Table Of Content

Every bank work different, please consider specifically Citi and not generally for any bank

Citi is one of the most well established banks in the U.S today, with over 200 years of experience. With such a solid reputation, it is understandable if you’re considering a Citi bank account. But, how do you go about opening a Citi account? Here we’ll delve into the topic in more detail.

What Documents Do You Need to Open an Account With Citi?

As with all U.S Banks, Citi needs to adhere to federal law, which requires Citi to identify each person opening an account. This means that you need to provide your name, address, date of birth and an identification number such as your Social Security Number. You also need to be at least 18 years old and a U.S citizen or resident.

To support your application, you will need to provide proof of your ID. Acceptable forms of ID include:

- A valid driver’s license

- A valid U.S passport

- State issued photo ID

You may also be required to provide proof of your address. This can be done by providing a copy of a recent utility bill or bank statement.

Bear in mind that if you are trying to open a joint account, you will need to provide the above information and supporting documents for both parties.

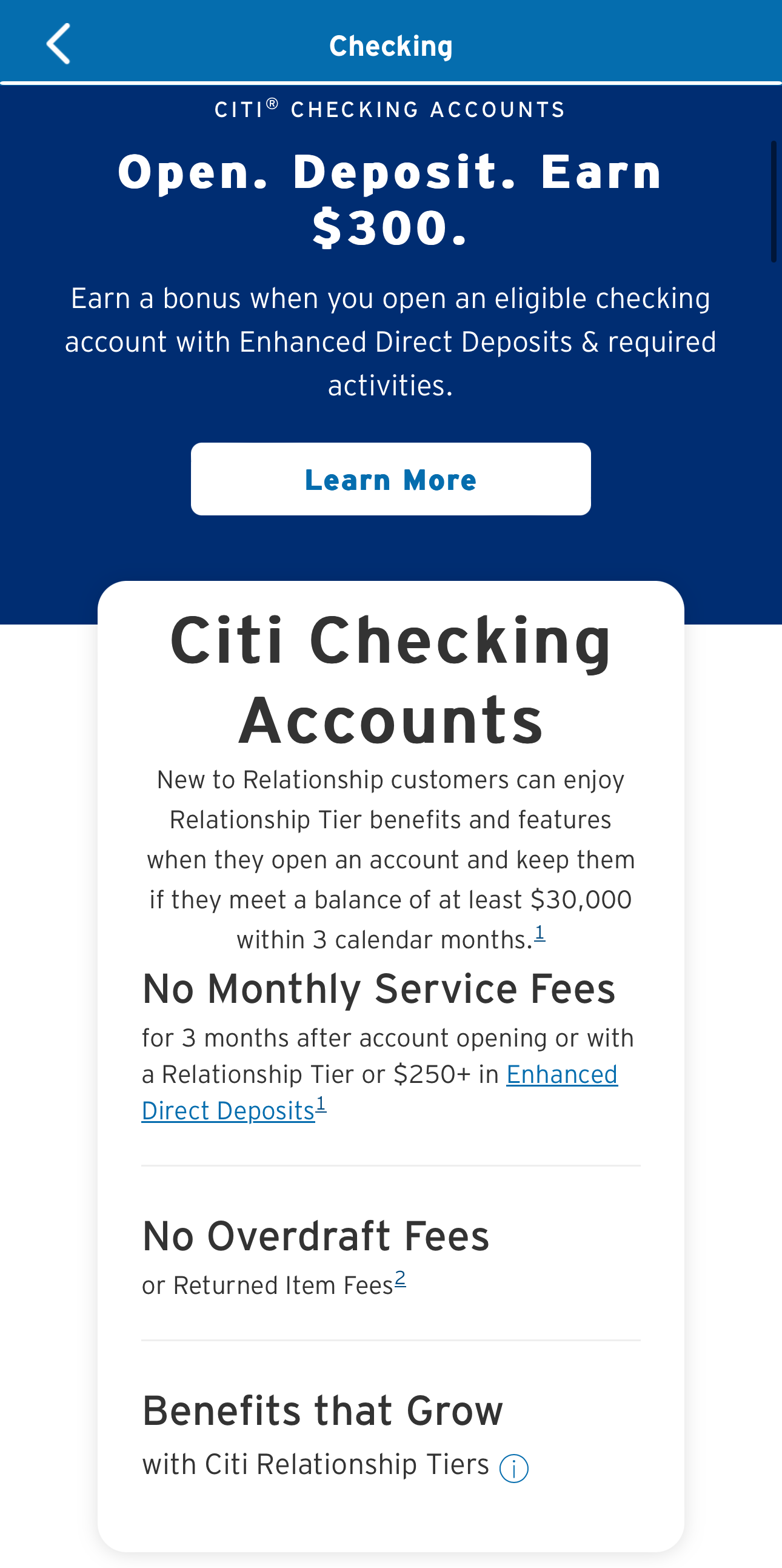

How Much Do You Need to Open a Citi Bank Account?

Citi does not have a minimum deposit requirement to open any of its accounts. This means that you don’t need to deposit anything to get the account opened.

However, a number of account maintenance fee waivers involve maintaining an average monthly balance. So, you may want to get started on this by opening your account with some funds.

Can You Open a Citi Account Online?

Yes, Citi makes it easy to open a new account online. You’ll need to complete the appropriate application form, which you’ll see when you click on the “apply” button. The website will walk you through the steps involved in opening your account including how to submit your supporting documentation.

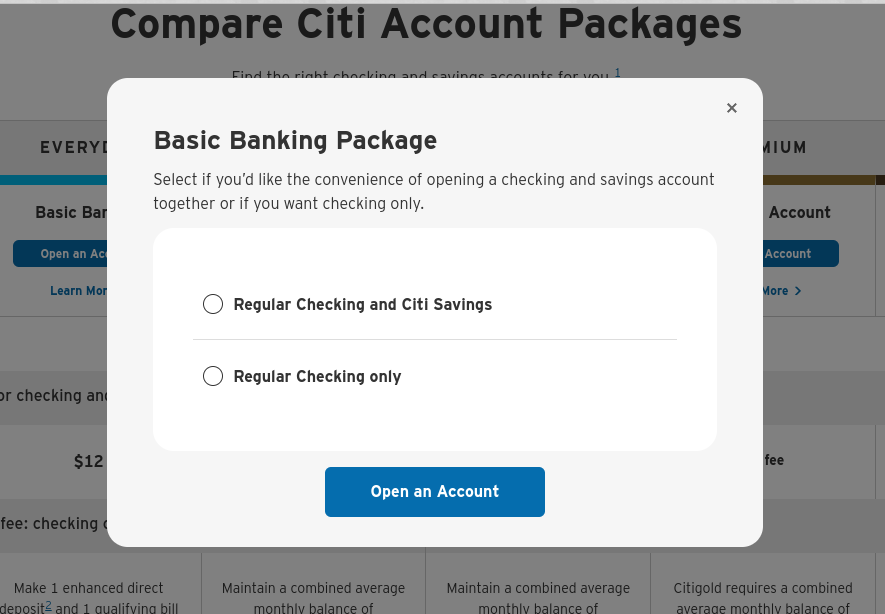

You can even use the website to compare account packages including their features and benefits if you’re not sure which account is the right choice for you.

Steps to Open a Citi Checking Account

While it is possible to open a new checking account at a local branch, one of the easiest ways is to open your account online. To do this you’ll need to follow a few basic steps:

