Table Of Content

Certificates of Deposit (CDs) are a popular way for savers to earn interest on their money while keeping it safe and secure. Two of the top choices for online banking and CD options are Ally Bank and Discover. While both banks offer competitive rates and flexible terms, there are some notable differences between the two.

In this article, we'll take a closer look at the CDs offered by Ally Bank and Discover, comparing rates, minimum deposits, early withdrawal penalties, and other features to help you decide which bank's CDs are right for you.

Ally | Discover | |

|---|---|---|

CD Range | 2.90% – 3.90% | 2.00% – 4.00%

|

Minimum Deposit | $0 | $2,500 |

Early Withdrawal penalty | 60-150 days of interest | 3-24 months of interest |

Terms | 3 – 60 months | 3 – 120 months |

How Do CD Rates Compare?

The CD rates battle between Ally and Discover has no clear winner.

While Ally CD rates are slightly better for the short term, if you compare long-term CD rates – Discover is the winner, so it mainly depends on your chosen term. Both offer very competitive rates compared to other online banks or credit unions.

Discover terms are more diverse, and there are many more options for investors than the terms offered by Ally Bank.

CD Term | Discover APY | Ally APY |

|---|---|---|

3 Months | 2.00% | 3.00% |

6 Months | 3.50%

| 3.90% |

9 Months | 3.50%

| 3.90% |

12 Months | 4.00% | 3.85% |

18 Months | 3.80%

| 3.65% |

24 Months | 3.60%

| N/A |

30 Months | 3.60%

| N/A |

36 Months | 3.60%

| 3.50% |

48 Months | 3.60%

| N/A |

60 Months | 3.60%

| 3.50% |

120 Months | 3.50% | N/A |

The Top Choice for Flexible CDs: Ally's No Penalty Option

Unlike traditional CDs, which typically impose a penalty for early withdrawal, Ally's No Penalty CD allows customers to withdraw their funds without penalty at any time after the first six days of opening the account.

The rate is one of the highest in the market for no penalty CD, makes it a great choice for many investors.

CD Term | APY |

|---|---|

Ally Bank 11 Months – No Penalty | 3.30%

|

Top Offers From Our Partners

![]()

