Table Of Content

PNC Bank is a regional bank based in Pittsburgh that offers a diversified range of services, from checking and savings to short-term planning. PNC refers to their personal banking experience as a “Virtual Wallet.”

Virtual Wallets are tiered, based on the amount of money you plan to keep in your account, and offer personalized money tools and resources.

What Documents Do You Need to Open a PNC Bank Account?

Opening a Virtual Wallet or personal checking account with PNC Bank can be done online or at a local branch. For customers over 18, applying online with a state-issued ID will be the simplest way. Customers under 18 without a primary form of ID must visit a local branch to apply.

Examples of primary IDs according to the PNC website:

- Drivers License

- State-Issued IDs

- Military IDs

- Passport

- Resident Alien ID

- Veterans Healthcare ID

- Firearm ID

- Global Entry ID

Two forms of ID are required, along with a valid US address. When applying at local branches, secondary forms of IDs are accepted. The type of documentation may fluctuate depending on the applicant.

Examples of secondary IDs according to the PNC website:

- US Visa

- Paystub

- Home Rental Agreement

- Utility Bill

- Major Credit or Debit Card

- Vehicle Registration

Neither a Social Security Number nor a Taxpayer Identification Number is required to open a PNC Bank account. However, opening a PNC bank account requires application and approval- which is not guaranteed.

Steps to Open a PNC Bank Account

Before you begin the application process, it is important to consider the type of banking experience you want your account to reflect and what your needs are.

PNC offers different levels of their Virtual Wall, and each experience offers additional benefits. The application process can be done online or in person at a local branch.

1. Gather The Necessary Documents

The documents required for an application may vary depending on whether you apply in person or online. Be sure to collect all of the necessary information so that you are prepared for the application process.

2. Choose Your Virtual Wallet

Potential account holders will be able to choose between three tiers of the Spend account: The first step to opening a Virtual Wallet with PNC is determining which account will benefit you the most.

Checking-only accounts consist of Spend and come with tools to track spending, while Checking + Savings consists of Spend, Reserve, and Growth. Applicants will have the option to create a customized Virtual Wallet online or in person.

3. Fill Out Your Application

Whether you are looking to open your PNC account online or in person, you must fill out an application. It can be intimidating to apply with a new bank, but to begin banking with PNC- and to utilize their resources- is necessary. Online applications do not require a deposit and consider meeting optional criteria to avoid monthly fees.

Applications can be filled out online or in person; it is up to you to decide your preferred method. In-person applications are beneficial to those who need flexibility in ID types; or those who need additional assistance that the PNC website cannot provide.

Applications may be approved instantly or can take up to several days.

PNC Bank

Fees

Minimum Deposit

Current Promotion

APY Savings

How to Open a Joint Bank Account With PNC?

Opening a joint account through PNC Bank is almost as simple as opening a traditional checking account.

You will have the option to open a joint account via the website; or in person at a local branch. The co-owner owner of the account will be asked to submit the necessary information to be approved.

- Go to the PNC website and select “Virtual Wallet” or “Checking” under the “personal” tab

- Select the banking experience you want to apply for

- Below the second question, there will be an option to select “Apply with Co-Applicant”

- Both applicants will need to provide the necessary documents and information requested by PNC

Adding someone to an already-existing account to make it a joint account is also an option and can be done in person, via a customer service call, or online.

Which PNC Checking Account Should I Open?

With PNC Virtual Wallet, banking becomes an entire experience- allowing customers to create an account centered around their specific needs. From a basic package to a full buffet- your virtual wallet should serve you.

PNC Virtual Wallet comes with three tiers of checking:

-

PNC Virtual Wallet

Virtual Wallet is PNC’s checking account. It offers tools to assist in money management, such as Low Cash Mode, and resources to speed up payments, such as Zelle and contactless pay.

Virtual Wallet charges a monthly service fee of $7 that is waived if the account holder keeps a minimum balance of $500, has a monthly deposit of $500 or higher or is age 62+.

Though this is PNC’s most basic account, members can optimize their banking by setting goals and saving money with digital tools and resources.

-

Virtual Wallet With Performance Spend

A Performance Spend account comes with Spend, along with additional checking and savings. Account holders earn rewards and receive higher interest rates on their growth accounts by using their debit cards.

Virtual Wallet with Performance Spend charges a monthly fee of $15 that can be waived if the account holder keeps a monthly balance of $2,000, has a monthly direct deposit of $2,000 or more in Spend and Reserve, or has a minimum of $10,000 across all accounts.

-

Virtual Wallet with Performance Select

The Performance Select account has the most benefits of all three accounts. It has an interest-bearing checking account and allows up to eight linked additional PNC checking or savings accounts without charging a monthly fee.