1. Choose Your Account On Citi Website

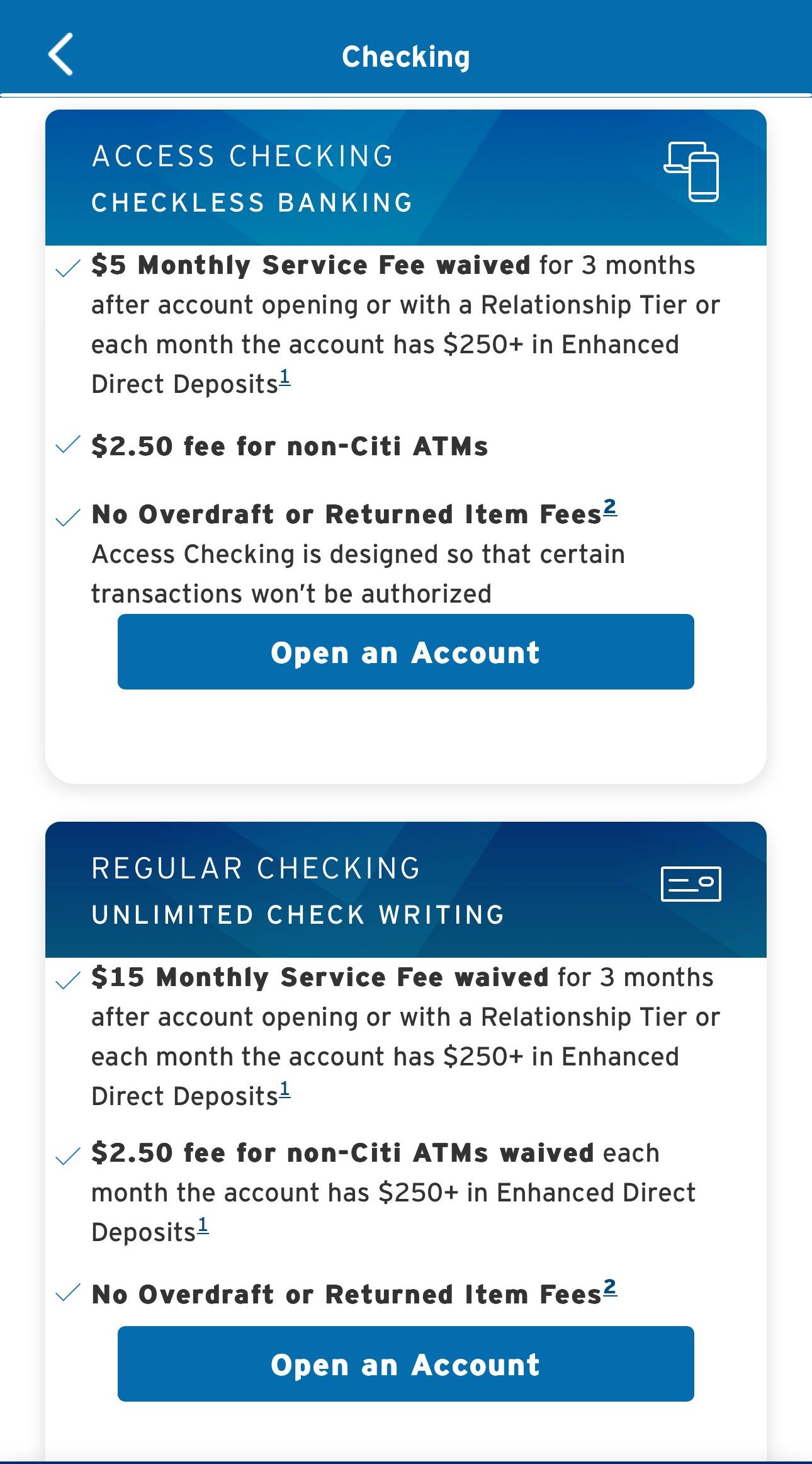

Citi has three everyday checking accounts, so you’ll need to find the product for the account you wish to open. However, if you’re using the comparison feature, you can proceed from this page, as each option has an “open an account” button.

Once you click the button, you’ll see a prompt that will ask if you want to open just a checking account or a checking account with a savings account. Citi savings accounts are designed to work in concert with the checking accounts, so it may be a good idea to open both.

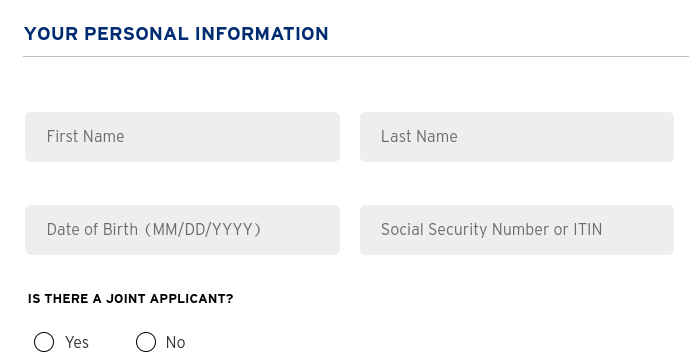

2. Fill Basic Details

After you have made your selection, you’ll be redirected to the first page of the application form.

