Table Of Content

If you're in search of competitive online bank CD rates, Ally is definitely a top contender worth considering. Ally offers High Yield CDs with flexible terms ranging from three months to five years, with rates that favor terms of 12 months or more. Besides CDs, Ally Bank offers competitive savings accounts, loans, and a broad set of banking products.

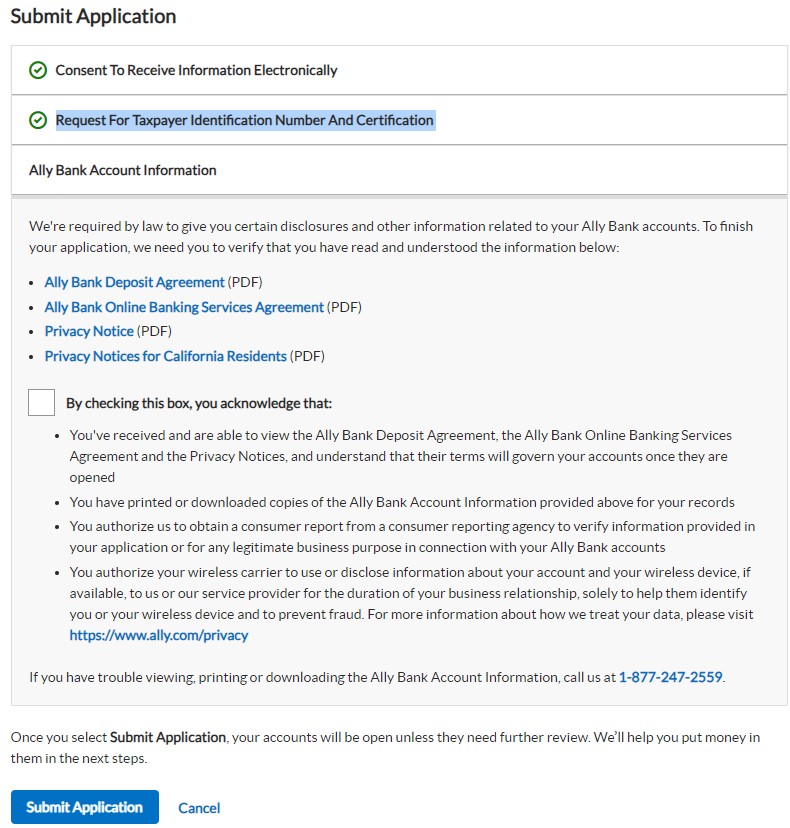

In this article, we'll guide you through the process of opening a CD account with Ally, providing precise screenshots and step-by-step instructions for your convenience.

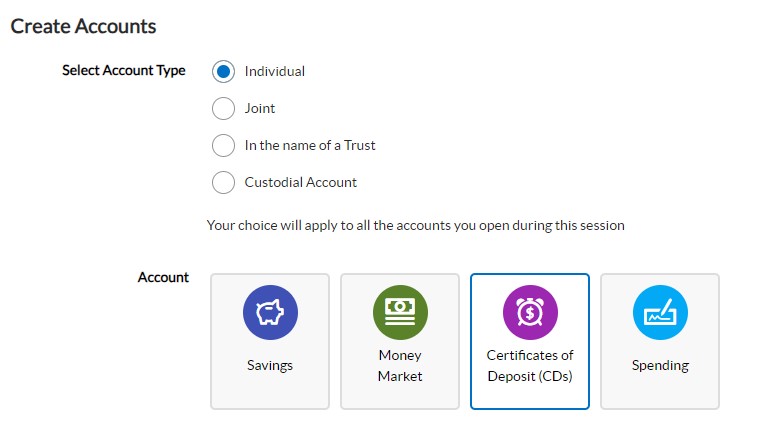

1. Select Account Type

In this step, you are required to select the account type that suits your needs. Here are the options available:

Individual: This option is for opening an account solely in your name. It is suitable if you want to manage the account and its funds independently.

Joint: If you want to open an account with another person, such as a spouse or family member, you can choose the joint account option. Both account holders will have equal rights and access to the funds.

