TD Bank is one of the largest brick-and-mortar banks in the US. On the other hand, Ally Bank is among the best online banks, and both offer a great portfolio of banking services.

Let's compare them side by side: checking account options, savings accounts, CDs, and loan options.

Checking Accounts

TD Bank wins when it comes to checking accounts.

While Ally offers free checking with interest on the balance and great online features, TD Bank offers a variety of accounts and features for different needs. They offer accounts for 60-plus, students and second-chance banking options.

-

Account Types

Ally offers a single checking account called the Ally Bank spending account, and it lets you earn interest based on your account balance.

With Ally's checking accounts, you get free checks and debit cards, and there are no monthly fees for maintaining your checking account.

Bank Account | Monthly Fee | APY On Balance |

|---|---|---|

Ally Spending Account | $0 | 0.25% |

TD Bank offers various checking accounts for individuals, including for particular audiences such as students and seniors, while most accounts monthly fees can be waived:

TD Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

TD Convenience Checking Account | $15 | $100 |

TD Beyond Checking Account | $25 | $2,500 |

TD Simple Checking Account | $5.99 | Can't be waived |

TD Essential Banking | $4.95 | Can't be waived |

TD 60 Plus Checking Account | $10 | $250 |

Student Checking Account | $0 | N/A |

-

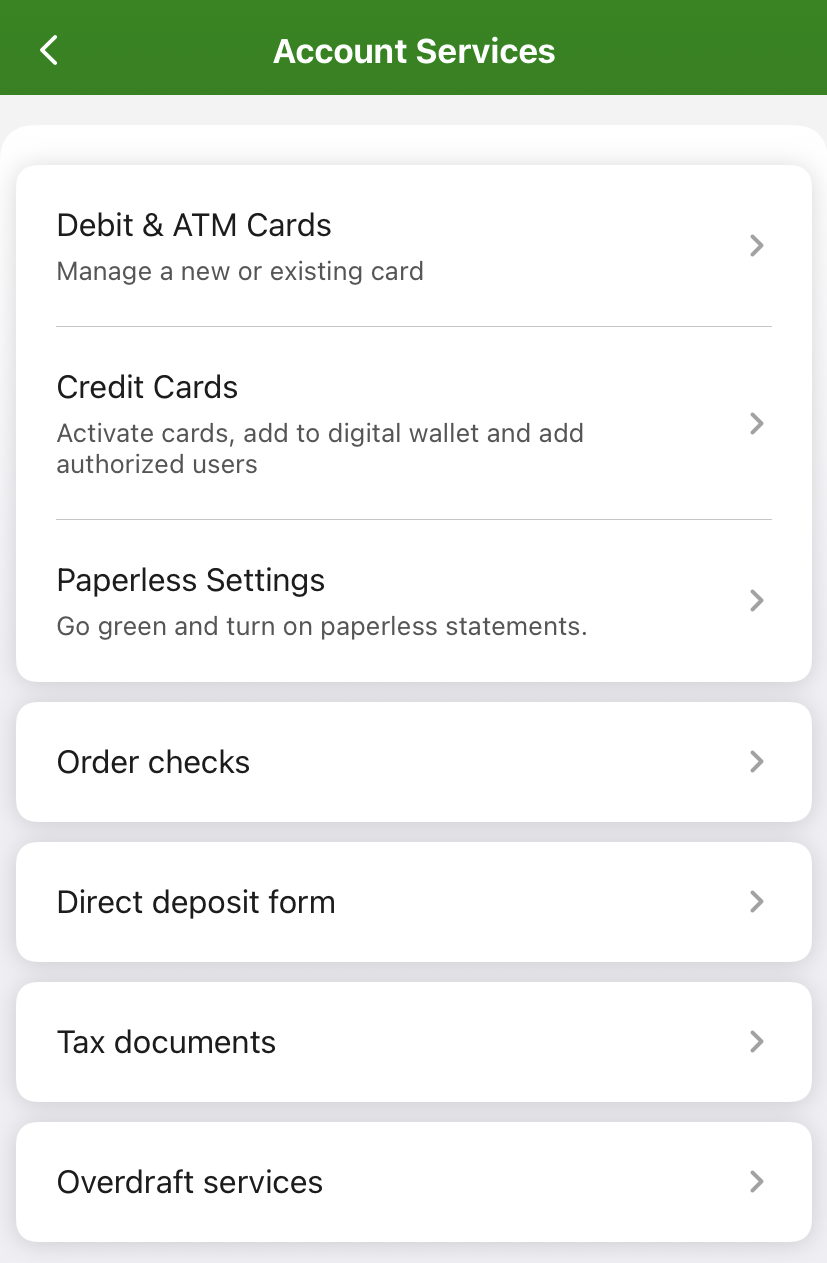

Features

The Ally Checking Account lets you use over 43,000 ATMs without any fees through Allpoint. If you use a different ATM and get charged, Ally will reimburse you up to $10 per month.