This will involve providing your personal details including your full name, date of birth, and social security number. You can also indicate if you would like it to be a joint account at this stage.

3. Confirm Citizenship And Security Password

The next step requires that you provide your full postal address including zip code, email address, and cell phone number. Although there is an option to use your home phone number.

You will also need to indicate what type of ID you wish to use to support your application. You’ll need to specify the ID, enter the number and indicate the state where it was issued. You will also need to confirm your citizenship and set up a security password.

4. Review & Fund

Once you have completed this basic application, Citi will guide you through the ID verification process and provide your income and employment details.

The final stage of the application is to set up your online access before you review the agreements and complete the optional step of funding the account.

How to Open a Joint Bank Account With Citi

The process of opening a joint bank account with Citi is very similar to the steps we’ve detailed above. The key difference is that you’ll need to indicate “yes” to the question of whether you want to open a joint account on the first page.

From there, you will need to complete the stages above for both applicant one and applicant two. This means that you’ll need to know:

- Social Security Numbers

- Dates of birth

- Postal address (if different)

- Mobile phone numbers

- And income and employment details.

This will mean that both applicants will co-own the account. Both of you will have responsibility for any fees or charges, but Citi will not distinguish who paid in what amounts.

So, you need to be confident that you can trust your account co-owner, since either party can withdraw funds or authorize charges on the account.

Which Citi Checking Account Should You Open?

As we touched on earlier, there are several checking account options with Citi. Which one is best for you will depend on your circumstances.

Citi Account | Monthly Fee | Balance To Waive Fee |

|---|---|---|

Access Account Package | $10 | $1,500 |

Basic Banking Package | $12 | $1,500 |

The Citibank Account Package

| $25 | $10,000 |

Citi Priority Account Package | $30 | $30,000 |

Citigold Account Package | $0 | / |

Citigold Private Client | $0 | / |

- Citi Access Account

This is designed to be an affordable checking account package. You can access the basic checking account services, but you cannot write checks on this account.

There is also a $2.50 fee for using non-Citi ATMs. In addition, the account has a $10 monthly service fee, which can be waived if you make one qualifying bill payment or one enhanced direct deposit per statement period.

You can also have the fee waived if you maintain a combined monthly average balance of at least $1,500 in your eligible linked accounts.

- Citi Basic Banking

This is very similar to the Access Account, but you can write checks and the monthly service fee is $12. However, the fee waiver criteria are the same as with Access.

This is why it makes sense to have a checking and savings account package since the combined balance will count toward your minimum monthly average.

The Basic Banking account is considered Citi’s standard checking account option. However, if this account lacks features, there is an upgrade option with Citibank.

- The Citibank® Account Package

This is one of the premium account options, with no fee for the first standard checkbook and the potential for non-Citi ATM fees to be waived.

However, this does come at a cost. The monthly service fee on this account is $25, and the waiver criteria are more demanding. If you want your service fees waived, you’ll need to maintain a combined monthly average balance of over $10,000 in your eligible linked accounts.

This can include deposit, investment, and retirement accounts. So, this account is a good option if you feel comfortable moving all of your banking over to Citi.

- Citi Priority

Citi Priority has no fees for checkbooks or Citi fees for non-Citi ATM transactions. You can also enjoy no foreign transaction fees on your debit card and preferential rates on select products. The account also offers financial guidance.

However, the monthly maintenance fee is $30 unless you maintain a combined balance of at least $30,000 across eligible linked accounts.

- Citi Gold

Like the Priority, this premium checking account offers no checkbook or foreign transaction fees. You can also access complimentary financial guidance with a dedicated team, global and travel benefits, and the Citi Gold concierge.

In addition, there is no fee for this account, but you will need to maintain a monthly average balance of at least $200,000 across all your eligible Citi accounts.

Citibank

Fees

Minimum Deposit

Current Promotion

APY Savings

Why Can’t I Open a Citi Bank Account

There could be a number of reasons why your application for a new Citi bank account was declined. These include:

- Insufficient Income: If you’ve applied for a top-tier Citi checking account, but don’t have the income to support that specific account, Citi may decline your application. However, in this scenario, they may offer you a different checking account option that is better suited to your financial circumstances.