In the name of a Trust: This option is applicable if you want to open an account under the name of a trust. Trust accounts are typically used for estate planning purposes and have specific legal and tax implications.

Custodial Account: A custodial account is designed for minors, where a custodian (usually a parent or guardian) manages the account on behalf of the minor until they reach a certain age.

After selecting the account type, you need to choose CD as the account you want to open.

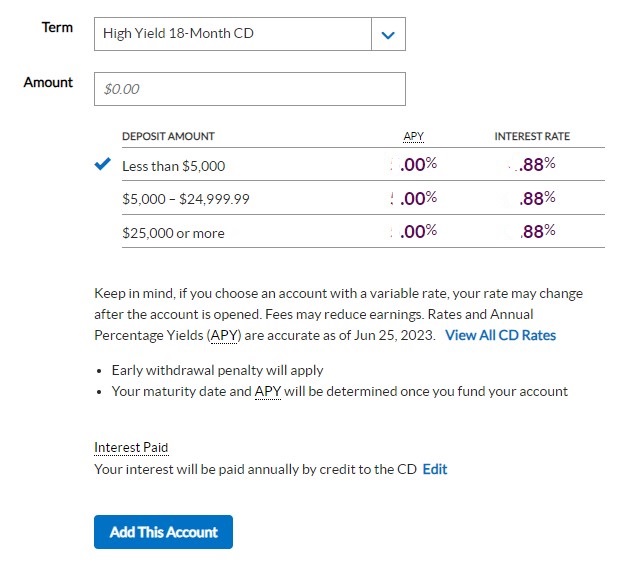

2. Choose Term And Amount

This step involves making decisions about the CD term, the amount of money you want to deposit, and understanding how your deposit amount affects the Annual Percentage Yield (APY) or interest rates you will earn. Here's a breakdown of the process:

Choose CD term: This refers to the length of time you want to keep your money in the CD. You can select a term that suits your needs, whether it's a few months, a year, or even several years.

Choose Amount: Decide on the specific amount of money you want to deposit into the CD. The rates you earn will depend on the amount you deposit.

See your APY based on your deposit: Once you determine your deposit amount, the bank will provide you with the APY. The bank may offer different rates for each category.

If you decide to withdraw your funds from the CD before the agreed-upon maturity date, the bank will impose a penalty. This penalty serves as a charge for early withdrawal.

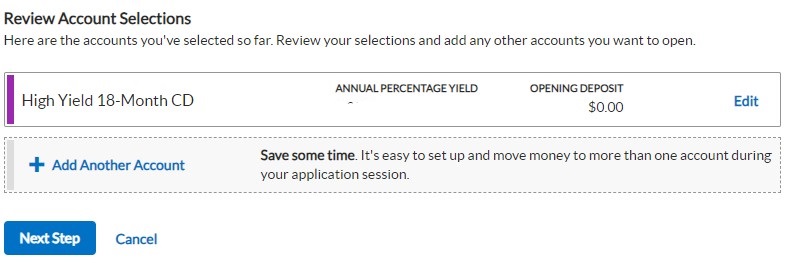

3. Choose Additional CD Terms

In this step, you have the chance to customize your Ally CD account and implement a strategy known as CD laddering. You have the option to add additional terms based on your personal preference. You can allocate a different amount for each term if you wish.

Ensure that the terms and deposit amounts align with your goals. If desired, you can also add any other accounts you wish to open. By personalizing your Ally CD account and considering CD laddering, you can optimize your investment strategy.

