Table Of Content

Citibank is a global financial services company with over 100 million customers in 98 countries. If you're looking for a dependable financial service where you can open a checking and savings account with no minimum deposit, Citibank is a great option.

Because there are over 60,000 ATMs available for you to use to access your money, this is a great way to organize your finances and access your funds. You can also easily obtain a credit card, which is an excellent tool for organically increasing your credit rating.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings CD options, and recently launched a rewards checking account with interesting features.

There is no required minimum balance to open an account. With any amount deposited into the high-yield savings account, you begin earning interest. The more money you deposit, the more interest you earn, but there is no minimum deposit amount.

Banking Options

Citi | American Express | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

As of November 2025, the American Express savings account offers similar rates as Citi Accelerate savings with no monthly maintenance fees and is considered one of the best savings accounts available.

While Amex doesn't charge a monthly fee, you can waive the Citi fees by linking your savings account to an eligible checking accoun.

Citi | American Express | |

|---|---|---|

APY | 0.03% – 1.18%

| 3.50% |

Fees | $4.50/$10 per month

Can be waived if you maintain an average combined monthly balance of $500/$1,500 in your eligible accounts, make one enhanced direct deposit or one qualifying bill payment per statement period

| $0 |

Minimum Deposit | $0 | $0 |

Checking Needed? | Yes | No |

Main Benefits |

|

|

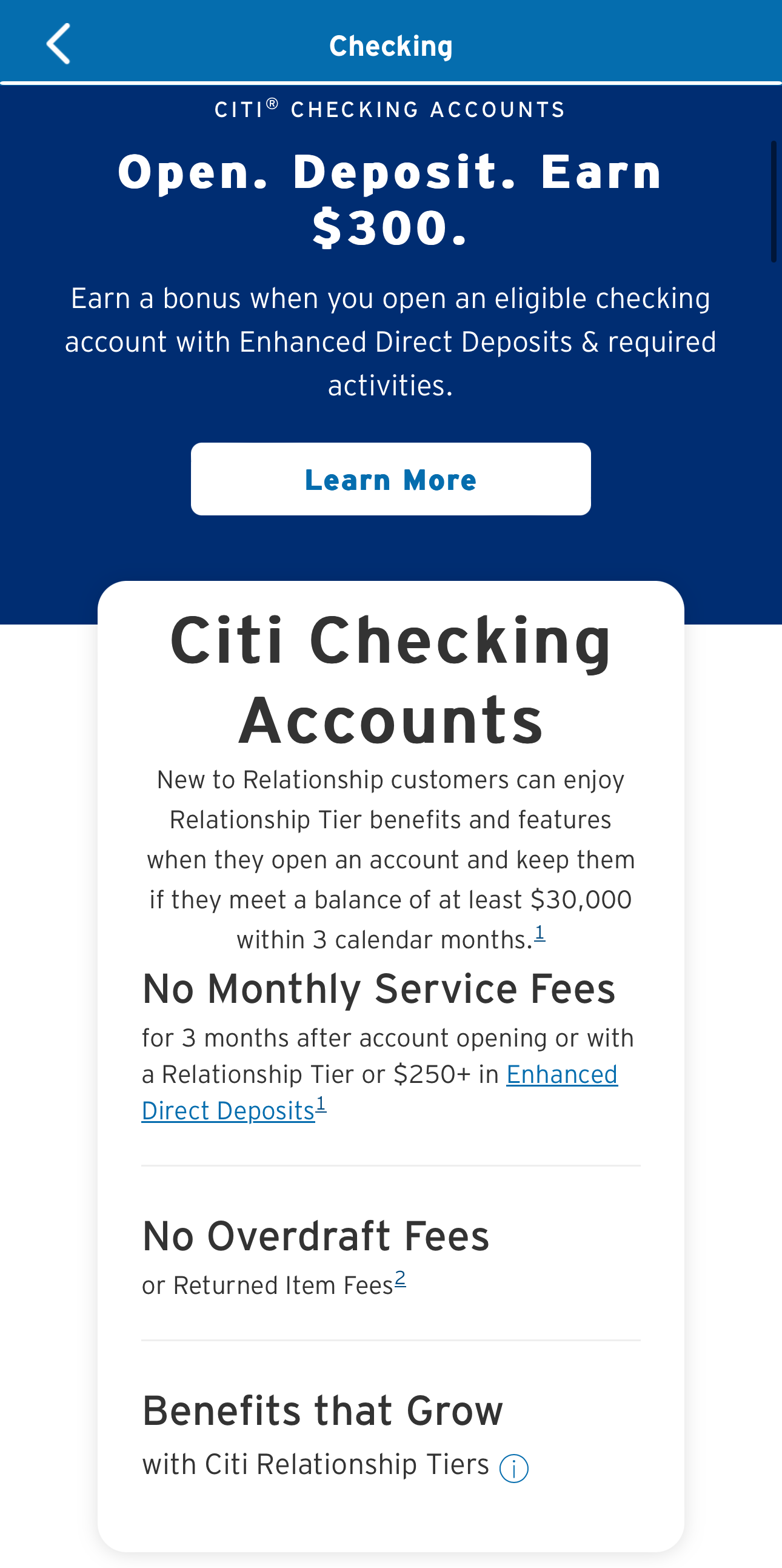

