Table Of Content

While they have some products in common, Ally and Chime have a different banking product line, but does this mean one is a better bank?

We’ll need to look a little closer to make that determination.

When Ally Bank Wins?

Ally has quite a comprehensive banking product line that could easily rival a conventional bank. There is a savings account, checking account, CDs, investments via Ally Invest, retirement products, personal loans, auto loans, and mortgages available.

Ally Bank can be a better choice than Chime if:

You want to earn interest on your checking account

You want to access loans and mortgages

You’re interested in CDs

When Chime Wins?

Chime’s product line is more streamlined. All Chime products are structured to help customers rebuild or build credit. There is just one savings account, one checking account and one credit card option.

Open account on Chime can be a better choice than Ally if:

You want a secured credit card

You want to build your credit

You want access to a fee free overdraft facility.

Ally | Chime | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

As of [month-year], Ally savings rates are higher. Neither account has a minimum deposit, so you can enjoy a great rate regardless of how much you hold in your account.

However, there are some stand out features for both banks. For example, the Ally savings account has buckets to allow you to organize your savings. This means that you can allocate funds for different savings goals without needing to manage multiple accounts.

However, Chime has a When I Get Paid feature that automatically saves a percentage of your paycheck each time you get paid. Both these account features are designed to make it easier to save towards achieving your financial goals.

Ally | Chime | |

|---|---|---|

APY | 3.50% | 2.00% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

Checking Needed? | No | No |

Main Benefits |

|

|

Checking Account

Ally Bank's Spending Account offers a 0.10% APY on balances under $15,000 and 0.25% on higher amounts, with no monthly fees or minimum balance requirements.

It provides access to over 43,000 AllPoint ATMs and reimburses up to $10 per month for out-of-network ATM fees.

Chime's Checking Account features no monthly fees or minimum balances, access to over 60,000 fee-free ATMs, and early direct deposit access.

Chime also offers SpotMe®, allowing eligible members to overdraw up to $200 without fees.

Ally | Chime | |

|---|---|---|

APY | 0.25% | 0% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

Main Benefits |

|

|

CDs

There is no CD comparison, as while Chime does not offer CDs, Ally has an impressive selection. There is no minimum deposit and the rates are tailored to incentivize committing to a longer term CD.

There is the potential highly competitive within the marketplace with Ally CDs, particularly with no minimum deposit requirements. Here are Ally CD rates as of October 2025:

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 3.00% | 60 days of interest

|

6 Months | 4.00% | 60 days of interest

|

9 Months | 3.90% | 60 days of interest

|

12 Months | 3.90% | 60 days of interest

|

11 Months – No Penalty | 3.40%

| / |

36 Months | 3.50% | 90 days of interest |

60 Months | 3.50% | 150 days of interest

|

Credit Cards

In this area of comparison, Chime has the edge. Chime has a secured card designed to help you to build your credit score. There are no annual fees or credit checks on application.

However, you will need to provide a security deposit, but Chime does not have a minimum requirement.

When your card is in use, Chime reports your monthly repayments to the major credit bureaus, which will help you to start building your credit. Chime claims to have helped its members experience an increase of 30 score points on average.

Previously, there was an Ally credit card, but T.D Bank, the card issuer converted all the accounts over to a T.D Cash credit card. This has left Ally without a credit card option at the moment.

Mortgage

Ally has a selection of mortgage products for home purchase or refinancing. You’ll find adjustable rates, fixed rates, and jumbo loans.

However, Ally also has some nice home loan tools including calculators and guides to help you to choose the right product. Ally also takes pride in providing customers pre approval in as little as three minutes.

On the other hand, Chime does not offer any mortgage products.

Customer Service

Ally has 24/7 customer service. In fact, the bank claims a typical wait time for customers calling in of just one minute.

Chime also has a toll free number that is available 24/7, so you can access the customer service team at any time if you have any queries or questions.

However, consumer review ratings are a mixed bag. Ally has a Trustpilot rating of just 2 out of 5 while Chime’s is far better at 3.7 out of 5.

Online/Digital Experience

Both Ally and Chime have an easy to use website to help you access help and guidance with various finance topics and browse the product line. This ensures a great user experience, particularly if you’re not 100% on which banking services and products are the best choice for you.

Both the banks also have highly rated apps. Ally’s app is rated 4.7/5 for Apple and 4.2 out of 5 for Google, while the Chime app is rated 4.8/5 on Apple and 4.7/5 on Google.

These apps allow you to not only transfer funds and manage your transactions, but you can access support and manage your card.