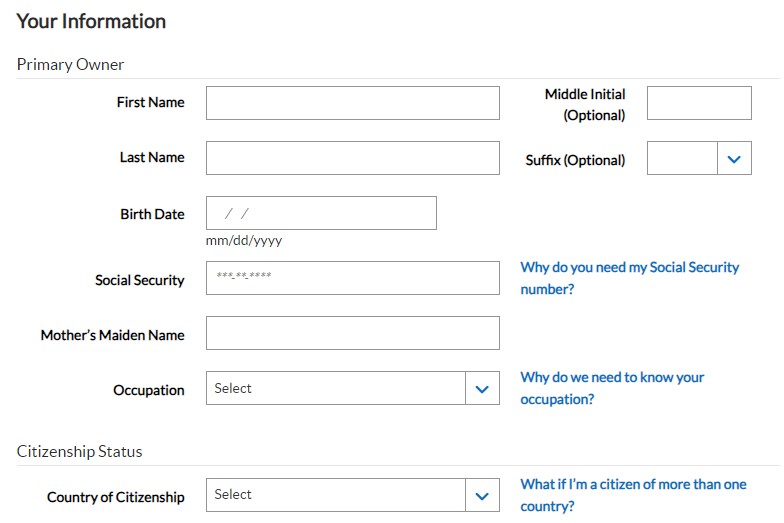

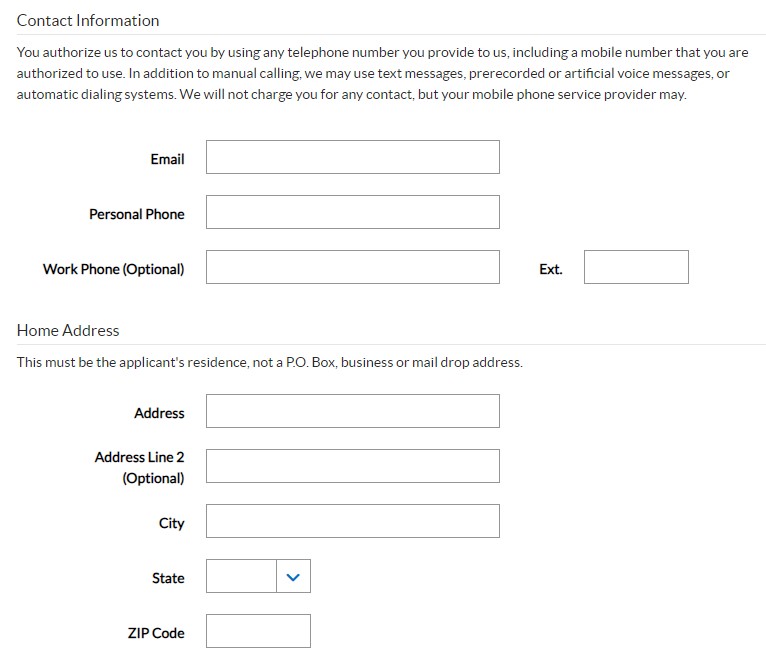

4. Add Perosnal And Contact Information

In this step, you will provide your personal information to set up the CD account. Enter your first name, middle initial (if applicable), last name, and suffix (if applicable).

Provide your birth date in the format of month, day, and year. Enter your Social Security number, mother's maiden name, and occupation. Select your citizenship status and indicate the country of your citizenship.

By providing your telephone number, including a mobile number that you are authorized to use, you grant us permission to contact you.

Additionally, please provide your email, personal phone, work phone (optional), home address (residence, not a P.O. Box), address line 2 (optional), city, state, and ZIP code.

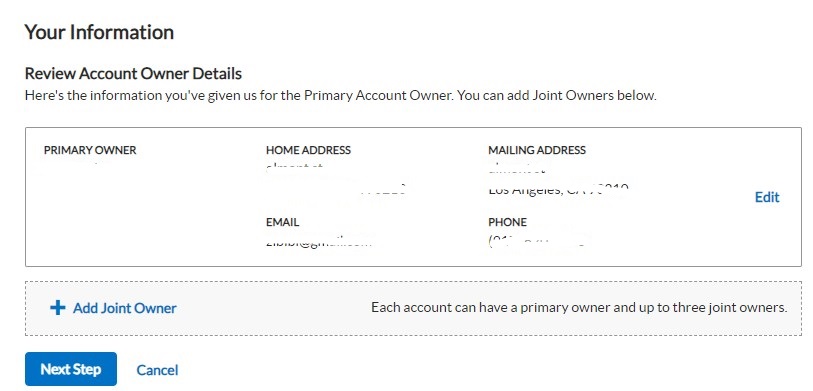

5. Review And Add A Joint Account (Optional)

In this step, you need to review the provided details of the primary account owner. You can also add joint owners if applicable. Ensure that the information you've provided is accurate and complete.