A Closer Look at Ally and Discover CDs

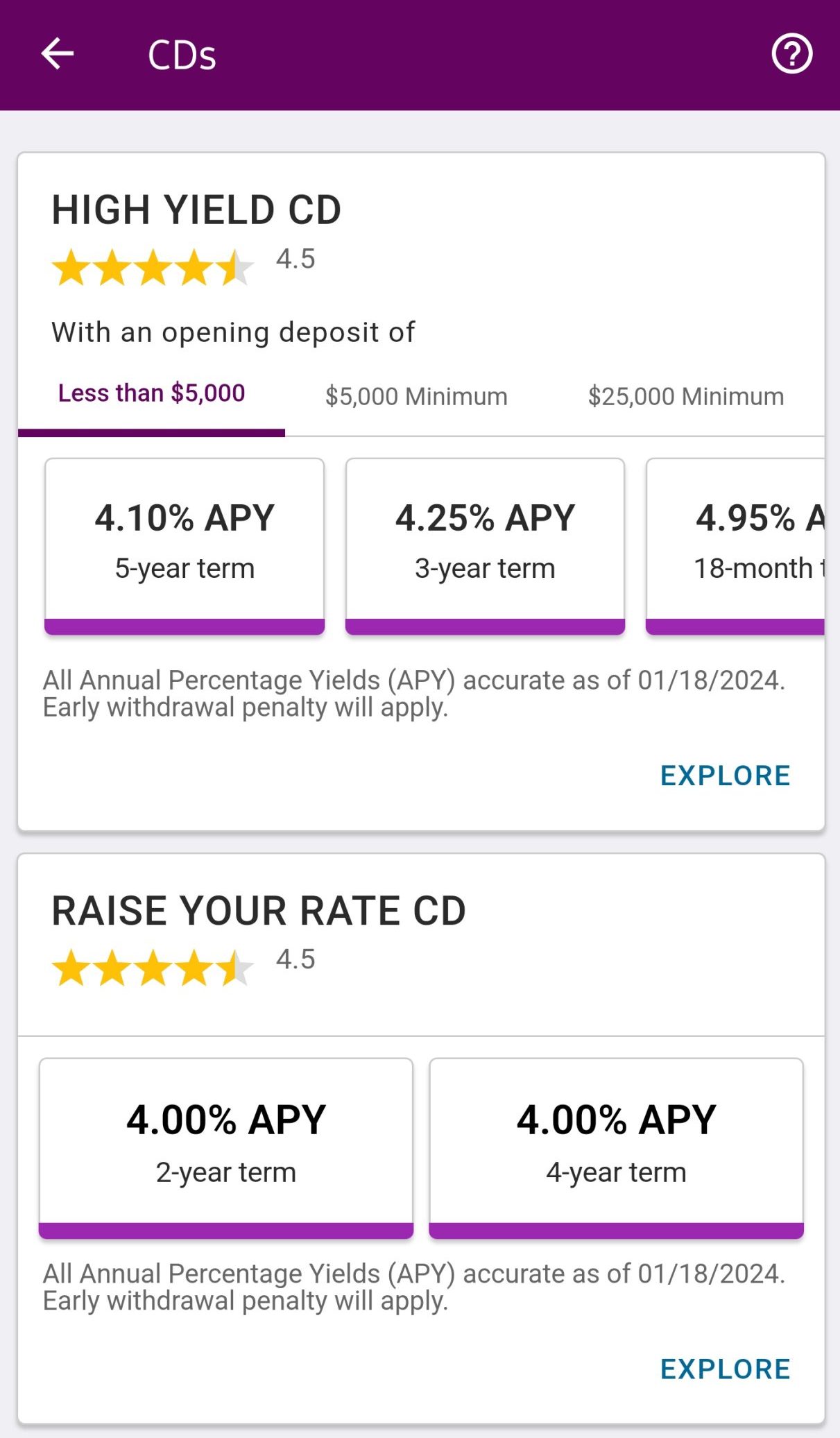

If you're looking for a reliable and competitive option for a CD, both Ally Bank and Discover are worth considering. Ally's High Yield CDs offer terms ranging from three months to five years, with a focus on longer terms. However, if you need to withdraw funds early, you'll face a penalty that varies based on the term of your CD.

On the other hand, Discover CDs require a minimum deposit of $2,500 and offer terms ranging from three months to ten years, with rates varying depending on the selected term. While Discover CD rates are competitive, Discover doesn't offer a no-penalty CD, so early withdrawals will result in a penalty.

Overall, Ally's High Yield CDs offer flexibility with terms and competitive rates, but you'll need to be prepared for potential penalties if you need to withdraw funds early. Meanwhile, Discover's CDs offer a range of terms and competitive rates, but you'll need to commit to the selected term since early withdrawals come with penalties.

Compare CD Early Withdrawal Penalty

Ally emerges as the champion when it comes to early withdrawal penalties.

Compared to Discover penalties, Ally imposes better conditions across all its CD offerings, making it one of the most flexible options available. In fact, Ally stands out as a top choice for CDs due to its extremely low penalty fees.

CD Term | Discover | Ally |

|---|---|---|

3 Months | 3 months of interest | 60 days of interest

|

6 Months | 3 months of interest | 60 days of interest |

9 Months | 3 months of interest | 60 days of interest

|

12 Months | 6 months of interest | 60 days of interest |

18 Months | 6 months of interest | N/A |

24 Months | 6 months of interest | N/A |

30 Months | 6 months of interest | N/A |

36 Months | 6 months interest | 90 days of interest |

48 Months | 6 of months interest | N/A |

60 Months | 18 months interest | 150 days of interest

|

120 Months | 24 months interest

| N/A |

About Ally Bank

Despite its reputation as a newcomer to the banking industry, Ally Bank has actually been in operation for over a decade, having been established in 2009. As an online bank, Ally offers a full range of services, including savings and CD accounts, money market accounts, loans, mortgages, checking accounts, investments, and retirement services.

With a focus on low fees, 24/7 customer support, and highly competitive rates, Ally has earned a reputation for providing exceptional services. The addition of checking accounts to its lineup of offerings makes Ally a credible alternative to traditional banks, with the ability to handle all your day-to-day financial needs using only Ally.

About Discover Bank

With a history of over 30 years, Discover has a proven track record of offering a range of financial products. While the company first gained popularity for its credit card, it has since expanded its offerings to include savings products, such as savings and CD accounts, as well as personal and home loans, IRAs, and a checking account.

Discover has a commitment to being a top digital bank and is dedicated to helping customers achieve a brighter financial future.

How We Compare CDs: Methodology

In our comprehensive certificate of deposit (CD) comparison, The Smart Investor team meticulously evaluated various CDs across four key categories to assist you in selecting the most suitable option for your savings goals.

- CD Rates: We thoroughly examined the interest rates offered by each CD, considering their competitiveness in the market. Higher rates typically translate to greater returns on your investment over the CD's term. Additionally, we scrutinized any special promotional rates or conditions that might affect the overall value of the CD.

- CD Features: This category focuses on the unique features and terms associated with each CD. We assessed factors such as minimum deposit requirements, early withdrawal penalties, and the availability of flexible terms. Additionally, we considered any additional perks like interest compounding frequency or options for automatic renewal.

- Customer Experience: A positive customer experience is crucial in banking, and we evaluated each institution's performance in this regard. We looked into aspects such as the ease of opening a CD, the quality of customer service, and the availability of support channels. Reviews from reputable sources such as Trustpilot and JD Power rankings were also considered to gauge overall user satisfaction.

- Bank Reputation: The reputation of the bank is a significant factor in the decision-making process. We examined the bank's financial stability, regulatory compliance, and public perception to assess its overall trustworthiness and reliability as a CD provider.

Compare Ally CDs

Synchrony Bank and Ally CDs offer competitive rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Synchrony CDs vs Ally CDs

Citi Bank and Ally offer competitive CD rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Citibank CDs vs Ally CDs

Compare Discover Certificate Of Deposit (CDs)

Discover the best CD rates Marcus and Discover offer with our comprehensive comparison, including early withdrawal penalty.

Discover and Capital One offer high CD rates on all terms. However, for each term there is a different winner – here's a full comparison: Synchrony CDs vs. Discover CDs

Synchrony Bank offers better CD rates than Discover for most terms. Compare CD rates, minimum deposit, and early withdrawal fees.