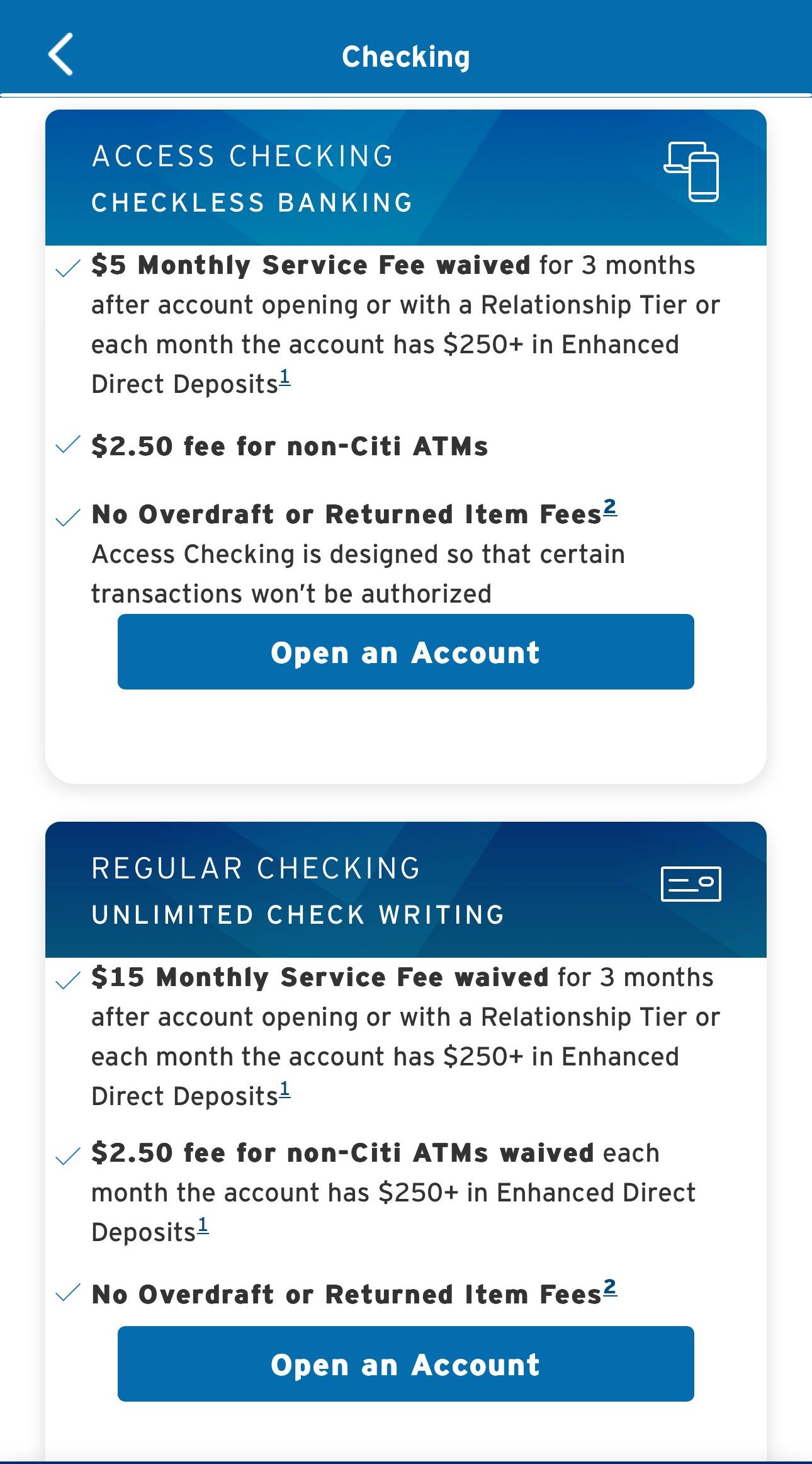

Checking Account

Citi checking accounts offer straightforward and convenient banking solutions. With features like online and mobile banking, direct deposit, and fee-free access to a large ATM network, managing your money is easy.

Citi provides various account options, such as Access Checking, Regular Checking, Priority, Citigold, and Private Client, each designed to suit different needs.

The Amex Rewards Checking account is not open to everyone right now. You must have held an American Express personal credit card for at least three months to qualify.

When you open a Rewards Checking account, you'll not only earn interest on your balance, but you'll also earn one Amex Membership Reward point for every $2 you spend with your debit card.

There is no limit to the amount of rewards you can earn with your debit card, and your purchases are protected for 90 days against theft or damage.

Citi | Amex | |

|---|---|---|

APY | 0.01% | 1.00% |

Fees | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| $0 |

Minimum Deposit | $0 | $0 |

Main Benefits |

|

|

Compare CDs

This is another area where American Express comes out on top. Citi has only a slight difference in rates for taking on a longer term CD, whereas American Express has a tiered structure that encourages longer investments. . However, even the basic one year CD rate is double that of Citi.

The only advantage Citi has is that it does offer a no penalty CD, where you can withdraw your funds early with no penalty.

American Express | Citi | |

|---|---|---|

Minimum Deposit | $0 | $500 – $2,500 |

APY Range | Up to 4.00% | 0.05% – 4.00%

|

APY 6 months | / | 1.5% – 2%

|

APY 12 months | 3.25% | 2.25% – 2.75%

|