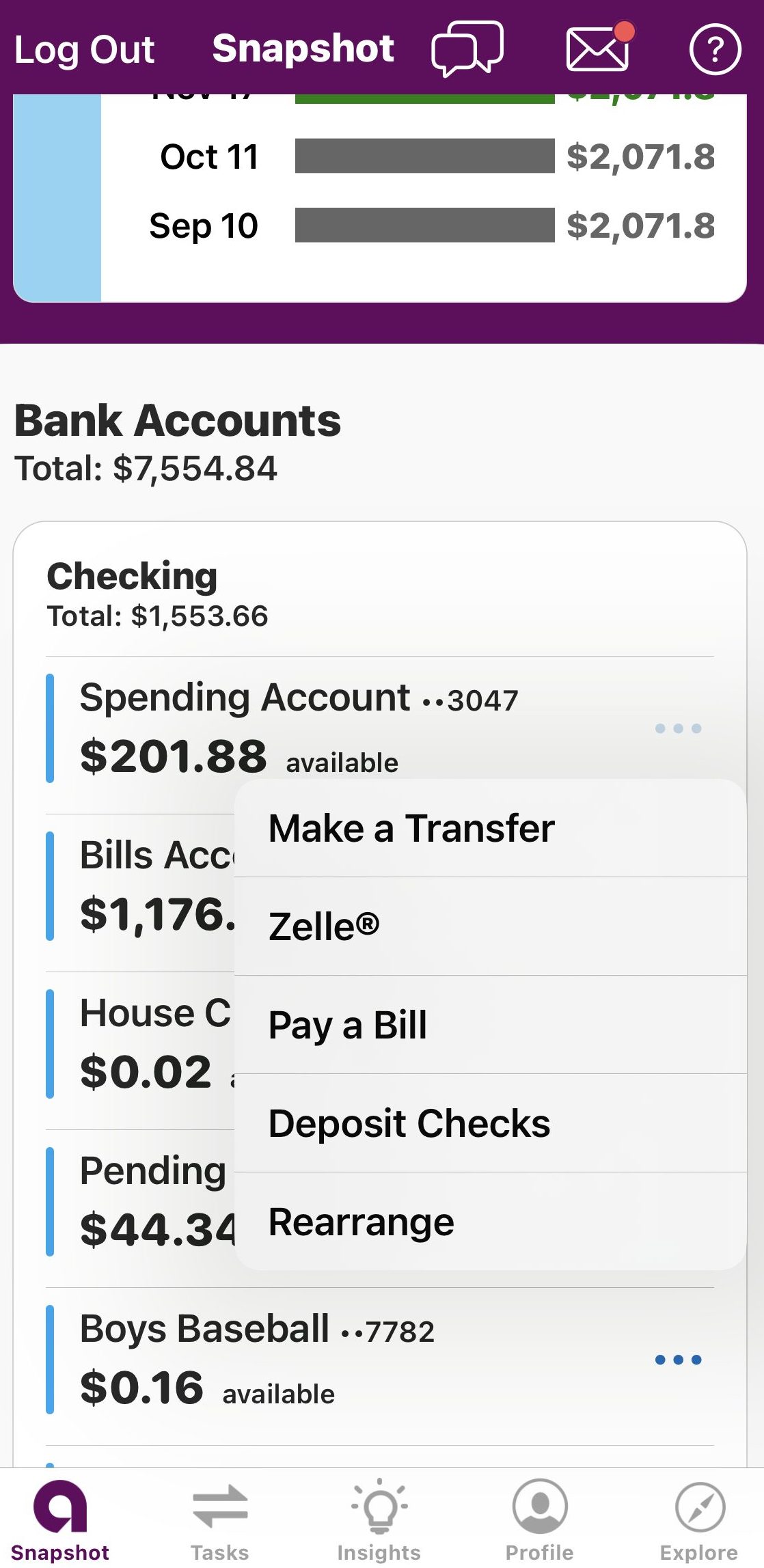

As we can see in the following following screenshot within Ally app, when you log in, you'll see a full picture of your account – how much money you have, recent transactions, any pending deposits or withdrawals, and even a quick look at how you've been spending each month.

Which Bank is The Winner?

Both Ally and Chime offer fee free accounts, but Chime is more geared towards those who want to build their credit. On the other hand, Ally has a far more comprehensive product line. While both banks offer similar rates on savings, Ally also has an interest bearing checking account.

FAQs

Does Ally offer a promotion?

Ally’s primary promotion is that the accounts have no hidden fees or account minimums. Currently, there is no cash or cashback bank promotion for new accounts.