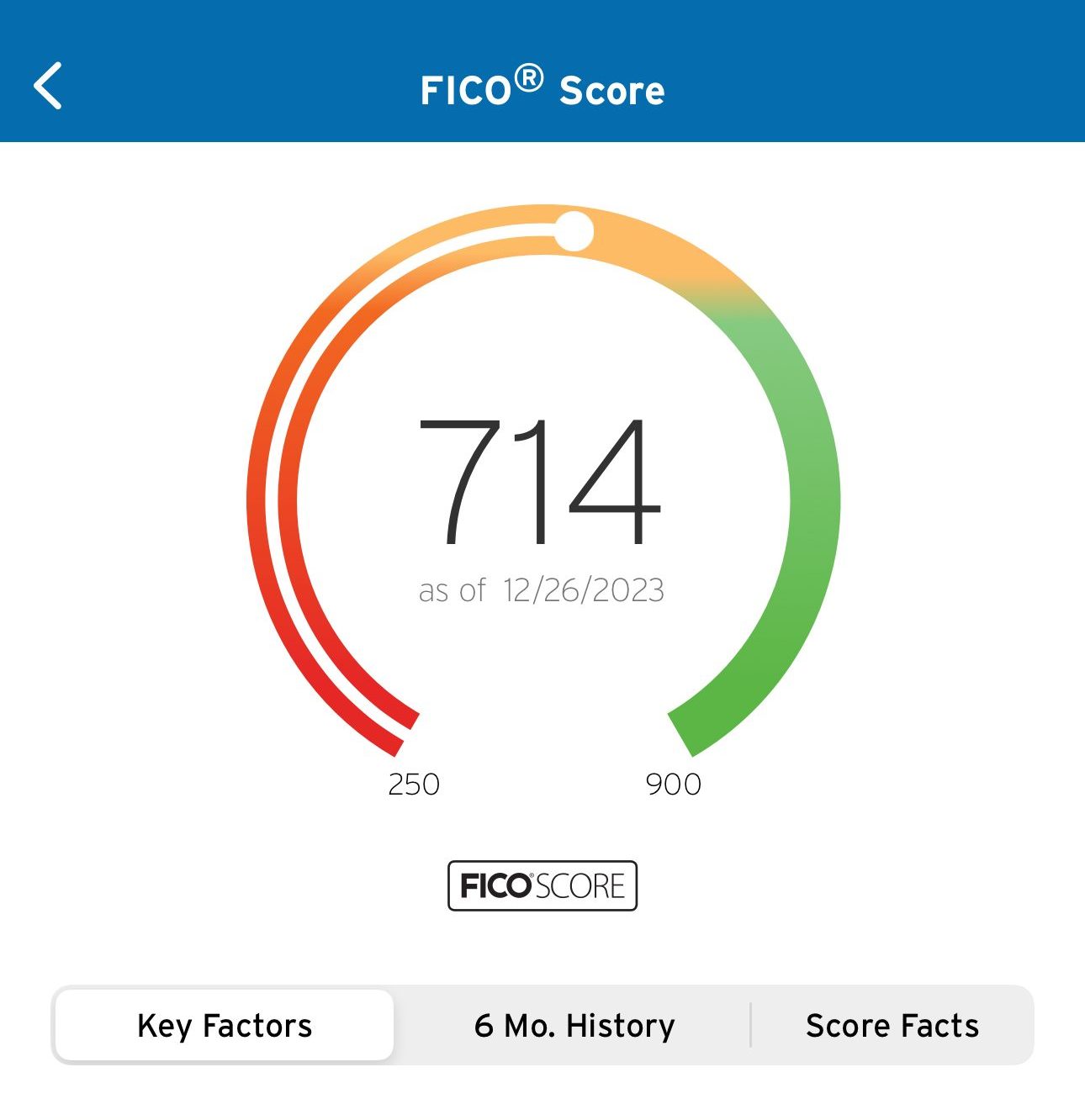

- Past Problems: Citi typically uses a soft credit pull to evaluate applicant qualification, but they will also check ChexSystems reports. This will highlight if you’ve had issues with a checking account before. This could be something such as being overdrawn frequently or even having your account closed by the bank for unpaid fees.

- Unable to Verify Your ID: Citi must adhere to federal ID verification laws for all account applicants. If for some reason, Citi is unable to verify your ID, they will decline your application.