APY 24 months | 3.85% | 0.5% – 1.01%

|

APY 36 months | 3.60% | 2.00% |

No Penalty CD | / | 12 months, 0.05% APY |

Credit Cards

American Express built its reputation on being a credit card provider, but over the years has expanded its product line. So, as you would expect, there is an impressive array of American Express credit card options.

Citi also has a vast selection of credit cards, in categories including Rewards, Travel, Cash back, Balance Transfer and 0% intro rate.

Many of the cards have no annual fee, and you can earn up to 5% cash back. One of the Citi most popular cards is the Simplicity card, which offers 0% Intro APR for 18 months on purchases and balance transfers with no annual fee.

Card | Rewards | Bonus | Annual Fee |

| Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $0 |

|---|---|---|---|---|

| Citi Premier® Card | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 75,000 points

60,000 bonus ThankYou® points after spending $4,000 in purchases within the first three months of account opening

| $95 |

| Citi Simplicity® Card | None | None | $0 |

| Citi® Secured Mastercard® | None | None | $0 |

| Citi Custom Cash℠ Card | 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| $0 |

Citi has even partnered with some popular brands including AT&T, American Airlines, Expedia and Costco, so you can get the best rewards with your preferred brands. For those who want to improve their credit score, Citi offers a secured card.

Personal Loans

Citi provides personal loans . The loans can be used to make home improvements, pay off high-interest debt, fund a large purchase, or even invest.

Citibank has no set minimum credit score requirements. If you already have a good relationship with Citibank, you are more likely to get approved.