This account also helps you manage your spending better by dividing it into different categories. You can get your direct deposit money up to 2 days earlier.

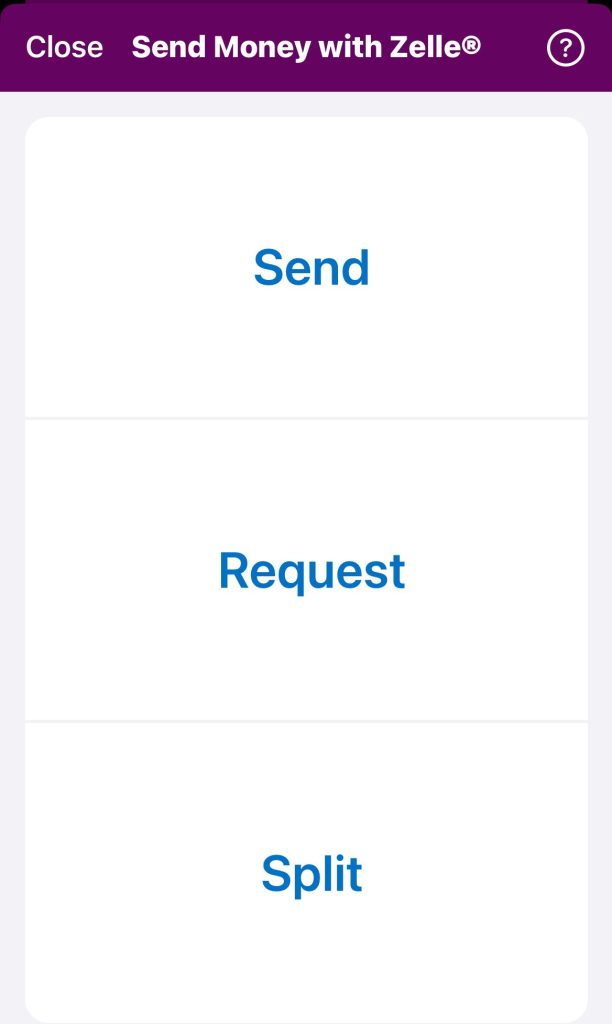

You can easily deposit checks by taking a picture with your smartphone using Ally eCheck Deposit. Plus, you can send and receive money easily with Zelle.

Bank Account | Main Features |

|---|---|

Ally Spending Account | Deposit checks remotely, early pay, interest bearing, debit card, overdraft solutions, savings buckets |

Sending money to friends and family is a breeze with Ally's integration of Zelle. Enter the recipient's email or phone number, specify the amount, and your funds are swiftly transferred:

TD Bank's basic checking accounts give you useful things like online bill pay, free statements, mobile deposit, Zelle, and a debit card.

The premium account takes it up a notch by giving you even more perks: no ATM fees, reversing two overdraft fees, overdraft payback, interest on your balance, and free checks.

TD Checking Account | Main Features |

|---|---|

TD Convenience Checking Account | Online banking, mobile deposit, Zelle, debit card |

TD Beyond Checking Account | No ATM fees, 2 overdraft fees reversed, overdraft payback, interest bearing |

TD Simple Checking Account | Online banking, mobile deposit, Zelle, debit card |

TD Essential Banking | digital tools, no overdraft fees, debit card |

TD 60 Plus Checking Account | Interest bearing, free checks, money orders and paper statements |

