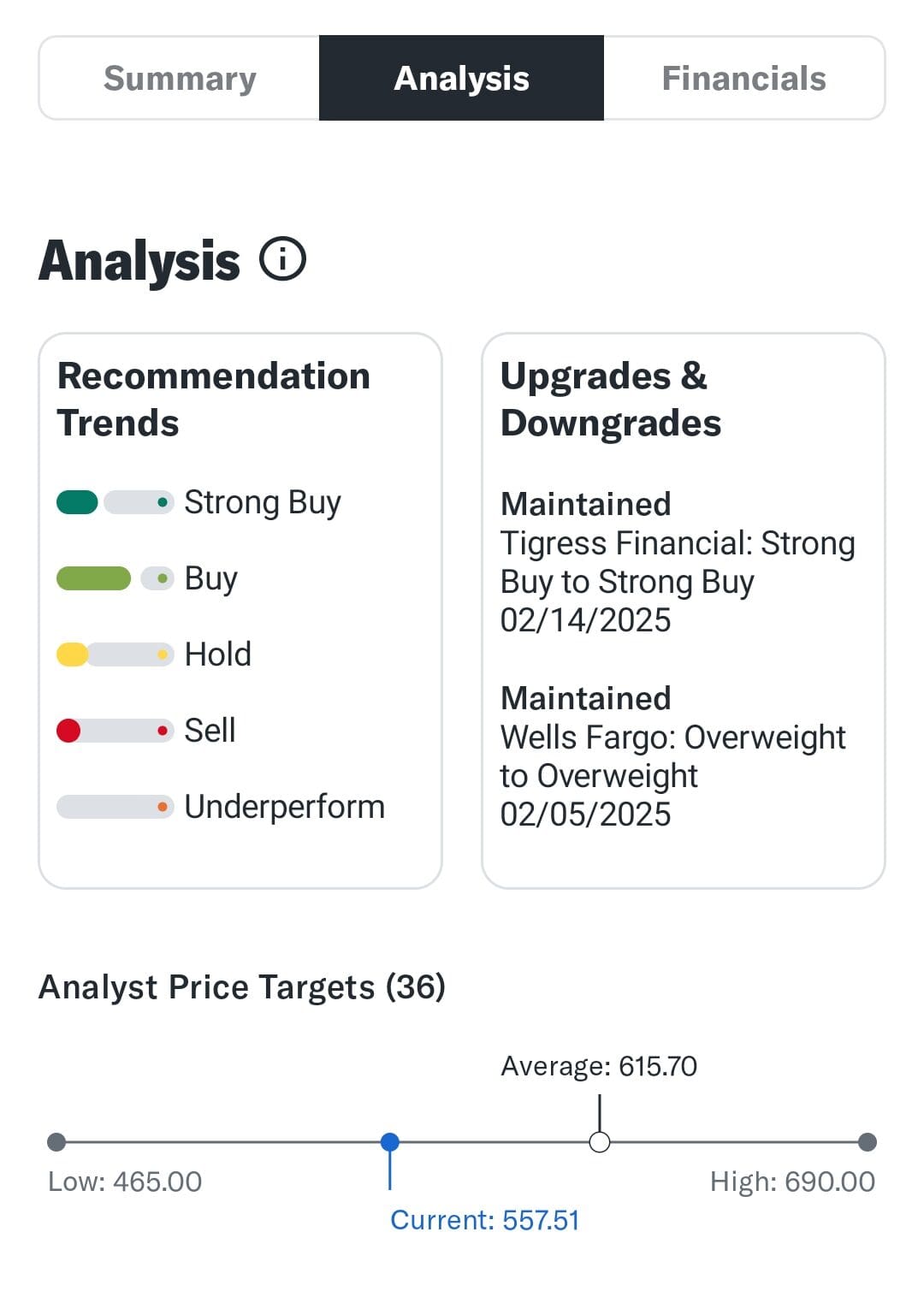

Access Company Profiles & Key Statistics

Yahoo Finance’s free plan gives you access to detailed company profiles, including financial metrics like market capitalization, EPS trend, earnings history, revenue estimate, and many more fundamental options.

Nice options is to see how analyst rate specific stock/ETF:

For fundamental investors, these insights are useful for long-term stock research.

You can compare different stocks side by side, check if a stock is undervalued or overvalued, and make informed investment choices.

-

Earnings Calendar & Economic Events

The Yahoo Finance earnings calendar helps traders stay on top of quarterly earnings reports for public companies.

Earnings reports can cause huge price swings, so it’s important to know when companies like Amazon (AMZN), Tesla (TSLA), or Meta (META) are reporting results.

You can also view economic event schedules, such as Federal Reserve rate decisions, job reports, and inflation data.

These events impact the stock market and can help traders time their entries and exits.