Documentation such as ID, paystubs, or even tax returns may be required to verify your information. You should bring those items with you if you go to the branch.

Citi | American Express | |

|---|---|---|

APR | 10.49% – 19.49% APR

| 6.98% – 19.99% |

Loan Amount | $2,000 – $30,000 | $3,500 – $40,000 |

Terms | 12-60 months

| 12-36 months |

American Express personal loans are only available to pre-approved AmEx cardholders. These loans have no origination or prepayment fees, and most are funded within two days of signing the loan agreement.

American Express does not make many borrower requirements public. You must be a preapproved cardholder to be eligible for a personal loan. In the case of the most creditworthy borrowers,

Furthermore, American Express does not perform a hard credit inquiry during the preapproval or application.

Customer Service

American Express offers 24/7 customer support online or on the phone, so if you have a query or need help, you can easily access the customer service team.

Citi’s customer service is a little more complicated. There are several phone lines to access the support team according to your product. So, if you have a credit card query, it is a different number than if you had a question about your savings account.

However, Citi also has a comprehensive help page. You can type in an inquiry and receive an answer, or message the customer service team via the website. You can even scan a QR code within the phone app to message the team.

Online/Digital Experience

Both American Express and Capital One have apps to enhance the customer’s digital experience. The Amex app is available for iOS and Android with a rating of 4.9/5 and 4.5/5 respectively on the Apple Store and Google Play. The Citi mobile app is rated 4.9/5 on Apple and 4.7/5 on Google.

Both apps allow you more control over your account, with 24/7 access to manage your transactions, make transfers, lock your card and receive notifications.

The bank’s websites are also very helpful and enhance the customer’s digital experience. You can browse the available products and compare options if you’re not sure which is the best choice for you.

Which Bank is The Winner?

With both banks offering similar products, we need to look a little more closely at which bank is better.

If you’re looking for a more full service bank with variet of personal banking options and personal service then Citi is a better choice.

However, American Express does have a higher APY on both savings and checking account , better CD rates and plenty of card options. If you already have an Amex card, it may be a better option for you.

FAQs

Does Citi offers a promotion or bonus for new customers?

Yes, CitiBank offers bank promotions for new accounts as well as on a variety of credit cards. As of November 2025 , you can get $325, based on your minimum deposit.

Does American Express offers a promotion or bonus for new customers?

While American Express banking promotions are quite limited, you can find welcome bonuses on many Amex cards.

Is Citibank reliable?

Citibank is concerned about security. When you use the online banking services, the information is encrypted with 128 bit encryption to keep it safe.

Furthermore, Citibank is FDIC insured, so your funds are safe up to the legal limits. Finally, you can enroll in Citibank Safety Check. This automatically uses funds from your savings account to help cover overdrafts on your checking account. Citibank is clearly not in the business of charging exorbitant overdraft fees.

Which bank wins: Citibank or Bank of America?

Citibank and Bank of America are both national banks known for their convenience rather than higher savings rates. Both banks offer a wide range of banking products as well as cutting-edge technology.

You can also gain access to a large ATM network, but Citibank's network is larger. Furthermore, Citibank provides live customer service, particularly during odd hours. So, unless you prioritize access to more physical branches, Citibank is likely to be a better choice.

Is American Express National Bank recommended?

American Express has been in business since 1850 and is a household name in the credit card industry. As a national bank, this online-only platform has some outstanding features.

With no minimum deposit requirements or monthly fees, you can earn competitive rates on your savings. So, unless you're looking specifically for a checking account, American Express National Bank is a good option.

Is there a physical American Express bank?

American Express Bank is an online-only bank that provides a few personal banking options, such as a high-yield savings account and certificates of deposit (CDs). There are also no physical locations to visit, so all transactions must be completed online.

Compare American Express Bank

Discover Bank is a full-service online bank as well as a provider of payment services. Discover can be used for banking and retirement planning by individuals. Discover is best known for its credit cards with rewards, but it also provides personal, student, and home equity loans.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. They do not, however, provide as many products as Discover Bank does.

Read Full Comparison: Discover vs American Express: Which Bank Account Is Better?