Student Checking Account | Online banking, mobile deposit, Zelle, debit card |

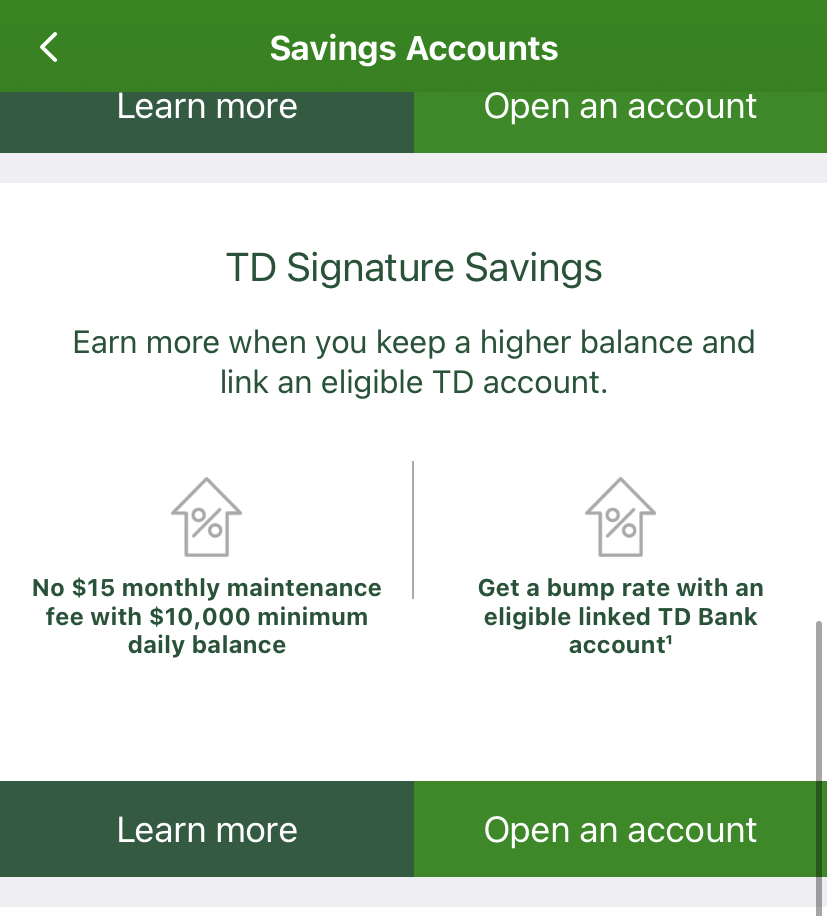

Savings Accounts

Ally wins when it comes to savings accounts.

Ally savings accounts offer higher rates than what you can get with TD, with no fees and no minimum. Also, TD's highest savings rates can be earned only if you have a significant deposit.

Both banks don't have money market accounts for regular people.

TD Savings | Ally Bank Savings Account | |

|---|---|---|

Savings Rate | 0.01% – 3.00% | 3.40%

|

Minimum Deposit | $0 | $0 |

Fees | $5

Can be waived if you carry $300 minimum account balance or $25+ recurring transfer

| $0 |

Certificate Of Deposits (CDs)

If you need a CD, Ally offers better rates than TD Bank.

Since Ally Bank offers high rates on a variety of terms, depositors can leverage this to create any combination of long and short-term CDs.

-

Ally Bank CD Rates

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 3.00% | 60 days of interest

|

6 Months | 3.90% | 60 days of interest

|

9 Months | 3.90% | 60 days of interest

|

12 Months | 3.85% | 60 days of interest

|

11 Months – No Penalty | 3.30%

| / |

36 Months | 3.50% | 90 days of interest |

60 Months | 3.50% | 150 days of interest

|

-

TD Bank CD Rates

CD Term | APY |

|---|---|

3 Months | 1.00% – 4.00% |

6 Months | 1.00% – 3.51%

|

12 Months | 1.00% – 3.00% |

18 Months | 1.00% – 3.00% |

24 Months | 1.00% – 3.00% |

36 Months | 1.00% – 2.75% |

48 Months | N/A |

60 Months (Step Rate CD) | 1.00% – 2.25% |

Credit Cards

There is no clear winner when it comes to credit cards. Both banks offer a limited portfolio of credit cards, but TD offers a bit more options. In terms of redemption options, both cards are far behind the biggest issuers, such as Amex or Chase.

After not having a credit card for a while, Ally recently introduced three new credit cards. These include a cashback card with a fixed cashback rate, another card that offers cashback in specific categories, and a Platinum card designed for people looking to improve their credit.

It's worth noting that while Ally's cards have some benefits, such as cashback, their rewards are somewhat limited. Additionally, the features are pretty basic compared to what U.S. Bank provides, and the card selection is not as extensive.

Card | Rewards | Bonus | Annual Fee |

| Ally Unlimited Cash Back | 2%

Unlimited 2% cash back on all purchases

| N/A | $0 |

|---|---|---|---|---|

| Ally Everyday Cash Back | 1% – 3%

3% cash back at gas stations, grocery stores, and drugstores, with 1% cash back on everything else | N/A | $0 – $39 |

| Ally Platinum Credit Card | N/A | N/A | $0 |

TD Bank offers a couple of rewards credit cards, including cash back and points rewards, travel rewards, secured cards and long 0% intro APR cards.

Card | Rewards | Bonus | Annual Fee |

| TD Cash Credit Card | 1% – 3%

3% and 2% Cash Back on your choice of Spend Categories (you can switch your categories quarterly), and 1% Cash Back on all other purchases | $200

Earn $200 Cash Back when you spend $1,000 within the first 90 days after account opening. | $0 |

|---|---|---|---|---|

| TD Double Up Credit Card | 2%

2% unlimited Cash Back – no rotating Spend Categories, no caps or limits | $150

$200 Cash Back in the form of a statement credit when you spend $1,500 within the first 90 days after account opening | $0 |

| TD FlexPay Credit Card | N/A | 0% Intro APR: 18 billing cycles on balance transfers | $0 |

| TD First Class Visa Signature Credit Card | 1X – 3X

3X First Class miles on travel and dining purchases and 1X First Class miles on all other purchases | 25,000 miles

25,000 miles on $3,000 spent in first 6 cycles | $89 (waived first year) |

| TD Clear Visa Platinum Credit Card | N/A | N/A | $120 / $240 |

Mortgage And Loans

When it comes to borrowing money, Ally offers a bit more options, but both banks do not include all types of loans.