Virtual Wallet twitch Performance Select requires a monthly service charge of $25 that will be waived if the account holder keeps a monthly balance of $5,000 and has a monthly direct deposit of at least. $5,000, or has a combined minimum of $25,000 across all accounts.

Why Was My PNC Bank Account Application Rejected?

There are several reasons why your PNC Checking Application was denied.

- Negative Checking History: negative history can be mainly affected by one of the both reasons:

- Overdrafts or bounced checks: A negative checking history may be reflected due to too many overdrafts or bounced checks. If you consistently overdraw your account due to too few funds or you write bad checks, overtime may cause a negative checking history.

- Unpaid fees or negative balances: Unpaid fees or carrying a negative balance can cause a negative checking history. It is important to keep enough money in your account to pay bills or to cover purchases.

- Suspected fraud or identity theft: Unfortunately, fraud or identity theft is something that, though often not the account holder's fault, can leave a bad impression on their finances. If a case is pending for identity theft or an account has been flagged for fraud, this may cause PNC to deny your application for a checking account.

- Insufficient information: It's possible that your information was given incorrectly or did not meet the criteria during the application process. Account holders must be 18 years or older (or have a legal guardian on the account), must be legal US citizens, and provide the necessary documents.

What Can I Do?

If your PNC Checking application was rejected, there are a few things you can do to combat that decision or to gain approval later on:

- Check your Chexsystems: Go to Chexsystems to review your checking reports. Your Chexsystems will provide more details as to your checking history and may offer insight on what needs to improve to obtain a PNC Checking account.

- Call your local branch: Your local PNC branch should be able to offer more details as to why your account application was rejected. PNC Bank will also mail a rejection letter with more specific details leading to that decision.

- Continue making healthy money choices: The best thing you can do is to constantly work towards maintaining healthy money choices and creating positive spending habits. A responsible banker with a positive checking history will eventually gain approval for a PNC Checking account.

What Factors Should I Consider When Opening a PNC Checking Account?

Opening a new account with PNC may mean changes in your daily banking experience. Every bank is different, so give yourself time to adjust and utilize provided resources to optimize your banking experience.

-

PNC Virtual Wallet

Virtual Wallet is PNC’s checking account. It offers tools to assist in money management, such as Low Cash Mode, and resources to speed up payments, such as Zelle and contactless pay.

Virtual Wallet charges a monthly service fee of $7 that is waived if the account holder keeps a minimum balance of $500, has a monthly deposit of $500 or higher or is age 62+.

Though this is PNC’s most basic account, members can optimize their banking by setting goals and saving money with digital tools and resources.

-

Account Fees

All PNC Virtual Wallet Accounts charge a monthly service fees unless specific criteria are met.

This can be a difficult adjustment for those coming from a bank with no service charges, as meeting the criteria may take conscious effort for some.

PNC also charges a high overdraft though many banks require an overdraft charge, it’s necessary to consider before opening an account.

-

Digital Tools And Products

PNC offers a variety of digital tools and products to enhance your mobile banking experience.

Some are purely educational and can be found on the Personal Finance and Managing Wealth page, while others intend to assist you on your financial journeys, such as Overdraft Solutions and their Online and Mobile Banking Resources.

How Can I Maximize My PNC Banking Experience?

The PNC website provides information as to how you can optimize your Virtual Wallet experience. The key is to research your account and take advantage of the resources provided. If you have any questions that the website can’t answer, give PNC customer service a call.

- Take advantage of low cash mode: With low cash mode, users have 24 hours to get their balance back up to $0 before being charged an overdraft fee. Low cash mode offers payment control and alerts to help you track payments.