Does Chime offer a promotion?

Chime appreciates that customers of traditional banks can pay billions of dollars each year. So the primary Chime promotion is to offer overdrafts of up to $200 with no fees.

Does Ally Offers Car Loans?

Ally offers car financing packages with flexible terms to suit virtually any budget. You can set up easy payment options and manage your account online. There are also specialty vehicle financing options if you need accessibility features such as a wheelchair lift.

Ally also has Ally SmartLease, which has lower payments and shortened financing terms, so you can trade up more often.

Is Ally ready for recession?

Since Ally is a fully online bank, it does not need to support the infrastructure of a large, branch network. This can help Ally to weather more challenging financial times.

However, since the bank has only been operating since 2009, we have no data on how it handled previous recessions

Is Chime suitable for Millenials?

Millennials prefer convenience and simplicity, which Chime can provide. Even if you don't have a problem with your credit, the fee-free checking account and impressive savings account are a great way to manage your money. The online platform is simple to use, and there is an accompanying app that allows you to manage your finances while on the go.

If you require more from your bank than a checking account, savings account, and secured credit card, this is not the bank for you.

Does Chime Allow Joint Accounts?

Chime does not currently support joint accounts or the use of secondary cards on your account. Chime recognizes the importance of sharing your bank account with your spouse and is working to add this feature to the accounts, but for the time being, if you want a joint account, you'll need to look into other banks.

Ally Bank vs Chime: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at Ally Bank and Chime in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Ally With Other Banks

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Marcus' banking product offering is more specialized. Marcus' product line reflects its investment pedigree as part of the Goldman Sachs Group. CDs, high-yield savings, investment options, and a variety of loans are available.

Ally has a banking product line that competes with traditional, high-street banks. A checking account, savings account, CDs, mortgages, auto loans, personal loans, retirement products, and investments are among the numerous products available.

Read Full Comparison: Ally vs Marcus: Which Online Bank Is Better?

Discover is a completely online bank, so there are no local branches where customers can go for banking services. Customers can get in touch with Discovery via customer service, which is available 24 hours a day, seven days a week. You can log in to your account in a number of ways. All accounts are accessible online.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: Discover vs Ally: Which Bank Wins?

Ally Bank is an online bank that arose from the banking division of General Motors Acceptance Corporation. GMAC used to be an auto financing company before being purchased by Ally Bank. This bank now offers a wide range of products. Among the products available are credit cards, home loans, investing products, savings accounts including certificates of deposit, and checking account options. Ally Bank serves millions of customers and provides high-quality banking services.

Axos is a well-established online-only banking service. It has been in business since 2000 and is constantly expanding its services for both individuals and businesses. The bank is a subsidiary of Axos Financial and is headquartered in San Diego, California. Despite the fact that the bank has three locations, the vast majority of its customers are served online.

Read Full Comparison: Axos Vs Ally Bank Comparison – Which Is Better?

Aspiration has a streamlined banking product line that includes a hybrid account with a $7.99 per month upgrade option and only one credit card option. Aspiration's premise is to help you live a greener life, so the products are heavily weighted in this category. This means that you can earn cash back and other rewards for making environmentally conscious purchases and taking action.

Ally offers a much broader range of banking products. In addition to checking, savings, and CD accounts, you can also get investment and retirement products, mortgages, auto loans, and personal loans. This brings it more in line with a traditional bank, which may make switching from your high street bank easier.

While Wells Fargo has a far more comprehensive product line, Ally does offer better rates on savings, CDs and even its checking account. The only areas where Wells Fargo has the edge is its credit cards and its impressive selection of mortgage products and loans.

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

U.S. Bank is one of the largest brick-and-mortar banks, while Ally is among the best online banks. Let's compare them and find our winner: Ally Bank vs. U.S. Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why:

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option for those who want an online-only bank.

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

Ally Bank is one of the top online banks, while HSBC Bank focuses on serving wealthier customers. Let's compare them side by side: Ally Bank vs. HSBC Bank

Barclays provides a comprehensive range of services to US customers, while Ally bank is among the best online banks. How do they compare? Barclays Bank vs. Ally Bank

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Both Ally and Upgrade offer a complete banking package, including savings, checking, and credit cards. Here's our side by side comparison.

Banking Reviews

Aspiration Review

Alliant Credit Union Review

Banks & Credit Unions Reviews

Chime Disclosure:

- *The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is accurate as of November 17, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

- Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A. Chime Spending Account and $200 or more qualifying direct deposit required to apply for the secured Chime Credit Builder Visa® Credit Card. See chime.com to learn more.