Both TD and Ally Bank focus more on mortgages for homebuyers, mortgage refinancing, home equity loans and personal loans. Ally also offers auto loans that you won't find with TD.

None of them offer student loans.

Which Bank Is Our Winner?

There is no clear winner in this comparison.

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option if you are willing to manage your account online or want to enjoy better savings options.

However, it's important to think about different things, especially the ones that matter most to you. This might include looking at banking services, help with overdrafts, how often you use ATMs, how close the bank is to where you live, and other things that are different for each person.

Compare TD Bank

Chase has some innovative features with the potential for comparable CD rates without TD Bank’s minimum deposit. However, there is little to separate the checking accounts, TD Bank’s savings rate is double that of Chase.

Chase does offer more credit card choices, but don’t rule out TD Bank, which has some interesting options.

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner.

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead.

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner:

TD Bank is our winner with better banking products compared to M&T, but there are cases when M&T wins. See our complete comparison

Both Truist and TD Bank are active in a variety of states, such as Florida, Georgia, North And South Carolina, and more. Here's our winner:

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

While TD offers a better selection of checking accounts and lending options, Amex is a great option for online banking. How do they compare?

Compare Ally With Other Banks

Ally has a robust banking product offering that rivals that of a traditional bank. Savings accounts, checking accounts, CDs, investments, retirement products, personal loans, auto loans, and mortgages are all available.

Chime's product line has been simplified. All Chime products are designed to assist customers in rebuilding or establishing credit. There are only two savings accounts, one checking account, and one credit card available.

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Marcus' banking product offering is more specialized. Marcus' product line reflects its investment pedigree as part of the Goldman Sachs Group. CDs, high-yield savings, investment options, and a variety of loans are available.

Ally has a banking product line that competes with traditional, high-street banks. A checking account, savings account, CDs, mortgages, auto loans, personal loans, retirement products, and investments are among the numerous products available.

Read Full Comparison: Ally vs Marcus: Which Online Bank Is Better?

Discover is a completely online bank, so there are no local branches where customers can go for banking services. Customers can get in touch with Discovery via customer service, which is available 24 hours a day, seven days a week. You can log in to your account in a number of ways. All accounts are accessible online.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: Discover vs Ally: Which Bank Wins?

Ally Bank is an online bank that arose from the banking division of General Motors Acceptance Corporation. GMAC used to be an auto financing company before being purchased by Ally Bank. This bank now offers a wide range of products. Among the products available are credit cards, home loans, investing products, savings accounts including certificates of deposit, and checking account options. Ally Bank serves millions of customers and provides high-quality banking services.

Axos is a well-established online-only banking service. It has been in business since 2000 and is constantly expanding its services for both individuals and businesses. The bank is a subsidiary of Axos Financial and is headquartered in San Diego, California. Despite the fact that the bank has three locations, the vast majority of its customers are served online.

Read Full Comparison: Axos Vs Ally Bank Comparison – Which Is Better?

Aspiration has a streamlined banking product line that includes a hybrid account with a $7.99 per month upgrade option and only one credit card option. Aspiration's premise is to help you live a greener life, so the products are heavily weighted in this category. This means that you can earn cash back and other rewards for making environmentally conscious purchases and taking action.

Ally offers a much broader range of banking products. In addition to checking, savings, and CD accounts, you can also get investment and retirement products, mortgages, auto loans, and personal loans. This brings it more in line with a traditional bank, which may make switching from your high street bank easier.

While Wells Fargo has a far more comprehensive product line, Ally does offer better rates on savings, CDs and even its checking account. The only areas where Wells Fargo has the edge is its credit cards and its impressive selection of mortgage products and loans.

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

U.S. Bank is one of the largest brick-and-mortar banks, while Ally is among the best online banks. Let's compare them and find our winner: Ally Bank vs. U.S. Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why:

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

Ally Bank is one of the top online banks, while HSBC Bank focuses on serving wealthier customers. Let's compare them side by side: Ally Bank vs. HSBC Bank

Barclays provides a comprehensive range of services to US customers, while Ally bank is among the best online banks. How do they compare? Barclays Bank vs. Ally Bank

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Both Ally and Upgrade offer a complete banking package, including savings, checking, and credit cards. Here's our side by side comparison.

Our Methodology: Breaking Down Bank Comparisons

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.