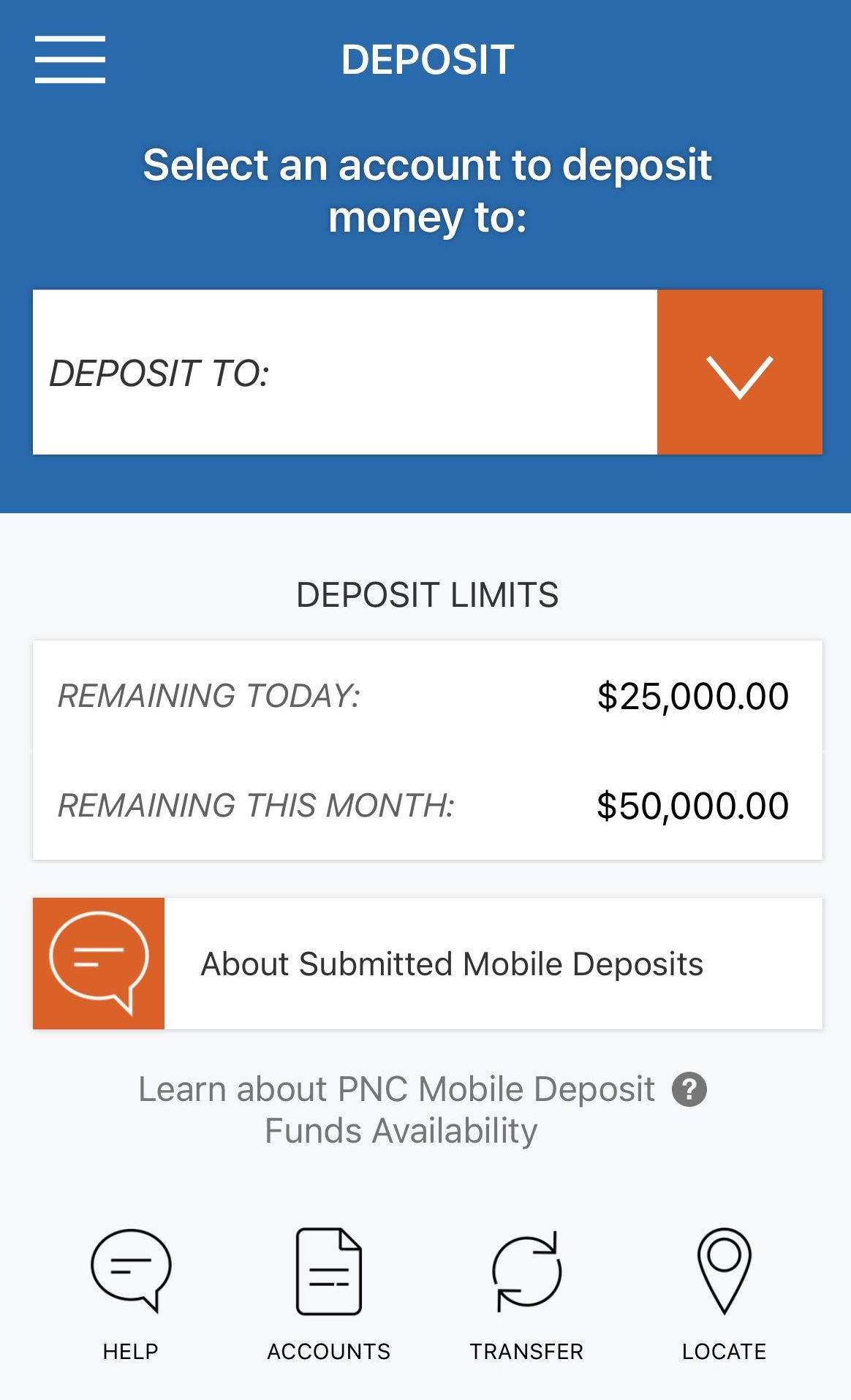

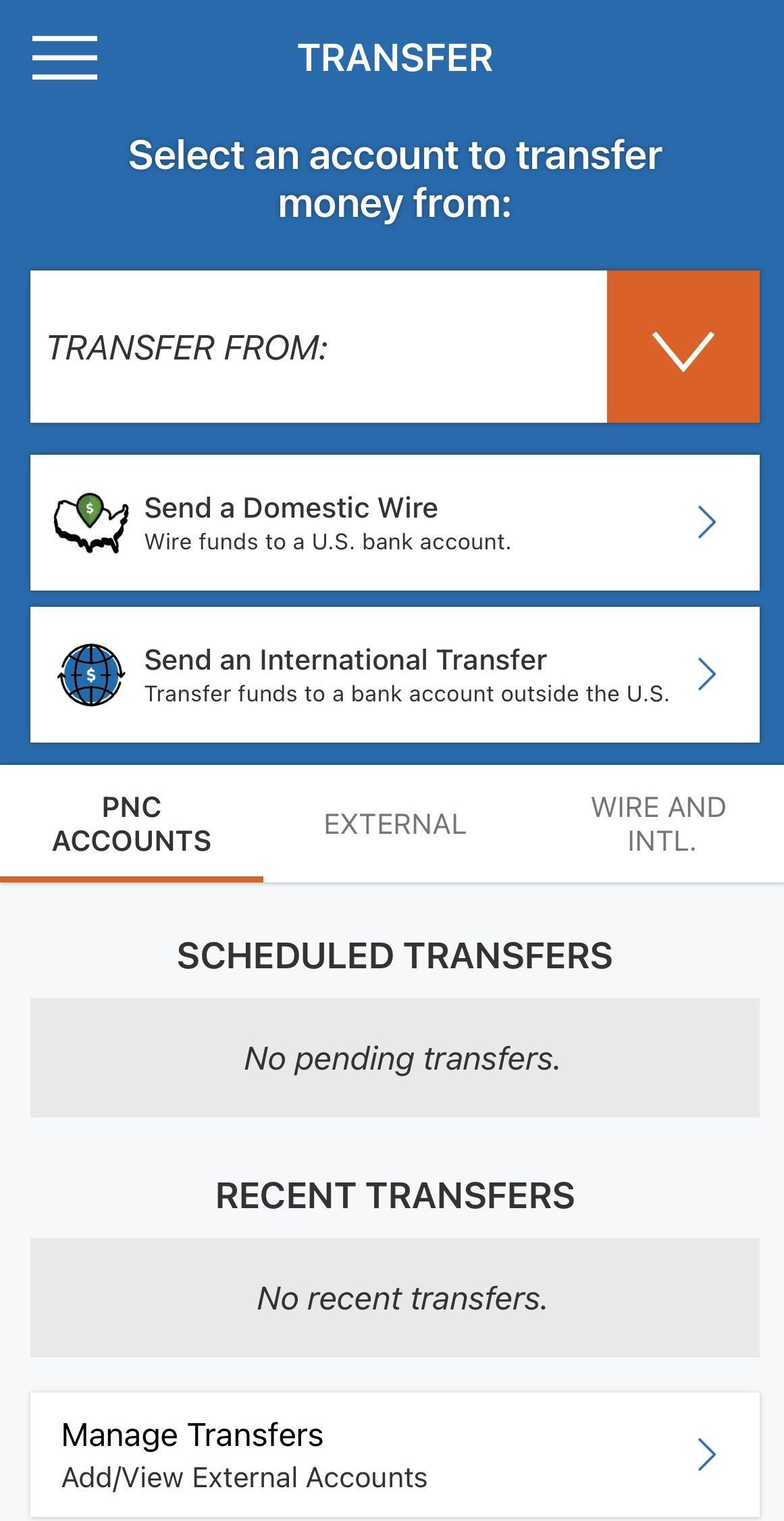

- Keep your account minimum and set up direct deposit: You can avoid monthly service charges by keeping the account minimum or setting up direct deposit of at least the account minimum. Setting up direct deposit allows users access to their money faster- though users can upload checks through the app when they enroll in mobile banking.

- Enroll in online and mobile banking: Mobile banking with PNC allows you to bank anywhere at any time. Users can log in to their accounts through the app with face authentication or a PIN, allowing easier access than logging in on the website.

- Add your card to your mobile wallet: By adding your debit card to your mobile wallet, you can make purchases online or in-store- without your physical card in hand.

- Utilize your debit card benefits: PNC Visa Debit Cards offer Cash Back rewards with Purchase Payback, several layers of fraud protection, and contactless payment methods via chip.

FAQs

Can a non-US citizen open a PNC bank account?

People that are not registered US citizens must go to a local branch when applying for a PNC Bank account. The criteria for applying online are specific, whereas multiple forms of identification are acceptable for in-person applications.

How to close PNC bank account?

It's possible to start your closing application via the PNC website, verify the details and make the rest of the closing process when talking to a PNC representative.

In Which Mediums Can I open a PNC savings account?

You can apply online for a Standard Savings account or at a local branch. The Standard Savings account requires no minimum deposit and comes with digital tools and resources to help with short-term and long-term savings.

How long does it take to open a PNC Bank account?