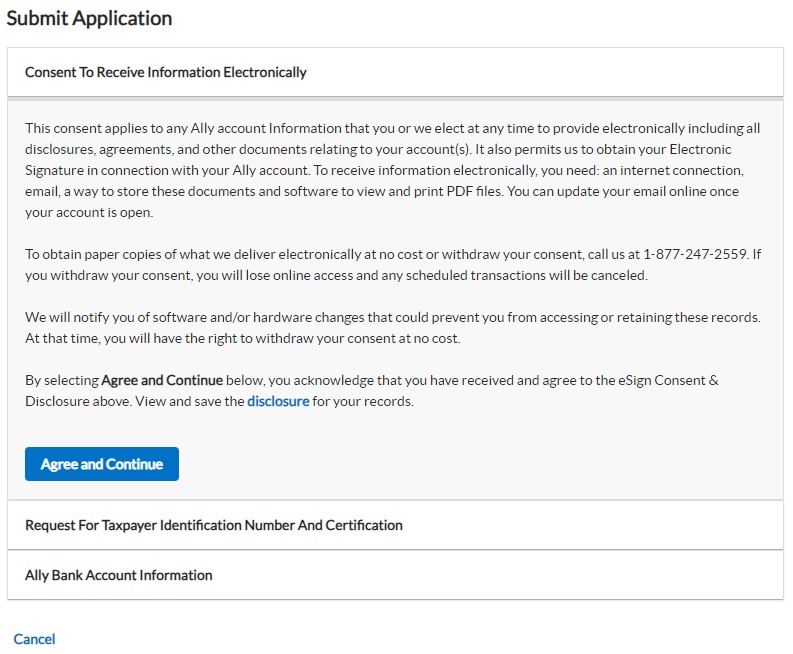

6. Consent To Receive Information Electronically

By agreeing to receive information electronically, you allow Ally to provide all account-related disclosures, agreements, and documents digitally. This includes obtaining your electronic signature.

By selecting “Agree and Continue,” you confirm acceptance of the eSign Consent & Disclosure. Save the disclosure for future reference.

