Barclays Online Savings

APY Savings

Minimum Deposit

Our Rating

Fees

The Barclays Online Savings account is a great choice for the tech savvy who are looking to get decent returns and are comfortable managing their account online or via an app.

While there are some restrictions, including not being able to deposit or withdraw cash, if this is not a problem for you, this account is a solid choice.

Interest on your funds is compounded daily and credited to your account monthly, and with no monthly fees to worry about, you can simply watch your savings grow.

Table Of Content

What Does The Barclays Online Savings Account Offer?

The Barclays savings account operates like an online savings account. Here are the main things to know if you consider it:

- High Yield APY: Barclays offers a highly competitive rate on its online savings account, that is currently five times the national average savings rate.

- No Account Minimums: There is no initial deposit requirement and you don’t need to have a minimum amount in the account to access this impressive rate.

- No Monthly Maintenance Fees: Unlike many bank accounts, Barclays does not impose a monthly maintenance fee on its online savings account, which makes it one of the best free savings accounts.

- Savings Tools: With this account, you can access the Barclays Savings Assistant. This innovative tool allows you to choose a savings goal and play around with how long it will take you to reach your goal by saving different amounts each month.

- Secure Online Account Management: You can access your account 24/7 via the secure Barclays platform, transferring money from or into other banks and other management tasks for the ultimate convenience.

- Highly Rated App: You can also manage your account via the highly rated Barclays app. This includes mobile check deposit and initiating electronic transfers.

- Direct Deposits Accepted: If you want to boost your savings, you can directly deposit salary payments into your account.

But, It Has Some Limitations

No financial product is perfect and there are some potential drawbacks which may mean that this account is not the right choice for you.

- Limit of Six Withdrawals Per Month: This is fairly standard with high yield savings accounts, but with the Online Savings Account, Barclays will impose a $5 fee if you exceed six withdrawals per statement cycle. This is one of the limitations of savings accounts.

- No ATM Access: While having a debit card with a savings account is very unusual, many savings accounts offer an ATM card. This is not the case with the Barclays Online Savings Account. If you need cash, you’ll need to transfer funds into another account and then withdraw cash from that account.

- No Branch Support: This is a wholly online account, so you won’t have access to in person support if you run into an issue or problem.

Find Out How Fast Your Savings Can Grow

Initial deposit

Monthly contribution

Period (years)

APY

-

Interest earned

-

Contributions

-

Initial deposit

Total savings

* Make sure to adjust APY and deposit

Barclays Online Savings vs Capital One 360 Performance Savings

The Barclays Online Savings account is not unique and one logical product for comparison is the Capital One 360 Performance Savings. This account has many similarities with the Barclays product, but there are also some key differences.

The Similarities | The Differences |

|---|---|

Mobile Check Deposit | Branch Access |

Similar Rates | Multiple Accounts |

No ATMs |

- Mobile Check Deposit

Both the Barclays and Capital One apps allow mobile check deposit for convenient depositing.

- Similar Rates

The accounts have similar APYs, so you can expect similar returns on your savings account.

- No ATMs

Neither bank provides an ATM card for these accounts, so if you need cash, you’ll need to transfer funds out.

- Branch Access

While the Barclays account is wholly online, there is no branch support, Capital One has some locations where you can withdraw funds or perform other transactions.

- Multiple Accounts

Capital One allows you to open multiple 360 Performance accounts, so you can separate your funds according to different savings goals.

Barclays Online Savings vs Amex Savings: Which Is Better?

Another product that is a good source for comparison is the American Express online savings account. There are very similar features between the two:

Barclays Online Savings | Amex Savings | |

|---|---|---|

APY | 3.90% | 3.50% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

- No ATMs: Both accounts are not provided with ATM cards, so you cannot simply withdraw cash from your account.

- 24/7 Support: Both financial institutions offer 24/7 support, so if you run into a problem or issue outside of business hours, you can access help.

- No Monthly Fees: Neither account has monthly maintenance fees to worry about.

- No Minimums: Likewise, neither of the accounts has minimum initial deposit requirements.

- No Branches: Neither bank has physical locations, so you cannot access face-to-face customer support.

- APYs: Currently, Amex is offering a slightly lower APY on its online savings account. However, both accounts offer competitive rates and are considered one of the best banks for savings accounts.

How to Deposit and Withdraw Money From Barclays Online Savings

You can deposit funds into your account and withdraw in several ways:

Deposits | Withdrawals |

|---|---|

Mobile Deposit |

Electronic Transfer |

Direct Deposit | Mailed Check |

Electronic Funds Transfer | |

Mailed Check |

- Mobile Deposit

You can deposit checks into your account via the Barclays app

- Direct Deposit

You can arrange to have your salary or other automated payment direct deposited into your account.

- Electronic Funds Transfer

You can initiate a transfer into your Barclays account from a third party account.

- Mailed Check

Finally, you can mail a check to Barclays HQ and it will be applied to your account as soon as it is processed.

- Electronic Transfer

You can initiate a transfer out of your Barclays account to a third party account.

- Mailed Check

You can request a check from Barclays. This will usually take approximately three business days.

Should I Open a Barclays Online Savings Account?

If you’re still unsure if this is the right choice of account for you, there are several questions you should ask yourself to make a final decision.