An application for a PNC Bank account takes only a couple of minutes to complete. You can gain access to your funds immediately upon approval when completing an application online. When applying in person, it may take up to three days to receive your application status.

Can I open a PNC bank account without an SSN?

Yes, you can open a PNC Bank Account without an SSN. To open a PNC Bank account without an SSN, applicants must visit a local branch and provide an alternative proof of identity, such as an ITIN. A social security number is required for online applications.

What is the minimum balance for a PNC checking account?

The minimum balance for a PNC checking account varies depending on the type of account you choose. PNC offers three levels of their Virtual Wallet. The standard Virtual Wallet has a minimum deposit of $500, Virtual Wallet with Performance speed is $2,000, and Virtual Wallet with Performance Select is $5,000.

How to find PNC branches near me?

To find PNC Bank locations near you, visit the PNC website under the PNC Bank Locator page. You can also use your location on your preferred search engine to find a location near you.

How to find PNC ATMs near me?

Finding PNC ATMs near you is the same process as finding local branches. The PNC Bank Locator on the website, or your preferred search engine can show you ATM locations in your area.

How do I contact PNC customer service?

The best way to contact PNC customer service is by calling their customer service line at 1-888-PNC-Bank, or 1-888-762-2265. PNC also offers customer service and support through their online and mobile banking.

What are PNC Bank's open hours?

PNC Bank's open hours are dependent on the location and branch you are trying to visit. PNC Bank is open during business hours- Monday through Friday. The customer service line's business hours are Monday through Friday, 8:30 am-4 pm.

Related Posts

Banking Reviews

Aspiration Review

Alliant Credit Union Review