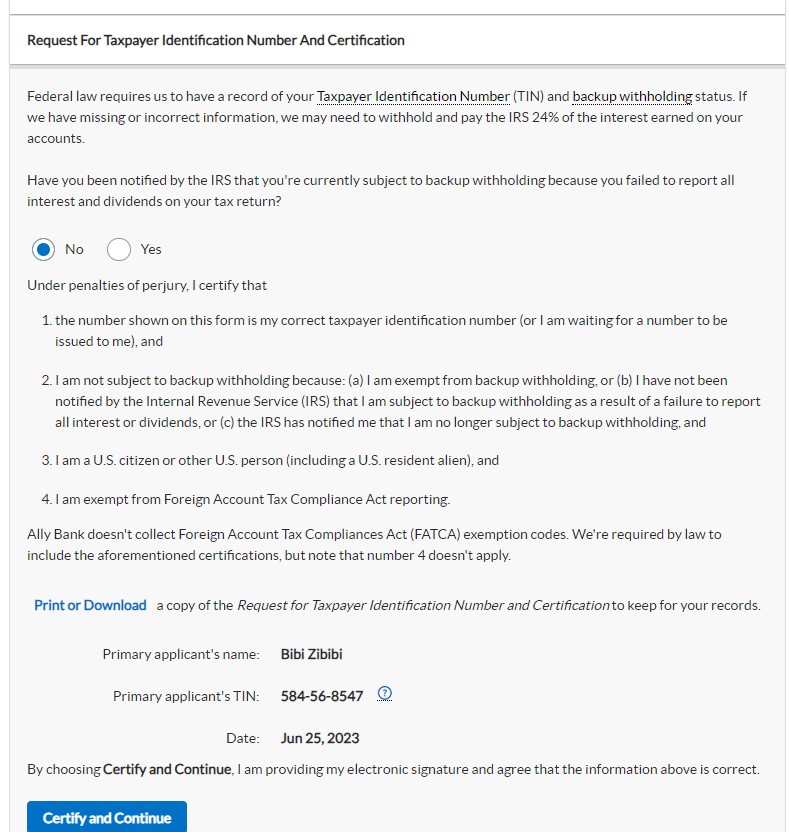

7. Taxpayer Identification Number And Certification

To comply with federal law, Ally Bank requires your Taxpayer Identification Number (TIN) and backup withholding status. Incorrect or missing information may result in withholding 24% of the interest earned.

You'll need to certify your TIN, backup withholding status, exemption from backup withholding, U.S. citizenship, and exemption from Foreign Account Tax Compliance Act reporting.

8. Ally Bank Account Agreements

To complete your Ally Bank account application, you must confirm that you have read and understood important disclosures.

These include the Ally Bank Deposit Agreement, Online Banking Services Agreement, Privacy Notice, and Privacy Notices for California Residents. By checking the box, you acknowledge that these terms will govern your accounts, and you have saved or printed copies for reference.

Additionally, you authorize obtaining consumer reports and allow limited disclosure of account and device information for fraud prevention purposes.

Should I Open Ally Bank CD Account?

Ally Bank provides high-yield CDs that offer competitive rates without requiring a minimum deposit. With Ally CDs, the interest you earn compounds daily and is credited to your account annually or when the CD matures, depending on how long you've chosen to keep it.

After your CD matures, Ally automatically renews it within a 10-day grace period. During this time, you have the flexibility to make changes such as adjusting the term length, adding or withdrawing funds, or closing the CD if needed.

It's important to note that if you withdraw funds from your CD before it reaches maturity, Ally Bank, like most banks, will charge a penalty. The penalty amount varies based on the term length of your CD, ranging from 60 days' interest to 150 days' interest.

To ensure you get the best possible return on your investment, it's always a good idea to compare CD rates offered by different banks and credit unions. This way, you can make sure you're receiving the highest rate available.

Here's how Ally CD rates compared to top banks and credit unions:

CD APY Range | Minimum Deposit | |

|---|---|---|

Marcus | 3.75% – 4.50% | $500 |

Barclays Bank | 3.00% – 4.00% | $0 |

Alliant Credit Union | 3.10% – 4.25% | $1,000 |

Sallie Mae | 3.40% – 4.35% | $2,500 |

Capital One | 3.50% – 4.00% | $0 |

Discover Bank | 2.00% – 4.00% | $0 |

CIT Bank | 0.30% – 3.50% | $1,000 |

Citibank (Compare) | 0.05% – 4.16% | $500 |

Connexus Credit Union | 3.51% – 4.85% | $5,000 |

Merrick Bank | 4.10% – 4.35% | $25,000 |

Synchrony Bank (Compare) | Up to 4.35% | $0 |

Navy Federal | 4.05% | $1,000 |

LendingClub | 3.40% – 4.50% | $2,500 |

FAQs

Can I Open CD Account via Ally mobile app?

Yes. To open an Ally CD account, you can visit the Ally Bank website or use their mobile app. Follow the prompts to provide your personal information, choose the CD term and deposit amount, and complete the necessary steps to fund the account.

What are the minimum deposit requirements for Ally CD accounts?

Ally Bank does not have a minimum deposit requirement for their CD accounts, making it accessible for individuals who want to start with any amount.

Is there a grace period after the maturity date of my Ally CD?

Yes, Ally Bank provides a 10-day grace period following the maturity date of your CD. During this period, you can make changes to your CD, such as adjusting the term length, adding or withdrawing funds, or closing the CD.

Can I change the term length of my Ally CD during the grace period?

Yes, you have the option to change the term length of your Ally CD during the 10-day grace period after the maturity date. This allows you to adjust your investment strategy based on your current financial goals.