- Are you happy with managing your account online? Since this is an online account, you need to ask yourself if you are comfortable with not having access to any branch support. If you prefer face to face customer support, you will need to consider other accounts, but you are likely to have to sacrifice the high APY, since most high-yield savings accounts are online only.

- Do you need an ATM card? If you tend to deal in cash and need to withdraw cash or pay cash into the account, this is not a convenient account for you. Since cash deposits are not possible and there is no ATM card supplied, you will need to transfer to a third party account and then perform the appropriate transactions.

- Do you need savings tools? If you’re looking for a straight savings account to hold your funds, you may be satisfied with any account, but if you need a little help working out how to reach your savings goals, the Barclays Online Savings account may appeal to you.

- Do you need to make frequent withdrawals? Finally, you need to be realistic about how many withdrawals you’ll need to make in a typical month. If you exceed six withdrawals with this account, you will incur a fee.

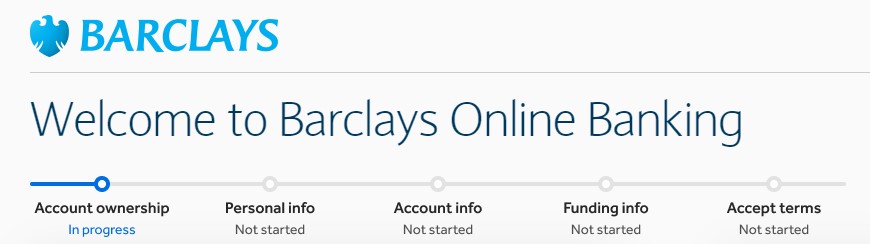

How to Open a Barclays Online Savings Account?

Since this is an online account, you will need to open your Barclays account via the Barclays website. However, you can complete this process in a few simple steps.

- Find the Product Page: On the Barclays website, you’ll need to click “Savings and CDs” on the top menu bar and then select “Online Savings Account.” From this product page, you will see all the account terms and conditions and the option to open an account via the blue button.

- Complete the Application: You’ll need to provide your full name, email address and Social Security Number. You will also need to add banking details of the account that you want to use for funding your new account.

- Select an Opening Deposit: This is not a mandatory step, since there is no minimum deposit requirement, but at this stage, you can start your savings.

Can I Open a Barclays Online Savings Joint Account?

Yes, you can select a joint account during the application. You will need to provide the details for both account holders.

So, you’ll need to know the other person’s full name and Social Security Number along with providing ID to verify both your identities. This can be driver’s licenses, passports or state issued photo IDs.

About Barclays Bank

While Barclays Bank has only been operating in the U.S since the 1960’s, this financial institution actually has a history spanning 230 years. Besides savings accounts, Barclays U.S. also offers CDs.

While this bank may have started in London before the invention of railroads, Barclays is not stuck in the past and offers some solid online financial products. This includes the Barclays Online Savings Account.

FAQs

Can I transfer my IRA to a Barclays Online Savings account ?

Yes, you can transfer your IRA to a Barclays online savings account if you are comfortable with a completely online account and will not need more than six withdrawals per month.

How much can I withdraw from Barclays Online Savings?

There are no limits to how much you can withdraw from your online savings account, but you are restricted to a maximum of six withdrawals per statement period or you’ll incur a fee.

How do you close a Barclays Online Savings account?

You can request closure of your account by calling the Barclays customer support helpline or by a live chat on Barclays app. A Barclays representative will guide you through the closure process.

Can you direct deposit into a Barclays savings account?

Yes, Barclays does allow direct deposits into its online savings account.

Does Barclays offer a health savings account?

There is a HSA account for Barclays employees, but this is not available for the general public.

Top Offers From Our Partners

How We Rate And Review Savings Account: Methodology

The Smart Investor team has conducted an in-depth analysis of savings accounts offered by banks and credit unions tailored to the needs of savers. Our review focused on four key categories, with specific considerations for savers, and here's how we rated them:

- Savings Rates and Terms (40%): We thoroughly examined the interest rates provided by financial institutions, along with any unique terms and conditions attached to their savings accounts. Higher scores were awarded to banks and credit unions, offering competitive rates, reasonable minimum deposit requirements, and minimal fees, ensuring savers get the best value for their money.

- Savings Account Features (30%): This category assessed the array of features designed to cater to savers' needs, including fees, minimum deposit requirements, mobile app functionality, ATM access, and withdrawal options. Financial institutions providing a diverse range of features and convenient banking solutions received higher ratings in this category, reflecting their commitment to meeting the specific needs savers.

- Customer Experience (20%): The ease of account opening, the responsiveness of customer service, the usability of mobile apps (thoroughly tested by our team), and the bank's policies for assisting customers were evaluated in this category. Banks and credit unions offering seamless account opening processes, efficient customer service, and user-friendly digital platforms were rated higher, ensuring a positive banking experience for savers.

- Bank Reputation (10%): We considered the reputation of each financial institution, incorporating ratings from trusted sources such as JD Power, TrustPilot, and local Better Business Bureau reviews. Higher scores were awarded to banks and credit unions with positive reputations and satisfied customers, reflecting their reliability and trustworthiness.

By weighing these categories appropriately and focusing on factors relevant to savers, our review provides valuable insights to help residents of the state make informed decisions when selecting a savings account.