What Can I Do If I've Been Rejected?

It's a frustrating situation, but there are a couple of things you can consider when Citi rejects your bank account application:

- Contact Citi: If your account application is declined, the first thing to do is contact Citi. If the approval decision was due to ID problems, this can be easily resolved by submitting additional supporting documentation. For example, you may have inadvertently supplied the details of an expired driver’s license. Once you provide a valid ID, the issue is likely to be resolved.

- Request Your ChexSystems Report: You can request a copy of your report and go through it to see if there are any discrepancies or errors. If there are any errors, you can apply for them to be corrected. However, there may be another reason that was a red flag for Citi. For example, you may be unaware that an account you previously held as a joint account has defaulted. In this case, you’ll need to try to rectify any outstanding issues.

- Consider Second Chance Accounts: If your past is causing problems getting approval for a Citi checking account, you may need to consider second chance accounts. This is a more basic type of account and it may have higher fees, but it could help you to rebuild your financial credibility.

Factors to Consider When Opening a Citi Checking Account

As we discussed, there are a number of Citi checking account options, so you’ll need to choose which one is best for you. There are several factors to consider including:

- The Monthly Service Fee Waiver Criteria

Almost all Citi checking accounts have a monthly service fee, but there are also several ways to waive these fees. You need to ensure that you can comfortably achieve at least one of the waiver criteria.

For example, the Access and Basic accounts have similar minimum average monthly balance requirements, but it is significantly more with the Citibank account.

- Account Benefits

If you’re planning on moving your retirement and investment accounts to a new platform, it may be advantageous to open up one of the premium Citi checking accounts.

However, if you just want a basic checking account, you’ll need to be prepared for fewer account benefits.

- Checking or Accounts Package

As we mentioned earlier, you can open just a checking account or a checking and savings account package.

While you may only be looking for a checking account, having both accounts will make meeting the monthly service fee waiver criteria easier.

- Online Experience

Part of the application will include registering for online access. If you’re not comfortable with using online banking and prefer to stick to traditional branch access only, this may not be the right financial institution for you.

Citi only has approximately 700 branches throughout the U.S and most of the checking accounts have Citi fees for using non Citi ATMs.

Tips to Maximize Your Citi Checking Account

If you want to get the most out of your new Citi checking account, there are several tips that may be able to help you.

- Open a savings account: Citi has an odd fee structure, where you’ll potentially pay more if you don’t have a checking and savings account. So, take advantage of the option to open an account package when you apply. Citi Accelerate savings is the top Citi savings account, offering 3.70% APY, which is very high for a traditional bank.

- Link all eligible accounts: You can link deposit and other Citi accounts to your new checking account. This will make it easier to reach the minimum average monthly balance requirements to have your monthly service fees waived.

- Stick to Citi ATMs: Citi has an ATM network with over 2,300 machines, so it is a good idea to locate a machine in your local area. Most accounts have a Citi fee for using a non network machine, plus you may incur fees from the ATM owner. This is a quick way to rack up significant charges on your account.

FAQs

Can a non US citizen open a Citi bank account?

No, you need to be a US citizen or permanent resident to be able to open a Citi bank account.

How do you open a savings account with Citi?

The easiest way is to open a savings account with your checking account. However, you can also apply to open a savings account online.

How long does it take to open Citi bank account?

You should be able to complete the application in less than ten minutes. Citi will provide an approval decision quite quickly and you’ll then have the account up and running.

Can I open a Citi bank account without SSN?

No, Citi requires that you provide a Social Security Number to open an account.

What Is the Minimum Balance for Citi Checking Accounts?

Citi checking accounts don’t have minimum balance requirements to open an account, but you’ll need to maintain an average monthly balance if you want to have service fees waived.

How do you find Citi bank branches near me?

There is a branch locator on the Citi website.

How do you find Citi bank ATMs near me?

You can use the ATM locator at the top of the Citi website home page.

How do you contact Citi customer service?

You can call the customer service helpline at 1-888-248-4226 or speak to a team member in your local branch.

What are Citi bank opening hours?

Most branches are open 9am to 5pm Monday to Friday. Some branches also open for a half day on Saturday.

Banking Reviews

Aspiration Review

Alliant Credit Union Review