Additional Features & Tools

Beyond the core features, Yahoo Finance Free offers several additional tools and resources that can help investors and traders analyze stocks, track market trends, and make better investment decisions—all without a paid subscription. Here are 10 more free features you can take advantage of:

Top Movers & Trending Stocks: See the biggest gainers, losers, and most actively traded stocks each day, helping you identify market trends and potential breakout stocks.

IPO Calendar: Stay updated on new stock listings and upcoming IPOs, helping you track opportunities in emerging companies before they go public.

Currency Exchange Rates: View real-time forex data, including major currency pairs like EUR/USD, USD/JPY, and GBP/USD, useful for forex traders and global investors.

Commodity & Futures Data: Track live prices for gold, silver, oil, and other commodities, plus futures contracts for indices, bonds, and agricultural products.

Stock Market Heat Maps: Get a visual overview of the stock market with heat maps, showing which sectors and stocks are leading or lagging in performance. (Available on the homepage under market summary.)

Cryptocurrency Market Tracker: Monitor Bitcoin, Ethereum, and altcoins, with live price updates, market cap data, and trend analysis for crypto investors.

These extra tools make Yahoo Finance Free a solid resource for both new and experienced investors.

Limitations

While the Yahoo Finance Free plan offers solid tools for investors, it lacks several advanced features that competing platforms and Yahoo’s premium tiers (Bronze, Silver, Gold) provide:

-

No Premium Stock Ratings

Yahoo Finance Free doesn’t provide premium stock ratings, analyst reports, or in-depth research from top firms like Morningstar, Argus Research, or The Information (which is available through the silver plan).

This makes it harder for investors to get expert insights and buy/sell recommendations in one place.

Many competitors, like Zacks Premium and InvestingPro, offer detailed analyst reports and proprietary stock ratings to help users make informed decisions.

-

Limited Technical Analysis & Charting Tools

Yahoo Finance Free offers basic stock charts, but it lacks advanced charting tools, including technical indicators, customizable chart overlays, and pattern recognition.

Upgrading to Silver Finance Gold unlocks 50+ chart patterns, historical data exports, and technical events, but free users must rely on external charting software for deeper analysis.

Also, competitive platforms such as TradingView (even in its free version) can offer more options.

-

No Personalized Trade Ideas or AI-Based Insights

While Yahoo Finance Free lets users track stocks, it doesn’t offer personalized trade ideas, AI-driven alerts, or backtested strategies.

Yahoo’s Gold plan includes personalized trade ideas, but free users must rely on their own research to find high-probability setups.

Who Benefits Most from Yahoo Finance?

The Yahoo Finance Free plan is a solid choice for certain types of investors and traders who need basic market data, stock tracking, and news updates without paying for premium tools. Here’s who can benefit the most:

Beginner Investors: Great for those just starting out who need a simple way to track stocks, read market news, and learn the basics of investing without spending money on research tools.

Long-Term Investors: Ideal for those who follow a buy-and-hold strategy and mainly need price tracking, company profiles, and earnings updates rather than real-time trading insights.

Casual Traders: Works well for traders who don’t rely on advanced charting or technical indicators and mainly trade based on news, basic stock analysis, and market trends.

Passive Market Watchers: Perfect for people who want to keep an eye on the stock market, track major indices, and monitor trending stocks without making frequent trades.

Who Might Find Yahoo Finance Lacking?

The Yahoo Finance Free plan might not suit everyone, especially if you need more advanced research or trading tools. Here are some types of investors and traders who may find it limiting:

- Advanced Technical Traders: If you rely on detailed charting tools, multiple technical indicators, and real-time data for day trading, you may find the free plan too basic.

- Active Day Traders: Those who require immediate execution, fast real-time data, and sophisticated trading platforms may need more robust, professional tools.

- Fundamental Analysts: Investors who depend on deep, premium research reports, in-depth stock ratings, and comprehensive analyst insights might find the free features insufficient.

- Portfolio Managers: If you manage complex portfolios and need advanced risk analysis, diversification tools, and automated rebalancing suggestions, the free plan falls short.

Yahoo Finance: Exploring Higher-Tier Plans

The Yahoo Finance Free plan offers basic market data and stock tracking, but premium plans provide deeper tools.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Yahoo Finance Bronze, Silver, and Gold plans offer progressively more advanced research tools, expert analysis, and technical insights, catering to investors who need deeper data, premium stock ratings, and smarter trade ideas.

FAQ

No, Yahoo Finance Free does not allow users to export historical stock data to CSV files—this feature is only available in the Gold plan

Yes, you can track U.S. Treasury yields and some corporate bond data, but detailed bond analysis and fixed-income tools are not included.

Yes, you can view pre-market and after-hours stock prices, but real-time extended-hours data may be delayed.

Yes, Yahoo Finance Free allows unlimited price alerts, but it does not offer alerts for technical patterns or analyst rating changes.

Yes, you can filter stocks based on various criteria, but premium plans provide more advanced screening options like technical event screening.

You can view upcoming earnings dates and past reports, but detailed forecasts and expert analysis are only available in premium tiers.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.