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

While CIT Bank lacks a credit card option, it does have a decent eChecking account, mortgages, and home loans. However, American Express has personal loans and an impressive choice of credit card options.

CIT Bank vs American Express: Which Bank Account Is Better For You?

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

For most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth. Here's why.

American Express Bank vs. Bank of America: Which Bank Account Is Better?

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

While PNC Bank is a brick-and-mortar bank, American Express Bank's is an online bank. Let's compare their banking products side by side: American Express Bank vs. PNC Bank

U.S. Bank is one of the largest brick-and-mortar banks in the US, while Amex Bank is among the best online banks. Let's compare them: U.S. Bank vs. American Express Bank

Our preferred choice is American Express, which provides a comprehensive banking package that outshines Truist Bank. Here's how they compare: Truist Bank vs. American Express Bank

While TD offers a better selection of checking accounts and lending options, Amex is a great option for online banking. How do they compare? American Express Bank vs. TD Bank

American Express and HSBC focus on serving wealthier customers by providing services and features beyond the standard. How do they compare? American Express Bank vs. HSBC Bank (USA)

Amex comes out on top with a solid checking option (which Barclays doesn't have), an excellent savings account, and great credit cards.

Barclays Bank vs. American Express Bank: Which Bank Account Is Better?

American Express is our winner with a decent checking account, an impressive savings account, and a great selection of credit cards.

Synchrony Bank vs. American Express Bank: Which Bank Account Is Better?

Compare Citibank Versus Other Banks

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

CIT Bank has a banking product line that rivals that of traditional banks. Savings accounts, CDs, an eChecking account, home loans, and mortgages are all available. The main shortfalls in this lineup are the lack of personal loans and a credit card option.

Citibank has a credit card background, but that doesn't mean it has a limited banking product line. Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services.

Read Full Comparison: CIT Bank vs Citi: Which Bank Account Suits You Best?

Citi offers an excellent range of banking products that cover the majority of your financial needs.

Personal loans, mortgages, credit cards, investment options, IRAs, and wealth management plans are available in addition to savings and checking accounts. Barclays' product line is more streamlined. This bank offers credit cards, savings accounts, credit cards, and personal loans.

The most obvious product gap is the absence of a checking account. As a result, Barclays becomes more of a supplementary bank rather than your primary day-to-day financial institution.

Read Full Comparison: Citi vs Barclays: Which Bank Account Is Better?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Discover began as a credit card company and has since expanded into banking services. As a result, it stands to reason that Discover would offer a diverse range of credit cards. Discover offers a simpler checking account. There are no account fees or minimum deposits, and you can earn 0.40 percent.

Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services. This exemplifies Citi's viability as a viable alternative to the traditional high-street bank.

Read Full Comparison: Discover vs Citi: Compare Banking Options

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner: Citibank vs. TD Bank

We'll explore Citibank and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Citibank vs. M&T Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why.

How We Compared Citibank and American Express: Methodology

In our comprehensive banking comparison, The Smart Investor team thoroughly assessed Citibank and American Express across five main categories:

- Checking Accounts (30%): We scrutinized essential features like direct deposit, debit card availability, monthly maintenance fees, ATM and branch access, check deposit, bill pay options, and account alerts. Additionally, we considered any special checking account options and promotions offered to customers.

- Savings Accounts including CDs (20%): Our evaluation focused on critical factors such as APY (Annual Percentage Yield), minimum deposit requirements, Terms and Flexibility of accounts, and the assurance of FDIC insurance. We also examined special savings options, variety of CDs, automatic renewal options, and early withdrawal penalties.

- Credit Cards (15%): We analyzed the rewards program, annual fees, intro bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards, ensuring a comprehensive comparison of available features.

- Lending Options (15%): We assessed the variety of lending options available, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, providing consumers with insights into the bank's lending capabilities.

- Customer Experience And Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, customer support accessibility, online reviews, JD Power research, Trustpilot ratings, and the overall Financial Stability of each bank, ensuring a holistic view of customer experience and reputation.

Banking Reviews

Aspiration Review

Alliant Credit Union Review